Intro:

In this choppy, super volatile trading environment I decided it was time to look for ways to smooth out the risk/reward ratios. Whether or not you believe we are in the middle of a sector rotation we can all agree things are getting a little sketchy in the market. Using two prebuilt thinkorswim indicators I built a scan that gives us low volatility combined with a high probability for above average returns.

The Conditions:

Caveats:

The Scan: https://tos.mx/JJUDFQz

In this choppy, super volatile trading environment I decided it was time to look for ways to smooth out the risk/reward ratios. Whether or not you believe we are in the middle of a sector rotation we can all agree things are getting a little sketchy in the market. Using two prebuilt thinkorswim indicators I built a scan that gives us low volatility combined with a high probability for above average returns.

The Conditions:

- 7 day RSI > 60

- 60 day RSI > 50

- BollingerBandwidth < 10

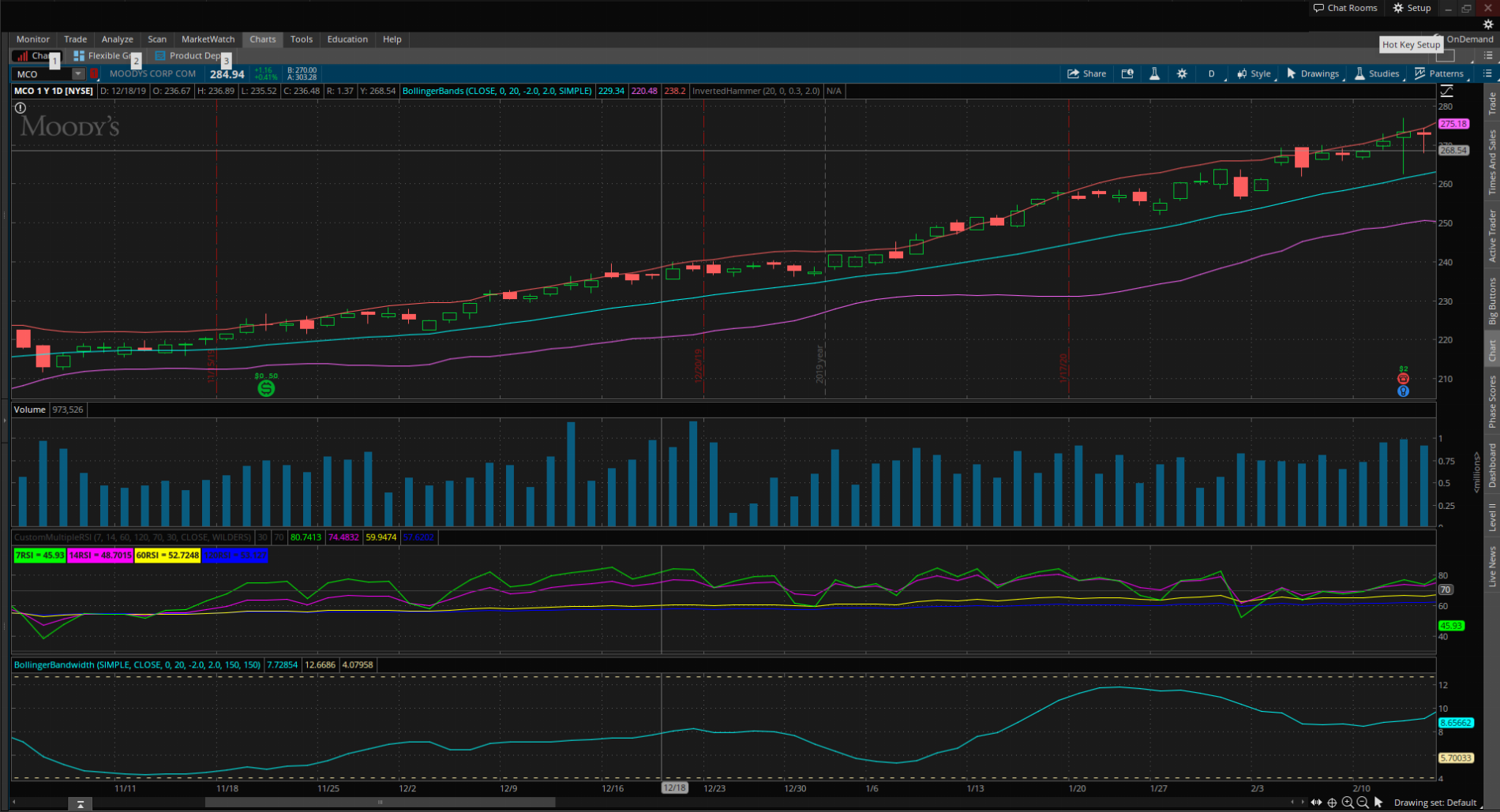

- RSI is a measure of momentum, many people view a high RSI as being overbought. I agree when there is a spike in price. I disagree when the price is slowly trending up. A slowly upward trending stock can hold high levels of RSI for extended periods of time. Consider the stock MCO during the periods of 11/2019-2/2020. The 14 day RSI of MCO was above 70 most of that period. During that same time the stock ran 27%.

- The BollingerBandwidth is the measure of volatility. High values imply high volatility, whereas low values imply low volatility. To my example, during 11/2019 MCO held the BollingerBandwidth value of less than 12.

Caveats:

- It should be a given but cherry pick the best charts for best results

- Manage your risks

- DD is your responsibility, its your money not mine

The Scan: https://tos.mx/JJUDFQz

Last edited: