Volatility Trading Range is an indicator for ThinkorSwim that measures the weekly and monthly movement of a stock based on its usual trading range.

This specific indicator will be plotted as an oscillator on your chart.

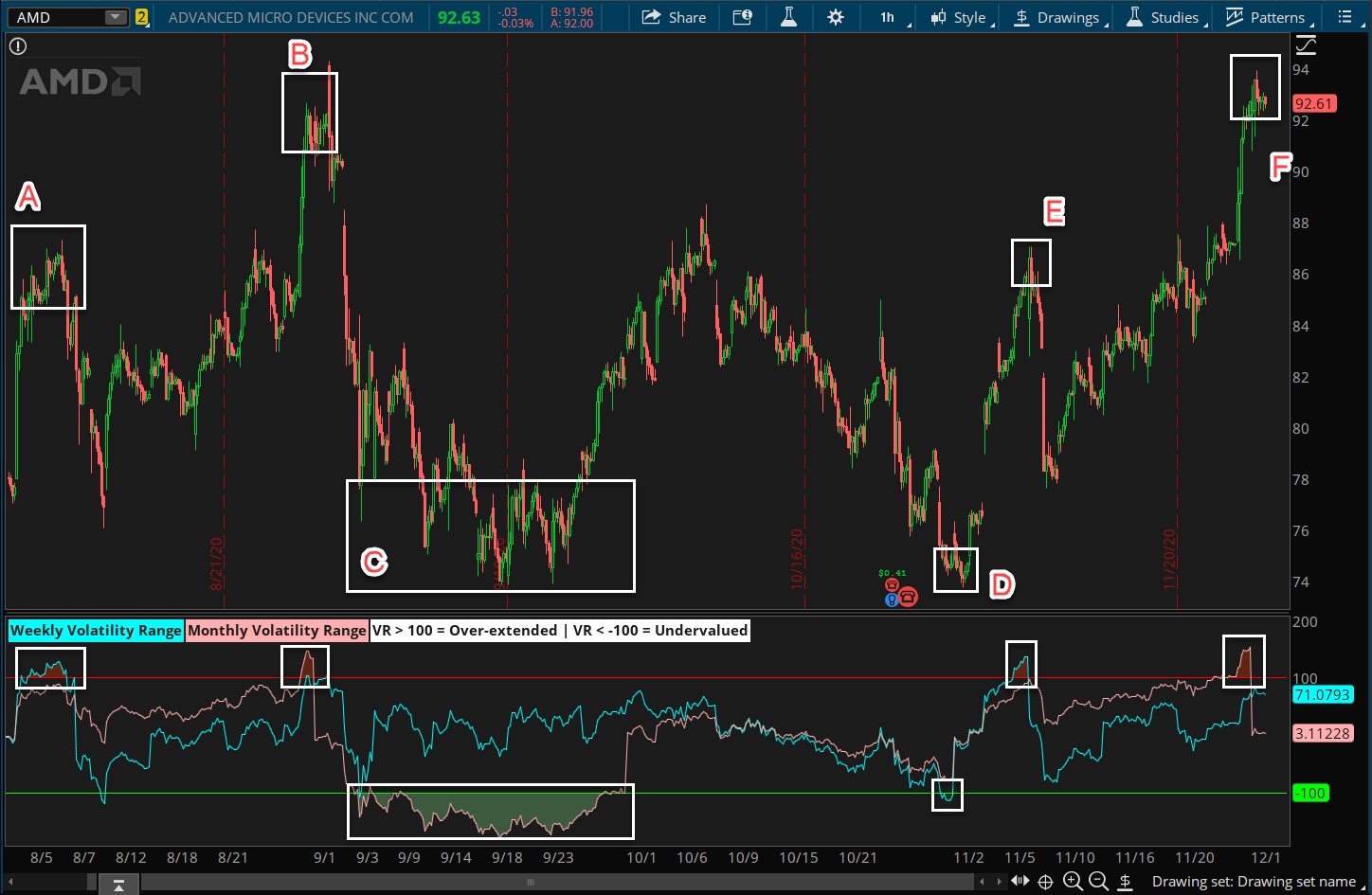

Here is what it would look like when you add it to ThinkorSwim.

A: AMD is already trading above its weekly trading range = Over-extended

B: Same thing as box A. AMD is trading above its average weekly AND monthly range to the upside. I would consider this to be an over-extended move.

C: At this level, AMD is trading below its average monthly range. At this level, I would consider it to be undervalued.

D: Same as C but this time it's the weekly trading range.

You get the idea.

If you're not a VIP member yet, consider upgrading your account or you can learn more about our VIP subscription on this page.

This specific indicator will be plotted as an oscillator on your chart.

Here is what it would look like when you add it to ThinkorSwim.

How do I read this indicator?

Pay attention to the following:- The blue line represents the weekly volatility movement

- The pink line represents the monthly volatility movement

- The red line is plotted at 100

- The green line is plotted at -100

- When the blue line is moving above the 100 level or below the -100 level, it means that the stock is currently exceeding its normal WEEKLY trading range.

- When the pink line moves above the 100 level or below the -100 level, it means that the stock is currently exceeding its normal MONTHLY trading range.

A few examples:

A: AMD is already trading above its weekly trading range = Over-extended

B: Same thing as box A. AMD is trading above its average weekly AND monthly range to the upside. I would consider this to be an over-extended move.

C: At this level, AMD is trading below its average monthly range. At this level, I would consider it to be undervalued.

D: Same as C but this time it's the weekly trading range.

You get the idea.

Scanner

Using the default indicator, you can quickly build your own scanner to look for "undervalued" and "over-extended" stocks.Personal Point of View

Based on my own analysis, it's safe to assume that the stocks in my watchlist don't usually trade outside of their average trading ranges. When they do, I look to trade the opposite direction. However, during this market condition, I don't like to short anything. As a result, the 100 level can be treated as a profit-taking point.Download Volatility Trading Range Indicator

Current VIP members can download the indicator from the customer area.If you're not a VIP member yet, consider upgrading your account or you can learn more about our VIP subscription on this page.