I do not favor one way or the other. I trade with the market as a whole. I will look for ES, NQ, QQQ to moving in the same direction and especially if they break and retest or reject a major S/R level. I typically get at the money unless the price is super low, then I may buy more in the money. After using the volatility trailing stop for a bit, I stopped using it. I will provide it later.

Thank you very much @METAL for the strategy. I tried with NVDA and those were good scalping trades.

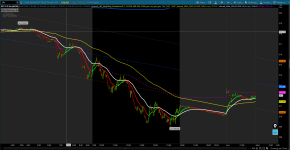

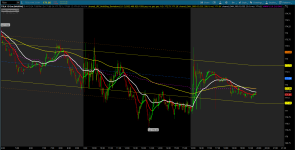

I see that reg channels plot correctly (as your screen shots) only if I use 2m 1d. Is the that the case?

but other charts you posted uses 2m/5 days. Do we have a setting that needs to adjusted?

Could you also please suggest how to enable 2nd dev (Yellow lines) levels. I tried with Multi-Day but not matching your charts.