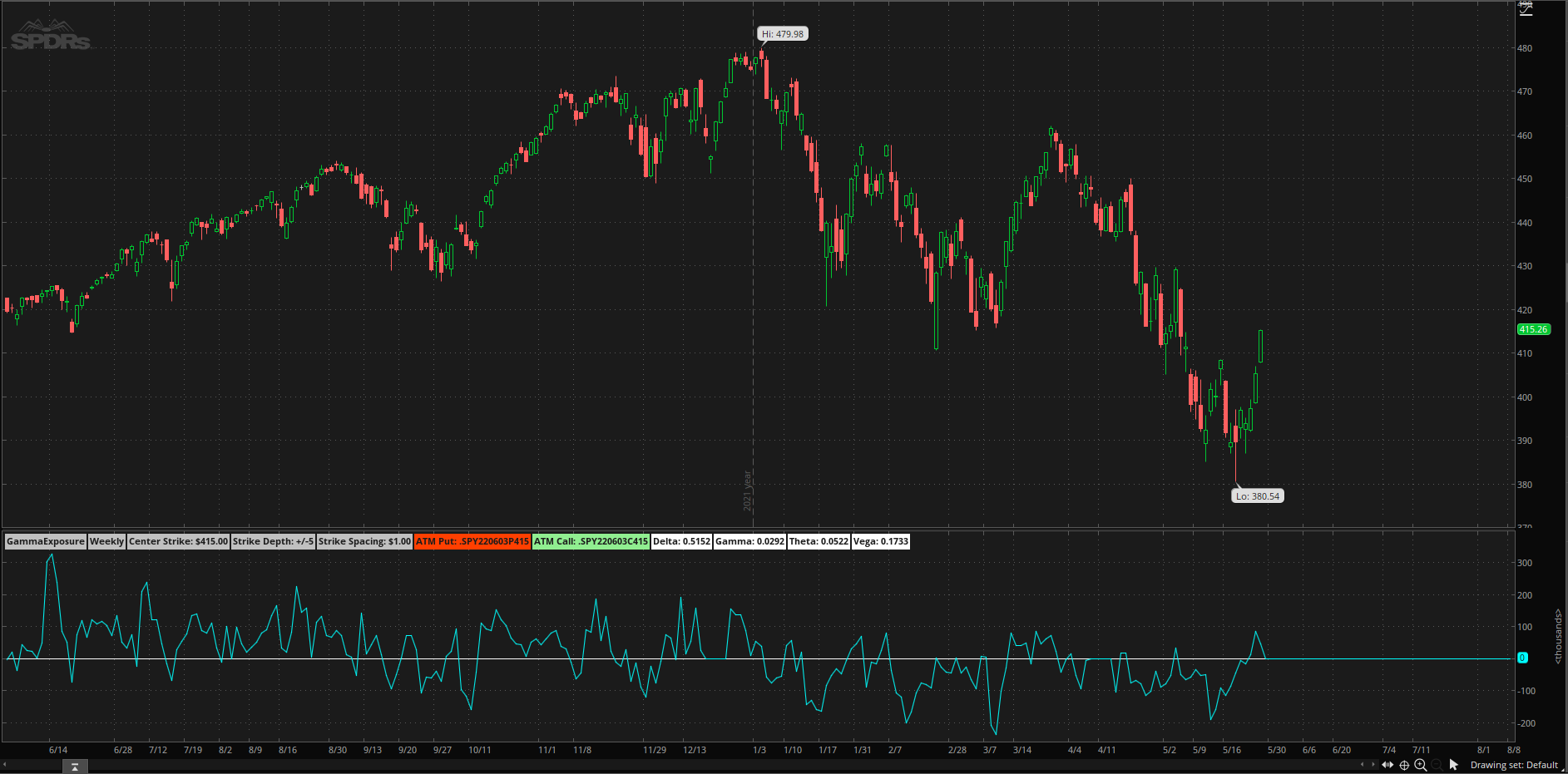

#hint: Options Hacker \n This study lets you scan the options chain for a series and given depth. \n<b>Warning: Setting the StrikeDepth to large values requires significant processing power, and will result in slow loading times.</b>

#-----------------------------------------------------------------------------------------------------------------#

# Settings

# Colors

DefineGlobalColor("Call", Color.GREEN);

DefineGlobalColor("Put", Color.RED);

DefineGlobalColor("CallCloud",Color.DARK_GREEN);

DefineGlobalColor("PutCloud",Color.DARK_RED);

#hint Mode: The mode to select an option symbol. \n AUTO will try to find the option symbol based on the Series and StrikeDepth inputs. \n MANUAL allow an override of the AUTO behavior by using the ManualCenterStrike and ManualStrikeSpacing inputs to determine the option symbol.

input Mode = {default AUTO, MANUAL};

#hint Series: The option expiration series to search. \n This value is used to determine the option symbol.

input Series = {

default Weekly,

Month1,

Month2,

Month3,

Month4,

Month5,

Month6,

Month7,

Month8,

Month9

};

#hint DataType: The type of option data to show.

input DataType = {default OpenInterest, Volume, GammaExposure};

#hint StrikeDepth: The level of depth to search a series. (+/- this far from ATM)

input StrikeDepth = 10;

#hint CenterStrikeOffset: The offset to use when calculating the center strike based on close price. \n Examples: \n 1 = nearest $1 interval \n 10 = nearest $10 interval.

input CenterStrikeOffset = 1.0;

#hint MaxStrikeSpacing: The maximum dollar amount between two adjacent contracts.

input MaxStrikeSpacing = 25;

#hint ManualCenterStrike: The starting price to use when in MANUAL mode.

input ManualCenterStrike = 440;

#hint ManualStrikeSpacing: The dollar amount between two adjacent contracts to use when in MANUAL mode.

input ManualStrikeSpacing = 1.0;

#hint ShowStrikeInfo: Show the strike info labels.

input ShowStrikeInfo = yes;

#hint ShowLabels: Show the open interest labels.

input ShowLabels = yes;

#hint ShowClouds: Show the open interest clouds.

input ShowClouds = no;

#hint ShowLines: Show the open interest lines.

input ShowLines = yes;

#hint ShowGreeks: Show the estimated Greek calculation labels for the latest bar.

input ShowGreeks = yes;

#-----------------------------------------------------------------------------------------------------------------#

# Date, Symbol, and Strike

# OptionSeries is the expiry starting at 1 and raising by one for each next expiry.

def OptionSeries;

switch (Series) {

case Weekly:

OptionSeries = 1;

case Month1:

OptionSeries = 2;

case Month2:

OptionSeries = 3;

case Month3:

OptionSeries = 4;

case Month4:

OptionSeries = 5;

case Month5:

OptionSeries = 6;

case Month6:

OptionSeries = 7;

case Month7:

OptionSeries = 8;

case Month8:

OptionSeries = 9;

case Month9:

OptionSeries = 10;

};

# Open price at Regular Trading Hours

def RTHopen = open(period = AggregationPeriod.DAY);

# Current year, month, day, and date

def CurrentYear = GetYear(); # number of current bar in CST

def CurrentMonth = GetMonth(); # 1 - 12

def CurrentDay = GetDay(); # 1 - 365 (366 for leap year)

def CurrentDate = GetYYYYMMDD(); # date of the current bar in the YYYYMMDD

# Current day of this month

def CurrentDayOfMonth = GetDayOfMonth(CurrentDate);

# Get the first day of this month - 1 (Monday) to 7 (Sunday)

def FirstDayThisMonth = GetDayOfWeek((CurrentYear * 10000) + (CurrentMonth * 100) + 1);

# Get the first upcoming friday

def FirstUpcomingFriday =

if FirstDayThisMonth < 6 then 6 - FirstDayThisMonth

else if FirstDayThisMonth == 6 then 7

else 6

;

# Get the second, third, and fourth upcoming fridays

def SecondUpcomingFriday = FirstUpcomingFriday + 7;

def ThirdUpcomingFriday = FirstUpcomingFriday + 14;

def FourthUpcomingFriday = FirstUpcomingFriday + 21;

# Pick up all Fridays of the current month for weekly options

def RollDOM = FirstUpcomingFriday + 21;

def ExpMonth1 =

if RollDOM > CurrentDayOfMonth then CurrentMonth + OptionSeries - 1

else CurrentMonth + OptionSeries

;

# Options month input

def ExpMonth2 = if ExpMonth1 > 12 then ExpMonth1 - 12 else ExpMonth1;

# Options year input

def ExpYear = if ExpMonth1 > 12 then CurrentYear + 1 else CurrentYear;

# First friday expiry calc

def ExpDay1DOW = GetDayOfWeek(ExpYear * 10000 + ExpMonth2 * 100 + 1);

def ExpFirstFridayDOM =

if ExpDay1DOW < 6 then 6 - ExpDay1DOW

else if ExpDay1DOW == 6 then 7

else 6

;

# Options code day of month input

def ExpDOM =

if CurrentDayOfMonth < ExpFirstFridayDOM -1 then FirstUpcomingFriday

else if between(CurrentDayOfMonth, ExpFirstFridayDOM, SecondUpcomingFriday - 1) then SecondUpcomingFriday

else if between(CurrentDayOfMonth, SecondUpcomingFriday, ThirdUpcomingFriday - 1) then ThirdUpcomingFriday

else if between(CurrentDayOfMonth, ThirdUpcomingFriday, FourthUpcomingFriday - 1) then FourthUpcomingFriday

else ExpFirstFridayDOM

;

# Option Expiration Date - This is still some voodoo to me ...

def OptionExpiryDate = ExpYear * 10000 + ExpMonth2 * 100 + ExpDOM + 1;

# Option Days to Expiration

def DTE = AbsValue(CountTradingDays(CurrentDate, OptionExpiryDate) - 1);

# Centerstrike

def CenterStrike =

if (Mode == Mode.AUTO and !IsNaN(close)) then Round(close / CenterStrikeOffset, 0) * CenterStrikeOffset

else if (Mode == Mode.MANUAL and !IsNaN(close)) then ManualCenterStrike

else CenterStrike[1]

;

# Strike Spacing

def StrikeSpacingC =

fold i = 1 to MaxStrikeSpacing

with spacing = 0

do if DataType == DataType.OpenInterest or DataType == DataType.GammaExposure and !IsNaN(

open_interest(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(CenterStrike + (MaxStrikeSpacing - i)))

)

then MaxStrikeSpacing - i

else if DataType == DataType.Volume and !IsNaN(

volume(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(CenterStrike + (MaxStrikeSpacing - i)))

)

then MaxStrikeSpacing - i

else spacing

;

def StrikeSpacing =

if (Mode == Mode.AUTO and !IsNaN(close)) then StrikeSpacingC

else if (Mode == Mode.MANUAL and !IsNaN(close)) then ManualStrikeSpacing

else StrikeSpacing[1]

;

#-----------------------------------------------------------------------------------------------------------------#

# Option Chain Data Gathering

# Total Put Open Interest for selected chain depth and expiry series

def TotalPutOpenInterest =

fold poiIndex = -(StrikeDepth) to StrikeDepth

with poi = 0

do

if DataType == DataType.OpenInterest and !IsNaN(

open_interest(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(CenterStrike + (StrikeSpacing * poiIndex)))

)

then poi + open_interest(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(CenterStrike + (StrikeSpacing * poiIndex)))

else 0

;

# Total Call Open Interest for selected chain depth and expiry series

def TotalCallOpenInterest =

fold coiIndex = -(StrikeDepth) to StrikeDepth

with coi = 0

do

if DataType == DataType.OpenInterest and !IsNaN(

open_interest(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "C" + AsPrice(CenterStrike + (StrikeSpacing * coiIndex)))

)

then coi + open_interest(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "C" + AsPrice(CenterStrike + (StrikeSpacing * coiIndex)))

else 0

;

# Total Put Volume for selected chain depth and expiry series

def TotalPutVolume =

fold pvIndex = -(StrikeDepth) to StrikeDepth

with pv = 0

do

if DataType == DataType.Volume and !IsNaN(

volume(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(CenterStrike + StrikeSpacing * pvIndex))

)

then pv + volume(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(CenterStrike + StrikeSpacing * pvIndex))

else 0

;

# Total Call Open Interest for selected chain depth and expiry series

def TotalCallVolume =

fold cvIndex = -(StrikeDepth) to StrikeDepth

with cv = 0

do

if DataType == DataType.Volume and !IsNaN(

volume(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "C" + AsPrice(CenterStrike + StrikeSpacing * cvIndex))

)

then cv + volume(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "C" + AsPrice(CenterStrike + StrikeSpacing * cvIndex))

else 0

;

#-----------------------------------------------------------------------------------------------------------------#

# Greeks Calculations

#

# K - Option strike price

# N - Standard normal cumulative distribution function

# r - Risk free interest rate

# IV - Volatility of the underlying

# S - Price of the underlying

# t - Time to option's expiry

#

# d1 = (ln(S/K) + (r + (sqr(IV)/2))t) / (? (sqrt(t)))

# d2 = e -(sqr(d1) / 2) / sqrt(2*pi)

#

# Delta = N(d1)

# Gamma = (d2) / S(IV(sqrt(t)))

# Theta = ((S d2))IV) / 2 sqrt(t)) - (rK e(rt)N(d4))

# where phi(d3) = (exp(-(sqr(x)/2))) / (2 * sqrt(t))

# where d4 = d1 - IV(sqrt(t))

# Vega = S phi(d1) Sqrt(t)

# Get the implied volatility for calculations

# Input: series is the expiry starting at 1 and raising by 1 for each next expiry

def IV = SeriesVolatility(series = OptionSeries);

def K = CenterStrike;

def S = close;

def r = GetInterestRate();

def t = (DTE / 365);

def d1 = (Log(S / K) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t));

def d2 = Exp(-(Sqr(d1) / 2)) / Sqrt(2 * Double.Pi);

script N {

input data = 1;

def a = AbsValue(data);

def b1 = .31938153;

def b2 = -.356563782;

def b3 = 1.781477937;

def b4 = -1.821255978;

def b5 = 1.330274429;

def b6 = .2316419;

def e = 1 / (1 + b6 * a);

def i = 1 - 1 / Sqrt(2 * Double.Pi) * Exp(-Power(a, 2) / 2) *

(b1 * e + b2 * e * e + b3 *

Power(e, 3) + b4 * Power(e, 4) + b5 * Power(e, 5));

plot CND = if data < 0

then 1 - i

else i;

}

# TODO: These values don't quite line up

# My background on options pricing models is not very good

# Delta

def Delta = N(d1);

# Gamma

def Gamma = d2 / (S * (IV * Sqrt(t)));

# Theta

def Theta = -(-(S*d2*IV*(.5000)/

(2*sqrt(t)))-

(r*(exp(-r*t)*K))*N(d2)+(S*N(d1)*(.5000)))/365;

# (.5000) variant less than .5 e(X/t)

# Vega

def Vega = (S*d2*sqrt(t))/100;

script SpotGamma {

input DTE = 0;

input K = 0;

input Series = 0;

def S = close;

def t = (DTE / 365);

def IV = SeriesVolatility(series = Series);

def d1 = (Log(S / K) + ((GetInterestRate() + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t));

# Delta

def Delta = N(d1);

# Gamma

def d2 = Exp(-(Sqr(d1) / 2)) / Sqrt(2 * Double.Pi);

def Gamma = d2 / (S * (IV * Sqrt(t)));

plot SpotGamma = Gamma;

}

input GEXCalculationMethod = {default ContributionShares, Contribution, ContributionPercent};

def GEXMethod;

switch (GEXCalculationMethod) {

case Contribution:

GEXMethod = 1;

case ContributionPercent:

GEXMethod = 2;

case ContributionShares:

GEXMethod = 3;

}

# Total Put Gamma Exposure for selected chain depth and expiry series

def TotalPutGammaExposure =

fold pgexIndex = -(StrikeDepth) to StrikeDepth

with pgex = 0

do

if DataType == DataType.GammaExposure and !IsNaN(

open_interest(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(CenterStrike + (StrikeSpacing * pgexIndex)))

)

then pgex +

open_interest(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(CenterStrike + (StrikeSpacing * pgexIndex))) *

if GEXMethod == 1 then

OptionPrice((CenterStrike + (StrikeSpacing * pgexIndex)), yes, DTE, close, IV, no, 0.0, r)

else if GEXMethod == 2 then

Sqr(OptionPrice((CenterStrike + (StrikeSpacing * pgexIndex)), yes, DTE, close, IV, no, 0.0, r)) * 0.01

else

1

#SpotGamma(DTE, (CenterStrike + (StrikeSpacing * pgexIndex)), OptionSeries) * # Honestly why cant I put the index inside here :(

* (Exp(-(Sqr((Log(close / (CenterStrike + (StrikeSpacing * pgexIndex))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))) / 2)) / Sqrt(2 * Double.Pi) / (close * (IV * Sqrt(t)))) *

100 *

-1

else 0

;

# Total Call Gamma Exposure for selected chain depth and expiry series

def TotalCallGammaExposure =

fold cgexIndex = -(StrikeDepth) to StrikeDepth

with cgex = 0

do

if DataType == DataType.GammaExposure and !IsNaN(

open_interest(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "C" + AsPrice(CenterStrike + (StrikeSpacing * cgexIndex)))

)

then cgex +

open_interest(("." + GetSymbolPart()) + AsPrice(OptionExpiryDate - 20000001) + "C" + AsPrice(CenterStrike + (StrikeSpacing * cgexIndex))) *

if GEXMethod == 1 then

OptionPrice((CenterStrike + (StrikeSpacing * cgexIndex)), no, DTE, close, IV, no, 0.0, r)

else if GEXMethod == 2 then

Sqr(OptionPrice((CenterStrike + (StrikeSpacing * cgexIndex)), no, DTE, close, IV, no, 0.0, r)) * 0.01

else

1

#SpotGamma(DTE, (CenterStrike + (StrikeSpacing * cgexIndex)), OptionSeries) * # Honestly why cant I put the index inside here :(

* (Exp(-(Sqr((Log(close / (CenterStrike + (StrikeSpacing * cgexIndex))) + ((r + (Sqr(IV) / 2)) * t)) / (IV * Sqrt(t))) / 2)) / Sqrt(2 * Double.Pi) / (close * (IV * Sqrt(t)))) *

100

else 0

;

plot GammaExposure = TotalPutGammaExposure + TotalCallGammaExposure;

#-----------------------------------------------------------------------------------------------------------------#

# Visuals

# Selected DataType

AddLabel(yes, DataType, Color.LIGHT_GRAY);

# Selected Series

AddLabel(yes, Series, Color.LIGHT_GRAY);

# Center Strike Label

AddLabel(ShowStrikeInfo, "Center Strike: " + AsDollars(CenterStrike), Color.LIGHT_GRAY);

# Chain Depth Label

AddLabel(ShowStrikeInfo, "Strike Depth: +/-" + StrikeDepth, Color.LIGHT_GRAY);

# Strike Spacing Label

AddLabel(ShowStrikeInfo, "Strike Spacing: " + AsDollars(StrikeSpacing), Color.LIGHT_GRAY);

# Current ATM Options Labels

Addlabel(ShowStrikeInfo, "ATM Put: " + ("." + GetSymbol()) + AsPrice(OptionExpiryDate - 20000001) + "P" + AsPrice(CenterStrike), Color.LIGHT_RED);

Addlabel(ShowStrikeInfo, "ATM Call: " + ("." + GetSymbol()) + AsPrice(OptionExpiryDate - 20000001) + "C" + AsPrice(CenterStrike), Color.LIGHT_GREEN);

# Create a center line

plot ZeroLine = 0;

ZeroLine.SetDefaultColor(Color.WHITE);

# Call Open Interest

plot CallOpenInterest = TotalCallOpenInterest;

CallOpenInterest.SetHiding(!ShowLines and DataType == DataType.OpenInterest);

CallOpenInterest.SetPaintingStrategy(PaintingStrategy.LINE);

CallOpenInterest.SetDefaultColor(GlobalColor("Call"));

AddLabel(ShowLabels and DataType == DataType.OpenInterest, "CallOI: " + CallOpenInterest, GlobalColor("Call"));

# Put Open Interest

plot PutOpenInterest = -(TotalPutOpenInterest); # Make negative to flip under axis

PutOpenInterest.SetHiding(!ShowLines and DataType == DataType.OpenInterest);

PutOpenInterest.SetPaintingStrategy(PaintingStrategy.LINE);

PutOpenInterest.SetDefaultColor(GlobalColor("Put"));

AddLabel(ShowLabels and DataType == DataType.OpenInterest, "PutOI: " + TotalPutOpenInterest, GlobalColor("Put"));

# Create Clouds for Open Interest

AddCloud(

if ShowClouds and DataType == DataType.OpenInterest then CallOpenInterest else Double.NaN,

if ShowClouds and DataType == DataType.OpenInterest then Zeroline else Double.NaN,

GlobalColor("CallCloud"), GlobalColor("PutCloud")

);

AddCloud(

if ShowClouds and DataType == DataType.OpenInterest then Zeroline else Double.NaN,

if ShowClouds and DataType == DataType.OpenInterest then PutOpenInterest else Double.NaN,

GlobalColor("PutCloud"), GlobalColor("CallCloud")

);

# Hull Moving Average of Put Open Interest

plot PutOpenInterestAverage = hullmovingavg(PutOpenInterest);

PutOpenInterestAverage.SetHiding(!ShowLines and DataType == DataType.OpenInterest);

PutOpenInterestAverage.SetDefaultColor(Color.ORANGE);

PutOpenInterestAverage.SetStyle(Curve.MEDIUM_DASH);

# Hull Moving Average of Call Open Interest

plot CallOpenInterestAverage = hullmovingavg(CallOpenInterest);

CallOpenInterestAverage.SetHiding(!ShowLines and DataType == DataType.OpenInterest);

CallOpenInterestAverage.SetDefaultColor(Color.LIGHT_GREEN);

CallOpenInterestAverage.SetStyle(Curve.MEDIUM_DASH);

# Color Gradient of Total Average Open Interest

#plot TotalOpenInterestAverage = average(CallOpenInterest + PutOpenInterest);

#TotalOpenInterestAverage.SetHiding(!ShowLines and DataType == DataType.OpenInterest);

#TotalOpenInterestAverage.SetLineWeight(3);

#TotalOpenInterestAverage.DefineColor("Default", Color.YELLOW);

#TotalOpenInterestAverage.DefineColor("Highest", Color.GREEN);

#TotalOpenInterestAverage.DefineColor("Lowest", Color.RED);

#TotalOpenInterestAverage.AssignNormGradientColor(14, TotalOpenInterestAverage.Color("Lowest"), TotalOpenInterestAverage.Color("Highest"));

#AddCloud(

# if ShowClouds and DataType == DataType.OpenInterest then TotalOpenInterestAverage else Double.NaN,

# if ShowClouds and DataType == DataType.OpenInterest then Zeroline else Double.NaN,

# color.GREEN, color.RED

#);

# Call Volume

plot CallVolume = TotalCallVolume;

CallVolume.SetHiding(!ShowLines and DataType == DataType.Volume);

CallVolume.SetPaintingStrategy(PaintingStrategy.LINE);

CallVolume.SetDefaultColor(GlobalColor("Call"));

AddLabel(ShowLabels and DataType == DataType.Volume, "CallVol: " + CallVolume, GlobalColor("Call"));

# Put Volume

plot PutVolume = -(TotalPutVolume); # Make negative to flip under axis

PutVolume.SetHiding(!ShowLines and DataType == DataType.Volume);

PutVolume.SetPaintingStrategy(PaintingStrategy.LINE);

PutVolume.SetDefaultColor(GlobalColor("Put"));

AddLabel(ShowLabels and DataType == DataType.Volume, "PutVol: " + TotalPutVolume, GlobalColor("Put"));

# Create Clouds for Volume

AddCloud(

if ShowClouds and DataType == DataType.Volume then CallVolume else Double.NaN,

if ShowClouds and DataType == DataType.Volume then Zeroline else Double.NaN,

GlobalColor("CallCloud"), GlobalColor("PutCloud")

);

AddCloud(

if ShowClouds and DataType == DataType.Volume then Zeroline else Double.NaN,

if ShowClouds and DataType == DataType.Volume then PutVolume else Double.NaN,

GlobalColor("PutCloud"), GlobalColor("CallCloud")

);

# Hull Moving Average of Put Volume

plot PutVolumeAverage = hullmovingavg(PutVolume);

PutVolumeAverage.SetHiding(!ShowLines and DataType == DataType.Volume);

PutVolumeAverage.SetDefaultColor(Color.ORANGE);

PutVolumeAverage.SetStyle(Curve.MEDIUM_DASH);

# Hull Moving Average of Call Volume

plot CallVolumeAverage = hullmovingavg(CallVolume);

CallVolumeAverage.SetHiding(!ShowLines and DataType == DataType.Volume);

CallVolumeAverage.SetDefaultColor(Color.LIGHT_GREEN);

CallVolumeAverage.SetStyle(Curve.MEDIUM_DASH);

# Color Gradient of Total Average Volume

#plot TotalVolumeAverage = average(CallVolume + PutVolume);

#TotalVolumeAverage.SetHiding(!ShowLines and DataType == DataType.Volume);

#TotalVolumeAverage.SetLineWeight(3);

#TotalVolumeAverage.DefineColor("Default", Color.YELLOW);

#TotalVolumeAverage.DefineColor("Highest", Color.GREEN);

#TotalVolumeAverage.DefineColor("Lowest", Color.RED);

#TotalVolumeAverage.AssignNormGradientColor(14, TotalVolumeAverage.Color("Lowest"), TotalVolumeAverage.Color("Highest"));

#AddCloud(

# if ShowClouds and DataType == DataType.Volume then TotalVolumeAverage else Double.NaN,

# if ShowClouds and DataType == DataType.Volume then Zeroline else Double.NaN,

# Color.GREEN, Color.RED

#);

# Greeks Labels

AddLabel(ShowGreeks, "Delta: " + Delta, Color.WHITE);

AddLabel(ShowGreeks, "Gamma: " + Gamma, Color.WHITE);

AddLabel(ShowGreeks, "Theta: " + Theta, Color.WHITE);

AddLabel(ShowGreeks, "Vega: " + Vega, Color.WHITE);