You should upgrade or use an alternative browser.

Confirmation Candles Indicator For ThinkorSwim

- Thread starter Christopher84

- Start date

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Beltaco

New member

Hi @Beltaco,

The codes are working properly. Please read carefully. The strategies posted here on pg.55 have been altered from the default settings in order to get the floating PL study to work properly for each strategy. However, the 1 min strategy posted here on pg.55 will paint EXACTLY like the Scalper Upper posted on pg.1 of this thread. I hope this helps!

Thanks for confirming. I may be doing something wrong, this is what I'm getting.

Falout

Member

Thanks very much. This is great.Hey @Falout!

It appears that the default time frames have to be changed in the code to get the floating PL study to work. I have put together 3 different versions. Please be cautious that these strategies can repaint until all time frames in the calculation have closed. Here's the Scalper strategy for 3 min chart.

Code:#Scalper Upper v2 Strategy Created 03/16/2022 by Christopher84 declare upper; input price = close; input length = 10; input length2 = 35; input agperiod1 = { "1 min", "2 min", default "3 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "2 hours", "4 hours", "Day", "Week", "Month"}; input agperiod2 = {"1 min", "2 min", "3 min",default "5 min", "10 min", "15 min", "30 min", "1 hour", "2 hours", "4 hours", "Day", "Week", "Month"}; input agperiod3 = {"1 min", "2 min", "3 min", "5 min", default "10 min", "15 min", "30 min", "1 hour", "2 hours", "4 hours", "Day", "Week", "Month"}; input agperiod4 = {"1 min", "2 min", "3 min", "5 min", "10 min", "15 min", default "30 min", "1 hour", "2 hours", "4 hours", "Day", "Week", "Month"}; input agperiod5 = {"1 min", "2 min", "3 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "2 hours", default "4 hours", "Day", "Week", "Month"}; input agperiod6 = {"1 min", "2 min", "3 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "2 hours", "4 hours", default "Day", "Week", "Month"}; def displace = 0; input paintCandles = yes; input show_ema_cloud = yes; #Current Period plot AvgExp = ExpAverage(price[-displace], length); AvgExp.SetStyle(Curve.SHORT_DASH); def UPC1 = AvgExp > AvgExp[1]; def DNC1 = AvgExp < AvgExp[1]; plot AvgExp2 = ExpAverage(price[-displace], length2); AvgExp2.SetStyle(Curve.SHORT_DASH); def UPC2 = AvgExp2 > AvgExp2[1]; def DNC2 = AvgExp2 < AvgExp2[1]; def Below = AvgExp < AvgExp2; def Spark = UPC1 + UPC2 + Below; def UPEMA = AvgExp[1] < AvgExp; def DOWNEMA = AvgExp[1] > AvgExp; AvgExp.AssignValueColor(if UPEMA then Color.LIGHT_GREEN else if DOWNEMA then Color.RED else Color.YELLOW); def UPEMA2 = AvgExp2[1] < AvgExp2; def DOWNEMA2 = AvgExp2[1] > AvgExp2; AvgExp2.AssignValueColor(if UPEMA2 then Color.LIGHT_GREEN else if DOWNEMA2 then Color.RED else Color.YELLOW); AddCloud(if show_ema_cloud and (AvgExp2 > AvgExp) then AvgExp2 else Double.NaN, AvgExp, Color.LIGHT_RED, Color.CURRENT); AddCloud(if show_ema_cloud and (AvgExp > AvgExp2) then AvgExp else Double.NaN, AvgExp2, Color.LIGHT_GREEN, Color.CURRENT); #Agperiod1 def avg = ExpAverage(close(period = agperiod1), length); def height = avg - avg[length]; def avg2 = ExpAverage(close(period = agperiod1), length2); def height2 = avg2 - avg2[length2]; def UP = avg > avg2; def DOWN = avg < avg2; def R1UP = avg > avg[1]; def R1DN = avg < avg[1]; def R2UP = avg2 > avg2[1]; def R2DN = avg2 < avg2[1]; #Agperiod2 def avg3 = ExpAverage(close(period = agperiod2), length); def height3 = avg3 - avg3[length]; def avg4 = ExpAverage(close(period = agperiod2), length2); def height4 = avg4 - avg4[length2]; def UP2 = avg3 > avg4; def DOWN2 = avg3 < avg4; def R3UP = avg3 > avg3[1]; def R3DN = avg3 < avg3[1]; def R4UP = avg4 > avg4[1]; def R4DN = avg4 < avg4[1]; #Agperiod3 def avg5 = ExpAverage(close(period = agperiod3), length); def height5 = avg5 - avg5[length]; def avg6 = ExpAverage(close(period = agperiod3), length2); def height6 = avg6 - avg6[length2]; def UP3 = avg5 > avg6; def DOWN3 = avg5 < avg6; def R5UP = avg5 > avg5[1]; def R5DN = avg5 < avg5[1]; def R6UP = avg6 > avg6[1]; def R6DN = avg6 < avg6[1]; #Agperiod4 def avg7 = ExpAverage(close(period = agperiod4), length); def height7 = avg7 - avg7[length]; def avg8 = ExpAverage(close(period = agperiod4), length2); def height8 = avg8 - avg8[length2]; def UP4 = avg7 > avg8; def DOWN4 = avg7 < avg8; def R7UP = avg7 > avg7[1]; def R7DN = avg7 < avg7[1]; def R8UP = avg8 > avg8[1]; def R8DN = avg8 < avg8[1]; #Agperiod5 def avg9 = ExpAverage(close(period = agperiod5), length); def height9 = avg9 - avg9[length]; def avg10 = ExpAverage(close(period = agperiod5), length2); def height10 = avg10 - avg10[length2]; def UP5 = avg9 > avg10; def DOWN5 = avg9 < avg10; def R9UP = avg9 > avg9[1]; def R9DN = avg9 < avg9[1]; def R10UP = avg10 > avg10[1]; def R10DN = avg10 < avg10[1]; #Agperiod6 def avg11 = ExpAverage(close(period = agperiod6), length); def height11 = avg11 - avg11[length]; def avg12 = ExpAverage(close(period = agperiod6), length2); def height12 = avg12 - avg12[length2]; def UP6 = avg11 > avg12; def DOWN6 = avg11 < avg12; def R11UP = avg11 > avg11[1]; def R11DN = avg11 < avg11[1]; def R12UP = avg12 > avg12[1]; def R12DN = avg12 < avg12[1]; def Long_Only = UP + UP2 + UP3 + UP4 + UP5 + UP6; def Short_Only = DOWN + DOWN2 + DOWN3 + DOWN4 + DOWN5 + DOWN6; def Consensus_Bias = Long_Only - Short_Only; def RUP = UPC1 + UPC2 + R1UP + R2UP + R3UP + R4UP + R5UP + R6UP + R7UP + R8UP + R9UP + R10UP + R11UP + R12UP; def RDN = DNC1 + DNC2 + R1DN + R2DN + R3DN + R4DN + R5DN + R6DN + R7DN + R8DN + R9DN + R10DN + R11DN + R12DN; def ConsensusR = RUP - RDN; script WMA_Smooth { input price = hl2; plot smooth = (4 * price + 3 * price[1] + 2 * price[2] + price[3]) / 10; } script Phase_Accumulation { # This is Ehler's Phase Accumulation code. It has a full cycle delay. # However, it computes the correction factor to a very high degree. # input price = hl2; rec Smooth; rec Detrender; rec Period; rec Q1; rec I1; rec I1p; rec Q1p; rec Phase1; rec Phase; rec DeltaPhase; rec DeltaPhase1; rec InstPeriod1; rec InstPeriod; def CorrectionFactor; if BarNumber() <= 5 then { Period = 0; Smooth = 0; Detrender = 0; CorrectionFactor = 0; Q1 = 0; I1 = 0; Q1p = 0; I1p = 0; Phase = 0; Phase1 = 0; DeltaPhase1 = 0; DeltaPhase = 0; InstPeriod = 0; InstPeriod1 = 0; } else { CorrectionFactor = 0.075 * Period[1] + 0.54; # Smooth and detrend my smoothed signal: Smooth = WMA_Smooth(price); Detrender = ( 0.0962 * Smooth + 0.5769 * Smooth[2] - 0.5769 * Smooth[4] - 0.0962 * Smooth[6] ) * CorrectionFactor; # Compute Quadrature and Phase of Detrended signal: Q1p = ( 0.0962 * Detrender + 0.5769 * Detrender[2] - 0.5769 * Detrender[4] - 0.0962 * Detrender[6] ) * CorrectionFactor; I1p = Detrender[3]; # Smooth out Quadrature and Phase: I1 = 0.15 * I1p + 0.85 * I1p[1]; Q1 = 0.15 * Q1p + 0.85 * Q1p[1]; # Determine Phase if I1 != 0 then { # Normally, ATAN gives results from -pi/2 to pi/2. # We need to map this to circular coordinates 0 to 2pi if Q1 >= 0 and I1 > 0 then { # Quarant 1 Phase1 = ATan(AbsValue(Q1 / I1)); } else if Q1 >= 0 and I1 < 0 then { # Quadrant 2 Phase1 = Double.Pi - ATan(AbsValue(Q1 / I1)); } else if Q1 < 0 and I1 < 0 then { # Quadrant 3 Phase1 = Double.Pi + ATan(AbsValue(Q1 / I1)); } else { # Quadrant 4 Phase1 = 2 * Double.Pi - ATan(AbsValue(Q1 / I1)); } } else if Q1 > 0 then { # I1 == 0, Q1 is positive Phase1 = Double.Pi / 2; } else if Q1 < 0 then { # I1 == 0, Q1 is negative Phase1 = 3 * Double.Pi / 2; } else { # I1 and Q1 == 0 Phase1 = 0; } # Convert phase to degrees Phase = Phase1 * 180 / Double.Pi; if Phase[1] < 90 and Phase > 270 then { # This occurs when there is a big jump from 360-0 DeltaPhase1 = 360 + Phase[1] - Phase; } else { DeltaPhase1 = Phase[1] - Phase; } # Limit our delta phases between 7 and 60 if DeltaPhase1 < 7 then { DeltaPhase = 7; } else if DeltaPhase1 > 60 then { DeltaPhase = 60; } else { DeltaPhase = DeltaPhase1; } # Determine Instantaneous period: InstPeriod1 = -1 * (fold i = 0 to 40 with v=0 do if v < 0 then v else if v > 360 then -i else v + GetValue(DeltaPhase, i, 41) ); if InstPeriod1 <= 0 then { InstPeriod = InstPeriod[1]; } else { InstPeriod = InstPeriod1; } Period = 0.25 * InstPeriod + 0.75 * Period[1]; } plot DC = Period; } script Ehler_MAMA { input price = hl2; input FastLimit = 0.5; input SlowLimit = 0.05; rec Period; rec Period_raw; rec Period_cap; rec Period_lim; rec Smooth; rec Detrender; rec I1; rec Q1; rec jI; rec jQ; rec I2; rec Q2; rec I2_raw; rec Q2_raw; rec Phase; rec DeltaPhase; rec DeltaPhase_raw; rec alpha; rec alpha_raw; rec Re; rec Im; rec Re_raw; rec Im_raw; rec SmoothPeriod; rec vmama; rec vfama; def CorrectionFactor = Phase_Accumulation(price).CorrectionFactor; if BarNumber() <= 5 then { Smooth = 0; Detrender = 0; Period = 0; Period_raw = 0; Period_cap = 0; Period_lim = 0; I1 = 0; Q1 = 0; I2 = 0; Q2 = 0; jI = 0; jQ = 0; I2_raw = 0; Q2_raw = 0; Re = 0; Im = 0; Re_raw = 0; Im_raw = 0; SmoothPeriod = 0; Phase = 0; DeltaPhase = 0; DeltaPhase_raw = 0; alpha = 0; alpha_raw = 0; vmama = 0; vfama = 0; } else { # Smooth and detrend my smoothed signal: Smooth = WMA_Smooth(price); Detrender = ( 0.0962 * Smooth + 0.5769 * Smooth[2] - 0.5769 * Smooth[4] - 0.0962 * Smooth[6] ) * CorrectionFactor; Q1 = ( 0.0962 * Detrender + 0.5769 * Detrender[2] - 0.5769 * Detrender[4] - 0.0962 * Detrender[6] ) * CorrectionFactor; I1 = Detrender[3]; jI = ( 0.0962 * I1 + 0.5769 * I1[2] - 0.5769 * I1[4] - 0.0962 * I1[6] ) * CorrectionFactor; jQ = ( 0.0962 * Q1 + 0.5769 * Q1[2] - 0.5769 * Q1[4] - 0.0962 * Q1[6] ) * CorrectionFactor; # This is the complex conjugate I2_raw = I1 - jQ; Q2_raw = Q1 + jI; I2 = 0.2 * I2_raw + 0.8 * I2_raw[1]; Q2 = 0.2 * Q2_raw + 0.8 * Q2_raw[1]; Re_raw = I2 * I2[1] + Q2 * Q2[1]; Im_raw = I2 * Q2[1] - Q2 * I2[1]; Re = 0.2 * Re_raw + 0.8 * Re_raw[1]; Im = 0.2 * Im_raw + 0.8 * Im_raw[1]; # Compute the phase if Re != 0 and Im != 0 then { Period_raw = 2 * Double.Pi / ATan(Im / Re); } else { Period_raw = 0; } if Period_raw > 1.5 * Period_raw[1] then { Period_cap = 1.5 * Period_raw[1]; } else if Period_raw < 0.67 * Period_raw[1] { Period_cap = 0.67 * Period_raw[1]; } else { Period_cap = Period_raw; } if Period_cap < 6 then { Period_lim = 6; } else if Period_cap > 50 then { Period_lim = 50; } else { Period_lim = Period_cap; } Period = 0.2 * Period_lim + 0.8 * Period_lim[1]; SmoothPeriod = 0.33 * Period + 0.67 * SmoothPeriod[1]; if I1 != 0 then { Phase = ATan(Q1 / I1); } else if Q1 > 0 then { # Quadrant 1: Phase = Double.Pi / 2; } else if Q1 < 0 then { # Quadrant 4: Phase = -Double.Pi / 2; } else { # Both numerator and denominator are 0. Phase = 0; } DeltaPhase_raw = Phase[1] - Phase; if DeltaPhase_raw < 1 then { DeltaPhase = 1; } else { DeltaPhase = DeltaPhase_raw; } alpha_raw = FastLimit / DeltaPhase; if alpha_raw < SlowLimit then { alpha = SlowLimit; } else { alpha = alpha_raw; } vmama = alpha * price + (1 - alpha) * vmama[1]; vfama = 0.5 * alpha * vmama + (1 - 0.5 * alpha) * vfama[1]; } plot MAMA = vmama; plot FAMA = vfama; } input price2 = hl2; input FastLimit = 0.5; input SlowLimit = 0.05; def MAMA = Ehler_MAMA(price2, FastLimit, SlowLimit).MAMA; def FAMA = Ehler_MAMA(price2, FastLimit, SlowLimit).FAMA; def Crossing = Crosses((MAMA < FAMA), yes); #Crossing.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); def Crossing1 = Crosses((MAMA > FAMA), yes); #Crossing1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); AddLabel(yes, Concat("MAMA: ", Concat("", if MAMA > FAMA then "Bull" else "Bear")), if MAMA > FAMA then Color.GREEN else Color.RED); ################################## plot C3_MF_Line = (MAMA + FAMA) / 2; C3_MF_Line.SetPaintingStrategy(PaintingStrategy.LINE); C3_MF_Line.SetLineWeight(3); def direction = if ConsensusR > Consensus_Bias then 1 else if ConsensusR < Consensus_Bias then -1 else 0; C3_MF_Line.AssignValueColor(if paintCandles and ((direction == 1) and (price > C3_MF_Line)) then Color.GREEN else if paintCandles and ((direction == -1) and (price < C3_MF_Line)) then Color.RED else Color.GRAY); plot buy = AvgExp crosses above AvgExp2;#direction crosses above 0; buy.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); buy.SetDefaultColor(Color.WHITE); plot sell = AvgExp crosses below AvgExp2;#direction crosses below 0; sell.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN ); sell.SetDefaultColor(Color.WHITE); AssignPriceColor(if paintCandles then if direction == 1 then Color.GREEN else if direction == -1 then Color.RED else Color.GRAY else Color.CURRENT); AddLabel(yes, if (Spark == 3) then "SPARK UP = " + Round(Spark, 1) else if (Spark == 0) then "SPARK DOWN = " + Round(Spark, 1) else "SPARK = " + Round(Spark, 1), if (Spark == 3) then Color.YELLOW else if ((Spark == 2) and (AvgExp > AvgExp2)) then Color.GREEN else if (Spark == 0) then Color.RED else Color.GRAY); AddLabel(yes, if ((UP6 == 1) and (Consensus_Bias > 0)) then " SCALP_LONG " else if ((DOWN6) and (Consensus_Bias < 0)) then " SCALP_SHORT " else " CHOP ", if ((Consensus_Bias > 0) and (UP6 == 1)) then Color.GREEN else if ((Consensus_Bias < 0) and (DOWN6 == 1)) then Color.RED else Color.GRAY); AddLabel(yes, if (ConsensusR > 0) then " LONG BIAS = %" + Round((ConsensusR / 14) * 100, 1) + " " else if (ConsensusR < 0) then " SHORT BIAS = %" + Round(((ConsensusR * -1) / 14) * 100, 1) + " " else " CHOP =" + Round((ConsensusR / 14) * 100, 1) + " ", if (ConsensusR > 0) then Color.GREEN else if (ConsensusR < 0) then Color.RED else Color.GRAY); Alert(direction crosses above 0, "long", Alert.BAR, Sound.DING); Alert(direction crosses below 0, "short", Alert.BAR, Sound.DING); #Strategy def Long_Entry = (ConsensusR crosses above Consensus_Bias); def Long_Exit = (ConsensusR crosses below Consensus_Bias); AddOrder(OrderType.BUY_AUTO, condition = Long_Entry, price = open[-1], 1, tickcolor = GetColor(1), arrowcolor = Color.LIME, name = "LE"); AddOrder(OrderType.SELL_AUTO, condition = Long_Exit, price = open[-1], 1, tickcolor = GetColor(2), arrowcolor = Color.LIME, name = "SE"); Alert(Long_Entry, "long", Alert.BAR, Sound.DING); Alert(Long_Exit, "short", Alert.BAR, Sound.DING);

Here's the strategy for the 1 min chart.

Code:#Scalper Upper v2 Strategy Created 03/16/2022 by Christopher84 declare upper; input price = close; input length = 10; input length2 = 35; input agperiod1 = { "1 min", default "2 min", "3 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "2 hours", "4 hours", "Day", "Week", "Month"}; input agperiod2 = {"1 min", "2 min", default "3 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "2 hours", "4 hours", "Day", "Week", "Month"}; input agperiod3 = {"1 min", "2 min", "3 min", "5 min", default "10 min", "15 min", "30 min", "1 hour", "2 hours", "4 hours", "Day", "Week", "Month"}; input agperiod4 = {"1 min", "2 min", "3 min", "5 min", "10 min", "15 min", default "30 min", "1 hour", "2 hours", "4 hours", "Day", "Week", "Month"}; input agperiod5 = {"1 min", "2 min", "3 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "2 hours", default "4 hours", "Day", "Week", "Month"}; input agperiod6 = {"1 min", "2 min", "3 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "2 hours", "4 hours", default "Day", "Week", "Month"}; def displace = 0; input paintCandles = yes; input show_ema_cloud = yes; #Current Period plot AvgExp = ExpAverage(price[-displace], length); AvgExp.SetStyle(Curve.SHORT_DASH); def UPC1 = AvgExp > AvgExp[1]; def DNC1 = AvgExp < AvgExp[1]; plot AvgExp2 = ExpAverage(price[-displace], length2); AvgExp2.SetStyle(Curve.SHORT_DASH); def UPC2 = AvgExp2 > AvgExp2[1]; def DNC2 = AvgExp2 < AvgExp2[1]; def Below = AvgExp < AvgExp2; def Spark = UPC1 + UPC2 + Below; def UPEMA = AvgExp[1] < AvgExp; def DOWNEMA = AvgExp[1] > AvgExp; AvgExp.AssignValueColor(if UPEMA then Color.LIGHT_GREEN else if DOWNEMA then Color.RED else Color.YELLOW); def UPEMA2 = AvgExp2[1] < AvgExp2; def DOWNEMA2 = AvgExp2[1] > AvgExp2; AvgExp2.AssignValueColor(if UPEMA2 then Color.LIGHT_GREEN else if DOWNEMA2 then Color.RED else Color.YELLOW); AddCloud(if show_ema_cloud and (AvgExp2 > AvgExp) then AvgExp2 else Double.NaN, AvgExp, Color.LIGHT_RED, Color.CURRENT); AddCloud(if show_ema_cloud and (AvgExp > AvgExp2) then AvgExp else Double.NaN, AvgExp2, Color.LIGHT_GREEN, Color.CURRENT); #Agperiod1 def avg = ExpAverage(close(period = agperiod1), length); def height = avg - avg[length]; def avg2 = ExpAverage(close(period = agperiod1), length2); def height2 = avg2 - avg2[length2]; def UP = avg > avg2; def DOWN = avg < avg2; def R1UP = avg > avg[1]; def R1DN = avg < avg[1]; def R2UP = avg2 > avg2[1]; def R2DN = avg2 < avg2[1]; #Agperiod2 def avg3 = ExpAverage(close(period = agperiod2), length); def height3 = avg3 - avg3[length]; def avg4 = ExpAverage(close(period = agperiod2), length2); def height4 = avg4 - avg4[length2]; def UP2 = avg3 > avg4; def DOWN2 = avg3 < avg4; def R3UP = avg3 > avg3[1]; def R3DN = avg3 < avg3[1]; def R4UP = avg4 > avg4[1]; def R4DN = avg4 < avg4[1]; #Agperiod3 def avg5 = ExpAverage(close(period = agperiod3), length); def height5 = avg5 - avg5[length]; def avg6 = ExpAverage(close(period = agperiod3), length2); def height6 = avg6 - avg6[length2]; def UP3 = avg5 > avg6; def DOWN3 = avg5 < avg6; def R5UP = avg5 > avg5[1]; def R5DN = avg5 < avg5[1]; def R6UP = avg6 > avg6[1]; def R6DN = avg6 < avg6[1]; #Agperiod4 def avg7 = ExpAverage(close(period = agperiod4), length); def height7 = avg7 - avg7[length]; def avg8 = ExpAverage(close(period = agperiod4), length2); def height8 = avg8 - avg8[length2]; def UP4 = avg7 > avg8; def DOWN4 = avg7 < avg8; def R7UP = avg7 > avg7[1]; def R7DN = avg7 < avg7[1]; def R8UP = avg8 > avg8[1]; def R8DN = avg8 < avg8[1]; #Agperiod5 def avg9 = ExpAverage(close(period = agperiod5), length); def height9 = avg9 - avg9[length]; def avg10 = ExpAverage(close(period = agperiod5), length2); def height10 = avg10 - avg10[length2]; def UP5 = avg9 > avg10; def DOWN5 = avg9 < avg10; def R9UP = avg9 > avg9[1]; def R9DN = avg9 < avg9[1]; def R10UP = avg10 > avg10[1]; def R10DN = avg10 < avg10[1]; #Agperiod6 def avg11 = ExpAverage(close(period = agperiod6), length); def height11 = avg11 - avg11[length]; def avg12 = ExpAverage(close(period = agperiod6), length2); def height12 = avg12 - avg12[length2]; def UP6 = avg11 > avg12; def DOWN6 = avg11 < avg12; def R11UP = avg11 > avg11[1]; def R11DN = avg11 < avg11[1]; def R12UP = avg12 > avg12[1]; def R12DN = avg12 < avg12[1]; def Long_Only = UP + UP2 + UP3 + UP4 + UP5 + UP6; def Short_Only = DOWN + DOWN2 + DOWN3 + DOWN4 + DOWN5 + DOWN6; def Consensus_Bias = Long_Only - Short_Only; def RUP = UPC1 + UPC2 + R1UP + R2UP + R3UP + R4UP + R5UP + R6UP + R7UP + R8UP + R9UP + R10UP + R11UP + R12UP; def RDN = DNC1 + DNC2 + R1DN + R2DN + R3DN + R4DN + R5DN + R6DN + R7DN + R8DN + R9DN + R10DN + R11DN + R12DN; def ConsensusR = RUP - RDN; script WMA_Smooth { input price = hl2; plot smooth = (4 * price + 3 * price[1] + 2 * price[2] + price[3]) / 10; } script Phase_Accumulation { # This is Ehler's Phase Accumulation code. It has a full cycle delay. # However, it computes the correction factor to a very high degree. # input price = hl2; rec Smooth; rec Detrender; rec Period; rec Q1; rec I1; rec I1p; rec Q1p; rec Phase1; rec Phase; rec DeltaPhase; rec DeltaPhase1; rec InstPeriod1; rec InstPeriod; def CorrectionFactor; if BarNumber() <= 5 then { Period = 0; Smooth = 0; Detrender = 0; CorrectionFactor = 0; Q1 = 0; I1 = 0; Q1p = 0; I1p = 0; Phase = 0; Phase1 = 0; DeltaPhase1 = 0; DeltaPhase = 0; InstPeriod = 0; InstPeriod1 = 0; } else { CorrectionFactor = 0.075 * Period[1] + 0.54; # Smooth and detrend my smoothed signal: Smooth = WMA_Smooth(price); Detrender = ( 0.0962 * Smooth + 0.5769 * Smooth[2] - 0.5769 * Smooth[4] - 0.0962 * Smooth[6] ) * CorrectionFactor; # Compute Quadrature and Phase of Detrended signal: Q1p = ( 0.0962 * Detrender + 0.5769 * Detrender[2] - 0.5769 * Detrender[4] - 0.0962 * Detrender[6] ) * CorrectionFactor; I1p = Detrender[3]; # Smooth out Quadrature and Phase: I1 = 0.15 * I1p + 0.85 * I1p[1]; Q1 = 0.15 * Q1p + 0.85 * Q1p[1]; # Determine Phase if I1 != 0 then { # Normally, ATAN gives results from -pi/2 to pi/2. # We need to map this to circular coordinates 0 to 2pi if Q1 >= 0 and I1 > 0 then { # Quarant 1 Phase1 = ATan(AbsValue(Q1 / I1)); } else if Q1 >= 0 and I1 < 0 then { # Quadrant 2 Phase1 = Double.Pi - ATan(AbsValue(Q1 / I1)); } else if Q1 < 0 and I1 < 0 then { # Quadrant 3 Phase1 = Double.Pi + ATan(AbsValue(Q1 / I1)); } else { # Quadrant 4 Phase1 = 2 * Double.Pi - ATan(AbsValue(Q1 / I1)); } } else if Q1 > 0 then { # I1 == 0, Q1 is positive Phase1 = Double.Pi / 2; } else if Q1 < 0 then { # I1 == 0, Q1 is negative Phase1 = 3 * Double.Pi / 2; } else { # I1 and Q1 == 0 Phase1 = 0; } # Convert phase to degrees Phase = Phase1 * 180 / Double.Pi; if Phase[1] < 90 and Phase > 270 then { # This occurs when there is a big jump from 360-0 DeltaPhase1 = 360 + Phase[1] - Phase; } else { DeltaPhase1 = Phase[1] - Phase; } # Limit our delta phases between 7 and 60 if DeltaPhase1 < 7 then { DeltaPhase = 7; } else if DeltaPhase1 > 60 then { DeltaPhase = 60; } else { DeltaPhase = DeltaPhase1; } # Determine Instantaneous period: InstPeriod1 = -1 * (fold i = 0 to 40 with v=0 do if v < 0 then v else if v > 360 then -i else v + GetValue(DeltaPhase, i, 41) ); if InstPeriod1 <= 0 then { InstPeriod = InstPeriod[1]; } else { InstPeriod = InstPeriod1; } Period = 0.25 * InstPeriod + 0.75 * Period[1]; } plot DC = Period; } script Ehler_MAMA { input price = hl2; input FastLimit = 0.5; input SlowLimit = 0.05; rec Period; rec Period_raw; rec Period_cap; rec Period_lim; rec Smooth; rec Detrender; rec I1; rec Q1; rec jI; rec jQ; rec I2; rec Q2; rec I2_raw; rec Q2_raw; rec Phase; rec DeltaPhase; rec DeltaPhase_raw; rec alpha; rec alpha_raw; rec Re; rec Im; rec Re_raw; rec Im_raw; rec SmoothPeriod; rec vmama; rec vfama; def CorrectionFactor = Phase_Accumulation(price).CorrectionFactor; if BarNumber() <= 5 then { Smooth = 0; Detrender = 0; Period = 0; Period_raw = 0; Period_cap = 0; Period_lim = 0; I1 = 0; Q1 = 0; I2 = 0; Q2 = 0; jI = 0; jQ = 0; I2_raw = 0; Q2_raw = 0; Re = 0; Im = 0; Re_raw = 0; Im_raw = 0; SmoothPeriod = 0; Phase = 0; DeltaPhase = 0; DeltaPhase_raw = 0; alpha = 0; alpha_raw = 0; vmama = 0; vfama = 0; } else { # Smooth and detrend my smoothed signal: Smooth = WMA_Smooth(price); Detrender = ( 0.0962 * Smooth + 0.5769 * Smooth[2] - 0.5769 * Smooth[4] - 0.0962 * Smooth[6] ) * CorrectionFactor; Q1 = ( 0.0962 * Detrender + 0.5769 * Detrender[2] - 0.5769 * Detrender[4] - 0.0962 * Detrender[6] ) * CorrectionFactor; I1 = Detrender[3]; jI = ( 0.0962 * I1 + 0.5769 * I1[2] - 0.5769 * I1[4] - 0.0962 * I1[6] ) * CorrectionFactor; jQ = ( 0.0962 * Q1 + 0.5769 * Q1[2] - 0.5769 * Q1[4] - 0.0962 * Q1[6] ) * CorrectionFactor; # This is the complex conjugate I2_raw = I1 - jQ; Q2_raw = Q1 + jI; I2 = 0.2 * I2_raw + 0.8 * I2_raw[1]; Q2 = 0.2 * Q2_raw + 0.8 * Q2_raw[1]; Re_raw = I2 * I2[1] + Q2 * Q2[1]; Im_raw = I2 * Q2[1] - Q2 * I2[1]; Re = 0.2 * Re_raw + 0.8 * Re_raw[1]; Im = 0.2 * Im_raw + 0.8 * Im_raw[1]; # Compute the phase if Re != 0 and Im != 0 then { Period_raw = 2 * Double.Pi / ATan(Im / Re); } else { Period_raw = 0; } if Period_raw > 1.5 * Period_raw[1] then { Period_cap = 1.5 * Period_raw[1]; } else if Period_raw < 0.67 * Period_raw[1] { Period_cap = 0.67 * Period_raw[1]; } else { Period_cap = Period_raw; } if Period_cap < 6 then { Period_lim = 6; } else if Period_cap > 50 then { Period_lim = 50; } else { Period_lim = Period_cap; } Period = 0.2 * Period_lim + 0.8 * Period_lim[1]; SmoothPeriod = 0.33 * Period + 0.67 * SmoothPeriod[1]; if I1 != 0 then { Phase = ATan(Q1 / I1); } else if Q1 > 0 then { # Quadrant 1: Phase = Double.Pi / 2; } else if Q1 < 0 then { # Quadrant 4: Phase = -Double.Pi / 2; } else { # Both numerator and denominator are 0. Phase = 0; } DeltaPhase_raw = Phase[1] - Phase; if DeltaPhase_raw < 1 then { DeltaPhase = 1; } else { DeltaPhase = DeltaPhase_raw; } alpha_raw = FastLimit / DeltaPhase; if alpha_raw < SlowLimit then { alpha = SlowLimit; } else { alpha = alpha_raw; } vmama = alpha * price + (1 - alpha) * vmama[1]; vfama = 0.5 * alpha * vmama + (1 - 0.5 * alpha) * vfama[1]; } plot MAMA = vmama; plot FAMA = vfama; } input price2 = hl2; input FastLimit = 0.5; input SlowLimit = 0.05; def MAMA = Ehler_MAMA(price2, FastLimit, SlowLimit).MAMA; def FAMA = Ehler_MAMA(price2, FastLimit, SlowLimit).FAMA; def Crossing = Crosses((MAMA < FAMA), yes); #Crossing.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); def Crossing1 = Crosses((MAMA > FAMA), yes); #Crossing1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); AddLabel(yes, Concat("MAMA: ", Concat("", if MAMA > FAMA then "Bull" else "Bear")), if MAMA > FAMA then Color.GREEN else Color.RED); ################################## plot C3_MF_Line = (MAMA + FAMA) / 2; C3_MF_Line.SetPaintingStrategy(PaintingStrategy.LINE); C3_MF_Line.SetLineWeight(3); def direction = if ConsensusR > Consensus_Bias then 1 else if ConsensusR < Consensus_Bias then -1 else 0; C3_MF_Line.AssignValueColor(if paintCandles and ((direction == 1) and (price > C3_MF_Line)) then Color.GREEN else if paintCandles and ((direction == -1) and (price < C3_MF_Line)) then Color.RED else Color.GRAY); plot buy = AvgExp crosses above AvgExp2;#direction crosses above 0; buy.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); buy.SetDefaultColor(Color.WHITE); plot sell = AvgExp crosses below AvgExp2;#direction crosses below 0; sell.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN ); sell.SetDefaultColor(Color.WHITE); AssignPriceColor(if paintCandles then if direction == 1 then Color.GREEN else if direction == -1 then Color.RED else Color.GRAY else Color.CURRENT); AddLabel(yes, if (Spark == 3) then "SPARK UP = " + Round(Spark, 1) else if (Spark == 0) then "SPARK DOWN = " + Round(Spark, 1) else "SPARK = " + Round(Spark, 1), if (Spark == 3) then Color.YELLOW else if ((Spark == 2) and (AvgExp > AvgExp2)) then Color.GREEN else if (Spark == 0) then Color.RED else Color.GRAY); AddLabel(yes, if ((UP6 == 1) and (Consensus_Bias > 0)) then " SCALP_LONG " else if ((DOWN6) and (Consensus_Bias < 0)) then " SCALP_SHORT " else " CHOP ", if ((Consensus_Bias > 0) and (UP6 == 1)) then Color.GREEN else if ((Consensus_Bias < 0) and (DOWN6 == 1)) then Color.RED else Color.GRAY); AddLabel(yes, if (ConsensusR > 0) then " LONG BIAS = %" + Round((ConsensusR / 14) * 100, 1) + " " else if (ConsensusR < 0) then " SHORT BIAS = %" + Round(((ConsensusR * -1) / 14) * 100, 1) + " " else " CHOP =" + Round((ConsensusR / 14) * 100, 1) + " ", if (ConsensusR > 0) then Color.GREEN else if (ConsensusR < 0) then Color.RED else Color.GRAY); Alert(direction crosses above 0, "long", Alert.BAR, Sound.DING); Alert(direction crosses below 0, "short", Alert.BAR, Sound.DING); #Strategy def Long_Entry = (ConsensusR crosses above Consensus_Bias); def Long_Exit = (ConsensusR crosses below Consensus_Bias); AddOrder(OrderType.BUY_AUTO, condition = Long_Entry, price = open[-1], 1, tickcolor = GetColor(1), arrowcolor = Color.LIME, name = "LE"); AddOrder(OrderType.SELL_AUTO, condition = Long_Exit, price = open[-1], 1, tickcolor = GetColor(2), arrowcolor = Color.LIME, name = "SE"); Alert(Long_Entry, "long", Alert.BAR, Sound.DING); Alert(Long_Exit, "short", Alert.BAR, Sound.DING);

And finally, here's the code for 1 hour charts. Hope you find these useful!

Code:#Scalper Upper v2 Strategy Created 03/16/2022 by Christopher84 declare upper; input price = close; input length = 10; input length2 = 35; input agperiod1 = { "1 min", "2 min", "3 min", "5 min", "10 min", "15 min", "30 min", default "1 hour", "2 hours", "4 hours", "Day", "Week", "Month"}; input agperiod2 = {"1 min", "2 min", "3 min", "5 min", "10 min", "15 min", "30 min", "1 hour", default "2 hours", "4 hours", "Day", "Week", "Month"}; input agperiod3 = {"1 min", "2 min", "3 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "2 hours", default "4 hours", "Day", "Week", "Month"}; input agperiod4 = {"1 min", "2 min", "3 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "2 hours", "4 hours", default "Day", "Week", "Month"}; input agperiod5 = {"1 min", "2 min", "3 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "2 hours", "4 hours", "Day", default "Week", "Month"}; input agperiod6 = {"1 min", "2 min", "3 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "2 hours", "4 hours", "Day", "Week", default "Month"}; def displace = 0; input paintCandles = yes; input show_ema_cloud = yes; #Current Period plot AvgExp = ExpAverage(price[-displace], length); AvgExp.SetStyle(Curve.SHORT_DASH); def UPC1 = AvgExp > AvgExp[1]; def DNC1 = AvgExp < AvgExp[1]; plot AvgExp2 = ExpAverage(price[-displace], length2); AvgExp2.SetStyle(Curve.SHORT_DASH); def UPC2 = AvgExp2 > AvgExp2[1]; def DNC2 = AvgExp2 < AvgExp2[1]; def Below = AvgExp < AvgExp2; def Spark = UPC1 + UPC2 + Below; def UPEMA = AvgExp[1] < AvgExp; def DOWNEMA = AvgExp[1] > AvgExp; AvgExp.AssignValueColor(if UPEMA then Color.LIGHT_GREEN else if DOWNEMA then Color.RED else Color.YELLOW); def UPEMA2 = AvgExp2[1] < AvgExp2; def DOWNEMA2 = AvgExp2[1] > AvgExp2; AvgExp2.AssignValueColor(if UPEMA2 then Color.LIGHT_GREEN else if DOWNEMA2 then Color.RED else Color.YELLOW); AddCloud(if show_ema_cloud and (AvgExp2 > AvgExp) then AvgExp2 else Double.NaN, AvgExp, Color.LIGHT_RED, Color.CURRENT); AddCloud(if show_ema_cloud and (AvgExp > AvgExp2) then AvgExp else Double.NaN, AvgExp2, Color.LIGHT_GREEN, Color.CURRENT); #Agperiod1 def avg = ExpAverage(close(period = agperiod1), length); def height = avg - avg[length]; def avg2 = ExpAverage(close(period = agperiod1), length2); def height2 = avg2 - avg2[length2]; def UP = avg > avg2; def DOWN = avg < avg2; def R1UP = avg > avg[1]; def R1DN = avg < avg[1]; def R2UP = avg2 > avg2[1]; def R2DN = avg2 < avg2[1]; #Agperiod2 def avg3 = ExpAverage(close(period = agperiod2), length); def height3 = avg3 - avg3[length]; def avg4 = ExpAverage(close(period = agperiod2), length2); def height4 = avg4 - avg4[length2]; def UP2 = avg3 > avg4; def DOWN2 = avg3 < avg4; def R3UP = avg3 > avg3[1]; def R3DN = avg3 < avg3[1]; def R4UP = avg4 > avg4[1]; def R4DN = avg4 < avg4[1]; #Agperiod3 def avg5 = ExpAverage(close(period = agperiod3), length); def height5 = avg5 - avg5[length]; def avg6 = ExpAverage(close(period = agperiod3), length2); def height6 = avg6 - avg6[length2]; def UP3 = avg5 > avg6; def DOWN3 = avg5 < avg6; def R5UP = avg5 > avg5[1]; def R5DN = avg5 < avg5[1]; def R6UP = avg6 > avg6[1]; def R6DN = avg6 < avg6[1]; #Agperiod4 def avg7 = ExpAverage(close(period = agperiod4), length); def height7 = avg7 - avg7[length]; def avg8 = ExpAverage(close(period = agperiod4), length2); def height8 = avg8 - avg8[length2]; def UP4 = avg7 > avg8; def DOWN4 = avg7 < avg8; def R7UP = avg7 > avg7[1]; def R7DN = avg7 < avg7[1]; def R8UP = avg8 > avg8[1]; def R8DN = avg8 < avg8[1]; #Agperiod5 def avg9 = ExpAverage(close(period = agperiod5), length); def height9 = avg9 - avg9[length]; def avg10 = ExpAverage(close(period = agperiod5), length2); def height10 = avg10 - avg10[length2]; def UP5 = avg9 > avg10; def DOWN5 = avg9 < avg10; def R9UP = avg9 > avg9[1]; def R9DN = avg9 < avg9[1]; def R10UP = avg10 > avg10[1]; def R10DN = avg10 < avg10[1]; #Agperiod6 def avg11 = ExpAverage(close(period = agperiod6), length); def height11 = avg11 - avg11[length]; def avg12 = ExpAverage(close(period = agperiod6), length2); def height12 = avg12 - avg12[length2]; def UP6 = avg11 > avg12; def DOWN6 = avg11 < avg12; def R11UP = avg11 > avg11[1]; def R11DN = avg11 < avg11[1]; def R12UP = avg12 > avg12[1]; def R12DN = avg12 < avg12[1]; def Long_Only = UP + UP2 + UP3 + UP4 + UP5 + UP6; def Short_Only = DOWN + DOWN2 + DOWN3 + DOWN4 + DOWN5 + DOWN6; def Consensus_Bias = Long_Only - Short_Only; def RUP = UPC1 + UPC2 + R1UP + R2UP + R3UP + R4UP + R5UP + R6UP + R7UP + R8UP + R9UP + R10UP + R11UP + R12UP; def RDN = DNC1 + DNC2 + R1DN + R2DN + R3DN + R4DN + R5DN + R6DN + R7DN + R8DN + R9DN + R10DN + R11DN + R12DN; def ConsensusR = RUP - RDN; script WMA_Smooth { input price = hl2; plot smooth = (4 * price + 3 * price[1] + 2 * price[2] + price[3]) / 10; } script Phase_Accumulation { # This is Ehler's Phase Accumulation code. It has a full cycle delay. # However, it computes the correction factor to a very high degree. # input price = hl2; rec Smooth; rec Detrender; rec Period; rec Q1; rec I1; rec I1p; rec Q1p; rec Phase1; rec Phase; rec DeltaPhase; rec DeltaPhase1; rec InstPeriod1; rec InstPeriod; def CorrectionFactor; if BarNumber() <= 5 then { Period = 0; Smooth = 0; Detrender = 0; CorrectionFactor = 0; Q1 = 0; I1 = 0; Q1p = 0; I1p = 0; Phase = 0; Phase1 = 0; DeltaPhase1 = 0; DeltaPhase = 0; InstPeriod = 0; InstPeriod1 = 0; } else { CorrectionFactor = 0.075 * Period[1] + 0.54; # Smooth and detrend my smoothed signal: Smooth = WMA_Smooth(price); Detrender = ( 0.0962 * Smooth + 0.5769 * Smooth[2] - 0.5769 * Smooth[4] - 0.0962 * Smooth[6] ) * CorrectionFactor; # Compute Quadrature and Phase of Detrended signal: Q1p = ( 0.0962 * Detrender + 0.5769 * Detrender[2] - 0.5769 * Detrender[4] - 0.0962 * Detrender[6] ) * CorrectionFactor; I1p = Detrender[3]; # Smooth out Quadrature and Phase: I1 = 0.15 * I1p + 0.85 * I1p[1]; Q1 = 0.15 * Q1p + 0.85 * Q1p[1]; # Determine Phase if I1 != 0 then { # Normally, ATAN gives results from -pi/2 to pi/2. # We need to map this to circular coordinates 0 to 2pi if Q1 >= 0 and I1 > 0 then { # Quarant 1 Phase1 = ATan(AbsValue(Q1 / I1)); } else if Q1 >= 0 and I1 < 0 then { # Quadrant 2 Phase1 = Double.Pi - ATan(AbsValue(Q1 / I1)); } else if Q1 < 0 and I1 < 0 then { # Quadrant 3 Phase1 = Double.Pi + ATan(AbsValue(Q1 / I1)); } else { # Quadrant 4 Phase1 = 2 * Double.Pi - ATan(AbsValue(Q1 / I1)); } } else if Q1 > 0 then { # I1 == 0, Q1 is positive Phase1 = Double.Pi / 2; } else if Q1 < 0 then { # I1 == 0, Q1 is negative Phase1 = 3 * Double.Pi / 2; } else { # I1 and Q1 == 0 Phase1 = 0; } # Convert phase to degrees Phase = Phase1 * 180 / Double.Pi; if Phase[1] < 90 and Phase > 270 then { # This occurs when there is a big jump from 360-0 DeltaPhase1 = 360 + Phase[1] - Phase; } else { DeltaPhase1 = Phase[1] - Phase; } # Limit our delta phases between 7 and 60 if DeltaPhase1 < 7 then { DeltaPhase = 7; } else if DeltaPhase1 > 60 then { DeltaPhase = 60; } else { DeltaPhase = DeltaPhase1; } # Determine Instantaneous period: InstPeriod1 = -1 * (fold i = 0 to 40 with v=0 do if v < 0 then v else if v > 360 then -i else v + GetValue(DeltaPhase, i, 41) ); if InstPeriod1 <= 0 then { InstPeriod = InstPeriod[1]; } else { InstPeriod = InstPeriod1; } Period = 0.25 * InstPeriod + 0.75 * Period[1]; } plot DC = Period; } script Ehler_MAMA { input price = hl2; input FastLimit = 0.5; input SlowLimit = 0.05; rec Period; rec Period_raw; rec Period_cap; rec Period_lim; rec Smooth; rec Detrender; rec I1; rec Q1; rec jI; rec jQ; rec I2; rec Q2; rec I2_raw; rec Q2_raw; rec Phase; rec DeltaPhase; rec DeltaPhase_raw; rec alpha; rec alpha_raw; rec Re; rec Im; rec Re_raw; rec Im_raw; rec SmoothPeriod; rec vmama; rec vfama; def CorrectionFactor = Phase_Accumulation(price).CorrectionFactor; if BarNumber() <= 5 then { Smooth = 0; Detrender = 0; Period = 0; Period_raw = 0; Period_cap = 0; Period_lim = 0; I1 = 0; Q1 = 0; I2 = 0; Q2 = 0; jI = 0; jQ = 0; I2_raw = 0; Q2_raw = 0; Re = 0; Im = 0; Re_raw = 0; Im_raw = 0; SmoothPeriod = 0; Phase = 0; DeltaPhase = 0; DeltaPhase_raw = 0; alpha = 0; alpha_raw = 0; vmama = 0; vfama = 0; } else { # Smooth and detrend my smoothed signal: Smooth = WMA_Smooth(price); Detrender = ( 0.0962 * Smooth + 0.5769 * Smooth[2] - 0.5769 * Smooth[4] - 0.0962 * Smooth[6] ) * CorrectionFactor; Q1 = ( 0.0962 * Detrender + 0.5769 * Detrender[2] - 0.5769 * Detrender[4] - 0.0962 * Detrender[6] ) * CorrectionFactor; I1 = Detrender[3]; jI = ( 0.0962 * I1 + 0.5769 * I1[2] - 0.5769 * I1[4] - 0.0962 * I1[6] ) * CorrectionFactor; jQ = ( 0.0962 * Q1 + 0.5769 * Q1[2] - 0.5769 * Q1[4] - 0.0962 * Q1[6] ) * CorrectionFactor; # This is the complex conjugate I2_raw = I1 - jQ; Q2_raw = Q1 + jI; I2 = 0.2 * I2_raw + 0.8 * I2_raw[1]; Q2 = 0.2 * Q2_raw + 0.8 * Q2_raw[1]; Re_raw = I2 * I2[1] + Q2 * Q2[1]; Im_raw = I2 * Q2[1] - Q2 * I2[1]; Re = 0.2 * Re_raw + 0.8 * Re_raw[1]; Im = 0.2 * Im_raw + 0.8 * Im_raw[1]; # Compute the phase if Re != 0 and Im != 0 then { Period_raw = 2 * Double.Pi / ATan(Im / Re); } else { Period_raw = 0; } if Period_raw > 1.5 * Period_raw[1] then { Period_cap = 1.5 * Period_raw[1]; } else if Period_raw < 0.67 * Period_raw[1] { Period_cap = 0.67 * Period_raw[1]; } else { Period_cap = Period_raw; } if Period_cap < 6 then { Period_lim = 6; } else if Period_cap > 50 then { Period_lim = 50; } else { Period_lim = Period_cap; } Period = 0.2 * Period_lim + 0.8 * Period_lim[1]; SmoothPeriod = 0.33 * Period + 0.67 * SmoothPeriod[1]; if I1 != 0 then { Phase = ATan(Q1 / I1); } else if Q1 > 0 then { # Quadrant 1: Phase = Double.Pi / 2; } else if Q1 < 0 then { # Quadrant 4: Phase = -Double.Pi / 2; } else { # Both numerator and denominator are 0. Phase = 0; } DeltaPhase_raw = Phase[1] - Phase; if DeltaPhase_raw < 1 then { DeltaPhase = 1; } else { DeltaPhase = DeltaPhase_raw; } alpha_raw = FastLimit / DeltaPhase; if alpha_raw < SlowLimit then { alpha = SlowLimit; } else { alpha = alpha_raw; } vmama = alpha * price + (1 - alpha) * vmama[1]; vfama = 0.5 * alpha * vmama + (1 - 0.5 * alpha) * vfama[1]; } plot MAMA = vmama; plot FAMA = vfama; } input price2 = hl2; input FastLimit = 0.5; input SlowLimit = 0.05; def MAMA = Ehler_MAMA(price2, FastLimit, SlowLimit).MAMA; def FAMA = Ehler_MAMA(price2, FastLimit, SlowLimit).FAMA; def Crossing = Crosses((MAMA < FAMA), yes); #Crossing.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); def Crossing1 = Crosses((MAMA > FAMA), yes); #Crossing1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); AddLabel(yes, Concat("MAMA: ", Concat("", if MAMA > FAMA then "Bull" else "Bear")), if MAMA > FAMA then Color.GREEN else Color.RED); ################################## plot C3_MF_Line = (MAMA + FAMA) / 2; C3_MF_Line.SetPaintingStrategy(PaintingStrategy.LINE); C3_MF_Line.SetLineWeight(3); def direction = if ConsensusR > Consensus_Bias then 1 else if ConsensusR < Consensus_Bias then -1 else 0; C3_MF_Line.AssignValueColor(if paintCandles and ((direction == 1) and (price > C3_MF_Line)) then Color.GREEN else if paintCandles and ((direction == -1) and (price < C3_MF_Line)) then Color.RED else Color.GRAY); plot buy = AvgExp crosses above AvgExp2;#direction crosses above 0; buy.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); buy.SetDefaultColor(Color.WHITE); plot sell = AvgExp crosses below AvgExp2;#direction crosses below 0; sell.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN ); sell.SetDefaultColor(Color.WHITE); AssignPriceColor(if paintCandles then if direction == 1 then Color.GREEN else if direction == -1 then Color.RED else Color.GRAY else Color.CURRENT); AddLabel(yes, if (Spark == 3) then "SPARK UP = " + Round(Spark, 1) else if (Spark == 0) then "SPARK DOWN = " + Round(Spark, 1) else "SPARK = " + Round(Spark, 1), if (Spark == 3) then Color.YELLOW else if ((Spark == 2) and (AvgExp > AvgExp2)) then Color.GREEN else if (Spark == 0) then Color.RED else Color.GRAY); AddLabel(yes, if ((UP6 == 1) and (Consensus_Bias > 0)) then " SCALP_LONG " else if ((DOWN6) and (Consensus_Bias < 0)) then " SCALP_SHORT " else " CHOP ", if ((Consensus_Bias > 0) and (UP6 == 1)) then Color.GREEN else if ((Consensus_Bias < 0) and (DOWN6 == 1)) then Color.RED else Color.GRAY); AddLabel(yes, if (ConsensusR > 0) then " LONG BIAS = %" + Round((ConsensusR / 14) * 100, 1) + " " else if (ConsensusR < 0) then " SHORT BIAS = %" + Round(((ConsensusR * -1) / 14) * 100, 1) + " " else " CHOP =" + Round((ConsensusR / 14) * 100, 1) + " ", if (ConsensusR > 0) then Color.GREEN else if (ConsensusR < 0) then Color.RED else Color.GRAY); Alert(direction crosses above 0, "long", Alert.BAR, Sound.DING); Alert(direction crosses below 0, "short", Alert.BAR, Sound.DING); #Strategy def Long_Entry = (ConsensusR crosses above Consensus_Bias); def Long_Exit = (ConsensusR crosses below Consensus_Bias); AddOrder(OrderType.BUY_AUTO, condition = Long_Entry, price = open[-1], 1, tickcolor = GetColor(1), arrowcolor = Color.LIME, name = "LE"); AddOrder(OrderType.SELL_AUTO, condition = Long_Exit, price = open[-1], 1, tickcolor = GetColor(2), arrowcolor = Color.LIME, name = "SE"); Alert(Long_Entry, "long", Alert.BAR, Sound.DING); Alert(Long_Exit, "short", Alert.BAR, Sound.DING);

Falout

Member

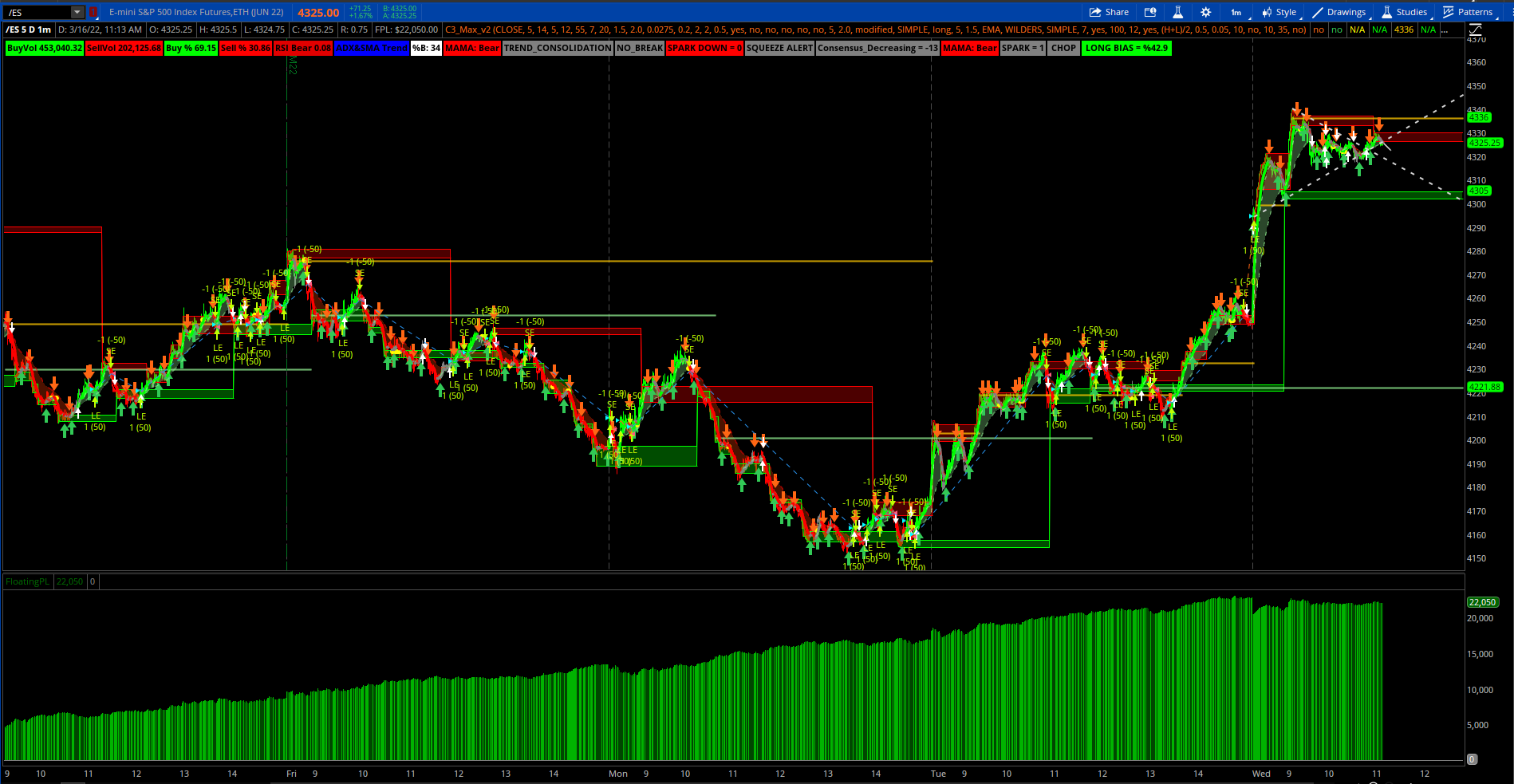

1 min chart 5 days with the new Scalper Strategy 1 share on the /ES....very interesting. Watching this strategy carefully.

Could you post a share link to your chart here. Not sure what I am doing different. For me your study does awesome on a 10 minute chart but mine is completely different when I change to a 1 minute chart.

Hey @Falout,

Could you post a share link to your chart here. Not sure what I am doing different. For me your study does awesome on a 10 minute chart but mine is completely different when I change to a 1 minute chart.

Try this out https://tos.mx/d2dcYNv. Let me know if that fixes it.

Falout

Member

Awesome. I did not realize you were using the c3Max and the scalper. that fixed it. Thank you sir.

is the strategies repaint? nice job

Awesome. I did not realize you were using the c3Max and the scalper. that fixed it. Thank you sir.

Hi @FOTM_8888!is the strategies repaint? nice job

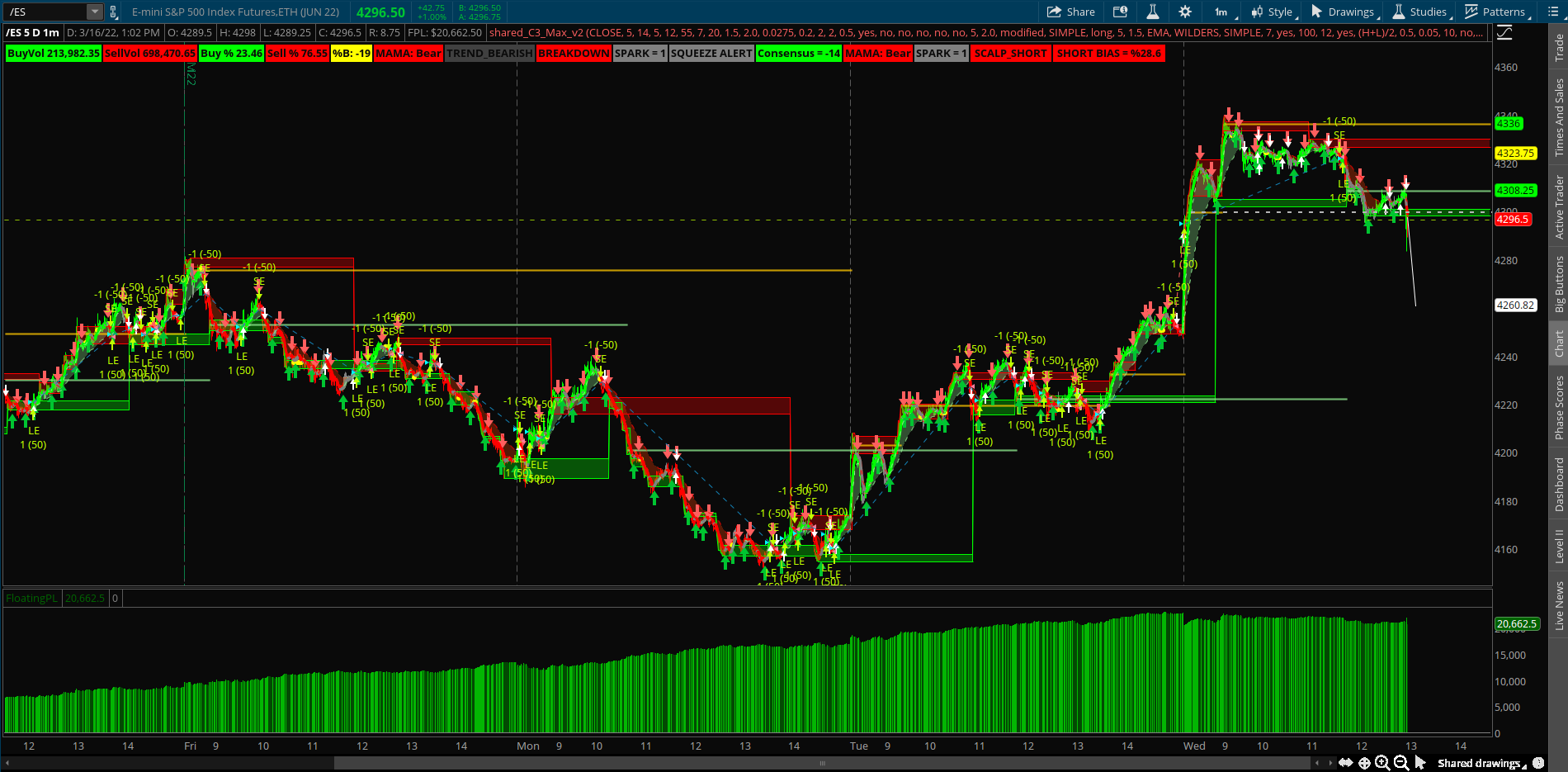

They are based on my Scalper indicator which utilizes MTF. It can repaint until the highest agperiod closes. However, it seems to play fairly true so far (I just wrote the strategy this morning though).

Falout

Member

It does. Cant be avoided since its multi time frame I think. I have been using it to see the longer term trend on all the different time frames. Works great for me to see the overall direction when scalping.is the strategies repaint? nice job

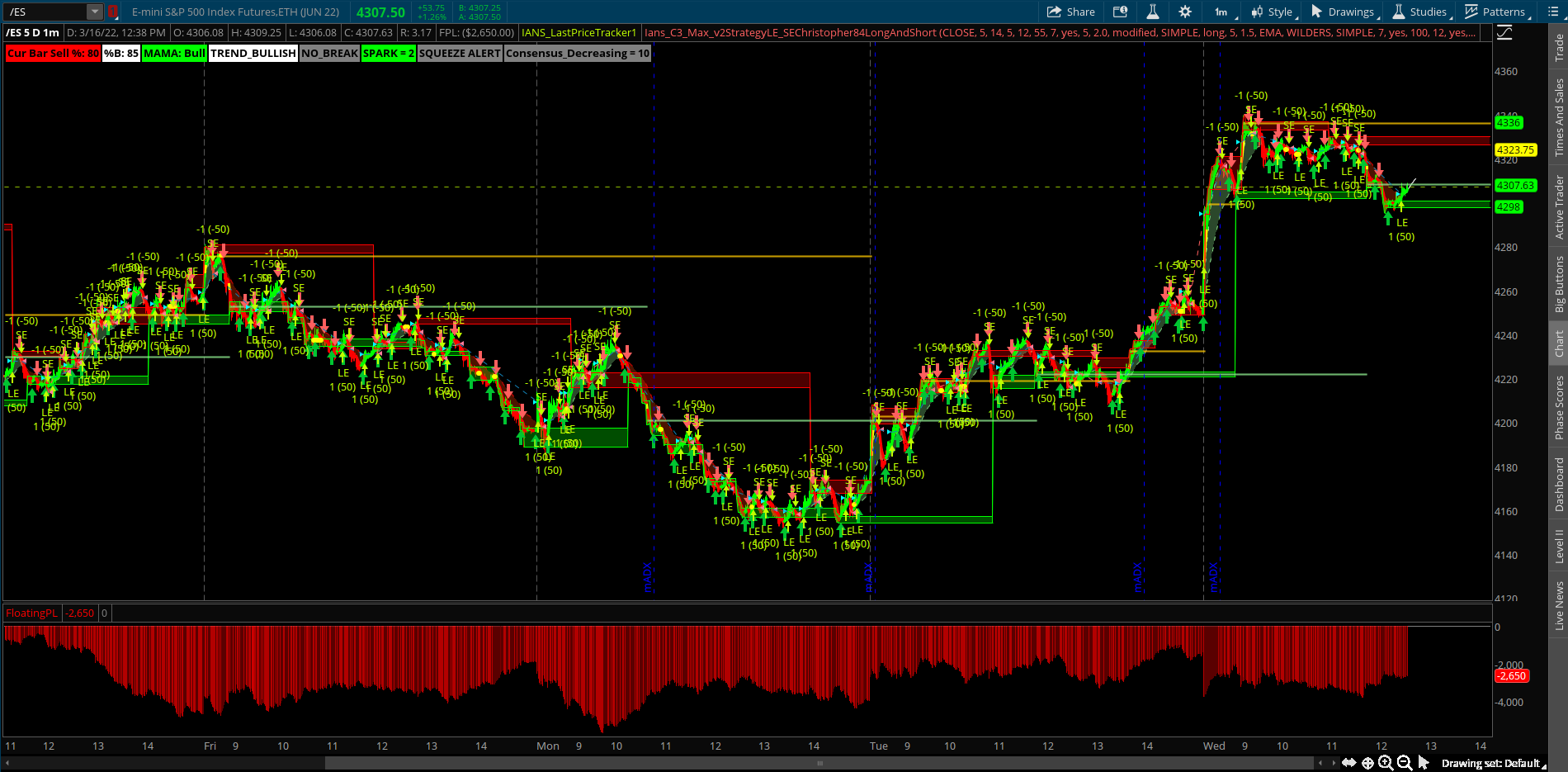

The signals today were excellent on the 1 min chart. I was truly impressed with how this trades. Thanks for the suggestion @Falout!It does. Cant be avoided since its multi time frame I think. I have been using it to see the longer term trend on all the different time frames. Works great for me to see the overall direction when scalping.

Falout

Member

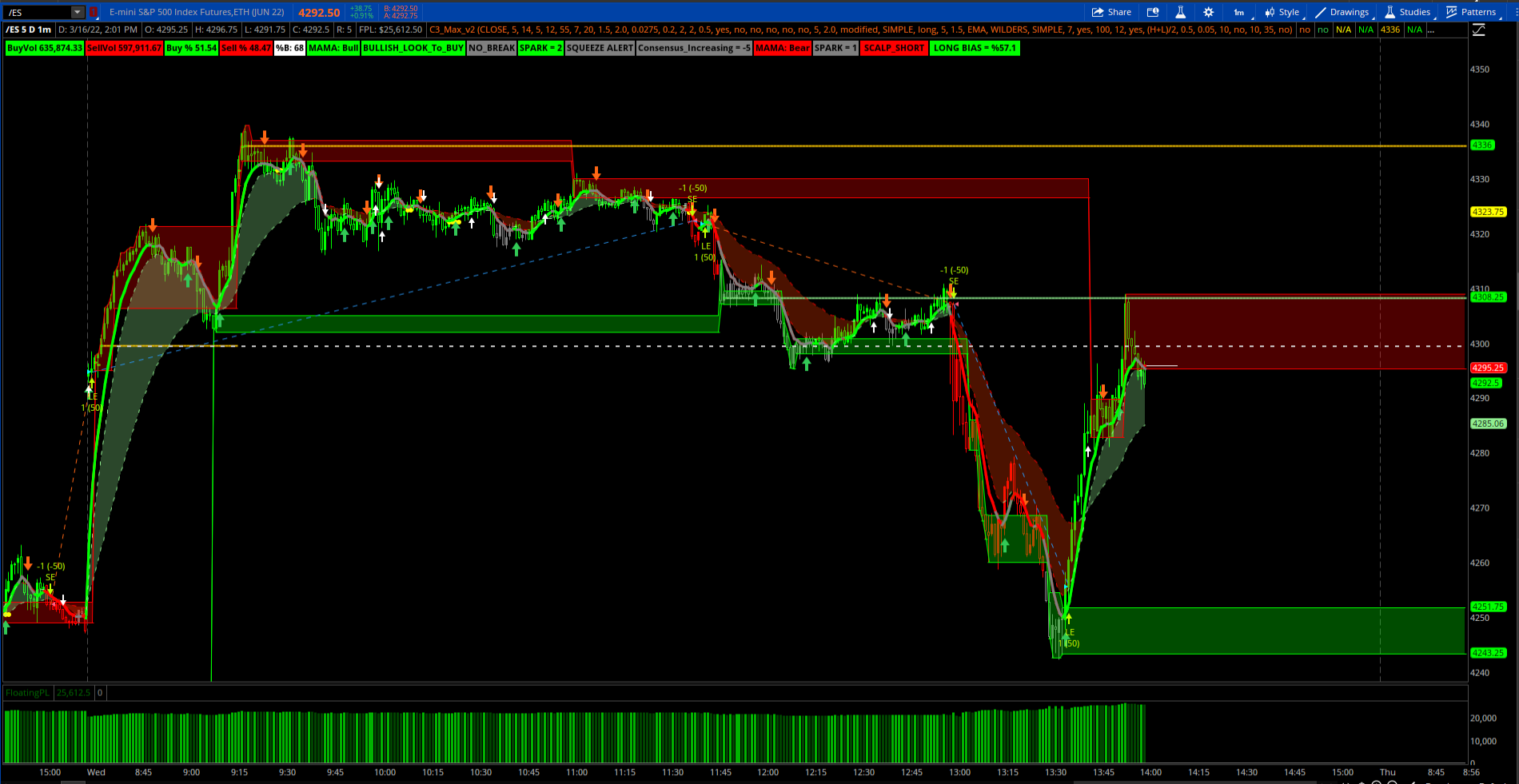

Seems to do just fine with after hours turned on. This scalper really takes a lot of the stress out of wondering if your on the right side of the trade or not. I appreciate all your work.The signals today were excellent on the 1 min chart. I was truly impressed with how this trades. Thanks for the suggestion @Falout!

30 day 1 minute haha.

Look at the YCOS and YCOB levels on the 1 min chart. Really nice support and resistance levels.

petergluis

Active member

@Christopher84 , on the repaint is it the kind that flashes on screen than off as the candle is forming or is it the kind that reappears and adjusts as the strategy gets more data?

petergluis

Active member

Hard to say. I didn’t see any entries or exits repaint on the 1 min chart today. I did see one short entry fail to plot. None of them repainted. It also shouldn’t repaint after the candle for the day has closed. That being said, I was extremely impressed with it today. $8k trading 1 share in 1 day isn’t bad.@Christopher84 , on the repaint is it the kind that flashes on screen than off as the candle is forming or is it the kind that reappears and adjusts as the strategy gets more data?

Falout

Member

On this chart its not even really a indicator. It is a continuing profit and loss that starts at the beginning of the chart. The upper chart is being run as a strategy versus just being a study. You can right click on the smaller sideways arrows to say show strategy reports.I would like to know how to use a lower indicator above, and why it keeps green colors.

- Status

- Not open for further replies.

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/