Mafia

New member

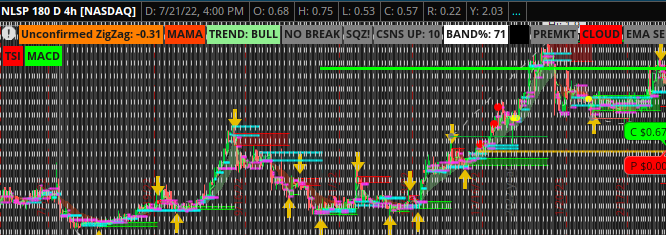

@HODL-Lay-HE-hoo! what is ur last version there is a lot of links

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

The link above is the latest. The screenshot attached shows what everything is but if the lower study (vertical lines) is too busy feel free to remove it.@HODL-Lay-HE-hoo! what is ur last version there is a lot of links

should be "showverticalline" in settingshow to remove this daily white lines ?

Looks good. Thank you. Do you mind sending the lower-study links, pleaseTS V9 combined 2 ags into one arrow (only if they plot on the same bar at the moment)

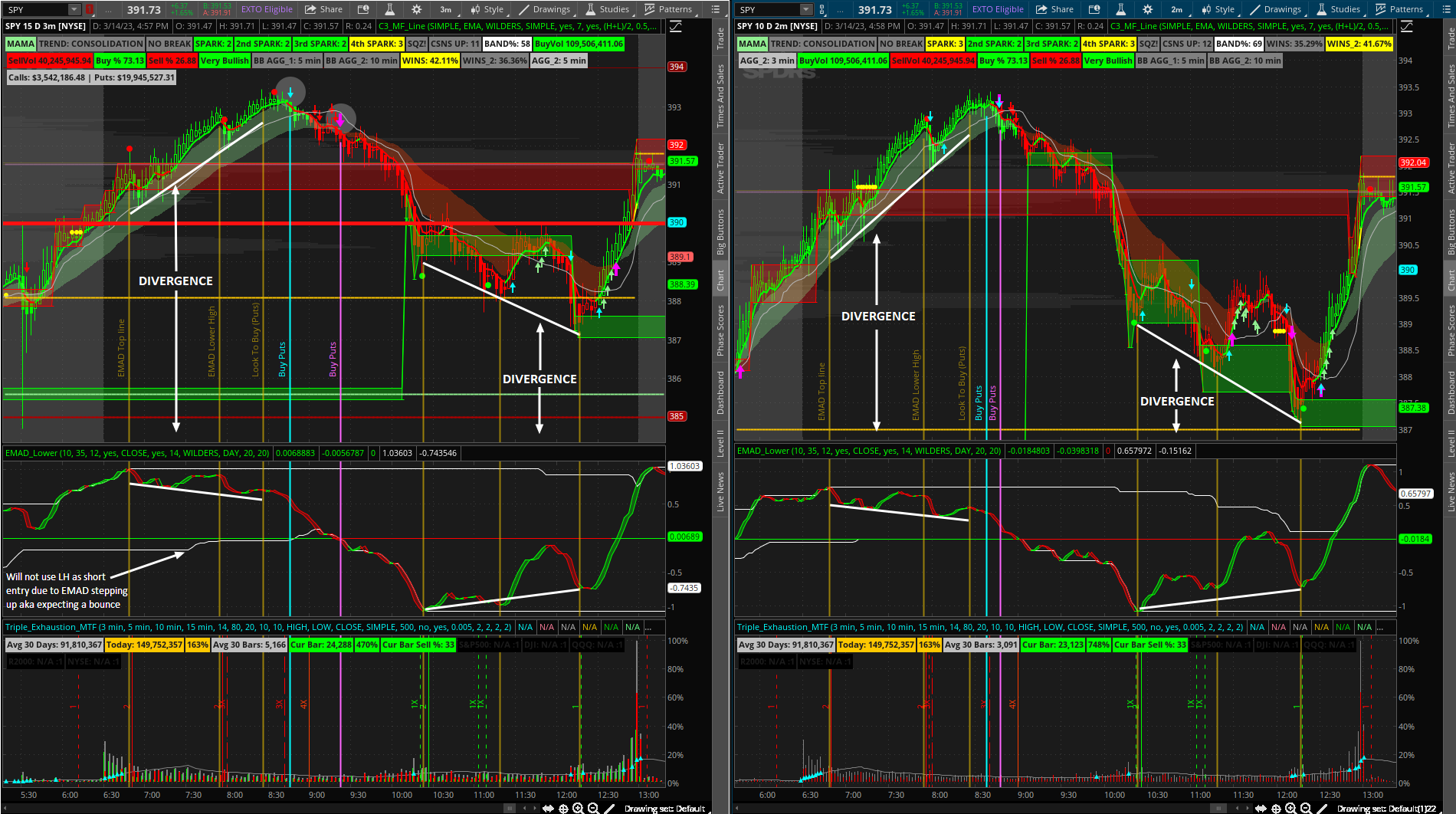

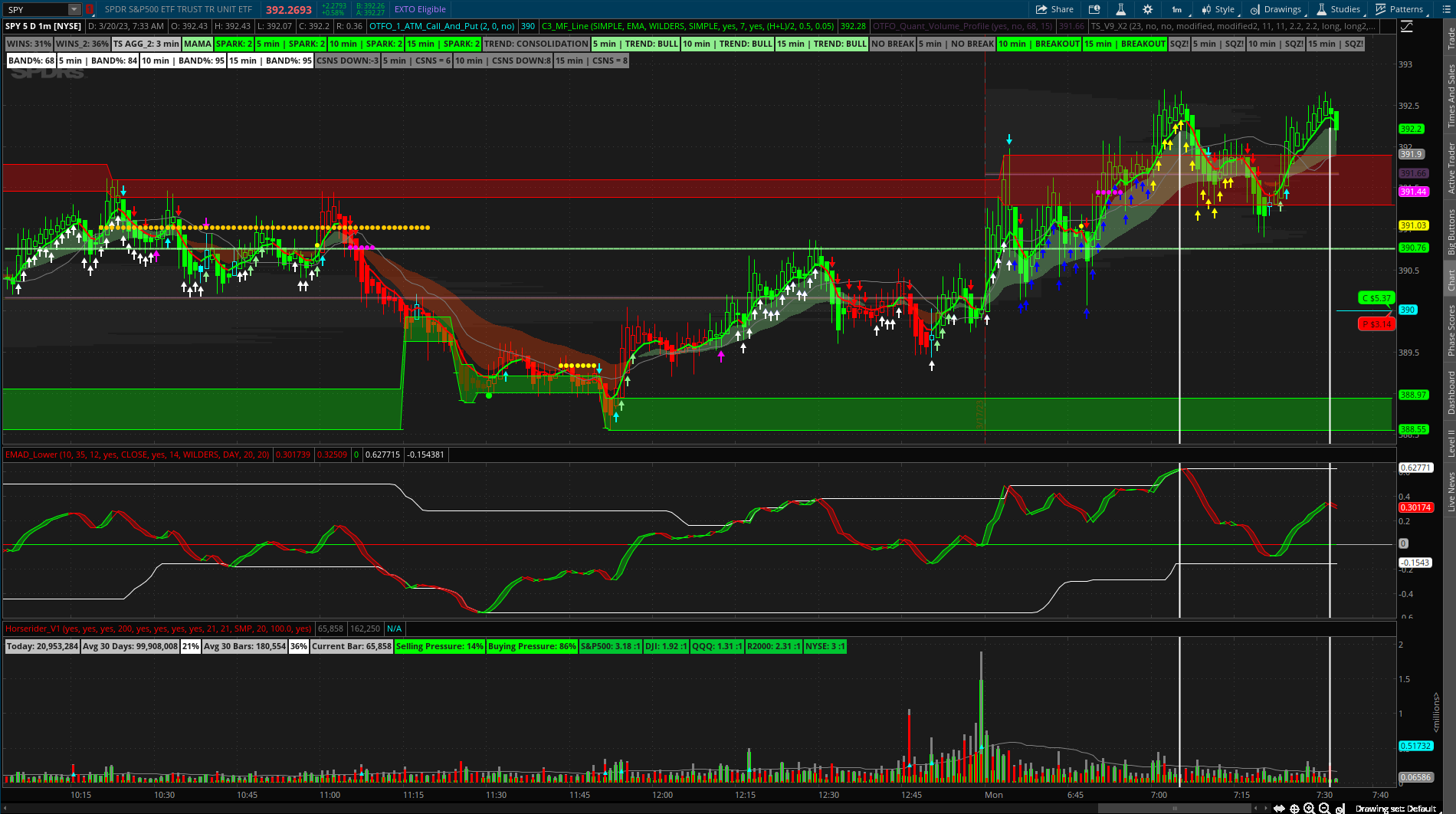

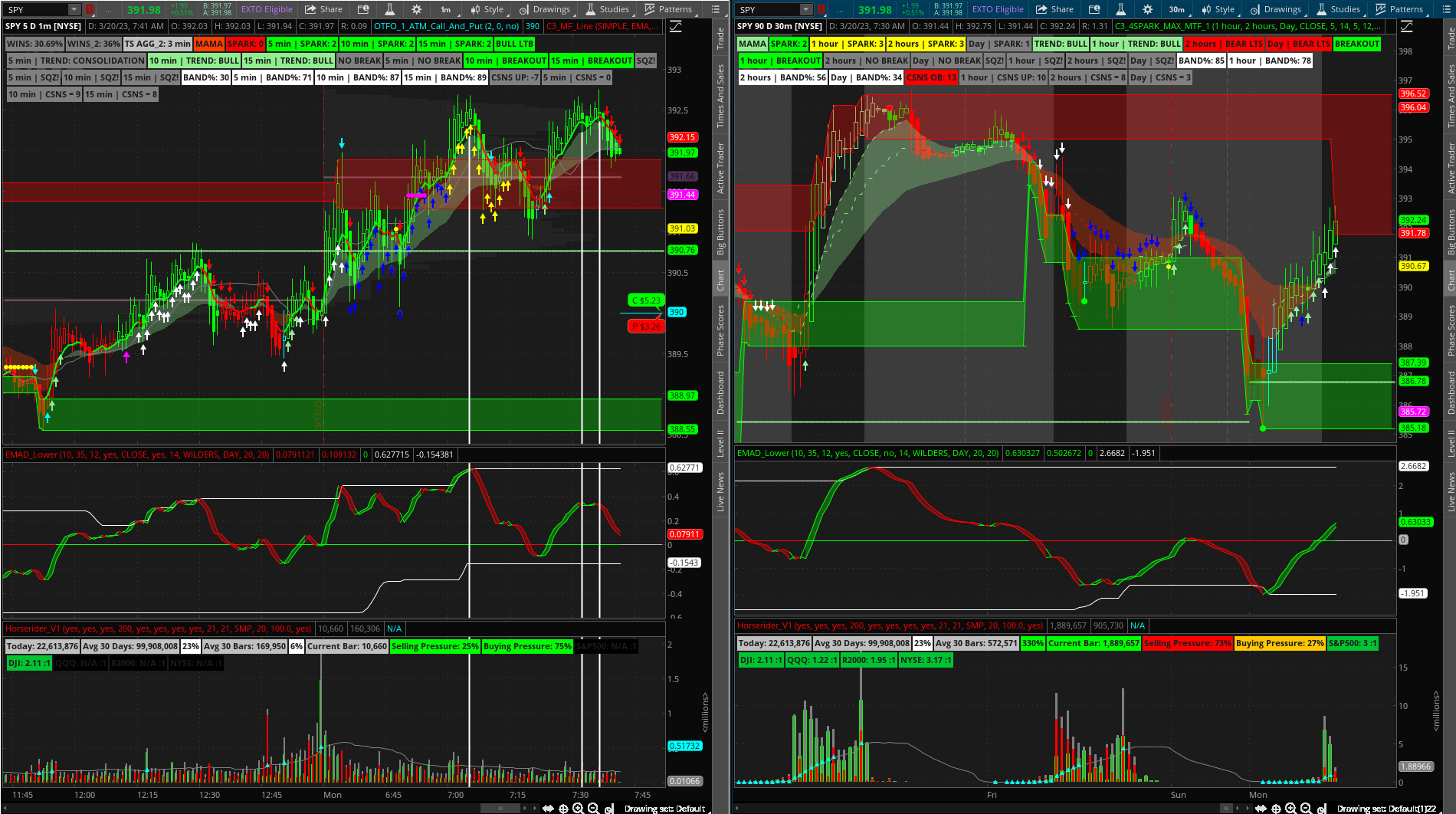

I have the regular buy and sell signals for TS_V9 turned off at the moment... the White arrows are when Both aggregations plot on the same bar. (you can turn the others back on in settings) (also the "wins" labels are still based on the normal calculation)

The candle painting and TS_V9 are 2 aggregations everything else is non MTF

Removed everything from the C3_Max_Spark code except the spark arrows, ema cloud, the yellow and green previous OB / OS lines, squeeze dots, and labels

Ok here is a less involved setup: http://tos.mx/kU9DpcV

theyre included in the linkLooks good. Thank you. Do you mind sending the lower-study links, please

I know you use these for options, but just wanted to say I've been using this set-up (as well as your last few iterations including the MTF) to great effect scalping stock on a variety of instruments. While the setup does work on the 1min, it is noticeably better on the 2min.TS V9 combined 2 ags into one arrow (only if they plot on the same bar at the moment)

I have the regular buy and sell signals for TS_V9 turned off at the moment... the White arrows are when Both aggregations plot on the same bar. (you can turn the others back on in settings) (also the "wins" labels are still based on the normal calculation)

The candle painting and TS_V9 are 2 aggregations everything else is non MTF

Removed everything from the C3_Max_Spark code except the spark arrows, ema cloud, the yellow and green previous OB / OS lines, squeeze dots, and labels

Ok here is a less involved setup: http://tos.mx/kU9DpcV

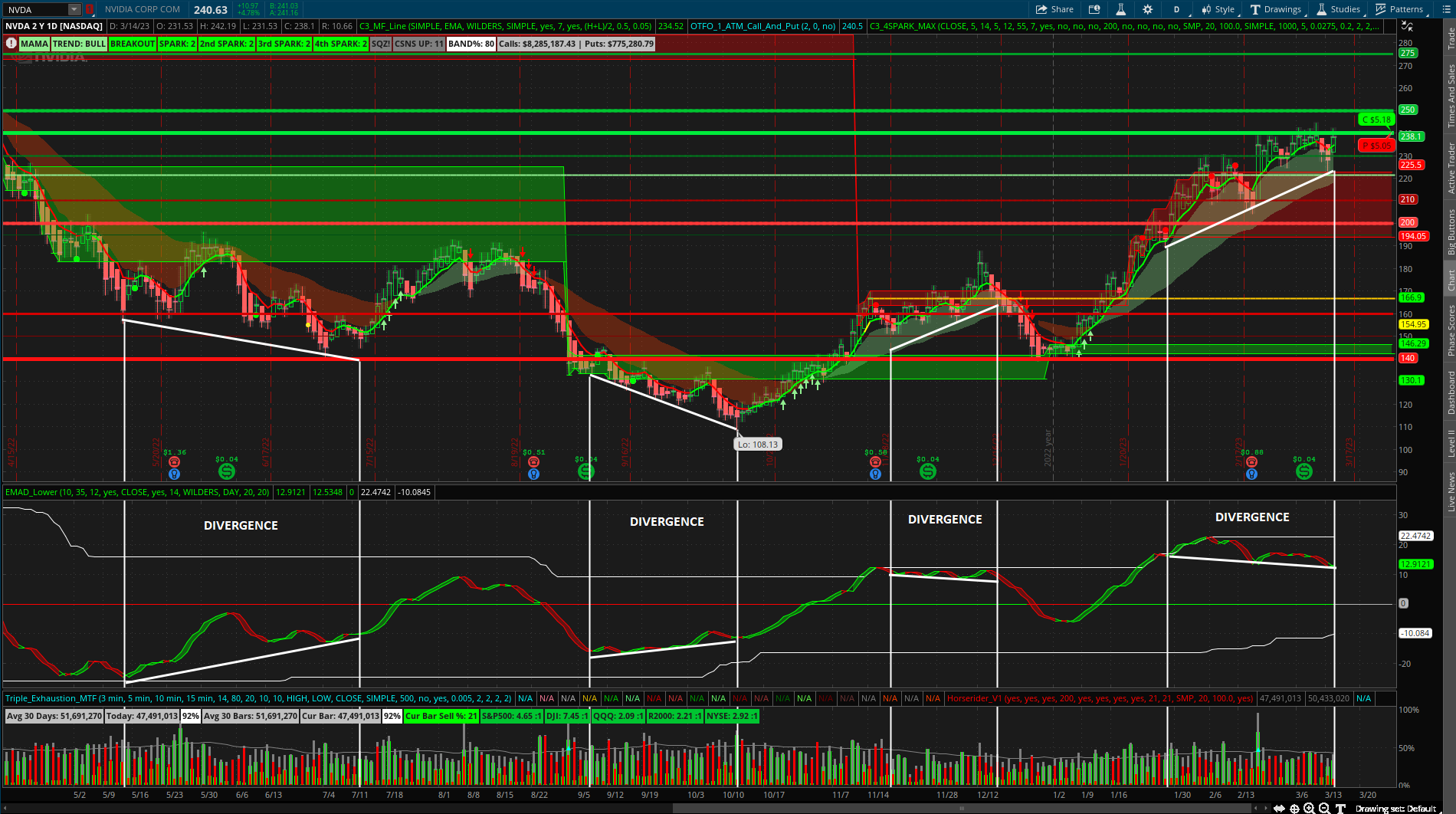

How did you get the Calls and Puts tab show the dollar amount on the NVDA chart?TS 2nd aggregation and Bull Bear aggregation labels on chart (*** I have read some posts that say you should be viewing divergence using the bottom of the candles not the top... I think? seems more reliable in real time as I have been watching it)

This is what I look at on the daily...

Todays happens to be Cyan (Vix Alert4)

Another daily with top 5 open interest calls and puts levels (NVDA)

its the Quant Open Interest study - it is on the Quant trading app discord for free but you have to copy paste the new code before open each day. https://www.quanttradingapp.com/discordHow did you get the Calls and Puts tab show the dollar amount on the NVDA chart?

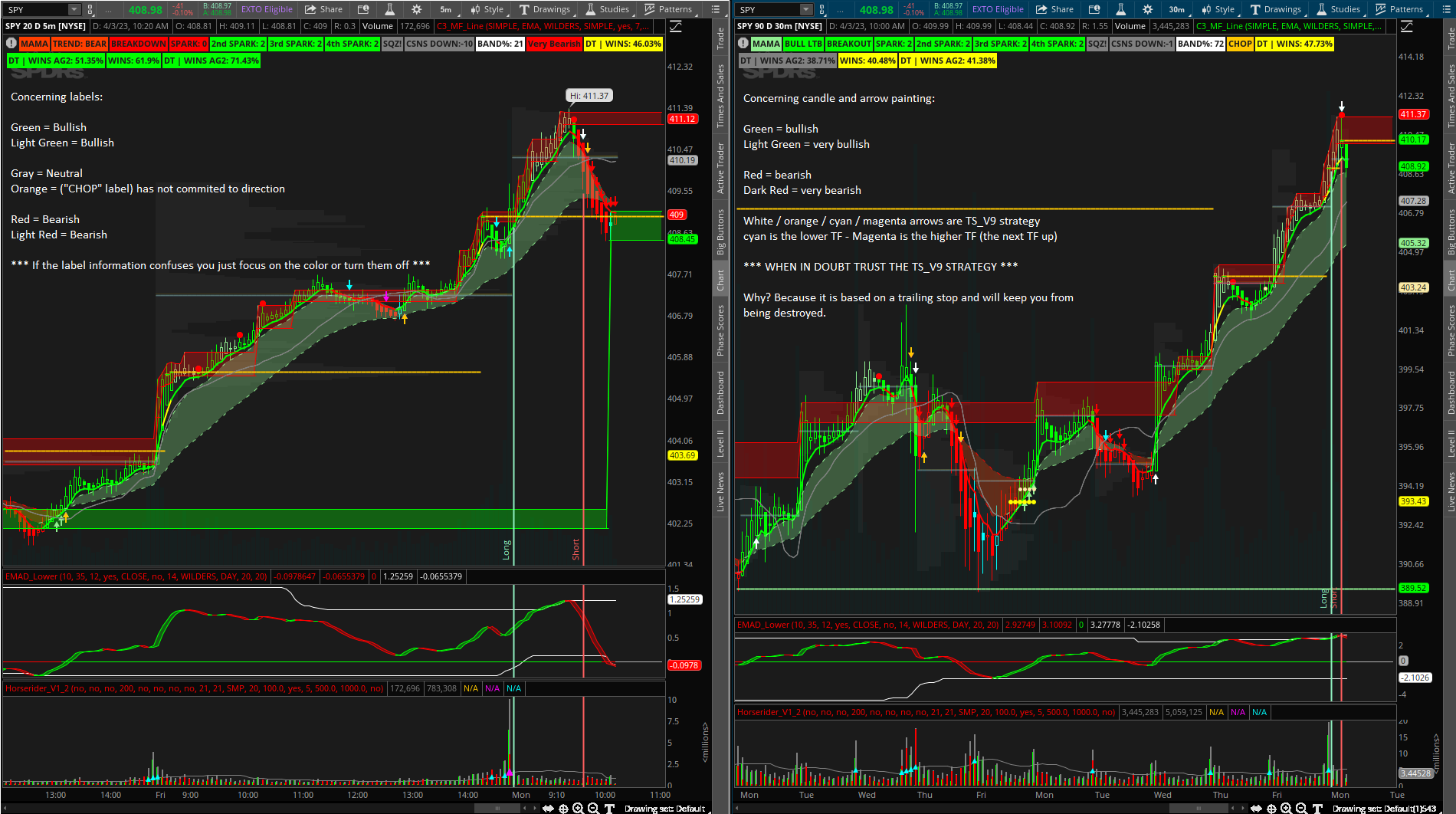

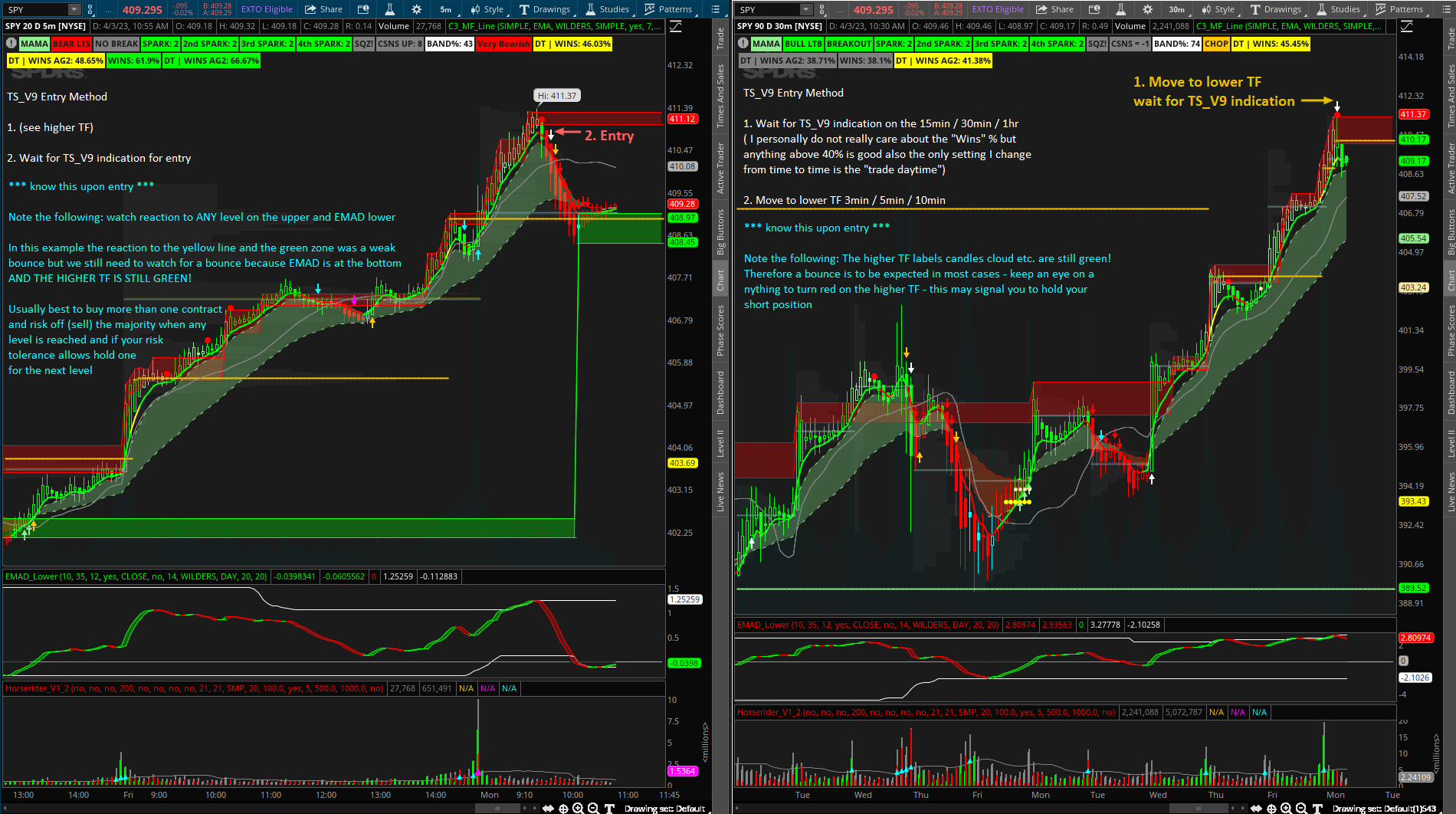

Great examples here; thanks for putting these together. This setup is legit, working well for me on SPY.Here are a few simple entry methods to whom it may concern... *NOTE if the dots, zones, labels, etc. confuse you just focus on the colors or turn off whatever causes confusion - when in doubt trust that TS_V9

(if you do what it says) will stop you out before you get destroyed as it is based on a trailing stop loss (depending on the contract you chose of course).

Colors:

Entry Method 1. TS_V9:

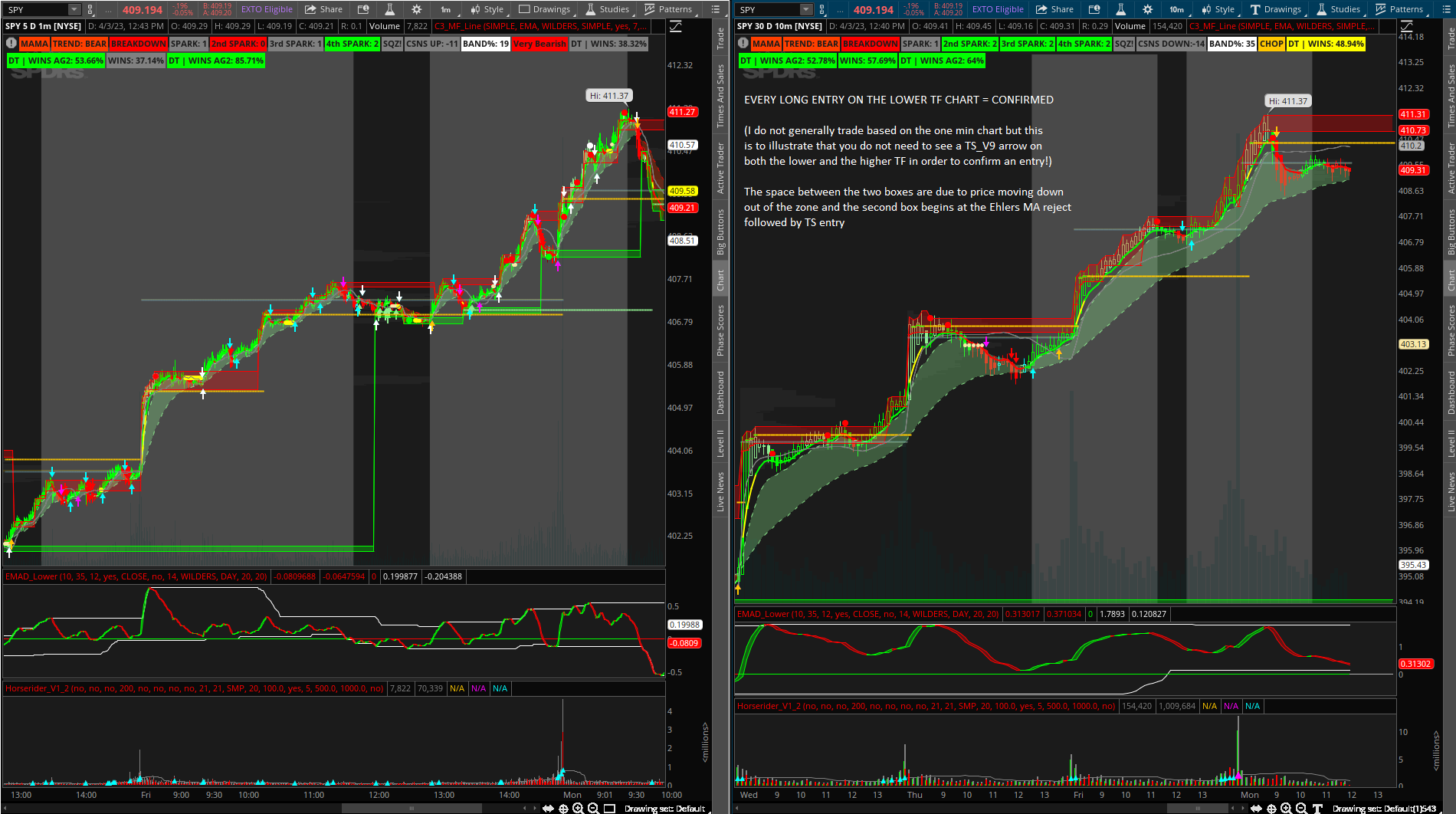

Confirming TS_V9 Entry on lower timeframe when TS_V9 indication on the higher timeframe is present many bars before the current bar:

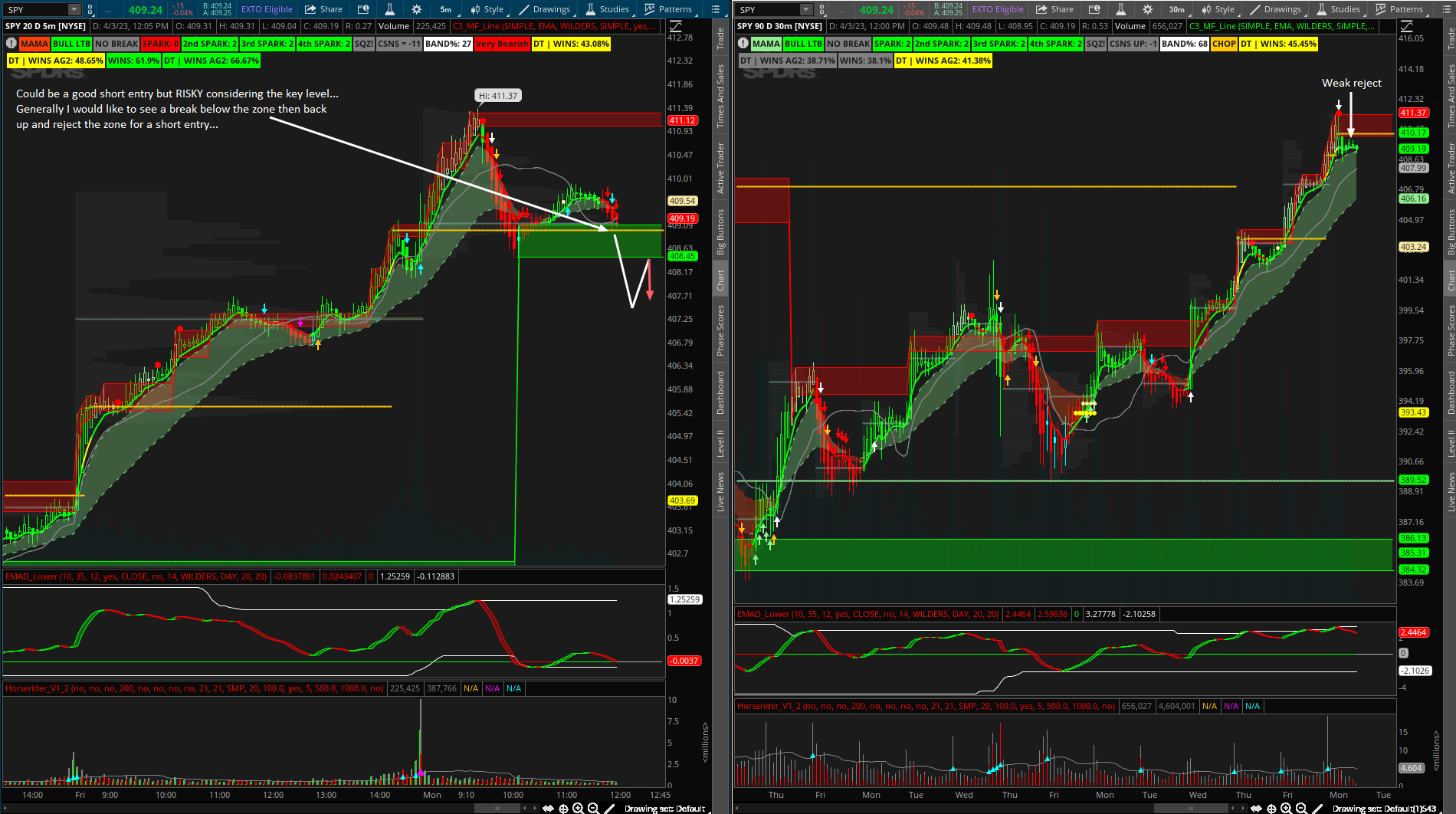

Example of when to re-enter short or when not to:

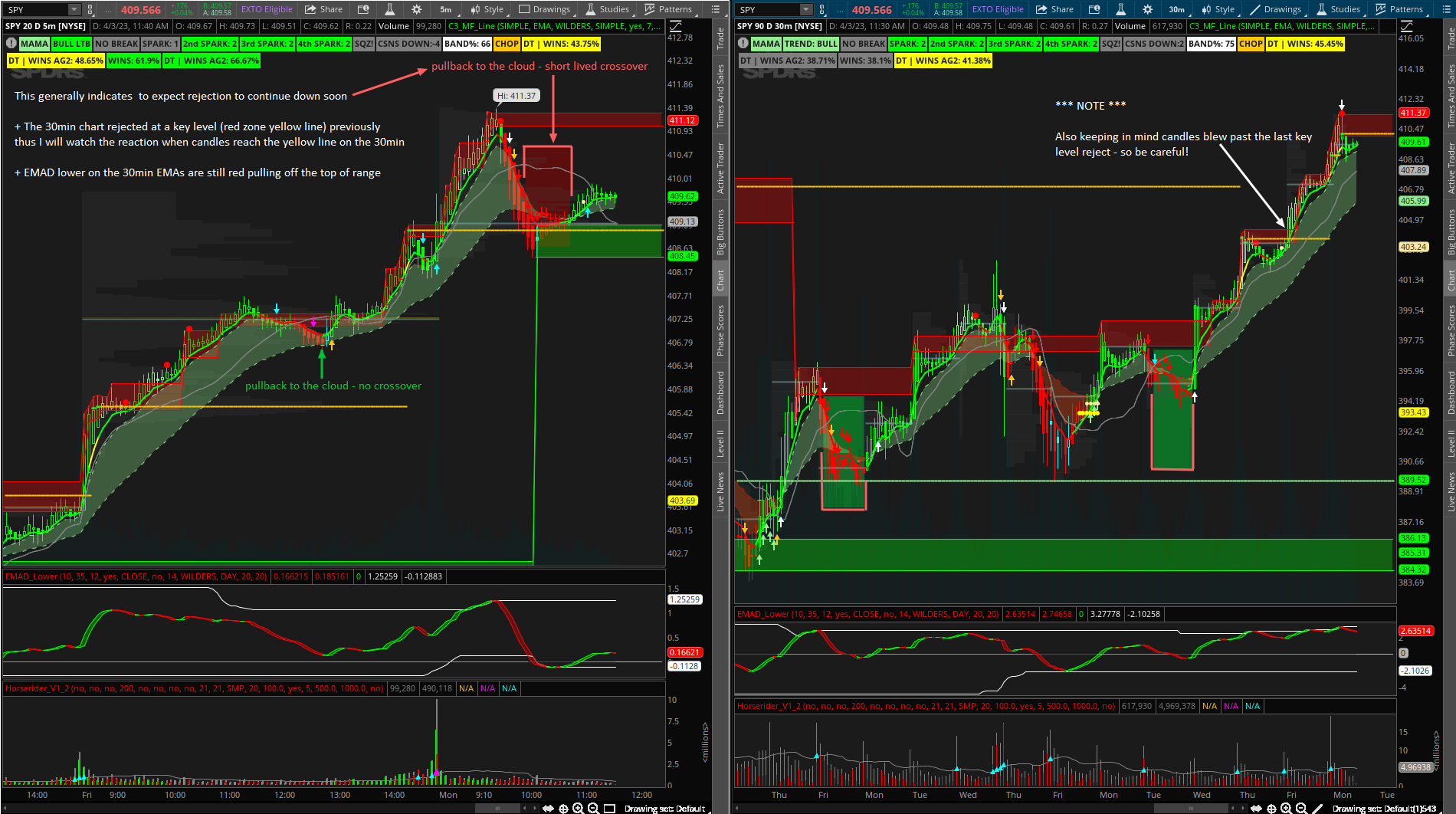

Random Observations:

I was wondering how can I get an alert when the vix (light blue line) shows on my 3 minutes chart?Do not trade based on this post

Emad top line then lower high (vertical lines)

update:

watching reaction to re entering the supply zone

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.