@ziongotoptions

Not at home now, but I will load it later tonight. Thanks!

@ziongotoptions

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

@ziongotoptions Thanks for your effort of trying to help. Not sure if it's my computer does not have enough memory resource, it keeps spinning awfully long time. Unfortunately, I wont be able to use this indicator until I get a new computer, (I am a big fan of Volume Profile TPO@ziongotoptions

Not at home now, but I will load it later tonight. Thanks!

You’re welcome it’s possible, I usually wait 2 minutes and then I go to edit studies, I just click the apply button and that usually helps it load faster also might be better to try it with 1 of the studies not both that I sent@ziongotoptions Thanks for your effort of trying to help. Not sure if it's my computer does not have enough memory resource, it keeps spinning awfully long time. Unfortunately, I wont be able to use this indicator until I get a new computer, (I am a big fan of Volume Profile TPO.

@ziongotoptions Thanks for your kindnessYou’re welcome it’s possible, I usually wait 2 minutes and then I go to edit studies, I just click the apply button and that usually helps it load faster also might be better to try it with 1 of the studies not both that I sent

# Depth of strikes to scan

# Todo: this only from ATM options to x levels ITM.

input StrikeDepth = 5;

# Call Open Interest

plot CallOpenInterest =

fold CallOIIndex = 0 to StrikeDepth

with cOI

do if IsNaN(

open_interest(

Concat(

Concat(".",

Concat(GetSymbolPart(),

Concat(

Concat(ExpYear - 2000,

if ExpMonth2 <= 9 then Concat("0", ExpMonth2)

else Concat("", ExpMonth2)

),

if ExpDOM <= 9 then Concat("0", ExpDOM)

else Concat("", ExpDOM)

)

)

),

Concat("C", AsPrice(centerStrike - strikeSpacing * CallOIIndex ))

)

)

)

then 0

else cOI + open_interest(

Concat(

Concat(".",

Concat(GetSymbolPart(),

Concat(

Concat(ExpYear - 2000,

if ExpMonth2 <= 9 then Concat("0", ExpMonth2)

else Concat("", ExpMonth2)

),

if ExpDOM <= 9 then Concat("0", ExpDOM)

else Concat("", ExpDOM)

)

)

),

Concat("C", AsPrice(centerStrike - strikeSpacing * CallOIIndex ))

)

)

;

CallOpenInterest.SetHiding(!ShowOI);

CallOpenInterest.SetPaintingStrategy(PaintingStrategy.LINE);

CallOpenInterest.SetDefaultColor(GlobalColor("Calls"));

AddLabel(ShowOI, "CallOI: " + CallOpenInterest, GlobalColor("Calls"));"series is the expiry starting at 1 and raising by one for each next expiry"#hint: Options Hacker \n This study lets you scan the options chain for a series and given depth. \n<b>Warning: Setting the StrikeDepth to large values requires significant processing power, and will result in slow loading times.</b>

#-----------------------------------------------------------------------------------------------------------------#

# Settings

# Colors

DefineGlobalColor("Call", Color.GREEN);

DefineGlobalColor("Put", Color.RED);

DefineGlobalColor("CallCloud",Color.DARK_GREEN);

DefineGlobalColor("PutCloud",Color.DARK_RED);

#hint Mode: The mode to select an option symbol. \n AUTO will use the option series input code. This will not always work, set to MANUAL to use the center strike and spacing inputs to manually determine the option symbol.

input Mode = {default AUTO, MANUAL};

#hint Series: The option expiration series to search. \n This value is used to determine the option symbol, and for the input to the SeriesVolatility(series = x) function where series is the expiry starting at 1 and raising by one for each next expiry.

input Series = {

default Weekly,

Month1,

Month2,

Month3,

Month4,

Month5,

Month6,

Month7,

Month8,

Month9

};

#hint DataType: The type of option data to show.

input DataType = {default OPEN_INTEREST, VOLUME};

#hint StrikeDepth: The level of depth to search a series. The search starts at the center strike price, and goes both ITM and OTM.

input StrikeDepth = 5;

#hint CenterStrikeOffset: The offset to use when calculating the center strike based on close price. \n Examples: \n 1 = nearest $1 interval \n 10 = nearest $10 interval.

input CenterStrikeOffset = 1.0;

#hint MaxStrikeSpacing: The maximum dollar amount between two adjacent contracts.

input MaxStrikeSpacing = 25;

#hint ManualCenterStrike: The starting price to use when in MANUAL mode.

input ManualCenterStrike = 440;

#hint ManualStrikeSpacing: The dollar amount between two adjacent contracts to use when in MANUAL mode.

input ManualStrikeSpacing = 1.0;

#hint ShowStrikeInfo: Show the strike info labels.

input ShowStrikeInfo = yes;

#hint ShowLabels: Show the open interest labels.

input ShowLabels = yes;

#hint ShowClouds: Show the open interest clouds.

input ShowClouds = no;

#hint ShowLines: Show the open interest lines.

input ShowLines = yes;

#hint ShowGreeks: Show the estimated Greek calculation labels for the latest bar.

input ShowGreeks = yes;

#-----------------------------------------------------------------------------------------------------------------#

# Date, Symbol, and Strike

# OptionSeries is the expiry starting at 1 and raising by one for each next expiry.

def OptionSeries;

switch (Series) {

case Weekly:

OptionSeries = 1;

case Month1:

OptionSeries = 2;

case Month2:

OptionSeries = 3;

case Month3:

OptionSeries = 4;

case Month4:

OptionSeries = 5;

case Month5:

OptionSeries = 6;

case Month6:

OptionSeries = 7;

case Month7:

OptionSeries = 8;

case Month8:

OptionSeries = 9;

case Month9:

OptionSeries = 10;

};

# Open price at Regular Trading Hours

def RTHopen = open(period = AggregationPeriod.DAY);

# Current year, month, and day

def CurrentYear = GetYear();

def CurrentMonth = GetMonth();

def CurrentDayOfMonth = GetDayOfMonth(GetYYYYMMDD());

# Get the first day of this month. 1 (Monday) to 7 (Sunday)

def FirstDayThisMonth = GetDayOfWeek((CurrentYear * 10000) + (CurrentMonth * 100) + 1);

# Get the first friday of this month

def FirstFridayDOM =

if FirstDayThisMonth < 6 then 6 - FirstDayThisMonth

else if FirstDayThisMonth == 6 then 7

else 6

;

# Get the second, third, and fourth fridays of this month

def SecondFridayDOM = FirstFridayDOM + 7;

def ThirdFridayDOM = FirstFridayDOM + 14;

def FourthFridayDOM = FirstFridayDOM + 21;

# Pick up all Fridays of the current month for weekly options

def RollDOM = FirstFridayDOM + 21;

def ExpMonth1 =

if RollDOM > CurrentDayOfMonth then CurrentMonth + OptionSeries - 1

else CurrentMonth + OptionSeries

;

# Options month input

def ExpMonth2 = if ExpMonth1 > 12 then ExpMonth1 - 12 else ExpMonth1;

# Options year input

def ExpYear = if ExpMonth1 > 12 then CurrentYear + 1 else CurrentYear;

# First friday expiry calc

def ExpDay1DOW = GetDayOfWeek(ExpYear * 10000 + ExpMonth2 * 100 + 1);

def ExpFirstFridayDOM =

if ExpDay1DOW < 6 then 6 - ExpDay1DOW

else if ExpDay1DOW == 6 then 7

else 6

;

# Options code day of month input

def ExpDOM =

if CurrentDayOfMonth < ExpFirstFridayDOM -1 then FirstFridayDOM

else if between(CurrentDayOfMonth, ExpFirstFridayDOM, SecondFridayDOM - 1) then SecondFridayDOM

else if between(CurrentDayOfMonth, SecondFridayDOM, ThirdFridayDOM - 1) then ThirdFridayDOM

else if between(CurrentDayOfMonth, ThirdFridayDOM, FourthFridayDOM - 1) then FourthFridayDOM

else ExpFirstFridayDOM

;

# Centerstrike

def CenterStrike =

if (Mode == Mode.AUTO and !IsNaN(close)) then Round(close / CenterStrikeOffset, 0) * CenterStrikeOffset

else if (Mode == Mode.MANUAL and !IsNaN(close)) then ManualCenterStrike

else CenterStrike[1]

;

# Strike Spacing

def StrikeSpacingC =

fold i = 1 to MaxStrikeSpacing

with spacing = 0

do if DataType == DataType.OPEN_INTEREST and !IsNaN(

open_interest(

Concat(

Concat(".",

Concat(GetSymbolPart(),

Concat(

Concat(ExpYear - 2000,

if ExpMonth2 <= 9 then Concat("0", ExpMonth2)

else Concat("", ExpMonth2)

),

if ExpDOM <= 9 then Concat("0", ExpDOM)

else Concat("", ExpDOM)

)

)

),

Concat("C", AsPrice(CenterStrike + (MaxStrikeSpacing - i)))

)

)

)

then MaxStrikeSpacing - i

else spacing

;

def StrikeSpacing =

if (Mode == Mode.AUTO and !IsNaN(close)) then StrikeSpacingC

else if (Mode == Mode.MANUAL and !IsNaN(close)) then ManualStrikeSpacing

else StrikeSpacing[1]

;

#-----------------------------------------------------------------------------------------------------------------#

# Option Chain

# Call Open Interest

def ITMCallOpenInterest =

fold itmCallOIIndex = 0 to StrikeDepth

with itmCOI

do if IsNaN(

open_interest(

Concat(

Concat(".",

Concat(GetSymbolPart(),

Concat(

Concat(ExpYear - 2000,

if ExpMonth2 <= 9 then Concat("0", ExpMonth2)

else Concat("", ExpMonth2)

),

if ExpDOM <= 9 then Concat("0", ExpDOM)

else Concat("", ExpDOM)

)

)

),

Concat("C", AsPrice(CenterStrike - strikeSpacing * itmCallOIIndex))

)

)

)

then 0

else itmCOI + open_interest(

Concat(

Concat(".",

Concat(GetSymbolPart(),

Concat(

Concat(ExpYear - 2000,

if ExpMonth2 <= 9 then Concat("0", ExpMonth2)

else Concat("", ExpMonth2)

),

if ExpDOM <= 9 then Concat("0", ExpDOM)

else Concat("", ExpDOM)

)

)

),

Concat("C", AsPrice(CenterStrike - strikeSpacing * itmCallOIIndex))

)

)

;

def OTMCallOpenInterest =

fold otmCallOIIndex = 0 to StrikeDepth

with otmCOI

do if IsNaN(

open_interest(

Concat(

Concat(".",

Concat(GetSymbolPart(),

Concat(

Concat(ExpYear - 2000,

if ExpMonth2 <= 9 then Concat("0", ExpMonth2)

else Concat("", ExpMonth2)

),

if ExpDOM <= 9 then Concat("0", ExpDOM)

else Concat("", ExpDOM)

)

)

),

Concat("C", AsPrice(CenterStrike + strikeSpacing * otmCallOIIndex))

)

)

)

then 0

else otmCOI + open_interest(

Concat(

Concat(".",

Concat(GetSymbolPart(),

Concat(

Concat(ExpYear - 2000,

if ExpMonth2 <= 9 then Concat("0", ExpMonth2)

else Concat("", ExpMonth2)

),

if ExpDOM <= 9 then Concat("0", ExpDOM)

else Concat("", ExpDOM)

)

)

),

Concat("C", AsPrice(CenterStrike + strikeSpacing * otmCallOIIndex))

)

)

;

# Put Open Interest

def ITMPutOpenInterest =

fold itmPutOIIndex = 0 to StrikeDepth

with itmPOI

do if IsNaN(

open_interest(

Concat(

Concat(".",

Concat(GetSymbolPart(),

Concat(

Concat(ExpYear - 2000,

if ExpMonth2 <= 9 then Concat("0", ExpMonth2)

else Concat("", ExpMonth2)

),

if ExpDOM <= 9 then Concat("0", ExpDOM)

else Concat("", ExpDOM)

)

)

),

Concat("P", AsPrice(CenterStrike - strikeSpacing * itmPutOIIndex))

)

)

)

then 0

else itmPOI + open_interest(

Concat(

Concat(".",

Concat(GetSymbolPart(),

Concat(

Concat(ExpYear - 2000,

if ExpMonth2 <= 9 then Concat("0", ExpMonth2)

else Concat("", ExpMonth2)

),

if ExpDOM <= 9 then Concat("0", ExpDOM)

else Concat("", ExpDOM)

)

)

),

Concat("P", AsPrice(CenterStrike - strikeSpacing * itmPutOIIndex))

)

)

;

def OTMPutOpenInterest =

fold otmPutOIIndex = 0 to StrikeDepth

with otmPOI

do if IsNaN(

open_interest(

Concat(

Concat(".",

Concat(GetSymbolPart(),

Concat(

Concat(ExpYear - 2000,

if ExpMonth2 <= 9 then Concat("0", ExpMonth2)

else Concat("", ExpMonth2)

),

if ExpDOM <= 9 then Concat("0", ExpDOM)

else Concat("", ExpDOM)

)

)

),

Concat("P", AsPrice(CenterStrike + strikeSpacing * otmPutOIIndex))

)

)

)

then 0

else otmPOI + open_interest(

Concat(

Concat(".",

Concat(GetSymbolPart(),

Concat(

Concat(ExpYear - 2000,

if ExpMonth2 <= 9 then Concat("0", ExpMonth2)

else Concat("", ExpMonth2)

),

if ExpDOM <= 9 then Concat("0", ExpDOM)

else Concat("", ExpDOM)

)

)

),

Concat("P", AsPrice(centerStrike + strikeSpacing * otmPutOIIndex))

)

)

;

#-----------------------------------------------------------------------------------------------------------------#

# Greeks Calculations

#

# K - Option strike price

# N - Standard normal cumulative distribution function

# r - Risk free interest rate

# IV - Volatility of the underlying

# S - Price of the underlying

# t - Time to option's expiry

#

# Delta = N(d1)

# d1 = (ln(S/K) + (r + (sqr(IV)/2))t) / (? (sqrt(t)))

# Gamma = (d2) / S(IV(sqrt(t)))

# d2 = e -(sqr(d1) / 2) / sqrt(2*pi)

# Theta = ((S d2))IV) / 2 sqrt(t)) - (rK e(rt)N(d4))

# where phi(d3) = (exp(-(sqr(x)/2))) / (2 * sqrt(t))

# where d4 = d1 - IV(sqrt(t))

# Vega = S phi(d1) Sqrt(t)

# TODO: Figure out how to dynamically get this value

input DayToExpiry = 6;

# Get the implied volatility for calculations

# Input: series is the expiry starting at 1 and raising by 1 for each next expiry

def IV = SeriesVolatility(series = OptionSeries);

def K = CenterStrike;

def S = close;

def r = GetInterestRate();

def t = DayToExpiry / 365;

def d1 = (Log(S / K) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t));

script N {

input data = 1;

def a = AbsValue(data);

def b1 = .31938153;

def b2 = -.356563782;

def b3 = 1.781477937;

def b4 = -1.821255978;

def b5 = 1.330274429;

def b6 = .2316419;

def e = 1 / (1 + b6 * a);

def i = 1 - 1 / Sqrt(2 * Double.Pi) * Exp(-Power(a, 2) / 2) *

(b1 * e + b2 * e * e + b3 *

Power(e, 3) + b4 * Power(e, 4) + b5 * Power(e, 5));

plot CND = if data < 0

then 1 - i

else i;

}

# TODO: These values don't quite line up

# My background on options pricing models is not very good

# Delta

def Delta = N(d1);

# Gamma

def d2 = Exp(-(Sqr(d1) / 2)) / Sqrt(2 * Double.Pi);

def Gamma = d2 / (S * (IV * Sqrt(t)));

# Theta

def Theta = -(-(S*d2*IV*(.5000)/

(2*sqrt(t)))-

(r*(exp(-r*t)*K))*N(d2)+(S*N(d1)*(.5000)))/365;

# (.5000) variant less than .5 e(X/t)

# Vega

def Vega = (S*d2*sqrt(t))/100;

#-----------------------------------------------------------------------------------------------------------------#

# Visuals

# Current Option Expiry Label

AddLabel(

ShowStrikeInfo,

Concat(".",

Concat(GetSymbolPart(),

Concat(

Concat(ExpYear - 2000,

if ExpMonth2 <= 9 then Concat("0", ExpMonth2)

else Concat("", ExpMonth2)

),

if ExpDOM <= 9 then Concat("0", ExpDOM)

else Concat("", ExpDOM)

)

)

),

Color.GRAY

);

# Center Strike Label

AddLabel(ShowStrikeInfo, "Center Strike: " + AsDollars(CenterStrike), Color.GRAY);

# Chain Depth Label

AddLabel(ShowStrikeInfo, "Chain Depth: +/-" + StrikeDepth, Color.GRAY);

# Strike Spacing Label

AddLabel(ShowStrikeInfo and StrikeSpacing, "Strike Spacing: " + StrikeSpacing, Color.GRAY);

# Call Open Interest

plot CallOpenInterest = ItMCallOpenInterest + OTMCallOpenInterest;

CallOpenInterest.SetHiding(!ShowLines);

CallOpenInterest.SetPaintingStrategy(PaintingStrategy.LINE);

CallOpenInterest.SetDefaultColor(GlobalColor("Call"));

AddLabel(ShowLabels, "CallOI: " + CallOpenInterest, GlobalColor("Call"));

# Put Open Interest

plot PutOpenInterest = -(ITMPutOpenInterest + OTMPutOpenInterest); # Make negative to flip under axis

PutOpenInterest.SetHiding(!ShowLines);

PutOpenInterest.SetPaintingStrategy(PaintingStrategy.LINE);

PutOpenInterest.SetDefaultColor(GlobalColor("Put"));

AddLabel(ShowLabels, "PutOI: " + (ITMPutOpenInterest + OTMPutOpenInterest), GlobalColor("Put"));

# Create a center line

plot ZeroLine = 0;

ZeroLine.SetDefaultColor(Color.WHITE);

# Create Clouds

AddCloud(if ShowClouds then CallOpenInterest else Double.NaN, if ShowClouds then Zeroline else Double.NaN, GlobalColor("CallCloud"), GlobalColor("PutCloud"));

AddCloud(if ShowClouds then Zeroline else Double.NaN, if ShowClouds then PutOpenInterest else Double.NaN, GlobalColor("PutCloud"), GlobalColor("CallCloud"));

# Hull Moving Average of Put Open Interest

plot PutVolumeAverage = hullmovingavg(PutOpenInterest);

PutVolumeAverage.SetHiding(!ShowLines);

PutVolumeAverage.setdefaultcolor(color.ORANGE);

PutVolumeAverage.setstyle(curve.MEDIUM_DASH);

# Hull Moving Average of Call Open Interest

plot CallVolumeAverage = hullmovingavg(CallOpenInterest);

CallVolumeAverage.SetHiding(!ShowLines);

CallVolumeAverage.setdefaultcolor(color.LIGHT_GREEN);

CallVolumeAverage.setstyle(curve.MEDIUM_DASH);

# Color Gradient of Total Average Open Interest

plot TotalVolumeAverage = average(CallOpenInterest + PutOpenInterest);

TotalVolumeAverage.SetHiding(!ShowLines);

def colornormlength = 14;

TotalVolumeAverage.setlineweight(3);

TotalVolumeAverage.definecolor("Default", Color.YELLOW);

TotalVolumeAverage.definecolor("Highest", Color.GREEN);

TotalVolumeAverage.DefineColor("Lowest", Color.RED);

TotalVolumeAverage.AssignNormGradientColor(colorNormLength, TotalVolumeAverage.Color("Lowest"), TotalVolumeAverage.Color("Highest"));

AddCloud(if ShowClouds then TotalVolumeAverage else Double.NaN, if ShowClouds then Zeroline else Double.NaN, color.GREEN, color.RED);

# Greeks

AddLabel(ShowGreeks, "Delta = " + Delta, Color.WHITE);

AddLabel(ShowGreeks, "Gamma = " + Gamma, Color.WHITE);

AddLabel(ShowGreeks, "Theta = " + theta, Color.WHITE);

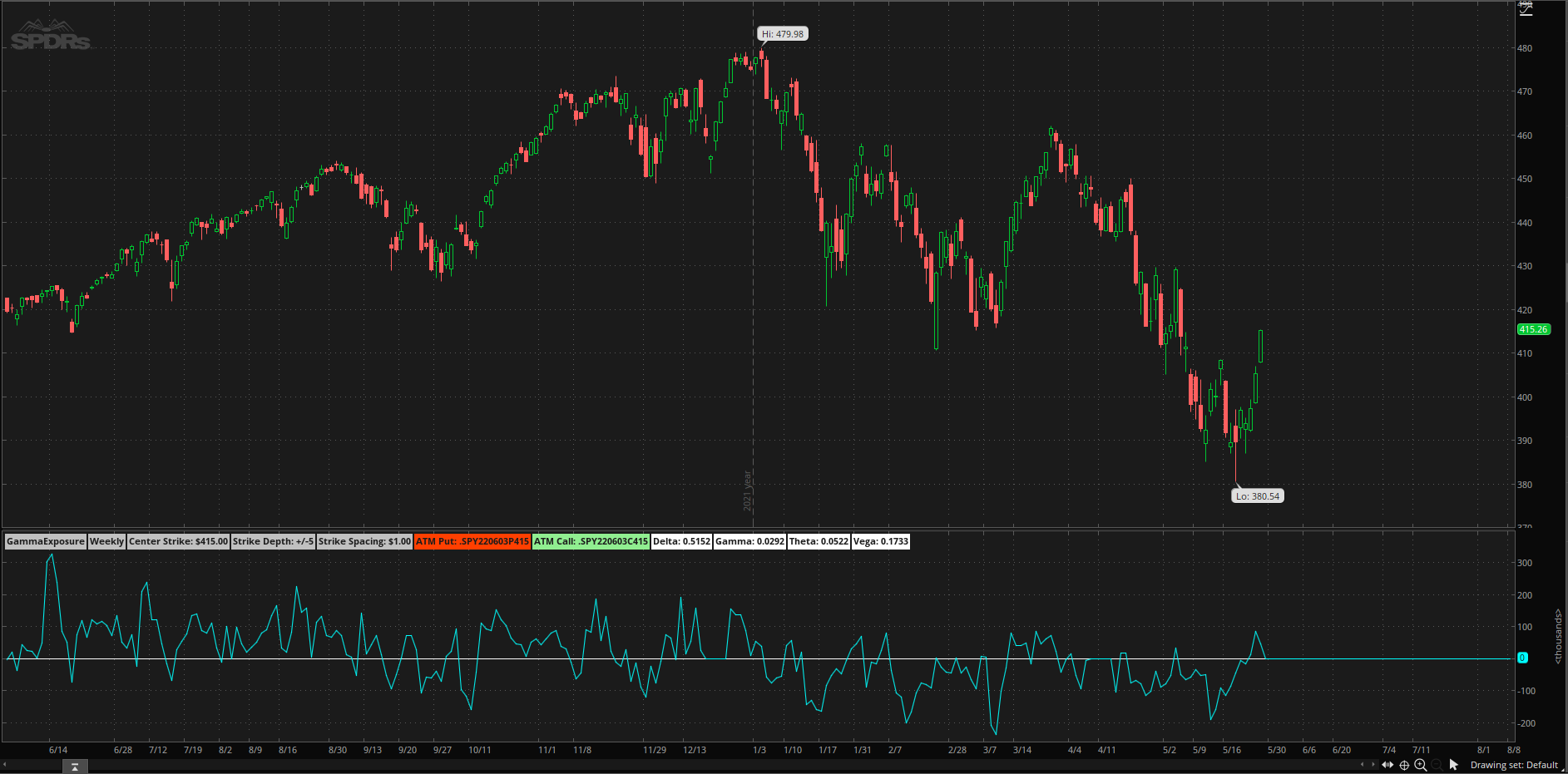

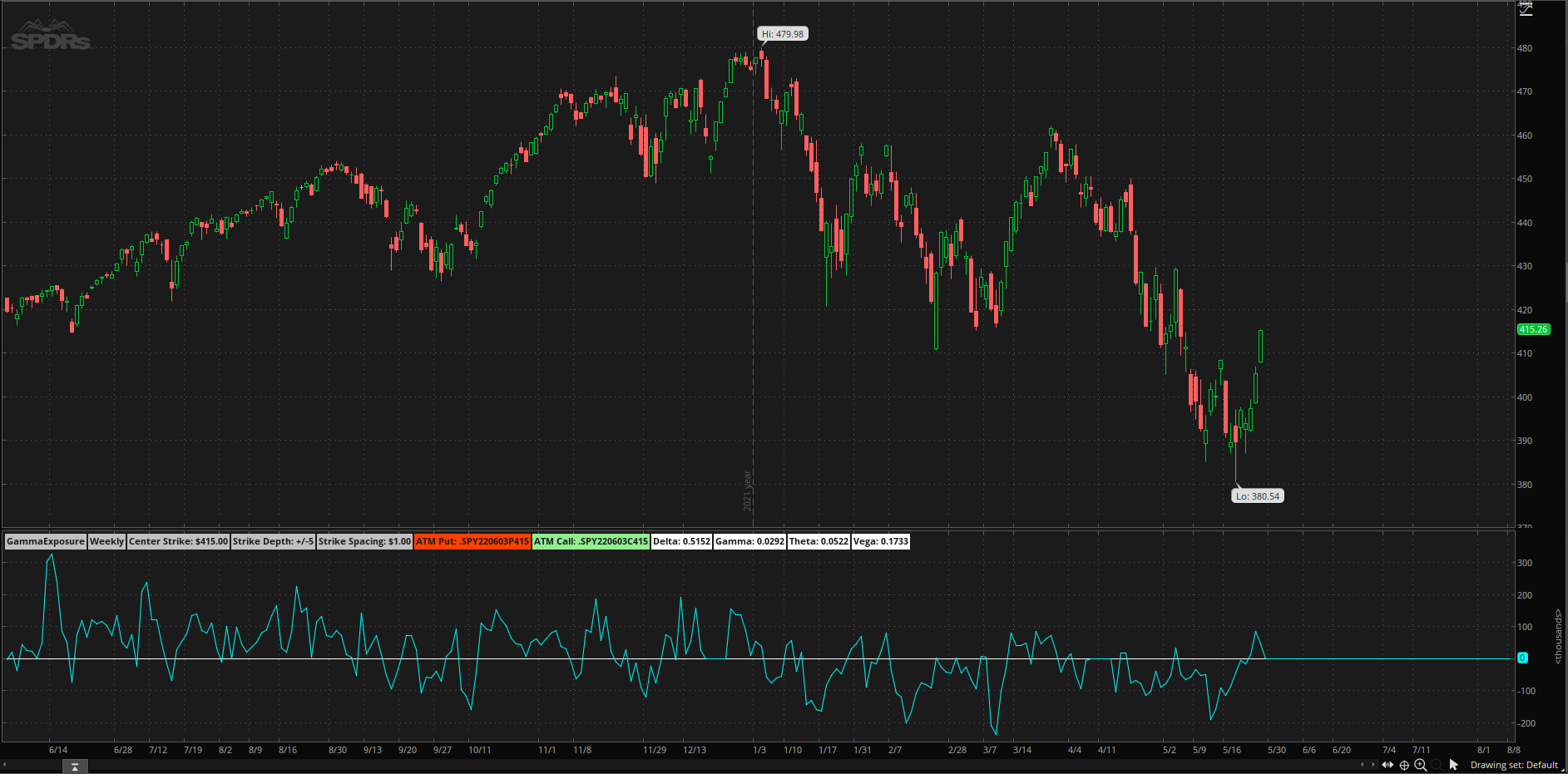

AddLabel(ShowGreeks, "Vega = " + Vega, Color.WHITE);Okay, uploading what I have so far. I heavily commented everything and renamed a lot of things, trying my best to understand it all and how thinkscript works in general. It would be 100x easier to do this if we could just dynamically assign a string to a variable. That whole 'series' thing had me stumped for a bit but I found a snippet from Mobius which helps to understand:

"series is the expiry starting at 1 and raising by one for each next expiry"

Using that logic, I setup a dropdown switch to select that instead of a number.

Note this is only setup for open interest right now, the DataType switch does nothing yet.

Change all the open_interest() function calls to volume() for option volume instead.

Code:#hint: Options Hacker \n This study lets you scan the options chain for a series and given depth. \n<b>Warning: Setting the StrikeDepth to large values requires significant processing power, and will result in slow loading times.</b> #-----------------------------------------------------------------------------------------------------------------# # Settings # Colors DefineGlobalColor("Call", Color.GREEN); DefineGlobalColor("Put", Color.RED); DefineGlobalColor("CallCloud",Color.DARK_GREEN); DefineGlobalColor("PutCloud",Color.DARK_RED); #hint Mode: The mode to select an option symbol. \n AUTO will use the option series input code. This will not always work, set to MANUAL to use the center strike and spacing inputs to manually determine the option symbol. input Mode = {default AUTO, MANUAL}; #hint Series: The option expiration series to search. \n This value is used to determine the option symbol, and for the input to the SeriesVolatility(series = x) function where series is the expiry starting at 1 and raising by one for each next expiry. input Series = { default Weekly, Month1, Month2, Month3, Month4, Month5, Month6, Month7, Month8, Month9 }; #hint DataType: The type of option data to show. input DataType = {default OPEN_INTEREST, VOLUME}; #hint StrikeDepth: The level of depth to search a series. The search starts at the center strike price, and goes both ITM and OTM. input StrikeDepth = 5; #hint CenterStrikeOffset: The offset to use when calculating the center strike based on close price. \n Examples: \n 1 = nearest $1 interval \n 10 = nearest $10 interval. input CenterStrikeOffset = 1.0; #hint MaxStrikeSpacing: The maximum dollar amount between two adjacent contracts. input MaxStrikeSpacing = 25; #hint ManualCenterStrike: The starting price to use when in MANUAL mode. input ManualCenterStrike = 440; #hint ManualStrikeSpacing: The dollar amount between two adjacent contracts to use when in MANUAL mode. input ManualStrikeSpacing = 1.0; #hint ShowStrikeInfo: Show the strike info labels. input ShowStrikeInfo = yes; #hint ShowLabels: Show the open interest labels. input ShowLabels = yes; #hint ShowClouds: Show the open interest clouds. input ShowClouds = no; #hint ShowLines: Show the open interest lines. input ShowLines = yes; #hint ShowGreeks: Show the estimated Greek calculation labels for the latest bar. input ShowGreeks = yes; #-----------------------------------------------------------------------------------------------------------------# # Date, Symbol, and Strike # OptionSeries is the expiry starting at 1 and raising by one for each next expiry. def OptionSeries; switch (Series) { case Weekly: OptionSeries = 1; case Month1: OptionSeries = 2; case Month2: OptionSeries = 3; case Month3: OptionSeries = 4; case Month4: OptionSeries = 5; case Month5: OptionSeries = 6; case Month6: OptionSeries = 7; case Month7: OptionSeries = 8; case Month8: OptionSeries = 9; case Month9: OptionSeries = 10; }; # Open price at Regular Trading Hours def RTHopen = open(period = AggregationPeriod.DAY); # Current year, month, and day def CurrentYear = GetYear(); def CurrentMonth = GetMonth(); def CurrentDayOfMonth = GetDayOfMonth(GetYYYYMMDD()); # Get the first day of this month. 1 (Monday) to 7 (Sunday) def FirstDayThisMonth = GetDayOfWeek((CurrentYear * 10000) + (CurrentMonth * 100) + 1); # Get the first friday of this month def FirstFridayDOM = if FirstDayThisMonth < 6 then 6 - FirstDayThisMonth else if FirstDayThisMonth == 6 then 7 else 6 ; # Get the second, third, and fourth fridays of this month def SecondFridayDOM = FirstFridayDOM + 7; def ThirdFridayDOM = FirstFridayDOM + 14; def FourthFridayDOM = FirstFridayDOM + 21; # Pick up all Fridays of the current month for weekly options def RollDOM = FirstFridayDOM + 21; def ExpMonth1 = if RollDOM > CurrentDayOfMonth then CurrentMonth + OptionSeries - 1 else CurrentMonth + OptionSeries ; # Options month input def ExpMonth2 = if ExpMonth1 > 12 then ExpMonth1 - 12 else ExpMonth1; # Options year input def ExpYear = if ExpMonth1 > 12 then CurrentYear + 1 else CurrentYear; # First friday expiry calc def ExpDay1DOW = GetDayOfWeek(ExpYear * 10000 + ExpMonth2 * 100 + 1); def ExpFirstFridayDOM = if ExpDay1DOW < 6 then 6 - ExpDay1DOW else if ExpDay1DOW == 6 then 7 else 6 ; # Options code day of month input def ExpDOM = if CurrentDayOfMonth < ExpFirstFridayDOM -1 then FirstFridayDOM else if between(CurrentDayOfMonth, ExpFirstFridayDOM, SecondFridayDOM - 1) then SecondFridayDOM else if between(CurrentDayOfMonth, SecondFridayDOM, ThirdFridayDOM - 1) then ThirdFridayDOM else if between(CurrentDayOfMonth, ThirdFridayDOM, FourthFridayDOM - 1) then FourthFridayDOM else ExpFirstFridayDOM ; # Centerstrike def CenterStrike = if (Mode == Mode.AUTO and !IsNaN(close)) then Round(close / CenterStrikeOffset, 0) * CenterStrikeOffset else if (Mode == Mode.MANUAL and !IsNaN(close)) then ManualCenterStrike else CenterStrike[1] ; # Strike Spacing def StrikeSpacingC = fold i = 1 to MaxStrikeSpacing with spacing = 0 do if DataType == DataType.OPEN_INTEREST and !IsNaN( open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("C", AsPrice(CenterStrike + (MaxStrikeSpacing - i))) ) ) ) then MaxStrikeSpacing - i else spacing ; def StrikeSpacing = if (Mode == Mode.AUTO and !IsNaN(close)) then StrikeSpacingC else if (Mode == Mode.MANUAL and !IsNaN(close)) then ManualStrikeSpacing else StrikeSpacing[1] ; #-----------------------------------------------------------------------------------------------------------------# # Option Chain # Call Open Interest def ITMCallOpenInterest = fold itmCallOIIndex = 0 to StrikeDepth with itmCOI do if IsNaN( open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("C", AsPrice(CenterStrike - strikeSpacing * itmCallOIIndex)) ) ) ) then 0 else itmCOI + open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("C", AsPrice(CenterStrike - strikeSpacing * itmCallOIIndex)) ) ) ; def OTMCallOpenInterest = fold otmCallOIIndex = 0 to StrikeDepth with otmCOI do if IsNaN( open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("C", AsPrice(CenterStrike + strikeSpacing * otmCallOIIndex)) ) ) ) then 0 else otmCOI + open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("C", AsPrice(CenterStrike + strikeSpacing * otmCallOIIndex)) ) ) ; # Put Open Interest def ITMPutOpenInterest = fold itmPutOIIndex = 0 to StrikeDepth with itmPOI do if IsNaN( open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("P", AsPrice(CenterStrike - strikeSpacing * itmPutOIIndex)) ) ) ) then 0 else itmPOI + open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("P", AsPrice(CenterStrike - strikeSpacing * itmPutOIIndex)) ) ) ; def OTMPutOpenInterest = fold otmPutOIIndex = 0 to StrikeDepth with otmPOI do if IsNaN( open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("P", AsPrice(CenterStrike + strikeSpacing * otmPutOIIndex)) ) ) ) then 0 else otmPOI + open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("P", AsPrice(centerStrike + strikeSpacing * otmPutOIIndex)) ) ) ; #-----------------------------------------------------------------------------------------------------------------# # Greeks Calculations # # K - Option strike price # N - Standard normal cumulative distribution function # r - Risk free interest rate # IV - Volatility of the underlying # S - Price of the underlying # t - Time to option's expiry # # Delta = N(d1) # d1 = (ln(S/K) + (r + (sqr(IV)/2))t) / (? (sqrt(t))) # Gamma = (d2) / S(IV(sqrt(t))) # d2 = e -(sqr(d1) / 2) / sqrt(2*pi) # Theta = ((S d2))IV) / 2 sqrt(t)) - (rK e(rt)N(d4)) # where phi(d3) = (exp(-(sqr(x)/2))) / (2 * sqrt(t)) # where d4 = d1 - IV(sqrt(t)) # Vega = S phi(d1) Sqrt(t) # TODO: Figure out how to dynamically get this value input DayToExpiry = 6; # Get the implied volatility for calculations # Input: series is the expiry starting at 1 and raising by 1 for each next expiry def IV = SeriesVolatility(series = OptionSeries); def K = CenterStrike; def S = close; def r = GetInterestRate(); def t = DayToExpiry / 365; def d1 = (Log(S / K) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t)); script N { input data = 1; def a = AbsValue(data); def b1 = .31938153; def b2 = -.356563782; def b3 = 1.781477937; def b4 = -1.821255978; def b5 = 1.330274429; def b6 = .2316419; def e = 1 / (1 + b6 * a); def i = 1 - 1 / Sqrt(2 * Double.Pi) * Exp(-Power(a, 2) / 2) * (b1 * e + b2 * e * e + b3 * Power(e, 3) + b4 * Power(e, 4) + b5 * Power(e, 5)); plot CND = if data < 0 then 1 - i else i; } # TODO: These values don't quite line up # My background on options pricing models is not very good # Delta def Delta = N(d1); # Gamma def d2 = Exp(-(Sqr(d1) / 2)) / Sqrt(2 * Double.Pi); def Gamma = d2 / (S * (IV * Sqrt(t))); # Theta def Theta = -(-(S*d2*IV*(.5000)/ (2*sqrt(t)))- (r*(exp(-r*t)*K))*N(d2)+(S*N(d1)*(.5000)))/365; # (.5000) variant less than .5 e(X/t) # Vega def Vega = (S*d2*sqrt(t))/100; #-----------------------------------------------------------------------------------------------------------------# # Visuals # Current Option Expiry Label AddLabel( ShowStrikeInfo, Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Color.GRAY ); # Center Strike Label AddLabel(ShowStrikeInfo, "Center Strike: " + AsDollars(CenterStrike), Color.GRAY); # Chain Depth Label AddLabel(ShowStrikeInfo, "Chain Depth: +/-" + StrikeDepth, Color.GRAY); # Strike Spacing Label AddLabel(ShowStrikeInfo and StrikeSpacing, "Strike Spacing: " + StrikeSpacing, Color.GRAY); # Call Open Interest plot CallOpenInterest = ItMCallOpenInterest + OTMCallOpenInterest; CallOpenInterest.SetHiding(!ShowLines); CallOpenInterest.SetPaintingStrategy(PaintingStrategy.LINE); CallOpenInterest.SetDefaultColor(GlobalColor("Call")); AddLabel(ShowLabels, "CallOI: " + CallOpenInterest, GlobalColor("Call")); # Put Open Interest plot PutOpenInterest = -(ITMPutOpenInterest + OTMPutOpenInterest); # Make negative to flip under axis PutOpenInterest.SetHiding(!ShowLines); PutOpenInterest.SetPaintingStrategy(PaintingStrategy.LINE); PutOpenInterest.SetDefaultColor(GlobalColor("Put")); AddLabel(ShowLabels, "PutOI: " + (ITMPutOpenInterest + OTMPutOpenInterest), GlobalColor("Put")); # Create a center line plot ZeroLine = 0; ZeroLine.SetDefaultColor(Color.WHITE); # Create Clouds AddCloud(if ShowClouds then CallOpenInterest else Double.NaN, if ShowClouds then Zeroline else Double.NaN, GlobalColor("CallCloud"), GlobalColor("PutCloud")); AddCloud(if ShowClouds then Zeroline else Double.NaN, if ShowClouds then PutOpenInterest else Double.NaN, GlobalColor("PutCloud"), GlobalColor("CallCloud")); # Hull Moving Average of Put Open Interest plot PutVolumeAverage = hullmovingavg(PutOpenInterest); PutVolumeAverage.SetHiding(!ShowLines); PutVolumeAverage.setdefaultcolor(color.ORANGE); PutVolumeAverage.setstyle(curve.MEDIUM_DASH); # Hull Moving Average of Call Open Interest plot CallVolumeAverage = hullmovingavg(CallOpenInterest); CallVolumeAverage.SetHiding(!ShowLines); CallVolumeAverage.setdefaultcolor(color.LIGHT_GREEN); CallVolumeAverage.setstyle(curve.MEDIUM_DASH); # Color Gradient of Total Average Open Interest plot TotalVolumeAverage = average(CallOpenInterest + PutOpenInterest); TotalVolumeAverage.SetHiding(!ShowLines); def colornormlength = 14; TotalVolumeAverage.setlineweight(3); TotalVolumeAverage.definecolor("Default", Color.YELLOW); TotalVolumeAverage.definecolor("Highest", Color.GREEN); TotalVolumeAverage.DefineColor("Lowest", Color.RED); TotalVolumeAverage.AssignNormGradientColor(colorNormLength, TotalVolumeAverage.Color("Lowest"), TotalVolumeAverage.Color("Highest")); AddCloud(if ShowClouds then TotalVolumeAverage else Double.NaN, if ShowClouds then Zeroline else Double.NaN, color.GREEN, color.RED); # Greeks AddLabel(ShowGreeks, "Delta = " + Delta, Color.WHITE); AddLabel(ShowGreeks, "Gamma = " + Gamma, Color.WHITE); AddLabel(ShowGreeks, "Theta = " + theta, Color.WHITE); AddLabel(ShowGreeks, "Vega = " + Vega, Color.WHITE);

# Strike Spacing

def StrikeSpacingC =

fold i = 1 to MaxStrikeSpacing

with spacing = 0

do if DataType == DataType.OPEN_INTEREST and !IsNaN(

open_interest(

("." + GetSymbolPart()) +

(ExpYear - 2000) +

# need the "" + to convert number to text. can't have 2 different data types as T/F values for if-then

(if ExpMonth2 <= 9 then ("0" + ExpMonth2) else ("" + ExpMonth2) ) +

(if ExpDOM <= 9 then ("0" + ExpDOM) else ("" + ExpDOM) ) +

("C" + AsPrice(CenterStrike + (MaxStrikeSpacing - i)) )

)

) then MaxStrikeSpacing - i

else spacing;# original code

# open_interest(

# Concat(

# Concat(".",

# Concat(GetSymbolPart(),

# Concat(

# Concat(ExpYear - 2000,

# if ExpMonth2 <= 9 then Concat("0", ExpMonth2)

# else Concat("", ExpMonth2)

# ),

# if ExpDOM <= 9 then Concat("0", ExpDOM)

# else Concat("", ExpDOM)

# )

# )

# ),

# Concat("C", AsPrice(CenterStrike + (MaxStrikeSpacing - i)))

# )

# )

# )

# then MaxStrikeSpacing - i

# else spacingThanks! That means a lot actually.a week here and you made this? you are talented.

thank you for posting the code in #106

def OptionExpiryDate = ExpYear * 10000 + ExpMonth2 * 100 + ExpDOM + 1;

Addlabel(ShowStrikeInfo, "ATM Put: " + ("." + GetSymbol()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(0 + CenterStrike), Color.LIGHT_RED);

Addlabel(ShowStrikeInfo, "ATM Call: " + ("." + GetSymbol()) + AsPrice(OptionExpiryDate - 20000001) + "C" + AsPrice(0 + CenterStrike), Color.LIGHT_GREEN);

plot test = OptionExpiryDate - 20000001; # For debugging date# Total Put Open Interest for selected chain depth and expiry series

def TotalPutOpenInterest =

fold poiIndex = -StrikeDepth to StrikeDepth

with poi = 0

do

#if IsNAN(poi + open_interest(Concat(Concat(Concat(".", GetSymbol()), Concat(AsPrice(OptionExpiryDate - 20000001), "P")), poiIndex + CenterStrike)))

if IsNaN(poi + open_interest(("." + GetSymbol()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(poiIndex + CenterStrike)))

then 0

else poi + open_interest(("." + GetSymbol()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(poiIndex + CenterStrike))

;

# Total Call Open Interest for selected chain depth and expiry series

def TotalCallOpenInterest =

fold coiIndex = -StrikeDepth to StrikeDepth

with coi = 0

do

#if IsNAN(coi + open_interest(Concat(Concat(Concat(".", GetSymbol()), Concat(AsPrice(OptionExpiryDate - 20000001), "C")), coiIndex + CenterStrike)))

if IsNaN(coi + open_interest(("." + GetSymbol()) + AsPrice(OptionExpiryDate - 20000001) + "C" + AsPrice(coiIndex + CenterStrike)))

then 0

else coi + open_interest(("." + GetSymbol()) + AsPrice(OptionExpiryDate - 20000001) + "C" + AsPrice(coiIndex + CenterStrike))

;it's great having a software engineer help with this, I definitely like what you've done so far with calculating OI and the greeks, it won't be completely accurate given these are theoretical calculations and there are bound to be nuisances but I definitely think you're on the right track. This can be used to calculate total volume and open interest but correct me if I'm wrong, the greek values are only for the center strike correct?Okay, uploading what I have so far. I heavily commented everything and renamed a lot of things, trying my best to understand it all and how thinkscript works in general. It would be 100x easier to do this if we could just dynamically assign a string to a variable. That whole 'series' thing had me stumped for a bit but I found a snippet from Mobius which helps to understand:

"series is the expiry starting at 1 and raising by one for each next expiry"

Using that logic, I setup a dropdown switch to select that instead of a number.

Note this is only setup for open interest right now, the DataType switch does nothing yet.

Change all the open_interest() function calls to volume() for option volume instead.

Code:#hint: Options Hacker \n This study lets you scan the options chain for a series and given depth. \n<b>Warning: Setting the StrikeDepth to large values requires significant processing power, and will result in slow loading times.</b> #-----------------------------------------------------------------------------------------------------------------# # Settings # Colors DefineGlobalColor("Call", Color.GREEN); DefineGlobalColor("Put", Color.RED); DefineGlobalColor("CallCloud",Color.DARK_GREEN); DefineGlobalColor("PutCloud",Color.DARK_RED); #hint Mode: The mode to select an option symbol. \n AUTO will use the option series input code. This will not always work, set to MANUAL to use the center strike and spacing inputs to manually determine the option symbol. input Mode = {default AUTO, MANUAL}; #hint Series: The option expiration series to search. \n This value is used to determine the option symbol, and for the input to the SeriesVolatility(series = x) function where series is the expiry starting at 1 and raising by one for each next expiry. input Series = { default Weekly, Month1, Month2, Month3, Month4, Month5, Month6, Month7, Month8, Month9 }; #hint DataType: The type of option data to show. input DataType = {default OPEN_INTEREST, VOLUME}; #hint StrikeDepth: The level of depth to search a series. The search starts at the center strike price, and goes both ITM and OTM. input StrikeDepth = 5; #hint CenterStrikeOffset: The offset to use when calculating the center strike based on close price. \n Examples: \n 1 = nearest $1 interval \n 10 = nearest $10 interval. input CenterStrikeOffset = 1.0; #hint MaxStrikeSpacing: The maximum dollar amount between two adjacent contracts. input MaxStrikeSpacing = 25; #hint ManualCenterStrike: The starting price to use when in MANUAL mode. input ManualCenterStrike = 440; #hint ManualStrikeSpacing: The dollar amount between two adjacent contracts to use when in MANUAL mode. input ManualStrikeSpacing = 1.0; #hint ShowStrikeInfo: Show the strike info labels. input ShowStrikeInfo = yes; #hint ShowLabels: Show the open interest labels. input ShowLabels = yes; #hint ShowClouds: Show the open interest clouds. input ShowClouds = no; #hint ShowLines: Show the open interest lines. input ShowLines = yes; #hint ShowGreeks: Show the estimated Greek calculation labels for the latest bar. input ShowGreeks = yes; #-----------------------------------------------------------------------------------------------------------------# # Date, Symbol, and Strike # OptionSeries is the expiry starting at 1 and raising by one for each next expiry. def OptionSeries; switch (Series) { case Weekly: OptionSeries = 1; case Month1: OptionSeries = 2; case Month2: OptionSeries = 3; case Month3: OptionSeries = 4; case Month4: OptionSeries = 5; case Month5: OptionSeries = 6; case Month6: OptionSeries = 7; case Month7: OptionSeries = 8; case Month8: OptionSeries = 9; case Month9: OptionSeries = 10; }; # Open price at Regular Trading Hours def RTHopen = open(period = AggregationPeriod.DAY); # Current year, month, and day def CurrentYear = GetYear(); def CurrentMonth = GetMonth(); def CurrentDayOfMonth = GetDayOfMonth(GetYYYYMMDD()); # Get the first day of this month. 1 (Monday) to 7 (Sunday) def FirstDayThisMonth = GetDayOfWeek((CurrentYear * 10000) + (CurrentMonth * 100) + 1); # Get the first friday of this month def FirstFridayDOM = if FirstDayThisMonth < 6 then 6 - FirstDayThisMonth else if FirstDayThisMonth == 6 then 7 else 6 ; # Get the second, third, and fourth fridays of this month def SecondFridayDOM = FirstFridayDOM + 7; def ThirdFridayDOM = FirstFridayDOM + 14; def FourthFridayDOM = FirstFridayDOM + 21; # Pick up all Fridays of the current month for weekly options def RollDOM = FirstFridayDOM + 21; def ExpMonth1 = if RollDOM > CurrentDayOfMonth then CurrentMonth + OptionSeries - 1 else CurrentMonth + OptionSeries ; # Options month input def ExpMonth2 = if ExpMonth1 > 12 then ExpMonth1 - 12 else ExpMonth1; # Options year input def ExpYear = if ExpMonth1 > 12 then CurrentYear + 1 else CurrentYear; # First friday expiry calc def ExpDay1DOW = GetDayOfWeek(ExpYear * 10000 + ExpMonth2 * 100 + 1); def ExpFirstFridayDOM = if ExpDay1DOW < 6 then 6 - ExpDay1DOW else if ExpDay1DOW == 6 then 7 else 6 ; # Options code day of month input def ExpDOM = if CurrentDayOfMonth < ExpFirstFridayDOM -1 then FirstFridayDOM else if between(CurrentDayOfMonth, ExpFirstFridayDOM, SecondFridayDOM - 1) then SecondFridayDOM else if between(CurrentDayOfMonth, SecondFridayDOM, ThirdFridayDOM - 1) then ThirdFridayDOM else if between(CurrentDayOfMonth, ThirdFridayDOM, FourthFridayDOM - 1) then FourthFridayDOM else ExpFirstFridayDOM ; # Centerstrike def CenterStrike = if (Mode == Mode.AUTO and !IsNaN(close)) then Round(close / CenterStrikeOffset, 0) * CenterStrikeOffset else if (Mode == Mode.MANUAL and !IsNaN(close)) then ManualCenterStrike else CenterStrike[1] ; # Strike Spacing def StrikeSpacingC = fold i = 1 to MaxStrikeSpacing with spacing = 0 do if DataType == DataType.OPEN_INTEREST and !IsNaN( open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("C", AsPrice(CenterStrike + (MaxStrikeSpacing - i))) ) ) ) then MaxStrikeSpacing - i else spacing ; def StrikeSpacing = if (Mode == Mode.AUTO and !IsNaN(close)) then StrikeSpacingC else if (Mode == Mode.MANUAL and !IsNaN(close)) then ManualStrikeSpacing else StrikeSpacing[1] ; #-----------------------------------------------------------------------------------------------------------------# # Option Chain # Call Open Interest def ITMCallOpenInterest = fold itmCallOIIndex = 0 to StrikeDepth with itmCOI do if IsNaN( open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("C", AsPrice(CenterStrike - strikeSpacing * itmCallOIIndex)) ) ) ) then 0 else itmCOI + open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("C", AsPrice(CenterStrike - strikeSpacing * itmCallOIIndex)) ) ) ; def OTMCallOpenInterest = fold otmCallOIIndex = 0 to StrikeDepth with otmCOI do if IsNaN( open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("C", AsPrice(CenterStrike + strikeSpacing * otmCallOIIndex)) ) ) ) then 0 else otmCOI + open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("C", AsPrice(CenterStrike + strikeSpacing * otmCallOIIndex)) ) ) ; # Put Open Interest def ITMPutOpenInterest = fold itmPutOIIndex = 0 to StrikeDepth with itmPOI do if IsNaN( open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("P", AsPrice(CenterStrike - strikeSpacing * itmPutOIIndex)) ) ) ) then 0 else itmPOI + open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("P", AsPrice(CenterStrike - strikeSpacing * itmPutOIIndex)) ) ) ; def OTMPutOpenInterest = fold otmPutOIIndex = 0 to StrikeDepth with otmPOI do if IsNaN( open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("P", AsPrice(CenterStrike + strikeSpacing * otmPutOIIndex)) ) ) ) then 0 else otmPOI + open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("P", AsPrice(centerStrike + strikeSpacing * otmPutOIIndex)) ) ) ; #-----------------------------------------------------------------------------------------------------------------# # Greeks Calculations # # K - Option strike price # N - Standard normal cumulative distribution function # r - Risk free interest rate # IV - Volatility of the underlying # S - Price of the underlying # t - Time to option's expiry # # Delta = N(d1) # d1 = (ln(S/K) + (r + (sqr(IV)/2))t) / (? (sqrt(t))) # Gamma = (d2) / S(IV(sqrt(t))) # d2 = e -(sqr(d1) / 2) / sqrt(2*pi) # Theta = ((S d2))IV) / 2 sqrt(t)) - (rK e(rt)N(d4)) # where phi(d3) = (exp(-(sqr(x)/2))) / (2 * sqrt(t)) # where d4 = d1 - IV(sqrt(t)) # Vega = S phi(d1) Sqrt(t) # TODO: Figure out how to dynamically get this value input DayToExpiry = 6; # Get the implied volatility for calculations # Input: series is the expiry starting at 1 and raising by 1 for each next expiry def IV = SeriesVolatility(series = OptionSeries); def K = CenterStrike; def S = close; def r = GetInterestRate(); def t = DayToExpiry / 365; def d1 = (Log(S / K) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t)); script N { input data = 1; def a = AbsValue(data); def b1 = .31938153; def b2 = -.356563782; def b3 = 1.781477937; def b4 = -1.821255978; def b5 = 1.330274429; def b6 = .2316419; def e = 1 / (1 + b6 * a); def i = 1 - 1 / Sqrt(2 * Double.Pi) * Exp(-Power(a, 2) / 2) * (b1 * e + b2 * e * e + b3 * Power(e, 3) + b4 * Power(e, 4) + b5 * Power(e, 5)); plot CND = if data < 0 then 1 - i else i; } # TODO: These values don't quite line up # My background on options pricing models is not very good # Delta def Delta = N(d1); # Gamma def d2 = Exp(-(Sqr(d1) / 2)) / Sqrt(2 * Double.Pi); def Gamma = d2 / (S * (IV * Sqrt(t))); # Theta def Theta = -(-(S*d2*IV*(.5000)/ (2*sqrt(t)))- (r*(exp(-r*t)*K))*N(d2)+(S*N(d1)*(.5000)))/365; # (.5000) variant less than .5 e(X/t) # Vega def Vega = (S*d2*sqrt(t))/100; #-----------------------------------------------------------------------------------------------------------------# # Visuals # Current Option Expiry Label AddLabel( ShowStrikeInfo, Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Color.GRAY ); # Center Strike Label AddLabel(ShowStrikeInfo, "Center Strike: " + AsDollars(CenterStrike), Color.GRAY); # Chain Depth Label AddLabel(ShowStrikeInfo, "Chain Depth: +/-" + StrikeDepth, Color.GRAY); # Strike Spacing Label AddLabel(ShowStrikeInfo and StrikeSpacing, "Strike Spacing: " + StrikeSpacing, Color.GRAY); # Call Open Interest plot CallOpenInterest = ItMCallOpenInterest + OTMCallOpenInterest; CallOpenInterest.SetHiding(!ShowLines); CallOpenInterest.SetPaintingStrategy(PaintingStrategy.LINE); CallOpenInterest.SetDefaultColor(GlobalColor("Call")); AddLabel(ShowLabels, "CallOI: " + CallOpenInterest, GlobalColor("Call")); # Put Open Interest plot PutOpenInterest = -(ITMPutOpenInterest + OTMPutOpenInterest); # Make negative to flip under axis PutOpenInterest.SetHiding(!ShowLines); PutOpenInterest.SetPaintingStrategy(PaintingStrategy.LINE); PutOpenInterest.SetDefaultColor(GlobalColor("Put")); AddLabel(ShowLabels, "PutOI: " + (ITMPutOpenInterest + OTMPutOpenInterest), GlobalColor("Put")); # Create a center line plot ZeroLine = 0; ZeroLine.SetDefaultColor(Color.WHITE); # Create Clouds AddCloud(if ShowClouds then CallOpenInterest else Double.NaN, if ShowClouds then Zeroline else Double.NaN, GlobalColor("CallCloud"), GlobalColor("PutCloud")); AddCloud(if ShowClouds then Zeroline else Double.NaN, if ShowClouds then PutOpenInterest else Double.NaN, GlobalColor("PutCloud"), GlobalColor("CallCloud")); # Hull Moving Average of Put Open Interest plot PutVolumeAverage = hullmovingavg(PutOpenInterest); PutVolumeAverage.SetHiding(!ShowLines); PutVolumeAverage.setdefaultcolor(color.ORANGE); PutVolumeAverage.setstyle(curve.MEDIUM_DASH); # Hull Moving Average of Call Open Interest plot CallVolumeAverage = hullmovingavg(CallOpenInterest); CallVolumeAverage.SetHiding(!ShowLines); CallVolumeAverage.setdefaultcolor(color.LIGHT_GREEN); CallVolumeAverage.setstyle(curve.MEDIUM_DASH); # Color Gradient of Total Average Open Interest plot TotalVolumeAverage = average(CallOpenInterest + PutOpenInterest); TotalVolumeAverage.SetHiding(!ShowLines); def colornormlength = 14; TotalVolumeAverage.setlineweight(3); TotalVolumeAverage.definecolor("Default", Color.YELLOW); TotalVolumeAverage.definecolor("Highest", Color.GREEN); TotalVolumeAverage.DefineColor("Lowest", Color.RED); TotalVolumeAverage.AssignNormGradientColor(colorNormLength, TotalVolumeAverage.Color("Lowest"), TotalVolumeAverage.Color("Highest")); AddCloud(if ShowClouds then TotalVolumeAverage else Double.NaN, if ShowClouds then Zeroline else Double.NaN, color.GREEN, color.RED); # Greeks AddLabel(ShowGreeks, "Delta = " + Delta, Color.WHITE); AddLabel(ShowGreeks, "Gamma = " + Gamma, Color.WHITE); AddLabel(ShowGreeks, "Theta = " + theta, Color.WHITE); AddLabel(ShowGreeks, "Vega = " + Vega, Color.WHITE);

I found this article it should help with knowing how to calculate the gamma at each strike, aswell as zero gamma line etc https://perfiliev.co.uk/market-commentary/how-to-calculate-gamma-exposure-and-zero-gamma-level/Okay, uploading what I have so far. I heavily commented everything and renamed a lot of things, trying my best to understand it all and how thinkscript works in general. It would be 100x easier to do this if we could just dynamically assign a string to a variable. That whole 'series' thing had me stumped for a bit but I found a snippet from Mobius which helps to understand:

"series is the expiry starting at 1 and raising by one for each next expiry"

Using that logic, I setup a dropdown switch to select that instead of a number.

Note this is only setup for open interest right now, the DataType switch does nothing yet.

Change all the open_interest() function calls to volume() for option volume instead.

Code:#hint: Options Hacker \n This study lets you scan the options chain for a series and given depth. \n<b>Warning: Setting the StrikeDepth to large values requires significant processing power, and will result in slow loading times.</b> #-----------------------------------------------------------------------------------------------------------------# # Settings # Colors DefineGlobalColor("Call", Color.GREEN); DefineGlobalColor("Put", Color.RED); DefineGlobalColor("CallCloud",Color.DARK_GREEN); DefineGlobalColor("PutCloud",Color.DARK_RED); #hint Mode: The mode to select an option symbol. \n AUTO will use the option series input code. This will not always work, set to MANUAL to use the center strike and spacing inputs to manually determine the option symbol. input Mode = {default AUTO, MANUAL}; #hint Series: The option expiration series to search. \n This value is used to determine the option symbol, and for the input to the SeriesVolatility(series = x) function where series is the expiry starting at 1 and raising by one for each next expiry. input Series = { default Weekly, Month1, Month2, Month3, Month4, Month5, Month6, Month7, Month8, Month9 }; #hint DataType: The type of option data to show. input DataType = {default OPEN_INTEREST, VOLUME}; #hint StrikeDepth: The level of depth to search a series. The search starts at the center strike price, and goes both ITM and OTM. input StrikeDepth = 5; #hint CenterStrikeOffset: The offset to use when calculating the center strike based on close price. \n Examples: \n 1 = nearest $1 interval \n 10 = nearest $10 interval. input CenterStrikeOffset = 1.0; #hint MaxStrikeSpacing: The maximum dollar amount between two adjacent contracts. input MaxStrikeSpacing = 25; #hint ManualCenterStrike: The starting price to use when in MANUAL mode. input ManualCenterStrike = 440; #hint ManualStrikeSpacing: The dollar amount between two adjacent contracts to use when in MANUAL mode. input ManualStrikeSpacing = 1.0; #hint ShowStrikeInfo: Show the strike info labels. input ShowStrikeInfo = yes; #hint ShowLabels: Show the open interest labels. input ShowLabels = yes; #hint ShowClouds: Show the open interest clouds. input ShowClouds = no; #hint ShowLines: Show the open interest lines. input ShowLines = yes; #hint ShowGreeks: Show the estimated Greek calculation labels for the latest bar. input ShowGreeks = yes; #-----------------------------------------------------------------------------------------------------------------# # Date, Symbol, and Strike # OptionSeries is the expiry starting at 1 and raising by one for each next expiry. def OptionSeries; switch (Series) { case Weekly: OptionSeries = 1; case Month1: OptionSeries = 2; case Month2: OptionSeries = 3; case Month3: OptionSeries = 4; case Month4: OptionSeries = 5; case Month5: OptionSeries = 6; case Month6: OptionSeries = 7; case Month7: OptionSeries = 8; case Month8: OptionSeries = 9; case Month9: OptionSeries = 10; }; # Open price at Regular Trading Hours def RTHopen = open(period = AggregationPeriod.DAY); # Current year, month, and day def CurrentYear = GetYear(); def CurrentMonth = GetMonth(); def CurrentDayOfMonth = GetDayOfMonth(GetYYYYMMDD()); # Get the first day of this month. 1 (Monday) to 7 (Sunday) def FirstDayThisMonth = GetDayOfWeek((CurrentYear * 10000) + (CurrentMonth * 100) + 1); # Get the first friday of this month def FirstFridayDOM = if FirstDayThisMonth < 6 then 6 - FirstDayThisMonth else if FirstDayThisMonth == 6 then 7 else 6 ; # Get the second, third, and fourth fridays of this month def SecondFridayDOM = FirstFridayDOM + 7; def ThirdFridayDOM = FirstFridayDOM + 14; def FourthFridayDOM = FirstFridayDOM + 21; # Pick up all Fridays of the current month for weekly options def RollDOM = FirstFridayDOM + 21; def ExpMonth1 = if RollDOM > CurrentDayOfMonth then CurrentMonth + OptionSeries - 1 else CurrentMonth + OptionSeries ; # Options month input def ExpMonth2 = if ExpMonth1 > 12 then ExpMonth1 - 12 else ExpMonth1; # Options year input def ExpYear = if ExpMonth1 > 12 then CurrentYear + 1 else CurrentYear; # First friday expiry calc def ExpDay1DOW = GetDayOfWeek(ExpYear * 10000 + ExpMonth2 * 100 + 1); def ExpFirstFridayDOM = if ExpDay1DOW < 6 then 6 - ExpDay1DOW else if ExpDay1DOW == 6 then 7 else 6 ; # Options code day of month input def ExpDOM = if CurrentDayOfMonth < ExpFirstFridayDOM -1 then FirstFridayDOM else if between(CurrentDayOfMonth, ExpFirstFridayDOM, SecondFridayDOM - 1) then SecondFridayDOM else if between(CurrentDayOfMonth, SecondFridayDOM, ThirdFridayDOM - 1) then ThirdFridayDOM else if between(CurrentDayOfMonth, ThirdFridayDOM, FourthFridayDOM - 1) then FourthFridayDOM else ExpFirstFridayDOM ; # Centerstrike def CenterStrike = if (Mode == Mode.AUTO and !IsNaN(close)) then Round(close / CenterStrikeOffset, 0) * CenterStrikeOffset else if (Mode == Mode.MANUAL and !IsNaN(close)) then ManualCenterStrike else CenterStrike[1] ; # Strike Spacing def StrikeSpacingC = fold i = 1 to MaxStrikeSpacing with spacing = 0 do if DataType == DataType.OPEN_INTEREST and !IsNaN( open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("C", AsPrice(CenterStrike + (MaxStrikeSpacing - i))) ) ) ) then MaxStrikeSpacing - i else spacing ; def StrikeSpacing = if (Mode == Mode.AUTO and !IsNaN(close)) then StrikeSpacingC else if (Mode == Mode.MANUAL and !IsNaN(close)) then ManualStrikeSpacing else StrikeSpacing[1] ; #-----------------------------------------------------------------------------------------------------------------# # Option Chain # Call Open Interest def ITMCallOpenInterest = fold itmCallOIIndex = 0 to StrikeDepth with itmCOI do if IsNaN( open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("C", AsPrice(CenterStrike - strikeSpacing * itmCallOIIndex)) ) ) ) then 0 else itmCOI + open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("C", AsPrice(CenterStrike - strikeSpacing * itmCallOIIndex)) ) ) ; def OTMCallOpenInterest = fold otmCallOIIndex = 0 to StrikeDepth with otmCOI do if IsNaN( open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("C", AsPrice(CenterStrike + strikeSpacing * otmCallOIIndex)) ) ) ) then 0 else otmCOI + open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("C", AsPrice(CenterStrike + strikeSpacing * otmCallOIIndex)) ) ) ; # Put Open Interest def ITMPutOpenInterest = fold itmPutOIIndex = 0 to StrikeDepth with itmPOI do if IsNaN( open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("P", AsPrice(CenterStrike - strikeSpacing * itmPutOIIndex)) ) ) ) then 0 else itmPOI + open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("P", AsPrice(CenterStrike - strikeSpacing * itmPutOIIndex)) ) ) ; def OTMPutOpenInterest = fold otmPutOIIndex = 0 to StrikeDepth with otmPOI do if IsNaN( open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("P", AsPrice(CenterStrike + strikeSpacing * otmPutOIIndex)) ) ) ) then 0 else otmPOI + open_interest( Concat( Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Concat("P", AsPrice(centerStrike + strikeSpacing * otmPutOIIndex)) ) ) ; #-----------------------------------------------------------------------------------------------------------------# # Greeks Calculations # # K - Option strike price # N - Standard normal cumulative distribution function # r - Risk free interest rate # IV - Volatility of the underlying # S - Price of the underlying # t - Time to option's expiry # # Delta = N(d1) # d1 = (ln(S/K) + (r + (sqr(IV)/2))t) / (? (sqrt(t))) # Gamma = (d2) / S(IV(sqrt(t))) # d2 = e -(sqr(d1) / 2) / sqrt(2*pi) # Theta = ((S d2))IV) / 2 sqrt(t)) - (rK e(rt)N(d4)) # where phi(d3) = (exp(-(sqr(x)/2))) / (2 * sqrt(t)) # where d4 = d1 - IV(sqrt(t)) # Vega = S phi(d1) Sqrt(t) # TODO: Figure out how to dynamically get this value input DayToExpiry = 6; # Get the implied volatility for calculations # Input: series is the expiry starting at 1 and raising by 1 for each next expiry def IV = SeriesVolatility(series = OptionSeries); def K = CenterStrike; def S = close; def r = GetInterestRate(); def t = DayToExpiry / 365; def d1 = (Log(S / K) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t)); script N { input data = 1; def a = AbsValue(data); def b1 = .31938153; def b2 = -.356563782; def b3 = 1.781477937; def b4 = -1.821255978; def b5 = 1.330274429; def b6 = .2316419; def e = 1 / (1 + b6 * a); def i = 1 - 1 / Sqrt(2 * Double.Pi) * Exp(-Power(a, 2) / 2) * (b1 * e + b2 * e * e + b3 * Power(e, 3) + b4 * Power(e, 4) + b5 * Power(e, 5)); plot CND = if data < 0 then 1 - i else i; } # TODO: These values don't quite line up # My background on options pricing models is not very good # Delta def Delta = N(d1); # Gamma def d2 = Exp(-(Sqr(d1) / 2)) / Sqrt(2 * Double.Pi); def Gamma = d2 / (S * (IV * Sqrt(t))); # Theta def Theta = -(-(S*d2*IV*(.5000)/ (2*sqrt(t)))- (r*(exp(-r*t)*K))*N(d2)+(S*N(d1)*(.5000)))/365; # (.5000) variant less than .5 e(X/t) # Vega def Vega = (S*d2*sqrt(t))/100; #-----------------------------------------------------------------------------------------------------------------# # Visuals # Current Option Expiry Label AddLabel( ShowStrikeInfo, Concat(".", Concat(GetSymbolPart(), Concat( Concat(ExpYear - 2000, if ExpMonth2 <= 9 then Concat("0", ExpMonth2) else Concat("", ExpMonth2) ), if ExpDOM <= 9 then Concat("0", ExpDOM) else Concat("", ExpDOM) ) ) ), Color.GRAY ); # Center Strike Label AddLabel(ShowStrikeInfo, "Center Strike: " + AsDollars(CenterStrike), Color.GRAY); # Chain Depth Label AddLabel(ShowStrikeInfo, "Chain Depth: +/-" + StrikeDepth, Color.GRAY); # Strike Spacing Label AddLabel(ShowStrikeInfo and StrikeSpacing, "Strike Spacing: " + StrikeSpacing, Color.GRAY); # Call Open Interest plot CallOpenInterest = ItMCallOpenInterest + OTMCallOpenInterest; CallOpenInterest.SetHiding(!ShowLines); CallOpenInterest.SetPaintingStrategy(PaintingStrategy.LINE); CallOpenInterest.SetDefaultColor(GlobalColor("Call")); AddLabel(ShowLabels, "CallOI: " + CallOpenInterest, GlobalColor("Call")); # Put Open Interest plot PutOpenInterest = -(ITMPutOpenInterest + OTMPutOpenInterest); # Make negative to flip under axis PutOpenInterest.SetHiding(!ShowLines); PutOpenInterest.SetPaintingStrategy(PaintingStrategy.LINE); PutOpenInterest.SetDefaultColor(GlobalColor("Put")); AddLabel(ShowLabels, "PutOI: " + (ITMPutOpenInterest + OTMPutOpenInterest), GlobalColor("Put")); # Create a center line plot ZeroLine = 0; ZeroLine.SetDefaultColor(Color.WHITE); # Create Clouds AddCloud(if ShowClouds then CallOpenInterest else Double.NaN, if ShowClouds then Zeroline else Double.NaN, GlobalColor("CallCloud"), GlobalColor("PutCloud")); AddCloud(if ShowClouds then Zeroline else Double.NaN, if ShowClouds then PutOpenInterest else Double.NaN, GlobalColor("PutCloud"), GlobalColor("CallCloud")); # Hull Moving Average of Put Open Interest plot PutVolumeAverage = hullmovingavg(PutOpenInterest); PutVolumeAverage.SetHiding(!ShowLines); PutVolumeAverage.setdefaultcolor(color.ORANGE); PutVolumeAverage.setstyle(curve.MEDIUM_DASH); # Hull Moving Average of Call Open Interest plot CallVolumeAverage = hullmovingavg(CallOpenInterest); CallVolumeAverage.SetHiding(!ShowLines); CallVolumeAverage.setdefaultcolor(color.LIGHT_GREEN); CallVolumeAverage.setstyle(curve.MEDIUM_DASH); # Color Gradient of Total Average Open Interest plot TotalVolumeAverage = average(CallOpenInterest + PutOpenInterest); TotalVolumeAverage.SetHiding(!ShowLines); def colornormlength = 14; TotalVolumeAverage.setlineweight(3); TotalVolumeAverage.definecolor("Default", Color.YELLOW); TotalVolumeAverage.definecolor("Highest", Color.GREEN); TotalVolumeAverage.DefineColor("Lowest", Color.RED); TotalVolumeAverage.AssignNormGradientColor(colorNormLength, TotalVolumeAverage.Color("Lowest"), TotalVolumeAverage.Color("Highest")); AddCloud(if ShowClouds then TotalVolumeAverage else Double.NaN, if ShowClouds then Zeroline else Double.NaN, color.GREEN, color.RED); # Greeks AddLabel(ShowGreeks, "Delta = " + Delta, Color.WHITE); AddLabel(ShowGreeks, "Gamma = " + Gamma, Color.WHITE); AddLabel(ShowGreeks, "Theta = " + theta, Color.WHITE); AddLabel(ShowGreeks, "Vega = " + Vega, Color.WHITE);

Yes only for the ATM strike right nowit's great having a software engineer help with this, I definitely like what you've done so far with calculating OI and the greeks, it won't be completely accurate given these are theoretical calculations and there are bound to be nuisances but I definitely think you're on the right track. This can be used to calculate total volume and open interest but correct me if I'm wrong, the greek values are only for the center strike correct?

Thanks, I did see that already, just need to figure out how perform that calculation inside the fold for each contract.I found this article it should help with knowing how to calculate the gamma at each strike, aswell as zero gamma line etc https://perfiliev.co.uk/market-commentary/how-to-calculate-gamma-exposure-and-zero-gamma-level/

Great work and thank you for sharing! you should also follow Dr. Harlin @stephenharlinmd, right up your alley.Thanks, I did see that already, just need to figure out how perform that calculation inside the fold for each contract.

Oh that is super interesting! In case anyone wants to follow along this led me to:Great work and thank you for sharing! you should also follow Dr. Harlin @stephenharlinmd, right up your alley.

#hint: Options Hacker \n This study lets you scan the options chain for a series and given depth. \n<b>Warning: Setting the StrikeDepth to large values requires significant processing power, and will result in slow loading times.</b>

#-----------------------------------------------------------------------------------------------------------------#

# Settings

# Colors

DefineGlobalColor("Call", Color.GREEN);

DefineGlobalColor("Put", Color.RED);

DefineGlobalColor("CallCloud",Color.DARK_GREEN);

DefineGlobalColor("PutCloud",Color.DARK_RED);

#hint Mode: The mode to select an option symbol. \n AUTO will try to find the option symbol based on the Series and StrikeDepth inputs. \n MANUAL allow an override of the AUTO behavior by using the ManualCenterStrike and ManualStrikeSpacing inputs to determine the option symbol.

input Mode = {default AUTO, MANUAL};

#hint Series: The option expiration series to search. \n This value is used to determine the option symbol.

input Series = {

default Weekly,

Month1,

Month2,

Month3,

Month4,

Month5,

Month6,

Month7,

Month8,

Month9

};

#hint DataType: The type of option data to show.

input DataType = {default OpenInterest, Volume, GammaExposure};

#hint StrikeDepth: The level of depth to search a series. (+/- this far from ATM)

input StrikeDepth = 10;

#hint CenterStrikeOffset: The offset to use when calculating the center strike based on close price. \n Examples: \n 1 = nearest $1 interval \n 10 = nearest $10 interval.

input CenterStrikeOffset = 1.0;

#hint MaxStrikeSpacing: The maximum dollar amount between two adjacent contracts.

input MaxStrikeSpacing = 25;

#hint ManualCenterStrike: The starting price to use when in MANUAL mode.

input ManualCenterStrike = 440;

#hint ManualStrikeSpacing: The dollar amount between two adjacent contracts to use when in MANUAL mode.

input ManualStrikeSpacing = 1.0;

#hint ShowStrikeInfo: Show the strike info labels.

input ShowStrikeInfo = yes;

#hint ShowLabels: Show the open interest labels.

input ShowLabels = yes;

#hint ShowClouds: Show the open interest clouds.

input ShowClouds = no;

#hint ShowLines: Show the open interest lines.

input ShowLines = yes;

#hint ShowGreeks: Show the estimated Greek calculation labels for the latest bar.

input ShowGreeks = yes;

#-----------------------------------------------------------------------------------------------------------------#

# Date, Symbol, and Strike

# OptionSeries is the expiry starting at 1 and raising by one for each next expiry.

def OptionSeries;

switch (Series) {

case Weekly:

OptionSeries = 1;

case Month1:

OptionSeries = 2;

case Month2:

OptionSeries = 3;

case Month3:

OptionSeries = 4;

case Month4:

OptionSeries = 5;

case Month5:

OptionSeries = 6;

case Month6:

OptionSeries = 7;

case Month7:

OptionSeries = 8;

case Month8:

OptionSeries = 9;

case Month9:

OptionSeries = 10;

};

# Open price at Regular Trading Hours

def RTHopen = open(period = AggregationPeriod.DAY);

# Current year, month, day, and date

def CurrentYear = GetYear(); # number of current bar in CST

def CurrentMonth = GetMonth(); # 1 - 12

def CurrentDay = GetDay(); # 1 - 365 (366 for leap year)

def CurrentDate = GetYYYYMMDD(); # date of the current bar in the YYYYMMDD

# Current day of this month

def CurrentDayOfMonth = GetDayOfMonth(CurrentDate);

# Get the first day of this month - 1 (Monday) to 7 (Sunday)

def FirstDayThisMonth = GetDayOfWeek((CurrentYear * 10000) + (CurrentMonth * 100) + 1);

# Get the first upcoming friday

def FirstUpcomingFriday =

if FirstDayThisMonth < 6 then 6 - FirstDayThisMonth

else if FirstDayThisMonth == 6 then 7

else 6

;

# Get the second, third, and fourth upcoming fridays

def SecondUpcomingFriday = FirstUpcomingFriday + 7;

def ThirdUpcomingFriday = FirstUpcomingFriday + 14;

def FourthUpcomingFriday = FirstUpcomingFriday + 21;

# Pick up all Fridays of the current month for weekly options

def RollDOM = FirstUpcomingFriday + 21;

def ExpMonth1 =

if RollDOM > CurrentDayOfMonth then CurrentMonth + OptionSeries - 1

else CurrentMonth + OptionSeries

;

# Options month input

def ExpMonth2 = if ExpMonth1 > 12 then ExpMonth1 - 12 else ExpMonth1;

# Options year input

def ExpYear = if ExpMonth1 > 12 then CurrentYear + 1 else CurrentYear;

# First friday expiry calc

def ExpDay1DOW = GetDayOfWeek(ExpYear * 10000 + ExpMonth2 * 100 + 1);

def ExpFirstFridayDOM =

if ExpDay1DOW < 6 then 6 - ExpDay1DOW

else if ExpDay1DOW == 6 then 7

else 6

;

# Options code day of month input

def ExpDOM =

if CurrentDayOfMonth < ExpFirstFridayDOM -1 then FirstUpcomingFriday

else if between(CurrentDayOfMonth, ExpFirstFridayDOM, SecondUpcomingFriday - 1) then SecondUpcomingFriday

else if between(CurrentDayOfMonth, SecondUpcomingFriday, ThirdUpcomingFriday - 1) then ThirdUpcomingFriday

else if between(CurrentDayOfMonth, ThirdUpcomingFriday, FourthUpcomingFriday - 1) then FourthUpcomingFriday

else ExpFirstFridayDOM

;

# Centerstrike

def CenterStrike =

if (Mode == Mode.AUTO and !IsNaN(close)) then Round(close / CenterStrikeOffset, 0) * CenterStrikeOffset

else if (Mode == Mode.MANUAL and !IsNaN(close)) then ManualCenterStrike

else CenterStrike[1]

;

# This is still some voodoo to me ...

def OptionExpiryDate = ExpYear * 10000 + ExpMonth2 * 100 + ExpDOM + 1;

# Strike Spacing

def StrikeSpacingC =

fold i = 1 to MaxStrikeSpacing

with spacing = 0

do if DataType == DataType.OpenInterest or DataType == DataType.GammaExposure and !IsNaN(

open_interest(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(CenterStrike + (MaxStrikeSpacing - i)))

)

then MaxStrikeSpacing - i

else if DataType == DataType.Volume and !IsNaN(

volume(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(CenterStrike + (MaxStrikeSpacing - i)))

)

then MaxStrikeSpacing - i

else spacing

;

def StrikeSpacing =

if (Mode == Mode.AUTO and !IsNaN(close)) then StrikeSpacingC

else if (Mode == Mode.MANUAL and !IsNaN(close)) then ManualStrikeSpacing

else StrikeSpacing[1]

;

# Testing ---------

#plot Date = GetYYYYMMDD();

#plot Expiry = (OptionExpiryDate);

#plot DTE = AbsValue(CountTradingDays(Date, Expiry));

#-----------------------------------------------------------------------------------------------------------------#

# Option Chain Data Gathering

# Total Put Open Interest for selected chain depth and expiry series

def TotalPutOpenInterest =

fold poiIndex = -(StrikeDepth) to StrikeDepth

with poi = 0

do

if DataType == DataType.OpenInterest and !IsNaN(

open_interest(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(CenterStrike + (StrikeSpacing * poiIndex)))

)

then poi + open_interest(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(CenterStrike + (StrikeSpacing * poiIndex)))

else 0

;

# Total Call Open Interest for selected chain depth and expiry series

def TotalCallOpenInterest =

fold coiIndex = -(StrikeDepth) to StrikeDepth

with coi = 0

do

if DataType == DataType.OpenInterest and !IsNaN(

open_interest(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "C" + AsPrice(CenterStrike + (StrikeSpacing * coiIndex)))

)

then coi + open_interest(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "C" + AsPrice(CenterStrike + (StrikeSpacing * coiIndex)))

else 0

;

# Total Put Volume for selected chain depth and expiry series

def TotalPutVolume =

fold pvIndex = -(StrikeDepth) to StrikeDepth

with pv = 0

do

if DataType == DataType.Volume and !IsNaN(

volume(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(CenterStrike + StrikeSpacing * pvIndex))

)

then pv + volume(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(CenterStrike + StrikeSpacing * pvIndex))

else 0

;

# Total Call Open Interest for selected chain depth and expiry series

def TotalCallVolume =

fold cvIndex = -(StrikeDepth) to StrikeDepth

with cv = 0

do

if DataType == DataType.Volume and !IsNaN(

volume(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "C" + AsPrice(CenterStrike + StrikeSpacing * cvIndex))

)

then cv + volume(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "C" + AsPrice(CenterStrike + StrikeSpacing * cvIndex))

else 0

;

#-----------------------------------------------------------------------------------------------------------------#

# Greeks Calculations

#

# K - Option strike price

# N - Standard normal cumulative distribution function

# r - Risk free interest rate

# IV - Volatility of the underlying

# S - Price of the underlying

# t - Time to option's expiry

#

# d1 = (ln(S/K) + (r + (sqr(IV)/2))t) / (? (sqrt(t)))

# d2 = e -(sqr(d1) / 2) / sqrt(2*pi)

#

# Delta = N(d1)

# Gamma = (d2) / S(IV(sqrt(t)))

# Theta = ((S d2))IV) / 2 sqrt(t)) - (rK e(rt)N(d4))

# where phi(d3) = (exp(-(sqr(x)/2))) / (2 * sqrt(t))

# where d4 = d1 - IV(sqrt(t))

# Vega = S phi(d1) Sqrt(t)

# TODO: Figure out how to dynamically get this value

def DayToExpiry = AbsValue(CountTradingDays(CurrentDate, OptionExpiryDate) - 1);

# Get the implied volatility for calculations

# Input: series is the expiry starting at 1 and raising by 1 for each next expiry

def IV = SeriesVolatility(series = OptionSeries);

def K = CenterStrike;

def S = close;

def r = GetInterestRate();

def t = (DayToExpiry / 365);

def d1 = (Log(S / K) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t));

def d2 = Exp(-(Sqr(d1) / 2)) / Sqrt(2 * Double.Pi);

script N {

input data = 1;

def a = AbsValue(data);

def b1 = .31938153;

def b2 = -.356563782;

def b3 = 1.781477937;

def b4 = -1.821255978;

def b5 = 1.330274429;

def b6 = .2316419;

def e = 1 / (1 + b6 * a);

def i = 1 - 1 / Sqrt(2 * Double.Pi) * Exp(-Power(a, 2) / 2) *

(b1 * e + b2 * e * e + b3 *

Power(e, 3) + b4 * Power(e, 4) + b5 * Power(e, 5));

plot CND = if data < 0

then 1 - i

else i;

}

# TODO: These values don't quite line up

# My background on options pricing models is not very good

# Delta

def Delta = N(d1);

# Gamma

def Gamma = d2 / (S * (IV * Sqrt(t)));

# Theta

def Theta = -(-(S*d2*IV*(.5000)/

(2*sqrt(t)))-

(r*(exp(-r*t)*K))*N(d2)+(S*N(d1)*(.5000)))/365;

# (.5000) variant less than .5 e(X/t)

# Vega

def Vega = (S*d2*sqrt(t))/100;

script SpotGamma {

input DTE = 0;

input K = 0;

input Series = 0;

def S = close;

def t = (DTE / 365);

def IV = SeriesVolatility(series = Series);

def d1 = (Log(S / K) + ((GetInterestRate() + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t));

# Delta

def Delta = N(d1);

# Gamma

def d2 = Exp(-(Sqr(d1) / 2)) / Sqrt(2 * Double.Pi);

def Gamma = d2 / (S * (IV * Sqrt(t)));

plot SpotGamma = Gamma;

}

# Total Put Gamma Exposure for selected chain depth and expiry series

def TotalPutGammaExposure =

fold pgexIndex = -(StrikeDepth) to StrikeDepth

with pgex = 0

do

if DataType == DataType.GammaExposure and !IsNaN(

open_interest(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(CenterStrike + (StrikeSpacing * pgexIndex)))

)

then pgex +