@Vince Field - I think every trader goes through their own educational/trading journey and then decides what is right for them. But my only thought is you trade such a wide range of stocks, perhaps consider narrowing your interest to a handful in a similar industry that have wider ranges.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trading Strategies Onenote Document

- Thread starter Vince Field

- Start date

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Vince Field

Active member

Can you give me some of the names of these professional traders you are referring to so I can do some research into their methods?"Most pro traders I've learned from usually use key levels to determine their stop loss. For example, the low of a consolidation range, nearby moving averages that are holding trend, vwap, trend swings, etc. Perhaps there are some scenarios when a 1 min candle low would be an appropriate stop loss. Probably a bad idea to only use that standard for every trade."This just my opinion but I can be wrong or right. I get what your saying but professional traders know where it moves and if doesn't go their way they get out quickly. In the end, they could always get back in and save money. I get what you saying you would think that a bigger stop loss would probably give you maybe a better probability without stoping out. Me personally I don't think so the probability is probably around the same.

Vince Field

Active member

I trade stocks that are "in play." This means stocks that gap up and have a news catalyst and thus heavy volume and high relative volume. I essentially trade the same stocks as most other momentum day traders. These stocks have the highest probability of making big moves and I see some of these traders having great success with the same stocks I am trading.@Vince Field - I think every trader goes through their own educational/trading journey and then decides what is right for them. But my only thought is you trade such a wide range of stocks, perhaps consider narrowing your interest to a handful in a similar industry that have wider ranges.

Vince Field

Active member

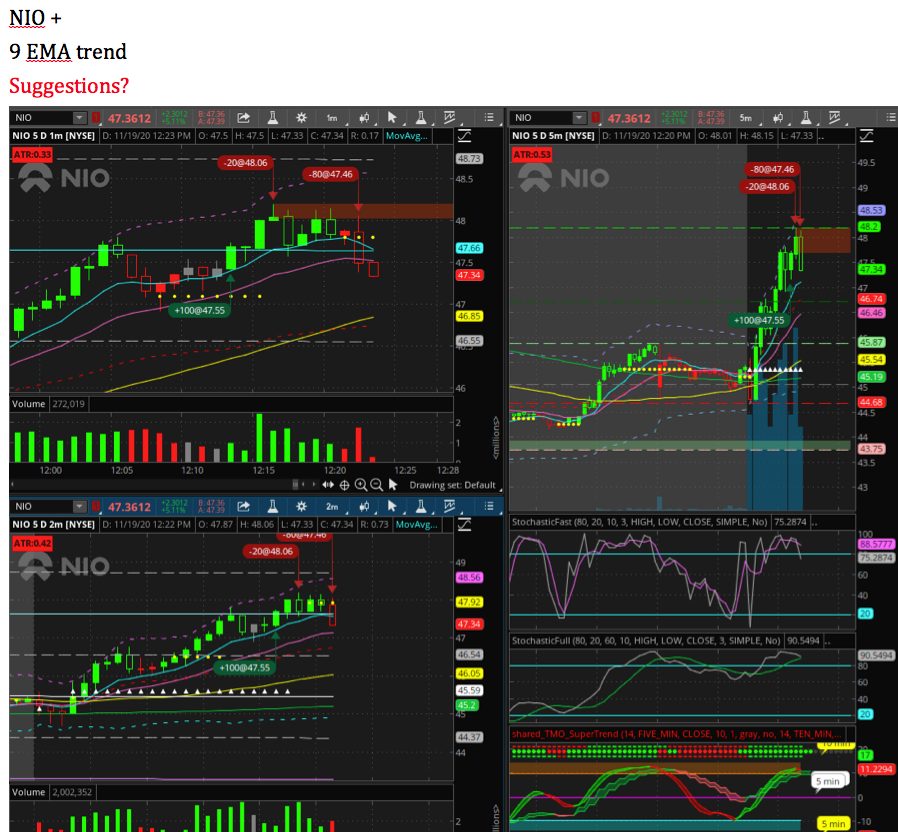

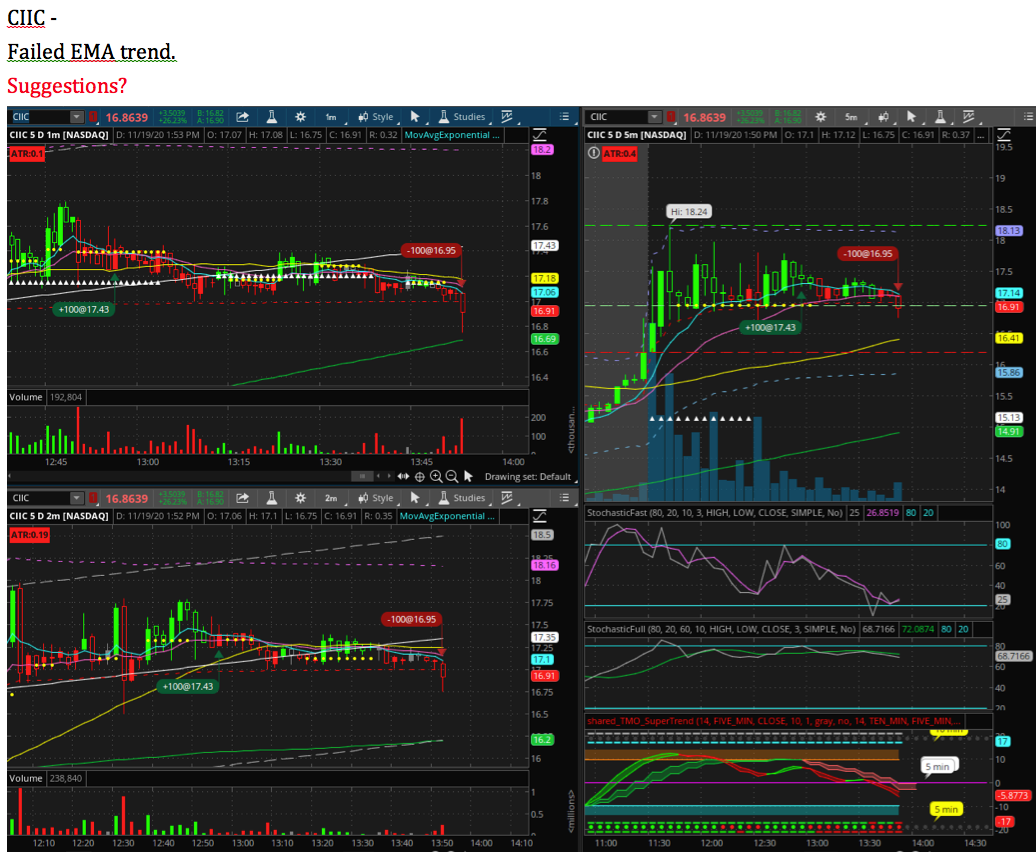

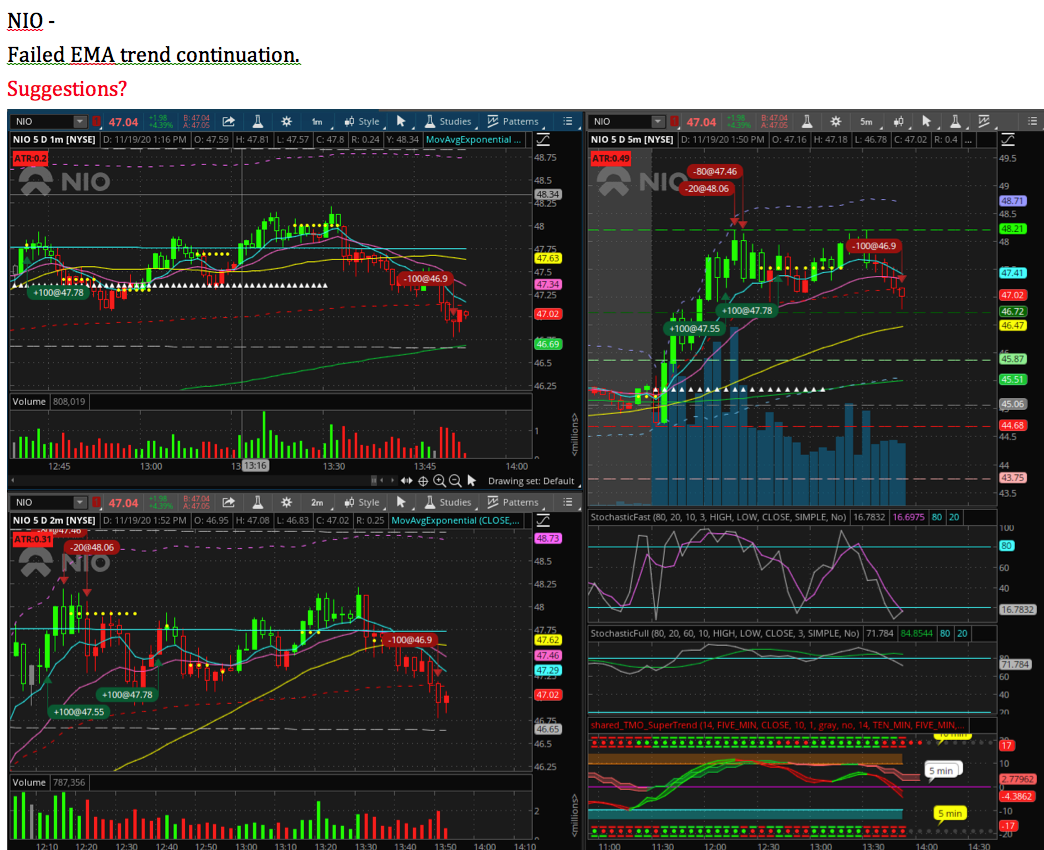

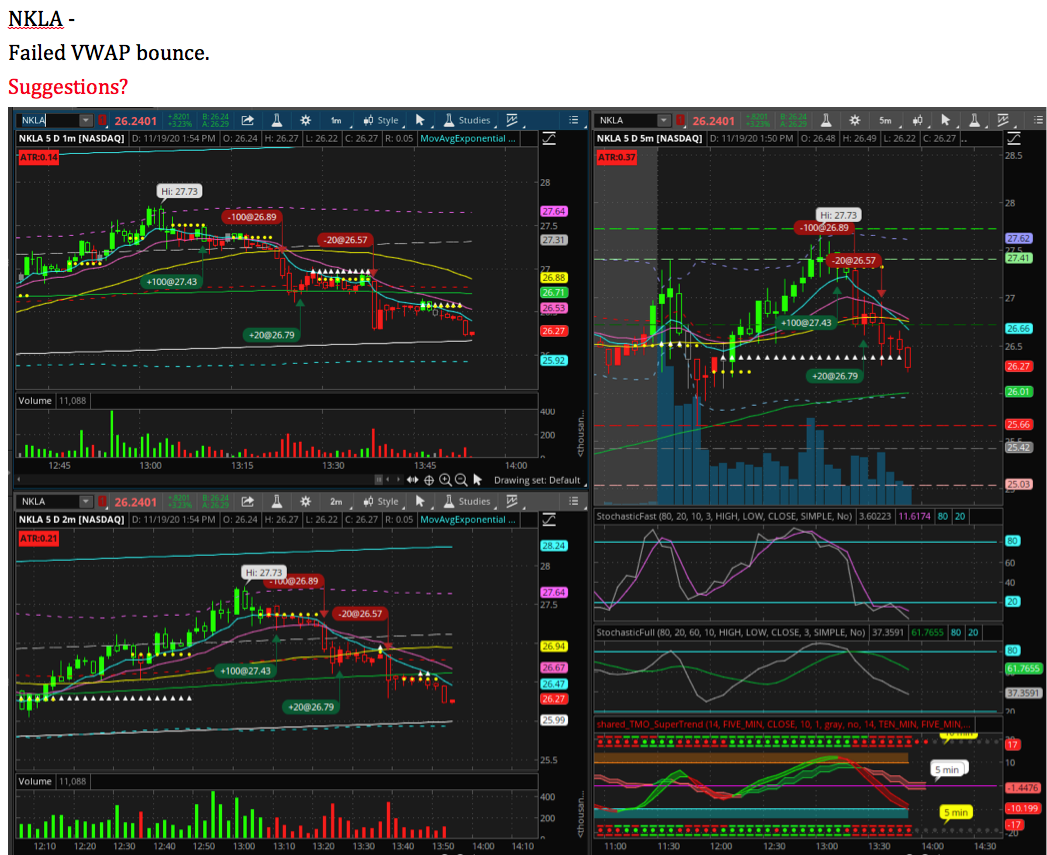

November 19, 2020

1 winner, 6 losers

Today I seemed to arrive late to the party in almost every trade.

Today's notes:

Be careful entering when slow stochastic is overbought?

Failed 2nd breakout from flat top rising wedge (bearish indication?)

5 EMA pullbacks before entrance (exhausted?)

1 winner, 6 losers

Today I seemed to arrive late to the party in almost every trade.

Today's notes:

Be careful entering when slow stochastic is overbought?

Failed 2nd breakout from flat top rising wedge (bearish indication?)

5 EMA pullbacks before entrance (exhausted?)

Looking good my only suggestions are to watch a chart larger picture less confusing than with all charts on one page and less cluttered IMO. Most important watch your daily/weekly fibs on the same chart. Here is a great script was written on-site. thinkorswim Sharing (tos.mx)

disregard my indicators but see how the whole picture opens up. Fibs daily on lesser time frames. You will find that stocks move between fib lines say 1-0 or 0-1 unless price breaks above or below. thinkorswim Sharing (tos.mx) fibs are it. 5-15 min charts can open your horizi=on maybe.

good job

disregard my indicators but see how the whole picture opens up. Fibs daily on lesser time frames. You will find that stocks move between fib lines say 1-0 or 0-1 unless price breaks above or below. thinkorswim Sharing (tos.mx) fibs are it. 5-15 min charts can open your horizi=on maybe.

good job

Vince Field

Active member

I'm creating a database of day trading strategies taken from trade reviews by successful traders. I plan on updating it daily with new strategies or examples of already covered strategies. You can access it here: https://1drv.ms/u/s!Ag3p10maeR_bjEr8zI1BRLgu1rUX?e=wf5foX

If anyone knows of any good traders who teach strategies or do trade reviews, feel free to share and I'll add them to the document.

If anyone knows of any good traders who teach strategies or do trade reviews, feel free to share and I'll add them to the document.

bizzet

New member

You mean just like this one? https://onedrive.live.com/View.aspx...-9e49-4cef983b8fc2/)&authkey=!AM6a5se-lH2yutg

lol. Little late to the show bud

lol. Little late to the show bud

Vince Field

Active member

No, not at all like that. Did you bother to open the link to see what it was that I shared? Like I said, It's a collection of day trading strategies. Mainly rules, patterns, price action scenarios and entry points in which high probability trades should be taken. What you've shared is a very small collection of thinkscripts. There is actually a much larger collection of thinkscripts here on the forum.You mean just like this one? https://onedrive.live.com/View.aspx?resid=186A54BC7E98AF81!114&wd=target(Introduction.one|4483a437-5d2c-4069-9f91-aa9bbfcf70b9/Welcome|f99ae07a-d245-4639-9e49-4cef983b8fc2/)&authkey=!AM6a5se-lH2yutg

lol. Little late to the show bud

Vince Field

Active member

I added some awesome strategies tonight from Oliver Velez. It was my first time checking out his youtube channel and he seems to be a good teacher. Plus his strategies are simple and appear to be effective. Check out the 20 MA Uptrend/Downtrend, Engulfing Bull/Bear 180 Candle, Small Candle Engulfing and the Bullish/Bearish Power Candle strategies.

Last edited:

https://1drv.ms/u/s!Ag3p10maeR_bjEr8zI1BRLgu1rUX?e=wf5foX

The link loads just fine for me.

The link loads just fine for me.

Vince Field

Active member

You need the OneNote app.Would love to take a look - however, it returns an error "Server Not Found" - is it possible to port to OneDrive, Box, Google Sheets, etc.?

scott69

Active member

Having an inventory of strategies is a great achievement, and it is helpful for anyone that has a strategy in mind and just needs to put that strategy into a code. My advice for anyone that is early in the game, though, is to first decide on what type of trader you are going to be based on your experience, abilities and time to devote. Are you going to be a day trader glued to the screen all day, a swing trader looking for short to intermediate entries, are you looking to feed a long term / retirement account for years? Compiling a database of indicators is helpful, but this site, @BenTen "usethinkscript" is also a wonderful compendium of various strategies, abilities, talents, coders, traders and investors. It doesn't hurt for the user of these sites to tinker with dozens of strategies, but that can be time consuming if you evaluate each idea thoroughly as you should. It is better to have an idea of which direction you going first. Thanks @Vince Field for your work. (you touched a soft spot in my heart as I used to be - still am? - the ultimate collector  )

)

Last edited:

Vince Field

Active member

No problem my man. I figure a reference guide is a good way to solidify my strategies, and the research I'm doing is opening my eyes not just to new strategies, but to new and different ways of executing my current strategies. As a new trader I can't contribute much to the forum but at least this can be helpful to others. Don't wanna be a complete leech lol.Having a inventory of strategies is a great achievement, and it is helpful for anyone that has a strategy in mind and just needs to put that strategy into a code. My advice for anyone that is early in the game, though, is to first decide on what type of trader you are going to be based on your experience, abilities and time to devote. Are you going to be a day trader glued to the screen all day, a swing trader looking for short to intermediate entries, are you looking to feed a long term / retirement account for years? Compiling a database of indicators is helpful, but this site, @BenTen "usethinkscript" is also a wonderful compendium of various strategies, abilities, talents, coders, traders and investors. It doesn't hurt for the user of these sites to tinker with dozens of strategies, but that can be time consuming if you evaluate each idea thoroughly as you should. It is better to have an idea of which direction you going first. Thanks @Vince Field for your work. (you touched a soft spot in my heart as I used to be - still am? - the ultimate collector)

Tonight I added an ORB strategy from the youtube channel Live Traders which is simple and looks pretty effective. It's called 3 & 4 Bar ORB (long and short).

bizzet

New member

Sorry, I meant this oneNo, not at all like that. Did you bother to open the link to see what it was that I shared? Like I said, It's a collection of day trading strategies. Mainly rules, patterns, price action scenarios and entry points in which high probability trades should be taken. What you've shared is a very small collection of thinkscripts. There is actually a much larger collection of thinkscripts here on the forum.

https://onedrive.live.com/redir?resid=2FF733D1BA1E1E79!404&page=View&wd=target(Welcome.one|a4f3f17e-e630-4d25-9b5b-ec957945a752/1. Introduction Usage (updated 02.13.|30461c4b-420e-4b83-b56f-55faf5d1461b/)

I read the notebook but it just looks like strategies in plain English that I have seen before already in thinkscript?

Sorry to be negative. Just my 2 cents

Vince Field

Active member

Right, that is the large collection of thinkscripts I mentioned in my previous reply to you, which I already had access to. It is quite different from my trading strategies document. My strategies document provides specific rules for the strategies and real trade examples that you won't find in the thinkscript cloud strategies document and which can be read, visualized and understood easily. The vast majority of the very limited number of strategies in the thinkscript cloud (I already have more strategies in my document after just 3 days) simply contain code which most traders wouldn't be able to make heads or tails of.Sorry, I meant this one

https://onedrive.live.com/redir?resid=2FF733D1BA1E1E79!404&page=View&wd=target(Welcome.one|a4f3f17e-e630-4d25-9b5b-ec957945a752/1. Introduction Usage (updated 02.13.|30461c4b-420e-4b83-b56f-55faf5d1461b/)

I read the notebook but it just looks like strategies in plain English that I have seen before already in thinkscript?

Sorry to be negative. Just my 2 cents

My strategies document will be a comprehensive and vast collection of strategies that any trader can understand and put into use. That cannot be said for the document you have compared it to.

Also, looking through the thinkscript cloud strategies to verify your claim that my strategies are already there, I didn't find one case of an overlap. I don't know if you're intentionally being dishonest or what your deal is, but perhaps you should rethink your approach.

Last edited:

The one from the Thinkorswim chat room - https://1drv.ms/u/s!AnkeHrrRM_cvgxQTl1xckINYlKhZ

Vince Field

Active member

This is the same document that bizzet posted in his last reply.The one from the Thinkorswim chat room - https://1drv.ms/u/s!AnkeHrrRM_cvgxQTl1xckINYlKhZ

I think we should read the comments and take a look at the links being shared before posting!

The link / http addresses are different - I have been having trouble loading some of the links but not others. Apologies if it ends up being duplication for some, but some of the links work better for me than others and they seem like especially useful repositories.This is the same document that bizzet posted in his last reply.

I think we should read the comments and take a look at the links being shared before posting!

Vince Field

Active member

Yeah the size of that link was kinda ridiculous lolThe link / http addresses are different - I have been having trouble loading some of the links but not others. Apologies if it ends up being duplication for some, but some of the links work better for me than others and they seem like especially useful repositories.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| G | Does consistent profitable day trading exist ? | Playground | 12 | |

| M | trading spy on 1 minute chart in downtrend? | Playground | 2 | |

| Z | Dick Diamond’s Method of Trading for a Living | Playground | 1 | |

|

|

Outside Auto-Trading Solutions for Thinkorswim | Playground | 6 | |

| C | Comedic Trading Wisdom | Playground | 0 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

2216

Online

Similar threads

Similar threads

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.