You should upgrade or use an alternative browser.

Option Heatmap and OI Strikes For ThinkOrSwim

- Thread starter ziongotoptions

- Start date

ziongotoptions

Active member

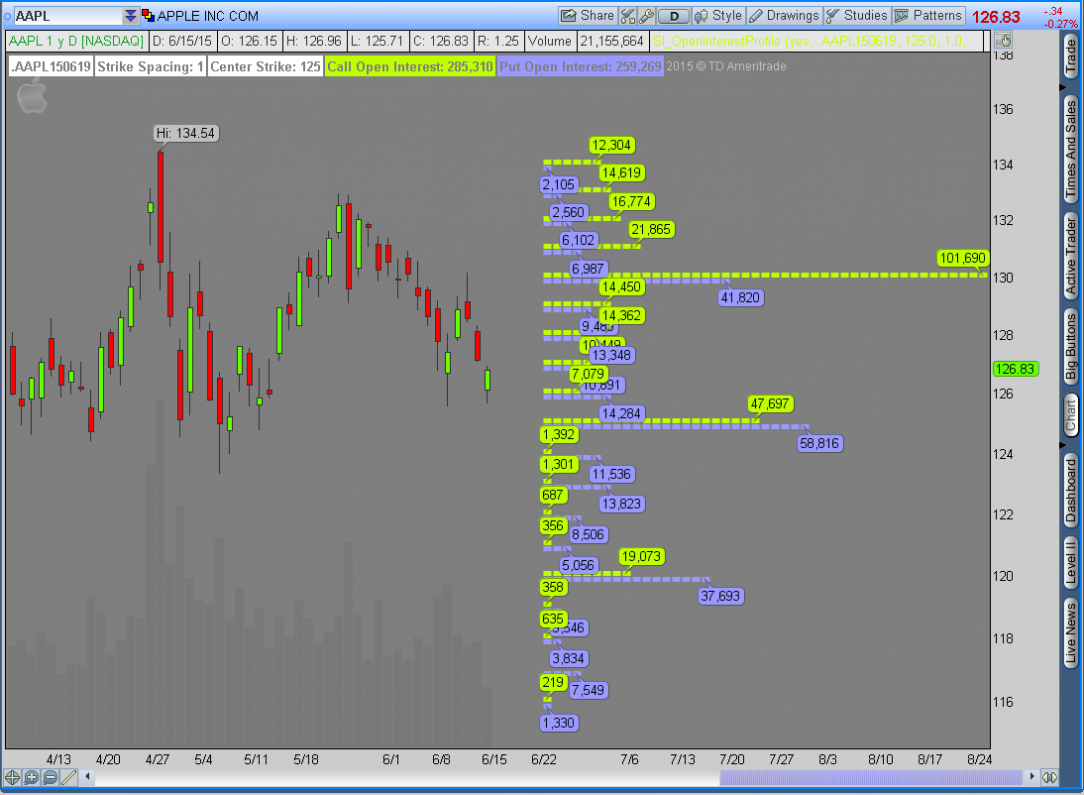

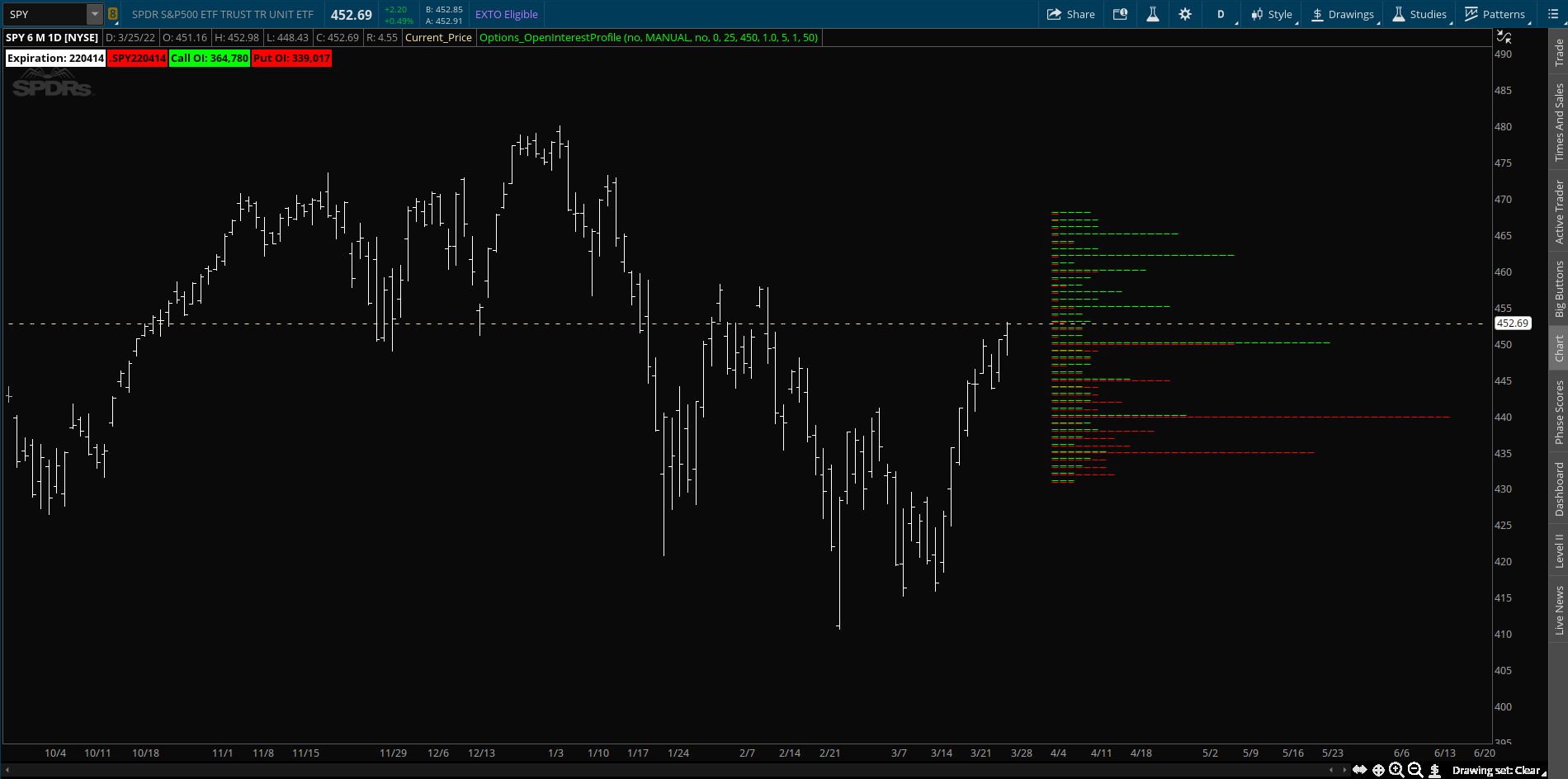

my apologies, i had remove the part of the script script for the chart bubbles, I just added it back. https://usethinkscript.com/threads/option-heatmap-and-oi-strikes.10664/post-94445 see if it works nowHi is it possible to have labels to the OI, maybe the highest 5 calls and puts or draw the lines on the main chart? Like this

Can one add a user defined filter to only plot price bubbles above a manually defined number. This way have less clutter or maybe just the top 5 biggest OI are marked with price bubbles. If not its still is great. Thanks

Also I found that this script for labeling open interest which is given free every day by https://www.quanttradingapp.com/discord_pub/thinkscript_open_interest. Don't know if this helps

Code:# # Plot Hightest OI Levels on Chart # Only Valid For: Friday, April 08, 2022 # # Script Generated: 2022-04-08 08:00:12 AM # Free Tickers Included: AAPL,AMZN,DIA,DIS,FB,GLD,GOOGL,IWM,NFLX,QQQ,SPY,TSLA,NVDA,AMD # Total Tickers: 14 # # Credit: Quant Trading App (c) 2021-2022 # Discord: https://quanttradingdiscord.com # def aggregationPeriod = AggregationPeriod.DAY;def LastPrice = close(priceType = PriceType.LAST);def total_call_premium;def total_put_premium; plot oi_call_1;plot oi_call_2;plot oi_call_3;plot oi_call_4;plot oi_call_5;plot oi_put_1;plot oi_put_2;plot oi_put_3;plot oi_put_4;plot oi_put_5; if (GetSymbol() == "AAPL") {total_call_premium = 382730.57;total_put_premium = 237766.65;oi_call_1 = 180;oi_call_2 = 175;oi_call_3 = 170;oi_call_4 = 177.5;oi_call_5 = 185;oi_put_1 = 170;oi_put_2 = 160;oi_put_3 = 175;oi_put_4 = 167.5;oi_put_5 = 165;}else if (GetSymbol() == "AMZN") {total_call_premium = 829120.56;total_put_premium = 3294755.32;oi_call_1 = 3300;oi_call_2 = 3400;oi_call_3 = 3500;oi_call_4 = 3200;oi_call_5 = 3600;oi_put_1 = 3000;oi_put_2 = 3100;oi_put_3 = 3015;oi_put_4 = 2950;oi_put_5 = 3490;}else if (GetSymbol() == "DIA") {total_call_premium = 38061.73;total_put_premium = 23450.76;oi_call_1 = 344;oi_call_2 = 354;oi_call_3 = 356;oi_call_4 = 349;oi_call_5 = 348;oi_put_1 = 329;oi_put_2 = 348;oi_put_3 = 315;oi_put_4 = 341;oi_put_5 = 342;}else if (GetSymbol() == "DIS") {total_call_premium = 4571.37;total_put_premium = 46655.94;oi_call_1 = 145;oi_call_2 = 144;oi_call_3 = 140;oi_call_4 = 133;oi_call_5 = 142;oi_put_1 = 128;oi_put_2 = 130;oi_put_3 = 134;oi_put_4 = 127;oi_put_5 = 129;}else if (GetSymbol() == "FB") {total_call_premium = 692845.36;total_put_premium = 102656.41;oi_call_1 = 200;oi_call_2 = 240;oi_call_3 = 250;oi_call_4 = 222.5;oi_call_5 = 230;oi_put_1 = 200;oi_put_2 = 190;oi_put_3 = 215;oi_put_4 = 220;oi_put_5 = 225;}else if (GetSymbol() == "GLD") {total_call_premium = 28848.77;total_put_premium = 24817.19;oi_call_1 = 198;oi_call_2 = 181;oi_call_3 = 185;oi_call_4 = 190;oi_call_5 = 180;oi_put_1 = 176;oi_put_2 = 179;oi_put_3 = 177;oi_put_4 = 180;oi_put_5 = 175;}else if (GetSymbol() == "GOOGL") {total_call_premium = 146315.7;total_put_premium = 310393.9;oi_call_1 = 2800;oi_call_2 = 2900;oi_call_3 = 3000;oi_call_4 = 2850;oi_call_5 = 2930;oi_put_1 = 2700;oi_put_2 = 2600;oi_put_3 = 2750;oi_put_4 = 2650;oi_put_5 = 2800;}else if (GetSymbol() == "IWM") {total_call_premium = 41415.24;total_put_premium = 293727.4;oi_call_1 = 211;oi_call_2 = 210;oi_call_3 = 201;oi_call_4 = 204;oi_call_5 = 207;oi_put_1 = 190;oi_put_2 = 204;oi_put_3 = 195;oi_put_4 = 194;oi_put_5 = 198;}else if (GetSymbol() == "NFLX") {total_call_premium = 55214.35;total_put_premium = 107048.6;oi_call_1 = 390;oi_call_2 = 425;oi_call_3 = 400;oi_call_4 = 410;oi_call_5 = 420;oi_put_1 = 360;oi_put_2 = 355;oi_put_3 = 350;oi_put_4 = 340;oi_put_5 = 365;}else if (GetSymbol() == "QQQ") {total_call_premium = 397452.26;total_put_premium = 1020109.49;oi_call_1 = 358;oi_call_2 = 355;oi_call_3 = 375;oi_call_4 = 370;oi_call_5 = 365;oi_put_1 = 350;oi_put_2 = 355;oi_put_3 = 345;oi_put_4 = 360;oi_put_5 = 340;}else if (GetSymbol() == "SPY") {total_call_premium = 935513.52;total_put_premium = 640624.12;oi_call_1 = 460;oi_call_2 = 450;oi_call_3 = 455;oi_call_4 = 465;oi_call_5 = 457;oi_put_1 = 440;oi_put_2 = 445;oi_put_3 = 425;oi_put_4 = 442;oi_put_5 = 435;}else if (GetSymbol() == "TSLA") {total_call_premium = 4085952.2;total_put_premium = 2404942.68;oi_call_1 = 1200;oi_call_2 = 1150;oi_call_3 = 1100;oi_call_4 = 1250;oi_call_5 = 1300;oi_put_1 = 1000;oi_put_2 = 950;oi_put_3 = 900;oi_put_4 = 1100;oi_put_5 = 1020;}else if (GetSymbol() == "NVDA") {total_call_premium = 156427.48;total_put_premium = 947041.4;oi_call_1 = 300;oi_call_2 = 240;oi_call_3 = 250;oi_call_4 = 275;oi_call_5 = 260;oi_put_1 = 240;oi_put_2 = 230;oi_put_3 = 250;oi_put_4 = 260;oi_put_5 = 255;}else if (GetSymbol() == "AMD") {total_call_premium = 44227.37;total_put_premium = 348995.29;oi_call_1 = 110;oi_call_2 = 115;oi_call_3 = 120;oi_call_4 = 125;oi_call_5 = 112;oi_put_1 = 110;oi_put_2 = 100;oi_put_3 = 85;oi_put_4 = 95;oi_put_5 = 90;}else {oi_call_1 = Double.NaN;oi_call_2 = Double.NaN;oi_call_3 = Double.NaN;oi_call_4 = Double.NaN;oi_call_5 = Double.NaN;oi_put_1 = Double.NaN;oi_put_2 = Double.NaN;oi_put_3 = Double.NaN;oi_put_4 = Double.NaN;oi_put_5 = Double.NaN;total_call_premium = 0;total_put_premium = 0;};oi_call_1.SetDefaultColor(CreateColor(0,236,59));oi_call_2.SetDefaultColor(CreateColor(0,197,49));oi_call_3.SetDefaultColor(CreateColor(0,158,39));oi_call_4.SetDefaultColor(CreateColor(0,119,29));oi_call_5.SetDefaultColor(CreateColor(0,79,20));oi_call_1.SetLineWeight(5);oi_call_2.SetLineWeight(4);oi_call_3.SetLineWeight(3);oi_call_4.SetLineWeight(2);oi_call_5.SetLineWeight(1);oi_put_1.SetDefaultColor(CreateColor(255,17,17));oi_put_2.SetDefaultColor(CreateColor(255,56,56));oi_put_3.SetDefaultColor(CreateColor(213,0,0));oi_put_4.SetDefaultColor(CreateColor(173,0,0));oi_put_5.SetDefaultColor(CreateColor(134,0,0));oi_put_1.SetLineWeight(5);oi_put_2.SetLineWeight(4);oi_put_3.SetLineWeight(3);oi_put_4.SetLineWeight(2);oi_put_5.SetLineWeight(1);addLabel (total_call_premium, "Calls: $"+ total_call_premium +" | Puts: $"+ total_put_premium, color.LIGHT_GRAY);

just to clarify, the code in post 80 does not read any data. all it is , is constants, that are plotted. someone has to manually edit the code and add the data for the day, every day.

ziongotoptions

Active member

Yeah it’s not possible to show on SPX, something about the chart doesn’t allow it to work, you’d have to manually enter the symbol in the code and display it on a chart like spy or ES, but it wouldn’t work as a profile in that case, so it’s impossible. I think I posted a script in option volume /open interest that will give the data and add labels for SPX options on the weekly , basically similar info but not in the form of a profile. As for your question, I’m sure it’s possible but you’d have to look into thatThat looks great. Noticed bars do not show up on SPX (price bubble do) though show up on SPY and other tickers. Wonder why?

Can one add a user defined filter to only plot price bubbles above a manually defined number. This way have less clutter or maybe just the top 5 biggest OI are marked with price bubbles. If not its still is great. Thanks

Does this only work during live market hours? I tried to load it on my charts this past weekend and it didn't work. I didn't have time this wk yet but was wondering so I could work on it this weekend...my apologies, i had remove the part of the script script for the chart bubbles, I just added it back. https://usethinkscript.com/threads/option-heatmap-and-oi-strikes.10664/post-94445 see if it works now

ziongotoptions

Active member

It works , it’s that for Expdom instead of 13 replace with 14 or you can just adjust the date by going into settings and inputting 1 for date fix, last month expiration ended on a Thursday so that’s why we used 13 normally it’s 14Does this only work during live market hours? I tried to load it on my charts this past weekend and it didn't work. I didn't have time this wk yet but was wondering so I could work on it this weekend...

Thanks, I ended up figuring that out. Could this be created for GEX levels? I got a script in the option chain that I export to excel and it displays each strike with the amount of gamma exposure. I do draw the gamma levels on my charts but it doesn't work well as the gamma amounts change as price moves.It works , it’s that for Expdom instead of 13 replace with 14 or you can just adjust the date by going into settings and inputting 1 for date fix, last month expiration ended on a Thursday so that’s why we used 13 normally it’s 14

ziongotoptions

Active member

That’s not possible on thinkorswim unfortunately, you can’t pull data directly from the option chain for think scriptThanks, I ended up figuring that out. Could this be created for GEX levels? I got a script in the option chain that I export to excel and it displays each strike with the amount of gamma exposure. I do draw the gamma levels on my charts but it doesn't work well as the gamma amounts change as price moves.

ziongotoptions

Active member

Go to settings, input 1 for date fix, that should clear up the problemI am not too sure if I am importing the script wrong but can someone post a ToS link with the working script? I've imported a few and nothing is showing up on my charts. Thank you.

ziongotoptions

Active member

I also updated the script just now, it will now work without having to use the date fix inputI am not too sure if I am importing the script wrong but can someone post a ToS link with the working script? I've imported a few and nothing is showing up on my charts. Thank you.

Can you please share the chart. I am not able to see the volume profile like on my chart. Thanks!!

@ziongotoptions looking good Thank you!

ziongotoptions

Active member

You have to go settings, time axis and in expansion area do 50 bars to the right@ziongotoptions

Can you please share the chart. I am not able to see the volume profile like on my chart. Thanks!!

@ziongotoptionsYou have to go settings, time axis and in expansion area do 50 bars to the right

I have changed expansion to 50 bars to the right. Still not working, so I load some of the different version of codes posted here, still not working.

What's the latest version of code that you use? Thanks!!

ziongotoptions

Active member

Post in thread 'Option Heatmap and OI Strikes'@ziongotoptions

I have changed expansion to 50 bars to the right. Still not working, so I load some of the different version of codes posted here, still not working.

What's the latest version of code that you use? Thanks!!

https://usethinkscript.com/threads/option-heatmap-and-oi-strikes.10664/post-94445

ziongotoptions

Active member

Also it can take awhile to load sometimesPost in thread 'Option Heatmap and OI Strikes'

https://usethinkscript.com/threads/option-heatmap-and-oi-strikes.10664/post-94445

@ziongotoptionsAlso it can take awhile to load sometimes

Not sure why it does not work, eventhough I changed the setting 50 bar to the right. If you can share your chart I appreciate it. Thanks!!

ziongotoptions

Active member

http://tos.mx/ekx8jww here ya go@ziongotoptions

Not sure why it does not work, eventhough I changed the setting 50 bar to the right. If you can share your chart I appreciate it. Thanks!!

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| S | Unusual Options Metric (Option Chain Column) For ThinkOrSwim | Indicators | 56 | |

|

|

Unusual Option Activity Scanner for ThinkorSwim | Indicators | 63 | |

|

|

FlowAlgo Dark pool and Option Flow for ThinkorSwim | Indicators | 23 | |

|

|

Option Greeks Calculation Labels for ThinkorSwim | Indicators | 5 |

Similar threads

-

Unusual Options Metric (Option Chain Column) For ThinkOrSwim

- Started by StoneMan

- Replies: 56

-

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

Unusual Options Metric (Option Chain Column) For ThinkOrSwim

- Started by StoneMan

- Replies: 56

-

-

-

Similar threads

-

Unusual Options Metric (Option Chain Column) For ThinkOrSwim

- Started by StoneMan

- Replies: 56

-

-

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/