You should upgrade or use an alternative browser.

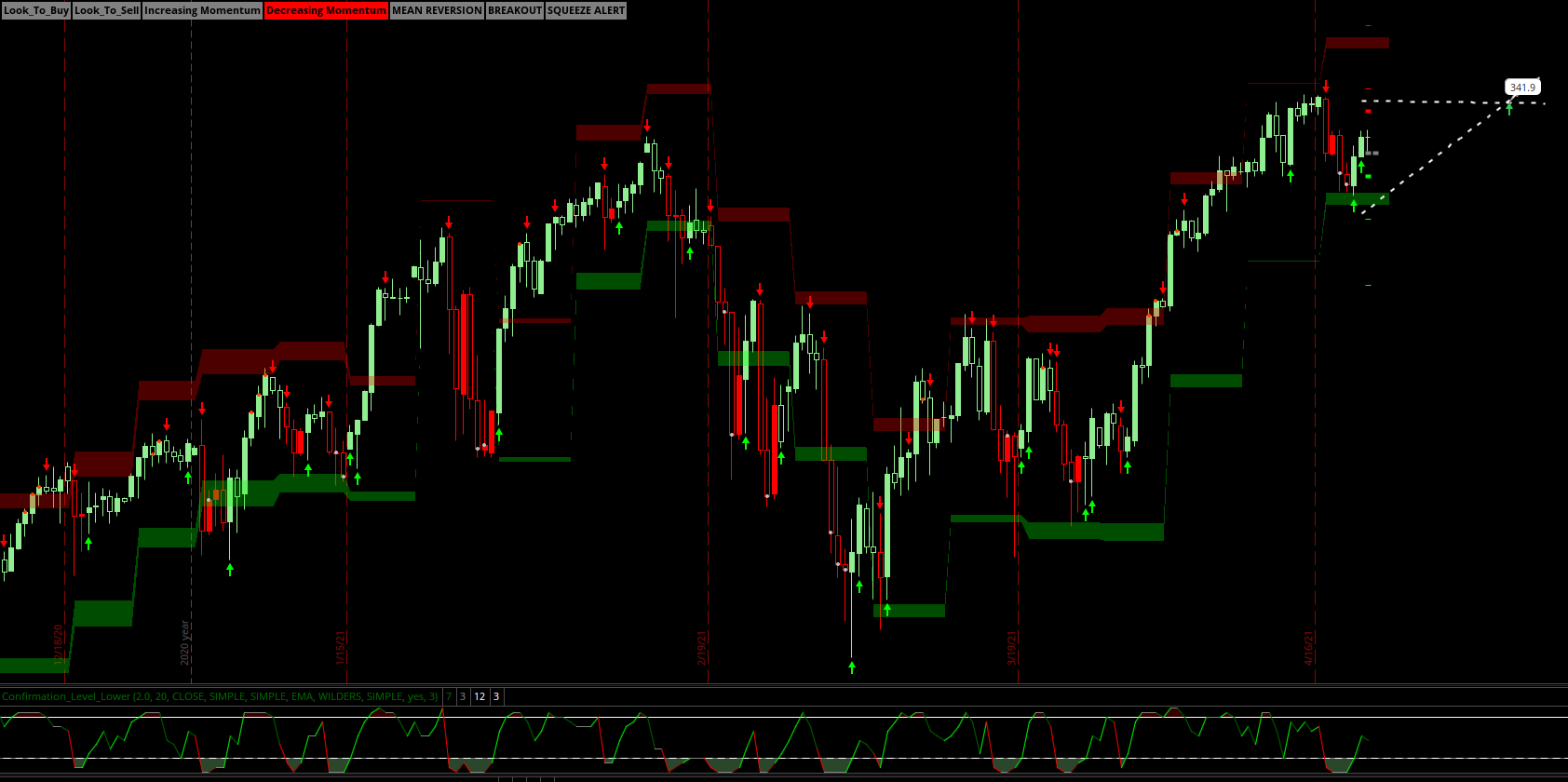

Confirmation Candles Indicator For ThinkorSwim

- Thread starter Christopher84

- Start date

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

That's awesome! Glad you are putting it to good use. I posted a Super OB OS indicator earlier today that complements the Confirmation Candles and Confirmation Level Lower study. Definitely try it out with it. I think you might like it. Thank you so much for the feedback.Thanks for your hard work! I've been testing the version 4 and its been throwing some nice signals. I'll chk out version 5 tonite.

Thanks Christopher. Sorry, but I've loaded, deleted and reloaded the study, but for some reason it does not paint any arrows on SPX. It does on other symbols, but not SPX. Weird. Thanks again!Hi rfb! The candles will still paint correctly for SPX, however, the signals and lower study will not show unfortunately. Thank you for trying it out and for your feedback!

Miami51961

Member

My question being new, is how would you scan for signals on the lower timeframe crossing up over oversold line?

thanks

Hi Miami51961! The study is too complex for the scan. However, my Super OB/OS indicator will do give you similar results. Here is the code. Copy and paste into a custom scan and you should be good to go. Hope this helps!Nice work. Looing at the study and it gives some pretty good signals.

My question being new, is how would you scan for signals on the lower timeframe crossing up over oversold line?

thanks

#Super_OB_OS_Lower

#Created by Christopher84 04/22/2021

declare lower;

#RSI

def price = close;

def RSI_length = 14;

def RSI_AverageType = AverageType.WILDERS;

def RSI_OB = 70;

def RSI_OS = 30;

def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length);

def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

def conditionOB1 = RSI > RSI_OB;

def conditionOS1 = RSI < RSI_OS;

#MFI

def MFI_Length = 14;

def MFIover_Sold = 20;

def MFIover_Bought = 80;

def movingAvgLength = 1;

def MoneyFlowIndex = Average(moneyflow(high, close, low, volume, MFI_Length), movingAvgLength);

def conditionOB2 = MoneyFlowIndex > MFIover_Bought;

def conditionOS2 = MoneyFlowIndex < MFIover_Sold;

#Forecast

def na = Double.NaN;

def MidLine = 50;

def Momentum = MarketForecast().Momentum;

def NearT = MarketForecast().NearTerm;

def Intermed = MarketForecast().Intermediate;

def FOB = 80;

def FOS = 20;

def upperLine = 110;

def conditionOB3 = Intermed > FOB;

def conditionOS3 = Intermed < FOS;

def conditionOB4 = NearT > FOB;

def conditionOS4 = NearT < FOS;

#Polarized Fractal Efficiency

def PFE_length = 5;#Typically 10

def smoothingLength = 2.5;#Typically 5

def PFE_diff = close - close[PFE_length - 1];

def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1);

def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength);

def UpperLevel = 50;

def LowerLevel = -50;

def conditionOB5 = PFE > UpperLevel;

def conditionOS5 = PFE < LowerLevel;

#Bollinger Bands PercentB

input BBPB_averageType = AverageType.Simple;

def displace = 0;

def BBPB_length = 5;#Typically 20

def Num_Dev_Dn = -2.0;

def Num_Dev_up = 2.0;

def BBPB_OB = 100;

def BBPB_OS = 0;

def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand;

def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand;

def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100;

def HalfLine = 50;

def UnitLine = 100;

def conditionOB6 = PercentB > BBPB_OB;

def conditionOS6 = PercentB < BBPB_OS;

#Projection Oscillator

def ProjectionOsc_length = 9;#Typically 10

def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price=high, length=ProjectionOsc_length));

def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price=low, length=ProjectionOsc_length));

def ProjectionOsc_diff = MaxBound - MinBound;

def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0;

def PROSC_OB = 80;

def PROSC_OS = 20;

def conditionOB7 = PROSC > PROSC_OB;

def conditionOS7 = PROSC < PROSC_OS;

#OB/OS Calculation

def OB_Level = conditionOB1 + conditionOB2 + conditionOB3 + conditionOB4 + conditionOB5 + conditionOB6 + conditionOB7;

def OS_Level = conditionOS1 + conditionOS2 + conditionOS3 + conditionOS4 + conditionOS5 + conditionOS6 + conditionOS7;

def Concensus_Line = OB_Level - OS_Level;

def Zero_Line = 0;

def Super_OB = 4;

def Super_OS = -2;

PLOT OSX = Concensus_Line crosses above Super_OS;Here's the code to add to your custom watchlist as well. It matches the indicator (when OS it will be green indicating a possible buy opportunity and red when OB and possible sell opportunity).Nice work. Looing at the study and it gives some pretty good signals.

My question being new, is how would you scan for signals on the lower timeframe crossing up over oversold line?

thanks

#Super_OB_OS_Lower

#Created by Christopher84 04/22/2021

declare lower;

#RSI

def price = close;

def RSI_length = 14;

def RSI_AverageType = AverageType.WILDERS;

def RSI_OB = 70;

def RSI_OS = 30;

def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length);

def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

def conditionOB1 = RSI > RSI_OB;

def conditionOS1 = RSI < RSI_OS;

#MFI

def MFI_Length = 14;

def MFIover_Sold = 20;

def MFIover_Bought = 80;

def movingAvgLength = 1;

def MoneyFlowIndex = Average(moneyflow(high, close, low, volume, MFI_Length), movingAvgLength);

def conditionOB2 = MoneyFlowIndex > MFIover_Bought;

def conditionOS2 = MoneyFlowIndex < MFIover_Sold;

#Forecast

def na = Double.NaN;

def MidLine = 50;

def Momentum = MarketForecast().Momentum;

def NearT = MarketForecast().NearTerm;

def Intermed = MarketForecast().Intermediate;

def FOB = 80;

def FOS = 20;

def upperLine = 110;

def conditionOB3 = Intermed > FOB;

def conditionOS3 = Intermed < FOS;

def conditionOB4 = NearT > FOB;

def conditionOS4 = NearT < FOS;

#Polarized Fractal Efficiency

def PFE_length = 5;#Typically 10

def smoothingLength = 2.5;#Typically 5

def PFE_diff = close - close[PFE_length - 1];

def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1);

def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength);

def UpperLevel = 50;

def LowerLevel = -50;

def conditionOB5 = PFE > UpperLevel;

def conditionOS5 = PFE < LowerLevel;

#Bollinger Bands PercentB

input BBPB_averageType = AverageType.Simple;

def displace = 0;

def BBPB_length = 5;#Typically 20

def Num_Dev_Dn = -2.0;

def Num_Dev_up = 2.0;

def BBPB_OB = 100;

def BBPB_OS = 0;

def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand;

def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand;

def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100;

def HalfLine = 50;

def UnitLine = 100;

def conditionOB6 = PercentB > BBPB_OB;

def conditionOS6 = PercentB < BBPB_OS;

#Projection Oscillator

def ProjectionOsc_length = 9;#Typically 10

def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price=high, length=ProjectionOsc_length));

def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price=low, length=ProjectionOsc_length));

def ProjectionOsc_diff = MaxBound - MinBound;

def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0;

def PROSC_OB = 80;

def PROSC_OS = 20;

def conditionOB7 = PROSC > PROSC_OB;

def conditionOS7 = PROSC < PROSC_OS;

#OB/OS Calculation

def OB_Level = conditionOB1 + conditionOB2 + conditionOB3 + conditionOB4 + conditionOB5 + conditionOB6 + conditionOB7;

def OS_Level = conditionOS1 + conditionOS2 + conditionOS3 + conditionOS4 + conditionOS5 + conditionOS6 + conditionOS7;

plot Concensus_Line = OB_Level - OS_Level;

def Zero_Line = 0;

def Super_OB = 4;

def Super_OS = -2;

def OB = Concensus_Line >= Super_OB;

def OS = Concensus_Line <= Super_OS;

AssignBackgroundColor(if OB then color.light_red else if OS then color.dark_green else color.black);Hi Christopher,Hi Miami51961! The study is too complex for the scan. However, my Super OB/OS indicator will do give you similar results. Here is the code. Copy and paste into a custom scan and you should be good to go. Hope this helps!

#Super_OB_OS_Lower

#Created by Christopher84 04/22/2021

declare lower;

#RSI

def price = close;

def RSI_length = 14;

def RSI_AverageType = AverageType.WILDERS;

def RSI_OB = 70;

def RSI_OS = 30;

def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length);

def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

def conditionOB1 = RSI > RSI_OB;

def conditionOS1 = RSI < RSI_OS;

#MFI

def MFI_Length = 14;

def MFIover_Sold = 20;

def MFIover_Bought = 80;

def movingAvgLength = 1;

def MoneyFlowIndex = Average(moneyflow(high, close, low, volume, MFI_Length), movingAvgLength);

def conditionOB2 = MoneyFlowIndex > MFIover_Bought;

def conditionOS2 = MoneyFlowIndex < MFIover_Sold;

#Forecast

def na = Double.NaN;

def MidLine = 50;

def Momentum = MarketForecast().Momentum;

def NearT = MarketForecast().NearTerm;

def Intermed = MarketForecast().Intermediate;

def FOB = 80;

def FOS = 20;

def upperLine = 110;

def conditionOB3 = Intermed > FOB;

def conditionOS3 = Intermed < FOS;

def conditionOB4 = NearT > FOB;

def conditionOS4 = NearT < FOS;

#Polarized Fractal Efficiency

def PFE_length = 5;#Typically 10

def smoothingLength = 2.5;#Typically 5

def PFE_diff = close - close[PFE_length - 1];

def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1);

def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength);

def UpperLevel = 50;

def LowerLevel = -50;

def conditionOB5 = PFE > UpperLevel;

def conditionOS5 = PFE < LowerLevel;

#Bollinger Bands PercentB

input BBPB_averageType = AverageType.Simple;

def displace = 0;

def BBPB_length = 5;#Typically 20

def Num_Dev_Dn = -2.0;

def Num_Dev_up = 2.0;

def BBPB_OB = 100;

def BBPB_OS = 0;

def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand;

def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand;

def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100;

def HalfLine = 50;

def UnitLine = 100;

def conditionOB6 = PercentB > BBPB_OB;

def conditionOS6 = PercentB < BBPB_OS;

#Projection Oscillator

def ProjectionOsc_length = 9;#Typically 10

def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price=high, length=ProjectionOsc_length));

def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price=low, length=ProjectionOsc_length));

def ProjectionOsc_diff = MaxBound - MinBound;

def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0;

def PROSC_OB = 80;

def PROSC_OS = 20;

def conditionOB7 = PROSC > PROSC_OB;

def conditionOS7 = PROSC < PROSC_OS;

#OB/OS Calculation

def OB_Level = conditionOB1 + conditionOB2 + conditionOB3 + conditionOB4 + conditionOB5 + conditionOB6 + conditionOB7;

def OS_Level = conditionOS1 + conditionOS2 + conditionOS3 + conditionOS4 + conditionOS5 + conditionOS6 + conditionOS7;

def Concensus_Line = OB_Level - OS_Level;

def Zero_Line = 0;

def Super_OB = 4;

def Super_OS = -2;

PLOT OSX = Concensus_Line crosses above Super_OS;

Can you please tell me the preferred time for this Indicator and scanner?

The indicator works well on any time frame. I like using it for swing trades usually on a two hour-day chart. However, I’ve also had some success using it to scalp on 10 minute charts. As far as the scans go, I would suggest scanning on larger time frames such as four hour or day to get higher probability signals.Hi Christopher,

Can you please tell me the preferred time for this Indicator and scanner?

Thank you so muchThe indicator works well on any time frame. I like using it for swing trades usually on a two hour-day chart. However, I’ve also had some success using it to scalp on 10 minute charts. As far as the scans go, I would suggest scanning on larger time frames such as four hour or day to get higher probability signals.

Bamapepper

New member

Hi Everyone! Here is Confirmation Candles V.5. Added new reversal signals. Reversal buy (gray points), reversal sell (red points). They seem to be pretty decent (will not repaint once the candle is closed). Looking forward to feedback.

Code:#Confirmation Candles V.5 #Created 04/15/2021 by Christopher84 #Select the level of agreement among the 14 indicators included. #Changed 04/19/2021 to V.3 - Removed ChaikinOsc and replaced with STARCBands. Added squeeze alert. #Changed 04/20/2021 to V.4 - Added Keltner Channel, Labels, and Buy and Sell Zones. Mean Reversion and Breakout Labels added. Reversal_Alert points added. #Changed 4/22/2021 to V.4 - Removed Buy/Sell clouds. Created new reversal alert buy(gray points) and take profit (red points). Increase factorK. #Keltner Channel declare upper; def displace = 0; input factorK = 6.5; input lengthK = 20; input price = close; input averageType = AverageType.SIMPLE; input trueRangeAverageType = AverageType.SIMPLE; def shift = factorK * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK); def averageK = MovingAverage(averageType, price, lengthK); def AvgK = averageK[-displace]; def Upper_BandK = averageK[-displace] + shift[-displace]; def Lower_BandK = averageK[-displace] - shift[-displace]; def conditionKup = price >= Upper_BandK; def conditionKdown = price <= Lower_BandK; #MACD with Price def fastLength = 12; def slowLength = 26; def MACDLength = 9; input MACD_AverageType = {SMA, default EMA}; def MACDLevel = 0.0; def fastEMA = ExpAverage(price, fastLength); def slowEMA = ExpAverage(price, slowLength); def Value; def Avg; switch (MACD_AverageType) { case SMA: Value = Average(price, fastLength) - Average(price, slowLength); Avg = Average(Value, MACDLength); case EMA: Value = fastEMA - slowEMA; Avg = ExpAverage(Value, MACDLength);} def Diff = Value - Avg; def Level = MACDLevel; def condition1 = Value[1] <= Value; #RSI def RSI_length = 14; def RSI_AverageType = AverageType.WILDERS; def RSI_OB = 70; def RSI_OS = 30; def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length); def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length); def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0; def RSI = 50 * (ChgRatio + 1); def condition2 = (RSI[3] < RSI) is true or (RSI >= 80) is true; def conditionRSI_OB = RSI > RSI_OB; def conditionRSI_OS = RSI < RSI_OS; #MFI def MFI_Length = 14; def MFIover_Sold = 20; def MFIover_Bought = 80; def movingAvgLength = 1; def MoneyFlowIndex = Average(moneyflow(high, close, low, volume, MFI_Length), movingAvgLength); def MFIOverBought = MFIover_Bought; def MFIOverSold = MFIover_Sold; def condition3 = (MoneyFlowIndex[2] < MoneyFlowIndex) is true or (MoneyFlowIndex > 85) is true; def conditionMFI_OB = MoneyFlowIndex > MFIover_Bought; def conditionMFI_OS = MoneyFlowIndex < MFIover_Sold; #Forecast def na = Double.NaN; def MidLine = 50; def Momentum = MarketForecast().Momentum; def NearT = MarketForecast().NearTerm; def Intermed = MarketForecast().Intermediate; def FOB = 80; def FOS = 20; def upperLine = 110; def condition4 = (Intermed[1] <= Intermed) and (NearT >= MidLine); def conditionFOB = Intermed > FOB; def conditionFOS = Intermed < FOS; #Pivot Signals def n = 20; def ticks = 2.0; def bnOK = barNumber() > n; def isHigher = fold i = 1 to n + 1 with p = 1 while p do high > GetValue(high, -i); def HH = if bnOK and isHigher and high == Highest(high, n)then high else Double.NaN; def isLower = fold j = 1 to n + 1 with q = 1 while q do low < GetValue(low, -j); def LL = if bnOK and isLower and low == Lowest(low, n) then low else Double.NaN; def PivH = if HH > 0 then HH else Double.NaN; def PivL = if LL > 0 then LL else Double.NaN; def UpPivotLow = !isNaN(PivL); #UpPivotLow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); #UpPivotLow.SetLineWeight(4); #UpPivotLow.SetDefaultColor(Color.GREEN); def DownPivotHigh = !isNaN(PivH); #DownPivotHigh.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); #DownPivotHigh.SetLineWeight(4); #DownPivotHigh.SetDefaultColor(Color.RED); def condition5 = !isNaN(PivL); #EMA_1 def EMA_length = 12; def AvgExp = ExpAverage(price[-displace], EMA_length); def condition6 = (price >= AvgExp) and (AvgExp[2] <= AvgExp); #EMA_2 def EMA_2length = 20; def displace2 = 0; def AvgExp2 = ExpAverage(price[-displace2], EMA_2length); def condition7 = (price >= AvgExp2) and (AvgExp[2] <= AvgExp); #DMI Oscillator def DMI_length = 5;#Typically set to 10 input DMI_averageType = AverageType.WILDERS; def diPlus = DMI(DMI_length, DMI_averageType)."DI+"; def diMinus = DMI(DMI_length, DMI_averageType)."DI-"; def Osc = diPlus - diMinus; def Hist = Osc; def ZeroLine = 0; def condition8 = Osc >= zeroline; #Trend_Periods def TP_fastLength = 3;#Typically 7 def TP_slowLength = 4;#Typically 15 def Periods = sign(ExpAverage(close, TP_fastLength) - ExpAverage(close, TP_slowLength)); def condition9 = Periods > 0; #Polarized Fractal Efficiency def PFE_length = 5;#Typically 10 def smoothingLength = 2.5;#Typically 5 def PFE_diff = close - close[PFE_length - 1]; def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1); def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength); def UpperLevel = 50; def LowerLevel = -50; def condition10 = PFE > 0; def conditionPFE_OB = PFE > UpperLevel; def conditionPFE_OS = PFE < LowerLevel; #Bollinger Bands PercentB input BBPB_averageType = AverageType.Simple; def BBPB_length = 5;#Typically 20 def Num_Dev_Dn = -2.0; def Num_Dev_up = 2.0; def BBPB_OB = 100; def BBPB_OS = 0; def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand; def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand; def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100; def HalfLine = 50; def UnitLine = 100; def condition11 = PercentB > HalfLine; def conditionBBPB_OB = PercentB > BBPB_OB; def conditionBBPB_OS = PercentB < BBPB_OS; #STARC Bands def ATR_length = 15; def SMA_lengthS = 6; def multiplier_factor = 1.5; def valS = Average(price, SMA_lengthS); def average_true_range = Average(TrueRange(high, close, low), length = ATR_length); def Upper_BandS = valS[-displace] + multiplier_factor * average_true_range[-displace]; def Middle_BandS = valS[-displace]; def Lower_BandS = valS[-displace] - multiplier_factor * average_true_range[-displace]; def condition12 = (Upper_BandS[1] <= Upper_BandS) and (Lower_BandS[1] <= Lower_BandS); #Klinger Histogram def Klinger_Length = 8; def KVOsc = KlingerOscillator(Klinger_Length).KVOsc; def KVOH = KVOsc - Average(KVOsc, Klinger_Length); def condition13 = (KVOH > 0) and (KVOsc[1] <= KVOsc); #Projection Oscillator def ProjectionOsc_length = 9;#Typically 10 def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price=high, length=ProjectionOsc_length)); def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price=low, length=ProjectionOsc_length)); def ProjectionOsc_diff = MaxBound - MinBound; def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0; def PROSC_OB = 80; def PROSC_OS = 20; def condition14 = PROSC > 50; def conditionPROSC_OB = PROSC > PROSC_OB; def conditionPROSC_OS = PROSC < PROSC_OS; #Trend Confirmation Calculator #Confirmation_Factor range 1-15. input coloredCandlesOn = yes; input Confirmation_Factor = 3; #Use for testing conditions individually. Remove # from line below and change Confirmation_Factor to 1. #def Agreement_Level = condition1; def Agreement_LevelOB = 12; def Agreement_LevelOS = 3; def Agreement_Level = condition1 + condition2 + condition3 + condition4 + condition5 + condition6 + condition7 + condition8 + condition9 + condition10 + condition11 + condition12 + condition13 + condition14 + conditionKup; def conditionChannel1 = Upper_BandK > price; def conditionChannel2 = Lower_BandK < price; def UP = if conditionChannel1 and conditionChannel2 then Agreement_Level >= Confirmation_Factor else 0; def DOWN = if conditionChannel1 and conditionChannel2 then Agreement_Level <= Confirmation_Factor else 0; AssignPriceColor(if coloredCandlesOn and UP or conditionKup then Color.LIGHT_GREEN else if coloredCandlesOn and DOWN or conditionkdown then Color.RED else Color.YELLOW); #Additional Signals #OB/OS Signal input Confirmation_OB = 2; def Agreement_OB = conditionRSI_OB + conditionMFI_OB + conditionFOB + conditionPFE_OB + conditionBBPB_OB + conditionPROSC_OB; input Confirmation_OS = 2; def Agreement_OS = conditionRSI_OS + conditionMFI_OS + conditionFOS + conditionPFE_OS + conditionBBPB_OS + conditionPROSC_OS; def DOWN_OB = (Agreement_Level > Agreement_LevelOB) and (Agreement_OB > Confirmation_OB); def UP_OS = (Agreement_Level < Agreement_LevelOS) and (Agreement_OS > Confirmation_OS); def OS_Buy = UP_OS; def OB_Sell = DOWN_OB; def neutral = Agreement_OB < Confirmation_OB and Agreement_OS < Confirmation_OS; #AddVerticalLine (OS_Buy and !OS_Buy[1], close, Color.GREEN, Curve.SHORT_DASH); #AddVerticalLine (Neutral and !neutral[1], close, Color.Gray, Curve.SHORT_DASH); #AddVerticalLine (OB_Sell and OB_Sell and !OB_Sell[1], close, Color.RED, Curve.SHORT_DASH); def Buy_Opportnity = if OS_Buy then Double.POSITIVE_INFINITY else Double.NEGATIVE_INFINITY; #AddCloud(Buy_Opportnity, Neutral, Color.LIGHT_GREEN, Color.LIGHT_RED); def Sell_Opportnity = if OB_Sell then Double.POSITIVE_INFINITY else Double.NEGATIVE_INFINITY; #AddCloud(Sell_Opportnity, Neutral, Color.LIGHT_RED, Color.LIGHT_RED); plot OB_Signal = price crosses below Upper_BandK;#(Agreement_OB crosses below Agreement_OS) or (Agreement_OB crosses below 5); OB_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); OB_Signal.SetLineWeight(1); OB_Signal.SetDefaultColor(Color.RED); plot OS_Signal = price crosses above Lower_BandK;#(Agreement_OB crosses above Agreement_OS); OS_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); OS_Signal.SetLineWeight(1); OS_Signal.SetDefaultColor(Color.GREEN); #Squeeze Alert def length = 20; def BulgeLength = 150; def SqueezeLength = 150; def upperBandBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_Up, averageType).UpperBand; def lowerBandBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_Up, averageType).LowerBand; def midLineBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_Up, averageType).MidLine; def Bandwidth = (upperBandBB - lowerBandBB) / midLineBB * 100; def Bulge = Highest(Bandwidth, BulgeLength); def Squeeze = Lowest(Bandwidth, SqueezeLength); plot Squeeze_Alert = bandwidth <= squeeze; Squeeze_Alert.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS); Squeeze_Alert.SetLineWeight(3); Squeeze_Alert.SetDefaultColor(Color.YELLOW); #Trend Signals plot UPConfirmSignal = Agreement_Level crosses above Confirmation_Factor; UPConfirmSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); UPConfirmSignal.SetLineWeight(1); UPConfirmSignal.SetDefaultColor(Color.GREEN); plot DOWNConfirmSignal = Agreement_Level crosses below Confirmation_Factor; DOWNConfirmSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); DOWNConfirmSignal.SetLineWeight(1); DOWNConfirmSignal.SetDefaultColor(Color.RED); plot Reversal_Alert1 = (Agreement_Level crosses below 13); Reversal_Alert1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); Reversal_Alert1.SetLineWeight(1); Reversal_Alert1.SetDefaultColor(Color.RED); plot Reversal_Alert2 =(Agreement_Level crosses above 2); Reversal_Alert2.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); Reversal_Alert2.SetLineWeight(1); Reversal_Alert2.SetDefaultColor(Color.GREEN); plot Reversal_Buy = (Agreement_Level < 1) and (Agreement_Level[1] <= Agreement_Level);#conditionMR and price>= Middle_BandS; Reversal_Buy.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS); Reversal_Buy.SetLineWeight(1); Reversal_Buy.SetDefaultColor(Color.LIGHT_GRAY); plot Reversal_Sell = (Agreement_Level > 12) and (Agreement_Level[1] >= Agreement_Level);#conditionMR and price>= Middle_BandS; Reversal_Sell.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS); Reversal_Sell.SetLineWeight(1); Reversal_Sell.SetDefaultColor(Color.LIGHT_RED); #Labels def Buy = UP_OS; def Sell = DOWN_OB; AddLabel(yes, "Look_To_Buy", if Buy then Color.GREEN else Color.GRAY); AddLabel(yes, "Look_To_Sell", if Sell then Color.RED else Color.GRAY); def MomentumUP = Agreement_Level[1] < Agreement_Level; def MomentumDOWN = Agreement_Level[1] > Agreement_Level; AddLabel(yes, "Increasing Momentum", if MomentumUP then Color.Green else Color.GRAY); AddLabel(yes, "Decreasing Momentum", if MomentumDOWN then Color.RED else Color.GRAY); def conditionMR = (Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS); AddLabel(yes, "MEAN REVERSION", if conditionMR then Color.RED else Color.GRAY); def conditionBO = (Upper_BandS[1] < Upper_BandS) and (Lower_BandS[1] < Lower_BandS); AddLabel(yes, "BREAKOUT", if conditionBO then Color.GREEN else Color.GRAY); def Squeeze_Signal = Squeeze_Alert; AddLabel(yes, "SQUEEZE ALERT", if Squeeze_Signal then Color.YELLOW else Color.GRAY);

Bamapepper

New member

Splinter

Member

When you can please point me to which post has the latest lower study. I'd like to chk it out, thanks!That's awesome! Glad you are putting it to good use. I posted a Super OB OS indicator earlier today that complements the Confirmation Candles and Confirmation Level Lower study. Definitely try it out with it. I think you might like it. Thank you so much for the feedback.

When I plot only the lower study with "colored candles on," I cannot get the candles to paint. Am I doing something wrong, or is it necessary to plot the upper study in order to get the candles to paint?

Thanks in advance

Here is the link. This one should work. Let me know if you have any issues.Do you have the latest share link, The other one didn't work

https://tos.mx/TmoTyuW

Hey Splinter!When you can please point me to which post has the latest lower study. I'd like to chk it out, thanks!

Here's the lower study. Let me know what you think once you get a chance to check it out.

#Confirmation Candles Lower V.3

#Created 04/15/2021 by Christopher84

#Select the level of agreement among the 14 indicators included.

#Last changed 04/20/2021 to V.3 - Removed ChaikinOsc and replaced with STARCBands. Adjusted levels to match upper study. Added OB/OS levels.

#Keltner Channel

declare lower;

def displace = 0;

input factorK = 2.0;

input lengthK = 20;

input price = close;

input averageType = AverageType.SIMPLE;

input trueRangeAverageType = AverageType.SIMPLE;

def shift = factorK * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK);

def averageK = MovingAverage(averageType, price, lengthK);

def AvgK = averageK[-displace];

def Upper_BandK = averageK[-displace] + shift[-displace];

def Lower_BandK = averageK[-displace] - shift[-displace];

def conditionKup = price >= Upper_BandK;

def conditionKdown = price <= Lower_BandK;

#MACD with Price

def fastLength = 12;

def slowLength = 26;

def MACDLength = 9;

input MACD_AverageType = {SMA, default EMA};

def MACDLevel = 0.0;

def fastEMA = ExpAverage(price, fastLength);

def slowEMA = ExpAverage(price, slowLength);

def Value;

def Avg;

switch (MACD_AverageType) {

case SMA:

Value = Average(price, fastLength) - Average(price, slowLength);

Avg = Average(Value, MACDLength);

case EMA:

Value = fastEMA - slowEMA;

Avg = ExpAverage(Value, MACDLength);}

def Diff = Value - Avg;

def Level = MACDLevel;

def condition1 = Value[1] <= Value;

#RSI

def RSI_length = 14;

def RSI_AverageType = AverageType.WILDERS;

def RSI_OB = 70;

def RSI_OS = 30;

def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length);

def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

def condition2 = (RSI[3] < RSI) is true or (RSI >= 80) is true;

def conditionRSI_OB = RSI > RSI_OB;

def conditionRSI_OS = RSI < RSI_OS;

#MFI

def MFI_Length = 14;

def MFIover_Sold = 20;

def MFIover_Bought = 80;

def movingAvgLength = 1;

def MoneyFlowIndex = Average(moneyflow(high, close, low, volume, MFI_Length), movingAvgLength);

def MFIOverBought = MFIover_Bought;

def MFIOverSold = MFIover_Sold;

def condition3 = (MoneyFlowIndex[2] < MoneyFlowIndex) is true or (MoneyFlowIndex > 85) is true;

def conditionMFI_OB = MoneyFlowIndex > MFIover_Bought;

def conditionMFI_OS = MoneyFlowIndex < MFIover_Sold;

#Forecast

def na = Double.NaN;

def MidLine = 50;

def Momentum = MarketForecast().Momentum;

def NearT = MarketForecast().NearTerm;

def Intermed = MarketForecast().Intermediate;

def FOB = 80;

def FOS = 20;

def upperLine = 110;

def condition4 = (Intermed[1] <= Intermed) and (NearT >= MidLine);

def conditionFOB = Intermed > FOB;

def conditionFOS = Intermed < FOS;

#Pivot Signals

def n = 20;

def ticks = 2.0;

def bnOK = barNumber() > n;

def isHigher = fold i = 1 to n + 1 with p = 1 while p do high > GetValue(high, -i);

def HH = if bnOK and isHigher and high == Highest(high, n)then high else Double.NaN;

def isLower = fold j = 1 to n + 1 with q = 1 while q do low < GetValue(low, -j);

def LL = if bnOK and isLower and low == Lowest(low, n) then low else Double.NaN;

def PivH = if HH > 0 then HH else Double.NaN;

def PivL = if LL > 0 then LL else Double.NaN;

def UpPivotLow = !isNaN(PivL);

#UpPivotLow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

#UpPivotLow.SetLineWeight(4);

#UpPivotLow.SetDefaultColor(Color.GREEN);

def DownPivotHigh = !isNaN(PivH);

#DownPivotHigh.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

#DownPivotHigh.SetLineWeight(4);

#DownPivotHigh.SetDefaultColor(Color.RED);

def condition5 = !isNaN(PivL);

#EMA_1

def EMA_length = 12;

def AvgExp = ExpAverage(price[-displace], EMA_length);

def condition6 = (price >= AvgExp) and (AvgExp[2] <= AvgExp);

#EMA_2

def EMA_2length = 20;

def displace2 = 0;

def AvgExp2 = ExpAverage(price[-displace2], EMA_2length);

def condition7 = (price >= AvgExp2) and (AvgExp[2] <= AvgExp);

#DMI Oscillator

def DMI_length = 5;#Typically set to 10

input DMI_averageType = AverageType.WILDERS;

def diPlus = DMI(DMI_length, DMI_averageType)."DI+";

def diMinus = DMI(DMI_length, DMI_averageType)."DI-";

def Osc = diPlus - diMinus;

def Hist = Osc;

def ZeroLine = 0;

def condition8 = Osc >= zeroline;

#Trend_Periods

def TP_fastLength = 3;#Typically 7

def TP_slowLength = 4;#Typically 15

def Periods = sign(ExpAverage(close, TP_fastLength) - ExpAverage(close, TP_slowLength));

def condition9 = Periods > 0;

#Polarized Fractal Efficiency

def PFE_length = 5;#Typically 10

def smoothingLength = 2.5;#Typically 5

def PFE_diff = close - close[PFE_length - 1];

def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1);

def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength);

def UpperLevel = 50;

def LowerLevel = -50;

def condition10 = PFE > 0;

def conditionPFE_OB = PFE > UpperLevel;

def conditionPFE_OS = PFE < LowerLevel;

#Bollinger Bands PercentB

input BBPB_averageType = AverageType.Simple;

def BBPB_length = 5;#Typically 20

def Num_Dev_Dn = -2.0;

def Num_Dev_up = 2.0;

def BBPB_OB = 100;

def BBPB_OS = 0;

def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand;

def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand;

def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100;

def HalfLine = 50;

def UnitLine = 100;

def condition11 = PercentB > HalfLine;

def conditionBBPB_OB = PercentB > BBPB_OB;

def conditionBBPB_OS = PercentB < BBPB_OS;

#STARC Bands

def ATR_length = 15;

def SMA_lengthS = 6;

def multiplier_factor = 1.5;

def valS = Average(price, SMA_lengthS);

def average_true_range = Average(TrueRange(high, close, low), length = ATR_length);

def Upper_BandS = valS[-displace] + multiplier_factor * average_true_range[-displace];

def Middle_BandS = valS[-displace];

def Lower_BandS = valS[-displace] - multiplier_factor * average_true_range[-displace];

def condition12 = (Upper_BandS[1] <= Upper_BandS) and (Lower_BandS[1] <= Lower_BandS);

#Klinger Histogram

def Klinger_Length = 8;

def KVOsc = KlingerOscillator(Klinger_Length).KVOsc;

def KVOH = KVOsc - Average(KVOsc, Klinger_Length);

def condition13 = (KVOH > 0) and (KVOsc[1] <= KVOsc);

#Projection Oscillator

def ProjectionOsc_length = 9;#Typically 10

def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price=high, length=ProjectionOsc_length));

def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price=low, length=ProjectionOsc_length));

def ProjectionOsc_diff = MaxBound - MinBound;

def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0;

def PROSC_OB = 80;

def PROSC_OS = 20;

def condition14 = PROSC > 50;

def conditionPROSC_OB = PROSC > PROSC_OB;

def conditionPROSC_OS = PROSC < PROSC_OS;

#Trend Confirmation Calculator

#Confirmation_Factor range 1-15.

input coloredCandlesOn = yes;

input Confirmation_Factor = 7;

#Use for testing conditions individually. Remove # from line below and change Confirmation_Factor to 1.

#def Agreement_Level = condition1;

plot Agreement_Level = condition1 + condition2 + condition3 + condition4 + condition5 + condition6 + condition7 + condition8 + condition9 + condition10 + condition11 + condition12 + condition13 + condition14 + conditionKup;

def conditionChannel1 = Upper_BandK > price;

def conditionChannel2 = Lower_BandK < price;

Agreement_Level.AssignValueColor(

if Agreement_Level > Agreement_Level[1] and Agreement_Level >= Confirmation_Factor then Color.RED

else if Agreement_Level < Agreement_Level[1] and Agreement_Level >= Confirmation_Factor then Color.DARK_RED

else if Agreement_Level < Agreement_Level[1] and Agreement_Level < Confirmation_Factor then Color.GREEN else

if Agreement_Level > Agreement_Level[1] and Agreement_Level < Confirmation_Factor then Color.DARK_GREEN

else Color.GRAY);

plot Factor_Line = Confirmation_Factor;

Factor_Line.SetStyle(Curve.SHORT_DASH);

Factor_Line.SetLineWeight(1);

Factor_Line.SetDefaultColor(Color.Gray);

plot OB_Level = 12;

OB_Level.SetPaintingStrategy(PaintingStrategy.LINE);

OB_Level.SetLineWeight(1);

OB_Level.SetDefaultColor(Color.RED);

plot OS_Level = 3;

OS_Level.SetPaintingStrategy(PaintingStrategy.LINE);

OS_Level.SetLineWeight(1);

OS_Level.SetDefaultColor(Color.LIGHT_GREEN);

AddCloud(Agreement_Level, OB_Level, Color.RED, Color.CURRENT);

AddCloud(Agreement_Level, OS_Level, Color.CURRENT, Color.LIGHT_GREEN);Yeah, sorry about that. The upper study has to be used to color the candles. I need to strip that line out of the lower study, its not really doing anything.@Christopher84, thank you for sharing your work! Studies that paint candles are especially helpful to keep my chart uncluttered.

When I plot only the lower study with "colored candles on," I cannot get the candles to paint. Am I doing something wrong, or is it necessary to plot the upper study in order to get the candles to paint?

Thanks in advance

@Christopher84 I haven't looked but if the code logic is the same then the lower indicator could color the chart bars, negating the need for the upper indicator... Again, I haven't compared the scripts... Another option would be to implement an input to enable/disable candle colors in one or both of the indicators...Yeah, sorry about that. The upper study has to be used to color the candles. I need to strip that line out of the lower study, its not really doing anything.

The input is already included to enable/disable candle colors.@Christopher84 I haven't looked but if the code logic is the same then the lower indicator could color the chart bars, negating the need for the upper indicator... Again, I haven't compared the scripts... Another option would be to implement an input to enable/disable candle colors in one or both of the indicators...

#Confirmation Candles V.6

#Created 04/15/2021 by Christopher84

#Select the level of agreement among the 14 indicators included.

#Changed 04/19/2021 to V.3 - Removed ChaikinOsc and replaced with STARCBands. Added squeeze alert.

#Changed 04/20/2021 to V.4 - Added Keltner Channel, Labels, and Buy and Sell Zones. Mean Reversion and Breakout Labels added. Reversal_Alert points added.

#Changed 4/22/2021 to V.5 - Removed Buy/Sell clouds. Created new reversal alert buy(gray points) and take profit (red points). Increase factorK.

#Changed 4/23/2021 to V.6 - Refined reversal signals. Fully integrated Super_OB_OS indicator. Fixed candles going yellow if colored_candles is off.

#Keltner Channel

declare upper;

def displace = 0;

input factorK = 6.5;

input lengthK = 20;

input price = close;

input averageType = AverageType.SIMPLE;

input trueRangeAverageType = AverageType.SIMPLE;

def shift = factorK * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK);

def averageK = MovingAverage(averageType, price, lengthK);

def AvgK = averageK[-displace];

def Upper_BandK = averageK[-displace] + shift[-displace];

def Lower_BandK = averageK[-displace] - shift[-displace];

def conditionKup = price >= Upper_BandK;

def conditionKdown = price <= Lower_BandK;

#MACD with Price

def fastLength = 12;

def slowLength = 26;

def MACDLength = 9;

input MACD_AverageType = {SMA, default EMA};

def MACDLevel = 0.0;

def fastEMA = ExpAverage(price, fastLength);

def slowEMA = ExpAverage(price, slowLength);

def Value;

def Avg;

switch (MACD_AverageType) {

case SMA:

Value = Average(price, fastLength) - Average(price, slowLength);

Avg = Average(Value, MACDLength);

case EMA:

Value = fastEMA - slowEMA;

Avg = ExpAverage(Value, MACDLength);}

def Diff = Value - Avg;

def Level = MACDLevel;

def condition1 = Value[1] <= Value;

#RSI

def RSI_length = 14;

def RSI_AverageType = AverageType.WILDERS;

def RSI_OB = 70;

def RSI_OS = 30;

def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length);

def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

def condition2 = (RSI[3] < RSI) is true or (RSI >= 80) is true;

def conditionOB1 = RSI > RSI_OB;

def conditionOS1 = RSI < RSI_OS;

#MFI

def MFI_Length = 14;

def MFIover_Sold = 20;

def MFIover_Bought = 80;

def movingAvgLength = 1;

def MoneyFlowIndex = Average(moneyflow(high, close, low, volume, MFI_Length), movingAvgLength);

def MFIOverBought = MFIover_Bought;

def MFIOverSold = MFIover_Sold;

def condition3 = (MoneyFlowIndex[2] < MoneyFlowIndex) is true or (MoneyFlowIndex > 85) is true;

def conditionOB2 = MoneyFlowIndex > MFIover_Bought;

def conditionOS2 = MoneyFlowIndex < MFIover_Sold;

#Forecast

def na = Double.NaN;

def MidLine = 50;

def Momentum = MarketForecast().Momentum;

def NearT = MarketForecast().NearTerm;

def Intermed = MarketForecast().Intermediate;

def FOB = 80;

def FOS = 20;

def upperLine = 110;

def condition4 = (Intermed[1] <= Intermed) and (NearT >= MidLine);

def conditionOB3 = Intermed > FOB;

def conditionOS3 = Intermed < FOS;

def conditionOB4 = NearT > FOB;

def conditionOS4 = NearT < FOS;

#Pivot Signals

def n = 20;

def ticks = 2.0;

def bnOK = barNumber() > n;

def isHigher = fold i = 1 to n + 1 with p = 1 while p do high > GetValue(high, -i);

def HH = if bnOK and isHigher and high == Highest(high, n)then high else Double.NaN;

def isLower = fold j = 1 to n + 1 with q = 1 while q do low < GetValue(low, -j);

def LL = if bnOK and isLower and low == Lowest(low, n) then low else Double.NaN;

def PivH = if HH > 0 then HH else Double.NaN;

def PivL = if LL > 0 then LL else Double.NaN;

def UpPivotLow = !isNaN(PivL);

#UpPivotLow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

#UpPivotLow.SetLineWeight(4);

#UpPivotLow.SetDefaultColor(Color.GREEN);

def DownPivotHigh = !isNaN(PivH);

#DownPivotHigh.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

#DownPivotHigh.SetLineWeight(4);

#DownPivotHigh.SetDefaultColor(Color.RED);

def condition5 = !isNaN(PivL);

#EMA_1

def EMA_length = 12;

def AvgExp = ExpAverage(price[-displace], EMA_length);

def condition6 = (price >= AvgExp) and (AvgExp[2] <= AvgExp);

#EMA_2

def EMA_2length = 20;

def displace2 = 0;

def AvgExp2 = ExpAverage(price[-displace2], EMA_2length);

def condition7 = (price >= AvgExp2) and (AvgExp[2] <= AvgExp);

#DMI Oscillator

def DMI_length = 5;#Typically set to 10

input DMI_averageType = AverageType.WILDERS;

def diPlus = DMI(DMI_length, DMI_averageType)."DI+";

def diMinus = DMI(DMI_length, DMI_averageType)."DI-";

def Osc = diPlus - diMinus;

def Hist = Osc;

def ZeroLine = 0;

def condition8 = Osc >= zeroline;

#Trend_Periods

def TP_fastLength = 3;#Typically 7

def TP_slowLength = 4;#Typically 15

def Periods = sign(ExpAverage(close, TP_fastLength) - ExpAverage(close, TP_slowLength));

def condition9 = Periods > 0;

#Polarized Fractal Efficiency

def PFE_length = 5;#Typically 10

def smoothingLength = 2.5;#Typically 5

def PFE_diff = close - close[PFE_length - 1];

def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1);

def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength);

def UpperLevel = 50;

def LowerLevel = -50;

def condition10 = PFE > 0;

def conditionOB5 = PFE > UpperLevel;

def conditionOS5 = PFE < LowerLevel;

#Bollinger Bands PercentB

input BBPB_averageType = AverageType.Simple;

def BBPB_length = 5;#Typically 20

def Num_Dev_Dn = -2.0;

def Num_Dev_up = 2.0;

def BBPB_OB = 100;

def BBPB_OS = 0;

def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand;

def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand;

def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100;

def HalfLine = 50;

def UnitLine = 100;

def condition11 = PercentB > HalfLine;

def conditionOB6 = PercentB > BBPB_OB;

def conditionOS6 = PercentB < BBPB_OS;

#STARC Bands

def ATR_length = 15;

def SMA_lengthS = 6;

def multiplier_factor = 1.5;

def valS = Average(price, SMA_lengthS);

def average_true_range = Average(TrueRange(high, close, low), length = ATR_length);

def Upper_BandS = valS[-displace] + multiplier_factor * average_true_range[-displace];

def Middle_BandS = valS[-displace];

def Lower_BandS = valS[-displace] - multiplier_factor * average_true_range[-displace];

def condition12 = (Upper_BandS[1] <= Upper_BandS) and (Lower_BandS[1] <= Lower_BandS);

#Klinger Histogram

def Klinger_Length = 8;

def KVOsc = KlingerOscillator(Klinger_Length).KVOsc;

def KVOH = KVOsc - Average(KVOsc, Klinger_Length);

def condition13 = (KVOH > 0) and (KVOsc[1] <= KVOsc);

#Projection Oscillator

def ProjectionOsc_length = 9;#Typically 10

def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price=high, length=ProjectionOsc_length));

def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price=low, length=ProjectionOsc_length));

def ProjectionOsc_diff = MaxBound - MinBound;

def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0;

def PROSC_OB = 80;

def PROSC_OS = 20;

def condition14 = PROSC > 50;

def conditionOB7 = PROSC > PROSC_OB;

def conditionOS7 = PROSC < PROSC_OS;

#Trend Confirmation Calculator

#Confirmation_Factor range 1-15.

input coloredCandlesOn = yes;

input Confirmation_Factor = 3;

#Use for testing conditions individually. Remove # from line below and change Confirmation_Factor to 1.

#def Agreement_Level = condition1;

def Agreement_LevelOB = 12;

def Agreement_LevelOS = 3;

def Agreement_Level = condition1 + condition2 + condition3 + condition4 + condition5 + condition6 + condition7 + condition8 + condition9 + condition10 + condition11 + condition12 + condition13 + condition14 + conditionKup;

def conditionChannel1 = Upper_BandK > price;

def conditionChannel2 = Lower_BandK < price;

def UP = if conditionChannel1 and conditionChannel2 then Agreement_Level >= Confirmation_Factor else 0;

def DOWN = if conditionChannel1 and conditionChannel2 then Agreement_Level <= Confirmation_Factor else 0;

AssignPriceColor(if coloredCandlesOn and UP or conditionKup then Color.LIGHT_GREEN else if coloredCandlesOn and DOWN or conditionkdown then Color.RED else Color.CURRENT);

#Additional Signals

#Super_OB/OS Signal

def OB_Level = conditionOB1 + conditionOB2 + conditionOB3 + conditionOB4 + conditionOB5 + conditionOB6 + conditionOB7;

def OS_Level = conditionOS1 + conditionOS2 + conditionOS3 + conditionOS4 + conditionOS5 + conditionOS6 + conditionOS7;

def Concensus_Line = OB_Level - OS_Level;

def Zero_Line = 0;

def Super_OB = 4;

def Super_OS = -2;

def DOWN_OB = (Agreement_Level > Agreement_LevelOB) and (Concensus_Line > Super_OB);

def UP_OS = (Agreement_Level < Agreement_LevelOS) and (Concensus_Line > Super_OS);

def OS_Buy = UP_OS;

def OB_Sell = DOWN_OB;

def neutral = Concensus_Line < Super_OB and Concensus_Line > Super_OS;

#AddVerticalLine (OS_Buy and !OS_Buy[1], close, Color.GREEN, Curve.SHORT_DASH);

#AddVerticalLine (Neutral and !neutral[1], close, Color.Gray, Curve.SHORT_DASH);

#AddVerticalLine (OB_Sell and OB_Sell and !OB_Sell[1], close, Color.RED, Curve.SHORT_DASH);

def Buy_Opportnity = if OS_Buy then Double.POSITIVE_INFINITY else Double.NEGATIVE_INFINITY;

#AddCloud(Buy_Opportnity, Neutral, Color.LIGHT_GREEN, Color.LIGHT_RED);

def Sell_Opportnity = if OB_Sell then Double.POSITIVE_INFINITY else Double.NEGATIVE_INFINITY;

#AddCloud(Sell_Opportnity, Neutral, Color.LIGHT_RED, Color.LIGHT_RED);

plot OB_Signal = price crosses below Upper_BandK;

OB_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

OB_Signal.SetLineWeight(1);

OB_Signal.SetDefaultColor(Color.RED);

plot OS_Signal = price crosses above Lower_BandK;

OS_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

OS_Signal.SetLineWeight(1);

OS_Signal.SetDefaultColor(Color.GREEN);

#Squeeze Alert

def length = 20;

def BulgeLength = 150;

def SqueezeLength = 150;

def upperBandBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_Up, averageType).UpperBand;

def lowerBandBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_Up, averageType).LowerBand;

def midLineBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_Up, averageType).MidLine;

def Bandwidth = (upperBandBB - lowerBandBB) / midLineBB * 100;

def Bulge = Highest(Bandwidth, BulgeLength);

def Squeeze = Lowest(Bandwidth, SqueezeLength);

plot Squeeze_Alert = bandwidth <= squeeze;

Squeeze_Alert.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS);

Squeeze_Alert.SetLineWeight(3);

Squeeze_Alert.SetDefaultColor(Color.YELLOW);

#Trend Signals

plot UPConfirmSignal = Agreement_Level crosses above Confirmation_Factor;

UPConfirmSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

UPConfirmSignal.SetLineWeight(1);

UPConfirmSignal.SetDefaultColor(Color.GREEN);

plot DOWNConfirmSignal = Agreement_Level crosses below Confirmation_Factor;

DOWNConfirmSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

DOWNConfirmSignal.SetLineWeight(1);

DOWNConfirmSignal.SetDefaultColor(Color.RED);

plot Reversal_Alert1 = ((Agreement_Level crosses below Agreement_LevelOB) and (Concensus_Line crosses below Super_OB));

Reversal_Alert1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

Reversal_Alert1.SetLineWeight(1);

Reversal_Alert1.SetDefaultColor(Color.RED);

plot Reversal_Alert2 = Agreement_Level crosses above Agreement_LevelOS;

Reversal_Alert2.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

Reversal_Alert2.SetLineWeight(1);

Reversal_Alert2.SetDefaultColor(Color.RED);

def condition_OS = ((Agreement_Level <= 1) or (Concensus_Line <= -3) and (price < lower_BandS));

def condition_Flat = (Agreement_Level[1] == Agreement_Level) or (Concensus_Line[1] == Concensus_Line);

plot Reversal_Alert3 = condition_OS and condition_Flat;

Reversal_Alert3.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS);

Reversal_Alert3.SetLineWeight(1);

Reversal_Alert3.SetDefaultColor(Color.LIGHT_GRAY);

def condition_OB = ((Agreement_Level >= 12) or (Concensus_Line >= 2) and (price > upper_BandS));

plot Reversal_Alert4 = condition_OB and condition_Flat;

Reversal_Alert4.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS);

Reversal_Alert4.SetLineWeight(1);

Reversal_Alert4.SetDefaultColor(Color.LIGHT_RED);

def condition_Flat2 = (Agreement_Level[1] == Agreement_Level) and (Concensus_Line[1] == Concensus_Line);

plot Reversal_Alert5 = condition_Flat2 and condition_OS;

Reversal_Alert5.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS);

Reversal_Alert5.SetLineWeight(4);

Reversal_Alert5.SetDefaultColor(Color.GREEN);

plot Reversal_Alert6 = condition_Flat2 and condition_OB;

Reversal_Alert6.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS);

Reversal_Alert6.SetLineWeight(4);

Reversal_Alert6.SetDefaultColor(Color.RED);

def condition_Reversal_CA_Buy = (Agreement_Level < 1) and (Agreement_Level[1] <= Agreement_Level);

def condition_Reversal_SOS_Buy = (Concensus_Line < -2) and (Concensus_Line[1] <= Concensus_Line);

#plot Reversal_Buy = (condition_Reversal_CA_Buy) or (condition_Reversal_SOS_Buy);

#Reversal_Buy.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS);

#Reversal_Buy.SetLineWeight(1);

#Reversal_Buy.SetDefaultColor(Color.LIGHT_GRAY);

#Labels

def Buy = UP_OS;

def Sell = DOWN_OB;

AddLabel(yes, "Look_To_Buy", if Buy then Color.GREEN else Color.GRAY);

AddLabel(yes, "Look_To_Sell", if Sell then Color.RED else Color.GRAY);

def MomentumUP = Agreement_Level[1] < Agreement_Level;

def MomentumDOWN = Agreement_Level[1] > Agreement_Level;

AddLabel(yes, "Increasing Momentum", if MomentumUP then Color.Green else Color.GRAY);

AddLabel(yes, "Decreasing Momentum", if MomentumDOWN then Color.RED else Color.GRAY);

def conditionMR = (Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS);

AddLabel(yes, "MEAN REVERSION", if conditionMR then Color.RED else Color.GRAY);

def conditionBO = (Upper_BandS[1] < Upper_BandS) and (Lower_BandS[1] < Lower_BandS);

AddLabel(yes, "BREAKOUT", if conditionBO then Color.GREEN else Color.GRAY);

def conditionBD = (Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS);

AddLabel(yes, "BREAKDOWN", if conditionBD then Color.RED else Color.GRAY);

def Squeeze_Signal = Squeeze_Alert;

AddLabel(yes, "SQUEEZE ALERT", if Squeeze_Signal then Color.YELLOW else Color.GRAY);- Status

- Not open for further replies.

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/