You should upgrade or use an alternative browser.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Johnny Cash

Member

input CorrelationWithSecurity = "SPX";

input referenceDate = 20190531;

def close2 = close(CorrelationWithSecurity);

def RS = if close2 == 0 then 0 else close/close2;

#RS.setDefaultColor(GetColor(6));

def startDate = DaysFromDate(referenceDate) == 0;

addchartbubble(startDate, RS,"Start", color.RED);

def sr = CompoundValue("historical data" = RS[0], "visible data" = if startDate <= 0 then sr[1] else RS[0]);

def SRatio = sr;

#SRatio.setDefaultColor(GetColor(5));

# use this plot statement to find bullish crossovers

#plot scan = RS[1] < SRatio[1] and RS > SRatio;

# use this plot statement to find bearish crossovers

#plot scan = RS[1] > SRatio[1] and RS < SRatio;

# use this plot statement to find stocks trending stronger than the index

plot scan = lowest(RS - SRatio, 21) > 0;

# use this plot statement to find stocks trending weaker than the index

#plot scan = highest(RS - SRatio, 21) < 0;Also, use this lower study to comfirm.

declare lower;

input correlationTicker = "SPX";

input startDate = 20180928;

def beginTracking = DaysFromDate(startDate) == 0;

def correlationClose = close(symbol = correlationTicker);

def correlationPrctChange = 100 * (correlationClose / correlationClose[1] - 1);

def plottedPrctChange = 100 * (close / close[1] - 1);

def correlationDiff = plottedPrctChange - correlationPrctChange;

rec data = CompoundValue(1, if beginTracking then correlationDiff else if DaysFromDate(startDate) > 0 then data[1] + correlationDiff else 0, 0);

plot signal = data;

plot zeroline = 0;

AddVerticalLine(beginTracking, "Start", Color.YELLOW, 2);

ZeroLine.SetDefaultColor(GetColor(7));gravity2726

Member

Thank you mate, Do we need to change the date everyday?See if this scan helps with what you need.

Code:input CorrelationWithSecurity = "SPX"; input referenceDate = 20190531; def close2 = close(CorrelationWithSecurity); def RS = if close2 == 0 then 0 else close/close2; #RS.setDefaultColor(GetColor(6)); def startDate = DaysFromDate(referenceDate) == 0; addchartbubble(startDate, RS,"Start", color.RED); def sr = CompoundValue("historical data" = RS[0], "visible data" = if startDate <= 0 then sr[1] else RS[0]); def SRatio = sr; #SRatio.setDefaultColor(GetColor(5)); # use this plot statement to find bullish crossovers #plot scan = RS[1] < SRatio[1] and RS > SRatio; # use this plot statement to find bearish crossovers #plot scan = RS[1] > SRatio[1] and RS < SRatio; # use this plot statement to find stocks trending stronger than the index plot scan = lowest(RS - SRatio, 21) > 0; # use this plot statement to find stocks trending weaker than the index #plot scan = highest(RS - SRatio, 21) < 0;

Also, use this lower study to comfirm.

Code:declare lower; input correlationTicker = "SPX"; input startDate = 20180928; def beginTracking = DaysFromDate(startDate) == 0; def correlationClose = close(symbol = correlationTicker); def correlationPrctChange = 100 * (correlationClose / correlationClose[1] - 1); def plottedPrctChange = 100 * (close / close[1] - 1); def correlationDiff = plottedPrctChange - correlationPrctChange; rec data = CompoundValue(1, if beginTracking then correlationDiff else if DaysFromDate(startDate) > 0 then data[1] + correlationDiff else 0, 0); plot signal = data; plot zeroline = 0; AddVerticalLine(beginTracking, "Start", Color.YELLOW, 2); ZeroLine.SetDefaultColor(GetColor(7));

Johnny Cash

Member

ex. 1Y 1D =20200223 and you are all set

input referenceDate =20200223;

input startDate =20200223;

If anyone one is insterested.

http://tos.mx/t71Peta

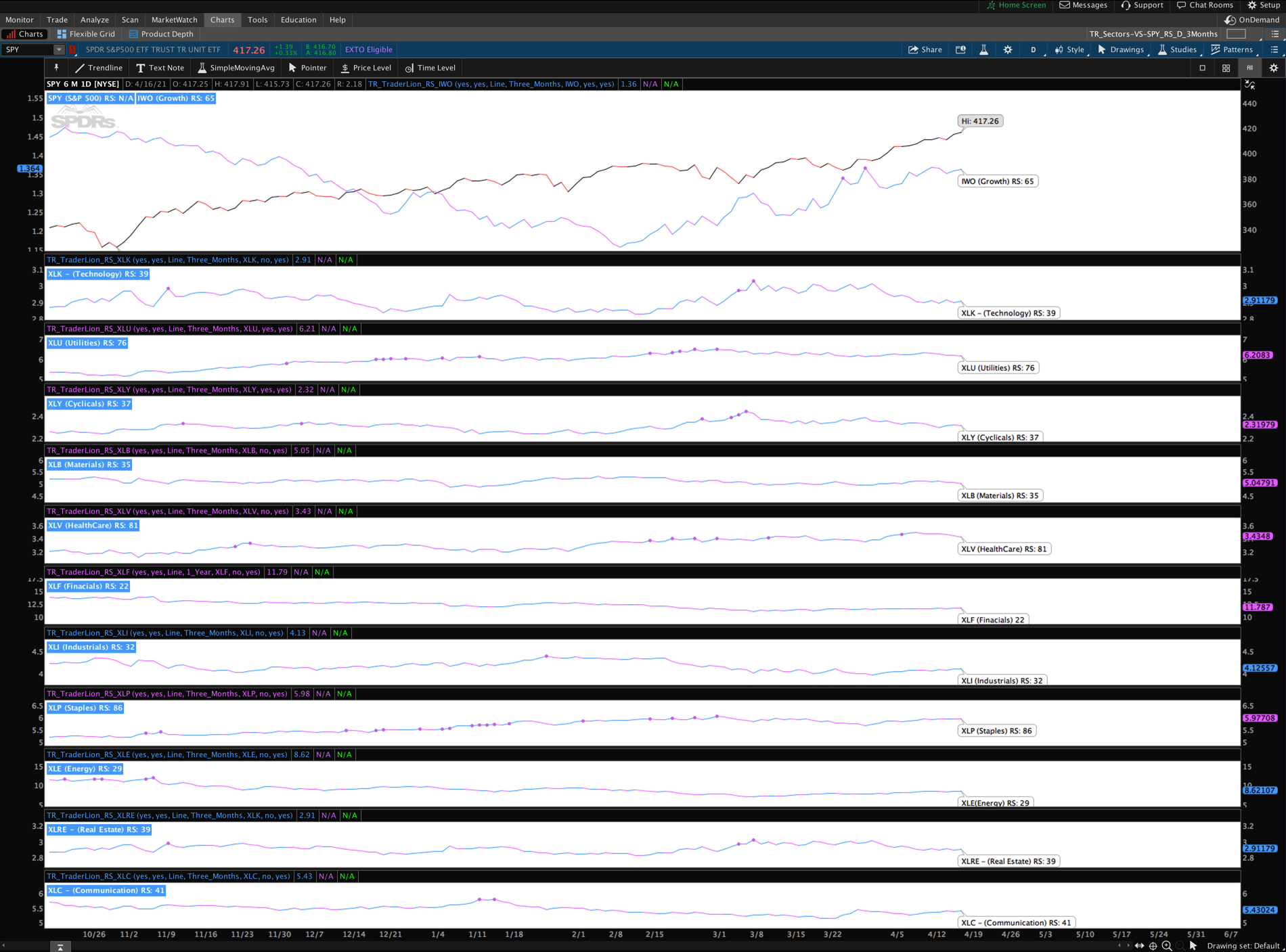

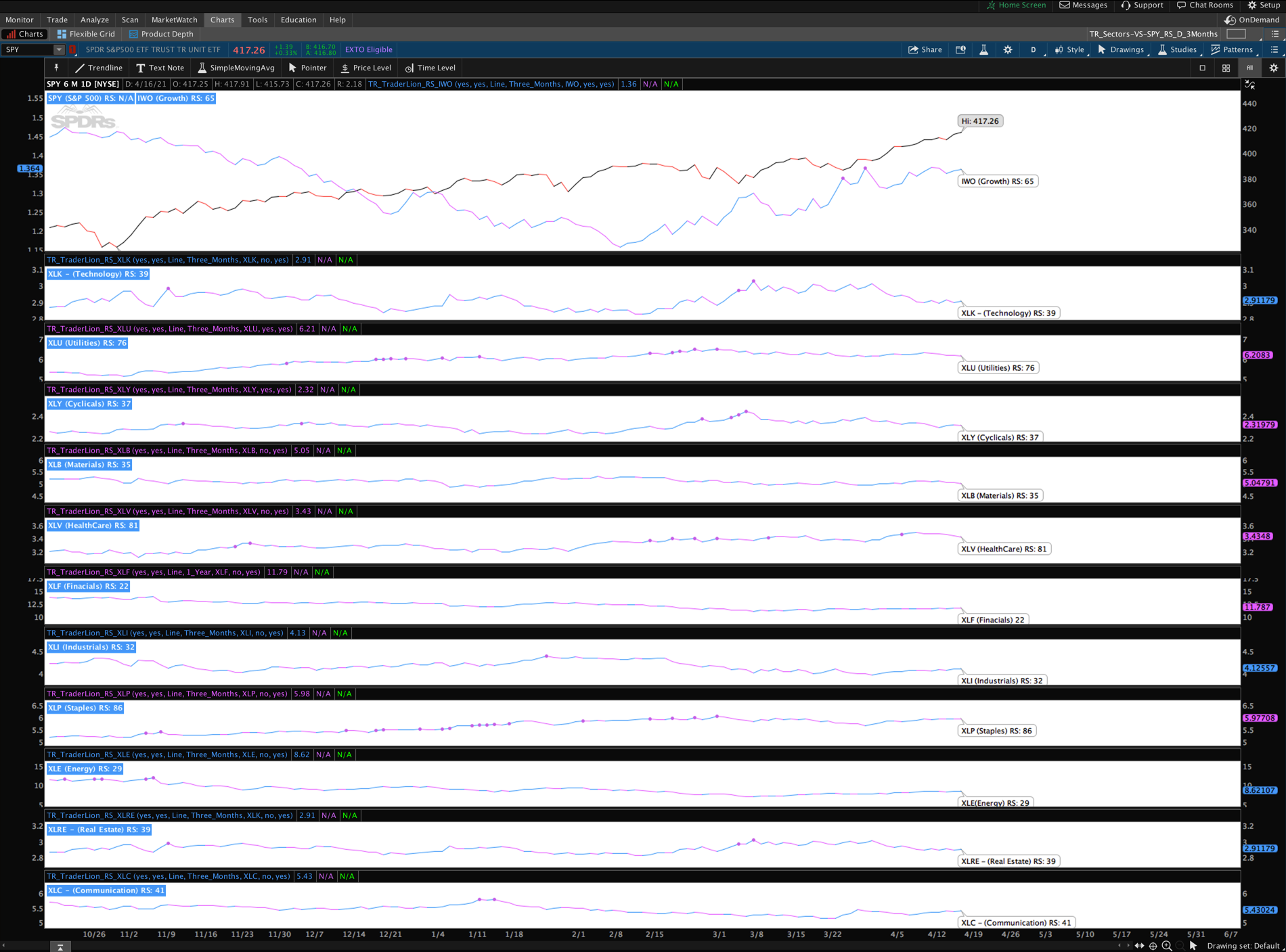

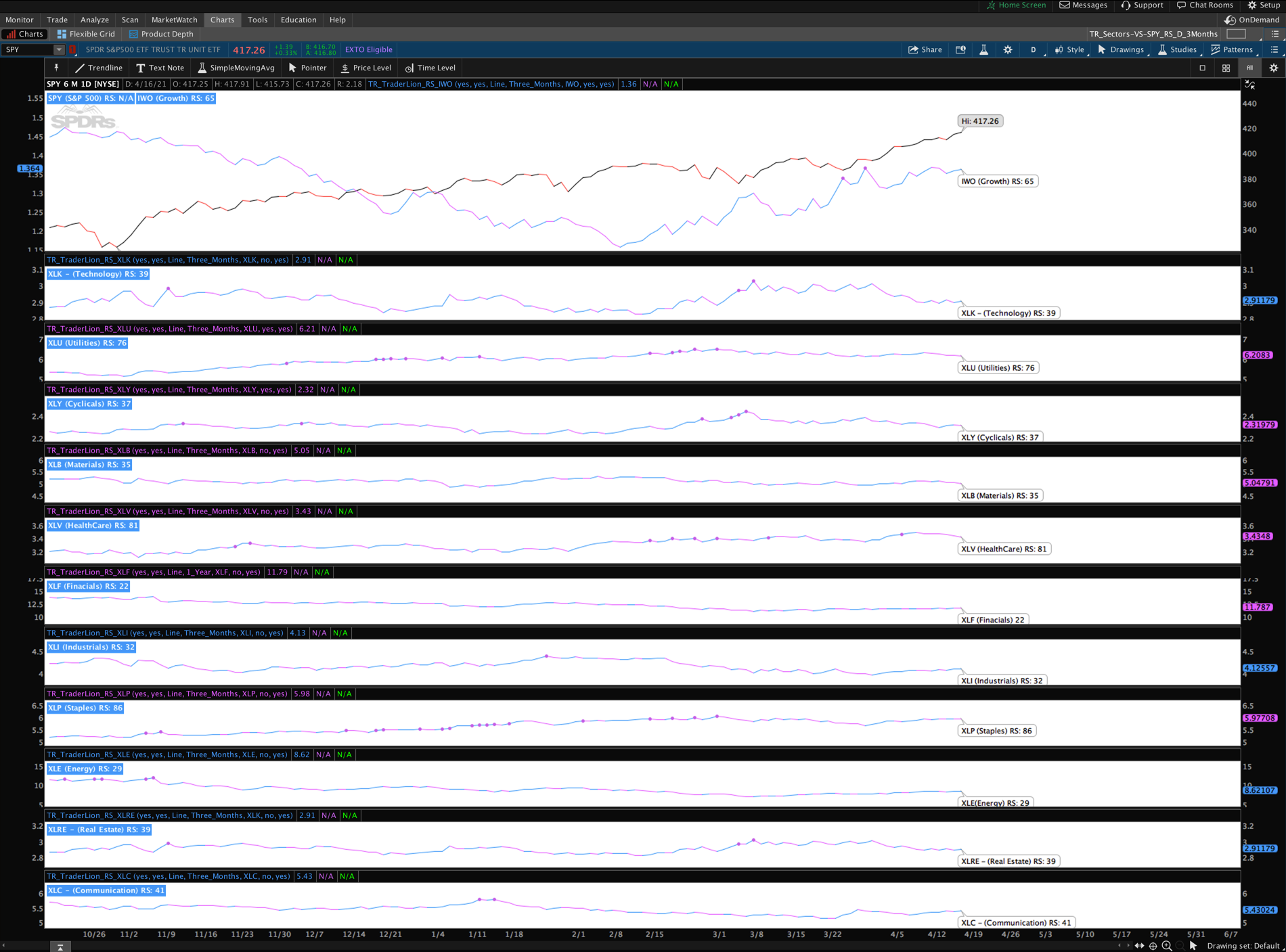

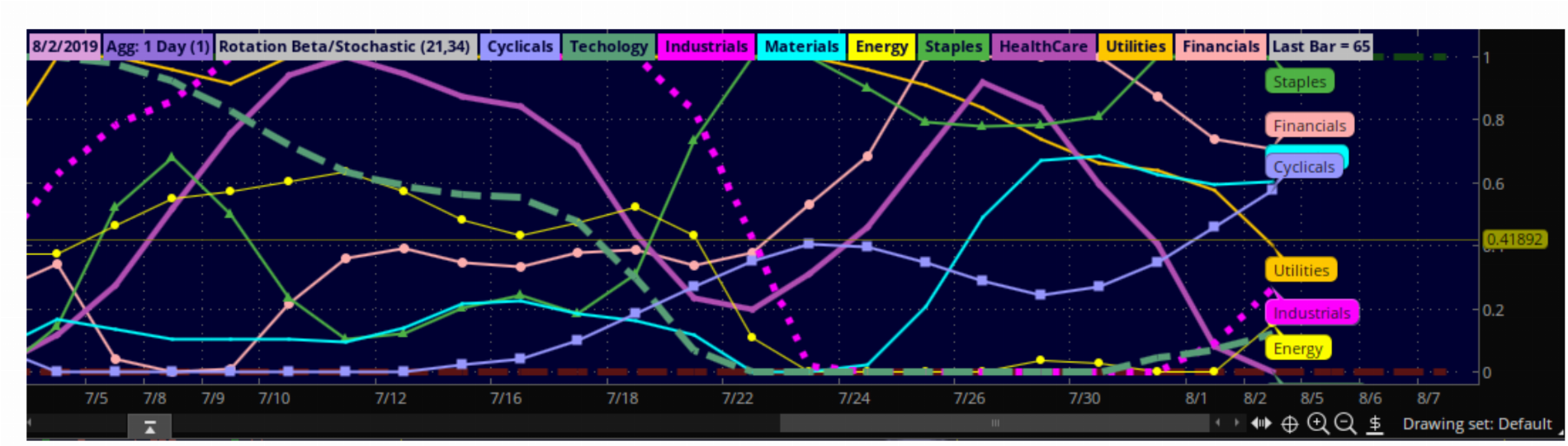

Hi TrendrThe layman's way. Lol I was interested to see how this would look.

If anyone one is insterested.

http://tos.mx/t71Peta

thank you . Did you perform any back testing with entry exit .

What are the entry exit places . If you can shoe one entry exit that would be a great help .

I wouldn't enter of these charts, they are to show you where the strength is then you would find stocks in those sectors at proper buy points (Pivots).Hi Trendr

thank you . Did you perform any back testing with entry exit .

What are the entry exit places . If you can shoe one entry exit that would be a great help .

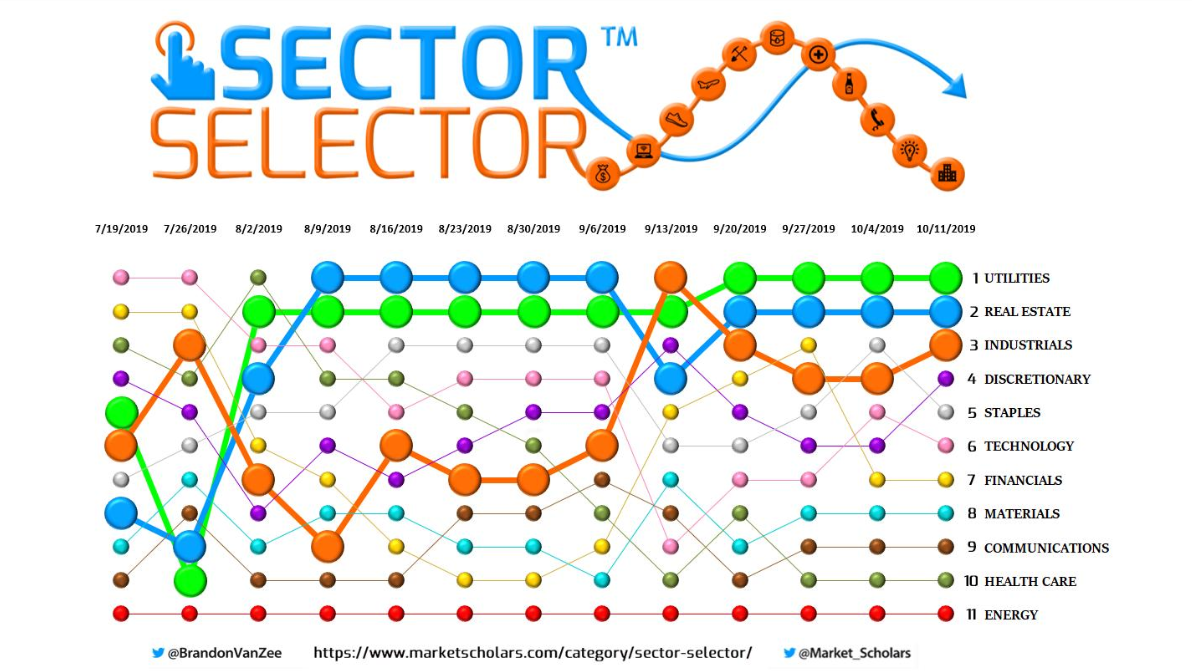

I've also been looking around the site and it looks like in this alternate-sector-analysis-study-for-thinkorswim the author pretty much did the same thing in a cleaner way.The layman's way. Lol I was interested to see how this would look.

If anyone one is insterested.

http://tos.mx/t71Peta

Hello, i have a question how would I read the right scaling numbers?The layman's way. Lol I was interested to see how this would look.

If anyone one is insterested.

http://tos.mx/t71Peta

declare lower;

DefineGlobalColor("Buy", Color.GREEN);

DefineGlobalColor("Sell", Color.RED);

DefineGlobalColor("Neutral", Color.YELLOW);

DefineGlobalColor("Above", Color.Dark_Green);

DefineGlobalColor("Below", Color.Dark_Red);

input symbol26 = "NYA";

input symbol25 = "XAX";

input symbol24 = "IWB";

input symbol23 = "FFTY";

input symbol22 = "BOUT";

input symbol21 = "XTC";

input symbol20 = "SOX";

input symbol19 = "RUT";

input symbol18 = "RUI";

input symbol17 = "COMP:GIDS";

input symbol16 = "SPY";

input symbol15 = "QQQ";

input symbol14 = "IWM";

input symbol13 = "$DJT";

input symbol12 = "IBB";

input symbol11 = "XLY";

input symbol10 = "XLV";

input symbol9 = "XLU";

input symbol8 = "XLRE";

input symbol7 = "XLP";

input symbol6 = "XLK";

input symbol5 = "XLI";

input symbol4 = "XLF";

input symbol3 = "XLE";

input symbol2 = "XLC";

input symbol1 = "XLB";

input DotSize = 5;

input displace = 0;

input length = 20;

input Num_Dev_Dn = -2.0;

input Num_Dev_up = 2.0;

input showLabels = yes;

input showBubbles = no;

script SymbolPB {

input symbol = "";

input averageType = AverageType.Simple;

def price = close(Symbol);

input displace = 0;

input length = 20;

input Num_Dev_Dn = -2.0;

input Num_Dev_up = 2.0;

def upperBand = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_up, averageType).UpperBand;

def lowerBand = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_up, averageType).LowerBand;

plot PercentB = Round((price - lowerBand) / (upperBand - lowerBand) * 100,2);

}

def s1PB = SymbolPB(symbol1);

def s2PB = SymbolPB(symbol2);

def s3PB = SymbolPB(symbol3);

def s4PB = SymbolPB(symbol4);

def s5PB = SymbolPB(symbol5);

def s6PB = SymbolPB(symbol6);

def s7PB = SymbolPB(symbol7);

def s8PB = SymbolPB(symbol8);

def s9PB = SymbolPB(symbol9);

def s10PB = SymbolPB(symbol10);

def s11PB = SymbolPB(symbol11);

def s12PB = SymbolPB(symbol12);

def s13PB = SymbolPB(symbol13);

def s14PB = SymbolPB(symbol14);

def s15PB = SymbolPB(symbol15);

def s16PB = SymbolPB(symbol16);

def s17PB = SymbolPB(symbol17);

def s18PB = SymbolPB(symbol18);

def s19PB = SymbolPB(symbol19);

def s20PB = SymbolPB(symbol20);

def s21PB = SymbolPB(symbol21);

def s22PB = SymbolPB (symbol22);

def s23PB = SymbolPB(symbol23);

def s24PB = SymbolPB(symbol24);

def s25PB = SymbolPB(symbol25);

def s26PB = SymbolPB(symbol26);

#######Plots

plot symb1 = if !IsNaN(close) and !IsNaN(close(symbol1)) then 1 else Double.NaN;

symb1.SetPaintingStrategy(PaintingStrategy.POINTS);

symb1.SetLineWeight(DotSize);

symb1.AssignValueColor(if s1PB >= 100 then GlobalColor("Above") else if s1PB<= 0 then GlobalColor(“Below”) else if s1PB >=70 then GlobalColor(“Buy”) else if s1PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol1)[1]), 1, "1: " + symbol1, if s1PB[1] >= 100 then GlobalColor("Above") else if s1PB[1]<= 0 then GlobalColor(“Below”) else if s1PB[1] >=70 then GlobalColor(“Buy”) else if s1PB[1] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb1.HideBubble();

plot symb2 = if !IsNaN(close) and !IsNaN(close(symbol2)) then 2 else Double.NaN;

symb2.SetPaintingStrategy(PaintingStrategy.POINTS);

symb2.SetLineWeight(DotSize);

symb2.AssignValueColor(if s2PB >= 100 then GlobalColor("Above") else if s2PB<= 0 then GlobalColor(“Below”) else if s2PB >=70 then GlobalColor(“Buy”) else if s2PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol2)[5]), 2, "2: " + symbol2, if s2PB[5] >= 100 then GlobalColor("Above") else if s2PB[5]<= 0 then GlobalColor(“Below”) else if s2PB[5] >=70 then GlobalColor(“Buy”) else if s2PB[5] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb2.HideBubble();

plot symb3 = if !IsNaN(close) and !IsNaN(close(symbol3)) then 3 else Double.NaN;

symb3.SetPaintingStrategy(PaintingStrategy.POINTS);

symb3.SetLineWeight(DotSize);

symb3.AssignValueColor(if s3PB >= 100 then GlobalColor("Above") else if s3PB<= 0 then GlobalColor(“Below”) else if s3PB >=70 then GlobalColor(“Buy”) else if s3PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol3)[1]), 3, "3: " + symbol3, if s3PB[1] >= 100 then GlobalColor("Above") else if s3PB[1]<= 0 then GlobalColor(“Below”) else if s3PB[1] >=70 then GlobalColor(“Buy”) else if s3PB[1] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

Symb3.HideBubble();

plot symb4 = if !IsNaN(close) and !IsNaN(close(symbol4)) then 4 else Double.NaN;

symb4.SetPaintingStrategy(PaintingStrategy.POINTS);

symb4.SetLineWeight(DotSize);

symb4.AssignValueColor(if s4PB >= 100 then GlobalColor("Above") else if s4PB<= 0 then GlobalColor(“Below”) else if s4PB >=70 then GlobalColor(“Buy”) else if s4PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol4)[5]), 4, "4: " + symbol4, if s4PB[5] >= 100 then GlobalColor("Above") else if s4PB[5]<= 0 then GlobalColor(“Below”) else if s4PB[5] >=70 then GlobalColor(“Buy”) else if s4PB[5] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

Symb4.HideBubble();

plot symb5 = if !IsNaN(close) and !IsNaN(close(symbol5)) then 5 else Double.NaN;

symb5.SetPaintingStrategy(PaintingStrategy.POINTS);

symb5.SetLineWeight(DotSize);

symb5.AssignValueColor(if s5PB >= 100 then GlobalColor("Above") else if s5PB<= 0 then GlobalColor(“Below”) else if s5PB >=70 then GlobalColor(“Buy”) else if s5PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol5)[1]), 5, "5: " + symbol5, if s5PB[1] >= 100 then GlobalColor("Above") else if s5PB[1]<= 0 then GlobalColor(“Below”) else if s5PB[1] >=70 then GlobalColor(“Buy”) else if s5PB[1] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

Symb5.HideBubble();

plot symb6 = if !IsNaN(close) and !IsNaN(close(symbol6)) then 6 else Double.NaN;

symb6.SetPaintingStrategy(PaintingStrategy.POINTS);

symb6.SetLineWeight(DotSize);

symb6.AssignValueColor(if s6PB >= 100 then GlobalColor("Above") else if s6PB<= 0 then GlobalColor(“Below”) else if s6PB >=70 then GlobalColor(“Buy”) else if s6PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol6)[5]), 6, "6: " + symbol6, if s6PB[5] >= 100 then GlobalColor("Above") else if s6PB[5]<= 0 then GlobalColor(“Below”) else if s6PB[5] >=70 then GlobalColor(“Buy”) else if s6PB[5] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

Symb6.HideBubble();

plot symb7 = if !IsNaN(close) and !IsNaN(close(symbol7)) then 7 else Double.NaN;

symb7.SetPaintingStrategy(PaintingStrategy.POINTS);

symb7.SetLineWeight(DotSize);

symb7.AssignValueColor(if s7PB >= 100 then GlobalColor("Above") else if s7PB<= 0 then GlobalColor(“Below”) else if s7PB >=70 then GlobalColor(“Buy”) else if s7PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol7)[1]), 7, "7: " + symbol7, if s7PB[1] >= 100 then GlobalColor("Above") else if s7PB[1]<= 0 then GlobalColor(“Below”) else if s7PB[1] >=70 then GlobalColor(“Buy”) else if s7PB[1] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

Symb7.HideBubble();

plot symb8 = if !IsNaN(close) and !IsNaN(close(symbol8)) then 8 else Double.NaN;

symb8.SetPaintingStrategy(PaintingStrategy.POINTS);

symb8.SetLineWeight(DotSize);

symb8.AssignValueColor(if s8PB >= 100 then GlobalColor("Above") else if s8PB<= 0 then GlobalColor(“Below”) else if s8PB >=70 then GlobalColor(“Buy”) else if s8PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol8)[5]), 8, "8: " + symbol8, if s8PB[5] >= 100 then GlobalColor("Above") else if s8PB[5]<= 0 then GlobalColor(“Below”) else if s8PB[5] >=70 then GlobalColor(“Buy”) else if s8PB[5] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

Symb8.HideBubble();

plot symb9 = if !IsNaN(close) and !IsNaN(close(symbol9)) then 9 else Double.NaN;

symb9.SetPaintingStrategy(PaintingStrategy.POINTS);

symb9.SetLineWeight(DotSize);

symb9.AssignValueColor(if s9PB >= 100 then GlobalColor("Above") else if s9PB<= 0 then GlobalColor(“Below”) else if s9PB >=70 then GlobalColor(“Buy”) else if s9PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol9)[1]), 9, "9: " + symbol9, if s9PB[1] >= 100 then GlobalColor("Above") else if s9PB[1]<= 0 then GlobalColor(“Below”) else if s9PB[1] >=70 then GlobalColor(“Buy”) else if s9PB[1] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

Symb9.HideBubble();

plot symb10 = if !IsNaN(close) and !IsNaN(close(symbol10)) then 10 else Double.NaN;

symb10.SetPaintingStrategy(PaintingStrategy.POINTS);

symb10.SetLineWeight(DotSize);

symb10.AssignValueColor(if s10PB >= 100 then GlobalColor("Above") else if s10PB<= 0 then GlobalColor(“Below”) else if s10PB >=70 then GlobalColor(“Buy”) else if s10PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol10)[5]), 10, "10: " + symbol10, if s10PB[5] >= 100 then GlobalColor("Above") else if s10PB[5]<= 0 then GlobalColor(“Below”) else if s10PB[5] >=70 then GlobalColor(“Buy”) else if s10PB[5] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

Symb10.HideBubble();

plot symb11 = if !IsNaN(close) and !IsNaN(close(symbol11)) then 11 else Double.NaN;

symb11.SetPaintingStrategy(PaintingStrategy.POINTS);

symb11.SetLineWeight(DotSize);

symb11.AssignValueColor(if s11PB >= 100 then GlobalColor("Above") else if s11PB<= 0 then GlobalColor(“Below”) else if s11PB >=70 then GlobalColor(“Buy”) else if s11PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol11)[1]), 11, "11: " + symbol11, if s11PB[1] >= 100 then GlobalColor("Above") else if s11PB[1]<= 0 then GlobalColor(“Below”) else if s11PB[1] >=70 then GlobalColor(“Buy”) else if s11PB[1] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

Symb11.HideBubble();

plot symb12 = if !IsNaN(close) and !IsNaN(close(symbol12)) then 13 else Double.NaN;

symb12.SetPaintingStrategy(PaintingStrategy.Triangles);

symb12.SetLineWeight(DotSize);

symb12.AssignValueColor(if s12PB >= 100 then GlobalColor("Above") else if s12PB<= 0 then GlobalColor(“Below”) else if s12PB >=70 then GlobalColor(“Buy”) else if s12PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol12)[5]), 13, "13: " + symbol12, if s12PB[5] >= 100 then GlobalColor("Above") else if s12PB[5]<= 0 then GlobalColor(“Below”) else if s12PB[5] >=70 then GlobalColor(“Buy”) else if s12PB[5] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

Symb12.HideBubble();

plot symb13 = if !IsNaN(close) and !IsNaN(close(symbol13)) then 14 else Double.NaN;

symb13.SetPaintingStrategy(PaintingStrategy.Triangles);

symb13.SetLineWeight(DotSize);

symb13.AssignValueColor(if s13PB >= 100 then GlobalColor("Above") else if s13PB<= 0 then GlobalColor(“Below”) else if s13PB >=70 then GlobalColor(“Buy”) else if s13PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol13)[1]), 14, "14: " + symbol13, if s13PB[1] >= 100 then GlobalColor("Above") else if s13PB[1]<= 0 then GlobalColor(“Below”) else if s13PB[1] >=70 then GlobalColor(“Buy”) else if s13PB[1] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb13.HideBubble();

plot symb14 = if !IsNaN(close) and !IsNaN(close(symbol14)) then 15 else Double.NaN;

symb14.SetPaintingStrategy(PaintingStrategy.Triangles);

symb14.SetLineWeight(DotSize);

symb14.AssignValueColor(if s14PB >= 100 then GlobalColor("Above") else if s14PB<= 0 then GlobalColor(“Below”) else if s14PB >=70 then GlobalColor(“Buy”) else if s14PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol14)[5]), 15, "15: " + symbol14, if s14PB[5] >= 100 then GlobalColor("Above") else if s14PB[5]<= 0 then GlobalColor(“Below”) else if s14PB[5] >=70 then GlobalColor(“Buy”) else if s14PB[5] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

Symb14.HideBubble();

plot symb15 = if !IsNaN(close) and !IsNaN(close(symbol15)) then 16 else Double.NaN;

symb15.SetPaintingStrategy(PaintingStrategy.Triangles);

symb15.SetLineWeight(DotSize);

symb15.AssignValueColor(if s15PB >= 100 then GlobalColor("Above") else if s15PB<= 0 then GlobalColor(“Below”) else if s15PB >=70 then GlobalColor(“Buy”) else if s15PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol15)[1]), 16, "16: " + symbol15, if s15PB[1] >= 100 then GlobalColor("Above") else if s15PB[1]<= 0 then GlobalColor(“Below”) else if s15PB[1] >=70 then GlobalColor(“Buy”) else if s15PB[1] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb15.HideBubble();

plot symb16 = if !IsNaN(close) and !IsNaN(close(symbol16)) then 17 else Double.NaN;

symb16.SetPaintingStrategy(PaintingStrategy.Triangles);

symb16.SetLineWeight(DotSize);

symb16.AssignValueColor(if s16PB >= 100 then GlobalColor("Above") else if s16PB<= 0 then GlobalColor(“Below”) else if s16PB >=70 then GlobalColor(“Buy”) else if s16PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol16)[5]), 17, "17: " + symbol16, if s16PB[5] >= 100 then GlobalColor("Above") else if s16PB[5]<= 0 then GlobalColor(“Below”) else if s16PB[5] >=70 then GlobalColor(“Buy”) else if s16PB[5] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

Symb16.HideBubble();

plot symb17 = if !IsNaN(close) and !IsNaN(close(symbol17)) then 18 else Double.NaN;

symb17.SetPaintingStrategy(PaintingStrategy.Triangles);

symb17.SetLineWeight(DotSize);

symb17.AssignValueColor(if s17PB >= 100 then GlobalColor("Above") else if s17PB<= 0 then GlobalColor(“Below”) else if s17PB >=70 then GlobalColor(“Buy”) else if s17PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol17)[1]), 18, "18: " + symbol17, if s17PB[1] >= 100 then GlobalColor("Above") else if s17PB[1]<= 0 then GlobalColor(“Below”) else if s17PB[1] >=70 then GlobalColor(“Buy”) else if s17PB[1] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

Symb17.HideBubble();

plot symb18 = if !IsNaN(close) and !IsNaN(close(symbol18)) then 19 else Double.NaN;

symb18.SetPaintingStrategy(PaintingStrategy.Triangles);

symb18.SetLineWeight(DotSize);

symb18.AssignValueColor(if s18PB >= 100 then GlobalColor("Above") else if s18PB<= 0 then GlobalColor(“Below”) else if s18PB >=70 then GlobalColor(“Buy”) else if s18PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol18)[5]), 19, "19: " + symbol18, if s18PB[5] >= 100 then GlobalColor("Above") else if s18PB[5]<= 0 then GlobalColor(“Below”) else if s18PB[5] >=70 then GlobalColor(“Buy”) else if s18PB[5] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

Symb18.HideBubble();

plot symb19 = if !IsNaN(close) and !IsNaN(close(symbol19)) then 20 else Double.NaN;

symb19.SetPaintingStrategy(PaintingStrategy.Triangles);

symb19.SetLineWeight(DotSize);

symb19.AssignValueColor(if s19PB >= 100 then GlobalColor("Above") else if s19PB<= 0 then GlobalColor(“Below”) else if s19PB >=70 then GlobalColor(“Buy”) else if s19PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol19)[1]), 20, "20: " + symbol19, if s19PB[1] >= 100 then GlobalColor("Above") else if s19PB[1]<= 0 then GlobalColor(“Below”) else if s19PB[1] >=70 then GlobalColor(“Buy”) else if s19PB[1] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb19.HideBubble();

plot symb20 = if !IsNaN(close) and !IsNaN(close(symbol20)) then 21 else Double.NaN;

symb20.SetPaintingStrategy(PaintingStrategy.Triangles);

symb20.SetLineWeight(DotSize);

symb20.AssignValueColor(if s20PB >= 100 then GlobalColor("Above") else if s20PB<= 0 then GlobalColor(“Below”) else if s20PB >=70 then GlobalColor(“Buy”) else if s20PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol20)[5]), 21, "21: " + symbol20, if s20PB[5] >= 100 then GlobalColor("Above") else if s20PB[5]<= 0 then GlobalColor(“Below”) else if s20PB[5] >=70 then GlobalColor(“Buy”) else if s20PB[5] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb20.HideBubble();

plot symb21 = if !IsNaN(close) and !IsNaN(close(symbol21)) then 22 else Double.NaN;

symb21.SetPaintingStrategy(PaintingStrategy.Triangles);

symb21.SetLineWeight(DotSize);

symb21.AssignValueColor(if s21PB >= 100 then GlobalColor("Above") else if s21PB<= 0 then GlobalColor(“Below”) else if s21PB >=70 then GlobalColor(“Buy”) else if s21PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol21)[1]), 22, "22: " + symbol21, if s21PB[1] >= 100 then GlobalColor("Above") else if s21PB[1]<= 0 then GlobalColor(“Below”) else if s21PB[1] >=70 then GlobalColor(“Buy”) else if s21PB[1] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

Symb21.HideBubble();

plot symb22 = if !IsNaN(close) and !IsNaN(close(symbol22)) then 23 else Double.NaN;

symb22.SetPaintingStrategy(PaintingStrategy.Triangles);

symb22.SetLineWeight(DotSize);

symb22.AssignValueColor(if s22PB >= 100 then GlobalColor("Above") else if s22PB<= 0 then GlobalColor(“Below”) else if s22PB >=70 then GlobalColor(“Buy”) else if s22PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol22)[5]), 23, "23: " + symbol22, if s22PB[5] >= 100 then GlobalColor("Above") else if s22PB[5]<= 0 then GlobalColor(“Below”) else if s22PB[5] >=70 then GlobalColor(“Buy”) else if s22PB[5] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

Symb22.HideBubble();

plot symb23 = if !IsNaN(close) and !IsNaN(close(symbol23)) then 24 else Double.NaN;

symb23.SetPaintingStrategy(PaintingStrategy.Triangles);

symb23.SetLineWeight(DotSize);

symb23.AssignValueColor(if s23PB >= 100 then GlobalColor("Above") else if s23PB<= 0 then GlobalColor(“Below”) else if s23PB >=70 then GlobalColor(“Buy”) else if s23PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol23)[1]), 24, "24: " + symbol23, if s23PB[1] >= 100 then GlobalColor("Above") else if s23PB[1]<= 0 then GlobalColor(“Below”) else if s23PB[1] >=70 then GlobalColor(“Buy”) else if s23PB[1] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

Symb23.HideBubble();

plot symb24 = if !IsNaN(close) and !IsNaN(close(symbol24)) then 25 else Double.NaN;

symb24.SetPaintingStrategy(PaintingStrategy.Triangles);

symb24.SetLineWeight(DotSize);

symb24.AssignValueColor(if s24PB >= 100 then GlobalColor("Above") else if s24PB<= 0 then GlobalColor(“Below”) else if s24PB >=70 then GlobalColor(“Buy”) else if s24PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol24)[5]), 25, "25: " + symbol24, if s24PB[5] >= 100 then GlobalColor("Above") else if s24PB[5]<= 0 then GlobalColor(“Below”) else if s24PB[5] >=70 then GlobalColor(“Buy”) else if s24PB[5] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb24.HideBubble();

plot symb25 = if !IsNaN(close) and !IsNaN(close(symbol25)) then 26 else Double.NaN;

symb25.SetPaintingStrategy(PaintingStrategy.Triangles);

symb25.SetLineWeight(DotSize);

symb25.AssignValueColor(if s25PB >= 100 then GlobalColor("Above") else if s25PB<= 0 then GlobalColor(“Below”) else if s25PB >=70 then GlobalColor(“Buy”) else if s25PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol25)[1]), 26, "26: " + symbol25, if s25PB[1] >= 100 then GlobalColor("Above") else if s25PB[1]<= 0 then GlobalColor(“Below”) else if s25PB[1] >=70 then GlobalColor(“Buy”) else if s25PB[1] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

Symb25.HideBubble();

plot symb26 = if !IsNaN(close) and !IsNaN(close(symbol26)) then 27 else Double.NaN;

symb26.SetPaintingStrategy(PaintingStrategy.Triangles);

symb26.SetLineWeight(DotSize);

symb26.AssignValueColor(if s26PB >= 100 then GlobalColor("Above") else if s26PB<= 0 then GlobalColor(“Below”) else if s26PB >=70 then GlobalColor(“Buy”) else if s26PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol26)[5]), 27, "27: " + symbol26, if s26PB[5] >= 100 then GlobalColor("Above") else if s26PB[5]<= 0 then GlobalColor(“Below”) else if s26PB[5] >=70 then GlobalColor(“Buy”) else if s26PB[5] <30 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb26.HideBubble();

plot spacer0 = if !IsNaN(close) and !IsNaN(close(symbol1)) then 0.5 else Double.NaN;

plot spacer1 = if !IsNaN(close) and !IsNaN(close(symbol1)) then 1.5 else Double.NaN;

plot spacer2 = if !IsNaN(close) and !IsNaN(close(symbol2)) then 2.5 else Double.NaN;

plot spacer3 = if !IsNaN(close) and !IsNaN(close(symbol3)) then 3.5 else Double.NaN;

plot spacer4 = if !IsNaN(close) and !IsNaN(close(symbol4)) then 4.5 else Double.NaN;

plot spacer5 = if !IsNaN(close) and !IsNaN(close(symbol5)) then 5.5 else Double.NaN;

plot spacer6 = if !IsNaN(close) and !IsNaN(close(symbol6)) then 6.5 else Double.NaN;

plot spacer7 = if !IsNaN(close) and !IsNaN(close(symbol7)) then 7.5 else Double.NaN;

plot spacer8 = if !IsNaN(close) and !IsNaN(close(symbol8)) then 8.5 else Double.NaN;

plot spacer9 = if !IsNaN(close) and !IsNaN(close(symbol9)) then 9.5 else Double.NaN;

plot spacer10 = if !IsNaN(close) and !IsNaN(close(symbol10)) then 10.5 else Double.NaN;

plot spacer11 = if !IsNaN(close) and !IsNaN(close(symbol11)) then 11.5 else Double.NaN;

plot spacer12 = if !IsNaN(close) and !IsNaN(close(symbol12)) then 12.5 else Double.NaN;

plot spacer13 = if !IsNaN(close) and !IsNaN(close(symbol13)) then 13.5 else Double.NaN;

plot spacer14 = if !IsNaN(close) and !IsNaN(close(symbol14)) then 14.5 else Double.NaN;

plot spacer15 = if !IsNaN(close) and !IsNaN(close(symbol15)) then 15.5 else Double.NaN;

plot spacer16 = if !IsNaN(close) and !IsNaN(close(symbol16)) then 16.5 else Double.NaN;

plot spacer17 = if !IsNaN(close) and !IsNaN(close(symbol17)) then 17.5 else Double.NaN;

plot spacer18 = if !IsNaN(close) and !IsNaN(close(symbol18)) then 18.5 else Double.NaN;

plot spacer19 = if !IsNaN(close) and !IsNaN(close(symbol19)) then 19.5 else Double.NaN;

plot spacer20 = if !IsNaN(close) and !IsNaN(close(symbol20)) then 20.5 else Double.NaN;

plot spacer21 = if !IsNaN(close) and !IsNaN(close(symbol21)) then 21.5 else Double.NaN;

plot spacer22 = if !IsNaN(close) and !IsNaN(close(symbol22)) then 22.5 else Double.NaN;

plot spacer23 = if !IsNaN(close) and !IsNaN(close(symbol23)) then 23.5 else Double.NaN;

plot spacer24 = if !IsNaN(close) and !IsNaN(close(symbol24)) then 24.5 else Double.NaN;

plot spacer25 = if !IsNaN(close) and !IsNaN(close(symbol25)) then 25.5 else Double.NaN;

plot spacer26 = if !IsNaN(close) and !IsNaN(close(symbol26)) then 26.5 else Double.NaN;

spacer0.SetDefaultColor(Color.GRAY);

spacer1.SetDefaultColor(Color.GRAY);

spacer2.SetDefaultColor(Color.GRAY);

spacer3.SetDefaultColor(Color.GRAY);

spacer4.SetDefaultColor(Color.GRAY);

spacer5.SetDefaultColor(Color.GRAY);

spacer6.SetDefaultColor(Color.GRAY);

spacer7.SetDefaultColor(Color.GRAY);

spacer8.SetDefaultColor(Color.GRAY);

spacer9.SetDefaultColor(Color.GRAY);

spacer10.SetDefaultColor(Color.GRAY);

spacer11.SetDefaultColor(Color.GRAY);

spacer12.SetDefaultColor(Color.GRAY);

spacer13.SetDefaultColor(Color.GRAY);

spacer14.SetDefaultColor(Color.GRAY);

spacer15.SetDefaultColor(Color.GRAY);

spacer16.SetDefaultColor(Color.GRAY);

spacer17.SetDefaultColor(Color.GRAY);

spacer18.SetDefaultColor(Color.GRAY);

spacer19.SetDefaultColor(Color.GRAY);

spacer20.SetDefaultColor(Color.GRAY);

spacer21.SetDefaultColor(Color.GRAY);

spacer22.SetDefaultColor(Color.GRAY);

spacer23.SetDefaultColor(Color.GRAY);

spacer24.SetDefaultColor(Color.GRAY);

spacer25.SetDefaultColor(Color.GRAY);

spacer26.SetDefaultColor(Color.GRAY);

spacer0.HideBubble();

spacer1.HideBubble();

spacer2.HideBubble();

spacer3.HideBubble();

spacer4.HideBubble();

spacer5.HideBubble();

spacer6.HideBubble();

spacer7.HideBubble();

spacer8.HideBubble();

spacer9.HideBubble();

spacer10.HideBubble();

spacer11.HideBubble();

spacer12.HideBubble();

spacer13.HideBubble();

spacer14.HideBubble();

spacer15.HideBubble();

spacer16.HideBubble();

spacer17.HideBubble();

spacer18.HideBubble();

spacer19.HideBubble();

spacer20.HideBubble();

spacer21.HideBubble();

spacer22.HideBubble();

spacer23.HideBubble();

spacer24.HideBubble();

spacer25.HideBubble();

spacer26.HideBubble();

spacer0.HideTitle();

spacer1.HideTitle();

spacer2.HideTitle();

spacer3.HideTitle();

spacer4.HideTitle();

spacer5.HideTitle();

spacer6.HideTitle();

spacer7.HideTitle();

spacer8.HideTitle();

spacer9.HideTitle();

spacer10.HideTitle();

spacer11.HideTitle();

spacer12.HideTitle();

spacer13.HideTitle();

spacer14.HideTitle();

spacer15.HideTitle();

spacer16.HideTitle();

spacer17.HideTitle();

spacer18.HideTitle();

spacer19.HideTitle();

spacer20.HideTitle();

spacer21.HideTitle();

spacer22.HideTitle();

spacer23.HideTitle();

spacer24.HideTitle();

spacer25.HideTitle();

spacer26.HideTitle();

AddLabel(1, "Pct B ", Color.ORANGE);

AddLabel(showLabels == yes,"1:" + symbol1 + s1PB + “%”, if s1PB >= 100 then GlobalColor("Above") else if s1PB<= 0 then GlobalColor(“Below”) else if s1PB >=70 then GlobalColor(“Buy”) else if s1PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"2:" + symbol2 + s2PB + “%”, if s2PB >= 100 then GlobalColor("Above") else if s2PB<= 0 then GlobalColor(“Below”) else if s2PB >=70 then GlobalColor(“Buy”) else if s2PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"3:" + symbol3 + s3PB + “%”, if s3PB >= 100 then GlobalColor("Above") else if s3PB<= 0 then GlobalColor(“Below”) else if s3PB >=70 then GlobalColor(“Buy”) else if s3PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"4:" + symbol4 + s4PB + “%”, if s4PB >= 100 then GlobalColor("Above") else if s4PB<= 0 then GlobalColor(“Below”) else if s4PB >=70 then GlobalColor(“Buy”) else if s4PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"5:" + symbol5 + s5PB + “%”, if s5PB >= 100 then GlobalColor("Above") else if s5PB<= 0 then GlobalColor(“Below”) else if s5PB >=70 then GlobalColor(“Buy”) else if s5PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"6:" + symbol6 + s6PB + “%”, if s6PB >= 100 then GlobalColor("Above") else if s6PB<= 0 then GlobalColor(“Below”) else if s6PB >=70 then GlobalColor(“Buy”) else if s6PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"7:" + symbol7 + s1PB + “%”, if s7PB >= 100 then GlobalColor("Above") else if s7PB<= 0 then GlobalColor(“Below”) else if s7PB >=70 then GlobalColor(“Buy”) else if s7PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"8:" + symbol8 + s8PB + “%”, if s8PB >= 100 then GlobalColor("Above") else if s8PB<= 0 then GlobalColor(“Below”) else if s8PB >=70 then GlobalColor(“Buy”) else if s8PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"9:" + symbol9 + s9PB + “%”, if s9PB >= 100 then GlobalColor("Above") else if s9PB<= 0 then GlobalColor(“Below”) else if s9PB >=70 then GlobalColor(“Buy”) else if s9PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"10:" + symbol10 + s10PB + “%”, if s10PB >= 100 then GlobalColor("Above") else if s10PB<= 0 then GlobalColor(“Below”) else if s10PB >=70 then GlobalColor(“Buy”) else if s10PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"11:" + symbol11 + s11PB + “%”, if s11PB >= 100 then GlobalColor("Above") else if s11PB<= 0 then GlobalColor(“Below”) else if s11PB >=70 then GlobalColor(“Buy”) else if s11PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"13:" + symbol12 + s12PB + “%”, if s12PB >= 100 then GlobalColor("Above") else if s12PB<= 0 then GlobalColor(“Below”) else if s12PB >=70 then GlobalColor(“Buy”) else if s12PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"14:" + symbol13 + s13PB + “%”, if s13PB >= 100 then GlobalColor("Above") else if s13PB<= 0 then GlobalColor(“Below”) else if s13PB >=70 then GlobalColor(“Buy”) else if s13PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"15:" + symbol14 + s14PB + “%”, if s14PB >= 100 then GlobalColor("Above") else if s14PB<= 0 then GlobalColor(“Below”) else if s14PB >=70 then GlobalColor(“Buy”) else if s14PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"16:" + symbol15 + s15PB + “%”, if s15PB >= 100 then GlobalColor("Above") else if s15PB<= 0 then GlobalColor(“Below”) else if s15PB >=70 then GlobalColor(“Buy”) else if s15PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"17:" + symbol16 + s16PB + “%”, if s16PB >= 100 then GlobalColor("Above") else if s16PB<= 0 then GlobalColor(“Below”) else if s16PB >=70 then GlobalColor(“Buy”) else if s16PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"18:" + symbol17 + s17PB + “%”, if s17PB >= 100 then GlobalColor("Above") else if s17PB<= 0 then GlobalColor(“Below”) else if s17PB >=70 then GlobalColor(“Buy”) else if s17PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"19:" + symbol18 + s18PB + “%”, if s18PB >= 100 then GlobalColor("Above") else if s18PB<= 0 then GlobalColor(“Below”) else if s18PB >=70 then GlobalColor(“Buy”) else if s18PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"20:" + symbol19 + s19PB + “%”, if s19PB >= 100 then GlobalColor("Above") else if s19PB<= 0 then GlobalColor(“Below”) else if s19PB >=70 then GlobalColor(“Buy”) else if s19PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"21:" + symbol20 + s20PB + “%”, if s20PB >= 100 then GlobalColor("Above") else if s20PB<= 0 then GlobalColor(“Below”) else if s20PB >=70 then GlobalColor(“Buy”) else if s20PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"22:" + symbol21 + s21PB + “%”, if s21PB >= 100 then GlobalColor("Above") else if s21PB<= 0 then GlobalColor(“Below”) else if s21PB >=70 then GlobalColor(“Buy”) else if s21PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"23:" + symbol22 + s22PB + “%”, if s22PB >= 100 then GlobalColor("Above") else if s22PB<= 0 then GlobalColor(“Below”) else if s22PB >=70 then GlobalColor(“Buy”) else if s22PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"24:" + symbol23 + s23PB + “%”, if s23PB >= 100 then GlobalColor("Above") else if s23PB<= 0 then GlobalColor(“Below”) else if s23PB >=70 then GlobalColor(“Buy”) else if s23PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"25:" + symbol24 + s24PB + “%”, if s24PB >= 100 then GlobalColor("Above") else if s24PB<= 0 then GlobalColor(“Below”) else if s24PB >=70 then GlobalColor(“Buy”) else if s24PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"26:" + symbol25 + s25PB + “%”, if s25PB >= 100 then GlobalColor("Above") else if s25PB<= 0 then GlobalColor(“Below”) else if s25PB >=70 then GlobalColor(“Buy”) else if s25PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes,"27:" + symbol26 + s26PB + “%”, if s26PB >= 100 then GlobalColor("Above") else if s26PB<= 0 then GlobalColor(“Below”) else if s26PB >=70 then GlobalColor(“Buy”) else if s26PB <30 then GlobalColor(“Sell") else GlobalColor("Neutral"));declare lower;

DefineGlobalColor("Buy", Color.GREEN);

DefineGlobalColor("Sell", Color.RED);

DefineGlobalColor("Neutral", Color.YELLOW);

input symbol26 = "NYA";

input symbol25 = "XAX";

input symbol24 = "IWB";

input symbol23 = "FFTY";

input symbol22 = "BOUT";

input symbol21 = "XTC";

input symbol20 = "SOX";

input symbol19 = "RUT";

input symbol18 = "RUI";

input symbol17 = "COMP:GIDS";

input symbol16 = "SPY";

input symbol15 = "QQQ";

input symbol14 = "IWM";

input symbol13 = "$DJT";

input symbol12 = "IBB";

input symbol11 = "XLY";

input symbol10 = "XLV";

input symbol9 = "XLU";

input symbol8 = "XLRE";

input symbol7 = "XLP";

input symbol6 = "XLK";

input symbol5 = "XLI";

input symbol4 = "XLF";

input symbol3 = "XLE";

input symbol2 = "XLC";

input symbol1 = "XLB";

input DotSize = 5;

input showLabels = yes;

input showBubbles = no;

script PBW {

input symbol = "";

def price = close(symbol);

input displace = 0;

input length = 20;

input Num_Dev_Dn = -2.0;

input Num_Dev_up = 2.0;

input averageType = AverageType.SIMPLE;

def upperBand = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_up, averageType).UpperBand;

def lowerBand = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_up, averageType).LowerBand;

def midLine = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_up, averageType).MidLine;

def Bandwidth = (upperBand - lowerBand) / midLine;

plot PercentBW = Round(((price - lowerBand) / (upperBand - lowerBand) * Bandwidth) * 100,2);

}

def s1PB = PBW(symbol1);

def s2PB = PBW(symbol2);

def s3PB = PBW(symbol3);

def s4PB = PBW(symbol4);

def s5PB = PBW(symbol5);

def s6PB = PBW(symbol6);

def s7PB = PBW(symbol7);

def s8PB = PBW(symbol8);

def s9PB = PBW(symbol9);

def s10PB = PBW(symbol10);

def s11PB = PBW(symbol11);

def s12PB = PBW(symbol12);

def s13PB = PBW(symbol13);

def s14PB = PBW(symbol14);

def s15PB = PBW(symbol15);

def s16PB = PBW(symbol16);

def s17PB = PBW(symbol17);

def s18PB = PBW(symbol18);

def s19PB = PBW(symbol19);

def s20PB = PBW(symbol20);

def s21PB = PBW(symbol21);

def s22PB = PBW(symbol22);

def s23PB = PBW(symbol23);

def s24PB = PBW(symbol24);

def s25PB = PBW(symbol25);

def s26PB = PBW(symbol26);

#######Plots

plot symb1 = if !IsNaN(close) and !IsNaN(close(symbol1)) then 1 else Double.NaN;

symb1.SetPaintingStrategy(PaintingStrategy.POINTS);

symb1.SetLineWeight(DotSize);

symb1.AssignValueColor(if s1PB >= 3.5 then GlobalColor(“Buy”) else if s1PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol1)[1]), 1, "1: " + symbol1, if s1PB[1] >= 3.5 then GlobalColor(“Buy”) else if s1PB[1] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb1.HideBubble();

plot symb2 = if !IsNaN(close) and !IsNaN(close(symbol2)) then 2 else Double.NaN;

symb2.SetPaintingStrategy(PaintingStrategy.POINTS);

symb2.SetLineWeight(DotSize);

symb2.AssignValueColor(if s2PB >= 3.5 then GlobalColor(“Buy”) else if s2PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol2)[5]), 2, "2: " + symbol2, if s2PB[5] >= 3.5 then GlobalColor(“Buy”) else if s2PB[5] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb2.HideBubble();

plot symb3 = if !IsNaN(close) and !IsNaN(close(symbol3)) then 3 else Double.NaN;

symb3.SetPaintingStrategy(PaintingStrategy.POINTS);

symb3.SetLineWeight(DotSize);

symb3.AssignValueColor(if s3PB >= 3.5 then GlobalColor(“Buy”) else if s3PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol3)[1]), 3, "3: " + symbol3, if s3PB[1] >= 3.5 then GlobalColor(“Buy”) else if s3PB[1] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb3.HideBubble();

plot symb4 = if !IsNaN(close) and !IsNaN(close(symbol4)) then 4 else Double.NaN;

symb4.SetPaintingStrategy(PaintingStrategy.POINTS);

symb4.SetLineWeight(DotSize);

symb4.AssignValueColor(if s4PB >= 3.5 then GlobalColor(“Buy”) else if s4PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol4)[5]), 4, "4: " + symbol4, if s4PB[5] >= 3.5 then GlobalColor(“Buy”) else if s4PB[5] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb4.HideBubble();

plot symb5 = if !IsNaN(close) and !IsNaN(close(symbol5)) then 5 else Double.NaN;

symb5.SetPaintingStrategy(PaintingStrategy.POINTS);

symb5.SetLineWeight(DotSize);

symb5.AssignValueColor(if s5PB >= 3.5 then GlobalColor(“Buy”) else if s5PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol5)[1]), 5, "5: " + symbol5, if s5PB[1] >= 3.5 then GlobalColor(“Buy”) else if s5PB[1] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb5.HideBubble();

plot symb6 = if !IsNaN(close) and !IsNaN(close(symbol6)) then 6 else Double.NaN;

symb6.SetPaintingStrategy(PaintingStrategy.POINTS);

symb6.SetLineWeight(DotSize);

symb6.AssignValueColor(if s6PB >= 3.5 then GlobalColor(“Buy”) else if s6PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol6)[5]), 6, "6: " + symbol6, if s6PB[5] >= 3.5 then GlobalColor(“Buy”) else if s6PB[5] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb6.HideBubble();

plot symb7 = if !IsNaN(close) and !IsNaN(close(symbol7)) then 7 else Double.NaN;

symb7.SetPaintingStrategy(PaintingStrategy.POINTS);

symb7.SetLineWeight(DotSize);

symb7.AssignValueColor(if s7PB >= 3.5 then GlobalColor(“Buy”) else if s7PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol7)[1]), 7, "7: " + symbol7, if s7PB[1] >= 3.5 then GlobalColor(“Buy”) else if s7PB[1] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb7.HideBubble();

plot symb8 = if !IsNaN(close) and !IsNaN(close(symbol8)) then 8 else Double.NaN;

symb8.SetPaintingStrategy(PaintingStrategy.POINTS);

symb8.SetLineWeight(DotSize);

symb8.AssignValueColor(if s8PB >= 3.5 then GlobalColor(“Buy”) else if s8PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol8)[5]), 8, "8: " + symbol8, if s8PB[5] >= 3.5 then GlobalColor(“Buy”) else if s8PB[5] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb8.HideBubble();

plot symb9 = if !IsNaN(close) and !IsNaN(close(symbol9)) then 9 else Double.NaN;

symb9.SetPaintingStrategy(PaintingStrategy.POINTS);

symb9.SetLineWeight(DotSize);

symb9.AssignValueColor(if s9PB >= 3.5 then GlobalColor(“Buy”) else if s9PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol9)[1]), 9, "9: " + symbol9, if s9PB[1] >= 3.5 then GlobalColor(“Buy”) else if s9PB[1] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb9.HideBubble();

plot symb10 = if !IsNaN(close) and !IsNaN(close(symbol10)) then 10 else Double.NaN;

symb10.SetPaintingStrategy(PaintingStrategy.POINTS);

symb10.SetLineWeight(DotSize);

symb10.AssignValueColor(if s10PB >= 3.5 then GlobalColor(“Buy”) else if s10PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol10)[5]), 10, "10: " + symbol10, if s10PB[5] >= 3.5 then GlobalColor(“Buy”) else if s10PB[5] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb10.HideBubble();

plot symb11 = if !IsNaN(close) and !IsNaN(close(symbol11)) then 11 else Double.NaN;

symb11.SetPaintingStrategy(PaintingStrategy.POINTS);

symb11.SetLineWeight(DotSize);

symb11.AssignValueColor(if s11PB >= 3.5 then GlobalColor(“Buy”) else if s11PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol11)[1]), 11, "11: " + symbol11, if s11PB[1] >= 3.5 then GlobalColor(“Buy”) else if s11PB[1] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb11.HideBubble();

plot symb12 = if !IsNaN(close) and !IsNaN(close(symbol12)) then 13 else Double.NaN;

symb12.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

symb12.SetLineWeight(DotSize);

symb12.AssignValueColor(if s12PB >= 3.5 then GlobalColor(“Buy”) else if s12PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol12)[5]), 13, "13: " + symbol12, if s12PB[5] >= 3.5 then GlobalColor(“Buy”) else if s12PB[5] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb12.HideBubble();

plot symb13 = if !IsNaN(close) and !IsNaN(close(symbol13)) then 14 else Double.NaN;

symb13.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

symb13.SetLineWeight(DotSize);

symb13.AssignValueColor(if s13PB >= 3.5 then GlobalColor(“Buy”) else if s13PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol13)[1]), 14, "14: " + symbol13, if s13PB[1] >= 3.5 then GlobalColor(“Buy”) else if s13PB[1] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb13.HideBubble();

plot symb14 = if !IsNaN(close) and !IsNaN(close(symbol14)) then 15 else Double.NaN;

symb14.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

symb14.SetLineWeight(DotSize);

symb14.AssignValueColor(if s14PB >= 3.5 then GlobalColor(“Buy”) else if s14PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol14)[5]), 15, "15: " + symbol14, if s14PB[5] >= 3.5 then GlobalColor(“Buy”) else if s14PB[5] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb14.HideBubble();

plot symb15 = if !IsNaN(close) and !IsNaN(close(symbol15)) then 16 else Double.NaN;

symb15.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

symb15.SetLineWeight(DotSize);

symb15.AssignValueColor(if s15PB >= 3.5 then GlobalColor(“Buy”) else if s15PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol15)[1]), 16, "16: " + symbol15, if s15PB[1] >= 3.5 then GlobalColor(“Buy”) else if s15PB[1] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb15.HideBubble();

plot symb16 = if !IsNaN(close) and !IsNaN(close(symbol16)) then 17 else Double.NaN;

symb16.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

symb16.SetLineWeight(DotSize);

symb16.AssignValueColor(if s16PB >= 3.5 then GlobalColor(“Buy”) else if s16PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol16)[5]), 17, "17: " + symbol16, if s16PB[5] >= 3.5 then GlobalColor(“Buy”) else if s16PB[5] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb16.HideBubble();

plot symb17 = if !IsNaN(close) and !IsNaN(close(symbol17)) then 18 else Double.NaN;

symb17.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

symb17.SetLineWeight(DotSize);

symb17.AssignValueColor(if s17PB >= 3.5 then GlobalColor(“Buy”) else if s17PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol17)[1]), 18, "18: " + symbol17, if s17PB[1] >= 3.5 then GlobalColor(“Buy”) else if s17PB[1] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb17.HideBubble();

plot symb18 = if !IsNaN(close) and !IsNaN(close(symbol18)) then 19 else Double.NaN;

symb18.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

symb18.SetLineWeight(DotSize);

symb18.AssignValueColor(if s18PB >= 3.5 then GlobalColor(“Buy”) else if s18PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol18)[5]), 19, "19: " + symbol18, if s18PB[5] >= 3.5 then GlobalColor(“Buy”) else if s18PB[5] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb18.HideBubble();

plot symb19 = if !IsNaN(close) and !IsNaN(close(symbol19)) then 20 else Double.NaN;

symb19.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

symb19.SetLineWeight(DotSize);

symb19.AssignValueColor(if s19PB >= 3.5 then GlobalColor(“Buy”) else if s19PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol19)[1]), 20, "20: " + symbol19, if s19PB[1] >= 3.5 then GlobalColor(“Buy”) else if s19PB[1] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb19.HideBubble();

plot symb20 = if !IsNaN(close) and !IsNaN(close(symbol20)) then 21 else Double.NaN;

symb20.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

symb20.SetLineWeight(DotSize);

symb20.AssignValueColor(if s20PB >= 3.5 then GlobalColor(“Buy”) else if s20PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol20)[5]), 21, "21: " + symbol20, if s20PB[5] >= 3.5 then GlobalColor(“Buy”) else if s20PB[5] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb20.HideBubble();

plot symb21 = if !IsNaN(close) and !IsNaN(close(symbol21)) then 22 else Double.NaN;

symb21.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

symb21.SetLineWeight(DotSize);

symb21.AssignValueColor(if s21PB >= 3.5 then GlobalColor(“Buy”) else if s21PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol21)[1]), 22, "22: " + symbol21, if s21PB[1] >= 3.5 then GlobalColor(“Buy”) else if s21PB[1] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb21.HideBubble();

plot symb22 = if !IsNaN(close) and !IsNaN(close(symbol22)) then 23 else Double.NaN;

symb22.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

symb22.SetLineWeight(DotSize);

symb22.AssignValueColor(if s22PB >= 3.5 then GlobalColor(“Buy”) else if s22PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol22)[5]), 23, "23: " + symbol22, if s22PB[5] >= 3.5 then GlobalColor(“Buy”) else if s22PB[5] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb22.HideBubble();

plot symb23 = if !IsNaN(close) and !IsNaN(close(symbol23)) then 24 else Double.NaN;

symb23.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

symb23.SetLineWeight(DotSize);

symb23.AssignValueColor(if s23PB >= 3.5 then GlobalColor(“Buy”) else if s23PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol23)[1]), 24, "24: " + symbol23, if s23PB[1] >= 3.5 then GlobalColor(“Buy”) else if s23PB[1] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb23.HideBubble();

plot symb24 = if !IsNaN(close) and !IsNaN(close(symbol24)) then 25 else Double.NaN;

symb24.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

symb24.SetLineWeight(DotSize);

symb24.AssignValueColor(if s24PB >= 3.5 then GlobalColor(“Buy”) else if s24PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol24)[5]), 25, "25: " + symbol24, if s24PB[5] >= 3.5 then GlobalColor(“Buy”) else if s24PB[5] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb24.HideBubble();

plot symb25 = if !IsNaN(close) and !IsNaN(close(symbol25)) then 26 else Double.NaN;

symb25.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

symb25.SetLineWeight(DotSize);

symb25.AssignValueColor(if s25PB >= 3.5 then GlobalColor(“Buy”) else if s25PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[1]) and !IsNaN(close(symbol25)[1]), 26, "26: " + symbol25, if s25PB[1] >= 3.5 then GlobalColor(“Buy”) else if s25PB[1] <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb25.HideBubble();

plot symb26 = if !IsNaN(close) and !IsNaN(close(symbol26)) then 27 else Double.NaN;

symb26.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

symb26.SetLineWeight(DotSize);

symb26.AssignValueColor(if s26PB >= 3.5 then GlobalColor(“Buy”) else if s26PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddChartBubble(showBubbles and IsNaN(close) and !IsNaN(close[4]) and !IsNaN(close(symbol26)[5]), 27, "27: " + symbol26, if s26PB[5] >= 3.5 then GlobalColor(“Buy”) else if s26PB[5] < 1 then GlobalColor(“Sell") else GlobalColor("Neutral"), yes);

symb26.HideBubble();

plot spacer0 = if !IsNaN(close) and !IsNaN(close(symbol1)) then 0.5 else Double.NaN;

plot spacer1 = if !IsNaN(close) and !IsNaN(close(symbol1)) then 1.5 else Double.NaN;

plot spacer2 = if !IsNaN(close) and !IsNaN(close(symbol2)) then 2.5 else Double.NaN;

plot spacer3 = if !IsNaN(close) and !IsNaN(close(symbol3)) then 3.5 else Double.NaN;

plot spacer4 = if !IsNaN(close) and !IsNaN(close(symbol4)) then 4.5 else Double.NaN;

plot spacer5 = if !IsNaN(close) and !IsNaN(close(symbol5)) then 5.5 else Double.NaN;

plot spacer6 = if !IsNaN(close) and !IsNaN(close(symbol6)) then 6.5 else Double.NaN;

plot spacer7 = if !IsNaN(close) and !IsNaN(close(symbol7)) then 7.5 else Double.NaN;

plot spacer8 = if !IsNaN(close) and !IsNaN(close(symbol8)) then 8.5 else Double.NaN;

plot spacer9 = if !IsNaN(close) and !IsNaN(close(symbol9)) then 9.5 else Double.NaN;

plot spacer10 = if !IsNaN(close) and !IsNaN(close(symbol10)) then 10.5 else Double.NaN;

plot spacer11 = if !IsNaN(close) and !IsNaN(close(symbol11)) then 11.5 else Double.NaN;

plot spacer12 = if !IsNaN(close) and !IsNaN(close(symbol12)) then 12.5 else Double.NaN;

plot spacer13 = if !IsNaN(close) and !IsNaN(close(symbol13)) then 13.5 else Double.NaN;

plot spacer14 = if !IsNaN(close) and !IsNaN(close(symbol14)) then 14.5 else Double.NaN;

plot spacer15 = if !IsNaN(close) and !IsNaN(close(symbol15)) then 15.5 else Double.NaN;

plot spacer16 = if !IsNaN(close) and !IsNaN(close(symbol16)) then 16.5 else Double.NaN;

plot spacer17 = if !IsNaN(close) and !IsNaN(close(symbol17)) then 17.5 else Double.NaN;

plot spacer18 = if !IsNaN(close) and !IsNaN(close(symbol18)) then 18.5 else Double.NaN;

plot spacer19 = if !IsNaN(close) and !IsNaN(close(symbol19)) then 19.5 else Double.NaN;

plot spacer20 = if !IsNaN(close) and !IsNaN(close(symbol20)) then 20.5 else Double.NaN;

plot spacer21 = if !IsNaN(close) and !IsNaN(close(symbol21)) then 21.5 else Double.NaN;

plot spacer22 = if !IsNaN(close) and !IsNaN(close(symbol22)) then 22.5 else Double.NaN;

plot spacer23 = if !IsNaN(close) and !IsNaN(close(symbol23)) then 23.5 else Double.NaN;

plot spacer24 = if !IsNaN(close) and !IsNaN(close(symbol24)) then 24.5 else Double.NaN;

plot spacer25 = if !IsNaN(close) and !IsNaN(close(symbol25)) then 25.5 else Double.NaN;

plot spacer26 = if !IsNaN(close) and !IsNaN(close(symbol26)) then 26.5 else Double.NaN;

spacer0.SetDefaultColor(Color.GRAY);

spacer1.SetDefaultColor(Color.GRAY);

spacer2.SetDefaultColor(Color.GRAY);

spacer3.SetDefaultColor(Color.GRAY);

spacer4.SetDefaultColor(Color.GRAY);

spacer5.SetDefaultColor(Color.GRAY);

spacer6.SetDefaultColor(Color.GRAY);

spacer7.SetDefaultColor(Color.GRAY);

spacer8.SetDefaultColor(Color.GRAY);

spacer9.SetDefaultColor(Color.GRAY);

spacer10.SetDefaultColor(Color.GRAY);

spacer11.SetDefaultColor(Color.GRAY);

spacer12.SetDefaultColor(Color.GRAY);

spacer13.SetDefaultColor(Color.GRAY);

spacer14.SetDefaultColor(Color.GRAY);

spacer15.SetDefaultColor(Color.GRAY);

spacer16.SetDefaultColor(Color.GRAY);

spacer17.SetDefaultColor(Color.GRAY);

spacer18.SetDefaultColor(Color.GRAY);

spacer19.SetDefaultColor(Color.GRAY);

spacer20.SetDefaultColor(Color.GRAY);

spacer21.SetDefaultColor(Color.GRAY);

spacer22.SetDefaultColor(Color.GRAY);

spacer23.SetDefaultColor(Color.GRAY);

spacer24.SetDefaultColor(Color.GRAY);

spacer25.SetDefaultColor(Color.GRAY);

spacer26.SetDefaultColor(Color.GRAY);

spacer0.HideBubble();

spacer1.HideBubble();

spacer2.HideBubble();

spacer3.HideBubble();

spacer4.HideBubble();

spacer5.HideBubble();

spacer6.HideBubble();

spacer7.HideBubble();

spacer8.HideBubble();

spacer9.HideBubble();

spacer10.HideBubble();

spacer11.HideBubble();

spacer12.HideBubble();

spacer13.HideBubble();

spacer14.HideBubble();

spacer15.HideBubble();

spacer16.HideBubble();

spacer17.HideBubble();

spacer18.HideBubble();

spacer19.HideBubble();

spacer20.HideBubble();

spacer21.HideBubble();

spacer22.HideBubble();

spacer23.HideBubble();

spacer24.HideBubble();

spacer25.HideBubble();

spacer26.HideBubble();

spacer0.HideTitle();

spacer1.HideTitle();

spacer2.HideTitle();

spacer3.HideTitle();

spacer4.HideTitle();

spacer5.HideTitle();

spacer6.HideTitle();

spacer7.HideTitle();

spacer8.HideTitle();

spacer9.HideTitle();

spacer10.HideTitle();

spacer11.HideTitle();

spacer12.HideTitle();

spacer13.HideTitle();

spacer14.HideTitle();

spacer15.HideTitle();

spacer16.HideTitle();

spacer17.HideTitle();

spacer18.HideTitle();

spacer19.HideTitle();

spacer20.HideTitle();

spacer21.HideTitle();

spacer22.HideTitle();

spacer23.HideTitle();

spacer24.HideTitle();

spacer25.HideTitle();

spacer26.HideTitle();

AddLabel(1, "PctBxBW ", Color.ORANGE);

AddLabel(showLabels == yes, "1:" + symbol1 + s1PB + “%”, if s1PB >= 3.5 then GlobalColor(“Buy”) else if s1PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "2:" + symbol2 + s2PB + “%”, if s2PB >= 3.5 then GlobalColor(“Buy”) else if s2PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "3:" + symbol3 + s3PB + “%”, if s3PB >= 3.5 then GlobalColor(“Buy”) else if s3PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "4:" + symbol4 + s4PB + "%",if s4PB >= 3.5 then GlobalColor(“Buy”) else if s4PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "5:" + symbol5 + s5PB + “%”, if s5PB >= 3.5 then GlobalColor(“Buy”) else if s5PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "6:" + symbol6 + s6PB + “%”, if s6PB >= 3.5 then GlobalColor(“Buy”) else if s6PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "7:" + symbol7 + s1PB + “%”, if s7PB >= 3.5 then GlobalColor(“Buy”) else if s7PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "8:" + symbol8 + s8PB + “%”, if s8PB >= 3.5 then GlobalColor(“Buy”) else if s8PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "9:" + symbol9 + s9PB + “%”, if s9PB >= 3.5 then GlobalColor(“Buy”) else if s9PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "10:" + symbol10 + s10PB + “%”, if s10PB >= 3.5 then GlobalColor(“Buy”) else if s10PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "11:" + symbol11 + s11PB + “%”, if s11PB >= 3.5 then GlobalColor(“Buy”) else if s11PB <=1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "13:" + symbol12 + s12PB + “%”, if s12PB >= 3.5 then GlobalColor(“Buy”) else if s12PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "14:" + symbol13 + s13PB + “%”, if s13PB >= 3.5 then GlobalColor(“Buy”) else if s13PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "15:" + symbol14 + s14PB + “%”, if s14PB >= 3.5 then GlobalColor(“Buy”) else if s14PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "16:" + symbol15 + s15PB + “%”, if s15PB >= 3.5 then GlobalColor(“Buy”) else if s15PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "17:" + symbol16 + s16PB + “%”, if s16PB >= 3.5 then GlobalColor(“Buy”) else if s16PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "18:" + symbol17 + s17PB + “%”, if s17PB >= 3.5 then GlobalColor(“Buy”) else if s17PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "19:" + symbol18 + s18PB + “%”, if s18PB >= 3.5 then GlobalColor(“Buy”) else if s18PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "20:" + symbol19 + s19PB + “%”, if s19PB >= 3.5 then GlobalColor(“Buy”) else if s19PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "21:" + symbol20 + s20PB + “%”, if s20PB >= 3.5 then GlobalColor(“Buy”) else if s20PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "22:" + symbol21 + s21PB + “%”, if s21PB >= 3.5 then GlobalColor(“Buy”) else if s21PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "23:" + symbol22 + s22PB + “%”, if s22PB >= 3.5 then GlobalColor(“Buy”) else if s22PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "24:" + symbol23 + s23PB + “%”, if s23PB >= 3.5 then GlobalColor(“Buy”) else if s23PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "25:" + symbol24 + s24PB + “%”, if s24PB >= 3.5 then GlobalColor(“Buy”) else if s24PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "26:" + symbol25 + s25PB + “%”, if s25PB >= 3.5 then GlobalColor(“Buy”) else if s25PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));

AddLabel(showLabels == yes, "27:" + symbol26 + s26PB + “%”, if s26PB >= 3.5 then GlobalColor(“Buy”) else if s26PB <= 1 then GlobalColor(“Sell") else GlobalColor("Neutral"));declare lower;

input symbol26 = "NYA";

input symbol25 = "XAX";

input symbol24 = "IWB";

input symbol23 = "FFTY";

input symbol22 = "BOUT";

input symbol21 = "XTC";

input symbol20 = "SOX";

input symbol19 = "RUT";

input symbol18 = "RUI";

input symbol17 = "COMP:GIDS";

input symbol16 = "SPY";

input symbol15 = "QQQ";

input symbol14 = "IWM";

input symbol13 = "$DJT";

input symbol12 = "IBB";

input symbol11 = "XLY";

input symbol10 = "XLV";

input symbol9 = "XLU";

input symbol8 = "XLRE";

input symbol7 = "XLP";

input symbol6 = "XLK";

input symbol5 = "XLI";

input symbol4 = "XLF";

input symbol3 = "XLE";

input symbol2 = "XLC";

input symbol1 = "XLB";

input Length1 = 3;

input Length2 = 6;

input Length3 = 9;

input Length4 = 12;

input Length5 = 15;

input Length6 = 30;

input Length7 = 45;

input Length8 = 60;

input averageType = AverageType.EXPONENTIAL;

input lookback = 21;

input smoothingPeriod = 10;

input showLabels = yes;

DefineGlobalColor("ALong", Color.CYAN);

DefineGlobalColor("AShort", Color.MAGENTA);

DefineGlobalColor("Buy", Color.GREEN);

DefineGlobalColor("Sell", Color.RED);

DefineGlobalColor("Neutral", Color.YELLOW);

input DotSize = 3;

script SymbolRank_AXL {

input symbol = "";

def price1 = (close(symbol) + open(symbol)) / 2;

input Length1 = 3;

input Length2 = 6;

input Length3 = 9;

input Length4 = 12;

input Length5 = 15;

input Length6 = 30;

input Length7 = 45;

input Length8 = 60;

input averageType = AverageType.EXPONENTIAL;

def D1 = MovingAverage(averageType, price1, Length1);

def D2 = MovingAverage(averageType, price1, Length2);

def D3 = MovingAverage(averageType, price1, Length3);

def D4 = MovingAverage(averageType, price1, Length4);

def W1 = MovingAverage(averageType, price1, Length5);

def W2 = MovingAverage(averageType, price1, Length6);

def W3 = MovingAverage(averageType, price1, Length7);

def W4 = MovingAverage(averageType, price1, Length8);

def DCondition1 = If(D1 > D2 and D2 > D3 and D3 > D4, 5,

If((D1 > D2 and D2 > D4 and D4 > D3) or (D1 > D3 and D3 > D2 and D2 > D4) or

(D2 > D1 and D1 > D3 and D3 > D4), 4, If(D2 > D1 and D1 > D4 and D4 > D3, 3,

If((D1 > D3 and D3 > D4 and D4 > D2) or ( D1 > D4 and D4 > D2 and D2 > D3) or

(D2 > D3 and D3 > D1 and D1 > D4) or (D3 > D1 and D1 > D2 and D2 > D4) , 2,

If((D1 > D4 and D4 > D3 and D3 > D2) or (D3 > D2 and D2 > D1 and D1 > D4), 1, 0)))));

def DCondition2 = If(D4 > D3 and D3 > D2 and D2 > D1, -5,

If((D3 > D4 and D4 > D2 and D2 > D1) or (D4 > D2 and D2 > D3 and D3 > D1) or

(D4 > D3 and D3 > D1 and D1 > D2), -4, If(D3 > D4 and D4 > D1 and D1 > D2, -3,

If((D2 > D4 and D4 > D3 and D3 > D1) or (D3 > D2 and D2 > D4 and D4 > D1) or

(D4 > D1 and D1 > D3 and D3 > D2) or (D4 > D2 and D2 > D1 and D1 > D3) , -2,

If((D2 > D3 and D3 > D4 and D4 > D1) or (D4 > D1 and D1 > D2 and D2 > D3), -1, 0)))));

def WCondition1 = If(W1 > W2 and W2 > W3 and W3 > W4, 50,

If((W1 > W2 and W2 > W4 and W4 > W3) or (W1 > W3 and W3 > W2 and W2 > W4) or

(W2 > W1 and W1 > W3 and W3 > W4), 40, If(W2 > W1 and W1 > W4 and W4 > W3, 30,

If((W1 > W3 and W3 > W4 and W4 > W2) or ( W1 > W4 and W4 > W2 and W2 > W3) or

(W2 > W3 and W3 > W1 and W1 > W4) or (W3 > W1 and W1 > W2 and W2 > W4) , 20,

If((W1 > W4 and W4 > W3 and W3 > W2) or (W3 > W2 and W2 > W1 and W1 > W4), 10, 0)))));

def WCondition2 = If(W4 > W3 and W3 > W2 and W2 > W1, -50,

If((W3 > W4 and W4 > W2 and W2 > W1) or (W4 > W2 and W2 > W3 and W3 > W1) or

(W4 > W3 and W3 > W1 and W1 > W2), -40, If(W3 > W4 and W4 > W1 and W1 > W2, -30,

If((W2 > W4 and W4 > W3 and W3 > W1) or (W3 > W2 and W2 > W4 and W4 > W1) or

(W4 > W1 and W1 > W3 and W3 > W2) or (W4 > W2 and W2 > W1 and W1 > W3) , -20,

If((W2 > W3 and W3 > W4 and W4 > W1) or (W4 > W1 and W1 > W2 and W2 > W3), -10, 0)))));

def WT = (WCondition1 + WCondition2);

def TT = (WCondition1 + WCondition2 + DCondition1 + DCondition2);

#####signals

plot AXL = TT crosses above WT;

}

script SymbolRank_AXS {

input symbol = "";

def price1 = (close(symbol) + open(symbol)) / 2;

input Length1 = 3;

input Length2 = 6;

input Length3 = 9;

input Length4 = 12;

input Length5 = 15;

input Length6 = 30;

input Length7 = 45;

input Length8 = 60;

input averageType = AverageType.EXPONENTIAL;

def D1 = MovingAverage(averageType, price1, Length1);

def D2 = MovingAverage(averageType, price1, Length2);

def D3 = MovingAverage(averageType, price1, Length3);

def D4 = MovingAverage(averageType, price1, Length4);

def W1 = MovingAverage(averageType, price1, Length5);

def W2 = MovingAverage(averageType, price1, Length6);

def W3 = MovingAverage(averageType, price1, Length7);

def W4 = MovingAverage(averageType, price1, Length8);

def DCondition1 = If(D1 > D2 and D2 > D3 and D3 > D4, 5,

If((D1 > D2 and D2 > D4 and D4 > D3) or (D1 > D3 and D3 > D2 and D2 > D4) or

(D2 > D1 and D1 > D3 and D3 > D4), 4, If(D2 > D1 and D1 > D4 and D4 > D3, 3,

If((D1 > D3 and D3 > D4 and D4 > D2) or ( D1 > D4 and D4 > D2 and D2 > D3) or

(D2 > D3 and D3 > D1 and D1 > D4) or (D3 > D1 and D1 > D2 and D2 > D4) , 2,

If((D1 > D4 and D4 > D3 and D3 > D2) or (D3 > D2 and D2 > D1 and D1 > D4), 1, 0)))));

def DCondition2 = If(D4 > D3 and D3 > D2 and D2 > D1, -5,

If((D3 > D4 and D4 > D2 and D2 > D1) or (D4 > D2 and D2 > D3 and D3 > D1) or

(D4 > D3 and D3 > D1 and D1 > D2), -4, If(D3 > D4 and D4 > D1 and D1 > D2, -3,

If((D2 > D4 and D4 > D3 and D3 > D1) or (D3 > D2 and D2 > D4 and D4 > D1) or

(D4 > D1 and D1 > D3 and D3 > D2) or (D4 > D2 and D2 > D1 and D1 > D3) , -2,

If((D2 > D3 and D3 > D4 and D4 > D1) or (D4 > D1 and D1 > D2 and D2 > D3), -1, 0)))));

def WCondition1 = If(W1 > W2 and W2 > W3 and W3 > W4, 50,

If((W1 > W2 and W2 > W4 and W4 > W3) or (W1 > W3 and W3 > W2 and W2 > W4) or

(W2 > W1 and W1 > W3 and W3 > W4), 40, If(W2 > W1 and W1 > W4 and W4 > W3, 30,

If((W1 > W3 and W3 > W4 and W4 > W2) or ( W1 > W4 and W4 > W2 and W2 > W3) or

(W2 > W3 and W3 > W1 and W1 > W4) or (W3 > W1 and W1 > W2 and W2 > W4) , 20,

If((W1 > W4 and W4 > W3 and W3 > W2) or (W3 > W2 and W2 > W1 and W1 > W4), 10, 0)))));

def WCondition2 = If(W4 > W3 and W3 > W2 and W2 > W1, -50,

If((W3 > W4 and W4 > W2 and W2 > W1) or (W4 > W2 and W2 > W3 and W3 > W1) or

(W4 > W3 and W3 > W1 and W1 > W2), -40, If(W3 > W4 and W4 > W1 and W1 > W2, -30,

If((W2 > W4 and W4 > W3 and W3 > W1) or (W3 > W2 and W2 > W4 and W4 > W1) or

(W4 > W1 and W1 > W3 and W3 > W2) or (W4 > W2 and W2 > W1 and W1 > W3) , -20,

If((W2 > W3 and W3 > W4 and W4 > W1) or (W4 > W1 and W1 > W2 and W2 > W3), -10, 0)))));

def WT = (WCondition1 + WCondition2);

def TT = (WCondition1 + WCondition2 + DCondition1 + DCondition2);

#####signals

plot AXS = TT crosses below WT;

}

script SymbolRank_ALong {

input symbol = "";

def price1 = (close(symbol) + open(symbol)) / 2;

input Length1 = 3;

input Length2 = 6;

input Length3 = 9;

input Length4 = 12;

input Length5 = 15;

input Length6 = 30;

input Length7 = 45;

input Length8 = 60;

input averageType = AverageType.EXPONENTIAL;

def D1 = MovingAverage(averageType, price1, Length1);

def D2 = MovingAverage(averageType, price1, Length2);

def D3 = MovingAverage(averageType, price1, Length3);

def D4 = MovingAverage(averageType, price1, Length4);

def W1 = MovingAverage(averageType, price1, Length5);

def W2 = MovingAverage(averageType, price1, Length6);

def W3 = MovingAverage(averageType, price1, Length7);

def W4 = MovingAverage(averageType, price1, Length8);

def DCondition1 = If(D1 > D2 and D2 > D3 and D3 > D4, 5,

If((D1 > D2 and D2 > D4 and D4 > D3) or (D1 > D3 and D3 > D2 and D2 > D4) or

(D2 > D1 and D1 > D3 and D3 > D4), 4, If(D2 > D1 and D1 > D4 and D4 > D3, 3,

If((D1 > D3 and D3 > D4 and D4 > D2) or ( D1 > D4 and D4 > D2 and D2 > D3) or

(D2 > D3 and D3 > D1 and D1 > D4) or (D3 > D1 and D1 > D2 and D2 > D4) , 2,

If((D1 > D4 and D4 > D3 and D3 > D2) or (D3 > D2 and D2 > D1 and D1 > D4), 1, 0)))));

def DCondition2 = If(D4 > D3 and D3 > D2 and D2 > D1, -5,

If((D3 > D4 and D4 > D2 and D2 > D1) or (D4 > D2 and D2 > D3 and D3 > D1) or

(D4 > D3 and D3 > D1 and D1 > D2), -4, If(D3 > D4 and D4 > D1 and D1 > D2, -3,

If((D2 > D4 and D4 > D3 and D3 > D1) or (D3 > D2 and D2 > D4 and D4 > D1) or

(D4 > D1 and D1 > D3 and D3 > D2) or (D4 > D2 and D2 > D1 and D1 > D3) , -2,

If((D2 > D3 and D3 > D4 and D4 > D1) or (D4 > D1 and D1 > D2 and D2 > D3), -1, 0)))));

def WCondition1 = If(W1 > W2 and W2 > W3 and W3 > W4, 50,

If((W1 > W2 and W2 > W4 and W4 > W3) or (W1 > W3 and W3 > W2 and W2 > W4) or

(W2 > W1 and W1 > W3 and W3 > W4), 40, If(W2 > W1 and W1 > W4 and W4 > W3, 30,

If((W1 > W3 and W3 > W4 and W4 > W2) or ( W1 > W4 and W4 > W2 and W2 > W3) or

(W2 > W3 and W3 > W1 and W1 > W4) or (W3 > W1 and W1 > W2 and W2 > W4) , 20,

If((W1 > W4 and W4 > W3 and W3 > W2) or (W3 > W2 and W2 > W1 and W1 > W4), 10, 0)))));

def WCondition2 = If(W4 > W3 and W3 > W2 and W2 > W1, -50,

If((W3 > W4 and W4 > W2 and W2 > W1) or (W4 > W2 and W2 > W3 and W3 > W1) or

(W4 > W3 and W3 > W1 and W1 > W2), -40, If(W3 > W4 and W4 > W1 and W1 > W2, -30,

If((W2 > W4 and W4 > W3 and W3 > W1) or (W3 > W2 and W2 > W4 and W4 > W1) or

(W4 > W1 and W1 > W3 and W3 > W2) or (W4 > W2 and W2 > W1 and W1 > W3) , -20,

If((W2 > W3 and W3 > W4 and W4 > W1) or (W4 > W1 and W1 > W2 and W2 > W3), -10, 0)))));

def WT = (WCondition1 + WCondition2);

def TT = (WCondition1 + WCondition2 + DCondition1 + DCondition2);

#####signals

plot ALong = TT > WT;

}

script SymbolRank_AShort {

input symbol = "";

def price1 = (close(symbol) + open(symbol)) / 2;

input Length1 = 3;

input Length2 = 6;

input Length3 = 9;

input Length4 = 12;

input Length5 = 15;

input Length6 = 30;

input Length7 = 45;

input Length8 = 60;

input averageType = AverageType.EXPONENTIAL;

def D1 = MovingAverage(averageType, price1, Length1);

def D2 = MovingAverage(averageType, price1, Length2);

def D3 = MovingAverage(averageType, price1, Length3);

def D4 = MovingAverage(averageType, price1, Length4);

def W1 = MovingAverage(averageType, price1, Length5);

def W2 = MovingAverage(averageType, price1, Length6);

def W3 = MovingAverage(averageType, price1, Length7);

def W4 = MovingAverage(averageType, price1, Length8);

def DCondition1 = If(D1 > D2 and D2 > D3 and D3 > D4, 5,

If((D1 > D2 and D2 > D4 and D4 > D3) or (D1 > D3 and D3 > D2 and D2 > D4) or

(D2 > D1 and D1 > D3 and D3 > D4), 4, If(D2 > D1 and D1 > D4 and D4 > D3, 3,