Lots of buzz around Unusual Option Activity (UOA) so thought I'll share out this scanner that I fine tuned for my personal use.

The scanner looks for the following:

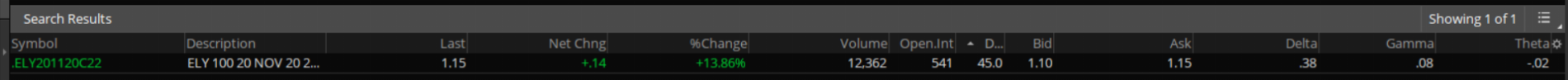

Example from today:

Option chain for ELY:

As you can see there's already good OI in 20 and 21 in the call side and 22 has 10K volume come in with 1K OI. And on the PUT side you don't see much interest. This is an entry I'll try and test it.

There could be other things that might come into play as well, but nevertheless it's a good way to track how Unusual Option Activity shows it's hands and potentially give an insight into following smart money.

Share link: http://tos.mx/REAjsH9

The scanner looks for the following:

- Option Volume of 10k or more

- OI of 5k or less - Usually indicates fresh volume coming in or the part where Unusual comes from

- Delta 0 -> 40 - You can fine tune this as you see fit. I try to stay close to the money

- DTE 14 -> 100 - Best for getting long term ones that come here

Example from today:

Option chain for ELY:

As you can see there's already good OI in 20 and 21 in the call side and 22 has 10K volume come in with 1K OI. And on the PUT side you don't see much interest. This is an entry I'll try and test it.

There could be other things that might come into play as well, but nevertheless it's a good way to track how Unusual Option Activity shows it's hands and potentially give an insight into following smart money.

Share link: http://tos.mx/REAjsH9

Last edited: