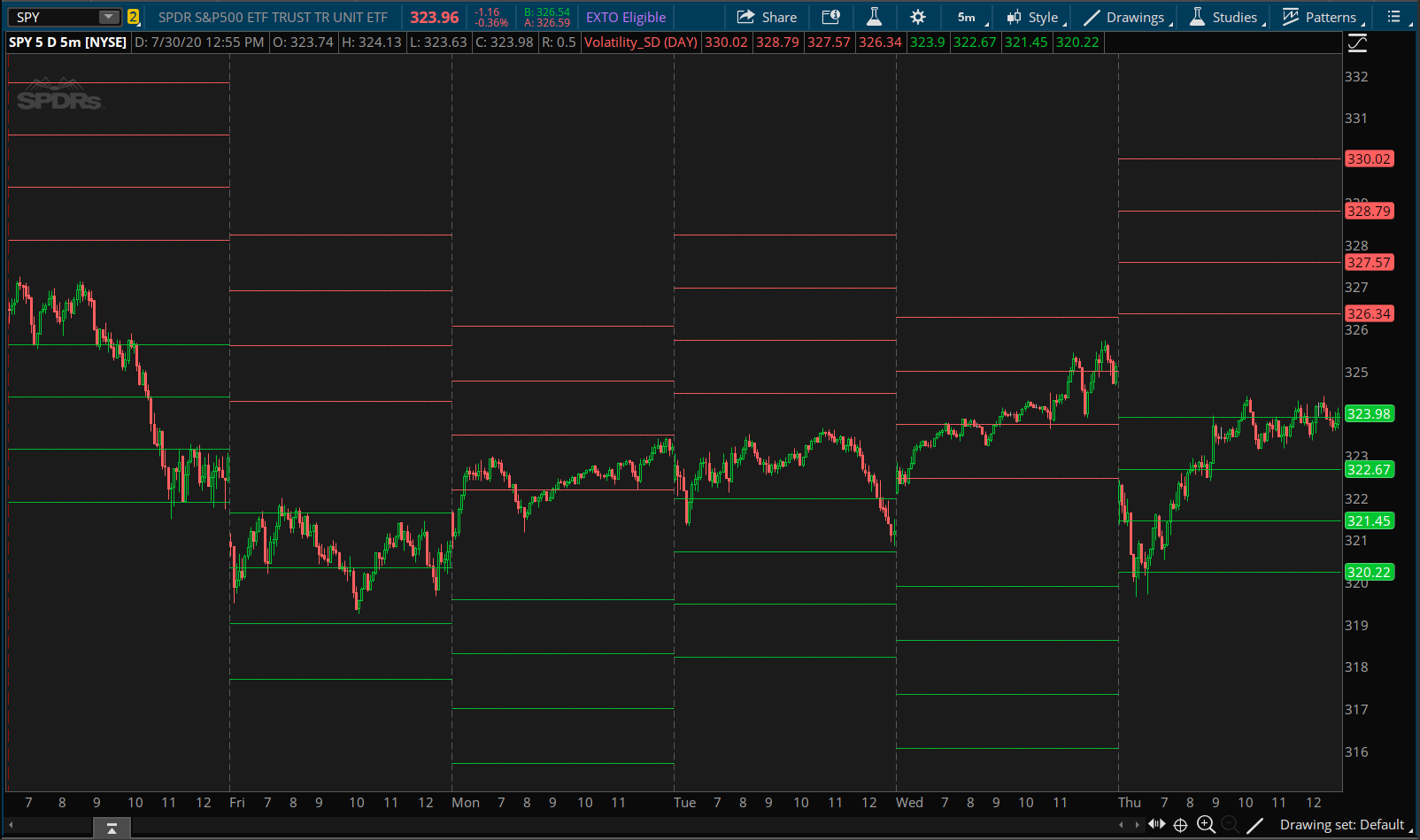

This indicator will plot volatility based standard deviation levels for the S&P 500 (SPY) and some futures instruments such as /ES, /NQ, and /RTY.

How does this work?

The standard deviation levels are based on the previous day closing value of $SPY and $VIX. The indicator was ported to ThinkorSwim from TradingView.

Here is a brief note from the developer for anyone trading futures:

No need to modify the code or change any value if you're going to use this on SPY chart. You will have to edit the script a bit if you want to get the previous day value of VXN instead of VIX.

How does this work?

The standard deviation levels are based on the previous day closing value of $SPY and $VIX. The indicator was ported to ThinkorSwim from TradingView.

Here is a brief note from the developer for anyone trading futures:

For NQ, I use VXN closing price and for ES or RTY, I use VIX closing price.

No need to modify the code or change any value if you're going to use this on SPY chart. You will have to edit the script a bit if you want to get the previous day value of VXN instead of VIX.

Code:

# Volatility Based Standard Deviations

# Assembled by BenTen at UseThinkScript.com

# Converted from https://www.tradingview.com/script/vXGZ9DdQ-Volatility-based-Standarde-Deviation-and-Fib-Pivot-Points/

input aggregationPeriod = AggregationPeriod.DAY;

def SettlementPrice = close(period = aggregationPeriod)[1];

def VixClose = close("VIX", period = aggregationPeriod)[1];

def ZTable = 0.0625;

def SD = SettlementPrice * (VixClose / 100) * ZTable;

# Standard Deviation Calculation

plot usd1 = SettlementPrice + SD;

plot usd75 = SettlementPrice + (0.75 * SD);

plot usd5 = SettlementPrice + (0.5 * SD);

plot usd25 = SettlementPrice + (0.25 * SD);

plot dsd25 = SettlementPrice - (0.25 * SD);

plot dsd5 = SettlementPrice - (0.5 * SD);

plot dsd75 = SettlementPrice - (0.75 * SD);

plot dsd1 = SettlementPrice - SD;

usd1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

usd1.SetDefaultColor(Color.DOWNTICK);

usd75.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

usd75.SetDefaultColor(Color.DOWNTICK);

usd5.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

usd5.SetDefaultColor(Color.DOWNTICK);

usd25.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

usd25.SetDefaultColor(Color.DOWNTICK);

dsd25.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

dsd25.SetDefaultColor(Color.UPTICK);

dsd5.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

dsd5.SetDefaultColor(Color.UPTICK);

dsd75.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

dsd75.SetDefaultColor(Color.UPTICK);

dsd1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

dsd1.SetDefaultColor(Color.UPTICK);

Last edited by a moderator: