You should upgrade or use an alternative browser.

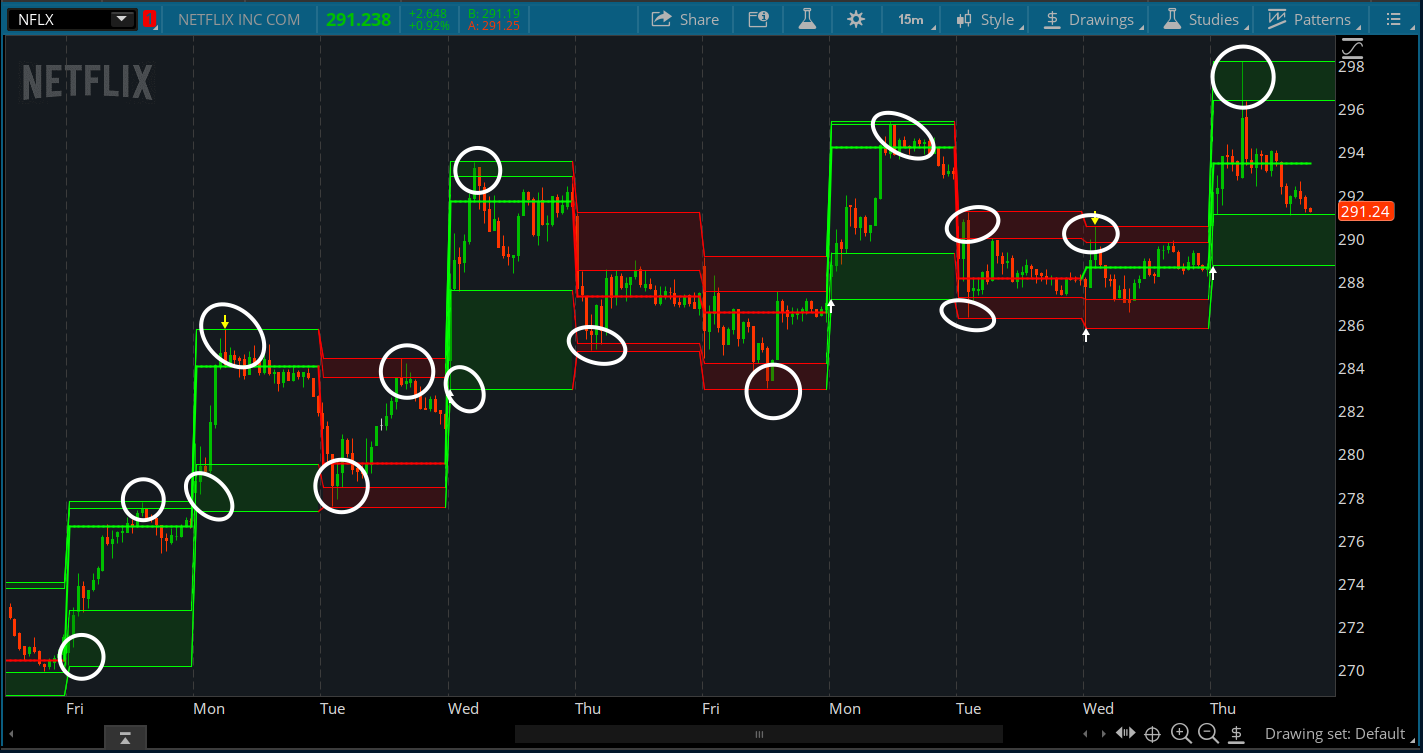

Volatility Box Indicator for ThinkorSwim

- Thread starter Srt4ever

- Start date

Volatility Trading Range

VTR is a momentum indicator that shows if a stock is overbought or oversold based on its Weekly and Monthly average volatility trading range.

@john3 I believe so

Does the Volatility Box use a volume profile?

Huffmac90

Member

##code base from TOS TPO and multiple codes from the OneNote page.

#VM_Drummond_61_Channel

#VM_Drummond_RS_Zones

declare upper;

input showlines = yes;

input pricePerRowHeightMode = { AUTOMATIC, default TICKSIZE, CUSTOM};

input customRowHeight = .01;

input timePerProfile = {CHART, MINUTE, MIN2, MIN3, MIN4, MIN5, MIN10, default MIN15, MIN20, MIN30, HOUR, TWOHOUR, FOURHOUR, DAY , TWODAY, THREEDAY, FOURDAY, WEEK, MONTH, "OPT EXP", BAR};

input timePerProfile2 = {CHART, MINUTE, MIN2, MIN3, MIN4, MIN5, MIN10, default MIN15, MIN20, MIN30, HOUR, TWOHOUR, FOURHOUR, DAY , TWODAY, THREEDAY, FOURDAY, WEEK, MONTH, "OPT EXP", BAR};

input multiplier = 1.0;

input onExpansion = no;

input profiles = 1000;

input showPointOfControl = yes;

input showValueArea = yes;

input valueAreaPercent = 100.0;

input valueAreaPercent2 = 87.5;

input opacity = 99;

def period;

def agg;

def yyyymmdd = GetYYYYMMDD();

def seconds = SecondsFromTime(0);

def month = GetYear() * 12 + GetMonth();

def day_number = DaysFromDate(First(yyyymmdd)) + GetDayOfWeek(First(yyyymmdd));

def dom = GetDayOfMonth(yyyymmdd);

def dow = GetDayOfWeek(yyyymmdd - dom + 1);

def expthismonth = (if dow > 5 then 27 else 20) - dow;

def exp_opt = month + (dom > expthismonth);

switch (timePerProfile) {

case CHART:

period = 0;

agg = AggregationPeriod.DAY;

case MINUTE:

period = Floor(seconds / 60 + day_number * 24 * 60);

agg = AggregationPeriod.MIN;

case MIN2:

period = Floor(seconds / 120 + day_number * 24);

agg = AggregationPeriod.TWO_MIN;

case MIN3:

period = Floor(seconds / 180 + day_number * 24);

agg = AggregationPeriod.THREE_MIN;

case MIN4:

period = Floor(seconds / 240 + day_number * 24);

agg = AggregationPeriod.FOUR_MIN;

case MIN5:

period = Floor(seconds / 300 + day_number * 24);

agg = AggregationPeriod.FIVE_MIN;

case MIN10:

period = Floor(seconds / 600 + day_number * 24);

agg = AggregationPeriod.TEN_MIN;

case MIN15:

period = Floor(seconds / 900 + day_number * 24);

agg = AggregationPeriod.FIFTEEN_MIN;

case MIN20:

period = Floor(seconds / 1200 + day_number * 24);

agg = AggregationPeriod.TWENTY_MIN;

case MIN30:

period = Floor(seconds / 1800 + day_number * 24);

agg = AggregationPeriod.THIRTY_MIN;

case HOUR:

period = Floor(seconds / 3600 + day_number * 24);

agg = AggregationPeriod.HOUR;

case TWOHOUR:

period = Floor(seconds / 7200 + day_number * 24);

agg = AggregationPeriod.TWO_HOURS;

case FOURHOUR:

period = Floor(seconds / 14400 + day_number * 24);

agg = AggregationPeriod.FOUR_HOURS;

case DAY:

period = CountTradingDays(Min(First(yyyymmdd), yyyymmdd), yyyymmdd) - 1;

agg = AggregationPeriod.DAY;

case TWODAY:

period = CountTradingDays(Min(First(yyyymmdd), yyyymmdd), yyyymmdd) - 1;

agg = AggregationPeriod.TWO_DAYS;

case THREEDAY:

period = CountTradingDays(Min(First(yyyymmdd), yyyymmdd), yyyymmdd) - 1;

agg = AggregationPeriod.THREE_DAYS;

case FOURDAY:

period = CountTradingDays(Min(First(yyyymmdd), yyyymmdd), yyyymmdd) - 1;

agg = AggregationPeriod.FOUR_DAYS;

case WEEK:

period = Floor(day_number / 7);

agg = AggregationPeriod.WEEK;

case MONTH:

period = Floor(month - First(month));

agg = AggregationPeriod.MONTH;

case "OPT EXP":

period = exp_opt - First(exp_opt);

agg = AggregationPeriod.DAY;

case BAR:

period = BarNumber() - 1;

agg = AggregationPeriod.DAY;

}

input price = close;

input displace = 0;

input length = 20;

input Num_Dev_Dn = -1.9;

input Num_Dev_Dn1 = -2.9;

input Num_Dev_Dn2 = -3.9;

input Num_Dev_Dn3 = -4.9;

input Num_Dev_Dn4 = -5.9;

input Num_Dev_up = 1.9;

input Num_Dev_up1 = 2.9;

input Num_Dev_up2 = 3.9;

input Num_Dev_up3 = 4.9;

input Num_Dev_up4 = 5.9;

input averageType = AverageType.HULL;

def sDev = StDev(data = price[-displace], length = length);

#DrummondChannel

def o = open(period = agg);

def h = high(period = agg);

def l = low(period = agg);

def c = close(period = agg);

def HMA = MovingAverage(AverageType.HULL, price, length)[displace];

plot Hull = HMA;

#====1-1Channel====

def y = HMA - AbsValue(h[1] - HMA);

def x = HMA + AbsValue(HMA - l[1]);

plot res = x;

plot sup = y;

plot LowerBand = y + Num_Dev_Dn * sDev;

plot UpperBand = x + Num_Dev_up * sDev;

plot LowerBand1 = y + Num_Dev_Dn1 * sDev;

plot UpperBand1 = x + Num_Dev_up1 * sDev;

plot LowerBand2 = y + Num_Dev_Dn2 * sDev;

plot UpperBand2 = x + Num_Dev_up2 * sDev;

plot LowerBand3 = y + Num_Dev_Dn3 * sDev;

plot UpperBand3 = x + Num_Dev_up3 * sDev;

plot LowerBand4 = y + Num_Dev_Dn4 * sDev;

plot UpperBand4 = x + Num_Dev_up4 * sDev;

LowerBand4.SetDefaultColor(Color.GREEN);

LowerBand3.SetDefaultColor(Color.GREEN);

LowerBand2.SetDefaultColor(Color.GREEN);

LowerBand1.SetDefaultColor(Color.GREEN);

LowerBand.SetDefaultColor(Color.GREEN);

UpperBand.SetDefaultColor(Color.RED);

UpperBand1.SetDefaultColor(Color.RED);

UpperBand2.SetDefaultColor(Color.RED);

UpperBand3.SetDefaultColor(Color.RED);

UpperBand4.SetDefaultColor(Color.RED);

Hull.DefineColor("Up", Color.GREEN);

Hull.DefineColor("Down", Color.RED);

Hull.AssignValueColor(if HMA > HMA[1] then Hull.Color("Up") else Hull.Color("Down"));

AddCloud(LowerBand3, LowerBand4, Color.GREEN);

AddCloud(LowerBand1, LowerBand3, Color.DARK_GREEN);

AddCloud(UpperBand4, UpperBand3, Color.RED);

AddCloud(UpperBand3, UpperBand1, Color.DARK_RED);

input AtrMult = 1.0;

input nATR = 4;

input AvgType = AverageType.HULL;

input PaintBars = yes;

def ATR = MovingAverage(AvgType, TrueRange(high, close, low), nATR);

def UP = HL2 + (AtrMult * ATR);

def DN = HL2 + (-AtrMult * ATR);

def ST = if close < ST[1] then UP else DN;

plot SuperTrend = ST;

SuperTrend.AssignValueColor(if close < ST then Color.RED else Color.GREEN);

AssignPriceColor(if PaintBars and close < ST then Color.RED else if PaintBars and close > ST then Color.GREEN else Color.CURRENT);

# End Code SuperTrendi noticed so many codes in this thread and i got a bit confused on which one is corresponding with this chart. any chance i can get the tos link plzzzz@Huffmac90 This indicator looks really cool. Can you confirm that it's not showing the top and bottom line after the fact? Looking at the 20d 15m. I have yet to find a single false signal. This usually mean the indicator will repaint or delay. You said you're currently using it. Can you confirm its not?

DeusMecanicus

Active member

The first picture I tracked the cloud movement from the beginning of the hour to where it ended up at the end of the hour. The second picture shows what would have been an entry if you looked at it at the end of the day but in real time the blue entry line was dragged down to the candle by the price dropping lower throughout the hour.

https://www.prorealcode.com/prorealtime-indicators/volatility-breakout-indicator/

Thomas

Guest

An alternative,.......https://tos.mx/N2f9cAA@Huffmac90 You can find the Vwap Z-Score here https://usethinkscript.com/threads/vwap-deviation-z-score-with-chart-and-lower-indicators.602/

@Thomas

@barbaros

As @BenTen stated above in post 61, what was posted earlier was premium code. I subscribed to the Volatility Box for quite a while and can assure you that it's no holy grail. It may provide a clean chart layout but it's not a complete trading system. You need additional confirmation at the pivot points and some basic knowledge of price action. The creator of the indicator is a nice guy. His product just didn't help me win trades.

For what it's worth, I overlaid the Volatility Box with numerous indicators available on this site. @horserider 's SD bands were a very close approximation.

Best wishes.

Thank you for the clarification. I did not realize that BenTen was talking about the Volatility Box code, I thought Diazlaz has made a replica.

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

Similar threads

-

-

4 & 20 Period Historical Volatility - Reversals and Trend Exhaustion

- Started by autoloader

- Replies: 6

-

-

-

Implied Volatility (IV) Rank & Percentile for ThinkorSwim

- Started by Camelotnite

- Replies: 33

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

4 & 20 Period Historical Volatility - Reversals and Trend Exhaustion

- Started by autoloader

- Replies: 6

-

-

-

Implied Volatility (IV) Rank & Percentile for ThinkorSwim

- Started by Camelotnite

- Replies: 33

Similar threads

-

-

4 & 20 Period Historical Volatility - Reversals and Trend Exhaustion

- Started by autoloader

- Replies: 6

-

-

-

Implied Volatility (IV) Rank & Percentile for ThinkorSwim

- Started by Camelotnite

- Replies: 33

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/