Good to hear man.Great examples here; thanks for putting these together. This setup is legit, working well for me on SPY.

Cheers

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Confirmation Candles Indicator For ThinkorSwim

- Thread starter Christopher84

- Start date

- Status

- Not open for further replies.

Sometimes you just have to increase chart aggregation and go back to make sure it is plotting. I will post new links for the MTF versions you are using to automatically change the aggregation settings as you change to different TF charts. But yeah if you have the ag settings set higher than the chart you are using you should be good. Or it is turned off in settings.I was wondering how can I get an alert when the vix (light blue line) shows on my 3 minutes chart?

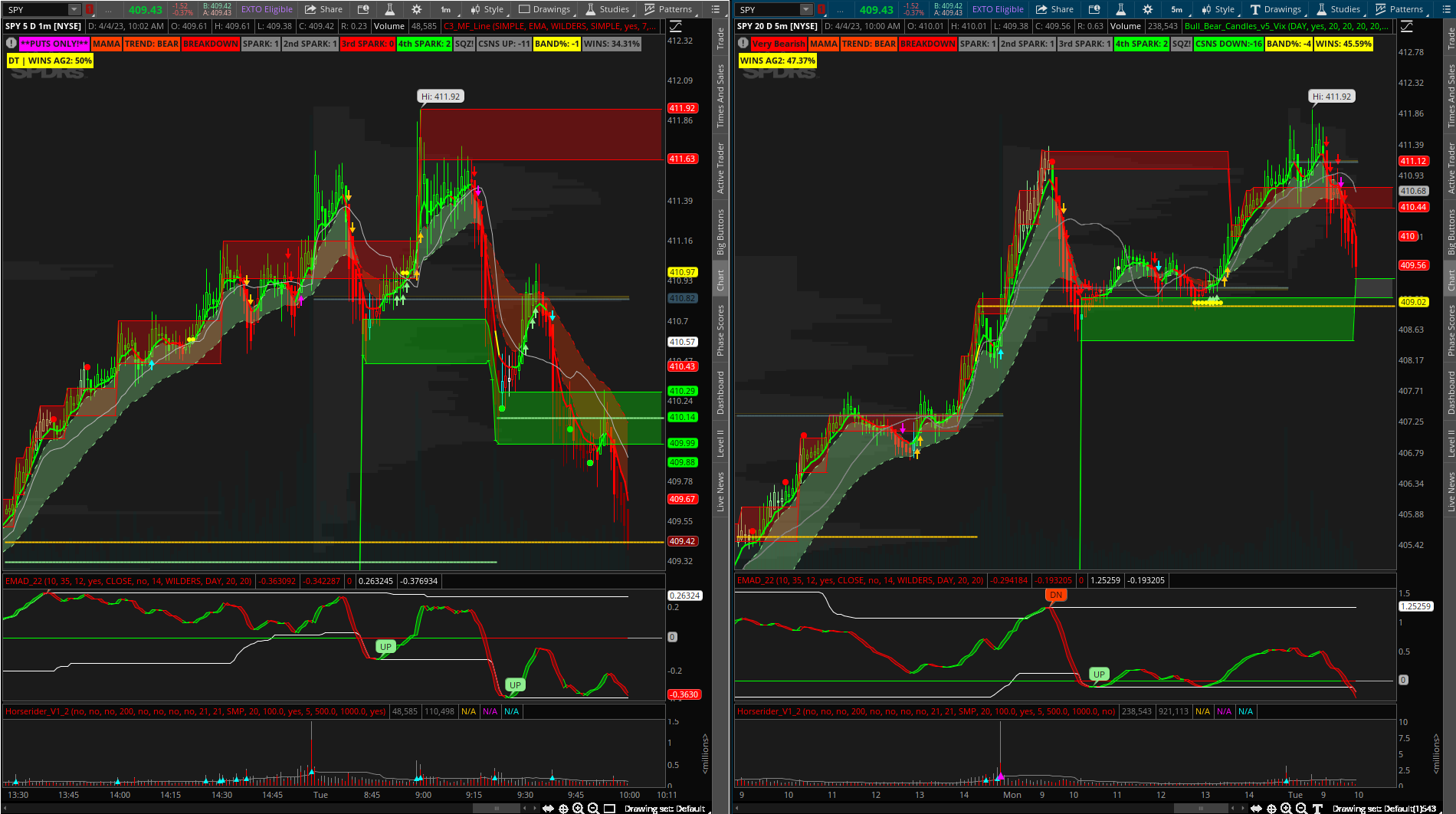

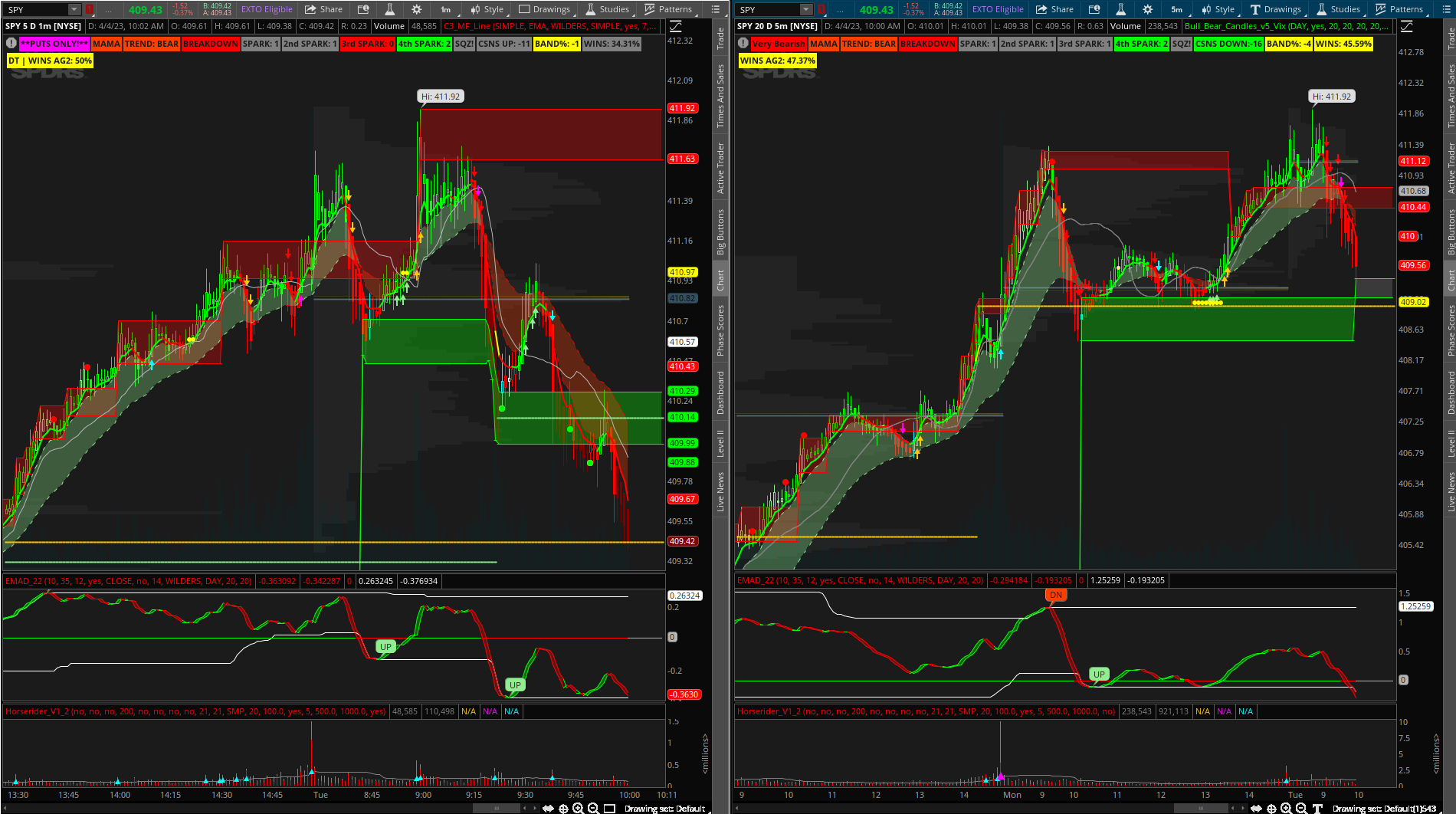

SHEEEEAAA... Arrow on the five - arrow on the one... NICE. puts only label... NICE.

Last edited:

SuperContra

New member

Puts were glorious today on this. Although my setup looks different than yours. Is this the most recent link you sent? or can you resend your latest chart?SHEEEEAAA... Arrow on the five - arrow on the one... NICE. puts only label... NICE.

Thanks again

(sorry I forgot to remove the "Up" "down" bubbles on EMAD I added them to test something so they do not really mean much of anything)Puts were glorious today on this. Although my setup looks different than yours. Is this the most recent link you sent? or can you resend your latest chart?

Thanks again

This is the newest version including the filtered TS_V9 signals... the wins label does not necessarily represent the filtered signals... but just follow the entry method above its working extremely well and no need to change any settings.

(all arrows except red and green - are TS_V9)

http://tos.mx/UEPSVmk

Last edited:

@SuperContra @jrock8903 and to whom it may concern...

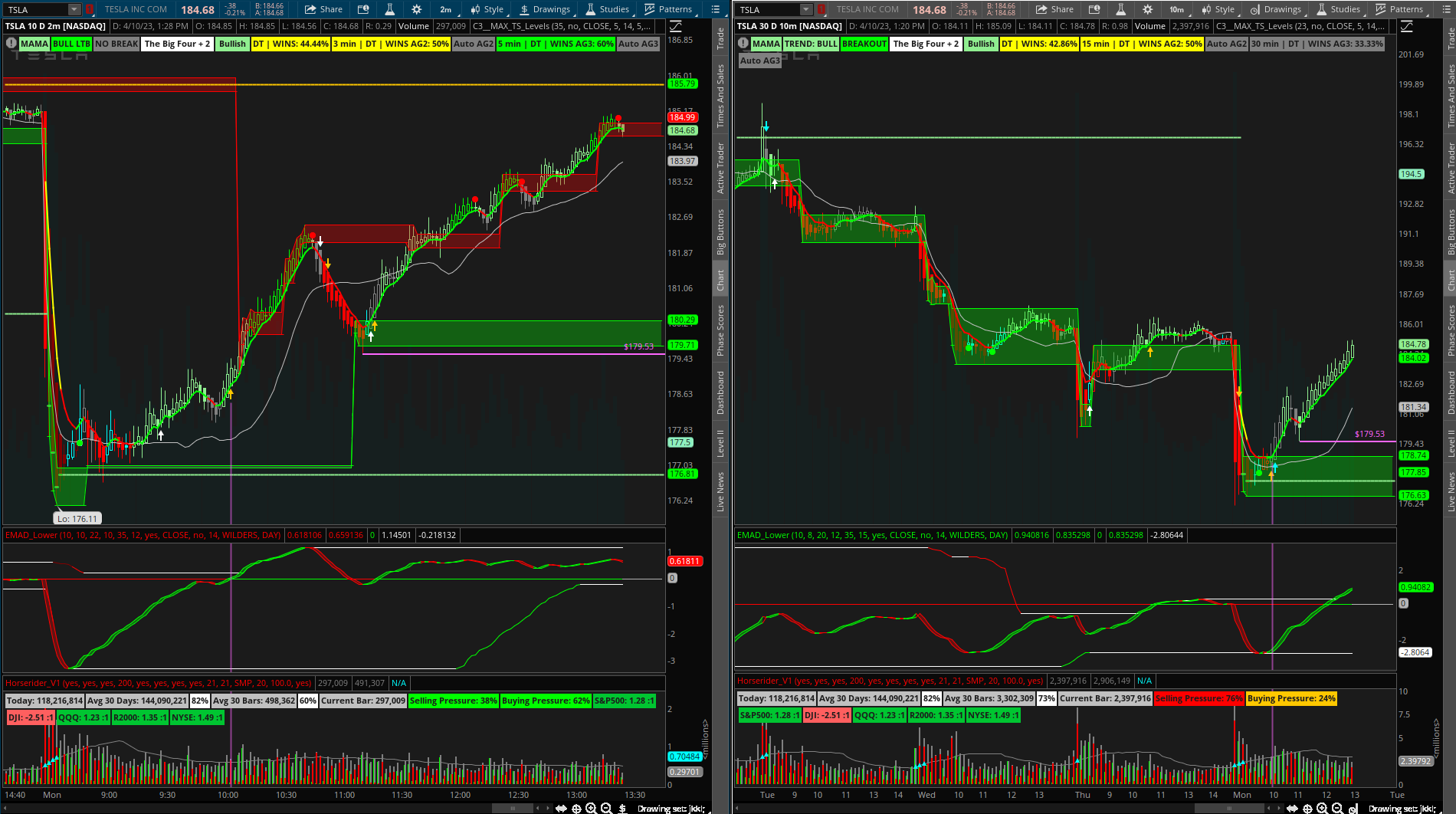

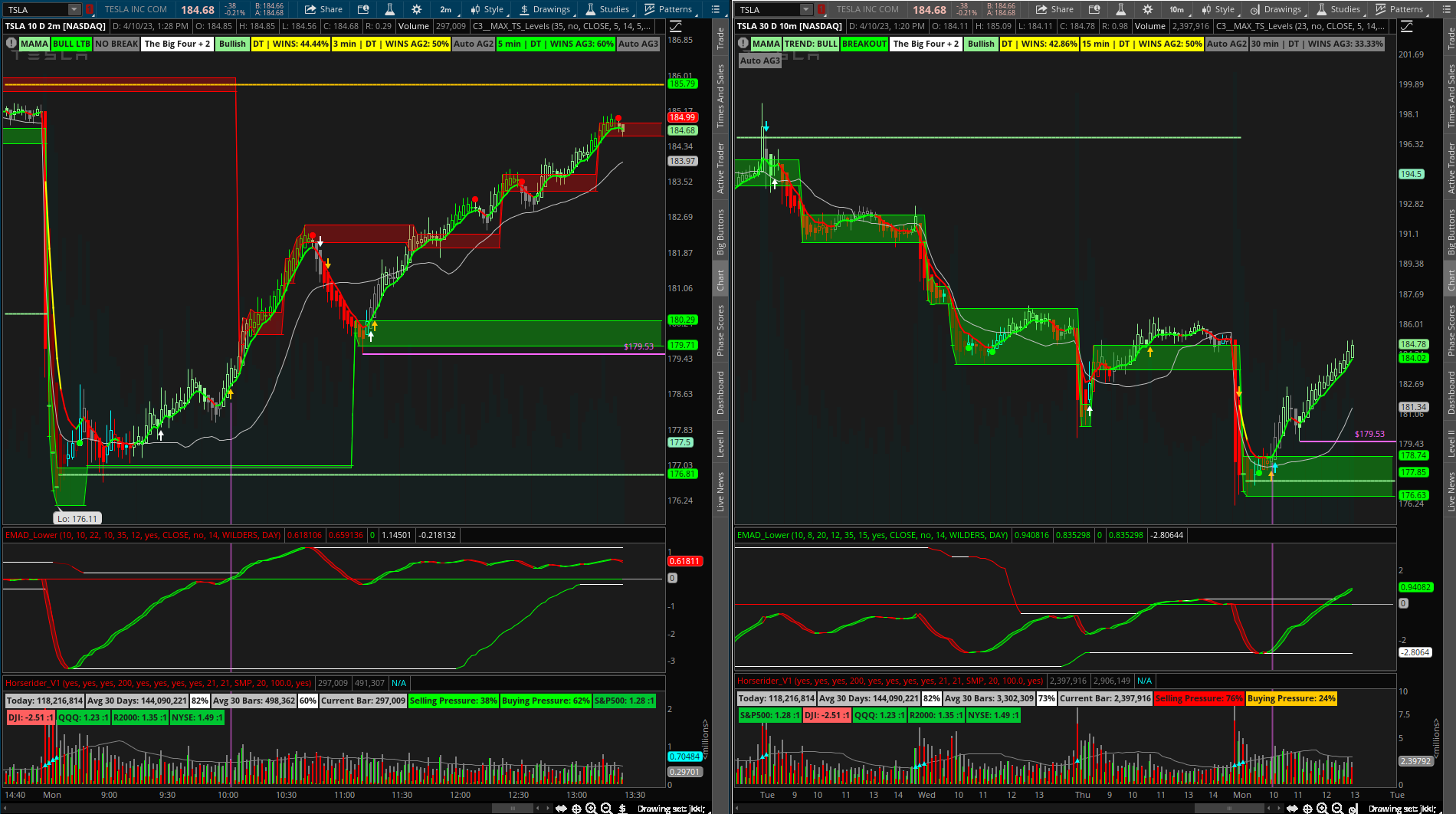

This is the most recent version of my setup... with a 10,000% win rate. (?) Anyway... the TS_V9 arrows are now Cyan and Magenta as to avoid confusion with the orange that I threw in there.

http://tos.mx/IMdS5Xn

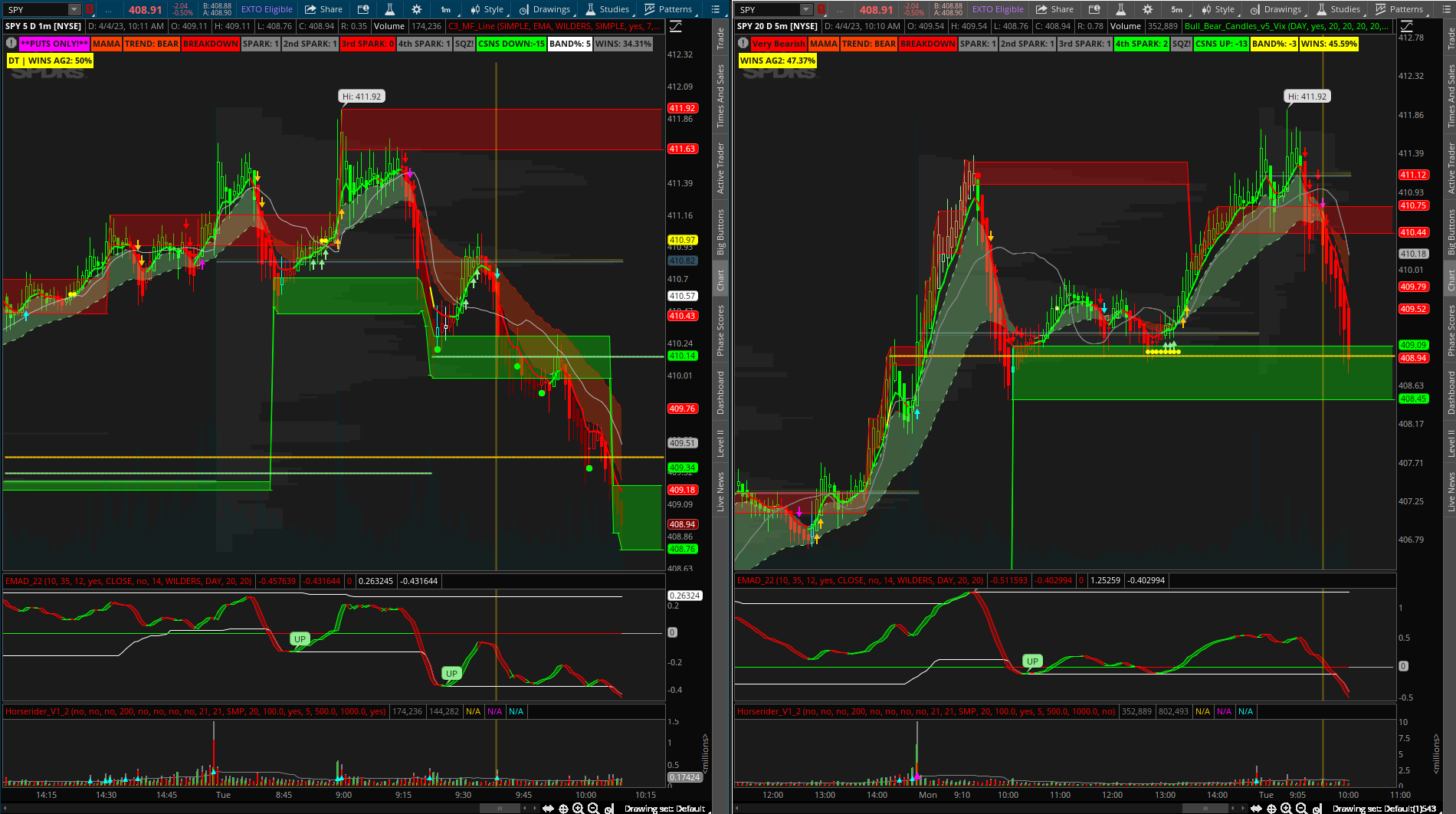

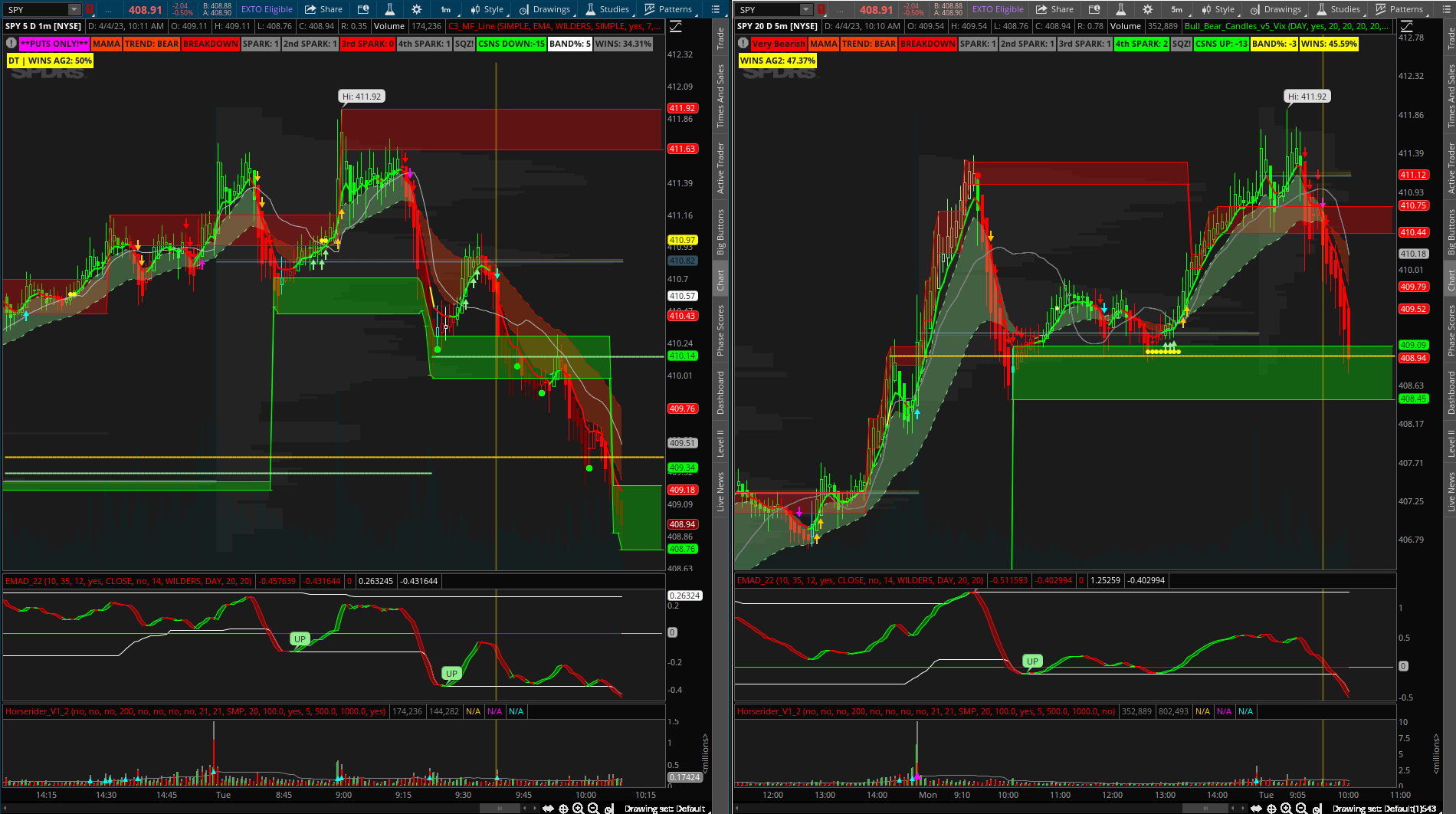

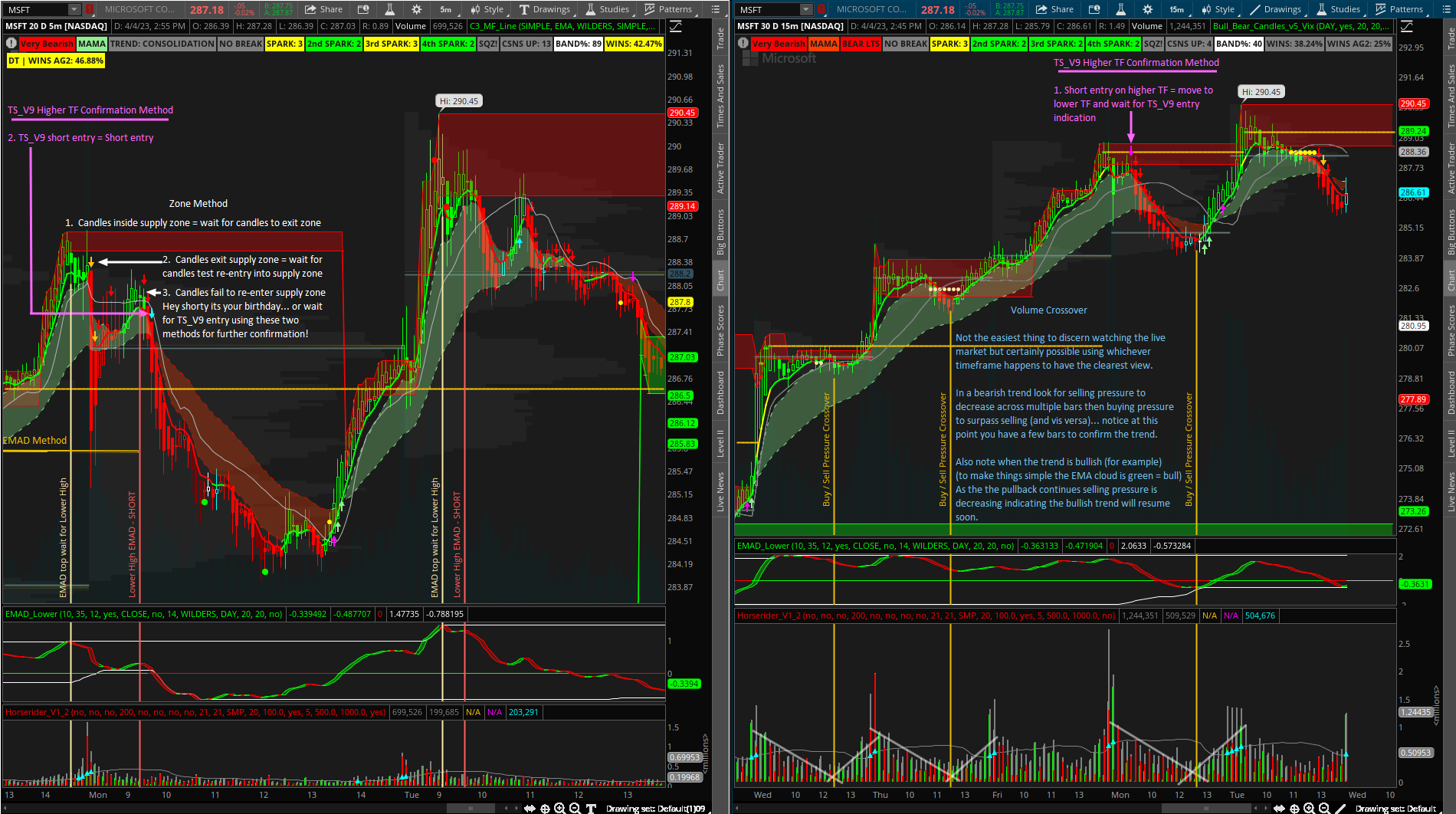

This screenshot shows 3 different Entry Methods happening simultaneously resulting in the same entry. Also pointing out use for the Horserider Volume study for crossovers...

(the volume being above or below average and greater or less than buying or selling among others are apart of the Bull_Bear_V5 code that paints the candles so if that is too much to look at then just focus on the candle colors... most times the C3_MF_Line will turn green before the candles do - which you can use to alert you to a potential bounce or reversal)

This is the most recent version of my setup... with a 10,000% win rate. (?) Anyway... the TS_V9 arrows are now Cyan and Magenta as to avoid confusion with the orange that I threw in there.

http://tos.mx/IMdS5Xn

This screenshot shows 3 different Entry Methods happening simultaneously resulting in the same entry. Also pointing out use for the Horserider Volume study for crossovers...

(the volume being above or below average and greater or less than buying or selling among others are apart of the Bull_Bear_V5 code that paints the candles so if that is too much to look at then just focus on the candle colors... most times the C3_MF_Line will turn green before the candles do - which you can use to alert you to a potential bounce or reversal)

lolreconlol

Active member

@SuperContra @jrock8903 and to whom it may concern...

This is the most recent version of my setup... with a 10,000% win rate. (?) Anyway... the TS_V9 arrows are now Cyan and Magenta as to avoid confusion with the orange that I threw in there.

http://tos.mx/IMdS5Xn

This screenshot shows 3 different Entry Methods happening simultaneously resulting in the same entry. Also pointing out use for the Horserider Volume study for crossovers...

(the volume being above or below average and greater or less than buying or selling among others are apart of the Bull_Bear_V5 code that paints the candles so if that is too much to look at then just focus on the candle colors... most times the C3_MF_Line will turn green before the candles do - which you can use to alert you to a potential bounce or reversal)

This is great.. thank you!!

Been trying to catch up on this thread. @HODL-Lay-HE-hoo! do you use the setup shown on post #2426 just above for /ES also or the "end all be all" grid shown on post #2408?

@WalshyBeen trying to catch up on this thread. @HODL-Lay-HE-hoo! do you use the setup shown on post #2426 just above for /ES also or the "end all be all" grid shown on post #2408?

I use the chart style and studies in #2426. The style in post #2408 was great but had extreme lag due to 4 aggregations on multiple studies (if it were not for the lag I would use it with TS_V9_2X the one from post #2426)

I use two charts... the previously shared grids (#2408 and prior) were due to two different charts requiring different ag settings that need to be adjusted in order for the study to show when you change to a higher TF chart - but I modified the studies with 2 aggregations (TS and Bull_Bear) to automatically change the ag settings as you change the chart aggregation therefore you can just add the same style to two different charts and set the to whicheve timeframes without changing settings.

Also the C3_max study variation included shows the 4 spark labels - there are no longer 4 aggregations and therefore no longer represent to exact spark number of a higher timeframe chart rather I modified the code to change the avg8 and avg9 settings for the 3 extra spark labels - whichever chart you are currently viewing for example the 2min chart - the av8 avg9 lengths will be adjusted to represent the EMAs of the subsequent aggregation(s) - so a 2min Spark (first label) - will adjust for Spark_2 to represent the 3min Spark_3 to represent the 5min and Spark_4 to represent the 10min... etc.

Since they are not calculated based on the actual aggregation of the higher timeframe I have not been able to account for the other 16 conditions that the actual Spark uses to derive the number... this is why I say it really just tells you what the moving average 8 (length 10) and 9 (length 35) are doing on a higher TF... if they are no help turn them off in settings if you want to figure out what they are telling you turn on all the "Avg8_1 2 3 4" etc. to see the moving averages.

That being said the spark 234 number are still a close representation of the actual spark of the timeframes they represent.

Last edited:

Hey go figure guys... more changes...

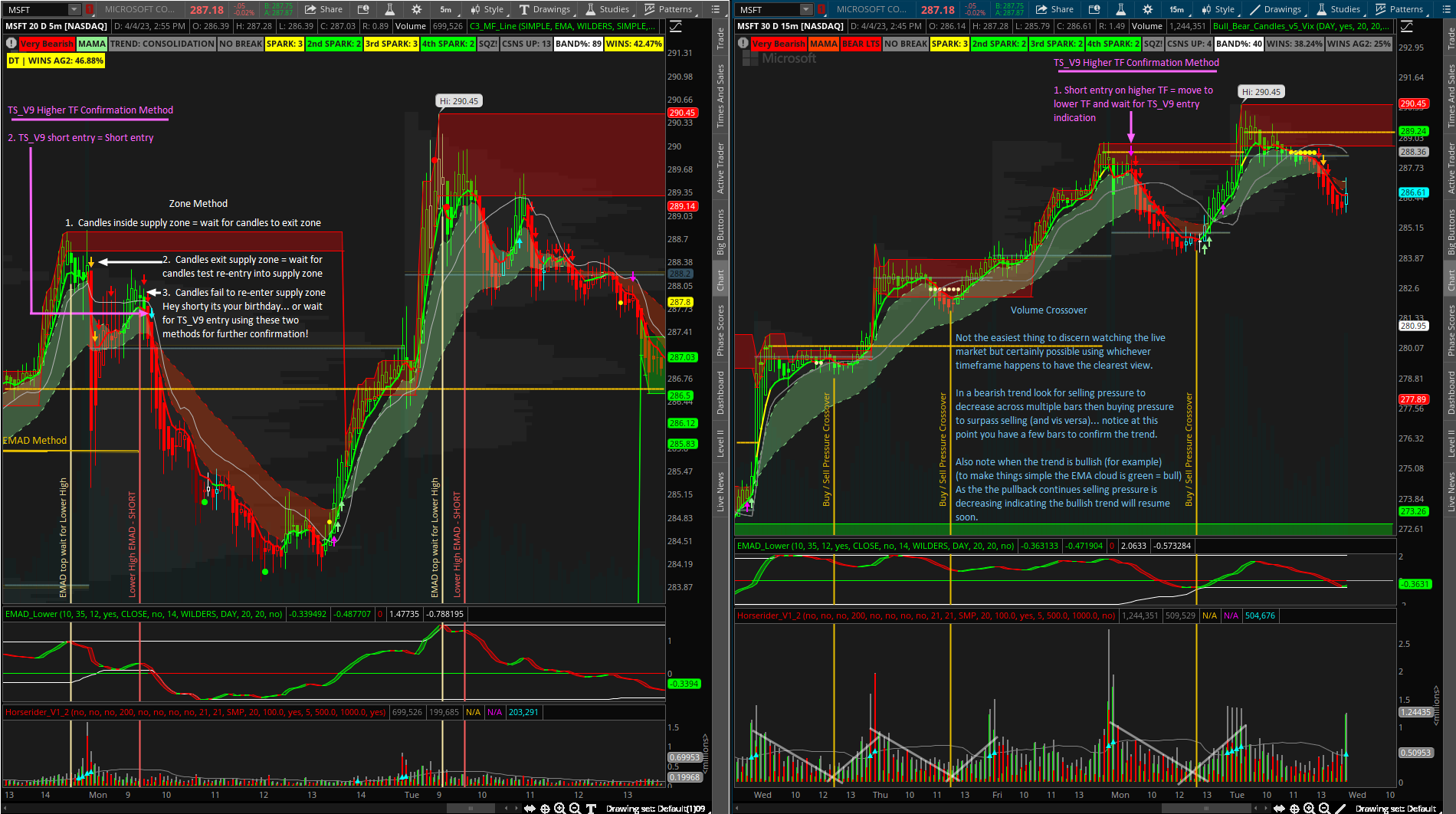

I added the option to use auto or manual setting for the 2nd aggregation of TS_V9. Also added "AG Skip" - with ag skip off the ag2 will be set to the next TF up so if you are looking at the 1min chart it will set ag2 to 3min... with ag skip on it will set ag2 to 5min etc.

http://tos.mx/5fU7M6m

Two three min charts one with ag skip on one with ag skip off

I added the option to use auto or manual setting for the 2nd aggregation of TS_V9. Also added "AG Skip" - with ag skip off the ag2 will be set to the next TF up so if you are looking at the 1min chart it will set ag2 to 3min... with ag skip on it will set ag2 to 5min etc.

http://tos.mx/5fU7M6m

Two three min charts one with ag skip on one with ag skip off

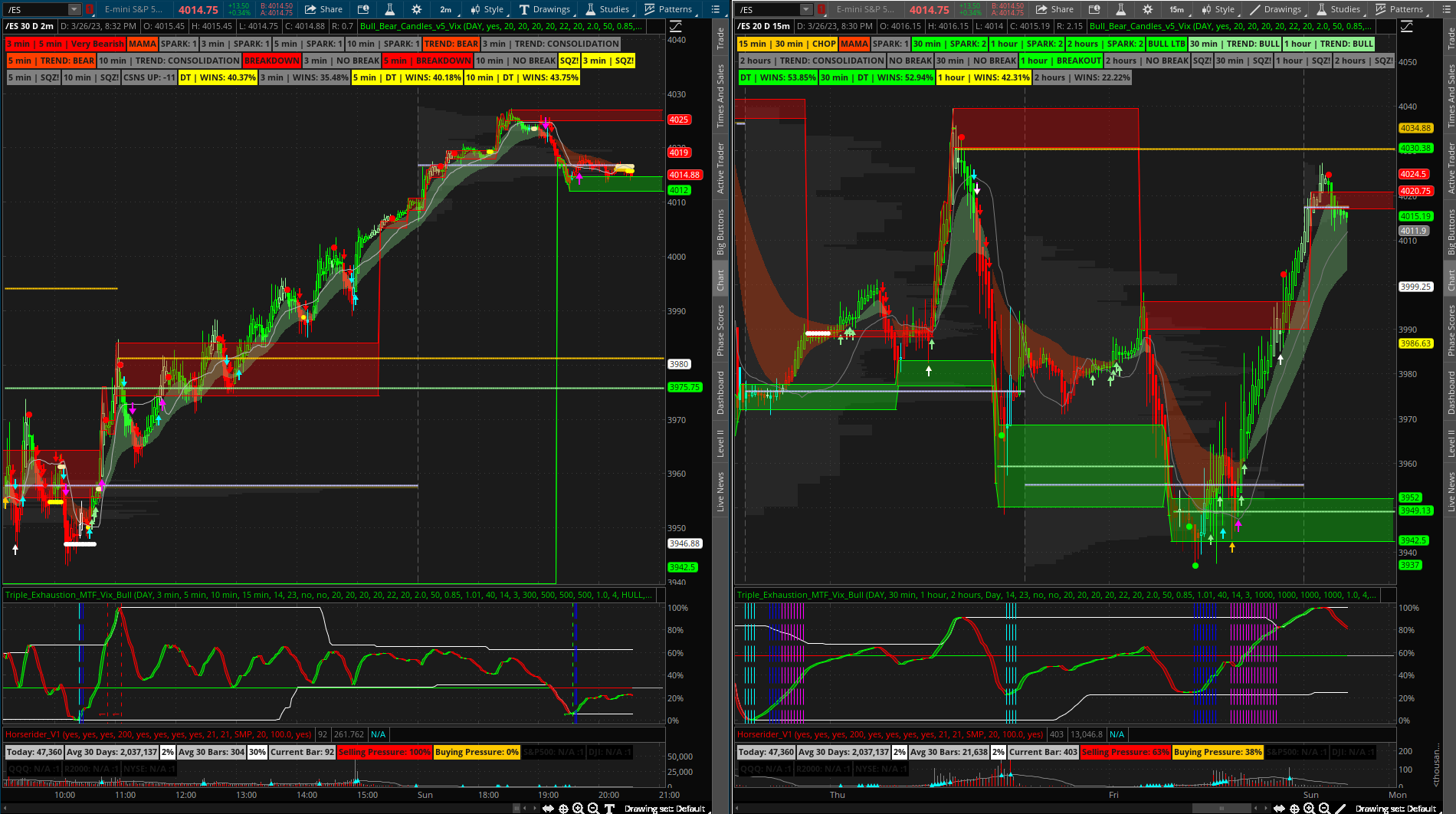

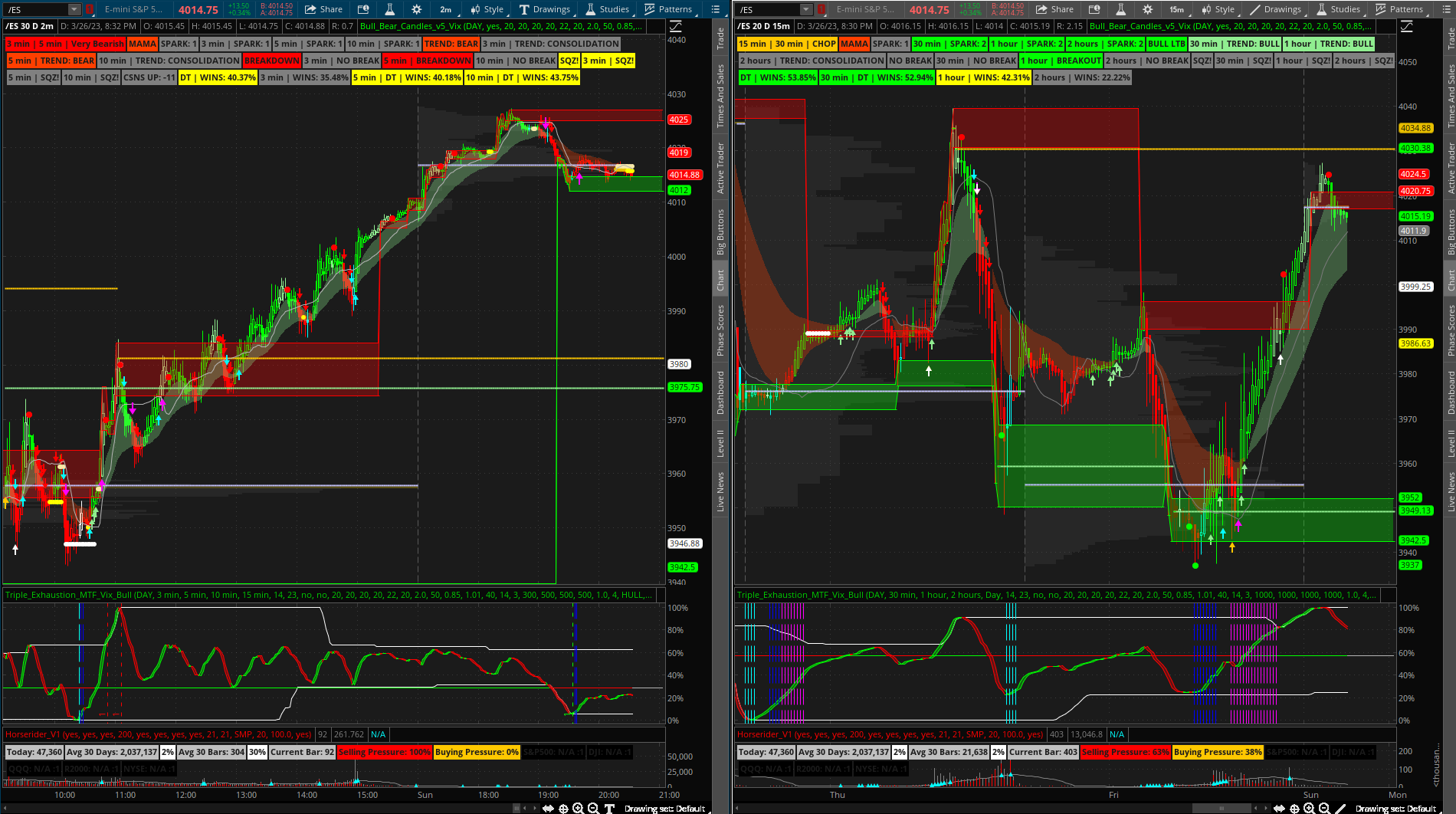

Hod,SUPER MTF MAX RETURN END ALL BE ALL GRID!

- 4 AG - TS_V9 (ag1 cyan, ag2 magenta, ag3 orange, ag4 white) (*** the ts_v9 labels now indicate trade daytime only status (DT means day time only is on)

- 4 AG - C3_MAX_SPARK

- 4 AG - Triple_Exhaustion_Vix_MTF (lower verical lines)

- 2 AG - Bull_bear_v5_3x_Vix

Two chart grid: https://tos.mx/MvgNxaz

The following setup is the 2min chart showing the 3min, 5min, 10min | the 15min chart showing the 30min, 1hr, 2hr

I would love to see some live trading with you setup if possible. Also, What do you use or see that stops you from use the false emad signals. I get a lot of bottoms that break up just to fake me out and visa versa.

Here is an EMAD lower indicator modified to color the upper and lower lines as they increase or decrease (green and red)... if both lines are moving the same direction the color will be dark red or dark green

EMAD lower study: http://tos.mx/yBtn9oC

EMAD lower study: http://tos.mx/yBtn9oC

@METAL This is the setup right here sir. MTF was too much lag and the study painting the candles is killer. I'll at some explanations and what not soon. As for the video I have made a few attempts for some reason the video is always extremely small or just will not want to play when I try to open the file... mind you those of free version of screen recording but I am working on it.

Style all studies: https://tos.mx/Fe6iQl7

Style all studies: https://tos.mx/Fe6iQl7

Yeah, I looked at this today. This one really seems to be on point and less laggy. Great Job man!@METAL This is the setup right here sir. MTF was too much lag and the study painting the candles is killer. I'll at some explanations and what not soon. As for the video I have made a few attempts for some reason the video is always extremely small or just will not want to play when I try to open the file... mind you those of free version of screen recording but I am working on it.

Style all studies: https://tos.mx/Fe6iQl7

I am fairly new. Is this strategy working for anyone? I do not see where anyone has shown their experience. Is there any live trading videos for this. That would be very helpful.SUPER MTF MAX RETURN END ALL BE ALL GRID!

UPDATE - go figure... this ol girl laaaagin

- 4 AG - TS_V9 (ag1 cyan, ag2 magenta, ag3 orange, ag4 white) (*** the ts_v9 labels now indicate trade daytime only status (DT means day time only is on)

- 4 AG - C3_MAX_SPARK

- 4 AG - Triple_Exhaustion_Vix_MTF (lower verical lines)

- 2 AG - Bull_bear_v5_3x_Vix

Two chart grid: https://tos.mx/MvgNxaz

The following setup is the 2min chart showing the 3min, 5min, 10min | the 15min chart showing the 30min, 1hr, 2hr

No problem. The TS_V9 as 3 aggregations but the first two ag signals are filtered so there’s not 6000 also if you have “trade daytime“ set to “yes” it will only show trades within the “open” “close” times in settings which is helpful come to find out.Yeah, I looked at this today. This one really seems to be on point and less laggy. Great Job man!

Hi HODL,theyre included in the link

Is it possible to add divergence to EMAD lower indicator?

Sorry I am new to this and have tried some versions of C3 Max indicators and still need to get a hang of these. Is there a tutorial on what each label means? @Christopher84 @HODL-Lay-HE-hoo! - Thank you for so many variations, would you be able to help me with picking a version or variation that helps with trading SPY/QQQ scalping? I tried 3m variation for scalping but wasn't very successful. Cheers.

No videos yet… search my name you will find the 10,000 screenshots I have posted explaining what everything is and how to use it. I would suggest NOT using the MTF version from this post as it lags way too much. Instead use the most recent link I shared. The system is simple - though it looks like a lot the entry methods are essentially breakout - retest - entry | all the indicators show you the levels and confirm the highest probability of a successful trade and the included strategy is based on a trailing stop loss.I am fairly new. Is this strategy working for anyone? I do not see where anyone has shown their experience. Is there any live trading videos for this. That would be very helpful.

Also when you learn the entry methods and what to look for (tos has a feature to playback the live market if it’s closed but doesn’t work well with indicators like these) you can pull up a chart scroll back in time and click your mouse to shift the chart to the right one bar at a time so you can try to predict what is to come and or when you would risk off (sell) - yeah it’s kind of a to-do but it’s really easy to identify all the setups when the full chart is in front of your eyes so either watch during market hours and apply the entry methods (with an insignificant amount of $ or no money on the line) and you will get it.

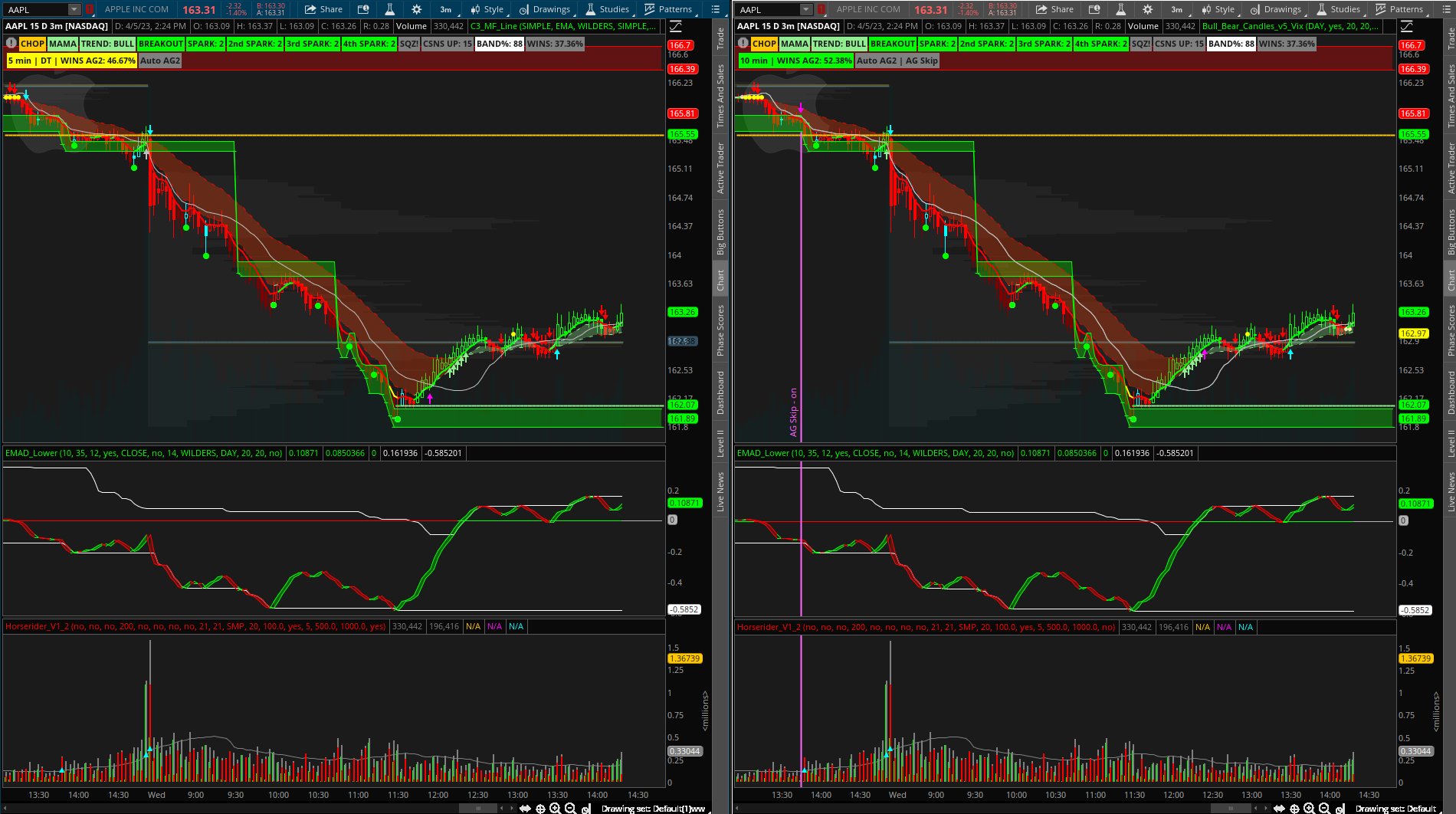

This is on mobile but a quick example (works on any TF)

Here is what I mean about watching live vs after the fact… so in this (I won’t explain the entry at the moment) you can see the buying and selling pressure dropping out plus a breakout and retest (if this is your entry that’s great but you need a TIGHT stoploss:

Then next bar or two the buying pressure crosses over and the yellow arrow (strategy) confirms entry (this is kinda wild as its on the one min but yeah)

Last edited:

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

832

Online

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.