Recommend you put it on your scanner. Nothing beats personal experienceWhy is delta only .40 and if we raise it higher what are the ramifications of that in your opinion. What do you mean "I try and stay close to the money?"

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Unusual Option Activity Scanner for ThinkorSwim

- Thread starter theelderwand

- Start date

Jeff MulHolland

New member

@theelderwand @XeoNoX Golden sweeps are as defined by FlowAlgo:

Can a scanner like flowalgo be developed with Thinkorswim?

The ToS Options Hacker Module doesn't allow the using of custom scripts to scan against options related data. We aren't allowed to use custom Thinkscript code in the Options Scanner.Can a scanner like flowalgo be developed with Thinkorswim?

@timyoung You might try https://usethinkscript.com/threads/unusual-option-activity-scanner-for-thinkorswim.4056/.

Jon Najarian probably finds those (if he isn't the cause behind them) by using a paid live-data unusual activity scanner.

Personally, I think CNBC and 99% of stock market news in general is for entertainment purposes only. I've seen and read about too much pumping the markets to trust anyone giving "tips". I've even seen former floor traders talking about corruption involving past CNBC hosts in particular - there's a reason why CNBC runs disclaimers. If trading stock market news worked, everyone would be a millionaire.

I'm curious, does Jon Najarian always happen to find some kind of unusual activity during his TV show?

Jon Najarian probably finds those (if he isn't the cause behind them) by using a paid live-data unusual activity scanner.

Personally, I think CNBC and 99% of stock market news in general is for entertainment purposes only. I've seen and read about too much pumping the markets to trust anyone giving "tips". I've even seen former floor traders talking about corruption involving past CNBC hosts in particular - there's a reason why CNBC runs disclaimers. If trading stock market news worked, everyone would be a millionaire.

I'm curious, does Jon Najarian always happen to find some kind of unusual activity during his TV show?

Last edited:

kayiman2006

New member

the scanner work great, just have to adjusted it a little

natcom2020

Member

whats the best setting for this scanner please share the setting that are working for you.

Thanks for sharing, i will try itLots of buzz around Unusual Option Activity (UOA) so thought I'll share out this scanner that I fine tuned for my personal use.

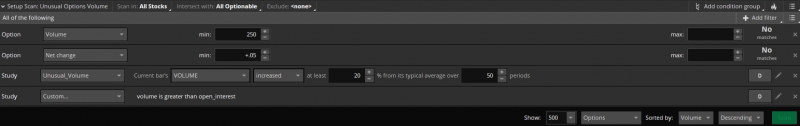

The scanner looks for the following:

This is just a starter to filter through and analyze how to play the UOA. Use this as a starter to find the options and then drill down. Best used on "All stocks", the indices are too noisy with many players whose underlying intentions are usually unclear.

- Option Volume of 10k or more

- OI of 5k or less - Usually indicates fresh volume coming in or the part where Unusual comes from

- Delta 0 -> 40 - You can fine tune this as you see fit. I try to stay close to the money

- DTE 14 -> 100 - Best for getting long term ones that come here

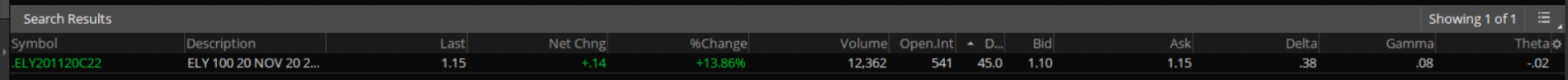

Example from today:

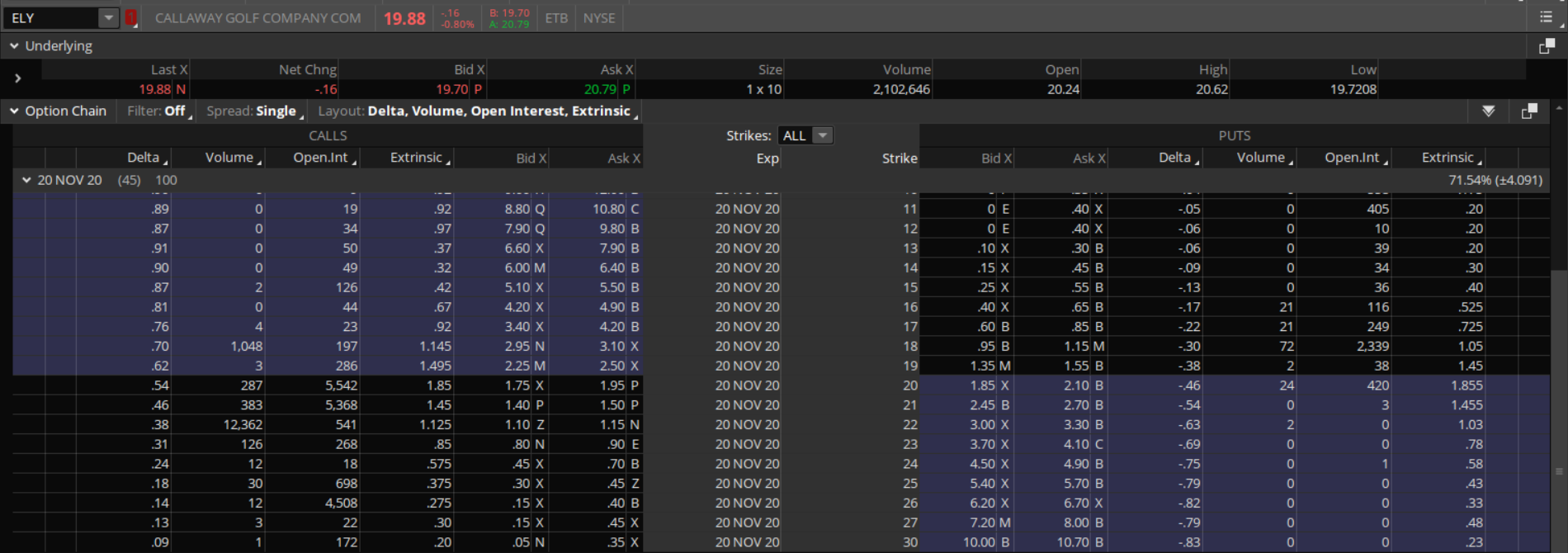

Option chain for ELY:

As you can see there's already good OI in 20 and 21 in the call side and 22 has 10K volume come in with 1K OI. And on the PUT side you don't see much interest. This is an entry I'll try and test it.

There could be other things that might come into play as well, but nevertheless it's a good way to track how Unusual Option Activity shows it's hands and potentially give an insight into following smart money.

Share link: http://tos.mx/REAjsH9

gmadabushi

New member

I am still not sure I can read buying or selling from the above picture, please advise.you can check the same day via the <TRADE> tab then go below the option chain to <TIMES AND SALES>and expand the drop down menu

https://usethinkscript.com/threads/watchlist-which-will-display-buyorsell.12030/#post-103837I am still not sure I can read buying or selling from the above picture, please advise.

look at O/I during the day and look at volume, the next day should reflect the volume of today, henc O/I 285 today volume 5000 today, then tomorrow should reflect 5285, maybe not perfect, some position may close by end of day etc.... you get what im saying@theelderwand, is there a way to scan for open interest change day over day? I want to scan for oi[4]<oi[3]<oi[2]<oi[1],oi. I want to find stocks that smart money keeps betting on increasingly in the last 5 days.

https://usethinkscript.com/threads/unusual-option-activity-scanner-for-thinkorswim.4056/#post-37522Unusual option scanner is not working in pre market , it is not giving any result. any changes need to be made to get the result set.

DHouzer

New member

Hey MerryDay , Quick question about the unusual option activity scan... I have the scan setup to alert me of any changes so it scans all the time M-F. Is it accurate that it would be scanning on Saturdays though since there is no market activity ? Thanks for your input !

Attachments

Hey MerryDay , Quick question about the unusual option activity scan... I have the scan setup to alert me of any changes so it scans all the time M-F. Is it accurate that it would be scanning on Saturdays though since there is no market activity ? Thanks for your input !

The Scan Hacker does not take weekends off. It updates every 3-5 minutes 24/7.

When there is no activity, it provides no updates.

DHouzer

New member

Ok thanks appreciate you !!The Scan Hacker does not take weekends off. It updates every 3-5 minutes 24/7.

When there is no activity, it provides no updates.

gmadabushi

New member

HI MerryDay: Thanks for all the responses and answers provided. I am using the Unusual Option volume, getting results but unable to get information on the nature of call or put(Buy or Sell).

this section does not depict if the user bought a call/put or sold a call/put.

Does font green depict buy and red depict sell?

Please advise.

this section does not depict if the user bought a call/put or sold a call/put.

Does font green depict buy and red depict sell?

Please advise.

Last edited by a moderator:

HI MerryDay: Thanks for all the responses and answers provided. I am using the Unusual Option volume, getting results but unable to get information on the nature of call or put(Buy or Sell).

this section does not depict if the user bought a call/put or sold a call/put.

Does font green depict buy and red depict sell?

Please advise.

As the op pointed out throughout this thread, it is not possible

https://usethinkscript.com/threads/unusual-option-activity-scanner-for-thinkorswim.4056/#post-39532There's almost nobody who can tell you if an UOA is a buy call or a sell call.

Last edited:

gmadabushi

New member

Thank you!!

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| S | Unusual Options Metric (Option Chain Column) For ThinkOrSwim | Indicators | 56 | |

|

|

Unusual Volume For ThinkOrSwim | Indicators | 45 | |

| Z | Option Heatmap and OI Strikes For ThinkOrSwim | Indicators | 206 | |

|

|

FlowAlgo Dark pool and Option Flow for ThinkorSwim | Indicators | 23 | |

|

|

Option Greeks Calculation Labels for ThinkorSwim | Indicators | 5 |

Similar threads

-

Unusual Options Metric (Option Chain Column) For ThinkOrSwim

- Started by StoneMan

- Replies: 56

-

-

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

831

Online

Similar threads

-

Unusual Options Metric (Option Chain Column) For ThinkOrSwim

- Started by StoneMan

- Replies: 56

-

-

-

-

Similar threads

-

Unusual Options Metric (Option Chain Column) For ThinkOrSwim

- Started by StoneMan

- Replies: 56

-

-

-

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.