You should upgrade or use an alternative browser.

Trust The Levels - Trade Options In ThinkOrSwim

- Thread starter METAL

- Start date

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

adriantran

New member

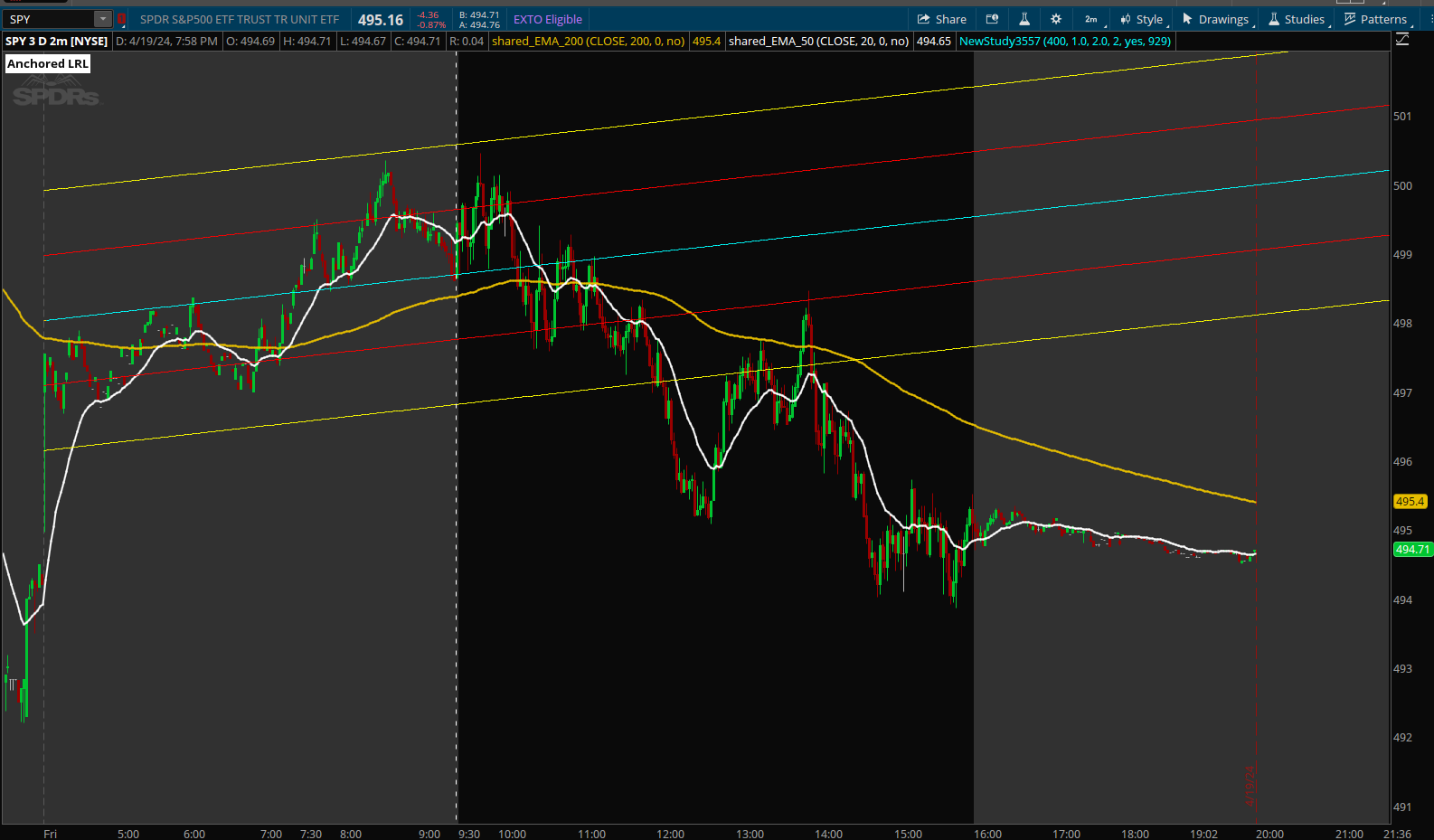

I have the same issue where the regression channel doesn't show but the standard deviation channel does. I changed the starttime to 0 instead and it shows up. Might work for you.Thank you very much for the response. I dont know what's causing it but when I remove price zoom, I could see the 2nd dev yellow lines. They are disappeared for SPY. Here are the screen shots

Appreciate all your help and contribution to this forum.

Thanks again for amazing strategy. Will watch and post results from this week.

I have the same issue where the regression channel doesn't show but the standard deviation channel does. I changed the starttime to 0 instead and it shows up. Might work for you.

The issue is that the code I posted has a very specific starttime. In a heavily traded symbol like SPY, there is usually activity. In the case of stocks, that is not always the case and if so, the indicator will not plot unless you do as you did by changing the starttime.

I have another version that modifies a Mobius script. It has a fix that seems to work in the event of the above issue by using getday() != getday()[1]. Otherwise, the input times work.

This works on charts other than TODAY charts.

Code:

Code:#Mobius_Anchored_Linear_Regression_modified_End_at_Cond_y_Extended_Option #08:35 Mobius: Here's the anchored Regression Channel I use AddLabel(1, "Anchored LRL", Color.WHITE); # Time Anchored Regression Channel # Mobius # V01.01.2016 input StartTime = 0400; input Channel_1_Width = 1.0; input Channel_2_Width = 2.00; input LineWeight = 2; script E { input y = close; input n = 20; def s = fold i = 0 to n with j do j + GetValue(y, i); plot D = s; } # Variables def o = open; def h = high; def l = low; def c = close; def x = BarNumber(); def nan = Double.NaN; def xx = if IsNaN(c[-1]) and !IsNaN(c) then x else xx[1]; def firstBar = if SecondsFromTime(StartTime) == 0 then x else if (SecondsFromTime(StartTime) != 0) and GetDay() != GetDay()[1] then x else firstBar[1]; #Options to End Plot Based Upon Condition and Extended from there input extend = yes; input endtime = 0929; #Examples of Some Potential Conditions def cond_y = if SecondsFromTime(endtime) <= 0 then x else nan; #if high==high(period=aggregationPeriod.DAY) then barnumber() else double.nan; #if low==low(period=aggregationPeriod.DAY) then barnumber() else double.nan; AddVerticalLine(x == HighestAll(cond_y), " ", Color.WHITE); def y = if x == 1 or IsNaN(close) then nan else if Between(x, HighestAll(firstBar), HighestAll(cond_y)) then close else y[1]; ############# def S_y = if x == HighestAll(firstBar) then y else if x > HighestAll(firstBar) then S_y[1] + y else S_y[1]; def S_x = if x == HighestAll(firstBar) then 1 else if x > HighestAll(firstBar) then S_x[1] + 1 else S_x[1]; def x0_ = HighestAll(xx) - firstBar; def x1 = HighestAll(if !IsNaN(y) and IsNaN(y[-1]) then x else nan); def x0 = HighestAll(if GetValue(x, -x0_) == x1 then x else nan); def x_ = if GetValue(x, -x0_) >= x1 then x - x0 else x_[1]; def Ex = E(x_, x0_); def Ey = E(y, x0_); def Exy = E(x_ * y, x0_); def Exsq = E(Sqr(x_), x0_); def b = (x0_ * Exy - (Ex * Ey)) / (x0_ * Exsq - (Ex * Ex)); def a = (GetValue(Ey, x - x1) - GetValue(b, x - x1) * GetValue(Ex, x - x1)) / x0_; def LR = a + (GetValue(b, x - x1) * x_); def r = Max(h, c[1]) - Min(l, c[1]); def Er = E(r, x0_) / x0_; def mean = S_y / S_x; def SD = Sqrt((1 / S_x) * (E(Sqr(y - mean), S_x))); # Plots plot LRL = if extend == no and x <= HighestAll(cond_y) #x >= x0 # x is defined as barnumber() then LR else if extend == yes and x >= x0 then LR else nan; LRL.SetStyle(Curve.SHORT_DASH); LRL.SetLineWeight(LineWeight + 1); LRL.AssignValueColor(if GetValue(a, x - x1) < LR then Color.CYAN else Color.ORANGE); LRL.HideBubble(); LRL.HideTitle(); plot upper1 = LRL + (HighestAll(SD) * Channel_1_Width); upper1.SetStyle(Curve.MEDIUM_DASH); upper1.SetLineWeight(LineWeight); upper1.SetDefaultColor(Color.RED); upper1.HideBubble(); upper1.HideTitle(); plot lower1 = LRL - (HighestAll(SD) * Channel_1_Width); lower1.SetStyle(Curve.MEDIUM_DASH); lower1.SetLineWeight(LineWeight); lower1.SetDefaultColor(Color.RED); lower1.HideBubble(); lower1.HideTitle(); plot upper2 = LRL + (HighestAll(SD) * Channel_2_Width); upper2.SetStyle(Curve.LONG_DASH); upper2.SetLineWeight(LineWeight); upper2.SetDefaultColor(Color.YELLOW); upper2.HideBubble(); upper2.HideTitle(); plot lower2 = LRL - (HighestAll(SD) * Channel_2_Width); lower2.SetStyle(Curve.LONG_DASH); lower2.SetLineWeight(LineWeight); lower2.SetDefaultColor(Color.YELLOW); lower2.HideBubble(); lower2.HideTitle(); # End Code Time Anchored Regression Channel #

Thank you. Tried using this version. Some how its not plotting regression lines. Tried with Spy and other stocks with same time frame you used. Anything to be changed?The issue is that the code I posted has a very specific starttime. In a heavily traded symbol like SPY, there is usually activity. In the case of stocks, that is not always the case and if so, the indicator will not plot unless you do as you did by changing the starttime.

I have another version that modifies a Mobius script. It has a fix that seems to work in the event of the above issue by using getday() != getday()[1]. Otherwise, the input times work.

This works on charts other than TODAY charts.

Thank you. Tried using this version. Some how its not plotting regression lines. Tried with Spy and other stocks with same time frame you used. Anything to be changed?

Here is a link to the SPY 3d2m chart displayed below http://tos.mx/DalVmJL

The link constains the studies shown in the image

mod note:

unfortunately, some members will not have shared links enabled until after the May 13 integration

workarounds: https://usethinkscript.com/threads/...tions-in-thinkorswim.18367/page-4#post-140610

BMartin1776

New member

I altered the start time to 830(hasnt happened yet at time I post this! I also tried 7 and I get the same plot) and it plots from 1 am on a 2mToday chart

WEDenterprise

New member

JP782

Active member

Thanks a lot. Appreciate all your help.Here is a link to the SPY 3d2m chart displayed below http://tos.mx/DalVmJL

The link constains the studies shown in the image

mod note:

View attachment 21664

Anchored LRC does not work correctly.

I altered the start time to 830(hasnt happened yet at time I post this! I also tried 7 and I get the same plot) and it plots from 1 am on a 2mToday chart

Not sure which LRC code you are referring to, so this relates to the last code I posted in post #65

The code has been modified to hopefully plot on various timeframe settings. including TODAY, and also work on most symbols, including futures

Here is SPY 3d2m charts starting at 0700-0929 and 0400-0929

Here is SPY 3d2m at 0400-929, /ES 3c2m at 1800-929 and GOOG 2mToday at 0400-929

Here is full code used above with just time input differences

Code:#Mobius_Anchored_Linear_Regression_modified_End_at_Cond_y_Extended_Option_v1 #08:35 Mobius: Here's the anchored Regression Channel I use # Time Anchored Regression Channel # Mobius # V01.01.2016 input StartTime = 0400; input extend = yes; input endtime = 0929; input Channel_1_Width = 0.70; input Channel_2_Width = 1.00; input lineweight = 1; def sec1 = SecondsFromTime(StartTime); def isTime1 = (sec1 >= 0 and sec1[1] < 0) or (sec1 < sec1[1] and sec1 >= 0); script E { input y = close; input n = 20; def s = fold i = 0 to n with j do j + GetValue(y, i); plot D = s; } # Variables def o = open; def h = high; def l = low; def c = close; def x = BarNumber(); def nan = Double.NaN; def xx = if IsNaN(c[-1]) and !IsNaN(c) then x else xx[1]; def firstBar = if isTime1 == 1 then x + 1 else firstBar[1]; #Options to End Plot Based Upon Condition and Extended from there #Examples of Some Potential Conditions def cond_y = if SecondsFromTime(endtime) <= 0 then x else nan; #if high==high(period=aggregationPeriod.DAY) then barnumber() else double.nan; #if low==low(period=aggregationPeriod.DAY) then barnumber() else double.nan; AddVerticalLine(x == HighestAll(cond_y), " ", Color.WHITE); def y = if x == 1 or IsNaN(close) then nan else if Between(x, HighestAll(firstBar), HighestAll(cond_y)) then close else y[1]; ############# def S_y = if x == HighestAll(firstBar) then y else if x > HighestAll(firstBar) then S_y[1] + y else S_y[1]; def S_x = if x == HighestAll(firstBar) then 1 else if x > HighestAll(firstBar) then S_x[1] + 1 else S_x[1]; def x0_ = HighestAll(xx) - firstBar; def x1 = HighestAll(if !IsNaN(y) and IsNaN(y[-1]) then x else nan); def x0 = HighestAll(if GetValue(x, -x0_) == x1 then x else nan); def x_ = if GetValue(x, -x0_) >= x1 then x - x0 else x_[1]; def Ex = E(x_, x0_); def Ey = E(y, x0_); def Exy = E(x_ * y, x0_); def Exsq = E(Sqr(x_), x0_); def b = (x0_ * Exy - (Ex * Ey)) / (x0_ * Exsq - (Ex * Ex)); def a = (GetValue(Ey, x - x1) - GetValue(b, x - x1) * GetValue(Ex, x - x1)) / x0_; def LR = a + (GetValue(b, x - x1) * x_); def r = Max(h, c[1]) - Min(l, c[1]); def Er = E(r, x0_) / x0_; def mean = S_y / S_x; def SD = Sqrt((1 / S_x) * (E(Sqr(y - mean), S_x))); # Plots plot LRL = if extend == no and x <= HighestAll(cond_y) #x >= x0 # x is defined as barnumber() then LR else if extend == yes and x >= x0 then LR else nan; LRL.SetStyle(Curve.SHORT_DASH); LRL.SetLineWeight(lineweight + 1); LRL.AssignValueColor(if GetValue(a, x - x1) < LR then Color.CYAN else Color.ORANGE); LRL.HideBubble(); LRL.HideTitle(); plot upper1 = LRL + (HighestAll(SD) * Channel_1_Width); upper1.SetStyle(Curve.MEDIUM_DASH); upper1.SetLineWeight(lineweight); upper1.SetDefaultColor(Color.RED); upper1.HideBubble(); upper1.HideTitle(); plot lower1 = LRL - (HighestAll(SD) * Channel_1_Width); lower1.SetStyle(Curve.MEDIUM_DASH); lower1.SetLineWeight(lineweight); lower1.SetDefaultColor(Color.RED); lower1.HideBubble(); lower1.HideTitle(); plot upper2 = LRL + (HighestAll(SD) * Channel_2_Width); upper2.SetStyle(Curve.LONG_DASH); upper2.SetLineWeight(lineweight); upper2.SetDefaultColor(Color.YELLOW); upper2.HideBubble(); upper2.HideTitle(); plot lower2 = LRL - (HighestAll(SD) * Channel_2_Width); lower2.SetStyle(Curve.LONG_DASH); lower2.SetLineWeight(lineweight); lower2.SetDefaultColor(Color.YELLOW); lower2.HideBubble(); lower2.HideTitle(); # End Code Time Anchored Regression Channel #

Sorry to bother. Any way to make it work on mobile?Not sure which LRC code you are referring to, so this relates to the last code I posted in post #65

The code has been modified to hopefully plot on various timeframe settings. including TODAY, and also work on most symbols, including futures

Here is SPY 3d2m charts starting at 0700-0929 and 0400-0929

Here is SPY 3d2m at 0400-929, /ES 3c2m at 1800-929 and GOOG 2mToday at 0400-929

Here is full code used above with just time input difference

Not sure which LRC code you are referring to, so this relates to the last code I posted in post #65

The code has been modified to hopefully plot on various timeframe settings. including TODAY, and also work on most symbols, including futures

Here is SPY 3d2m charts starting at 0700-0929 and 0400-0929

Here is SPY 3d2m at 0400-929, /ES 3c2m at 1800-929 and GOOG 2mToday at 0400-929

Here is full code used above with just time input differences

Sorry, I do not use mobile charts.Sorry to bother. Any way to make it work on mobile?

what indicator is the support/resistance green bars? I can't seem to get my chart setup to look like yours even after importing the main grid and the ema color studyTodays LRC Strategy.

Thank You @SleepyZ .The issue is that the code I posted has a very specific starttime. In a heavily traded symbol like SPY, there is usually activity. In the case of stocks, that is not always the case and if so, the indicator will not plot unless you do as you did by changing the starttime.

I have another version that modifies a Mobius script. It has a fix that seems to work in the event of the above issue by using getday() != getday()[1]. Otherwise, the input times work.

This works on charts other than TODAY charts.

I draw those manually every morning using higher TF as Supply/Demand and Support/Resistance zones.what indicator is the support/resistance green bars? I can't seem to get my chart setup to look like yours even after importing the main grid and the ema color study

Yeah I did. It worked extremely well. I took profit at the rejection of the orange line and left runners for the breakdown.

Sir please put daily profit lossDid you trade spy at 9:50

@SleepyZ is there any reason why your Mobius LRC script wouldn't work on ES futures chart? It did work for me this week, but then suddenly it doesn't work on an ES chart. Yes, works on a SPY chart. When I open an ES chart and apply the script, it flashes likes it's going to work, but then it goes away. Hmmm. Any thoughts? I should add ... thank you for sharing your expertise.

Using the code in this link worked just now

https://usethinkscript.com/threads/trust-the-levels-trade-options-in-thinkorswim.18367/post-140739

- Status

- Not open for further replies.

Similar threads

-

Money Zone Auto Fib Levels For ThinkOrSwim

- Started by BrooklynMintCapital

- Replies: 12

-

Hourly CCI -200/200 levels For ThinkOrSwim

- Started by autoloader

- Replies: 3

-

Swing Trade Stocks Outperforming Market In ThinkOrSwim

- Started by tellyt

- Replies: 15

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

Money Zone Auto Fib Levels For ThinkOrSwim

- Started by BrooklynMintCapital

- Replies: 12

-

Hourly CCI -200/200 levels For ThinkOrSwim

- Started by autoloader

- Replies: 3

-

Swing Trade Stocks Outperforming Market In ThinkOrSwim

- Started by tellyt

- Replies: 15

-

Similar threads

-

Money Zone Auto Fib Levels For ThinkOrSwim

- Started by BrooklynMintCapital

- Replies: 12

-

Hourly CCI -200/200 levels For ThinkOrSwim

- Started by autoloader

- Replies: 3

-

Swing Trade Stocks Outperforming Market In ThinkOrSwim

- Started by tellyt

- Replies: 15

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/