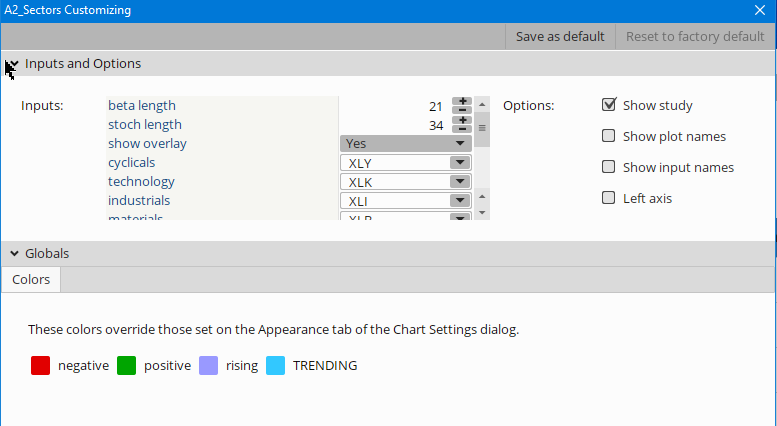

Can someone let me know why this is not scaling right?@Trading51 Click on the settings gear for the study and check the "Left Axis" checkbox.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Use the study in "lower"Can someone let me know why this is not scaling right?

by default its loading in upper/price column. Drag it to lower.

Studies --> Edit Studies --> Drag the study from Price to Lower.

Used the original version and added the 2 additional sectors Real Estate (XLRE) and Communications (XLC). I tried this on a weekly chart and the signals didn't work well for predicting next month's movements. It seems to work best on a daily chart.

Does anyone have trading recommendations as when to buy/sell?

Does anyone have trading recommendations as when to buy/sell?

Code:

# ETF_Rotate_Lower by ED_nn ThinkScriptLounge 4-2019

# from 4/4/2019 chat room:

# 06:37 Mobius: johnny - To find rotation quickly - Use primary ETF's in a watchlist with 2 columns first column is Correlation to SPX second is a stochastic of Beta, if Beta is 1 or close to 1 that ETF is moving at the fastest momentum in that range and if correlation is with SPX .85 or better it's moving with SPX cor# daily start with 13,34 as starting point.

# 4-19-19 Markos took out Beta 1 & 2.

# 6-23-19 Markos put Beta back in

# 12-6-20 pjk added RealEstate (XLRE) and Communications sectors (XLC)

declare lower;

input BetaLength = 21;

input StochLength =34;

input showBeta = No;

input showOverlay = Yes;

input Cyclicals = "XLY"; #=Discretionary

input Technology = "XLK";

input Industrials = "XLI";

input Materials = "XLB";

input Energy = "XLE";

input Staples = "XLP";

input HealthCare = "XLV";

input Utilities = "XLU";

input Financials = "XLF";

input RealEstate = "XLRE";

input Communications = "XLC"; #XTL

#------------------------------

#----purple colors

defineglobalColor(“PlumMedium“, createColor(221, 160, 221));

defineglobalColor(“Orchid“, createColor(218, 130, 214));

defineglobalColor(“MediumOrchid“, createColor(186, 85, 211));

defineglobalColor(“MediumPurple“, createColor(147, 112, 219));

defineglobalColor(“DarkOrchid“, createColor(153, 50, 204));

plot Scriptlabel = Double.NaN;

Scriptlabel.SetDefaultColor(CreateColor (0, 0, 0));

def Agg = GetAggregationPeriod();

#--------------------date start

addLabel(1, getMonth() + "/" +

getDayOfMonth(getYyyyMmDd()) + "/" +

AsPrice(getYear()), GlobalColor("PlumMedium"));

#--------------------date end

#addLabel(1, " Ticker: '" + GetSymbol() + "' ", GlobalColor("Orchid"));

addLabel(1, "Agg: " +

( if Agg == 60000 then "1 Min"

else if Agg == 120000 then "2 Min"

else if Agg == 180000 then "3 Min"

else if Agg == 240000 then "4 Min"

else if Agg == 300000 then "5 Min"

else if Agg == 600000 then "10 Min"

else if Agg == 900000 then "15 Min"

else if Agg == 1800000 then "30 Min"

else if Agg == 3600000 then "1 Hour"

else if Agg == 7200000 then "2 Hour"

else if Agg == 14400000 then "4 Hours"

else if Agg == 86400000 then "1 Day"

else if Agg == 604800000 then "1 Week"

else if Agg == 2592000000 then "1 Month"

else (Agg / 1000 / 60) + "Minutes") +

" (" + (if Agg<=23400000

then 23400000/Agg

else 86400000/Agg)+ ")"

, GlobalColor("MediumPurple"));

#addLabel(1, BarNumber() + " Bars", GlobalColor("DarkOrchid"));

#-----------------------------

#-----------------------------

addLabel(1,"Rotation Beta/Stochastic (" + betaLength + "," +stochLength + ") ", color.Light_Gray);

script calcBeta {

input secondSymbol = "XLF";

input refSymbol = "SPX";

input betaLength = 21;

input returnLength = 1;

def refPrice = close(refSymbol);

def primary = if refPrice[returnLength] == 0

then 0

else (refPrice - refPrice[returnLength]) /

refPrice[returnLength] * 100;

def secondPrice = close(secondSymbol);

def secondary = if secondPrice[returnLength] == 0

then 0

else (secondPrice - secondPrice[returnLength]) /

secondPrice[returnLength] * 100;

plot Beta = covariance(secondary, primary, betaLength) /

Sqr(stdev(primary, betaLength));

}

script EhlersESSfilter {

input price = close;

input length = 8;

def ESS_coeff_0 = Exp(-Double.Pi * Sqrt(2) / length);

def ESS_coeff_2 = 2 * ESS_coeff_0 * Cos(Sqrt(2) * Double.Pi / length);

def ESS_coeff_3 = - Sqr(ESS_coeff_0);

def ESS_coeff_1 = 1 - ESS_coeff_2 - ESS_coeff_3;

def ESS_filter = if IsNaN(price + price[1]) then

ESS_filter[1]

else ESS_coeff_1 * (price + price[1]) / 2 +

ESS_coeff_2 * ESS_filter[1] +

ESS_coeff_3 * ESS_filter[2];

plot Smooth_Filter =

if barnumber() < length then

price

else if !IsNaN(price) then

ESS_filter

else Double.NaN;

}

script calcStoch {

input data = close;

input StochLength = 21;

def stochasticValue = ((data - lowest(data, StochLength)) /

(highest(data, StochLength) - lowest(data, StochLength)));

plot stoch = stochasticValue;

}

plot beta1 = if showBeta then calcBeta(Cyclicals) else Double.NaN;

plot beta2 = if showBeta then calcBeta(Technology) else Double.NaN;

####

plot stoch1 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = Cyclicals,

betaLength = BetaLength)),

stochLength = StochLength);

stoch1.SetDefaultColor(Color.VIOLET);

stoch1.SetLineWeight(2);

stoch1.SetPaintingStrategy(PaintingStrategy.LINE_VS_SQUARES);

stoch1.HideBubble();

AddLabel(ShowOverlay, " Cyclicals ", Color.VIOLET);

AddChartBubble(ShowOverlay and IsNaN(close[-1]) and !IsNaN(close), if stoch1 < 0.15 then 0 else if stoch1 > 0.85 then 1 else stoch1, "Cyclicals", Color.VIOLET, stoch1 > 0.5);

plot stoch2 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = Technology,

betaLength = BetaLength)),

stochLength = StochLength);

stoch2.SetDefaultColor(CreateColor(90, 160, 120));

stoch2.SetLineWeight(5);

stoch2.SetStyle(Curve.LONG_DASH);

stoch2.HideBubble();

AddLabel(ShowOverlay, " Techology ", CreateColor(90, 160, 120));

AddChartBubble(ShowOverlay and IsNaN(close[-1]) and !IsNaN(close), if stoch2 < 0.15 then 0 else if stoch2 > 0.85 then 1 else stoch2, "Technology", CreateColor(90, 160, 120), stoch2 > 0.5);

plot stoch3 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = Industrials,

betaLength = BetaLength)),

stochLength = StochLength);

stoch3.SetDefaultColor(Color.MAGENTA);

stoch3.SetLineWeight(5);

stoch3.SetStyle(Curve.SHORT_DASH);

stoch3.HideBubble();

AddLabel(ShowOverlay, " Industrials ", Color.MAGENTA);

AddChartBubble(ShowOverlay and IsNaN(close[-1]) and !IsNaN(close), if stoch3 < 0.15 then 0 else if stoch3 > 0.85 then 1 else stoch3, "Industrials", Color.MAGENTA, stoch3 > 0.5);

plot stoch4 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = Materials,

betaLength = BetaLength)),

stochLength = StochLength);

stoch4.SetDefaultColor(Color.CYAN);

stoch4.SetLineWeight(2);

stoch4.SetPaintingStrategy(PaintingStrategy.LINE);

stoch4.HideBubble();

AddLabel(ShowOverlay, " Materials ", Color.CYAN);

AddChartBubble(ShowOverlay and IsNaN(close[-1]) and !IsNaN(close), if stoch4 < 0.15 then 0 else if stoch4 > 0.85 then 1 else stoch4, "Materials", Color.CYAN, stoch4 > 0.5);

plot stoch5 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = Energy,

betaLength = BetaLength)),

stochLength = StochLength);

stoch5.SetDefaultColor(Color.YELLOW);

stoch5.SetLineWeight(1);

stoch5.SetPaintingStrategy(PaintingStrategy.Line_vs_POINTS);

stoch5.HideBubble();

AddLabel(ShowOverlay, " Energy ", Color.YELLOW);

AddChartBubble(ShowOverlay and IsNaN(close[-1]) and !IsNaN(close), if stoch5 < 0.15 then 0 else if stoch5 > 0.85 then 1 else stoch5, "Energy", Color.YELLOW, stoch5 > 0.5);

plot stoch6 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = Staples,

betaLength = BetaLength)),

stochLength = StochLength);

stoch6.SetDefaultColor(CreateColor(80, 180, 70));

stoch6.SetLineWeight(2);

stoch6.SetPaintingStrategy(PaintingStrategy.LINE_VS_TRIANGLES);

stoch6.HideBubble();

AddLabel(ShowOverlay, " Staples ", CreateColor(80, 180, 70));

AddChartBubble(ShowOverlay and IsNaN(close[-1]) and !IsNaN(close), if stoch6 < 0.15 then 0 else if stoch6 > 0.85 then 1 else stoch6, "Staples", CreateColor(80, 180, 70), stoch6 > close);

plot stoch7 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = HealthCare,

betaLength = BetaLength)),

stochLength = StochLength);

stoch7.SetDefaultColor(CreateColor(180, 80, 180));

stoch7.SetLineWeight(4);

stoch7.SetPaintingStrategy(PaintingStrategy.LINE);

stoch7.HideBubble();

AddLabel(ShowOverlay, " HealthCare ", CreateColor(180, 80, 180));

AddChartBubble("time condition" = ShowOverlay and IsNaN(close[-1]) and !IsNaN(close), "price location" = if stoch7 < 0.15 then 0 else if stoch7 > 0.85 then 1 else stoch7, text = "HealthCare", color = CreateColor(180, 80, 180), stoch7 > 0.5);

plot stoch8 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = Utilities,

betaLength = BetaLength)),

stochLength = StochLength);

stoch8.SetDefaultColor(Color.ORANGE);

stoch8.SetLineWeight(2);

stoch8.SetPaintingStrategy(PaintingStrategy.LINE);

stoch8.HideBubble();

AddLabel(ShowOverlay, " Utilities ", Color.ORANGE);

AddChartBubble(ShowOverlay and IsNaN(close[-1]) and !IsNaN(close[0]), if stoch8 < 0.15 then 0 else if stoch8 > 0.85 then 1 else stoch8, "Utilities", Color.ORANGE, stoch8 > 0.5);

plot stoch9 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = Financials,

betaLength = BetaLength)),

stochLength = StochLength);

stoch9.SetDefaultColor(Color.pink);

stoch9.SetLineWeight(2);

stoch9.SetPaintingStrategy(PaintingStrategy.LINE_VS_POINTS);

stoch9.HideBubble();

AddLabel(ShowOverlay, " Financials ", Color.pink);

AddChartBubble(ShowOverlay and IsNaN(close[-1]) and !IsNaN(close), if stoch9 < 0.15 then 0 else if stoch9 > 0.85 then 1 else stoch9, "Financials", Color.pink, stoch9 > 0.5);

plot stoch10 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = RealEstate,

betaLength = BetaLength)),

stochLength = StochLength);

stoch10.SetDefaultColor(Color.gray);

stoch10.SetLineWeight(2);

stoch10.SetPaintingStrategy(PaintingStrategy.LINE_VS_POINTS);

stoch10.HideBubble();

AddLabel(ShowOverlay, " RealEstate ", Color.gray);

AddChartBubble(ShowOverlay and IsNaN(close[-1]) and !IsNaN(close), if stoch10 < 0.15 then 0 else if stoch10 > 0.85 then 1 else stoch10, "RealEstate", Color.gray, stoch10 > 0.5);

#Communications

plot stoch11 = calcStoch(

data = EhlersESSfilter(

calcBeta(secondSymbol = Communications,

betaLength = BetaLength)),

stochLength = StochLength);

stoch11.SetDefaultColor(Color.PINK);

stoch11.SetLineWeight(2);

stoch11.SetPaintingStrategy(PaintingStrategy.LINE_VS_POINTS);

stoch11.HideBubble();

AddLabel(ShowOverlay, " Communications ", Color.PINK);

AddChartBubble(ShowOverlay and IsNaN(close[-1]) and !IsNaN(close), if stoch11 < 0.15 then 0 else if stoch11 > 0.85 then 1 else stoch11, "Communications", Color.PINK, stoch11 > 0.5);

#----------------------------------------------

def barNumber = BarNumber();

def endBar = if !IsNaN(close) and IsNaN(close[-1]) then barNumber else endBar[1];

def lastBar = HighestAll(endBar);

input flowLabelStep = 40;

addLabel(1,"Last Bar = " + lastBar, color.Light_Gray);

DefineGlobalColor("YellowGreen", CreateColor(90, 140, 5));

AddChartBubble(barNumber == (lastBar - flowLabelStep), 1.01,

"M O N E Y F L O W S I N", globalColor("YellowGreen"), 1);

AddChartBubble(barNumber == (lastBar - 2*flowLabelStep), 1.01,

"M O N E Y F L O W S I N", globalColor("YellowGreen"), 1);

#mAddChartBubble(barNumber == (lastBar - 3*flowLabelStep), 1.01,

#"M O N E Y F L O W S I N", globalColor("YellowGreen"), 1);

DefineGlobalColor("Cinamon", CreateColor(200, 10, 40));

AddChartBubble(barNumber == (lastBar - flowLabelStep), -0.01,

"M O N E Y F L O W S O U T", globalColor("Cinamon"), 0);

AddChartBubble(barNumber == (lastBar - 2*flowLabelStep), -0.01,

"M O N E Y F L O W S O U T", globalColor("Cinamon"), 0);

#mAddChartBubble(barNumber == (lastBar - 3*flowLabelStep), -0.01,

#m"M O N E Y F L O W S O U T", globalColor("Cinamon"), 0);

#plot zero = if isNaN(close) then double.nan else 0;

plot zero = if barNumber > (lastBar + 7) then double.nan else 0;

zero.SetDefaultColor(createColor(90, 20, 20));

zero.SetStyle(Curve.Long_Dash);

zero.SetLineWeight(5);

zero.HideBubble();

plot one = if barNumber > (lastBar + 7) then double.nan else 1;

one.SetDefaultColor(createColor(20, 70, 20));

one.SetStyle(Curve.Long_Dash);

one.SetLineWeight(5);

one.HideBubble();

#EOCI think a post above noted it, as a sector moves below 80 its going out of favor, as it moves above 20 momentum is picking up. Play sectors that are moving up for long and sectors moving down for shorts. Half the stocks moves are based on the performance of the sectors they are in.How could this be used to spot a sector rotation?

Last edited:

@boatshoes

I didn't create the logic for this study (my specialty is putting the lipstick on the pig)

If you look at the first post in this thread, you will find how the movement is defined.

According to this study, technology has been down down down for quite a while now... And look there is staples slowly rising...

I didn't create the logic for this study (my specialty is putting the lipstick on the pig)

If you look at the first post in this thread, you will find how the movement is defined.

According to this study, technology has been down down down for quite a while now... And look there is staples slowly rising...

Last edited:

@boatshoes This is based on the daily chart. I am not sure that the study works intraday; you would have to read through the whole thread to determine that.

The labels are consistent with the study in post#1.

You can look through the code if you have questions. As I said, I didn't create the logic just the labels.

The labels are consistent with the study in post#1.

You can look through the code if you have questions. As I said, I didn't create the logic just the labels.

Makes sense, nice share on the labels. I too prefer the labels than the spaghetti maze haha@boatshoes

This is based on the daily chart. I am not sure that the study works intraday; you would have to read through the whole thread to determine that.

The labels are consistent with the study in post#1.

You can look through the code if you have questions. As I said, I didn't create the logic just the labels.

@boatshoes I understand your question better now. We don't have the ability to determine sector relative strength so this study does it's best approximation using these calculations

@datager, when you add a study, TOS usually adds it by default in the 'lower' section. You have to drag the study from the lower to the 'price' or 'volume' upper section. Thanks for the praise, I just did a copy/edit/paste job on the original code. I unfortunately (still) know very little about Thinkscript syntax.

aceboogie_11

Member

will this only work during the trading day because I am trying to test it out on demand and the boxes are gray the whole day?In this version, I got rid of the spaghetti and just went with labels:

Here is the chart link: http://tos.mx/u1u8vzO

It's probably related to OnDemand not being able to access the historic sector fundamentals... The capabilities of OndDemand are somewhat limited...will this only work during the trading day because I am trying to test it out on demand and the boxes are gray the whole day?

T

Thomas

Guest

Here's one I like, simple, and symbols can be changed: https://tos.mx/6H6kdCj

@xad I agree the default colors in my sector labels post may not be optimal on a black background. I have updated the shared link w/ a study that uses all global colors. After re-downloading and adding to your chart; clicking on the gear icon will allow you to change the colors to better co-ordinate w/ your chart settings.

HTH

HTH

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Alternate Sector Analysis Study for ThinkorSwim | Indicators | 19 | |

| T | S&P 500 Sector Performance for ThinkorSwim | Indicators | 28 | |

|

|

Repaints Cup and Handle Indicator for ThinkorSwim | Indicators | 25 | |

|

|

The Ultimate Buy and Sell Indicator for ThinkOrSwim | Indicators | 6 | |

| J | ATR Expected Move Indicator For ThinkOrSwim | Indicators | 17 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1179

Online

Similar threads

Similar threads

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.