Fantastic work! Thank. you very much for your efforts. I really like using this for support and resistance.You’re welcome it’s possible, I usually wait 2 minutes and then I go to edit studies, I just click the apply button and that usually helps it load faster also might be better to try it with 1 of the studies not both that I sent

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Option Heatmap and OI Strikes For ThinkOrSwim

- Thread starter ziongotoptions

- Start date

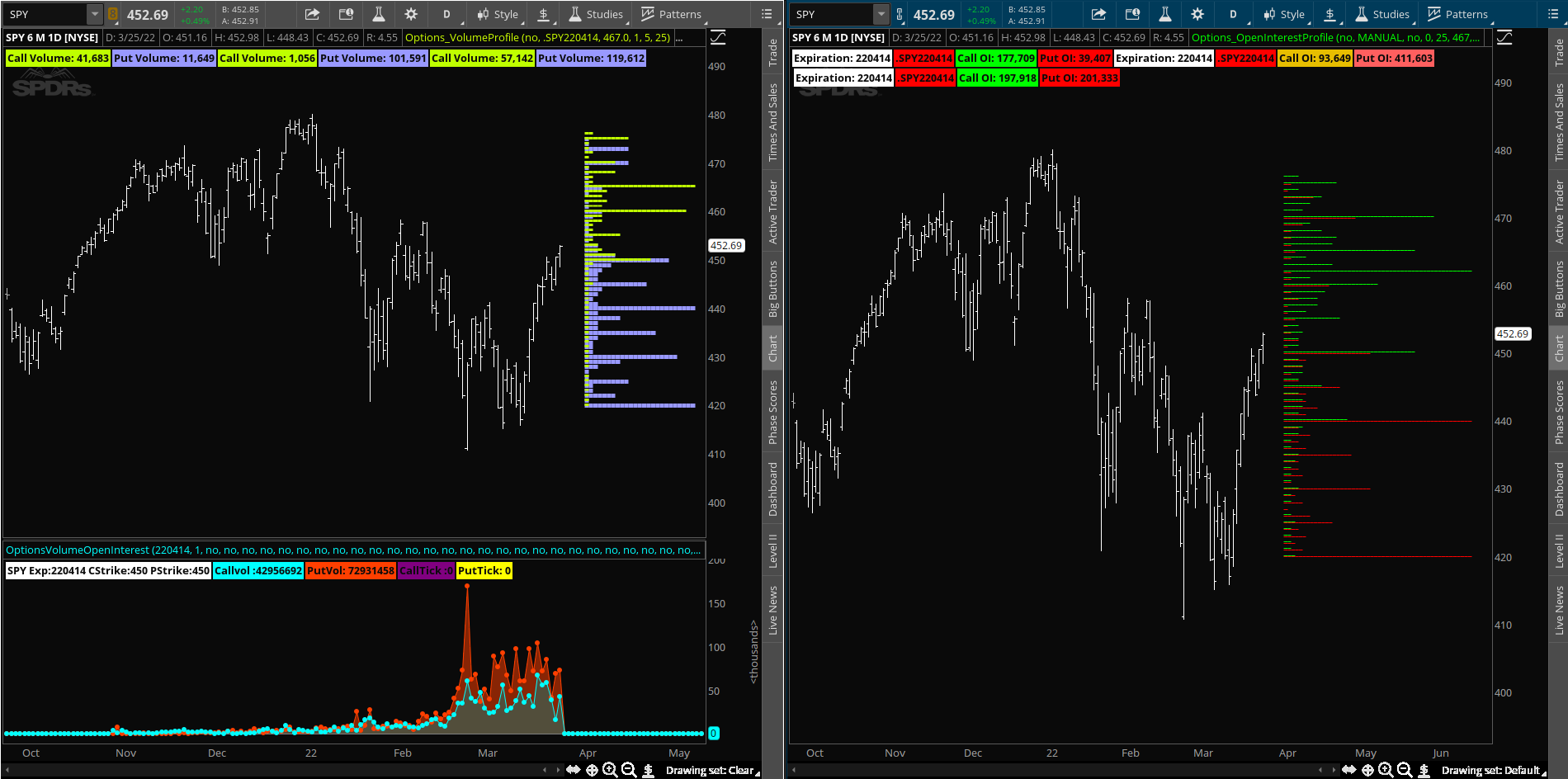

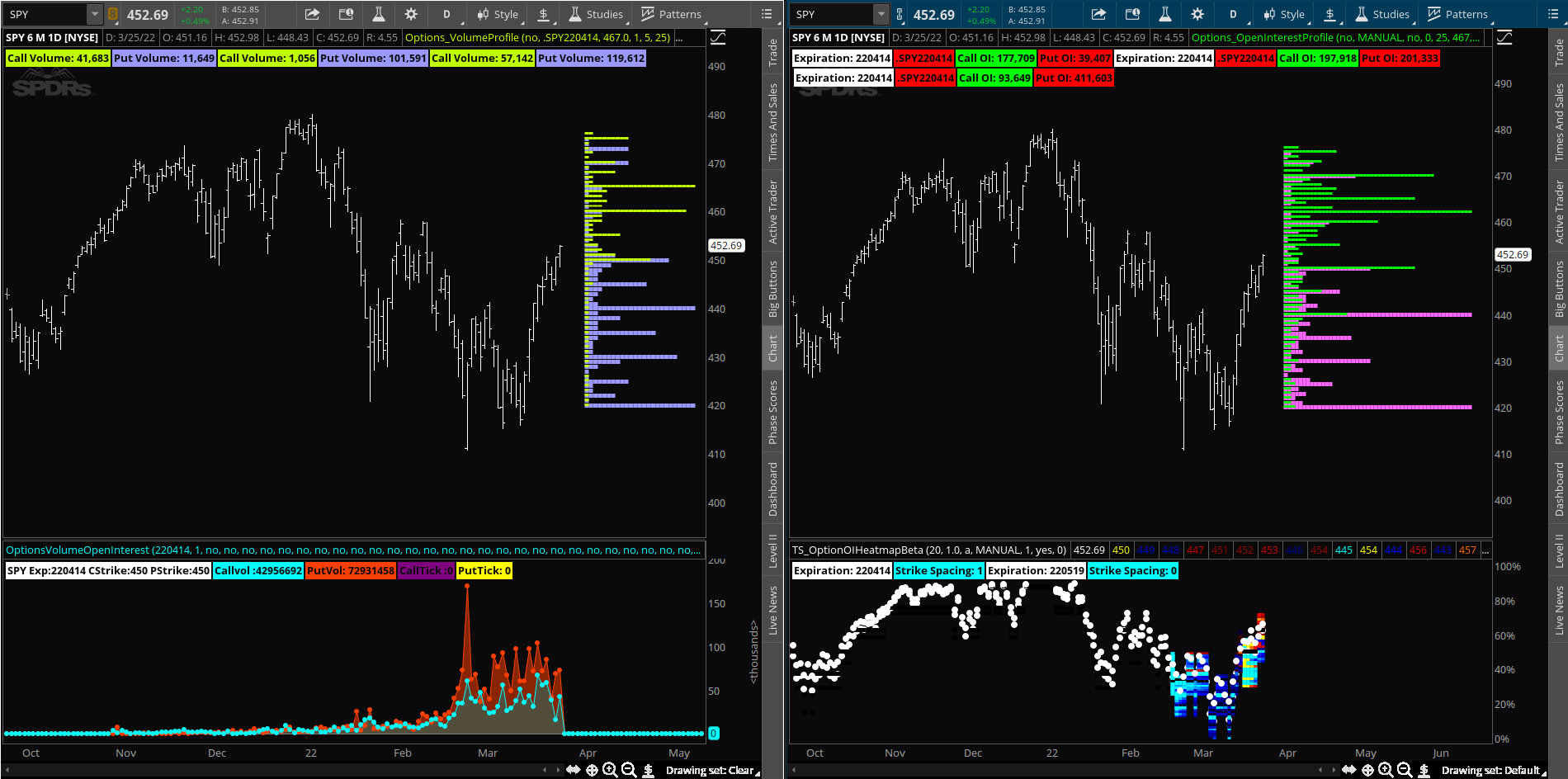

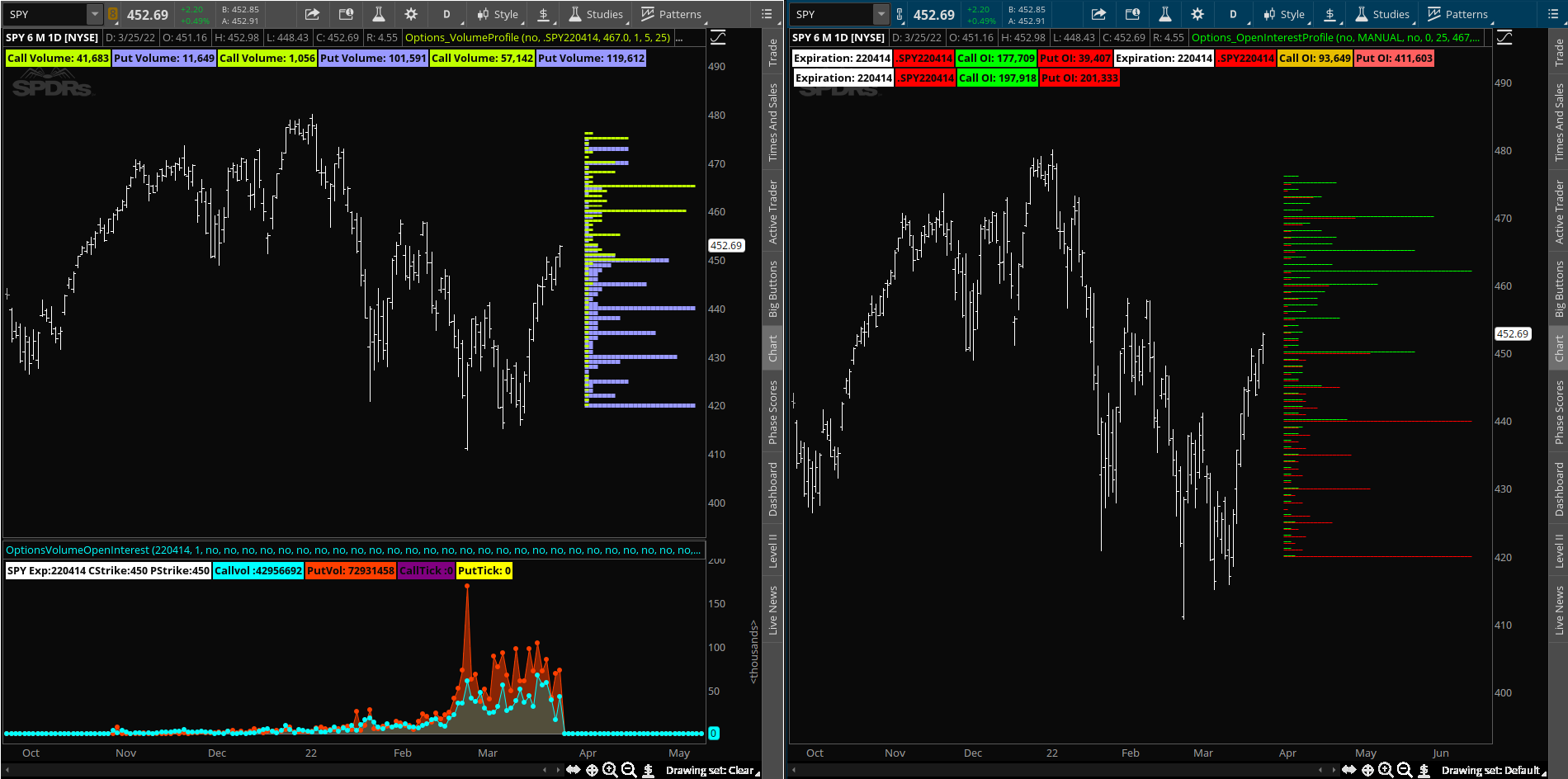

Can you post the chart tos link?Now looking awesome!

If anyone can get the heatmap to work, then this template will be complete.

expanding the strike range will also help, I'm currently plotting 3 to cover the range, so instead of 19 maybe 60?

@Angrybear : Where is the code for the above chart?@ziongotoptions looking good Thank you!

I used the code in Post #67, but it seems not the right one.

Thanks!

wwejonathan

New member

Does anyone know why my heat map doesn’t work ?

ziongotoptions

Active member

It’s the right one , it has the wrong expiration date this week because this month is longer than the 4 weeks it’s coded for, after Friday it’ll be the right expiration date again@Angrybear : Where is the code for the above chart?

I used the code in Post #67, but it seems not the right one.

Thanks!

Thanks @ziongotoptions !It’s the right one , it has the wrong expiration date this week because this month is longer than the 4 weeks it’s coded for, after Friday it’ll be the right expiration date again

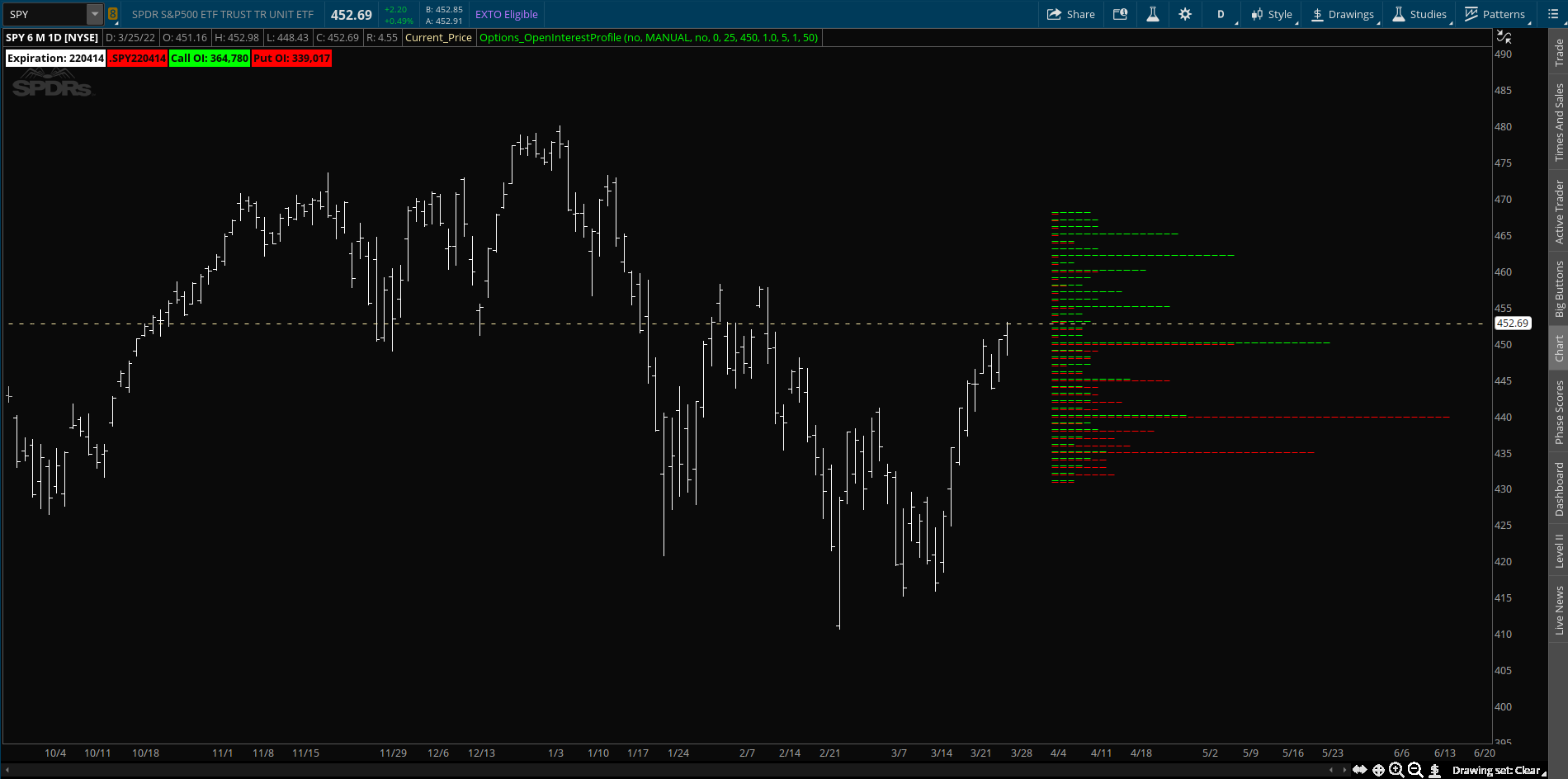

After I changed "manual center strike" = today's close price, it does show up OI at different strike prices.

But the current stock price line does not show up, I cannot turn-off the labels for OIs shown in chart in Post #49.

ziongotoptions

Active member

I don’t understand what you mean by current stock price line doesn’t show up. Also the labels can only be removed by deleting the script that adds the bubbles at the endThanks @ziongotoptions !

After I changed "manual center strike" = today's close price, it does show up OI at different strike prices.

But the current stock price line does not show up, I cannot turn-off the labels for OIs shown in chart in Post #49.

@ziongotoptions Sorry for the confusion! The current price line is shown in the picture below.I don’t understand what you mean by current stock price line doesn’t show up. Also the labels can only be removed by deleting the script that adds the bubbles at the end

ziongotoptions

Active member

Yeah there’s no code for current price line , I think that was a drawing, and you have to delete the part of the script that has “hide bubbles” towards the bottom to see the bubbles@ziongotoptions Sorry for the confusion! The current price line is shown in the picture below.

I have been trying to look for code for OpenVolumeOpenInterest but I am not unable to locate, Can someone please share? really appreciatedOk I kind of fixed the date part for the heat map!

Can someone please help with adding an auto plot current price as a line and is there a way to fetch and plot more historical data? maybe TOS limitations.

@

Odd for me.. The labels tell me 221215 exp and SPY 221215 .... CAll volume 0 Put Volume 0 what am I doing wrong. I just wanted the profile and I don't see that either. Help?wow! thanks @MountainKing333 you're a genius it works perfectly!!! . think you could modify it for weekly options?

ziongotoptions

Active member

Post in thread 'Option Heatmap and OI Strikes'Odd for me.. The labels tell me 221215 exp and SPY 221215 .... CAll volume 0 Put Volume 0 what am I doing wrong. I just wanted the profile and I don't see that either. Help?

https://usethinkscript.com/threads/option-heatmap-and-oi-strikes.10664/post-94445

This is the right code, try it now , it can take awhile to load, if u have and problems just read my recent reply to someone above

Thank you... I didn't notice the aggregation ... lol Let's say I want to look at strikes farther out? SPY is at 402 and I want to look at 360's for JanuaryPost in thread 'Option Heatmap and OI Strikes'

https://usethinkscript.com/threads/option-heatmap-and-oi-strikes.10664/post-94445

This is the right code, try it now , it can take awhile to load, if u have and problems just read my recent reply to someone above

...

How did you get the profile to pick up the whole chart, and how did you get the profile bars thick thick like that? Mine only cover a quarter of the chart and the lines are very small? Thanks!I have been trying to look for code for OpenVolumeOpenInterest but I am not unable to locate, Can someone please share? really appreciated

ziongotoptions

Active member

We didn’t code for that, it plots only for the upcoming weekThank you... I didn't notice the aggregation ... lol Let's say I want to look at strikes farther out? SPY is at 402 and I want to look at 360's for January

...

I'm missing something then, the label says "SPY221216C400"... This isn't for the next week... Sorry, I'm VERY new to this... How do you change the option strike and date for "the upcoming week? .. Thank you.We didn’t code for that, it plots only for the upcoming week

ziongotoptions

Active member

Np my apologies the code is the monthly expiration, the 3rd Friday of every monthI'm missing something then, the label says "SPY221216C400"... This isn't for the next week... Sorry, I'm VERY new to this... How do you change the option strike and date for "the upcoming week? .. Thank you.

using I7-32GB, all the other lines come up right away but in the gamma exposure line nothing happens

THIS IS THE GAMMA EXPOSURE I USE FOR THE OPTION CHAIN

# Gamma Exposure at each strike is calculated by the formula option gamma * open interest * 100 (calls, x-100 for puts)

input gate = 2000;

plot data = if IsPut() then gamma() * -100 * open_interest() else gamma() * 100 * open_interest();

assignbackgroundcolor(if AbsValue(data) > gate then createcolor(250,150,100) else color.black);

data.assignvaluecolor(if AbsValue(data) > gate then color.black else color.current);

Now looking awesome!

If anyone can get the heatmap to work, then this template will be complete.

expanding the strike range will also help, I'm currently plotting 3 to cover the range, so instead of 19 maybe 60?

Does anyone know where I can find the latest version of the script that produced the above two charts? Thanks you!

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| S | Unusual Options Metric (Option Chain Column) For ThinkOrSwim | Indicators | 56 | |

|

|

Unusual Option Activity Scanner for ThinkorSwim | Indicators | 63 | |

|

|

FlowAlgo Dark pool and Option Flow for ThinkorSwim | Indicators | 23 | |

|

|

Option Greeks Calculation Labels for ThinkorSwim | Indicators | 5 |

Similar threads

-

Unusual Options Metric (Option Chain Column) For ThinkOrSwim

- Started by StoneMan

- Replies: 56

-

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

887

Online

Similar threads

-

Unusual Options Metric (Option Chain Column) For ThinkOrSwim

- Started by StoneMan

- Replies: 56

-

-

-

Similar threads

-

Unusual Options Metric (Option Chain Column) For ThinkOrSwim

- Started by StoneMan

- Replies: 56

-

-

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.