@MerryDay

I think the scan you are referring is for daily . I change the input and gave interval as 5 minutes but not getting any results . I am using this code for drawing fib on 5 minutes chart , I just added the plot scan at the end of the code , but it give TooComplexException .What am i missing here

#Auto Fib Levels After Bar @rangeEnd Closes

#Using Mobius' OR logic for Range

#Plots limited to RTHrs

#edit by @brooklyngfellaz, added addtional fibs, color and labels.

input rangeStart = 0930;

input rangeEnd = 0935;

input ShowTodayOnly = no;

def A = if SecondsTillTime(rangeEnd) > 0 and SecondsFromTime(rangeStart) >= 0

then 1

else 0;

def today = if ShowTodayOnly == no or

GetDay() == GetLastDay() and SecondsFromTime(rangeStart) >= 0

then 1

else 0;

def H = if H[1] == 0 or

A[1] == 0 and A == 1

then high

else if A and high > H[1]

then high

else H[1];

def L = if IsNaN(low) then L[1] else if L[1] == 0 or

A[1] == 0 and A == 1

then low

else if A and low < L[1]

then low

else L[1];

def Range = H - L;

def HA = if A or today < 1

then Double.NaN

else H;

def LA = if A or today < 1

then Double.NaN

else L;

def fib001 = if IsNaN(close) and SecondsTillTime(1615) > 0 then fib001[1]

else if SecondsFromTime(1615)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * 0.0;

plot f001 = fib001;

f001.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

f001.SetDefaultColor( Createcolor(255,255,255));

def fib33 = if IsNaN(close) and SecondsTillTime(1615) > 0 then fib33[1]

else if SecondsFromTime(1615)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * .33;

#plot f33 = fib33;

#f33.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f33.SetDefaultColor( Createcolor(192,192,192));

def fib332 = if IsNaN(close) and SecondsTillTime(1615) > 0 then fib332[1]

else if SecondsFromTime(1615)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * -.33;

#plot f332 = fib332;

#f332.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f332.SetDefaultColor( Createcolor(192,192,192));

def fib133 = if IsNaN(close) and SecondsTillTime(1615) > 0 then fib133[1]

else if SecondsFromTime(1615)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * 1.33;

#plot f133 = fib133;

#f133.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f133.SetDefaultColor( Createcolor(255,0,0));

def fib1332 = if IsNaN(close) and SecondsTillTime(1615) > 0 then fib1332[1]

else if SecondsFromTime(1615)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * -1.33;

#plot f1332 = fib1332;

#f1332.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f1332.SetDefaultColor( Createcolor(255,0,0));

def fib333 = if IsNaN(close) and SecondsTillTime(1615) > 0 then fib333[1]

else if SecondsFromTime(1615)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * 3.33;

#plot f333 = fib333;

#f333.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f333.SetDefaultColor( Createcolor(255,0,0));

def fib334 = if IsNaN(close) and SecondsTillTime(1600) > 0 then fib334[1]

else if SecondsFromTime(1600)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * -3.33;

#plot f334 = fib334;

#f334.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f334.SetDefaultColor( Createcolor(255,0,0));

def fib382 = if IsNaN(close) and SecondsTillTime(1615) > 0 then fib382[1]

else if SecondsFromTime(1615)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * .79;

#plot f382 = fib382;

#f382.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f382.SetDefaultColor( Createcolor(218,165,32));

def fib618 = if IsNaN(close) and SecondsTillTime(1615) > 0 then fib618[1]

else if SecondsFromTime(1615)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * .88;

#plot f618 = fib618;

#f618.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f618.SetDefaultColor( Createcolor(218,165,32));

def fib792 = if IsNaN(close) and SecondsTillTime(1615) > 0 then fib792[1]

else if SecondsFromTime(1615)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * -.79;

#plot f792 = fib792;

#f792.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f792.SetDefaultColor( Createcolor(218,165,32));

def fib888 = if IsNaN(close) and SecondsTillTime(1615) > 0 then fib888[1]

else if SecondsFromTime(1615)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * -.88;

#plot f888 = fib888;

#f888.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f888.SetDefaultColor( Createcolor(218,165,32));

def fib179 = if IsNaN(close) and SecondsTillTime(1615) > 0 then fib179[1]

else if SecondsFromTime(1615)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * 1.79;

#plot f179 = fib179;

#f179.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f179.SetDefaultColor( Createcolor(255,0,0));

def fib188 = if IsNaN(close) and SecondsTillTime(1615) > 0 then fib188[1]

else if SecondsFromTime(1615)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * 1.88;

#plot f188 = fib188;

#f188.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f188.SetDefaultColor( Createcolor(255,0,0));

def fib1792 = if IsNaN(close) and SecondsTillTime(1615) > 0 then fib1792[1]

else if SecondsFromTime(1615)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * -1.79;

#plot f1792 = fib1792;

#f1792.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f1792.SetDefaultColor( Createcolor(255,0,0));

def fib1882 = if IsNaN(close) and SecondsTillTime(1615) > 0 then fib1882[1]

else if SecondsFromTime(1615)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * -1.88;

#plot f1882 = fib1882;

#f1882.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f1882.SetDefaultColor( Createcolor(255,0,0));

def fib479 = if IsNaN(close) and SecondsTillTime(1600) > 0 then fib479[1]

else if SecondsFromTime(1600)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * 4.79;

#plot f479 = fib479;

#f479.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f479.SetDefaultColor( Createcolor(255,0,0));

def fib488 = if IsNaN(close) and SecondsTillTime(1600) > 0 then fib488[1]

else if SecondsFromTime(1600)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * 4.88;

#plot f488 = fib488;

#f488.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f488.SetDefaultColor( Createcolor(255,0,0));

def fib4792 = if IsNaN(close) and SecondsTillTime(1600) > 0 then fib4792[1]

else if SecondsFromTime(1600)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * -4.79;

#plot f4792 = fib4792;

#f4792.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f4792.SetDefaultColor( Createcolor(255,0,0));

def fib4889 = if IsNaN(close) and SecondsTillTime(1600) > 0 then fib4889[1]

else if SecondsFromTime(1600)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * -4.88;

#plot f4889 = fib4889;

#f4889.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f4889.SetDefaultColor( Createcolor(255,0,0));

def fib633 = if IsNaN(close) and SecondsTillTime(1600) > 0 then fib633[1]

else if SecondsFromTime(1600)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * 6.33;

#plot f633 = fib633;

#f633.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f633.SetDefaultColor( Createcolor(192,192,192));

def fib6332 = if IsNaN(close) and SecondsTillTime(1600) > 0 then fib6332[1]

else if SecondsFromTime(1600)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * -6.33;

#plot f6332 = fib6332;

#f6332.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f6332.SetDefaultColor( Createcolor(192,192,192));

def fib779 = if IsNaN(close) and SecondsTillTime(1600) > 0 then fib779[1]

else if SecondsFromTime(1600)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * 7.79;

#plot f779 = fib779;

#f779.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f779.SetDefaultColor( Createcolor(255,0,0));

def fib788 = if IsNaN(close) and SecondsTillTime(1600) > 0 then fib788[1]

else if SecondsFromTime(1600)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * 7.88;

#plot f788 = fib788;

#f788.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f788.SetDefaultColor( Createcolor(255,0,0));

def fib7792 = if IsNaN(close) and SecondsTillTime(1600) > 0 then fib7792[1]

else if SecondsFromTime(1600)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * -7.79;

#plot f7792 = fib7792;

#f7792.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f7792.SetDefaultColor( Createcolor(255,0,0));

def fib7882 = if IsNaN(close) and SecondsTillTime(1600) > 0 then fib7882[1]

else if SecondsFromTime(1600)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * -7.88;

#plot f7882 = fib7882;

#f7882.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f7882.SetDefaultColor( Createcolor(255,0,0));

def fib933 = if IsNaN(close) and SecondsTillTime(1600) > 0 then fib933[1]

else if SecondsFromTime(1600)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * 9.33;

#plot f933 = fib933;

#f933.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f933.SetDefaultColor( Createcolor(192,192,192));

def fib9332 = if IsNaN(close) and SecondsTillTime(1600) > 0 then fib9332[1]

else if SecondsFromTime(1600)[1] >= 0 or

(SecondsFromTime(0000) > 0 and SecondsFromTime(rangeStart) < 0)

then Double.NaN

else LA + Range * -9.33;

#plot f9332 = fib9332;

#f9332.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#f9332.SetDefaultColor( Createcolor(192,192,192));

input bubble = yes;

input bubblemover = 3;

def b = bubblemover;

def b1 = b + 1;

plot scan = close crosses above fib792;

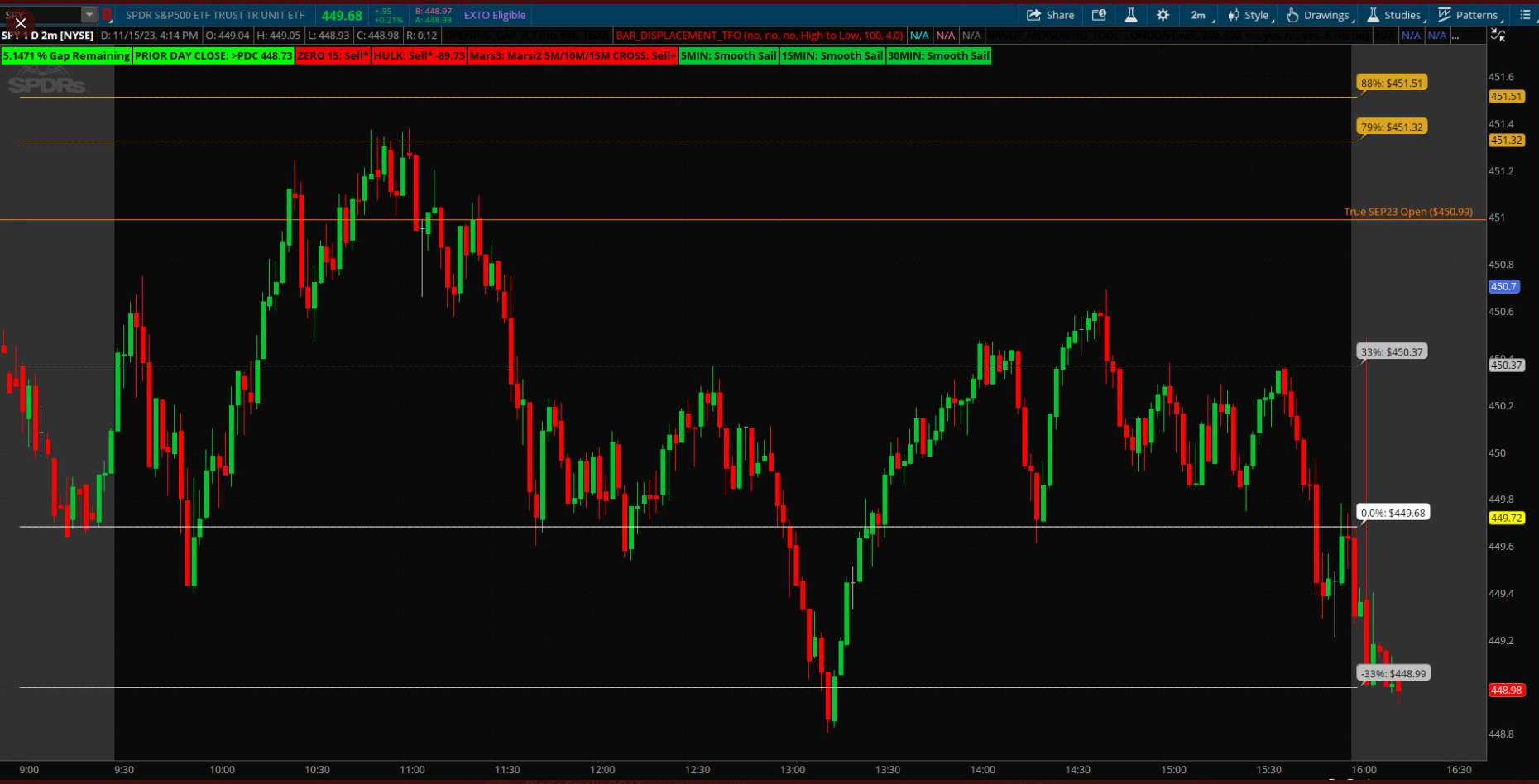

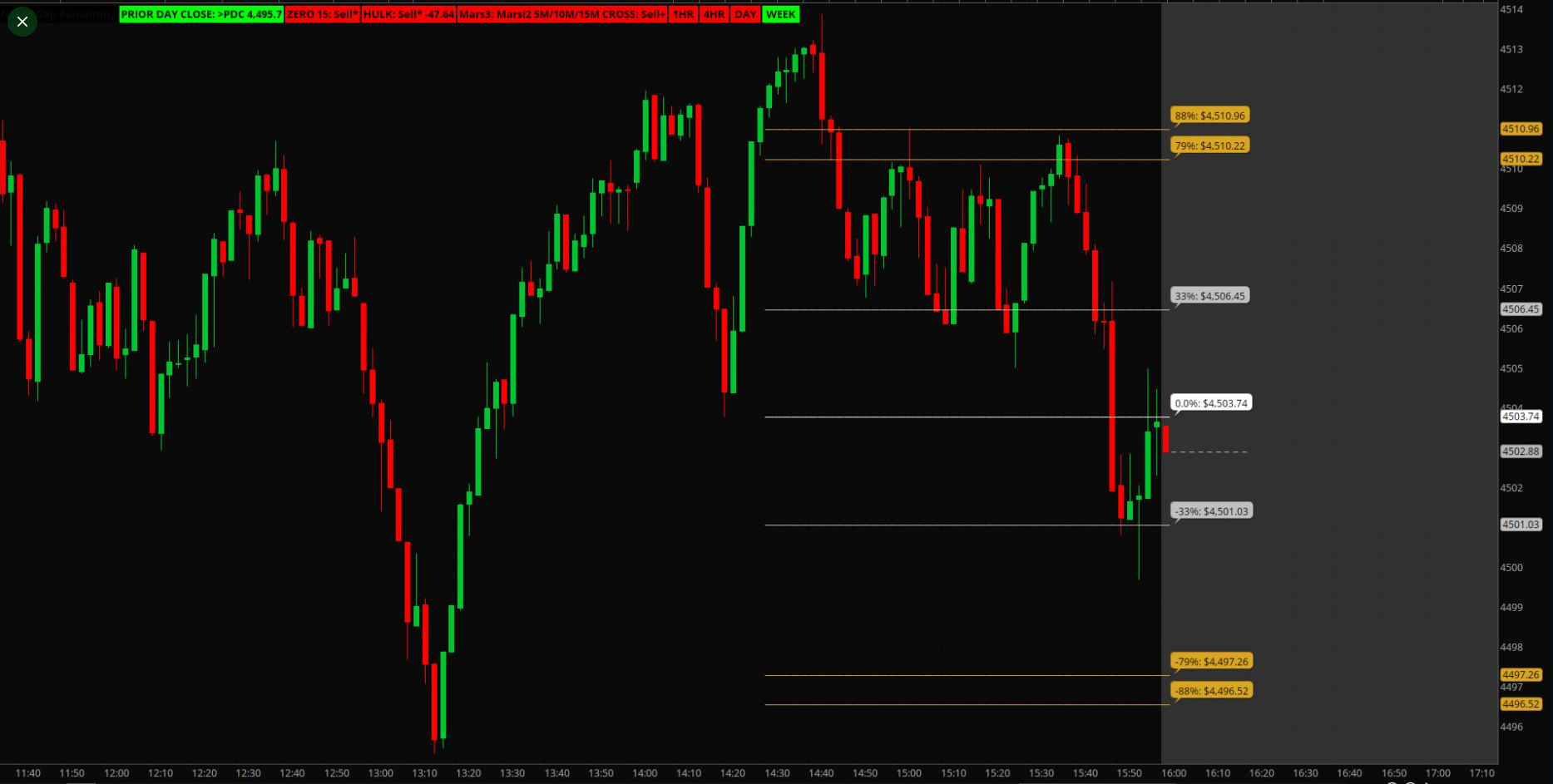

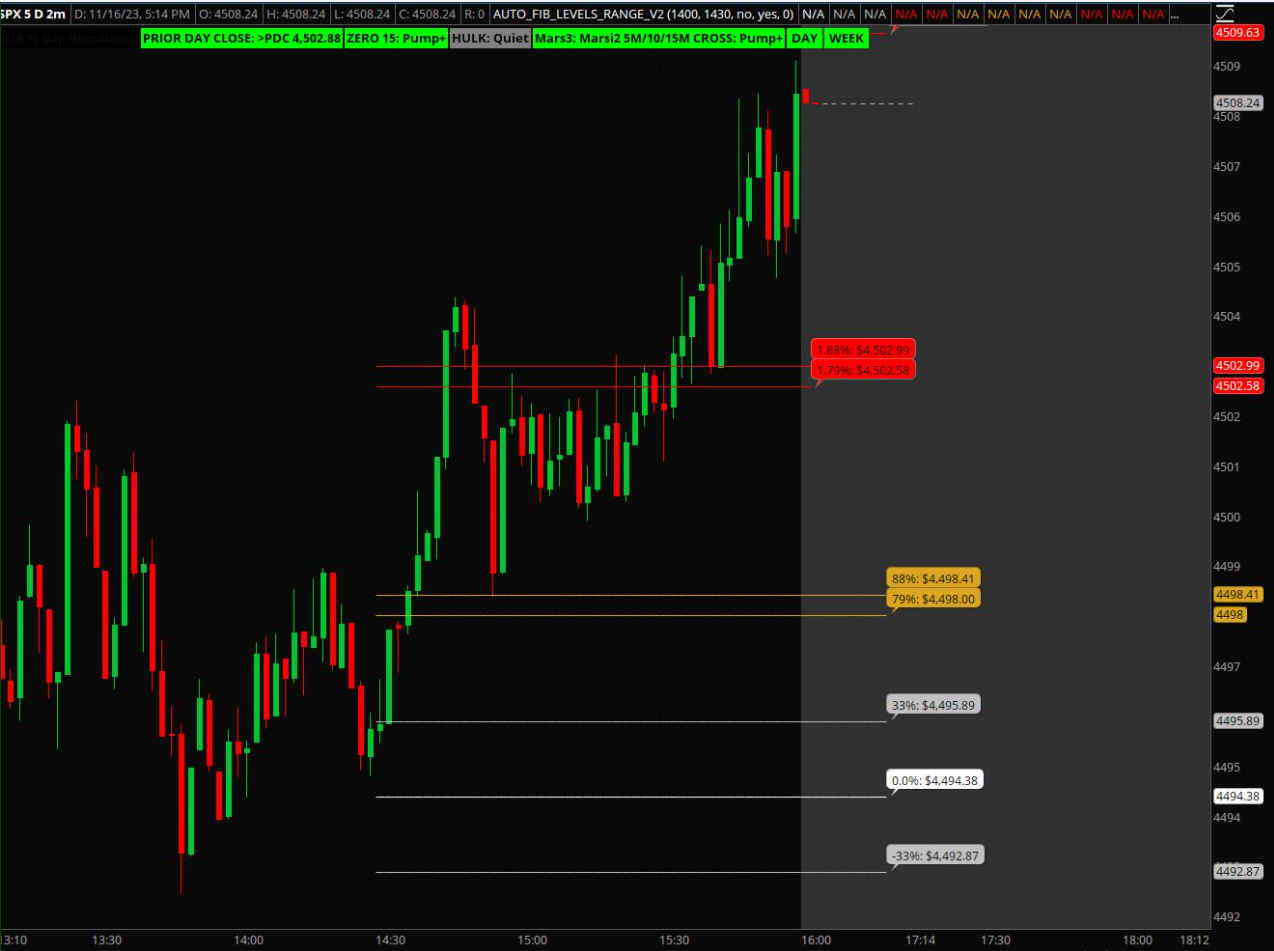

In the screenshot fib 792 is in golden color . i want the scan to chk if the list of stocks get in to this range in 5 minute interval

I did line by line comparison with the FIB code that you shared earlier . There is not much difference except there is an additional condition for the each definitions defined .