RmS59

Member

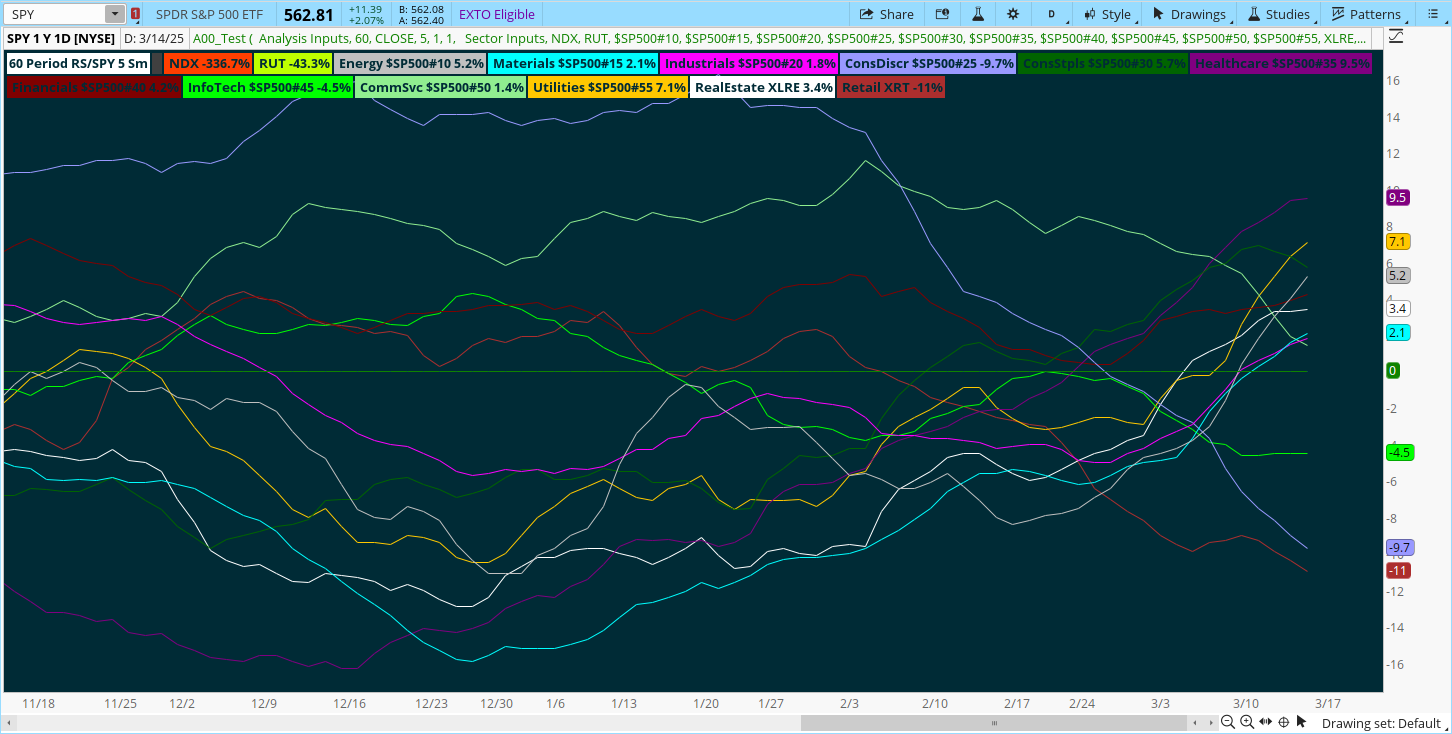

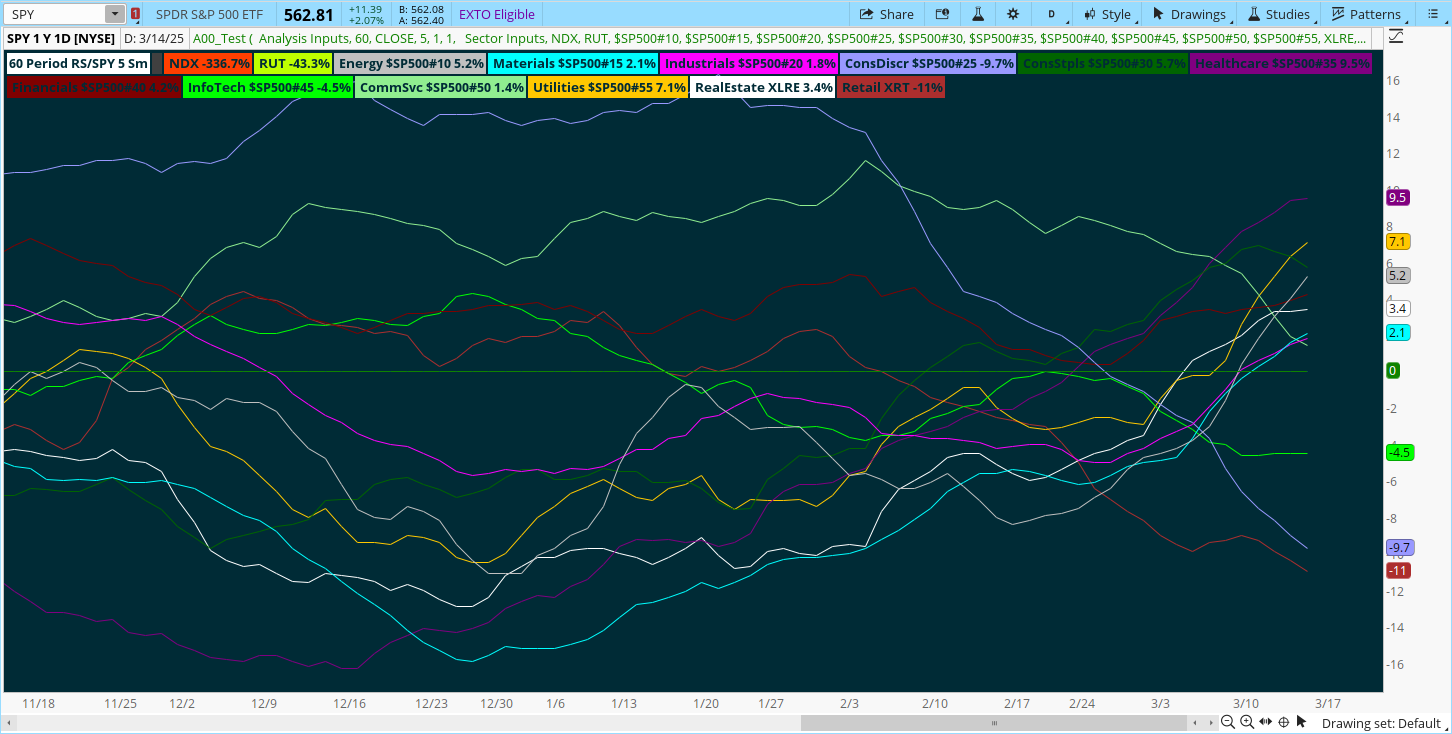

Here is a Sector Analysis Study that I created a few years ago and like. It ranks the sectors vs SP500 (or other). Also see the second version below.

I developed the Relative Performance study first. The Relative Strength compares the sector performance vs the SPX. This also gives you a good idea of performance, but be wary when the SPX is down. A sector's performance may be better than the SPX, but still not be positive.

So, I look at the Relative Strength first to see how the sectors compare to SPX, then check the RoC to see if change is actually positive.

Since I mostly trade daily charts, I look at these indicators on a daily chart looking back 13 periods. When I trade weekly charts, I look at the same indicators on a weekly chart.

This study shows sector Rate of Change performance over time. It allows best performing sectors to be easily identified.

I developed the Relative Performance study first. The Relative Strength compares the sector performance vs the SPX. This also gives you a good idea of performance, but be wary when the SPX is down. A sector's performance may be better than the SPX, but still not be positive.

So, I look at the Relative Strength first to see how the sectors compare to SPX, then check the RoC to see if change is actually positive.

Since I mostly trade daily charts, I look at these indicators on a daily chart looking back 13 periods. When I trade weekly charts, I look at the same indicators on a weekly chart.

Code:

# SectorRelativePerformance

################

# Displays relative performance over defined period

# Intended for Sector Analysis

# Created 7/15/18 RmS59

declare lower;

input n1 = " Analysis Inputs";

input Period = 60;

input price = FundamentalType.CLOSE;

input smoothPeriod = 5;

input DisplayLabel = 1;

input DisplayAltIndex = 1;

input n2 = " Sector Inputs";

#input Base = "SPX";

input AltIndex1 = "NDX";

input AltIndex2 = "RUT";

input Energy = {default "$SP500#10","XLE"};

input Materials = {default "$SP500#15", "XLB"};

input Industrials = {default "$SP500#20", "XLI"};

input ConsDiscr = {default "$SP500#25", "XLY"};

input ConsStpls = {default "$SP500#30", "XLP"};

input Healthcare = {default "$SP500#35", "XLV"};

input Financials = {default "$SP500#40", "XLF"};

input InfoTech = {default "$SP500#45", "XLK"};

input Telecom = {default "$SP500#50", "IYZ", "XLC"};

input Utilities = {default "$SP500#55", "XLU"};

input RealEstate = "XLRE";

input Retail = "XRT";

# For Reference, the S&P500 Sectors are as follows:

# Energy = "$SP500#10";

# Materials = "$SP500#15";

# Industrials = "$SP500#20";

# ConsDiscr = "$SP500#25";

# ConsStpls = "$SP500#30";

# Healthcare = "$SP500#35";

# Financials = "$SP500#40";

# InfoTech = "$SP500#45"

# Telecom = "$SP500#50";

# Utilities = "$SP500#55";

def priceBase = Fundamental(price);

#def priceBase = Fundamental(price, Base);

def priceAltIndex1 = Fundamental(price, AltIndex1);

def priceAltIndex2 = Fundamental(price, AltIndex2);

def priceEnergy = Fundamental(price, Energy);

def priceMaterials = Fundamental(price, Materials);

def priceIndustrials = Fundamental(price, Industrials);

def priceConsDiscr = Fundamental(price, ConsDiscr);

def priceConsStpls = Fundamental(price, ConsStpls);

def priceHealthcare = Fundamental(price, Healthcare);

def priceFinancials = Fundamental(price, Financials);

def priceInfoTech = Fundamental(price, InfoTech);

def priceTelecom = Fundamental(price, Telecom);

def priceUtilities = Fundamental(price, Utilities);

def priceRealEstate = Fundamental(price, RealEstate);

def priceRetail = Fundamental(price, Retail);

def changeBase = (priceBase - priceBase[Period]) / priceBase[Period];

def changeAltIndex1 = (priceAltIndex1 - priceAltIndex1[Period]) / priceBase[Period];

def changeAltIndex2 = (priceAltIndex2 - priceAltIndex2[Period]) / priceBase[Period];

def changeEnergy = (priceEnergy - priceEnergy[Period]) / priceEnergy[Period];

def changeMaterials = (priceMaterials - priceMaterials[Period]) / priceMaterials[Period];

def changeIndustrials = (priceIndustrials - priceIndustrials[Period]) / priceIndustrials[Period];

def changeConsDiscr = (priceConsDiscr - priceConsDiscr[Period]) / priceConsDiscr[Period];

def changeConsStpls = (priceConsStpls - priceConsStpls[Period]) / priceConsStpls[Period];

def changeHealthcare = (priceHealthcare - priceHealthcare[Period]) / priceHealthcare[Period];

def changeFinancials = (priceFinancials - priceFinancials[Period]) / priceFinancials[Period];

def changeInfoTech = (priceInfoTech - priceInfoTech[Period]) / priceInfoTech[Period];

def changeTelecom = (priceTelecom - priceTelecom[Period]) / priceTelecom[Period];

def changeUtilities = (priceUtilities - priceUtilities[Period]) / priceUtilities[Period];

def changeRealEstate = (priceRealEstate - priceRealEstate[Period]) / priceRealEstate[Period];

def changeRetail = (priceRetail - priceRetail[Period]) / priceRetail[Period];

plot BasePerf = if priceBase == 0 then Double.NaN else round(movAvgExponential(changeBase - changeBase,2),smoothPeriod);

plot AltIndex1Perf = if priceAltIndex1== 0 then Double.NaN else round(100*(changeAltIndex1 - changeBase),1);

plot AltIndex2Perf = if priceAltIndex2== 0 then Double.NaN else round(100*(changeAltIndex2 - changeBase),1);

plot EnergyPerf = if priceEnergy == 0 then Double.NaN else round(expAverage(100*(changeEnergy - changeBase),smoothPeriod),1);

plot MaterialsPerf = if priceMaterials == 0 then Double.NaN else round(expAverage(100*(changeMaterials - changeBase),smoothPeriod),1);

plot IndustrialsPerf = if priceIndustrials== 0 then Double.NaN else round(expAverage(100*(changeIndustrials - changeBase),smoothPeriod),1);

plot ConsDiscrPerf = if priceConsDiscr== 0 then Double.NaN else round(expAverage(100*(changeConsDiscr - changeBase),smoothPeriod) ,1);

plot ConsStplsPerf = if priceConsStpls== 0 then Double.NaN else round(expAverage(100*(changeConsStpls - changeBase),smoothPeriod),1);

plot HealthcarePerf = if priceHealthcare== 0 then Double.NaN else round(expAverage(100*(changeHealthcare - changeBase),smoothPeriod),1);

plot FinancialsPerf = if priceFinancials== 0 then Double.NaN else round(expAverage(100*(changeFinancials - changeBase),smoothPeriod),1);

plot InfoTechPerf = if priceInfoTech== 0 then Double.NaN else round(expAverage(100*(changeInfoTech - changeBase),smoothPeriod),1);

plot TelecomPerf = if priceTelecom== 0 then Double.NaN else round(expAverage(100*(changeTelecom - changeBase),smoothPeriod),1);

plot UtilitiesPerf = if priceUtilities== 0 then Double.NaN else round(expAverage(100*(changeUtilities - changeBase),smoothPeriod),1);

plot RealEstatePerf = if priceRealEstate== 0 then Double.NaN else round(expAverage(100*(changeRealEstate - changeBase),smoothPeriod),1);

plot RetailPerf = if priceRetail== 0 then Double.NaN else round(expAverage(100*(changeRetail - changeBase),smoothPeriod),1);

plot Zero = if !IsNaN(close) then 0 else Double.NaN;

AltIndex1Perf.SetDefaultColor(Color.LIGHT_RED);

AltIndex2Perf.SetDefaultColor(Color.LIME);

EnergyPerf.SetDefaultColor(Color.LIGHT_GRAY);

MaterialsPerf.SetDefaultColor(Color.CYAN);

IndustrialsPerf.SetDefaultColor(Color.MAGENTA);

ConsDiscrPerf.SetDefaultColor(Color.VIOLET);

ConsStplsPerf.SetDefaultColor(Color.DARK_GREEN);

HealthcarePerf.SetDefaultColor(Color.PLUM);

FinancialsPerf.SetDefaultColor(Color.DARK_RED);

InfoTechPerf.SetDefaultColor(Color.GREEN);

TelecomPerf.SetDefaultColor(Color.LIGHT_GREEN);

UtilitiesPerf.SetDefaultColor(Color.ORANGE);

RealEstatePerf.SetDefaultColor(Color.White);

AddLabel(DisplayLabel, period +" Period RS/"+ GetUnderlyingSymbol() + " " + smoothPeriod + " Sm", Color.WHITE);

AddLabel(DisplayLabel, " ",Color.DARK_GRAY);

AddLabel(DisplayLabel && DisplayAltIndex, " "+ AltIndex1 + " " + AltIndex1Perf + "%",AltIndex1Perf.TakeValueColor());

AddLabel(DisplayLabel && DisplayAltIndex, " "+ AltIndex2 + " " + AltIndex2Perf + "%",AltIndex2Perf.TakeValueColor());

AddLabel(DisplayLabel, " Energy "+ Energy + " " + EnergyPerf + "%",EnergyPerf.TakeValueColor());

AddLabel(DisplayLabel, " Materials "+ Materials + " " + MaterialsPerf + "%",MaterialsPerf.TakeValueColor());

AddLabel(DisplayLabel, " Industrials "+ Industrials + " " + IndustrialsPerf + "%",IndustrialsPerf.TakeValueColor());

AddLabel(DisplayLabel, " ConsDiscr "+ ConsDiscr + " " + ConsDiscrPerf + "%",ConsDiscrPerf.TakeValueColor());

AddLabel(DisplayLabel, " ConsStpls "+ ConsStpls + " " + ConsStplsPerf + "%",ConsStplsPerf.TakeValueColor());

AddLabel(DisplayLabel, " Healthcare "+ Healthcare + " " + HealthcarePerf + "%",HealthcarePerf.TakeValueColor());

AddLabel(DisplayLabel, " Financials "+ Financials + " " + FinancialsPerf + "%",FinancialsPerf.TakeValueColor());

AddLabel(DisplayLabel, " InfoTech "+ InfoTech + " " + InfoTechPerf + "%",InfoTechPerf.TakeValueColor());

AddLabel(DisplayLabel, " CommSvc "+ Telecom + " " + TelecomPerf + "%",TelecomPerf.TakeValueColor());

AddLabel(DisplayLabel, " Utilities "+ Utilities + " " + UtilitiesPerf + "%",UtilitiesPerf.TakeValueColor());

AddLabel(DisplayLabel, " RealEstate "+ RealEstate + " " + RealEstatePerf + "%",RealEstatePerf.TakeValueColor());

AddLabel(DisplayLabel, " Retail "+ Retail + " " + RetailPerf + "%",RetailPerf.TakeValueColor());

#### EndThis study shows sector Rate of Change performance over time. It allows best performing sectors to be easily identified.

Code:

Sector_ROC

############

# Sector_ROC

# Displays rate of changeAltIndex1 (%) over defined period

# Intended for Sector Analysis

# Created 9/10/18 RmS59

declare lower;

input n1 = " Analysis Inputs";

input lookback = 13;

input smoothingPeriod = 19;

input DisplayLabel = 1;

input DisplayIndexes = 1;

input price = FundamentalType.CLOSE;

input n2 = " Sector Inputs";

input SandP = {default "SPY","SPX"};

input Nasdaq = {default "QQQ","COMP"};

input Russell = {default "IWM","RUT"};

input Energy = {default "XLE","$SP500#10"};

input Materials = {default "XLB", "$SP500#15" };

input Industrials = {default "XLI", "$SP500#20"};

input ConsDiscr = {default "XLY","$SP500#25"};

input ConsStpls = {default "XLP","$SP500#30"};

input Healthcare = {default "XLV","$SP500#35"};

input Financials = {default "XLF","$SP500#40"};

input InfoTech = {default "XLK","$SP500#45"};

input Telecom = {default "IYZ","XLC","$SP500#50"};

input Utilities = {default "XLU","$SP500#55"};

input RealEstate = "XLRE";

def priceSandP = Fundamental(price,SandP);

def priceNasdaq = Fundamental(price, Nasdaq);

def priceRussell = Fundamental(price, Russell);

def priceEnergy = Fundamental(price, Energy);

def priceMaterials = Fundamental(price, Materials);

def priceIndustrials = Fundamental(price, Industrials);

def priceConsDiscr = Fundamental(price, ConsDiscr);

def priceConsStpls = Fundamental(price, ConsStpls);

def priceHealthcare = Fundamental(price, Healthcare);

def priceFinancials = Fundamental(price, Financials);

def priceInfoTech = Fundamental(price, InfoTech);

def priceTelecom = Fundamental(price, Telecom);

def priceUtilities = Fundamental(price, Utilities);

def priceRealEstate = Fundamental(price, RealEstate);

def SandPROC1 = round(expAverage(100*((priceSandP - priceSandP[lookback])/priceSandP[lookback]),smoothingPeriod),1) ;

def NasdaqROC1 = round(expAverage(100*((priceNasdaq - priceNasdaq[lookback])/priceNasdaq[lookback]),smoothingPeriod),1);

def RussellROC1 = round(expAverage(100*((priceRussell - priceRussell[lookback])/priceRussell[lookback]),smoothingPeriod),1) ;

plot SandPROC = if DisplayIndexes then SandPROC1 else Double.NaN;;

plot NasdaqROC = if DisplayIndexes then NasdaqROC1 else Double.NaN;

plot RussellROC = if DisplayIndexes then RussellROC1 else Double.NaN;

plot EnergyROC = round(expAverage(100*((priceEnergy - priceEnergy[lookback])/priceEnergy[lookback]),smoothingPeriod),1);;

plot MaterialsROC = round(expAverage(100*((priceMaterials - priceMaterials[lookback])/priceMaterials[lookback]),smoothingPeriod),1);;

plot IndustrialsROC = round(expAverage(100*((priceIndustrials - priceIndustrials[lookback])/priceIndustrials[lookback]),smoothingPeriod),1);;

plot ConsDiscrROC = round(expAverage(100*((priceConsDiscr - priceConsDiscr[lookback])/priceConsDiscr[lookback]),smoothingPeriod),1);;

plot ConsStplsROC = round(expAverage(100*((priceConsStpls - priceConsStpls[lookback])/priceConsStpls[lookback]),smoothingPeriod),1);;

plot HealthcareROC = round(expAverage(100*((priceHealthcare - priceHealthcare[lookback])/priceHealthcare[lookback]),smoothingPeriod),1);;

plot FinancialsROC = round(expAverage(100*((priceFinancials - priceFinancials[lookback])/priceFinancials[lookback]),smoothingPeriod),1);;

plot InfoTechROC = round(expAverage(100*((priceInfoTech - priceInfoTech[lookback])/priceInfoTech[lookback]),smoothingPeriod),1);;

plot TelecomROC = round(expAverage(100*((priceTelecom - priceTelecom[lookback])/priceTelecom[lookback]),smoothingPeriod),1);;

plot UtilitiesROC = round(expAverage(100*((priceUtilities - priceUtilities[lookback])/priceUtilities[lookback]),smoothingPeriod),1);;

plot RealEstateROC = round(expAverage(100*((priceRealEstate - priceRealEstate[lookback])/priceRealEstate[lookback]),smoothingPeriod),1);;

plot Zero = if !IsNaN(close) then 1 else Double.NaN;

Zero.setDefaultColor(Color.White);

Zero.SetLineWeight(3);

SandPROC.SetDefaultColor(Color.WHITE);

NasdaqROC.SetDefaultColor(Color.LIGHT_RED);

RussellROC.SetDefaultColor(Color.LIME);

SandPROC.SetLineWeight(2);

NasdaqROC.SetLineWeight(2);

RussellROC.SetLineWeight(2);

SandPROC.SetStyle(Curve.SHORT_DASH);

NasdaqROC.SetStyle(Curve.SHORT_DASH);

RussellROC.SetStyle(Curve.SHORT_DASH);

EnergyROC.SetDefaultColor(Color.LIGHT_GRAY);

MaterialsROC.SetDefaultColor(Color.CYAN);

IndustrialsROC.SetDefaultColor(Color.MAGENTA);

ConsDiscrROC.SetDefaultColor(Color.VIOLET);

ConsStplsROC.SetDefaultColor(Color.DARK_GREEN);

HealthcareROC.SetDefaultColor(Color.PLUM);

FinancialsROC.SetDefaultColor(Color.DARK_RED);

InfoTechROC.SetDefaultColor(Color.GREEN);

TelecomROC.SetDefaultColor(Color.LIGHT_GREEN);

UtilitiesROC.SetDefaultColor(Color.ORANGE);

RealEstateROC.SetDefaultColor(Color.White);

AddLabel(DisplayLabel, lookback +" Period ROC " + smoothingPeriod + " Sm", Color.WHITE); # Smoothing

AddLabel(DisplayLabel, " ",Color.DARK_GRAY);

AddLabel(DisplayLabel , " S&P " + SandPROC1 + "%",SandPROC.TakeValueColor());

AddLabel(DisplayLabel , " Nasdaq " + NasdaqROC1 + "%",NasdaqROC.TakeValueColor());

AddLabel(DisplayLabel , " Russell " + RussellROC1 + "%",RussellROC.TakeValueColor());

AddLabel(DisplayLabel, " Energy "+ Energy + " " + EnergyROC + "%",EnergyROC.TakeValueColor());

AddLabel(DisplayLabel, " Materials "+ Materials + " " + MaterialsROC + "%",MaterialsROC.TakeValueColor());

AddLabel(DisplayLabel, " Industrials "+ Industrials + " " + IndustrialsROC + "%",IndustrialsROC.TakeValueColor());

AddLabel(DisplayLabel, " ConsDiscr "+ ConsDiscr + " " + ConsDiscrROC + "%",ConsDiscrROC.TakeValueColor());

AddLabel(DisplayLabel, " ConsStpls "+ ConsStpls + " " + ConsStplsROC + "%",ConsStplsROC.TakeValueColor());

AddLabel(DisplayLabel, " Healthcare "+ Healthcare + " " + HealthcareROC + "%",HealthcareROC.TakeValueColor());

AddLabel(DisplayLabel, " Financials "+ Financials + " " + FinancialsROC + "%",FinancialsROC.TakeValueColor());

AddLabel(DisplayLabel, " InfoTech "+ InfoTech + " " + InfoTechROC + "%",InfoTechROC.TakeValueColor());

AddLabel(DisplayLabel, " Communications "+ Telecom + " " + TelecomROC + "%",TelecomROC.TakeValueColor());

AddLabel(DisplayLabel, " Utilities "+ Utilities + " " + UtilitiesROC + "%",UtilitiesROC.TakeValueColor());

AddLabel(DisplayLabel, " RealEstate "+ RealEstate + " " + RealEstateROC + "%",RealEstateROC.TakeValueColor());

### END

Last edited by a moderator: