Hi @ALV and @FaloutI'm willing to try it out too. Scalping using your indicators whenever I'm able to trade.

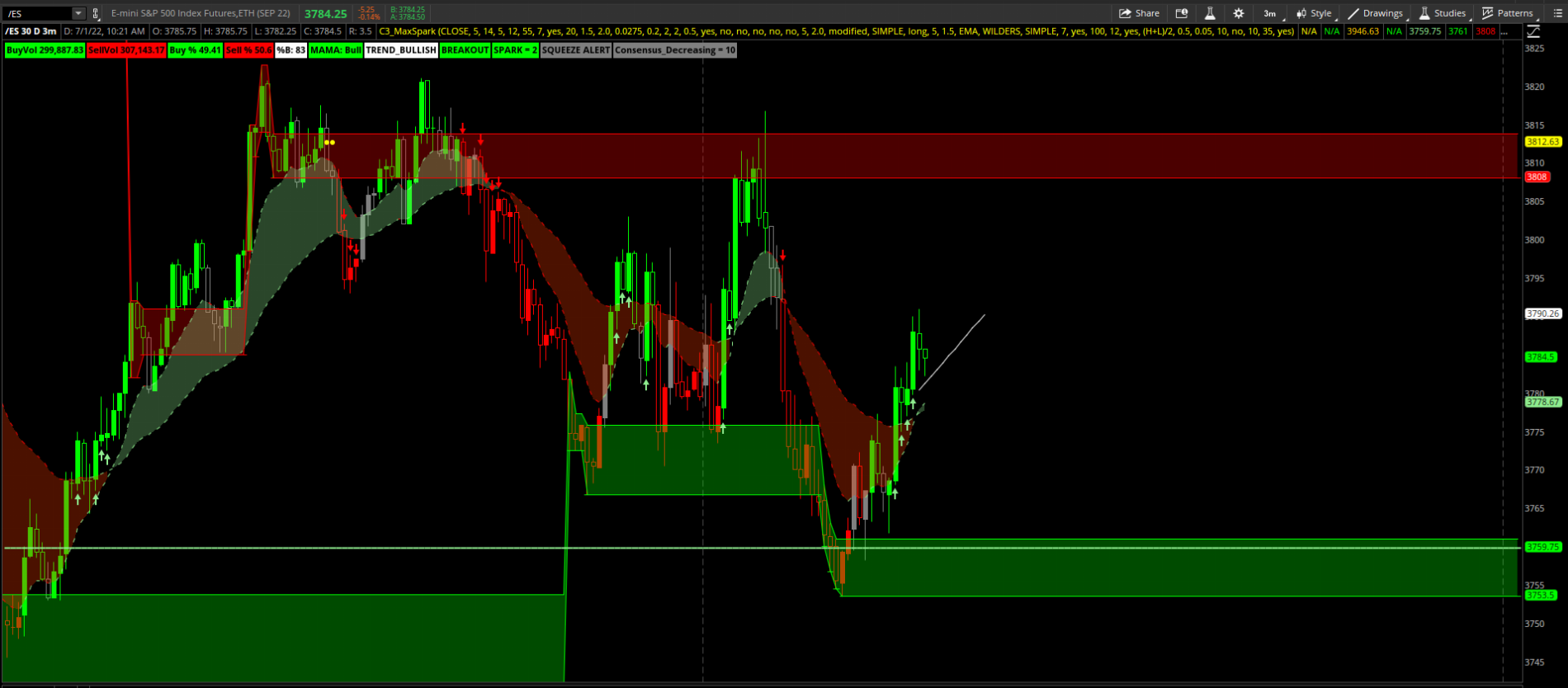

Here's a share link for my first attempt at C3_MaxSpark. See what you think.

https://tos.mx/MQGTrc3

Hi @ALV and @FaloutI'm willing to try it out too. Scalping using your indicators whenever I'm able to trade.

@Christopher84:Hi @ALV and @Falout

Here's a share link for my first attempt at C3_MaxSpark. See what you think.

https://tos.mx/MQGTrc3

@latinbori123456 ;I used this indicator on the 1 min chart in SPY along with https://usethinkscript.com/threads/...kout-breakdown-indicator-for-thinkorswim.103/ and the c3 max.

First time I traded spy 3 times on the 1 min chart while working a FT job EVER. All of them were profits today. One was 100%, one was 200.%c and the other was 10.%

I’ll put a pick up later this week. Just to warn you, it’s complete overkill.@latinbori123456 ;

Saludos! Glad you were able to go 3 for 3 from work. That is excellent.

Just to be clear, which indicator are you referring to? C3_MaxSpark sent by Christopher84 in message 1521? Can you post a picture of your chart?

Thanks.

@latinbori123456 : Can you please share your strategy on how you use the c3 max signal for scalping.I’ll put a pick up later this week. Just to warn you, it’s complete overkill.

2 sets of Bollinger bands, the c3 max from page 1 of this thread, the confirmation candles v10 with some custom adjustments made on my end, VWAP, the consolidation box that does a good job of drawing dibs as well, a smoothed Heiken ashi chart, ttm squeeze, rsi, stochastic rsi, 2 sets of ttm waves, MTF MACD and stochastic labels, volume pressure with hot percentage, balanced breakout indicators.

5/21/50/200 SMA

8/21 EMA.

A position size calculator

my overnight research also has OBV modified and MFI

They are all things that came with thinkorswim or things I found here.

It’s a lot. However, I built custom scanners that do 95% of the legwork to find stocks based on various conditions from multiple indicators. The other 5 is me going through them, finding a good ticker, mapping out support and resistance, and placing conditional orders with buy/short orders that trigger OCO for a stop loss or price target.

So once my order triggers I don’t have to do anything. I let the orders play out

I go for base hits so most of my long entries are in the middle of a consolidation with a stop loss a few ticks below the bottom of the consolidation box, and my PT are a few ticks below the low of the next consolidation box or where one of auto fibs are.

I use the c3 max signals from this thread to scalp or find day trades or add to my custom scanners.

It took me a little over 1 year, which is how long I’ve been trading and losing money up until recently.

my account is still red but I have yet to blow up my account. I just started March 2021 right when the OTC market started crashing and was forced to learn a lot of hard lessons very fast.

Since I work FT, I use daily charts as my base. C3 max on the first page@latinbori123456 : Can you please share your strategy on how you use the c3 max signal for scalping.

1. What time frame do you use?

2. What is your strategy for entry and exist?

3. Which version of c3 max you use?

Thanks a lot.

I use “@latinbori123456 : Can you please share your strategy on how you use the c3 max signal for scalping.

1. What time frame do you use?

2. What is your strategy for entry and exist?

3. Which version of c3 max you use?

Thanks a lot.

Since I work FT, I use daily charts as my base. C3 max on the first page

I use “

C3_Max_v2 Created by Christopher84 12/14/2021

#Last modified 4/11/2022” from the first page of this thread with the default values.

For scalps I use 1 min for entry and exits, the 5 min to gauge the intermediate trend, and 30 minute got supertrend.

For swings I use the 1 hour for entry and exit, the daily for intermediate trend, and weekly for supertrend.

Any histogram based indicator I look for histograms near the 0 area.

For long positions I want the macd, short term ttm wave, and ttm squeeze histograms to be negative but close to zero with progressively shrinking histograms on the fastest timeframe out of the 3. This will usually indicate the bottom of a play, potential support forming, and potential reversal but only if the intermediate trend is indeed trending. Follow the inverse for besrish trades.

I use the c3 max to wait for a signal to be generated, and very with macd, ttm, and rsi are all in the same direction of the trade I want.

If I see a signal and all the indicators are diverging in the same direction from a besrish trend, this usually indicates a bottom with reversal.

I also use the confirmation candles on this thread to see where the supply and demand consolidation zones are.

If my intention is for a scalp, I will watch for the green support to form and look at all these indicators and signals bc it almost always reverses. I will put an exit a few ticks below the bottom of the red resistance from the confirmation candles to scale out.

then if it hits a consolidation red zone and stays there, I’ll set a stop loss a few ticks below the zone so in the even short sellers crash the stock in the supply zone I’ll lock in profits.

If it breaks out I do the same thing in the next supply area

I know this all sounds like alot, but the idea is you want as many indicators to all go in the same direction as possible. I can process all this information pretty quickly so it’s not hard for me. But is information overload for most people.Since I work FT, I use daily charts as my base. C3 max on the first page

I use “

C3_Max_v2 Created by Christopher84 12/14/2021

#Last modified 4/11/2022” from the first page of this thread with the default values.

For scalps I use 1 min for entry and exits, the 5 min to gauge the intermediate trend, and 30 minute got supertrend.

For swings I use the 1 hour for entry and exit, the daily for intermediate trend, and weekly for supertrend.

Any histogram based indicator I look for histograms near the 0 area.

For long positions I want the macd, short term ttm wave, and ttm squeeze histograms to be negative but close to zero with progressively shrinking histograms on the fastest timeframe out of the 3. This will usually indicate the bottom of a play, potential support forming, and potential reversal but only if the intermediate trend is indeed trending. Follow the inverse for besrish trades.

I use the c3 max to wait for a signal to be generated, and very with macd, ttm, and rsi are all in the same direction of the trade I want.

If I see a signal and all the indicators are diverging in the same direction from a besrish trend, this usually indicates a bottom with reversal.

I also use the confirmation candles on this thread to see where the supply and demand consolidation zones are.

If my intention is for a scalp, I will watch for the green support to form and look at all these indicators and signals bc it almost always reverses. I will put an exit a few ticks below the bottom of the red resistance from the confirmation candles to scale out.

then if it hits a consolidation red zone and stays there, I’ll set a stop loss a few ticks below the zone so in the even short sellers crash the stock in the supply zone I’ll lock in profits.

If it breaks out I do the same thing in the next supply area.

If I happen to see a sell signal generated, I will also set stop losses just in case.

To be honest, the c3 max from April is the simplest way. It’s pretty reliable.

I also, when creating orders to enter, i will enter a 1st trigger OCO order all the time.

The 1st order is for entry and the OCO is for a stop loss GTC or limit sell GTC.

I also will NEVER enter into a bullish position if the On balance volume modified did not cross over the signal line or NEVER enter a besrish if the OBV did not already death cross.

@latinbori123456 -Since I work FT, I use daily charts as my base. C3 max on the first page

I use “

C3_Max_v2 Created by Christopher84 12/14/2021

#Last modified 4/11/2022” from the first page of this thread with the default values.

For scalps I use 1 min for entry and exits, the 5 min to gauge the intermediate trend, and 30 minute got supertrend.

For swings I use the 1 hour for entry and exit, the daily for intermediate trend, and weekly for supertrend.

Any histogram based indicator I look for histograms near the 0 area.

For long positions I want the macd, short term ttm wave, and ttm squeeze histograms to be negative but close to zero with progressively shrinking histograms on the fastest timeframe out of the 3. This will usually indicate the bottom of a play, potential support forming, and potential reversal but only if the intermediate trend is indeed trending. Follow the inverse for besrish trades.

I use the c3 max to wait for a signal to be generated, and very with macd, ttm, and rsi are all in the same direction of the trade I want.

If I see a signal and all the indicators are diverging in the same direction from a besrish trend, this usually indicates a bottom with reversal.

I also use the confirmation candles on this thread to see where the supply and demand consolidation zones are.

If my intention is for a scalp, I will watch for the green support to form and look at all these indicators and signals bc it almost always reverses. I will put an exit a few ticks below the bottom of the red resistance from the confirmation candles to scale out.

then if it hits a consolidation red zone and stays there, I’ll set a stop loss a few ticks below the zone so in the even short sellers crash the stock in the supply zone I’ll lock in profits.

If it breaks out I do the same thing in the next supply area.

If I happen to see a sell signal generated, I will also set stop losses just in case.

To be honest, the c3 max from April is the simplest way. It’s pretty reliable.

I also, when creating orders to enter, i will enter a 1st trigger OCO order all the time.

The 1st order is for entry and the OCO is for a stop loss GTC or limit sell GTC.

I also will NEVER enter into a bullish position if the On balance volume modified did not cross over the signal line or NEVER enter a besrish if the OBV did not already death cross.

https://tlc.thinkorswim.com/center/...s/studies-library/O-Q/OnBalanceVolumeModified@latinbori123456 -

Thanks for the information provided.

When you mention OBV modified, what modification(s) are you referring to?

Thank you

@latinbori123456

Can you show us how to change the candle color plsThis is my latest version of Scalper v2 converted to easyLanguage. The only thing I changed was to color candles based on higher timeframe EMAs. This morning I was looking for a long on the M2K after it couldn't follow through below VWAP. I got in when consensus was 100% biased to the upside and price closed above the C3 line. As additional confluence, the Pro Go showed retail traders trapped short. There was some volatility instead of a straight shot to my targets. Even so, I kept adding on because of the confidence I have in the consensus bias. All contracts closed in profit.

Thank you again for sharing your indicators, @Christopher84. Scalper is the just the best!

Hey Phat, Thanks for the info. Would you mind sharing your setup that you show. I am trying to get it but the Scalper V2 that I see looks different. Thanks in advance. Also, It would be GREAT if the forum would have a main forum header that was called "RESULTS" or something so that all of can post what we have tried and the results.Can you show us how to change the candle color pls

Just wanted to commend you for taking time to readfinally able to complete all 77 pages and watching the 1hr video and taking notes along the way ... I plan to paper trade for this week with only handful of equities

Can you show us how to change the candle color pls

Sb, Can you please direct me to the video that you watched. I cannot locate a video reference anywhere. I have went through all 77 pages and must have missed it.@Christopher84 Thanks for sharing your indicators with us. finally able to complete all 77 pages and watching the 1hr video and taking notes along the way.

Couple of questions (I did search the thread, but excuse me if I miss) - Am using TS_strategy_V9 & Ehler's coeff strategy

1. When both are enabled yellow candles are not seen even when I set colored Candles in Ehler to No. Yellow candles show up only when I remove Ehlers coeff strategy

2. Am trying to find ideal settings for diff times (3/15, 5/30min etc) - what factors decide the best? Is it the Profit Percentile/Winners/Long, Short profit/Avg per trade?

I plan to paper trade for this week with only handful of equities

It is on the first page https://usethinkscript.com/threads/confirmation-candles-indicator-for-thinkorswim.6316/Sb, Can you please direct me to the video that you watched. I cannot locate a video reference anywhere. I have went through all 77 pages and must have missed it.

OMG. Apparently I went right by it and thought it was deeper in the thread. Thanks!

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.