DISCLAIMER: Some of the indicators, in this thread, utilize an MTF (multi-timeframe). You will see the MTF signals repaint until the higher timeframe candle closes.

Hi Everyone!

I have been working on an Idea I am calling confirmation candles. I often times find myself trying to find agreement among the numerous indicators that I use to help guide my decisions. Unfortunately, a lot of the time this creates indicator overload and analysis paralysis. So I have included 15 indicators of trend within this indicator. You can choose how many of the 15 indicators have to be in agreement in order to confirm the trend. I may have gone a bit overboard here, however it makes it adaptable to individual risk tolerance and trading style.

***Please note that I will always post the newest version of these indicators on page 1 of this thread. I am always happy to answer questions for those who are trying to utilize these indicators. However, I ask that you review my post below explaining the various aspects of the indicators. I'll do my best to continue to elaborate to help everyone.

Here is the newest code for C3_Max! Happy trading!!!

View attachment 10381

Here is the code for C3_Max_v2_SPX_Forex.

Here is Confirmation Candles v10.

View attachment 10382

View attachment 10383

Here is the Confirmation Candles lower study.

View attachment 10384

View attachment 10385

View attachment 10386

For those of you that trade FOREX or the SPX, here is a modified version that will function on those instruments.

Here's the lower study.

View attachment 10387

Here is a custom watchlist column for the Confirmation Candles. If you sort the column, it makes it easier to see OB/OS conditions. Especially when grouped with the Super OB/OS custom watchlist column which is also posted below.

View attachment 10388

Here is the Super OB/OS custom watchlist column.

View attachment 10389

Here's a code for a cloud reversal WL column. This will show whether an OB/OS cloud is present. OB clouds are light red and OS clouds will show green. I like to group this with the Confirmation Level and SuperOB_OS for additional context.

Here is the WL code for the arrows up/down. If the cell is green there is an arrow up, if red there is an arrow down. Adjust the agperiod as desired.

View attachment 10390

For those of you that are intrested, here is the Super OB/OS lower indicator.

View attachment 10391

View attachment 10392

Here is the Super_OB_OS_SPX_Version.

So last but not least, I have had several request to share my MTF Cloud Upper and Lower studies. So here they are!

View attachment 10393

Here's the lower MTF Cloud study.

Here is the code for the MTF_MA_Lower study for SPX and FOREX.

This is an MTF STARC. Looks great with the MTF MA Cloud for anyone that is interested.

View attachment 10394

Here is one more EMA MTF study that can be useful for scalping. It definitely can help to keep you on the right side of the trade. The default settings will only show on a 1 min chart. The settings have be altered to go to different timeframes. One word of caution, this is an MTF study that can repaint. However, through my own experimentation I have found it to be quite useful for scalping 1 min charts and swinging 1 hour charts (setting must be adjusted to the 1 hour timeframe). The labels are intended to give insight to the broader trend. It is preferrable to scalp in the direction of the larger trend. The Bias label is intended to show potential pivots as well as when the lower timeframe trend is in sync with the larger trend.

View attachment 10395

By request, here is Scalper v3 which includes targets based on fib coefficients. Check it out!

View attachment 10396

**This is a basic strategy that I have put together and will do my best to continue to improve. It is by no means a perfect strategy, however it does show extremely strong performance on some assets in various time periods. Below are some examples (along with the codes). Please do your due dilligence and check the performance before attempting to use this tool in your trading. Feedback is always welcome.

Here is the code for C3_Max_v2_Strategy_LE_SE. This is a basic code that will trade long and short entries. It tends to work best around 5-10 min charts (especially on the /es), with after market hours turned off. ***Please remember to assess the strategy's performance using the Floating P/L study available on ToS before attempting to implement it in your own trading.

View attachment 10397

Here is the code for C3_Max_v2_Strategy_LE_LX. This is a basic code that will trade long positions only. It tends to work best around 5-10 min charts (especially on the /es), with after market hours turned off. This strategy can perform well on day charts as well. ***Please remember to assess the strategy's performance using the Floating P/L study available on ToS before attempting to implement it in your own trading.

View attachment 10398

Here is the code for EMAD_Range. This indicator helps to trader see the trend (below 0 bearish, above 0 bullish). It also helps to see where potential pullbacks may occur by looking at where previous pullbacks have occured.

View attachment 10399

Here is the code for the MTF_MOBO. Not the most intracate script, but very effective for showing trend direction and potential support and resistance. The band color reflects the slope of the bands. Hope you all find this useful.

View attachment 10400

Here is the code for the new C3_Max_v2_MA_Strategy. The strategy length can be modified to fit the asset and timeframe you wish to trade. The default setting is geared toward the /es 3min chart. Note that the best results are with aftermarket hours off and I would encourage using the floating p/l study to dial in the MA for best results. Adjust the "strategy MA Length" in settings (see image below).

View attachment 10401

View attachment 10402

Here's a strategy based on Ehler's Distant Coefficient Filter. Showing very reasonable results on the /es 3min chart. The candles are colored to match the strategy. The strategy length can be changed to achieve the optimal results for the asset and timeframe being traded.

View attachment 10403

Here's a strategy based on HiLo study. Showing very reasonable results on the /es 3min chart as well. The candles are colored to match the strategy. The strategy length can be changed to achieve the optimal results for the asset and timeframe being traded.

View attachment 10404

Here's the newest TS_Strategy. I have it set up for the /ES 15 min chart for the default settings. I like to pair it with the 3 min chart for scalping. For the 3 min chart change the settings to atr period = 10 and atr factor length to 2.3. Enjoy!

View attachment 10405

Here is the TS_Strategy_v9 with yellow candles for taking profit. The yellow candles appear when the strategy's profitability is peaking, and the trader should be considering taking profit. Also included in this version:

Stoploss = Orange line

Go Short = Red line

Go Long = Green line

Average Profit = White line

Targets = Gray lines (Targets utilize fib coefficient levels)

Target Labels show expected profit at each level.

Stoploss Label shows expected loss.

****Note that the indicator's default settings are geared for the 15 min /es chart. The "mult" (short for multiplier) setting is set to 50 to match the /es multiplier by default. This must be changed to match the asset you are trading (ie: For stocks it should be changed to 1. For the /mes and /btc it would be set to 5.).

View attachment 10406

Here is the PLD_Bands Strategy for anyone that is interested. In short, this strategy utilizes a displaced average and it's high/low over 5 periods to determine trend. Much like Ichimoku when price action is above or below kumo. It's setup for the 3min /es chart, however the displace is adjustable allowing it to work on a variety of assets.

View attachment 10407

Hi Everyone,

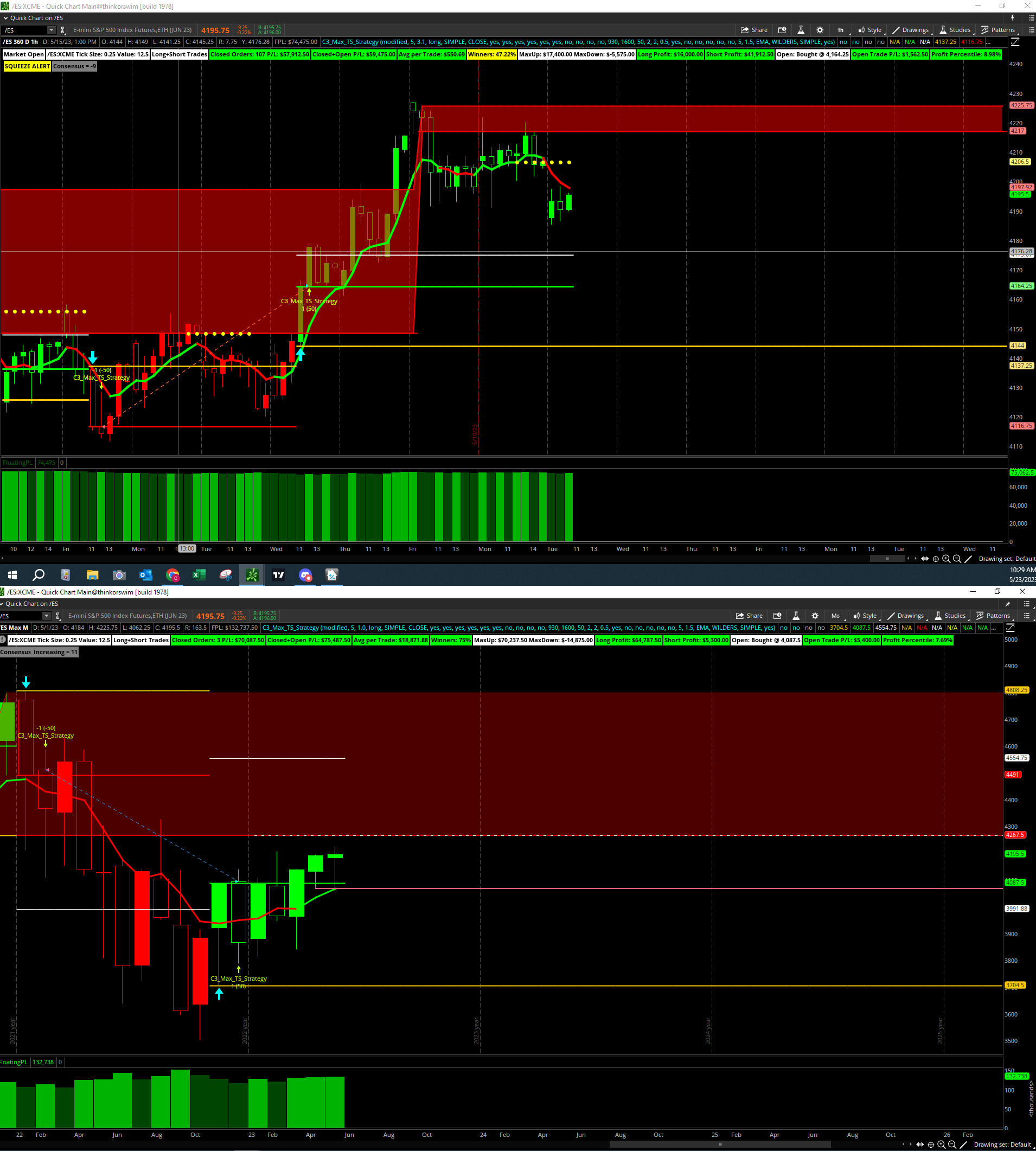

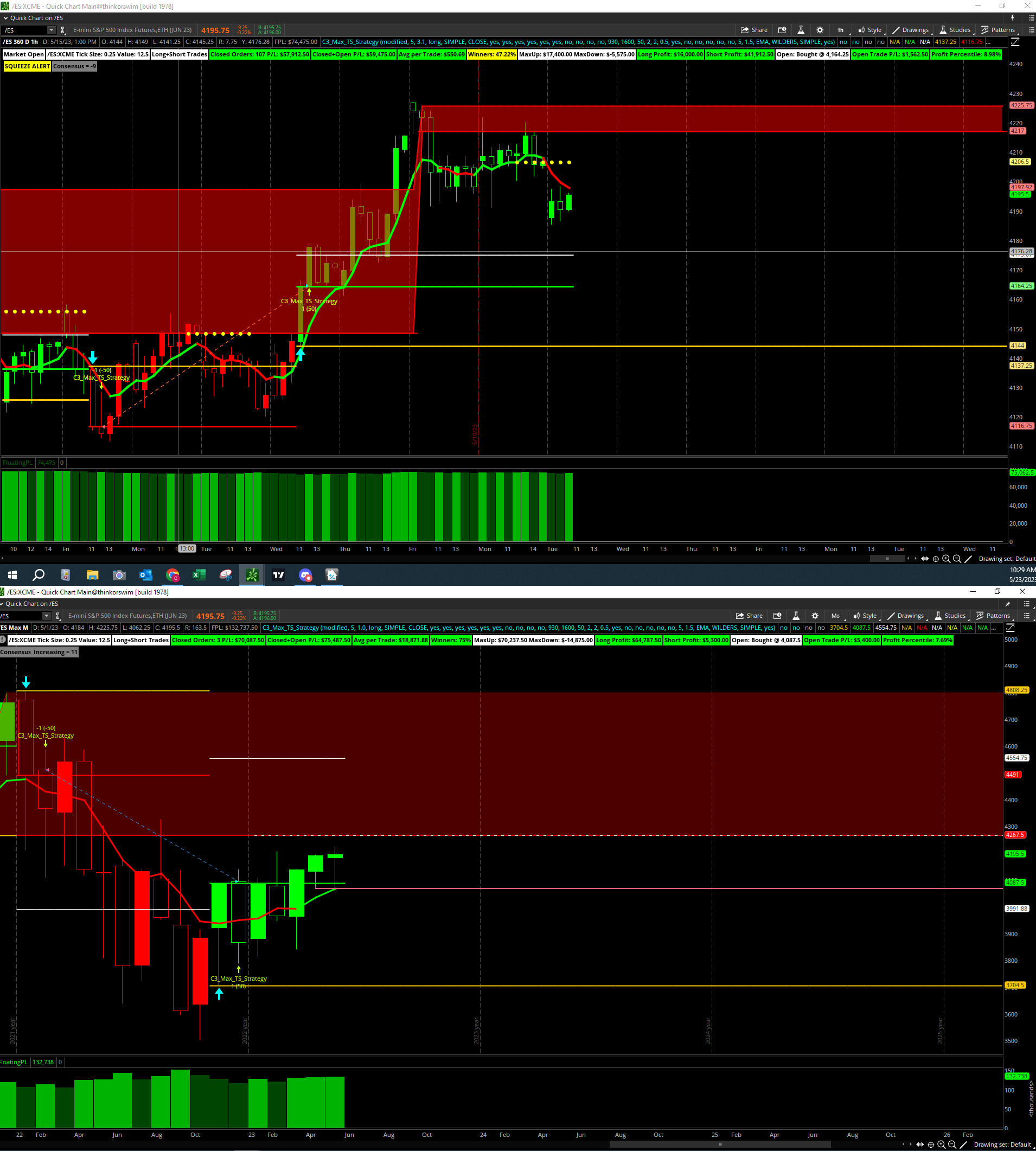

Here is C3_Max_TS_Strategy! I have combined the OB and OS zones, Consensus Level Label, Squeeze Alert, C3_MF_Line (colored by the Consensus Level), with the versatile TS_v9 Strategy in a single code! The entry, stop, and average trade lines were included from TS_v9 as well as the analysis labels for the strategy (to help you adjust to the asset you are trading). Using this setup on different timeframes can give tremendous insight on important technical levels. Note that the default version is setup for the /es 1 hour chart.

Hi Everyone!

I have been working on an Idea I am calling confirmation candles. I often times find myself trying to find agreement among the numerous indicators that I use to help guide my decisions. Unfortunately, a lot of the time this creates indicator overload and analysis paralysis. So I have included 15 indicators of trend within this indicator. You can choose how many of the 15 indicators have to be in agreement in order to confirm the trend. I may have gone a bit overboard here, however it makes it adaptable to individual risk tolerance and trading style.

***Please note that I will always post the newest version of these indicators on page 1 of this thread. I am always happy to answer questions for those who are trying to utilize these indicators. However, I ask that you review my post below explaining the various aspects of the indicators. I'll do my best to continue to elaborate to help everyone.

Here is the newest code for C3_Max! Happy trading!!!

View attachment 10381

Code:

#C3_Max_v2 Created by Christopher84 12/14/2021

#Last modified 4/11/2022 removed C3_MF_Line_Extension

# Based off of the Confirmation Candles Study. Main difference is that CC Candles weigh factors of positive

# and negative price movement to create the Consensus_Level. The Consensus_Level is considered positive if

# above zero and negative if below zero.

declare upper;

input price = CLOSE;

input ShortLength1 = 5;

input ShortLength2 = 14;

input ShortLength3 = 5;

input LongLength1 = 12;

input LongLength2 = 55;

input LongLength3 = 7;

input coloredCandlesOn = yes;

# Momentum Oscillators

def MS = Average(Average(price, ShortLength1) - Average(price, ShortLength2), ShortLength3);

def MS2 = Average(Average(price, LongLength1) - Average(price, LongLength2), LongLength3);

# Wave A

def MSGreens = If (MS >= 0, MS, 0);

def MSReds = If (MS < 0, MS, 0);

# Wave C

def MS2Blues = If (MS2 >= 0, MS2, 0);

def MS2Yellows = If (MS2 < 0, MS2, 0);

def MayhemBullish = MSGreens > MSGreens[1] and MS2Blues > MS2Blues[1];

def MayhemBearish = MSReds < MSReds[1] and MS2Yellows < MS2Yellows[1];

def MS_Pos = MSGreens;

def MS_Neg = MSReds;

def MS2_Pos = MS2Blues;

def MS2_Neg = MS2Yellows;

# Squeeze Indicator

def length = 20;

def nK = 1.5;

def nBB = 2.0;

def BBHalfWidth = StDev(price, length);

def KCHalfWidth = nK * Average(TrueRange(high, close, low), length);

def isSqueezed = nBB * BBHalfWidth / KCHalfWidth < 1;

def BBS_Ind = If(isSqueezed, 0, Double.NaN);

# Bollinger Resolution

def BBSMA = Average(price, length);

def BBSMAL = BBSMA + (-nBB * BBHalfWidth);

def BBSMAU = BBSMA + (nBB * BBHalfWidth);

def PerB = RoundUp((price - BBSMAL) / (BBSMAU - BBSMAL) * 100, 0);

AddLabel(yes, Concat("%B: ", PerB), if PerB < 0 then Color.YELLOW else if PerB > 0 and PerB[1] < 0 then Color.GREEN else Color.WHITE);

# Parabolic SAR Signal

def accelerationFactor = 0.0275;

def accelerationLimit = 0.2;

def SAR = ParabolicSAR(accelerationFactor = accelerationFactor, accelerationLimit = accelerationLimit);

def bearishCross = Crosses(SAR, price, CrossingDirection.ABOVE);

plot signalDown = bearishCross;#If(bearishCross, 0, Double.NaN);

signalDown.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

signalDown.SetLineWeight(3);

signalDown.AssignValueColor(Color.DOWNTICK);

def bullishCross = Crosses(SAR, price, CrossingDirection.BELOW);

plot signalUp = bullishCross;#If(bullishCross, 0, Double.NaN);

signalUp.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

signalUp.SetLineWeight(3);

signalUp.AssignValueColor(Color.UPTICK);

def UP = bullishCross;

def DOWN = bearishCross;

def priceColor = if UP then 1

else if DOWN then -1

else priceColor[1];

####################################################################################################################################################

#OB_OS_Levels_v5

def BarsUsedForRange = 2;

def BarsRequiredToRemainInRange = 2;

def TargetMultiple = 0.5;

def ColorPrice = yes;

def HideTargets = no;

def HideBalance = no;

def HideBoxLines = no;

def HideCloud = no;

def HideLabels = no;

#--------------

#Squeeze Alert

#--------------

#Squeeze Dots Created 04/28/2021 by Christopher84

input ATRPeriod = 5;

input ATRFactor = 2.0;

def HiLo = Min(high - low, 1.5 * Average(high - low, ATRPeriod));

def HRef = if low <= high[1]

then high - close[1]

else (high - close[1]) - 0.5 * (low - high[1]);

def LRef = if high >= low[1]

then close[1] - low

else (close[1] - low) - 0.5 * (low[1] - high);

input trailType = {default modified, unmodified};

def trueRange;

switch (trailType) {

case modified:

trueRange = Max(HiLo, Max(HRef, LRef));

case unmodified:

trueRange = TrueRange(high, close, low);

}

input averageType = AverageType.SIMPLE;

input firstTrade = {default long, short};

#input averageType = AverageType.WILDERS;####Use Simple instead of Wilders

def loss = ATRFactor * MovingAverage(averageType, trueRange, ATRPeriod);

def state = {default init, long, short};

def trail;

switch (state[1]) {

case init:

if (!IsNaN(loss)) {

switch (firstTrade) {

case long:

state = state.long;

trail = close - loss;

case short:

state = state.short;

trail = close + loss;

}

} else {

state = state.init;

trail = Double.NaN;

}

case long:

if (close > trail[1]) {

state = state.long;

trail = Max(trail[1], close - loss);

} else {

state = state.short;

trail = close + loss;

}

case short:

if (close < trail[1]) {

state = state.short;

trail = Min(trail[1], close + loss);

} else {

state = state.long;

trail = close - loss;

}

}

def TrailingStop = trail;

def H = Highest(TrailingStop, 12);

def L = Lowest(TrailingStop, 12);

def BulgeLengthPrice = 100;

def SqueezeLengthPrice = 100;

def BandwidthC3 = (H - L);

def IntermResistance2 = Highest(BandwidthC3, BulgeLengthPrice);

def IntermSupport2 = Lowest(BandwidthC3, SqueezeLengthPrice);

def sqzTrigger = BandwidthC3 <= IntermSupport2;

def sqzLevel = if !sqzTrigger[1] and sqzTrigger then hl2

else if !sqzTrigger then Double.NaN

else sqzLevel[1];

plot Squeeze_Alert = sqzLevel;

Squeeze_Alert.SetPaintingStrategy(PaintingStrategy.POINTS);

Squeeze_Alert.SetLineWeight(3);

Squeeze_Alert.SetDefaultColor(Color.YELLOW);

#-----------------------------

#Yellow Candle_height (OB_OS)

#-----------------------------

def displace = 0;

def factorK2 = 3.25;

def lengthK2 = 20;

def price1 = open;

def trueRangeAverageType = AverageType.SIMPLE;

def ATR_length = 15;

def SMA_lengthS = 6;

input ATRPeriod2 = 5;

input ATRFactor2 = 1.5;

#input averageType = AverageType.WILDERS;####Use Simple instead of Wilders

def HiLo2 = Min(high - low, 1.5 * Average(high - low, ATRPeriod));

def HRef2 = if low <= high[1]

then high - close[1]

else (high - close[1]) - 0.5 * (low - high[1]);

def LRef2 = if high >= low[1]

then close[1] - low

else (close[1] - low) - 0.5 * (low[1] - high);

def loss2 = ATRFactor2 * MovingAverage(averageType, trueRange, ATRPeriod2);

def multiplier_factor = 1.25;

def valS = Average(price, SMA_lengthS);

def average_true_range = Average(TrueRange(high, close, low), length = ATR_length);

def Upper_BandS = valS[-displace] + multiplier_factor * average_true_range[-displace];

def Middle_BandS = valS[-displace];

def Lower_BandS = valS[-displace] - multiplier_factor * average_true_range[-displace];

def shiftK2 = factorK2 * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK2);

def averageK2 = MovingAverage(averageType, price, lengthK2);

def AvgK2 = averageK2[-displace];

def Upper_BandK2 = averageK2[-displace] + shiftK2[-displace];

def Lower_BandK2 = averageK2[-displace] - shiftK2[-displace];

def condition_BandRevDn = (Upper_BandS > Upper_BandK2);

def condition_BandRevUp = (Lower_BandS < Lower_BandK2);

def fastLength = 12;

def slowLength = 26;

def MACDLength = 9;

input MACD_AverageType = {SMA, default EMA};

def fastEMA = ExpAverage(price, fastLength);

def slowEMA = ExpAverage(price, slowLength);

def Value;

def Avg1;

switch (MACD_AverageType) {

case SMA:

Value = Average(price, fastLength) - Average(price, slowLength);

Avg1 = Average(Value, MACDLength);

case EMA:

Value = fastEMA - slowEMA;

Avg1 = ExpAverage(Value, MACDLength);

}

def Diff = Value - Avg1;

def MACDLevel = 0.0;

def Level = MACDLevel;

def condition1 = Value[1] <= Value;

def condition1D = Value[1] > Value;

#RSI

def RSI_length = 14;

def RSI_AverageType = AverageType.WILDERS;

def RSI_OB = 70;

def RSI_OS = 30;

def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length);

def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

def condition2 = (RSI[3] < RSI) is true or (RSI >= 80) is true;

def condition2D = (RSI[3] > RSI) is true or (RSI < 20) is true;

def conditionOB1 = RSI > RSI_OB;

def conditionOS1 = RSI < RSI_OS;

#MFI

def MFI_Length = 14;

def MFIover_Sold = 20;

def MFIover_Bought = 80;

def movingAvgLength = 1;

def MoneyFlowIndex = Average(MoneyFlow(high, close, low, volume, MFI_Length), movingAvgLength);

def MFIOverBought = MFIover_Bought;

def MFIOverSold = MFIover_Sold;

def condition3 = (MoneyFlowIndex[2] < MoneyFlowIndex) is true or (MoneyFlowIndex > 85) is true;

def condition3D = (MoneyFlowIndex[2] > MoneyFlowIndex) is true or (MoneyFlowIndex < 20) is true;

def conditionOB2 = MoneyFlowIndex > MFIover_Bought;

def conditionOS2 = MoneyFlowIndex < MFIover_Sold;

#Forecast

def na = Double.NaN;

def MidLine = 50;

def Momentum = MarketForecast().Momentum;

def NearT = MarketForecast().NearTerm;

def Intermed = MarketForecast().Intermediate;

def FOB = 80;

def FOS = 20;

def upperLine = 110;

def condition4 = (Intermed[1] <= Intermed) or (NearT >= MidLine);

def condition4D = (Intermed[1] > Intermed) or (NearT < MidLine);

def conditionOB3 = Intermed > FOB;

def conditionOS3 = Intermed < FOS;

def conditionOB4 = NearT > FOB;

def conditionOS4 = NearT < FOS;

#Change in Price

def lengthCIP = 5;

def CIP = (price - price[1]);

def AvgCIP = ExpAverage(CIP[-displace], lengthCIP);

def CIP_UP = AvgCIP > AvgCIP[1];

def CIP_DOWN = AvgCIP < AvgCIP[1];

def condition5 = CIP_UP;

def condition5D = CIP_DOWN;

#EMA_1

def EMA_length = 8;

def AvgExp = ExpAverage(price[-displace], EMA_length);

def condition6 = (price >= AvgExp) and (AvgExp[2] <= AvgExp);

def condition6D = (price < AvgExp) and (AvgExp[2] > AvgExp);

#EMA_2

def EMA_2length = 20;

def displace2 = 0;

def AvgExp2 = ExpAverage(price[-displace2], EMA_2length);

def condition7 = (price >= AvgExp2) and (AvgExp2[2] <= AvgExp);

def condition7D = (price < AvgExp2) and (AvgExp2[2] > AvgExp);

#DMI Oscillator

def DMI_length = 5;#Typically set to 10

input DMI_averageType = AverageType.WILDERS;

def diPlus = DMI(DMI_length, DMI_averageType)."DI+";

def diMinus = DMI(DMI_length, DMI_averageType)."DI-";

def Osc = diPlus - diMinus;

def Hist = Osc;

def ZeroLine = 0;

def condition8 = Osc >= ZeroLine;

def condition8D = Osc < ZeroLine;

#Trend_Periods

def TP_fastLength = 3;#Typically 7

def TP_slowLength = 4;#Typically 15

def Periods = Sign(ExpAverage(close, TP_fastLength) - ExpAverage(close, TP_slowLength));

def condition9 = Periods > 0;

def condition9D = Periods < 0;

#Polarized Fractal Efficiency

def PFE_length = 5;#Typically 10

def smoothingLength = 2.5;#Typically 5

def PFE_diff = close - close[PFE_length - 1];

def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / Sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1);

def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength);

def UpperLevel = 50;

def LowerLevel = -50;

def condition10 = PFE > 0;

def condition10D = PFE < 0;

def conditionOB5 = PFE > UpperLevel;

def conditionOS5 = PFE < LowerLevel;

#Bollinger Bands PercentB

input BBPB_averageType = AverageType.SIMPLE;

def BBPB_length = 20;#Typically 20

def Num_Dev_Dn = -2.0;

def Num_Dev_up = 2.0;

def BBPB_OB = 100;

def BBPB_OS = 0;

def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand;

def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand;

def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100;

def HalfLine = 50;

def UnitLine = 100;

def condition11 = PercentB > HalfLine;

def condition11D = PercentB < HalfLine;

def conditionOB6 = PercentB > BBPB_OB;

def conditionOS6 = PercentB < BBPB_OS;

def condition12 = (Upper_BandS[1] <= Upper_BandS) and (Lower_BandS[1] <= Lower_BandS);

def condition12D = (Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS);

#Klinger Histogram

def Klinger_Length = 13;

def KVOsc = KlingerOscillator(Klinger_Length).KVOsc;

def KVOH = KVOsc - Average(KVOsc, Klinger_Length);

def condition13 = (KVOH > 0);

def condition13D = (KVOH < 0);

#Projection Oscillator

def ProjectionOsc_length = 30;#Typically 10

def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price = high, length = ProjectionOsc_length));

def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price = low, length = ProjectionOsc_length));

def ProjectionOsc_diff = MaxBound - MinBound;

def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0;

def PROSC_OB = 80;

def PROSC_OS = 20;

def condition14 = PROSC > 50;

def condition14D = PROSC < 50;

def conditionOB7 = PROSC > PROSC_OB;

def conditionOS7 = PROSC < PROSC_OS;

#Trend Confirmation Calculator

#Confirmation_Factor range 1-15.

input Confirmation_Factor = 7;

#Use for testing conditions individually. Remove # from line below and change Confirmation_Factor to 1.

#def Agreement_Level = condition1;

def Agreement_LevelOB = 12;

def Agreement_LevelOS = 2;

def factorK = 2.0;

def lengthK = 20;

def shift = factorK * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK);

def averageK = MovingAverage(averageType, price, lengthK);

def AvgK = averageK[-displace];

def Upper_BandK = averageK[-displace] + shift[-displace];

def Lower_BandK = averageK[-displace] - shift[-displace];

def conditionK1UP = price >= Upper_BandK;

def conditionK2UP = (Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK);

def conditionK3DN = (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK);

def conditionK4DN = price < Lower_BandK;

def Agreement_Level = condition1 + condition2 + condition3 + condition4 + condition5 + condition6 + condition7 + condition8 + condition9 + condition10 + condition11 + condition12 + condition13 + condition14 + conditionK1UP + conditionK2UP;

def Agreement_LevelD = (condition1D + condition2D + condition3D + condition4D + condition5D + condition6D + condition7D + condition8D + condition9D + condition10D + condition11D + condition12D + condition13D + condition14D + conditionK3DN + conditionK4DN);

def Consensus_Level = Agreement_Level - Agreement_LevelD;

def UP2 = Consensus_Level >= 4;

def DOWN2 = Consensus_Level < -5;

def priceColor2 = if UP2 then 1

else if DOWN2 then -1

else priceColor2[1];

def Consensus_Level_OB = 14;

def Consensus_Level_OS = -12;

#Super_OB/OS Signal

def OB_Level = conditionOB1 + conditionOB2 + conditionOB3 + conditionOB4 + conditionOB5 + conditionOB6 + conditionOB7;

def OS_Level = conditionOS1 + conditionOS2 + conditionOS3 + conditionOS4 + conditionOS5 + conditionOS6 + conditionOS7;

def Consensus_Line = OB_Level - OS_Level;

def Zero_Line = 0;

def Super_OB = 4;

def Super_OS = -4;

def DOWN_OB = (Agreement_Level > Agreement_LevelOB) and (Consensus_Line > Super_OB) and (Consensus_Level > Consensus_Level_OB);

def UP_OS = (Agreement_Level < Agreement_LevelOS) and (Consensus_Line < Super_OS) and (Consensus_Level < Consensus_Level_OS);

def OS_Buy = UP_OS;

def OB_Sell = DOWN_OB;

def neutral = Consensus_Line < Super_OB and Consensus_Line > Super_OS;

input use_line_limits = yes;#Yes, plots line from/to; No, plot line across entire chart

input linefrom = 100;#Hint linefrom: limits how far line plots in candle area

input lineto = 12;#Hint lineto: limits how far into expansion the line will plot

def YHOB = if coloredCandlesOn and ((price1 > Upper_BandS) and (condition_BandRevDn)) then high else Double.NaN;

def YHOS = if coloredCandlesOn and ((price1 < Lower_BandS) and (condition_BandRevUp)) then high else Double.NaN;

def YLOB = if coloredCandlesOn and ((price1 > Upper_BandS) and (condition_BandRevDn)) then low else Double.NaN;

def YLOS = if coloredCandlesOn and ((price1 < Lower_BandS) and (condition_BandRevUp)) then low else Double.NaN;

#extend midline of yellow candle

plot YCOB = if !IsNaN(YHOB) then hl2 else Double.NaN;

YCOB.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

YCOB.SetDefaultColor(Color.GREEN);

def YHextOB = if IsNaN(YCOB) then YHextOB[1] else YCOB;

plot YHextlineOB = YHextOB;

YHextlineOB.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

YHextlineOB.SetDefaultColor(Color.ORANGE);

YHextlineOB.SetLineWeight(2);

plot YCOS = if !IsNaN(YHOS) then hl2 else Double.NaN;

YCOS.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

YCOS.SetDefaultColor(Color.GREEN);

def YHextOS = if IsNaN(YCOS) then YHextOS[1] else YCOS;

plot YHextlineOS = YHextOS;

YHextlineOS.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

YHextlineOS.SetDefaultColor(Color.LIGHT_GREEN);

YHextlineOS.SetLineWeight(2);

def YC = coloredCandlesOn and priceColor2 == 1 and price1 > Upper_BandS and condition_BandRevDn;

#Additional Signals

input showCloud = yes;

#AddCloud(if showCloud and condition_BandRevUp then Lower_BandK2 else Double.NaN, Lower_BandS, Color.LIGHT_GREEN, Color.CURRENT);

#AddCloud(if showCloud and condition_BandRevDn then Upper_BandS else Double.NaN, Upper_BandK2, Color.LIGHT_RED, Color.CURRENT);

# Identify Consolidation

def HH = Highest(high[1], BarsUsedForRange);

def LL = Lowest(low[1], BarsUsedForRange);

def maxH = Highest(HH, BarsRequiredToRemainInRange);

def maxL = Lowest(LL, BarsRequiredToRemainInRange);

def HHn = if maxH == maxH[1] or maxL == maxL then maxH else HHn[1];

def LLn = if maxH == maxH[1] or maxL == maxL then maxL else LLn[1];

def Bh = if high <= HHn and HHn == HHn[1] then HHn else Double.NaN;

def Bl = if low >= LLn and LLn == LLn[1] then LLn else Double.NaN;

def CountH = if IsNaN(Bh) or IsNaN(Bl) then 2 else CountH[1] + 1;

def CountL = if IsNaN(Bh) or IsNaN(Bl) then 2 else CountL[1] + 1;

def ExpH = if BarNumber() == 1 then Double.NaN else

if CountH[-BarsRequiredToRemainInRange] >= BarsRequiredToRemainInRange then HHn[-BarsRequiredToRemainInRange] else

if high <= ExpH[1] then ExpH[1] else Double.NaN;

def ExpL = if BarNumber() == 1 then Double.NaN else

if CountL[-BarsRequiredToRemainInRange] >= BarsRequiredToRemainInRange then LLn[-BarsRequiredToRemainInRange] else

if low >= ExpL[1] then ExpL[1] else Double.NaN;

# Plot the High and Low of the Box; Paint Cloud

def BoxHigh = if ((DOWN_OB) or (Upper_BandS crosses above Upper_BandK2) or (condition_BandRevDn) and (high > high[1]) and ((price > Upper_BandK2) or (price > Upper_BandS))) then Highest(ExpH) else Double.NaN;

def BoxLow = if (DOWN_OB) or ((Upper_BandS crosses above Upper_BandK2)) then Lowest(low) else Double.NaN;

def BoxHigh2 = if ((UP_OS) or ((Lower_BandS crosses below Lower_BandK2))) then Highest(ExpH) else Double.NaN;

#def BH2 = if !IsNaN(BoxHigh2) then high else Double.NaN;

#def BH2ext = if IsNaN(BH2) then BH2ext[1] else BH2;

#def BH2extline = BH2ext;

#plot H_BH2extline = Lowest(BH2extline, 1);

#H_BH2extline.SetDefaultColor(Color.GREEN);

def BoxLow2 = if ((UP_OS) or (Lower_BandS crosses below Lower_BandK2) or (condition_BandRevUp) and (low < low[1]) and ((price < Lower_BandK2) or (price < Lower_BandS))) or ((UP_OS[1]) and (low < low[1])) then Lowest(low) else Double.NaN;

# extend the current YCHigh line to the right edge of the chart

def BH1 = if !IsNaN(BoxHigh) then high else Double.NaN;

def BH1ext = if IsNaN(BH1) then BH1ext[1] else BH1;

def BH1extline = BH1ext;

def BL1 = if !IsNaN(BoxLow) then low else Double.NaN;

#BL1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#BL1.SetDefaultColor(Color.RED);

def BL1ext = if IsNaN(BL1) then BL1ext[1] else BL1;

plot BL1extline = BL1ext;

BL1extline.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

BL1extline.SetDefaultColor(Color.RED);

BL1extline.SetLineWeight(1);

def BH2 = if !IsNaN(BoxHigh2) then high else Double.NaN;

#BH2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#BH2.SetDefaultColor(Color.GREEN);

def BH2ext = if IsNaN(BH2) then BH2ext[1] else BH2;

def BH2extline = BH2ext;

#BH2extline.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#BH2extline.SetDefaultColor(Color.GREEN);

#BH2extline.SetLineWeight(3);

def BL2 = if !IsNaN(BoxLow2) then low else Double.NaN;

#BL2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#BL2.SetDefaultColor(Color.RED);

def BL2ext = if IsNaN(BL2) then BL2ext[1] else BL2;

plot BL2extline = BL2ext;

BL2extline.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

BL2extline.SetDefaultColor(Color.GREEN);

BL2extline.SetLineWeight(1);

plot H_BH1extline = Highest(BH1extline, 1);

H_BH1extline.SetDefaultColor(Color.RED);

plot L_BL1extline = Highest(BL1extline, 1);

L_BL1extline.SetDefaultColor(Color.RED);

plot H_BH2extline = Lowest(BH2extline, 1);

H_BH2extline.SetDefaultColor(Color.Green);

plot L_BL2extline = Lowest(BL2extline, 1);

L_BL2extline.SetDefaultColor(Color.GREEN);

#plot L_BL1extline = Highest(BL1extline, 1);

# L_BL1extline.SetDefaultColor(Color.Red);

AddCloud(if showCloud and !HideCloud then BH1extline else Double.NaN, BL1extline, Color.RED, Color.GRAY);

AddCloud(if showCloud and !HideCloud then BH2extline else Double.NaN, BL2extline, Color.GREEN, Color.GRAY);

script WMA_Smooth {

input price = hl2;

plot smooth = (4 * price

+ 3 * price[1]

+ 2 * price[2]

+ price[3]) / 10;

}

script Phase_Accumulation {

input price = hl2;

rec Smooth;

rec Detrender;

rec Period;

rec Q1;

rec I1;

rec I1p;

rec Q1p;

rec Phase1;

rec Phase;

rec DeltaPhase;

rec DeltaPhase1;

rec InstPeriod1;

rec InstPeriod;

def CorrectionFactor;

if BarNumber() <= 5

then {

Period = 0;

Smooth = 0;

Detrender = 0;

CorrectionFactor = 0;

Q1 = 0;

I1 = 0;

Q1p = 0;

I1p = 0;

Phase = 0;

Phase1 = 0;

DeltaPhase1 = 0;

DeltaPhase = 0;

InstPeriod = 0;

InstPeriod1 = 0;

} else {

CorrectionFactor = 0.075 * Period[1] + 0.54;

# Smooth and detrend my smoothed signal:

Smooth = WMA_Smooth(price);

Detrender = ( 0.0962 * Smooth

+ 0.5769 * Smooth[2]

- 0.5769 * Smooth[4]

- 0.0962 * Smooth[6] ) * CorrectionFactor;

# Compute Quadrature and Phase of Detrended signal:

Q1p = ( 0.0962 * Detrender

+ 0.5769 * Detrender[2]

- 0.5769 * Detrender[4]

- 0.0962 * Detrender[6] ) * CorrectionFactor;

I1p = Detrender[3];

# Smooth out Quadrature and Phase:

I1 = 0.15 * I1p + 0.85 * I1p[1];

Q1 = 0.15 * Q1p + 0.85 * Q1p[1];

# Determine Phase

if I1 != 0

then {

# Normally, ATAN gives results from -pi/2 to pi/2.

# We need to map this to circular coordinates 0 to 2pi

if Q1 >= 0 and I1 > 0

then { # Quarant 1

Phase1 = ATan(AbsValue(Q1 / I1));

} else if Q1 >= 0 and I1 < 0

then { # Quadrant 2

Phase1 = Double.Pi - ATan(AbsValue(Q1 / I1));

} else if Q1 < 0 and I1 < 0

then { # Quadrant 3

Phase1 = Double.Pi + ATan(AbsValue(Q1 / I1));

} else { # Quadrant 4

Phase1 = 2 * Double.Pi - ATan(AbsValue(Q1 / I1));

}

} else if Q1 > 0

then { # I1 == 0, Q1 is positive

Phase1 = Double.Pi / 2;

} else if Q1 < 0

then { # I1 == 0, Q1 is negative

Phase1 = 3 * Double.Pi / 2;

} else { # I1 and Q1 == 0

Phase1 = 0;

}

# Convert phase to degrees

Phase = Phase1 * 180 / Double.Pi;

if Phase[1] < 90 and Phase > 270

then {

# This occurs when there is a big jump from 360-0

DeltaPhase1 = 360 + Phase[1] - Phase;

} else {

DeltaPhase1 = Phase[1] - Phase;

}

# Limit our delta phases between 7 and 60

if DeltaPhase1 < 7

then {

DeltaPhase = 7;

} else if DeltaPhase1 > 60

then {

DeltaPhase = 60;

} else {

DeltaPhase = DeltaPhase1;

}

# Determine Instantaneous period:

InstPeriod1 =

-1 * (fold i = 0 to 40 with v=0 do

if v < 0 then

v

else if v > 360 then

-i

else

v + GetValue(DeltaPhase, i, 41)

);

if InstPeriod1 <= 0

then {

InstPeriod = InstPeriod[1];

} else {

InstPeriod = InstPeriod1;

}

Period = 0.25 * InstPeriod + 0.75 * Period[1];

}

plot DC = Period;

}

script Ehler_MAMA {

input price = hl2;

input FastLimit = 0.5;

input SlowLimit = 0.05;

rec Period;

rec Period_raw;

rec Period_cap;

rec Period_lim;

rec Smooth;

rec Detrender;

rec I1;

rec Q1;

rec jI;

rec jQ;

rec I2;

rec Q2;

rec I2_raw;

rec Q2_raw;

rec Phase;

rec DeltaPhase;

rec DeltaPhase_raw;

rec alpha;

rec alpha_raw;

rec Re;

rec Im;

rec Re_raw;

rec Im_raw;

rec SmoothPeriod;

rec vmama;

rec vfama;

def CorrectionFactor = Phase_Accumulation(price).CorrectionFactor;

if BarNumber() <= 5

then {

Smooth = 0;

Detrender = 0;

Period = 0;

Period_raw = 0;

Period_cap = 0;

Period_lim = 0;

I1 = 0;

Q1 = 0;

I2 = 0;

Q2 = 0;

jI = 0;

jQ = 0;

I2_raw = 0;

Q2_raw = 0;

Re = 0;

Im = 0;

Re_raw = 0;

Im_raw = 0;

SmoothPeriod = 0;

Phase = 0;

DeltaPhase = 0;

DeltaPhase_raw = 0;

alpha = 0;

alpha_raw = 0;

vmama = 0;

vfama = 0;

} else {

# Smooth and detrend my smoothed signal:

Smooth = WMA_Smooth(price);

Detrender = ( 0.0962 * Smooth

+ 0.5769 * Smooth[2]

- 0.5769 * Smooth[4]

- 0.0962 * Smooth[6] ) * CorrectionFactor;

Q1 = ( 0.0962 * Detrender

+ 0.5769 * Detrender[2]

- 0.5769 * Detrender[4]

- 0.0962 * Detrender[6] ) * CorrectionFactor;

I1 = Detrender[3];

jI = ( 0.0962 * I1

+ 0.5769 * I1[2]

- 0.5769 * I1[4]

- 0.0962 * I1[6] ) * CorrectionFactor;

jQ = ( 0.0962 * Q1

+ 0.5769 * Q1[2]

- 0.5769 * Q1[4]

- 0.0962 * Q1[6] ) * CorrectionFactor;

# This is the complex conjugate

I2_raw = I1 - jQ;

Q2_raw = Q1 + jI;

I2 = 0.2 * I2_raw + 0.8 * I2_raw[1];

Q2 = 0.2 * Q2_raw + 0.8 * Q2_raw[1];

Re_raw = I2 * I2[1] + Q2 * Q2[1];

Im_raw = I2 * Q2[1] - Q2 * I2[1];

Re = 0.2 * Re_raw + 0.8 * Re_raw[1];

Im = 0.2 * Im_raw + 0.8 * Im_raw[1];

# Compute the phase

if Re != 0 and Im != 0

then {

Period_raw = 2 * Double.Pi / ATan(Im / Re);

} else {

Period_raw = 0;

}

if Period_raw > 1.5 * Period_raw[1]

then {

Period_cap = 1.5 * Period_raw[1];

} else if Period_raw < 0.67 * Period_raw[1] {

Period_cap = 0.67 * Period_raw[1];

} else {

Period_cap = Period_raw;

}

if Period_cap < 6

then {

Period_lim = 6;

} else if Period_cap > 50

then {

Period_lim = 50;

} else {

Period_lim = Period_cap;

}

Period = 0.2 * Period_lim + 0.8 * Period_lim[1];

SmoothPeriod = 0.33 * Period + 0.67 * SmoothPeriod[1];

if I1 != 0

then {

Phase = ATan(Q1 / I1);

} else if Q1 > 0

then { # Quadrant 1:

Phase = Double.Pi / 2;

} else if Q1 < 0

then { # Quadrant 4:

Phase = -Double.Pi / 2;

} else { # Both numerator and denominator are 0.

Phase = 0;

}

DeltaPhase_raw = Phase[1] - Phase;

if DeltaPhase_raw < 1

then {

DeltaPhase = 1;

} else {

DeltaPhase = DeltaPhase_raw;

}

alpha_raw = FastLimit / DeltaPhase;

if alpha_raw < SlowLimit

then {

alpha = SlowLimit;

} else {

alpha = alpha_raw;

}

vmama = alpha * price + (1 - alpha) * vmama[1];

vfama = 0.5 * alpha * vmama + (1 - 0.5 * alpha) * vfama[1];

}

plot MAMA = vmama;

plot FAMA = vfama;

}

input price2 = hl2;

input FastLimit = 0.5;

input SlowLimit = 0.05;

def MAMA = Ehler_MAMA(price2, FastLimit, SlowLimit).MAMA;

def FAMA = Ehler_MAMA(price2, FastLimit, SlowLimit).FAMA;

def Crossing = Crosses((MAMA < FAMA), yes);

#Crossing.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

def Crossing1 = Crosses((MAMA > FAMA), yes);

#Crossing1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

AddLabel(yes, Concat("MAMA: ", Concat("",

if MAMA > FAMA then "Bull" else "Bear")),

if MAMA > FAMA then Color.GREEN else Color.RED);

##################################

plot C3_MF_Line = (MAMA + FAMA) / 2;

C3_MF_Line.SetPaintingStrategy(PaintingStrategy.LINE);

C3_MF_Line.SetLineWeight(3);

C3_MF_Line.AssignValueColor(if ((priceColor2 == 1) and (price1 > Upper_BandS) and (condition_BandRevDn)) then Color.YELLOW else if ((priceColor2 == -1) and (price1 < Lower_BandS) and (condition_BandRevUp)) then Color.YELLOW else if priceColor2 == -1 then Color.RED else if (priceColor2 == 1) then Color.GREEN else Color.CURRENT);

def C3_MF_UP = C3_MF_Line > C3_MF_Line[1];

def C3_MF_DN = C3_MF_Line < C3_MF_Line[1];

def priceColor9 = if C3_MF_UP then 1

else if C3_MF_DN then -1

else priceColor9[1];

def MF_UP = FAMA < MAMA;

def MF_DN = FAMA > MAMA;

def priceColor10 = if MF_UP then 1

else if MF_DN then -1

else priceColor10[1];

input extension_length_limited_to = 10;

def lastbar = if isnan(close[-1]) and !isnan(close) then barnumber() else double.nan;

#def inertline = inertiaall(C3_MF_Line,2);

#def EXT_C3_MF = if !IsNaN(close()) then inertline else EXT_C3_MF[1] + ((EXT_C3_MF[1] - EXT_C3_MF[2]) / (2 - 1));

#plot extension = if barnumber()<=highestall(lastbar)+ extension_length_limited_to then EXT_C3_MF else double.nan;

#extension.SetDefaultColor(Color.white);

####################################################################################################################################################

#EMA's

input length8 = 10;

input length9 = 35;

input show_ema_cloud = yes;

plot AvgExp8 = ExpAverage(price[-displace], length8);

def UPD = AvgExp8[1] < AvgExp8;

AvgExp8.SetStyle(Curve.SHORT_DASH);

#AvgExp8.SetLineWeight(1);

plot AvgExp9 = ExpAverage(price[-displace], length9);

def UPW = AvgExp9[1] < AvgExp9;

AvgExp9.SetStyle(Curve.SHORT_DASH);

#AvgExp9.SetLineWeight(1);

def Below = AvgExp8 < AvgExp9;

def Spark = UPD + UPW + Below;

def UPEMA = AvgExp8[1] < AvgExp8;

def DOWNEMA = AvgExp8[1] > AvgExp8;

AvgExp8.AssignValueColor(if UPEMA then Color.LIGHT_GREEN else if DOWNEMA then Color.RED else Color.YELLOW);

def UPEMA2 = AvgExp9[1] < AvgExp9;

def DOWNEMA2 = AvgExp9[1] > AvgExp9;

AvgExp9.AssignValueColor(if UPEMA2 then Color.LIGHT_GREEN else if DOWNEMA2 then Color.RED else Color.YELLOW);

AddCloud(if show_ema_cloud and (AvgExp9 > AvgExp8) then AvgExp9 else Double.NaN, AvgExp8, Color.LIGHT_RED, Color.CURRENT);

AddCloud(if show_ema_cloud and (AvgExp8 > AvgExp9) then AvgExp8 else Double.NaN, AvgExp9, Color.LIGHT_GREEN, Color.CURRENT);

def UP8 = UPEMA and UPEMA2;

def DOWN8 = DOWNEMA and DOWNEMA2;

def priceColor8 = if UP8 then 1

else if DOWN8 then -1

else 0;

def UpCalc = (priceColor == 1) + (priceColor2 == 1) + (priceColor8 == 1) + (priceColor10 == 1);

def CandleColor = if (UpCalc >= 3) then 1

else if (UpCalc == 0) then -1

else if (priceColor2 == 1) then 1

else if (priceColor2 == -1) then -1

else CandleColor[1];

AssignPriceColor(if coloredCandlesOn and (CandleColor == 1) then Color.GREEN else if coloredCandlesOn and (CandleColor == -1) then Color.RED else Color.GRAY);

#Labels

def Buy = UP_OS;

def Sell = DOWN_OB;

def conditionLTB = (ConditionK2UP and (Consensus_Level < 0));

def conditionLTS = (ConditionK3DN and (Consensus_Level > 0));

def conditionBO = ((Upper_BandS[1] < Upper_BandS) and (Lower_BandS[1] < Lower_BandS)) and ((Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK));

def conditionBD = ((Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS) and (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK));

def MomentumUP = Consensus_Level[1] < Consensus_Level;

def MomentumDOWN = Consensus_Level[1] > Consensus_Level;

def Squeeze_Signal = !IsNaN(Squeeze_Alert);

def conditionOB = (Consensus_Level >= 12) and (Consensus_Line >= 4);

def conditionOS = (Consensus_Level <= -12) and (Consensus_Line <= -3);

AddLabel(yes, if conditionLTB then "BULLISH_LOOK_To_BUY" else if conditionLTS then "BEARISH_LOOK_TO_SELL" else if conditionK2UP then "TREND_BULLISH" else if conditionK3DN then "TREND_BEARISH" else "TREND_CONSOLIDATION", if conditionLTB then Color.GREEN else if conditionLTS then Color.RED else if conditionK2UP then Color.WHITE else if conditionK3DN then Color.DARK_GRAY else Color.GRAY);

AddLabel(yes, if conditionBD then "BREAKDOWN" else if conditionBO then "BREAKOUT" else "NO_BREAK", if conditionBD then Color.RED else if conditionBO then Color.GREEN else Color.GRAY);

AddLabel(yes, if (Spark == 3) then "SPARK UP = " + Round(Spark, 1) else if (Spark == 0) then "SPARK DOWN = " + Round(Spark, 1) else "SPARK = " + Round(Spark, 1), if (Spark == 3) then Color.YELLOW else if (Spark == 2) then Color.GREEN else if (Spark == 0) then Color.RED else Color.GRAY);

AddLabel(yes, "SQUEEZE ALERT", if Squeeze_Signal then Color.YELLOW else Color.GRAY);

AddLabel(yes, if MomentumUP then "Consensus_Increasing = " + Round(Consensus_Level, 1) else if MomentumUP or MomentumDOWN and conditionOB then "Consensus_OVERBOUGHT = " + Round(Consensus_Level, 1) else if MomentumDOWN then "Consensus_Decreasing = " + Round(Consensus_Level, 1) else if MomentumUP or MomentumDOWN and conditionOS then "Consensus_OVERSOLD = " + Round(Consensus_Level, 1) else "Consensus = " + Round(Consensus_Level, 1), if conditionOB then Color.RED else if conditionOS then Color.GREEN else Color.GRAY);Here is the code for C3_Max_v2_SPX_Forex.

Code:

#C3_Max_v2_SPX_Forex Created by Christopher84 03/14/2021

# Based off of the Confirmation Candles Study. Main difference is that CC Candles weigh factors of positive

# and negative price movement to create the Consensus_Level. The Consensus_Level is considered positive if

# above zero and negative if below zero.

declare upper;

input price = CLOSE;

input ShortLength1 = 5;

input ShortLength2 = 14;

input ShortLength3 = 5;

input LongLength1 = 12;

input LongLength2 = 55;

input LongLength3 = 7;

input coloredCandlesOn = yes;

# Momentum Oscillators

def MS = Average(Average(price, ShortLength1) - Average(price, ShortLength2), ShortLength3);

def MS2 = Average(Average(price, LongLength1) - Average(price, LongLength2), LongLength3);

# Wave A

def MSGreens = If (MS >= 0, MS, 0);

def MSReds = If (MS < 0, MS, 0);

# Wave C

def MS2Blues = If (MS2 >= 0, MS2, 0);

def MS2Yellows = If (MS2 < 0, MS2, 0);

def MayhemBullish = MSGreens > MSGreens[1] and MS2Blues > MS2Blues[1];

def MayhemBearish = MSReds < MSReds[1] and MS2Yellows < MS2Yellows[1];

def MS_Pos = MSGreens;

def MS_Neg = MSReds;

def MS2_Pos = MS2Blues;

def MS2_Neg = MS2Yellows;

# Squeeze Indicator

def length = 20;

def nK = 1.5;

def nBB = 2.0;

def BBHalfWidth = StDev(price, length);

def KCHalfWidth = nK * Average(TrueRange(high, close, low), length);

def isSqueezed = nBB * BBHalfWidth / KCHalfWidth < 1;

def BBS_Ind = If(isSqueezed, 0, Double.NaN);

# Bollinger Resolution

def BBSMA = Average(price, length);

def BBSMAL = BBSMA + (-nBB * BBHalfWidth);

def BBSMAU = BBSMA + (nBB * BBHalfWidth);

def PerB = RoundUp((price - BBSMAL) / (BBSMAU - BBSMAL) * 100, 0);

AddLabel(yes, Concat("%B: ", PerB), if PerB < 0 then Color.YELLOW else if PerB > 0 and PerB[1] < 0 then Color.GREEN else Color.WHITE);

# Parabolic SAR Signal

def accelerationFactor = 0.0275;

def accelerationLimit = 0.2;

def SAR = ParabolicSAR(accelerationFactor = accelerationFactor, accelerationLimit = accelerationLimit);

def bearishCross = Crosses(SAR, price, CrossingDirection.ABOVE);

plot signalDown = bearishCross;#If(bearishCross, 0, Double.NaN);

signalDown.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

signalDown.SetLineWeight(3);

signalDown.AssignValueColor(Color.DOWNTICK);

def bullishCross = Crosses(SAR, price, CrossingDirection.BELOW);

plot signalUp = bullishCross;#If(bullishCross, 0, Double.NaN);

signalUp.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

signalUp.SetLineWeight(3);

signalUp.AssignValueColor(Color.UPTICK);

def UP = bullishCross;

def DOWN = bearishCross;

def priceColor = if UP then 1

else if DOWN then -1

else priceColor[1];

####################################################################################################################################################

#OB_OS_Levels_v5

def BarsUsedForRange = 2;

def BarsRequiredToRemainInRange = 2;

def TargetMultiple = 0.5;

def ColorPrice = yes;

def HideTargets = no;

def HideBalance = no;

def HideBoxLines = no;

def HideCloud = no;

def HideLabels = no;

#--------------

#Squeeze Alert

#--------------

#Squeeze Dots Created 04/28/2021 by Christopher84

input ATRPeriod = 5;

input ATRFactor = 2.0;

def HiLo = Min(high - low, 1.5 * Average(high - low, ATRPeriod));

def HRef = if low <= high[1]

then high - close[1]

else (high - close[1]) - 0.5 * (low - high[1]);

def LRef = if high >= low[1]

then close[1] - low

else (close[1] - low) - 0.5 * (low[1] - high);

input trailType = {default modified, unmodified};

def trueRange;

switch (trailType) {

case modified:

trueRange = Max(HiLo, Max(HRef, LRef));

case unmodified:

trueRange = TrueRange(high, close, low);

}

input averageType = AverageType.SIMPLE;

input firstTrade = {default long, short};

#input averageType = AverageType.WILDERS;####Use Simple instead of Wilders

def loss = ATRFactor * MovingAverage(averageType, trueRange, ATRPeriod);

def state = {default init, long, short};

def trail;

switch (state[1]) {

case init:

if (!IsNaN(loss)) {

switch (firstTrade) {

case long:

state = state.long;

trail = close - loss;

case short:

state = state.short;

trail = close + loss;

}

} else {

state = state.init;

trail = Double.NaN;

}

case long:

if (close > trail[1]) {

state = state.long;

trail = Max(trail[1], close - loss);

} else {

state = state.short;

trail = close + loss;

}

case short:

if (close < trail[1]) {

state = state.short;

trail = Min(trail[1], close + loss);

} else {

state = state.long;

trail = close - loss;

}

}

def TrailingStop = trail;

def H = Highest(TrailingStop, 12);

def L = Lowest(TrailingStop, 12);

def BulgeLengthPrice = 100;

def SqueezeLengthPrice = 100;

def BandwidthC3 = (H - L);

def IntermResistance2 = Highest(BandwidthC3, BulgeLengthPrice);

def IntermSupport2 = Lowest(BandwidthC3, SqueezeLengthPrice);

def sqzTrigger = BandwidthC3 <= IntermSupport2;

def sqzLevel = if !sqzTrigger[1] and sqzTrigger then hl2

else if !sqzTrigger then Double.NaN

else sqzLevel[1];

plot Squeeze_Alert = sqzLevel;

Squeeze_Alert.SetPaintingStrategy(PaintingStrategy.POINTS);

Squeeze_Alert.SetLineWeight(3);

Squeeze_Alert.SetDefaultColor(Color.YELLOW);

#-----------------------------

#Yellow Candle_height (OB_OS)

#-----------------------------

def displace = 0;

def factorK2 = 3.25;

def lengthK2 = 20;

def price1 = open;

def trueRangeAverageType = AverageType.SIMPLE;

def ATR_length = 15;

def SMA_lengthS = 6;

input ATRPeriod2 = 5;

input ATRFactor2 = 1.5;

#input averageType = AverageType.WILDERS;####Use Simple instead of Wilders

def HiLo2 = Min(high - low, 1.5 * Average(high - low, ATRPeriod));

def HRef2 = if low <= high[1]

then high - close[1]

else (high - close[1]) - 0.5 * (low - high[1]);

def LRef2 = if high >= low[1]

then close[1] - low

else (close[1] - low) - 0.5 * (low[1] - high);

def loss2 = ATRFactor2 * MovingAverage(averageType, trueRange, ATRPeriod2);

def multiplier_factor = 1.25;

def valS = Average(price, SMA_lengthS);

def average_true_range = Average(TrueRange(high, close, low), length = ATR_length);

def Upper_BandS = valS[-displace] + multiplier_factor * average_true_range[-displace];

def Middle_BandS = valS[-displace];

def Lower_BandS = valS[-displace] - multiplier_factor * average_true_range[-displace];

def shiftK2 = factorK2 * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK2);

def averageK2 = MovingAverage(averageType, price, lengthK2);

def AvgK2 = averageK2[-displace];

def Upper_BandK2 = averageK2[-displace] + shiftK2[-displace];

def Lower_BandK2 = averageK2[-displace] - shiftK2[-displace];

def condition_BandRevDn = (Upper_BandS > Upper_BandK2);

def condition_BandRevUp = (Lower_BandS < Lower_BandK2);

def fastLength = 12;

def slowLength = 26;

def MACDLength = 9;

input MACD_AverageType = {SMA, default EMA};

def fastEMA = ExpAverage(price, fastLength);

def slowEMA = ExpAverage(price, slowLength);

def Value;

def Avg1;

switch (MACD_AverageType) {

case SMA:

Value = Average(price, fastLength) - Average(price, slowLength);

Avg1 = Average(Value, MACDLength);

case EMA:

Value = fastEMA - slowEMA;

Avg1 = ExpAverage(Value, MACDLength);

}

def Diff = Value - Avg1;

def MACDLevel = 0.0;

def Level = MACDLevel;

def condition1 = Value[1] <= Value;

def condition1D = Value[1] > Value;

#RSI

def RSI_length = 14;

def RSI_AverageType = AverageType.WILDERS;

def RSI_OB = 70;

def RSI_OS = 30;

def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length);

def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

def condition2 = (RSI[3] < RSI) is true or (RSI >= 80) is true;

def condition2D = (RSI[3] > RSI) is true or (RSI < 20) is true;

def conditionOB1 = RSI > RSI_OB;

def conditionOS1 = RSI < RSI_OS;

#MFI

#def MFI_Length = 14;

#def MFIover_Sold = 20;

#def MFIover_Bought = 80;

#def movingAvgLength = 1;

#def MoneyFlowIndex = Average(MoneyFlow(high, close, low, volume, MFI_Length), movingAvgLength);

#def MFIOverBought = MFIover_Bought;

#def MFIOverSold = MFIover_Sold;

#def condition3 = (MoneyFlowIndex[2] < MoneyFlowIndex) is true or (MoneyFlowIndex > 85) is true;

#def condition3D = (MoneyFlowIndex[2] > MoneyFlowIndex) is true or (MoneyFlowIndex < 20) is true;

#def conditionOB2 = MoneyFlowIndex > MFIover_Bought;

#def conditionOS2 = MoneyFlowIndex < MFIover_Sold;

#Forecast

def na = Double.NaN;

def MidLine = 50;

def Momentum = MarketForecast().Momentum;

def NearT = MarketForecast().NearTerm;

def Intermed = MarketForecast().Intermediate;

def FOB = 80;

def FOS = 20;

def upperLine = 110;

def condition4 = (Intermed[1] <= Intermed) or (NearT >= MidLine);

def condition4D = (Intermed[1] > Intermed) or (NearT < MidLine);

def conditionOB3 = Intermed > FOB;

def conditionOS3 = Intermed < FOS;

def conditionOB4 = NearT > FOB;

def conditionOS4 = NearT < FOS;

#Change in Price

def lengthCIP = 5;

def CIP = (price - price[1]);

def AvgCIP = ExpAverage(CIP[-displace], lengthCIP);

def CIP_UP = AvgCIP > AvgCIP[1];

def CIP_DOWN = AvgCIP < AvgCIP[1];

def condition5 = CIP_UP;

def condition5D = CIP_DOWN;

#EMA_1

def EMA_length = 8;

def AvgExp = ExpAverage(price[-displace], EMA_length);

def condition6 = (price >= AvgExp) and (AvgExp[2] <= AvgExp);

def condition6D = (price < AvgExp) and (AvgExp[2] > AvgExp);

#EMA_2

def EMA_2length = 20;

def displace2 = 0;

def AvgExp2 = ExpAverage(price[-displace2], EMA_2length);

def condition7 = (price >= AvgExp2) and (AvgExp2[2] <= AvgExp);

def condition7D = (price < AvgExp2) and (AvgExp2[2] > AvgExp);

#DMI Oscillator

def DMI_length = 5;#Typically set to 10

input DMI_averageType = AverageType.WILDERS;

def diPlus = DMI(DMI_length, DMI_averageType)."DI+";

def diMinus = DMI(DMI_length, DMI_averageType)."DI-";

def Osc = diPlus - diMinus;

def Hist = Osc;

def ZeroLine = 0;

def condition8 = Osc >= ZeroLine;

def condition8D = Osc < ZeroLine;

#Trend_Periods

def TP_fastLength = 3;#Typically 7

def TP_slowLength = 4;#Typically 15

def Periods = Sign(ExpAverage(close, TP_fastLength) - ExpAverage(close, TP_slowLength));

def condition9 = Periods > 0;

def condition9D = Periods < 0;

#Polarized Fractal Efficiency

def PFE_length = 5;#Typically 10

def smoothingLength = 2.5;#Typically 5

def PFE_diff = close - close[PFE_length - 1];

def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / Sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1);

def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength);

def UpperLevel = 50;

def LowerLevel = -50;

def condition10 = PFE > 0;

def condition10D = PFE < 0;

def conditionOB5 = PFE > UpperLevel;

def conditionOS5 = PFE < LowerLevel;

#Bollinger Bands PercentB

input BBPB_averageType = AverageType.SIMPLE;

def BBPB_length = 20;#Typically 20

def Num_Dev_Dn = -2.0;

def Num_Dev_up = 2.0;

def BBPB_OB = 100;

def BBPB_OS = 0;

def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand;

def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand;

def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100;

def HalfLine = 50;

def UnitLine = 100;

def condition11 = PercentB > HalfLine;

def condition11D = PercentB < HalfLine;

def conditionOB6 = PercentB > BBPB_OB;

def conditionOS6 = PercentB < BBPB_OS;

def condition12 = (Upper_BandS[1] <= Upper_BandS) and (Lower_BandS[1] <= Lower_BandS);

def condition12D = (Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS);

#Klinger Histogram

#def Klinger_Length = 13;

#def KVOsc = KlingerOscillator(Klinger_Length).KVOsc;

#def KVOH = KVOsc - Average(KVOsc, Klinger_Length);

#def condition13 = (KVOH > 0);

#def condition13D = (KVOH < 0);

#Projection Oscillator

def ProjectionOsc_length = 30;#Typically 10

def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price = high, length = ProjectionOsc_length));

def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price = low, length = ProjectionOsc_length));

def ProjectionOsc_diff = MaxBound - MinBound;

def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0;

def PROSC_OB = 80;

def PROSC_OS = 20;

def condition14 = PROSC > 50;

def condition14D = PROSC < 50;

def conditionOB7 = PROSC > PROSC_OB;

def conditionOS7 = PROSC < PROSC_OS;

#Trend Confirmation Calculator

#Confirmation_Factor range 1-15.

input Confirmation_Factor = 7;

#Use for testing conditions individually. Remove # from line below and change Confirmation_Factor to 1.

#def Agreement_Level = condition1;

def Agreement_LevelOB = 12;

def Agreement_LevelOS = 2;

def factorK = 2.0;

def lengthK = 20;

def shift = factorK * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK);

def averageK = MovingAverage(averageType, price, lengthK);

def AvgK = averageK[-displace];

def Upper_BandK = averageK[-displace] + shift[-displace];

def Lower_BandK = averageK[-displace] - shift[-displace];

def conditionK1UP = price >= Upper_BandK;

def conditionK2UP = (Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK);

def conditionK3DN = (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK);

def conditionK4DN = price < Lower_BandK;

def Agreement_Level = condition1 + condition2 + condition4 + condition5 + condition6 + condition7 + condition8 + condition9 + condition10 + condition11 + condition12 + condition14 + conditionK1UP + conditionK2UP;

def Agreement_LevelD = (condition1D + condition2D + condition4D + condition5D + condition6D + condition7D + condition8D + condition9D + condition10D + condition11D + condition12D + condition14D + conditionK3DN + conditionK4DN);

def Consensus_Level = Agreement_Level - Agreement_LevelD;

def UP2 = Consensus_Level >= 4;

def DOWN2 = Consensus_Level < -5;

def priceColor2 = if UP2 then 1

else if DOWN2 then -1

else priceColor2[1];

def Consensus_Level_OB = 14;

def Consensus_Level_OS = -12;

#Super_OB/OS Signal

def OB_Level = conditionOB1 + conditionOB3 + conditionOB4 + conditionOB5 + conditionOB6 + conditionOB7;

def OS_Level = conditionOS1 + conditionOS3 + conditionOS4 + conditionOS5 + conditionOS6 + conditionOS7;

def Consensus_Line = OB_Level - OS_Level;

def Zero_Line = 0;

def Super_OB = 4;

def Super_OS = -4;

def DOWN_OB = (Agreement_Level > Agreement_LevelOB) and (Consensus_Line > Super_OB) and (Consensus_Level > Consensus_Level_OB);

def UP_OS = (Agreement_Level < Agreement_LevelOS) and (Consensus_Line < Super_OS) and (Consensus_Level < Consensus_Level_OS);

def OS_Buy = UP_OS;

def OB_Sell = DOWN_OB;

def neutral = Consensus_Line < Super_OB and Consensus_Line > Super_OS;

input use_line_limits = yes;#Yes, plots line from/to; No, plot line across entire chart

input linefrom = 100;#Hint linefrom: limits how far line plots in candle area

input lineto = 12;#Hint lineto: limits how far into expansion the line will plot

def YHOB = if coloredCandlesOn and ((price1 > Upper_BandS) and (condition_BandRevDn)) then high else Double.NaN;

def YHOS = if coloredCandlesOn and ((price1 < Lower_BandS) and (condition_BandRevUp)) then high else Double.NaN;

def YLOB = if coloredCandlesOn and ((price1 > Upper_BandS) and (condition_BandRevDn)) then low else Double.NaN;

def YLOS = if coloredCandlesOn and ((price1 < Lower_BandS) and (condition_BandRevUp)) then low else Double.NaN;

#extend midline of yellow candle

plot YCOB = if !IsNaN(YHOB) then hl2 else Double.NaN;

YCOB.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

YCOB.SetDefaultColor(Color.GREEN);

def YHextOB = if IsNaN(YCOB) then YHextOB[1] else YCOB;

plot YHextlineOB = YHextOB;

YHextlineOB.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

YHextlineOB.SetDefaultColor(Color.ORANGE);

YHextlineOB.SetLineWeight(2);

plot YCOS = if !IsNaN(YHOS) then hl2 else Double.NaN;

YCOS.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

YCOS.SetDefaultColor(Color.GREEN);

def YHextOS = if IsNaN(YCOS) then YHextOS[1] else YCOS;

plot YHextlineOS = YHextOS;

YHextlineOS.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

YHextlineOS.SetDefaultColor(Color.LIGHT_GREEN);

YHextlineOS.SetLineWeight(2);

def YC = coloredCandlesOn and priceColor2 == 1 and price1 > Upper_BandS and condition_BandRevDn;

#Additional Signals

input showCloud = yes;

#AddCloud(if showCloud and condition_BandRevUp then Lower_BandK2 else Double.NaN, Lower_BandS, Color.LIGHT_GREEN, Color.CURRENT);

#AddCloud(if showCloud and condition_BandRevDn then Upper_BandS else Double.NaN, Upper_BandK2, Color.LIGHT_RED, Color.CURRENT);

# Identify Consolidation

def HH = Highest(high[1], BarsUsedForRange);

def LL = Lowest(low[1], BarsUsedForRange);

def maxH = Highest(HH, BarsRequiredToRemainInRange);

def maxL = Lowest(LL, BarsRequiredToRemainInRange);

def HHn = if maxH == maxH[1] or maxL == maxL then maxH else HHn[1];

def LLn = if maxH == maxH[1] or maxL == maxL then maxL else LLn[1];

def Bh = if high <= HHn and HHn == HHn[1] then HHn else Double.NaN;

def Bl = if low >= LLn and LLn == LLn[1] then LLn else Double.NaN;

def CountH = if IsNaN(Bh) or IsNaN(Bl) then 2 else CountH[1] + 1;

def CountL = if IsNaN(Bh) or IsNaN(Bl) then 2 else CountL[1] + 1;

def ExpH = if BarNumber() == 1 then Double.NaN else

if CountH[-BarsRequiredToRemainInRange] >= BarsRequiredToRemainInRange then HHn[-BarsRequiredToRemainInRange] else

if high <= ExpH[1] then ExpH[1] else Double.NaN;

def ExpL = if BarNumber() == 1 then Double.NaN else

if CountL[-BarsRequiredToRemainInRange] >= BarsRequiredToRemainInRange then LLn[-BarsRequiredToRemainInRange] else

if low >= ExpL[1] then ExpL[1] else Double.NaN;

# Plot the High and Low of the Box; Paint Cloud

def BoxHigh = if ((DOWN_OB) or (Upper_BandS crosses above Upper_BandK2) or (condition_BandRevDn) and (high > high[1]) and ((price > Upper_BandK2) or (price > Upper_BandS))) then Highest(ExpH) else Double.NaN;

def BoxLow = if (DOWN_OB) or ((Upper_BandS crosses above Upper_BandK2)) then Lowest(low) else Double.NaN;

def BoxHigh2 = if ((UP_OS) or ((Lower_BandS crosses below Lower_BandK2))) then Highest(ExpH) else Double.NaN;

#def BH2 = if !IsNaN(BoxHigh2) then high else Double.NaN;

#def BH2ext = if IsNaN(BH2) then BH2ext[1] else BH2;

#def BH2extline = BH2ext;

#plot H_BH2extline = Lowest(BH2extline, 1);

#H_BH2extline.SetDefaultColor(Color.GREEN);

def BoxLow2 = if ((UP_OS) or (Lower_BandS crosses below Lower_BandK2) or (condition_BandRevUp) and (low < low[1]) and ((price < Lower_BandK2) or (price < Lower_BandS))) or ((UP_OS[1]) and (low < low[1])) then Lowest(low) else Double.NaN;

# extend the current YCHigh line to the right edge of the chart

def BH1 = if !IsNaN(BoxHigh) then high else Double.NaN;

def BH1ext = if IsNaN(BH1) then BH1ext[1] else BH1;

def BH1extline = BH1ext;

def BL1 = if !IsNaN(BoxLow) then low else Double.NaN;

#BL1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#BL1.SetDefaultColor(Color.RED);

def BL1ext = if IsNaN(BL1) then BL1ext[1] else BL1;

plot BL1extline = BL1ext;

BL1extline.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

BL1extline.SetDefaultColor(Color.RED);

BL1extline.SetLineWeight(1);

def BH2 = if !IsNaN(BoxHigh2) then high else Double.NaN;

#BH2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#BH2.SetDefaultColor(Color.GREEN);

def BH2ext = if IsNaN(BH2) then BH2ext[1] else BH2;

def BH2extline = BH2ext;

#BH2extline.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#BH2extline.SetDefaultColor(Color.GREEN);

#BH2extline.SetLineWeight(3);

def BL2 = if !IsNaN(BoxLow2) then low else Double.NaN;

#BL2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#BL2.SetDefaultColor(Color.RED);

def BL2ext = if IsNaN(BL2) then BL2ext[1] else BL2;

plot BL2extline = BL2ext;

BL2extline.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

BL2extline.SetDefaultColor(Color.GREEN);

BL2extline.SetLineWeight(1);

plot H_BH1extline = Highest(BH1extline, 1);

H_BH1extline.SetDefaultColor(Color.RED);

plot L_BL1extline = Highest(BL1extline, 1);

L_BL1extline.SetDefaultColor(Color.RED);

plot H_BH2extline = Lowest(BH2extline, 1);

H_BH2extline.SetDefaultColor(Color.Green);

plot L_BL2extline = Lowest(BL2extline, 1);

L_BL2extline.SetDefaultColor(Color.GREEN);

#plot L_BL1extline = Highest(BL1extline, 1);

# L_BL1extline.SetDefaultColor(Color.Red);

AddCloud(if showCloud and !HideCloud then BH1extline else Double.NaN, BL1extline, Color.RED, Color.GRAY);

AddCloud(if showCloud and !HideCloud then BH2extline else Double.NaN, BL2extline, Color.GREEN, Color.GRAY);

script WMA_Smooth {

input price = hl2;

plot smooth = (4 * price

+ 3 * price[1]

+ 2 * price[2]

+ price[3]) / 10;

}

script Phase_Accumulation {

input price = hl2;

rec Smooth;

rec Detrender;

rec Period;

rec Q1;

rec I1;

rec I1p;

rec Q1p;

rec Phase1;

rec Phase;

rec DeltaPhase;

rec DeltaPhase1;

rec InstPeriod1;

rec InstPeriod;

def CorrectionFactor;

if BarNumber() <= 5

then {

Period = 0;

Smooth = 0;

Detrender = 0;

CorrectionFactor = 0;

Q1 = 0;

I1 = 0;

Q1p = 0;

I1p = 0;

Phase = 0;

Phase1 = 0;

DeltaPhase1 = 0;

DeltaPhase = 0;

InstPeriod = 0;

InstPeriod1 = 0;

} else {

CorrectionFactor = 0.075 * Period[1] + 0.54;

# Smooth and detrend my smoothed signal:

Smooth = WMA_Smooth(price);

Detrender = ( 0.0962 * Smooth

+ 0.5769 * Smooth[2]

- 0.5769 * Smooth[4]

- 0.0962 * Smooth[6] ) * CorrectionFactor;

# Compute Quadrature and Phase of Detrended signal:

Q1p = ( 0.0962 * Detrender

+ 0.5769 * Detrender[2]

- 0.5769 * Detrender[4]

- 0.0962 * Detrender[6] ) * CorrectionFactor;

I1p = Detrender[3];

# Smooth out Quadrature and Phase:

I1 = 0.15 * I1p + 0.85 * I1p[1];

Q1 = 0.15 * Q1p + 0.85 * Q1p[1];

# Determine Phase

if I1 != 0

then {

# Normally, ATAN gives results from -pi/2 to pi/2.

# We need to map this to circular coordinates 0 to 2pi

if Q1 >= 0 and I1 > 0

then { # Quarant 1

Phase1 = ATan(AbsValue(Q1 / I1));

} else if Q1 >= 0 and I1 < 0

then { # Quadrant 2

Phase1 = Double.Pi - ATan(AbsValue(Q1 / I1));

} else if Q1 < 0 and I1 < 0

then { # Quadrant 3

Phase1 = Double.Pi + ATan(AbsValue(Q1 / I1));

} else { # Quadrant 4

Phase1 = 2 * Double.Pi - ATan(AbsValue(Q1 / I1));

}

} else if Q1 > 0

then { # I1 == 0, Q1 is positive

Phase1 = Double.Pi / 2;

} else if Q1 < 0

then { # I1 == 0, Q1 is negative

Phase1 = 3 * Double.Pi / 2;

} else { # I1 and Q1 == 0

Phase1 = 0;

}

# Convert phase to degrees

Phase = Phase1 * 180 / Double.Pi;

if Phase[1] < 90 and Phase > 270

then {

# This occurs when there is a big jump from 360-0

DeltaPhase1 = 360 + Phase[1] - Phase;

} else {

DeltaPhase1 = Phase[1] - Phase;

}

# Limit our delta phases between 7 and 60

if DeltaPhase1 < 7

then {

DeltaPhase = 7;

} else if DeltaPhase1 > 60

then {

DeltaPhase = 60;

} else {

DeltaPhase = DeltaPhase1;

}

# Determine Instantaneous period:

InstPeriod1 =

-1 * (fold i = 0 to 40 with v=0 do

if v < 0 then

v

else if v > 360 then

-i

else

v + GetValue(DeltaPhase, i, 41)

);

if InstPeriod1 <= 0

then {

InstPeriod = InstPeriod[1];

} else {

InstPeriod = InstPeriod1;

}

Period = 0.25 * InstPeriod + 0.75 * Period[1];

}

plot DC = Period;

}

script Ehler_MAMA {

input price = hl2;

input FastLimit = 0.5;

input SlowLimit = 0.05;

rec Period;

rec Period_raw;

rec Period_cap;

rec Period_lim;

rec Smooth;

rec Detrender;

rec I1;

rec Q1;

rec jI;

rec jQ;

rec I2;

rec Q2;

rec I2_raw;

rec Q2_raw;

rec Phase;

rec DeltaPhase;

rec DeltaPhase_raw;

rec alpha;

rec alpha_raw;

rec Re;

rec Im;

rec Re_raw;

rec Im_raw;

rec SmoothPeriod;

rec vmama;

rec vfama;

def CorrectionFactor = Phase_Accumulation(price).CorrectionFactor;

if BarNumber() <= 5

then {

Smooth = 0;

Detrender = 0;

Period = 0;

Period_raw = 0;

Period_cap = 0;

Period_lim = 0;

I1 = 0;

Q1 = 0;

I2 = 0;

Q2 = 0;

jI = 0;

jQ = 0;

I2_raw = 0;

Q2_raw = 0;

Re = 0;

Im = 0;

Re_raw = 0;

Im_raw = 0;

SmoothPeriod = 0;

Phase = 0;

DeltaPhase = 0;

DeltaPhase_raw = 0;

alpha = 0;

alpha_raw = 0;

vmama = 0;

vfama = 0;

} else {

# Smooth and detrend my smoothed signal:

Smooth = WMA_Smooth(price);

Detrender = ( 0.0962 * Smooth

+ 0.5769 * Smooth[2]

- 0.5769 * Smooth[4]

- 0.0962 * Smooth[6] ) * CorrectionFactor;

Q1 = ( 0.0962 * Detrender

+ 0.5769 * Detrender[2]

- 0.5769 * Detrender[4]

- 0.0962 * Detrender[6] ) * CorrectionFactor;

I1 = Detrender[3];

jI = ( 0.0962 * I1

+ 0.5769 * I1[2]

- 0.5769 * I1[4]

- 0.0962 * I1[6] ) * CorrectionFactor;

jQ = ( 0.0962 * Q1

+ 0.5769 * Q1[2]

- 0.5769 * Q1[4]

- 0.0962 * Q1[6] ) * CorrectionFactor;

# This is the complex conjugate

I2_raw = I1 - jQ;

Q2_raw = Q1 + jI;

I2 = 0.2 * I2_raw + 0.8 * I2_raw[1];

Q2 = 0.2 * Q2_raw + 0.8 * Q2_raw[1];

Re_raw = I2 * I2[1] + Q2 * Q2[1];

Im_raw = I2 * Q2[1] - Q2 * I2[1];

Re = 0.2 * Re_raw + 0.8 * Re_raw[1];

Im = 0.2 * Im_raw + 0.8 * Im_raw[1];

# Compute the phase

if Re != 0 and Im != 0

then {

Period_raw = 2 * Double.Pi / ATan(Im / Re);

} else {

Period_raw = 0;

}

if Period_raw > 1.5 * Period_raw[1]

then {

Period_cap = 1.5 * Period_raw[1];

} else if Period_raw < 0.67 * Period_raw[1] {

Period_cap = 0.67 * Period_raw[1];

} else {

Period_cap = Period_raw;

}

if Period_cap < 6

then {

Period_lim = 6;

} else if Period_cap > 50

then {

Period_lim = 50;

} else {

Period_lim = Period_cap;

}

Period = 0.2 * Period_lim + 0.8 * Period_lim[1];

SmoothPeriod = 0.33 * Period + 0.67 * SmoothPeriod[1];

if I1 != 0

then {

Phase = ATan(Q1 / I1);

} else if Q1 > 0

then { # Quadrant 1:

Phase = Double.Pi / 2;

} else if Q1 < 0

then { # Quadrant 4:

Phase = -Double.Pi / 2;

} else { # Both numerator and denominator are 0.

Phase = 0;

}

DeltaPhase_raw = Phase[1] - Phase;

if DeltaPhase_raw < 1

then {

DeltaPhase = 1;

} else {

DeltaPhase = DeltaPhase_raw;

}

alpha_raw = FastLimit / DeltaPhase;

if alpha_raw < SlowLimit

then {

alpha = SlowLimit;

} else {

alpha = alpha_raw;

}

vmama = alpha * price + (1 - alpha) * vmama[1];

vfama = 0.5 * alpha * vmama + (1 - 0.5 * alpha) * vfama[1];

}

plot MAMA = vmama;

plot FAMA = vfama;

}

input price2 = hl2;

input FastLimit = 0.5;

input SlowLimit = 0.05;

def MAMA = Ehler_MAMA(price2, FastLimit, SlowLimit).MAMA;

def FAMA = Ehler_MAMA(price2, FastLimit, SlowLimit).FAMA;

def Crossing = Crosses((MAMA < FAMA), yes);

#Crossing.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

def Crossing1 = Crosses((MAMA > FAMA), yes);

#Crossing1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

AddLabel(yes, Concat("MAMA: ", Concat("",

if MAMA > FAMA then "Bull" else "Bear")),

if MAMA > FAMA then Color.GREEN else Color.RED);

##################################

plot C3_MF_Line = (MAMA + FAMA) / 2;

C3_MF_Line.SetPaintingStrategy(PaintingStrategy.LINE);

C3_MF_Line.SetLineWeight(3);

C3_MF_Line.AssignValueColor(if ((priceColor2 == 1) and (price1 > Upper_BandS) and (condition_BandRevDn)) then Color.YELLOW else if ((priceColor2 == -1) and (price1 < Lower_BandS) and (condition_BandRevUp)) then Color.YELLOW else if priceColor2 == -1 then Color.RED else if (priceColor2 == 1) then Color.GREEN else Color.CURRENT);

def C3_MF_UP = C3_MF_Line > C3_MF_Line[1];

def C3_MF_DN = C3_MF_Line < C3_MF_Line[1];

def priceColor9 = if C3_MF_UP then 1

else if C3_MF_DN then -1

else priceColor9[1];

def MF_UP = FAMA < MAMA;

def MF_DN = FAMA > MAMA;

def priceColor10 = if MF_UP then 1

else if MF_DN then -1

else priceColor10[1];

input extension_length_limited_to = 10;

def lastbar = if isnan(close[-1]) and !isnan(close) then barnumber() else double.nan;

def inertline = inertiaall(C3_MF_Line,2);

def EXT_C3_MF = if !IsNaN(close()) then inertline else EXT_C3_MF[1] + ((EXT_C3_MF[1] - EXT_C3_MF[2]) / (2 - 1));

plot extension = if barnumber()<=highestall(lastbar)+ extension_length_limited_to then EXT_C3_MF else double.nan;

extension.SetDefaultColor(Color.white);

####################################################################################################################################################

#EMA's

input length8 = 10;

input length9 = 35;

input show_ema_cloud = yes;

plot AvgExp8 = ExpAverage(price[-displace], length8);

def UPD = AvgExp8[1] < AvgExp8;

AvgExp8.SetStyle(Curve.SHORT_DASH);

#AvgExp8.SetLineWeight(1);

plot AvgExp9 = ExpAverage(price[-displace], length9);

def UPW = AvgExp9[1] < AvgExp9;

AvgExp9.SetStyle(Curve.SHORT_DASH);

#AvgExp9.SetLineWeight(1);

def Below = AvgExp8 < AvgExp9;

def Spark = UPD + UPW + Below;

def UPEMA = AvgExp8[1] < AvgExp8;

def DOWNEMA = AvgExp8[1] > AvgExp8;

AvgExp8.AssignValueColor(if UPEMA then Color.LIGHT_GREEN else if DOWNEMA then Color.RED else Color.YELLOW);

def UPEMA2 = AvgExp9[1] < AvgExp9;

def DOWNEMA2 = AvgExp9[1] > AvgExp9;

AvgExp9.AssignValueColor(if UPEMA2 then Color.LIGHT_GREEN else if DOWNEMA2 then Color.RED else Color.YELLOW);

AddCloud(if show_ema_cloud and (AvgExp9 > AvgExp8) then AvgExp9 else Double.NaN, AvgExp8, Color.LIGHT_RED, Color.CURRENT);

AddCloud(if show_ema_cloud and (AvgExp8 > AvgExp9) then AvgExp8 else Double.NaN, AvgExp9, Color.LIGHT_GREEN, Color.CURRENT);

def UP8 = UPEMA and UPEMA2;

def DOWN8 = DOWNEMA and DOWNEMA2;

def priceColor8 = if UP8 then 1

else if DOWN8 then -1

else 0;