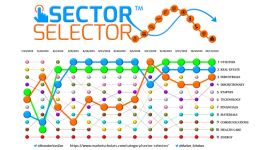

Sector Rotation involves shifting investments to sectors expected to outperform, optimizing returns based on market conditions.

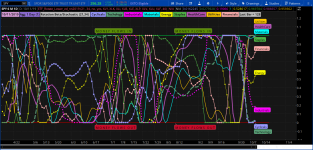

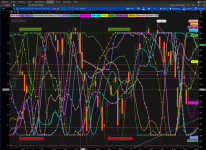

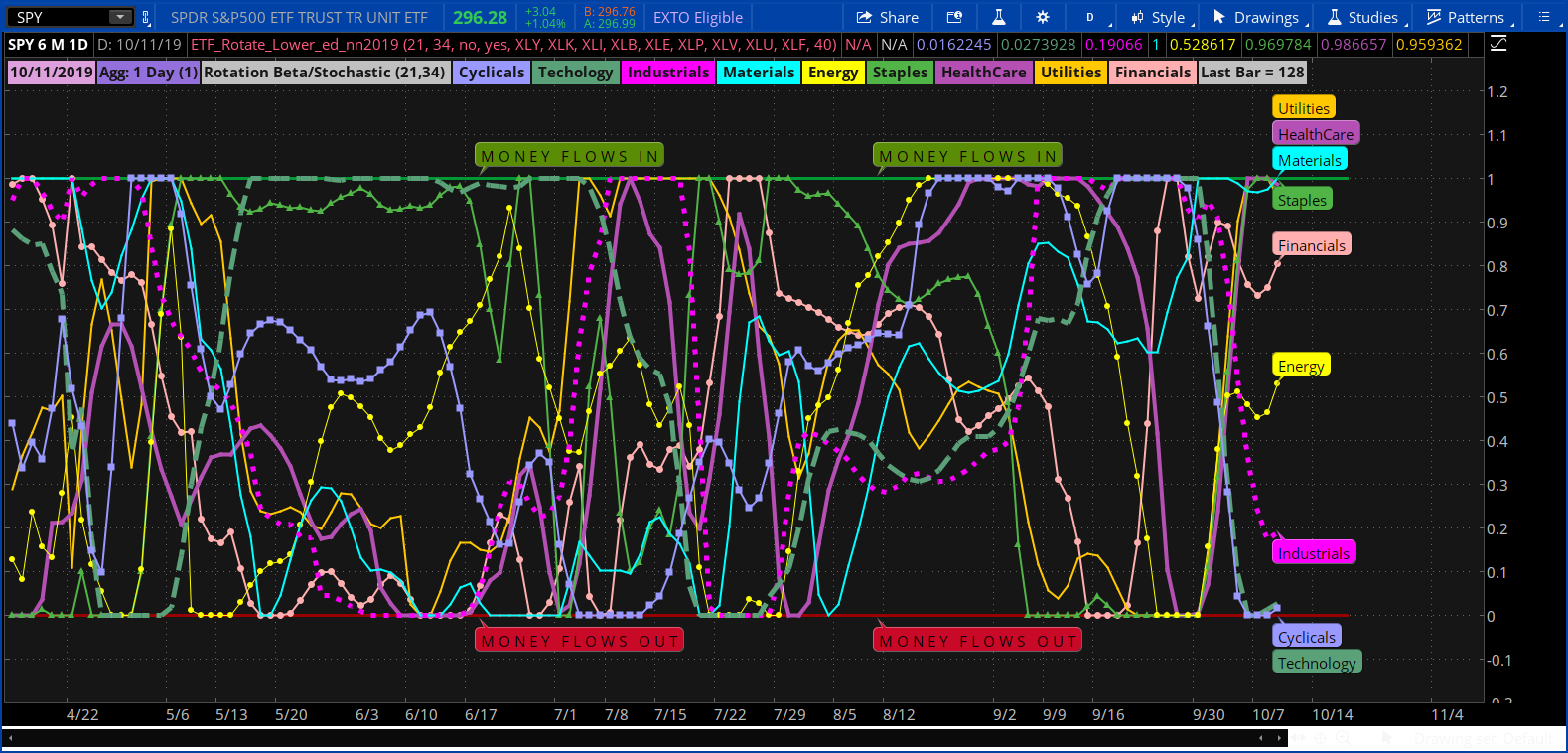

It's for the visual learner like me. Take a look at that chart on a weekly TF and you'll see the Rotation. I would move money into what is moving up and rotating out of what is dropping.

Once the top sectors are found, you would then look for stocks in that sector that are leading and place your trade according to your style.

@diazlaz See if this concept is workable. Idealy, to me, SPY should be at ==0 with the others rotating around it. Thoughts?

@BenTen Please copy this to its own thread...

SectorRotate_ED_NN

It's for the visual learner like me. Take a look at that chart on a weekly TF and you'll see the Rotation. I would move money into what is moving up and rotating out of what is dropping.

Once the top sectors are found, you would then look for stocks in that sector that are leading and place your trade according to your style.

@diazlaz See if this concept is workable. Idealy, to me, SPY should be at ==0 with the others rotating around it. Thoughts?

@BenTen Please copy this to its own thread...

Code:

# beta_rotation_v2

#ETF_Rotate_Lower_ED_nn 4-2019

# from 4/4/2019 chat room:

# 06:37 Mobius: johnny - To find rotation quickly - Use primary ETF's in a watchlist with 2 columns first column is Correlation to SPX second is a stochastic of Beta, if Beta is 1 or close to 1 that ETF is moving at the fastest momentum in that range and if correlation is with SPX .85 or better it's moving with SPX cor# daily start with 13,34 as starting point

#markos #took out out Beta 1 & 2 4-19-19 # Put Back in 6-23-19

declare lower;

input BetaLength = 21;

input StochLength =34;

input showBeta = No;

input showOverlay = Yes;

input Cyclicals = "XLY";

input Technology = "XLK";

input Industrials = "XLI";

input Materials = "XLB";

input Energy = "XLE";

input Staples = "XLP";

input HealthCare = "XLV";

input Utilities = "XLU";

input Financials = "XLF";

#------------------------------

#----purple colors

defineglobalColor(“PlumMedium“, createColor(221, 160, 221));

defineglobalColor(“Orchid“, createColor(218, 130, 214));

defineglobalColor(“MediumOrchid“, createColor(186, 85, 211));

defineglobalColor(“MediumPurple“, createColor(147, 112, 219));

defineglobalColor(“DarkOrchid“, createColor(153, 50, 204));

plot Scriptlabel = Double.NaN;

Scriptlabel.SetDefaultColor(CreateColor (0, 0, 0));

def Agg = GetAggregationPeriod();

#--------------------date start

addLabel(1, getMonth() + "/" +

getDayOfMonth(getYyyyMmDd()) + "/" +

AsPrice(getYear()), GlobalColor("PlumMedium"));

#--------------------date end

#addLabel(1, " Ticker: '" + GetSymbol() + "' ", GlobalColor("Orchid"));

addLabel(1, "Agg: " +

( if Agg == 60000 then "1 Min"

else if Agg == 120000 then "2 Min"

else if Agg == 180000 then "3 Min"

else if Agg == 240000 then "4 Min"

else if Agg == 300000 then "5 Min"

else if Agg == 600000 then "10 Min"

else if Agg == 900000 then "15 Min"

else if Agg == 1800000 then "30 Min"

else if Agg == 3600000 then "1 Hour"

else if Agg == 7200000 then "2 Hour"

else if Agg == 14400000 then "4 Hours"

else if Agg == 86400000 then "1 Day"

else if Agg == 604800000 then "1 Week"

else if Agg == 2592000000 then "1 Month"

else (Agg / 1000 / 60) + "Minutes") +

" (" + (if Agg<=23400000

then 23400000/Agg

else 86400000/Agg)+ ")"

, GlobalColor("MediumPurple"));

#addLabel(1, BarNumber() + " Bars", GlobalColor("DarkOrchid"));

#-----------------------------

#-----------------------------

addLabel(1,"Rotation Beta/Stochastic (" + betaLength + "," +stochLength + ") ", color.Light_Gray);

script calcBeta {

input secondSymbol = "XLF";

input refSymbol = "SPX";

input betaLength = 21;

input returnLength = 1;

def refPrice = close(refSymbol);

def primary = if refPrice[returnLength] == 0

then 0

else (refPrice - refPrice[returnLength]) /

refPrice[returnLength] * 100;

def secondPrice = close(secondSymbol);

def secondary = if secondPrice[returnLength] == 0

then 0

else (secondPrice - secondPrice[returnLength]) /

secondPrice[returnLength] * 100;

plot Beta = covariance(secondary, primary, betaLength) /

Sqr(stdev(primary, betaLength));

}

script EhlersESSfilter {

input price = close;

input length = 8;

def ESS_coeff_0 = Exp(-Double.Pi * Sqrt(2) / length);

def ESS_coeff_2 = 2 * ESS_coeff_0 * Cos(Sqrt(2) * Double.Pi / length);

def ESS_coeff_3 = - Sqr(ESS_coeff_0);

def ESS_coeff_1 = 1 - ESS_coeff_2 - ESS_coeff_3;

def ESS_filter = if IsNaN(price + price[1]) then

ESS_filter[1]

else ESS_coeff_1 * (price + price[1]) / 2 +

ESS_coeff_2 * ESS_filter[1] +

ESS_coeff_3 * ESS_filter[2];

plot Smooth_Filter =

if barnumber() < length then

price

else if !IsNaN(price) then

ESS_filter

else Double.NaN;

}

script calcStoch {

input data = close;

input StochLength = 21;

def stochasticValue = ((data - lowest(data, StochLength)) /

(highest(data, StochLength) - lowest(data, StochLength)));

plot stoch = stochasticValue;

}

plot beta1 = if showBeta then calcBeta(Cyclicals) else Double.NaN;

plot beta2 = if showBeta then calcBeta(Technology) else Double.NaN;

####

plot stoch1 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = Cyclicals,

betaLength = BetaLength)),

stochLength = StochLength);

stoch1.SetDefaultColor(Color.VIOLET);

stoch1.SetLineWeight(2);

stoch1.SetPaintingStrategy(PaintingStrategy.LINE_VS_SQUARES);

stoch1.HideBubble();

AddLabel(ShowOverlay, " Cyclicals ", Color.VIOLET);

AddChartBubble(ShowOverlay and IsNaN(close[-1]) and !IsNaN(close), if stoch1 < 0.15 then 0 else if stoch1 > 0.85 then 1 else stoch1, "Cyclicals", Color.VIOLET, stoch1 > 0.5);

plot stoch2 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = Technology,

betaLength = BetaLength)),

stochLength = StochLength);

stoch2.SetDefaultColor(CreateColor(90, 160, 120));

stoch2.SetLineWeight(5);

stoch2.SetStyle(Curve.LONG_DASH);

stoch2.HideBubble();

AddLabel(ShowOverlay, " Techology ", CreateColor(90, 160, 120));

AddChartBubble(ShowOverlay and IsNaN(close[-1]) and !IsNaN(close), if stoch2 < 0.15 then 0 else if stoch2 > 0.85 then 1 else stoch2, "Technology", CreateColor(90, 160, 120), stoch2 > 0.5);

plot stoch3 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = Industrials,

betaLength = BetaLength)),

stochLength = StochLength);

stoch3.SetDefaultColor(Color.MAGENTA);

stoch3.SetLineWeight(5);

stoch3.SetStyle(Curve.SHORT_DASH);

stoch3.HideBubble();

AddLabel(ShowOverlay, " Industrials ", Color.MAGENTA);

AddChartBubble(ShowOverlay and IsNaN(close[-1]) and !IsNaN(close), if stoch3 < 0.15 then 0 else if stoch3 > 0.85 then 1 else stoch3, "Industrials", Color.MAGENTA, stoch3 > 0.5);

plot stoch4 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = Materials,

betaLength = BetaLength)),

stochLength = StochLength);

stoch4.SetDefaultColor(Color.CYAN);

stoch4.SetLineWeight(2);

stoch4.SetPaintingStrategy(PaintingStrategy.LINE);

stoch4.HideBubble();

AddLabel(ShowOverlay, " Materials ", Color.CYAN);

AddChartBubble(ShowOverlay and IsNaN(close[-1]) and !IsNaN(close), if stoch4 < 0.15 then 0 else if stoch4 > 0.85 then 1 else stoch4, "Materials", Color.CYAN, stoch4 > 0.5);

plot stoch5 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = Energy,

betaLength = BetaLength)),

stochLength = StochLength);

stoch5.SetDefaultColor(Color.YELLOW);

stoch5.SetLineWeight(1);

stoch5.SetPaintingStrategy(PaintingStrategy.Line_vs_POINTS);

stoch5.HideBubble();

AddLabel(ShowOverlay, " Energy ", Color.YELLOW);

AddChartBubble(ShowOverlay and IsNaN(close[-1]) and !IsNaN(close), if stoch5 < 0.15 then 0 else if stoch5 > 0.85 then 1 else stoch5, "Energy", Color.YELLOW, stoch5 > 0.5);

plot stoch6 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = Staples,

betaLength = BetaLength)),

stochLength = StochLength);

stoch6.SetDefaultColor(CreateColor(80, 180, 70));

stoch6.SetLineWeight(2);

stoch6.SetPaintingStrategy(PaintingStrategy.LINE_VS_TRIANGLES);

stoch6.HideBubble();

AddLabel(ShowOverlay, " Staples ", CreateColor(80, 180, 70));

AddChartBubble(ShowOverlay and IsNaN(close[-1]) and !IsNaN(close), if stoch6 < 0.15 then 0 else if stoch6 > 0.85 then 1 else stoch6, "Staples", CreateColor(80, 180, 70), stoch6 > close);

plot stoch7 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = HealthCare,

betaLength = BetaLength)),

stochLength = StochLength);

stoch7.SetDefaultColor(CreateColor(180, 80, 180));

stoch7.SetLineWeight(4);

stoch7.SetPaintingStrategy(PaintingStrategy.LINE);

stoch7.HideBubble();

AddLabel(ShowOverlay, " HealthCare ", CreateColor(180, 80, 180));

AddChartBubble("time condition" = ShowOverlay and IsNaN(close[-1]) and !IsNaN(close), "price location" = if stoch7 < 0.15 then 0 else if stoch7 > 0.85 then 1 else stoch7, text = "HealthCare", color = CreateColor(180, 80, 180), stoch7 > 0.5);

plot stoch8 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = Utilities,

betaLength = BetaLength)),

stochLength = StochLength);

stoch8.SetDefaultColor(Color.ORANGE);

stoch8.SetLineWeight(2);

stoch8.SetPaintingStrategy(PaintingStrategy.LINE);

stoch8.HideBubble();

AddLabel(ShowOverlay, " Utilities ", Color.ORANGE);

AddChartBubble(ShowOverlay and IsNaN(close[-1]) and !IsNaN(close[0]), if stoch8 < 0.15 then 0 else if stoch8 > 0.85 then 1 else stoch8, "Utilities", Color.ORANGE, stoch8 > 0.5);

plot stoch9 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = Financials,

betaLength = BetaLength)),

stochLength = StochLength);

stoch9.SetDefaultColor(Color.PINK);

stoch9.SetLineWeight(2);

stoch9.SetPaintingStrategy(PaintingStrategy.LINE_VS_POINTS);

stoch9.HideBubble();

AddLabel(ShowOverlay, " Financials ", Color.PINK);

AddChartBubble(ShowOverlay and IsNaN(close[-1]) and !IsNaN(close), if stoch9 < 0.15 then 0 else if stoch9 > 0.85 then 1 else stoch9, "Financials", Color.PINK, stoch9 > 0.5);

#----------------------------------------------

def barNumber = BarNumber();

def endBar = if !IsNaN(close) and IsNaN(close[-1]) then barNumber else endBar[1];

def lastBar = HighestAll(endBar);

input flowLabelStep = 40;

addLabel(1,"Last Bar = " + lastBar, color.Light_Gray);

DefineGlobalColor("YellowGreen", CreateColor(90, 140, 5));

AddChartBubble(barNumber == (lastBar - flowLabelStep), 1.01,

"M O N E Y F L O W S I N", globalColor("YellowGreen"), 1);

AddChartBubble(barNumber == (lastBar - 2*flowLabelStep), 1.01,

"M O N E Y F L O W S I N", globalColor("YellowGreen"), 1);

#mAddChartBubble(barNumber == (lastBar - 3*flowLabelStep), 1.01,

#"M O N E Y F L O W S I N", globalColor("YellowGreen"), 1);

DefineGlobalColor("Cinamon", CreateColor(200, 10, 40));

AddChartBubble(barNumber == (lastBar - flowLabelStep), -0.01,

"M O N E Y F L O W S O U T", globalColor("Cinamon"), 0);

AddChartBubble(barNumber == (lastBar - 2*flowLabelStep), -0.01,

"M O N E Y F L O W S O U T", globalColor("Cinamon"), 0);

#mAddChartBubble(barNumber == (lastBar - 3*flowLabelStep), -0.01,

#m"M O N E Y F L O W S O U T", globalColor("Cinamon"), 0);

#plot zero = if isNaN(close) then double.nan else 0;

plot zero = if barNumber > (lastBar + 7) then double.nan else 0;

zero.SetDefaultColor(createColor(90, 20, 20));

zero.SetStyle(Curve.Long_Dash);

zero.SetLineWeight(5);

zero.HideBubble();

plot one = if barNumber > (lastBar + 7) then double.nan else 1;

one.SetDefaultColor(createColor(20, 70, 20));

one.SetStyle(Curve.Long_Dash);

one.SetLineWeight(5);

one.HideBubble();

#EOCSectorRotate_ED_NN

Attachments

Last edited by a moderator: