lolreconlol

Active member

This looks great! What timeframe have you tested? 1/5 looks very promising..

This looks great! What timeframe have you tested? 1/5 looks very promising..

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

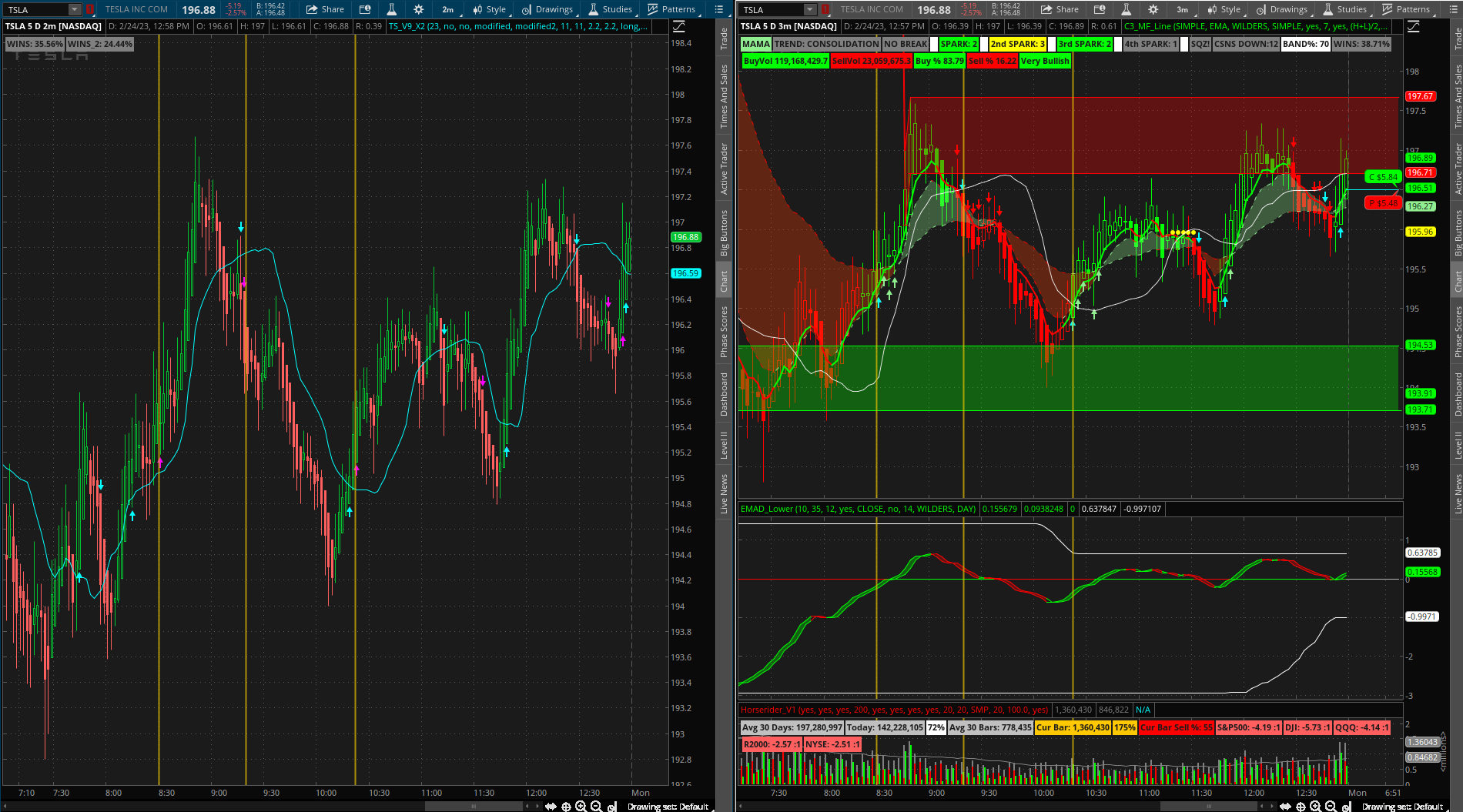

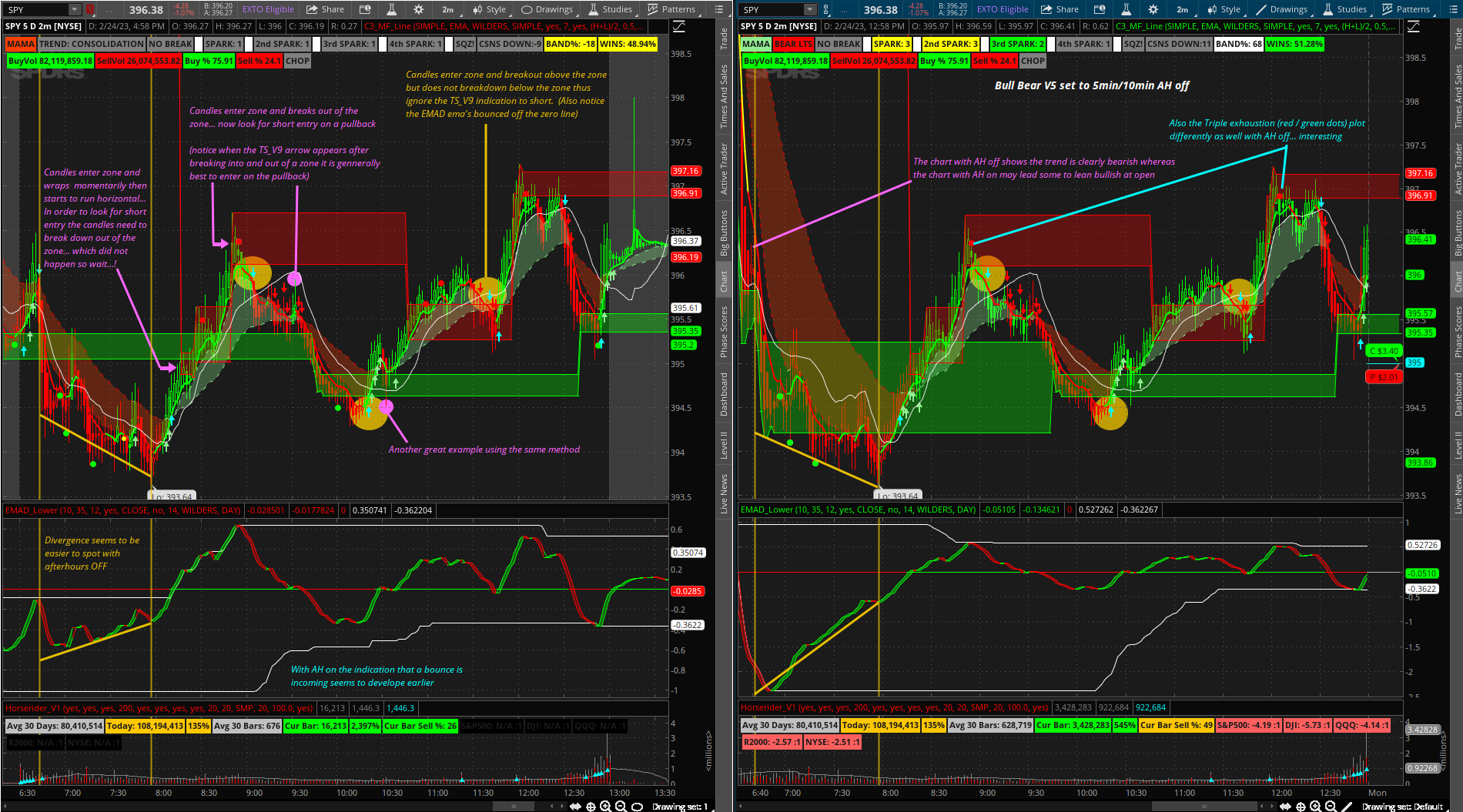

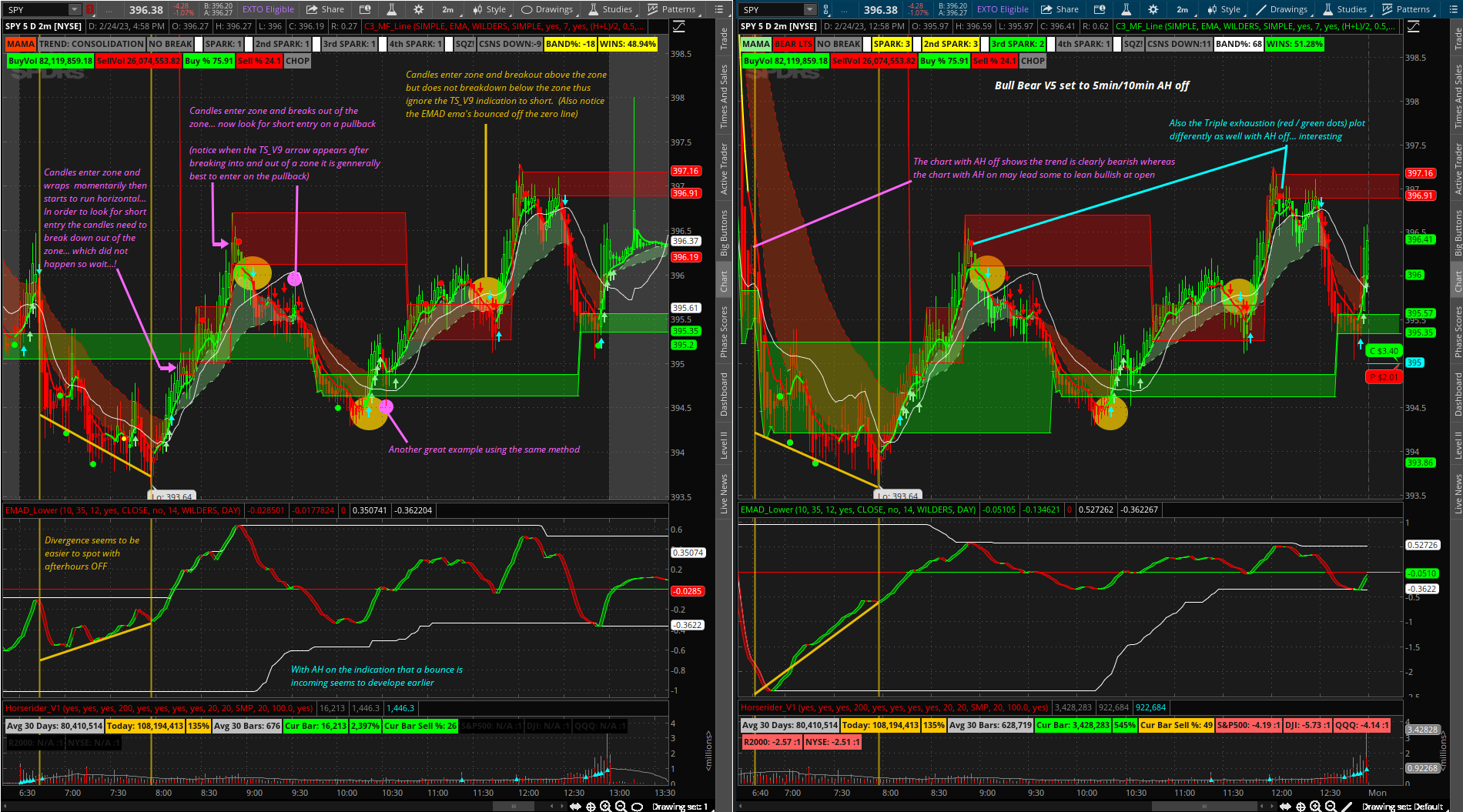

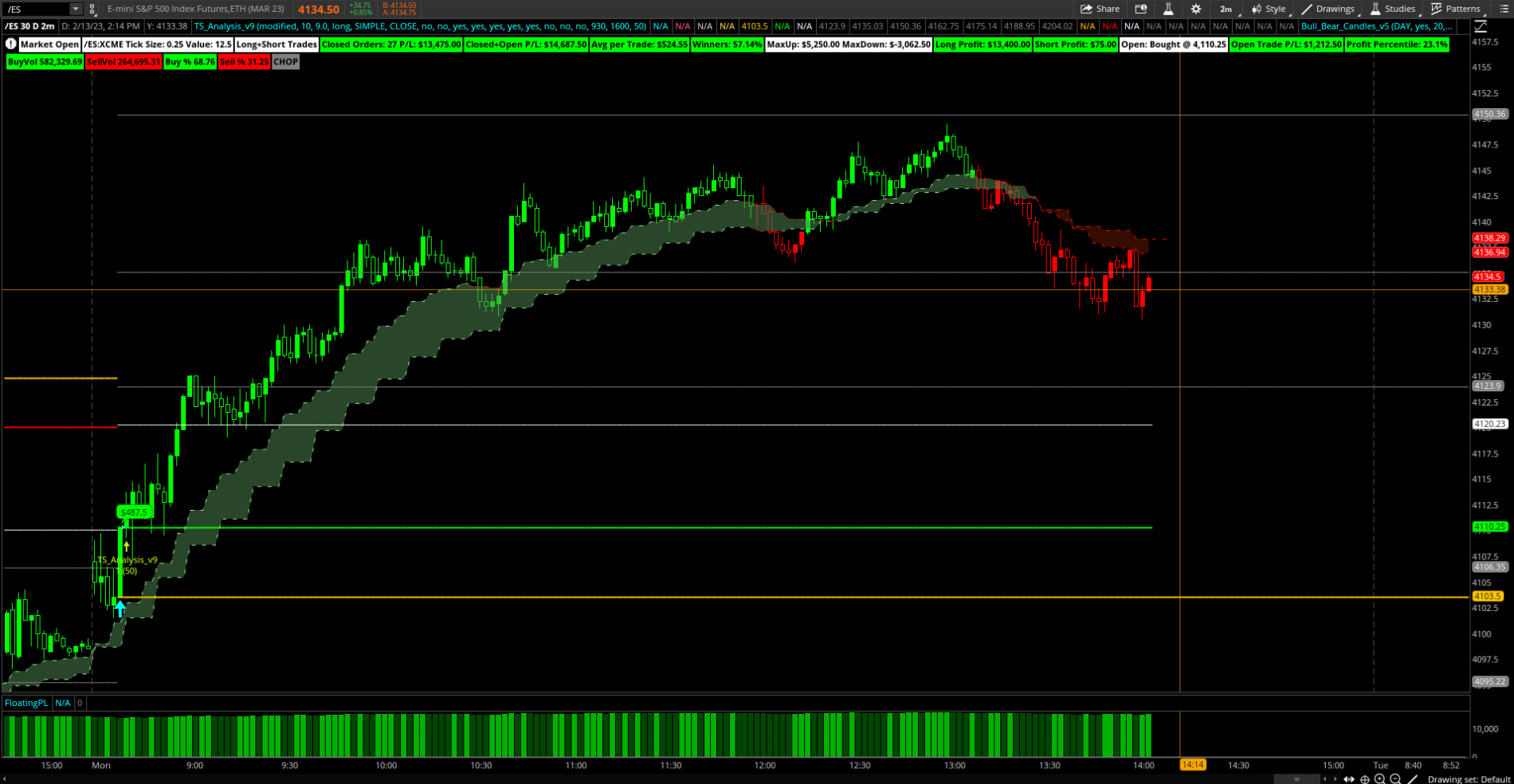

This is pretty amazing, trialing removing some of my longer tf charts to save resources in TOS and so far so good. Thank you for posting Hodl. Is there an option to turn on the dotted upper/lower lines (not sure of the proper verbiage, but I circled them in the attached link) in TS_V9_x2 or are they only in the Max Breakouts code? I've found these dotted lines serve as good entry/exit points after signals pop-up. Thank you.Due to earlier post about comparing the TS_V9 entries on 2 TF charts... I HAVE DONE THE UNTHINKABLE... and combined them into one study on one chart - 2 aggregations

In the screenshot one chart is 2min the other is 3mins the 2nd agg is set to 3 mins (magenta arrows and i added the verticle lines to compare to the 3min (you can also adjust the 2nd aggregation atr factor and whatnot... i have them both set to 11 / 2.2)

also shout out to CHAT GTP for saving me some time changing the name of a million inputs and def etc.

Note the size of the move where the cyan arrow plots then the magenta arrow plots a few bars after (haven’t tested much but looks interesting)

***Update link (previous link the wins 2 label calculation was wrong)

http://tos.mx/Ae6JxJC

the dashed lines are "near term support / resistance" in settingsThis is pretty amazing, trialing removing some of my longer tf charts to save resources in TOS and so far so good. Thank you for posting Hodl. Is there an option to turn on the dotted upper/lower lines (not sure of the proper verbiage, but I circled them in the attached link) in TS_V9_x2 or are they only in the Max Breakouts code? I've found these dotted lines serve as good entry/exit points after signals pop-up. Thank you.

I was only able to see them in the C4 breakouts indicator at the bottom (plot section). I was hoping there was a way to activate them via TS to consolidate some stuff. Maybe I'm missing something (99.9999% chance)Hodl, Where exactly are these in settings? I do not see them. I looked in C3 and TS

I thought I had you excommunicated from this thread @METALSuk Up!

I have a $15,000 Liquid cooled PC with... Joking people... it varys. But for the most part if I continuously change timeframes and switch windows etc it will start to lag... Do you have high end graphics? TOS support said to change a line of code in the TOS file concerning dumbing down something that has to do with high end graphics cards being overkill for TOS. The ideal processor is for TOS is not a 50 core 6ghz total with 100,000GB of ram... rather a processor that has the fastest speed per single core. Every now and then when I accumulate or save different versions of studys, styles, sets, etc. I will either re install TOS or delete everything I dont use and when I am done (if I went with a fresh install) I will load my share links.On a serious note, With your latest updated C4 version, Does it cause lag on TOS for you. I have a very high end PC and I get quite a bit of lag. I have already upped the memory and such.

It’s in there. The bull bear is also just separateI think the removal of those 2 will make a considerable difference. I will give the latest version a try. Is this it? https://tos.mx/ULVl7dj

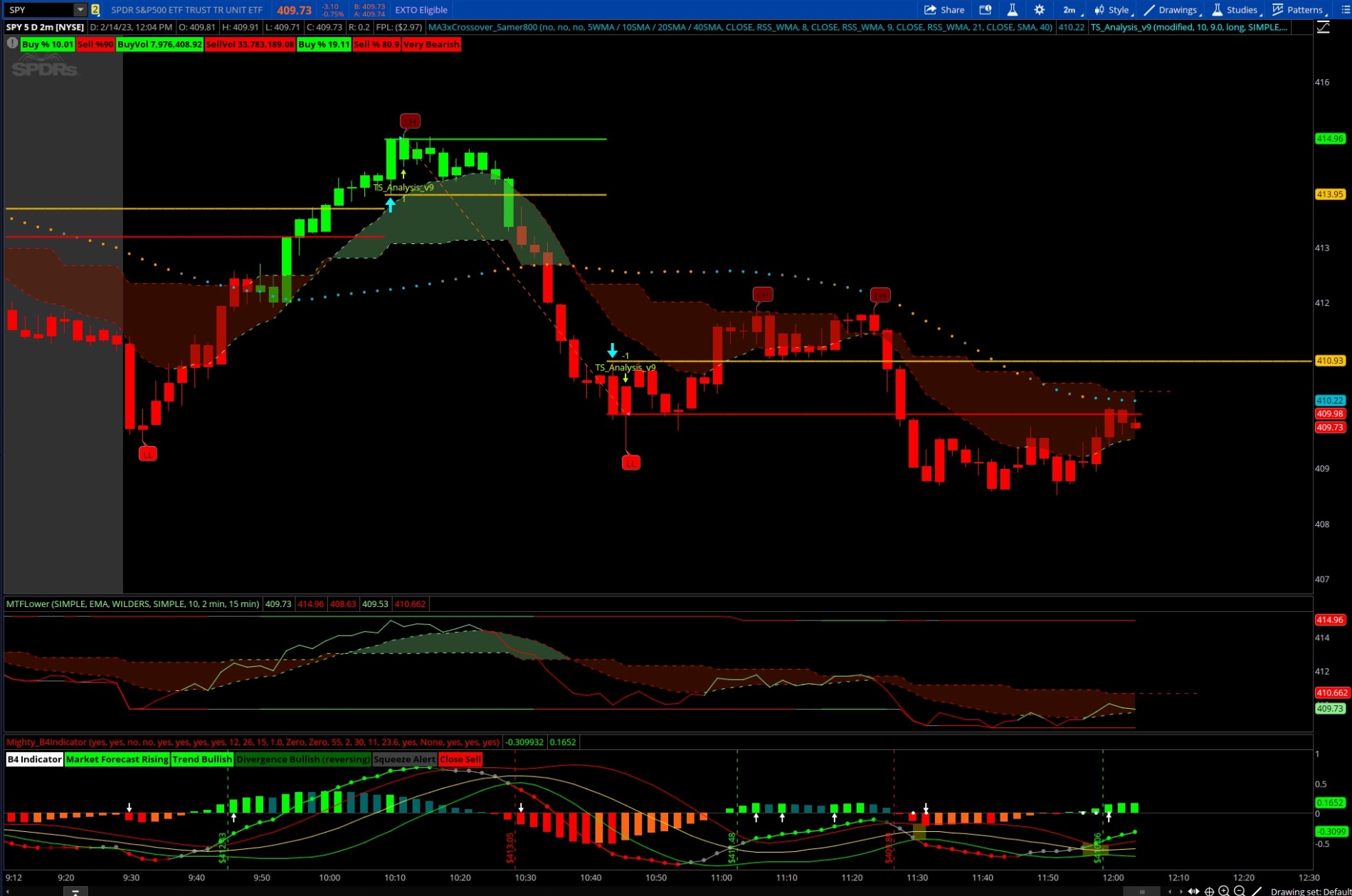

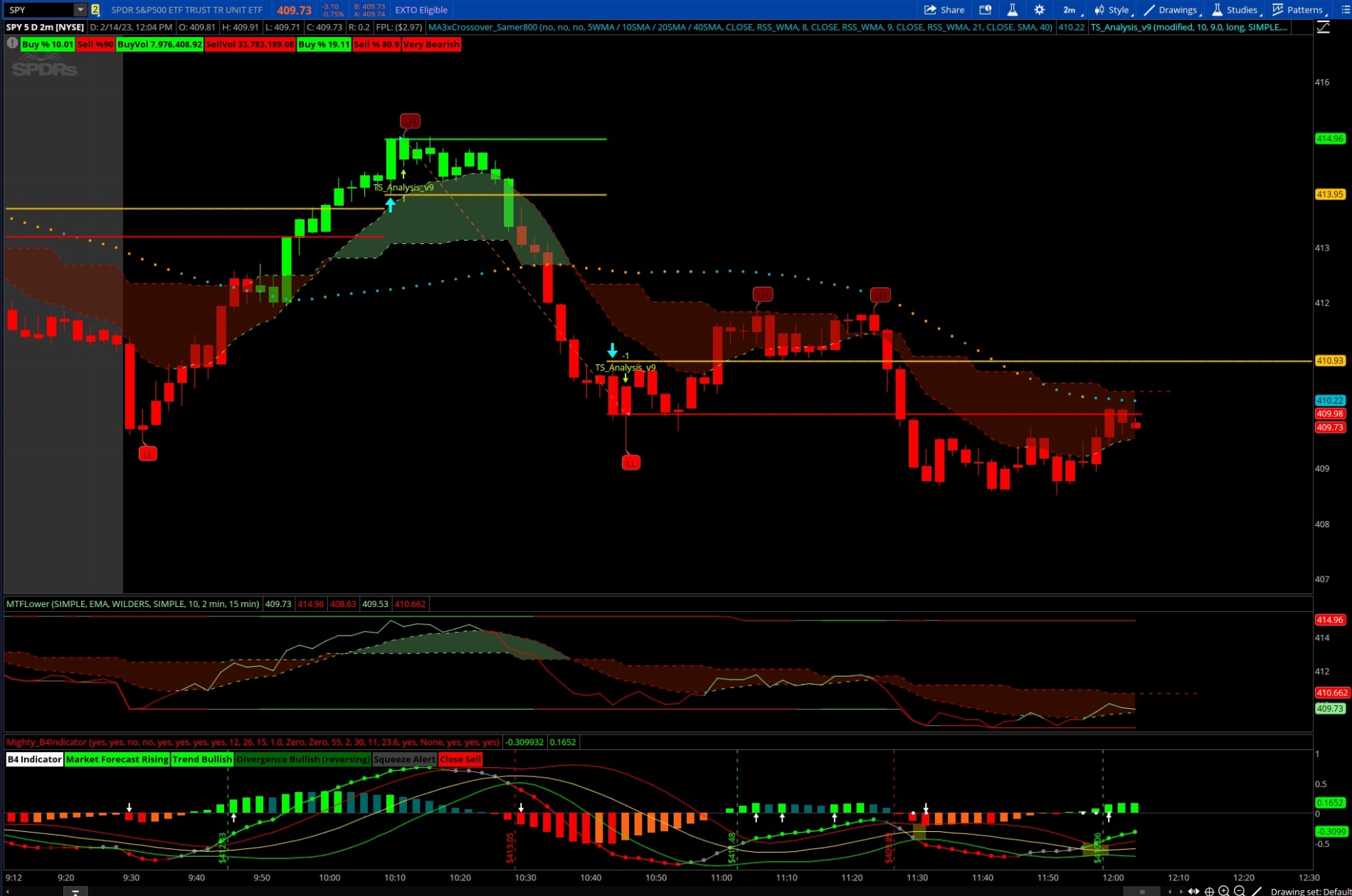

try “trade daytime only”@Christopher84 , Take a look at todays SPY on the 2 min. Not good results at all. What do you think needs adjusting if at all?

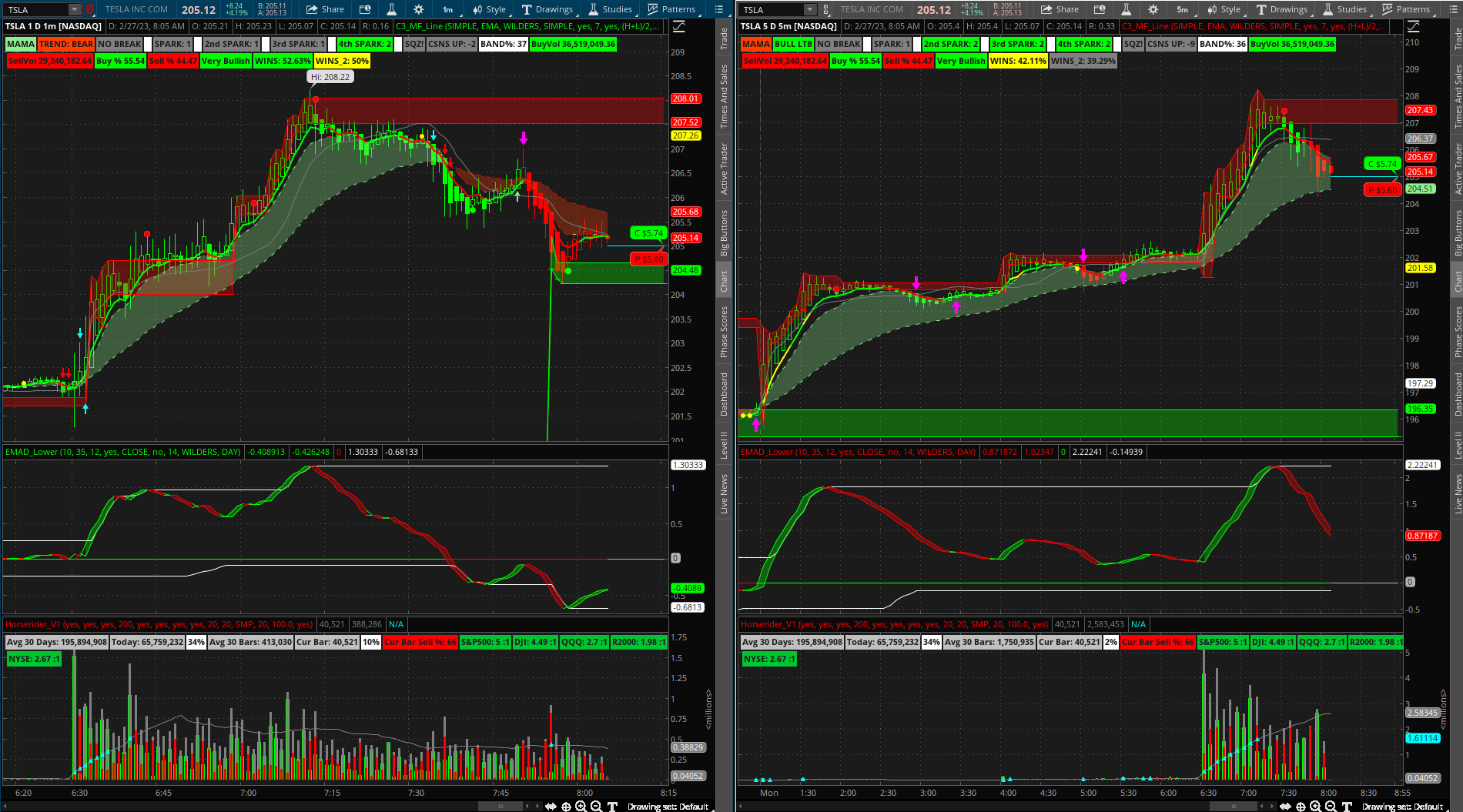

No problem. Sure I’ll share the link in a few… it is all the same for the most part with a few things removed like the “breakouts” portion of the code (because I could never find a consistent use for them but I would really like to use the code for indicating the yellow arrow on the screenshot - which the breakouts code will work for that but filtering out multiple indications and whatnot is proving to be difficult.) Not using the cumulative delta lower or the triple exhaustion MTF study at the moment… though I may add that one back. Then I have spark labels for four different lengths to represent four different timeframes however the 3 extra spark labels are not exactly the same as the do not account for the confirmation level as the original spark does… I am attempting to add it but its a lot and may cause some lag? I’m not sure…. But the extra spark labels indicate that the emas are turning over so they are useful (I added them in hopes to not need to look so much at higher timeframe charts during the day.)I notice you have this on a 1m TF. That is awesome!. Great job with the explanation. May I ask, what is the latest indicators you are using for this or would you mind sharing that chart? BTW, I never noticed the divergence detail before. Also, do you use support/resistance or supply/Demand zones from say daily or hourly chart as confirmation or do you just follow upper/lower zones? I typically go in every morning and mark out the zones from a blank chart so I know where the main zones are. curious if you even do that.

I dont really change my settings all that much and when I do I usually change them back to the current settings 11 and 2.2Totally agree. I guess what I was asking and I didn't do a great job, is, are you guys doing this for every stock you change to and is there any shortcut. I have tried keeping certain sets for different stocks based off of my adjustments but that really goes away the next day sometimes. sometimes it is really close.

I don’t believe so. I can make one when I get home but generally TS_V9 is more reliable. It may be of use to be able to look at a watchlist and see if the TS_V9 indication occurs above or below the elhers ma… hmmm…@Christopher84 Is there a watchlist code for the PLD and or Elhers strategies? If not, Is there a way to make one that would show the buy/sell signals for both?

I bought NVDA puts before close which were up 30% this morning. Today I bought a straddle spy call and put. Both went up about 10%. Also COIN calls when it was down about 8% as the demand zone started to run horizontally (it was slow moving after the morning so I bought further out (all the contracts were April expiration) than usual to be less stressful.Great examples. Definitely a learning moment for me. Did you trade today? If so, How did you do. I believe I asked before if you trade options. If you answered, I must have missed the reply. I believe one of my issues, is recognizing that a divergence is happening in real time. something I need to get better at for sure. Thanks again for the chart explanations. They really do help a ton!

@METAL also the divergence is just another possible confirmation method and not even something you would need to catch right on time. A (possibly short term) reversal happens after the divergence yes… but generally speaking there will be a pullback after reversal which you can see from my screenshots above. I only recently realized the potential of using the EMAD for divergence.I bought NVDA puts before close which were up 30% this morning. Today I bought a straddle spy call and put. Both went up about 10%. Also COIN calls when it was down about 8% as the demand zone started to run horizontally (it was slow moving after the morning so I bought further out (all the contracts were April expiration) than usual to be less stressful.

The following is my opinion:

When your close to expiration and it goes your way right off the bat it’s fine but when your down a fair amount and the move you wanted has not happened yet there is a much higher likely hood of getting scared and cutting them loose (which is likely a wise decision to stop out and re-enter as you may be down quite a bit in that case). Only go close to expiration when your confident it will go your way… and fast holding close to exp with sideways price action is a bad idea.

This is right after I bought CALLS for coin… not the smartest call entry but I the EMAD was stepping up so I figured it would bounce. Still using 11 and 2.2 … I need to make a post about when to ignore the arrows I’ll do that soon.Yep. I had not noticed the divergence with the EMAD before you pointed it out. What settings do you have for the TS watchlist? I have one set at 3m TF, ATR Period = 11, ATR Factor = 2.2.

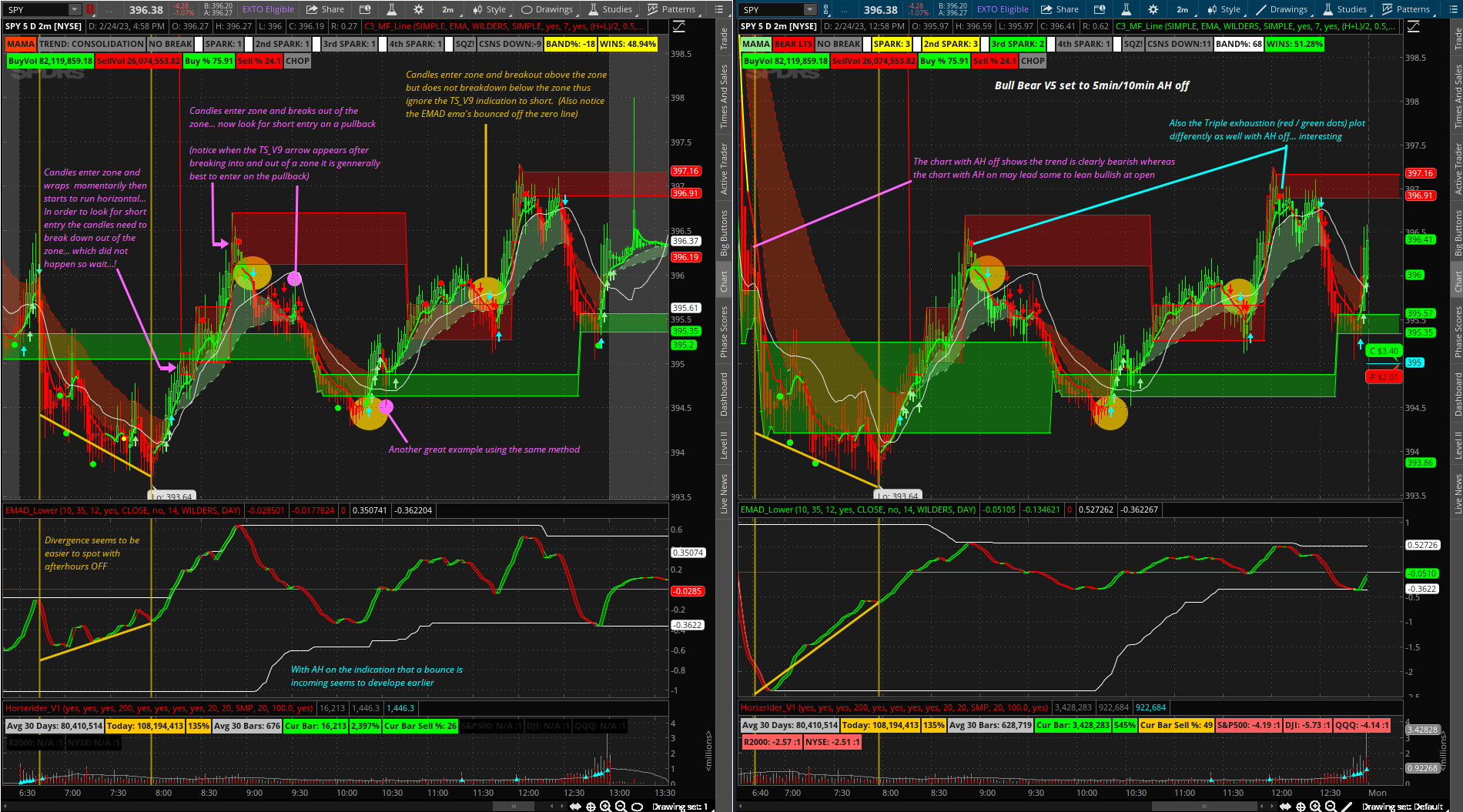

Well first… how dare you question the bullish bear of the 5th order!What is the point of using Bull/Bear Study? As far as I can tell, C3Max colors the candles the same. Do you mind explaining?

haha well the chart is a 1min 1day or 2min 3day or something of that nature. Also I use trade daytime only.How in the world did you get 48%+ Winn percentage? I have tried or quite a long time now and cannot get better than 35%

usually I set the 2m to 2min & 3min in one of the screenshots i believe i have the 3min set to 5min & 10min. which is fine but repaints too much at times.Also, with the Bull/Bear, If you are on a 2m TF chart, Do you set the agg1 to 2m and agg2 to 10 min

oooh ok yeah theyre both the same 2min 5day bull bear v5 set to 5/10 on one right side and After hours is off on the right side chart. settings are 11 and 2.2 for both the right side shows 51% wins but yeah thats only taking into account 5 days and "trade daytime only"No. The first one you posted that has the pink writing. They both say 2m 5 day.

Oooh I think you loaded the original link… you gotta load the new one… I replaced it because it was messed up.I figured it out. I need to be on the Higher agg TF.

I am not getting Buy2/sell2 signals.

I changed the settings to:

atr period -11

atr period2 - 83

atr fact - 2.2

atr fact2 - 5

agperiod2 - 10 m

Both day trade only - no

I am only getting the cyan agg1. No magenta for the others are showing up.

Did I miss something?

TS_V9_2x settingsHodl, Where exactly are these in settings? I do not see them. I looked in C3 and TS

Bollinger bands candles moving from one side of the bands to the otherStill cannot locate these. Hmm. Also, Do you mind explaining what Band% is for and how you utilize it?

In the screenshot for coin the % bands is like 33 so when it was at the high of day that was likely near 100% = touching the outer band then pulled back and is at 33% (maybe 0 is between the two outside bands I assume because it will show a negative number as well.)Okay. I am not sure how the percentage comes into play but I will look into it more. Thanks. I still cannot locate the "near term support / resistance" anywhere.

You can get in at or shortly after open… I would not do so without a stop loss usually when it’s one of those situations like COIN today right at open started wrapping so when that happens you generally will not be able to enter on a pullback. But when the trend is that strong you won’t get stopped out. Even under normal circumstances when using the 3 step method you enter on a pullback the likelihood of getting stopped out is far less than other methods… (in my opinion) but my problem is when a COIN situation happens like today and a few weeks ago and it’s up 5-6% and I’m like damn I missed the move up im gunna short the top… and it goes up another 10% after that but thankfully I learned from my last COIN mistake.Hodl, Doo yu ever get in right at open? There are soo many times that TS and C3 signal at open and they are spot on. I typically wait a bit for the market to settle a bit but after going back and looking, I miss a ton of great trades.

I would suggest loading one of my newer chart styles that include C3_Max with breakouts removed as I did not find a use for them … due to lack of testing I will revisit it soon though.This is pretty amazing, trialing removing some of my longer tf charts to save resources in TOS and so far so good. Thank you for posting Hodl. Is there an option to turn on the dotted upper/lower lines (not sure of the proper verbiage, but I circled them in the attached link) in TS_V9_x2 or are they only in the Max Breakouts code? I've found these dotted lines serve as good entry/exit points after signals pop-up. Thank you.

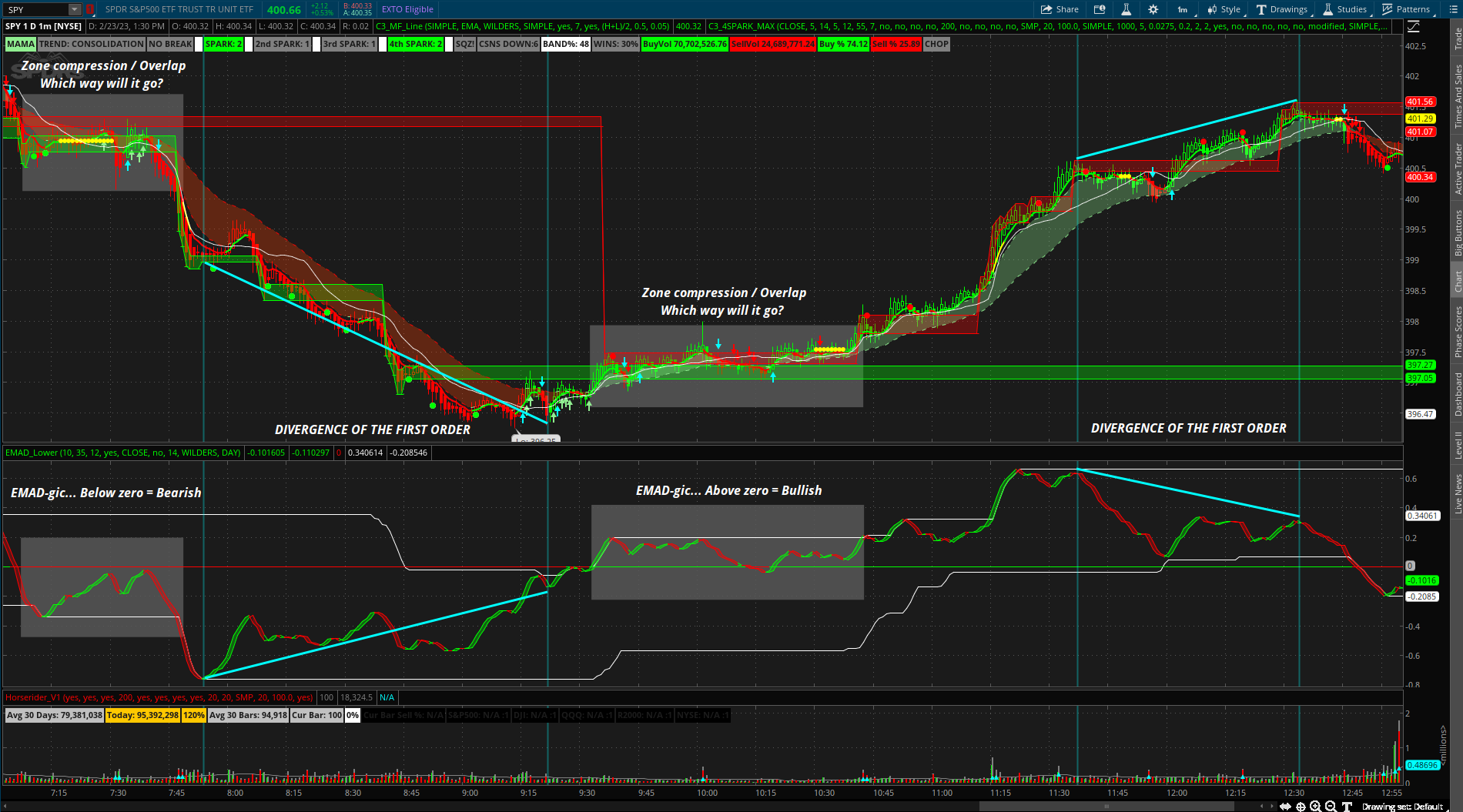

I am officially offended.To whom it may concern... It doesnt get any better than this people my goodness. I dont know what else @METAL will say "I dont like EMAD" "I dont believe in EMADgic" but hopefully this will change his mind... (its a joke people)

Look at this beautiful divergence and directional indication during zone compression (and "squeeze" indication ((yellow dots))

Though the EMAD provides a good idea of where the trend is headed it is still advised to what for a candle to breakout above or below the zone to look to buy. Of course this is on the 1min chart but it is extremely useful as candle wrapping occurs much more frequently on the 1min. Then look for divergence or a strong break out of a zone to look to sell. Combine that with thhe higher aggregation chart of choice for confirmation, however, keep in mind the EMAs 10 and 35 on a one min chart reflect the 10min and lets call it 30min timeframe. Notice before reversal the candles test the EMAs 2 or 3 times then the EMAs become compressed eventually turning over. While the EMAs are compressed the candle color and C3_MF_Line provide valuable insight as well. Also the Ehlers Moving Average (I have set to 28? I think... maybe 25... ((default is 34) adds another level of confirmation.

Good day.

Great examples. Definitely a learning moment for me. Did you trade today? If so, How did you do. I believe I asked before if you trade options. If you answered, I must have missed the reply. I believe one of my issues, is recognizing that a divergence is happening in real time. something I need to get better at for sure. Thanks again for the chart explanations. They really do help a ton!I am officially offended.

Yep. I had not noticed the divergence with the EMAD before you pointed it out. What settings do you have for the TS watchlist? I have one set at 3m TF, ATR Period = 11, ATR Factor = 2.2.@METAL also the divergence is just another possible confirmation method and not even something you would need to catch right on time. A (possibly short term) reversal happens after the divergence yes… but generally speaking there will be a pullback after reversal which you can see from my screenshots above. I only recently realized the potential of using the EMAD for divergence.

What is the point of using Bull/Bear Study? As far as I can tell, C3Max colors the candles the same. Do you mind explaining?More observations and whatnot.

More observations and whatnot.

AH = After Hours, correct?

How in the world did you get 48%+ Winn percentage? I have tried or quite a long time now and cannot get better than 35%More observations and whatnot.

Thanks. I will test the Bull Bear more. I was just trying to get m chart to match yours and could not. Very odd. The two 2m/5 day charts. I could not get the Bull/Bear to color the candles in the same place as the left chart with AH on.Well first… how dare you question the bullish bear of the 5th order!

C3 Max does not paint candles the same. Bull bear V5 is better (to me) because it helps to confirm you are not trading against the trend. It uses two aggregation and will only repaint until the highest agg bar is closed… Whatever TF I’m on I usually have it set to that TF for ag 1 and the next one up for ag 2… it is extremely useful as it takes into account the following: selling pressure vs buying pressure, above average volume, and (not exactly but the simplest way I know to explain it…) the direction of the EMAD emas, EMAD above or below zero… and I think that’s it… you can go back ten or so pages where I requested the code and I have a screenshot explaining it.

Side note* Also been using chat GTP to modify code… pretty cool stuff.

Also, with the Bull/Bear, If you are on a 2m TF chart, Do you set the agg1 to 2m and agg2 to 10 minThanks. I will test the Bull Bear more. I was just trying to get m chart to match yours and could not. Very odd. The two 2m/5 day charts. I could not get the Bull/Bear to color the candles in the same place as the left chart with AH on.

No. The first one you posted that has the pink writing. They both say 2m 5 day.haha well the chart is a 1min 1day or 2min 3day or something of that nature. Also I use trade daytime only.

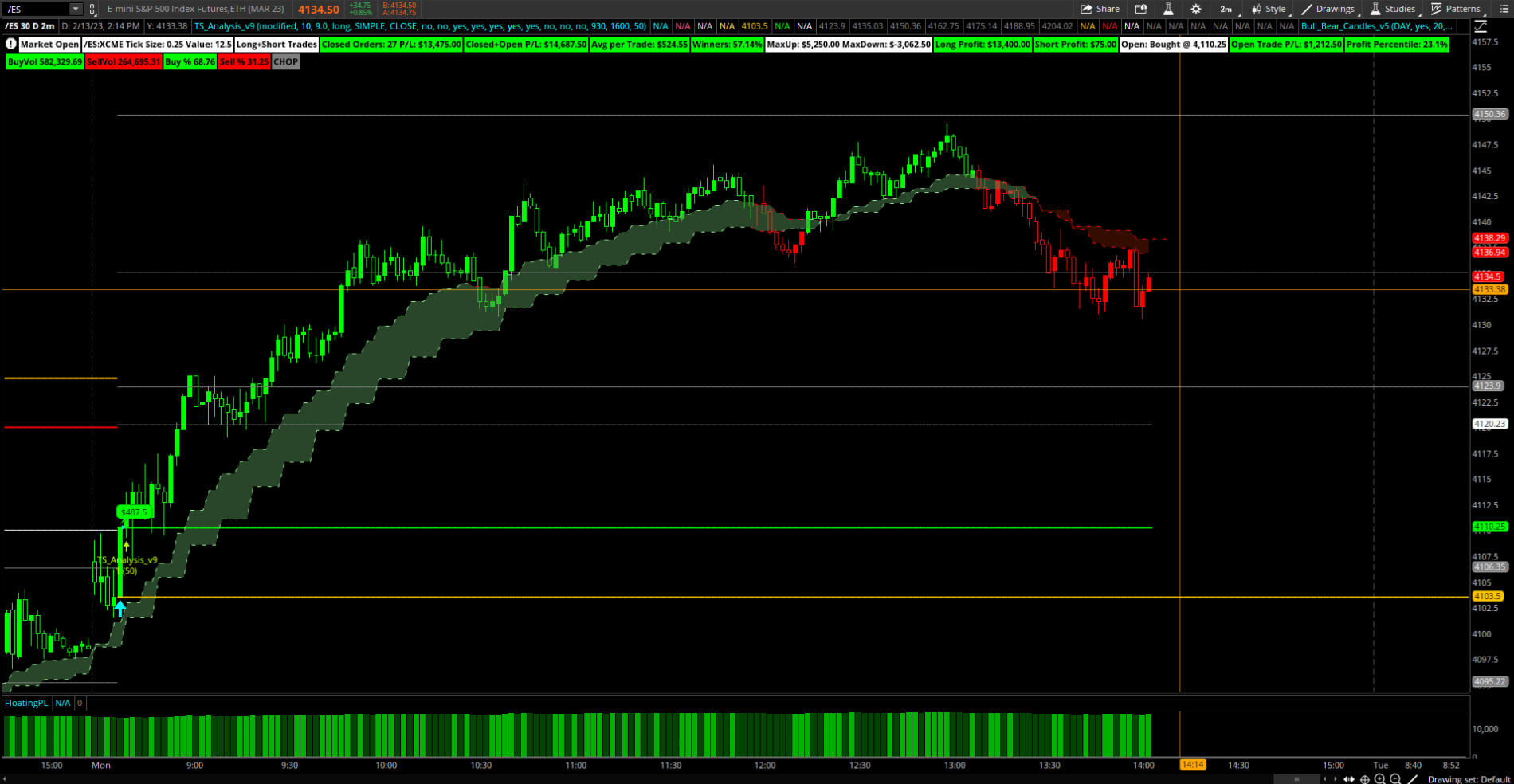

you guysss this TS_V9 with a 2ng aggregation is the real deal (these are set to different aggregations)

http://tos.mx/ITpso7c

Much better. Thank you. This is pretty Dang solid man. Good work. If you don't mind, could you share your TS watchlist. Mine doesn't seem to be working correctly.

Hodl, Where exactly are these in settings? I do not see them. I looked in C3 and TSthe dashed lines are "near term support / resistance" in settings

Still cannot locate these. Hmm. Also, Do you mind explaining what Band% is for and how you utilize it?Hodl, Where exactly are these in settings? I do not see them. I looked in C3 and TS

Okay. I am not sure how the percentage comes into play but I will look into it more. Thanks. I still cannot locate the "near term support / resistance" anywhere.Bollinger bands candles moving from one side of the bands to the other

I don’t really use it but if you are one to use bollinger bands it may be of use… just another level of confirmation

In the screenshot for coin the % bands is like 33 so when it was at the high of day that was likely near 100% = touching the outer band then pulled back and is at 33% (maybe 0 is between the two outside bands I assume because it will show a negative number as well

I figured it was tied in but it may be something to watch. I typically have an exit in place anyway.Well it’s part of the consensus label and all that so your using it wether you know it or not.

Suk Up!@Christopher84

Beautiful artwork dedicated to Christopher of the 84th order.

Code:########################################################################################## ########################################################################################## ### ### ### ############################# ######### ######### ### ### ################################# ######### ######### ### ### #################################### ######### ######### ### ### ######## ######### ######### ######### ### ### ######## ######### ######### ######### ### ### ######## @Christopher84 ######### ######### ######### ### ### ######## ######### ######### ######### ### ### ######## ######### ######### ######### ### ### ###################################### ################################## ### ### #################################### ################################## ### ### ################################# ################################## ### ### #################################### ################################## ### ### ######## ######### ######### ### ### ######## ######### ######### ### ### ######## ######### ######### ### ### ######## ######### ######### ### ### ######## ######### ######### ### ### ######## ######### ######### ### ### #################################### ######### ### ### ################################## ######### ### ### ############################### ######### ### ### ### ########################################################################################## ##########################################################################################

On a serious note, With your latest updated C4 version, Does it cause lag on TOS for you. I have a very high end PC and I get quite a bit of lag. I have already upped the memory and such.

I think the removal of those 2 will make a considerable difference. I will give the latest version a try. Is this it? https://tos.mx/ULVl7djI have a $15,000 Liquid cooled PC with... Joking people... it varys. But for the most part if I continuously change timeframes and switch windows etc it will start to lag... Do you have high end graphics? TOS support said to change a line of code in the TOS file concerning dumbing down something that has to do with high end graphics cards being overkill for TOS. The ideal processor is for TOS is not a 50 core 6ghz total with 100,000GB of ram... rather a processor that has the fastest speed per single core. Every now and then when I accumulate or save different versions of studys, styles, sets, etc. I will either re install TOS or delete everything I dont use and when I am done (if I went with a fresh install) I will load my share links.

Have you pulled up your performance monitor on your PC while TOS is running? Mine show the GPU is never even close to maxed out and the ram shows 40% at times however I have TOS on the highest settings. Been looking into overclocking or whatever it is called these days to bump up my speed per single core but have not done so yet.

Full disclosure I removed the "Breakouts" and "Bull Bear v5" code from C4_Max as it seems to run better that way (My share link from today is the separated version I am using now) Also came to the conclusion that my watchlist was extreme overkill thus I am removing all the low timeframe TS_V9 & 3X columns. (leaving 10min/1Hr/Daily for now)

Do you recommend changing the Bull/Bear agperiod1 to 2min? or should it stay at 5m. I can do some testing. Curious if that is the way it should be set up.Hi Everyone!

Just wanted to take a minute and share this 2 min chart utilizing Bull_Bear_Combo and TS_v9 (adjusted settings for the 2 min chart). Currently this strategy has 57% Winners. https://tos.mx/Yb4ajVS Happy trading everyone!

Won't speak for C84, but from the look of it you may want to adjust the settings in the TS Analysis ATR Period and ATR Factor. They'll most likely be considerably different for trading SPY.

Has anyone tested this TS 2 min< If so, please share the results as well as the settings that you used. ThanksHi Everyone!

Just wanted to take a minute and share this 2 min chart utilizing Bull_Bear_Combo and TS_v9 (adjusted settings for the 2 min chart). Currently this strategy has 57% Winners. https://tos.mx/Yb4ajVS Happy trading everyone!

Thank you for that. I was getting bad results with the original settings and tried changing a lot and really did not get the results I hoped for. I will try what you used and see how that works. Thanks again!Yes I tested this in live market on SPY yesterday and today, the performance on 2 min chart was superb and for the settings I changed ATR Period to 11 and ATR Factor 2.1. Also going back in time for past 30 days was spot on accurate. Many thanks to @Christopher84 , great work, as always very much appreciated.

Thanks for noticing the TF. I had changed that do to the chart moving/jittering as I found the further out the day the more it does it and it was driving me crazy. I do not get the use of the EMAD. The B4 is pretty solid for helping with chop and confirmation so far. Still testing.@METAL hey homeboy… your screenshot with no bueno results is due to your chart being 2min 5days change it to 2min 30days

Also you got the end all be all of indicators and using that lower??? Reaaaalllly broooo?! If your not using the EMAD lower then I don’t even know WHO YOU ARE anymore.

I notice you have this on a 1m TF. That is awesome!. Great job with the explanation. May I ask, what is the latest indicators you are using for this or would you mind sharing that chart? BTW, I never noticed the divergence detail before. Also, do you use support/resistance or supply/Demand zones from say daily or hourly chart as confirmation or do you just follow upper/lower zones? I typically go in every morning and mark out the zones from a blank chart so I know where the main zones are. curious if you even do that.To whom it may concern...

The following shows entry/exit methods and some of the ways to use the EMAD lower concerning divergence among others. Each entry has three arrows as explained in the notes on the left of side of the chart\

I believe you mentioned that you trade options also. Is that correct? That is what I have been doing for a while now. If so, How have you done using this strat if you don't mind me asking?No problem. Sure I’ll share the link in a few… it is all the same for the most part with a few things removed like the “breakouts” portion of the code (because I could never find a consistent use for them but I would really like to use the code for indicating the yellow arrow on the screenshot - which the breakouts code will work for that but filtering out multiple indications and whatnot is proving to be difficult.) Not using the cumulative delta lower or the triple exhaustion MTF study at the moment… though I may add that one back. Then I have spark labels for four different lengths to represent four different timeframes however the 3 extra spark labels are not exactly the same as the do not account for the confirmation level as the original spark does… I am attempting to add it but its a lot and may cause some lag? I’m not sure…. But the extra spark labels indicate that the emas are turning over so they are useful (I added them in hopes to not need to look so much at higher timeframe charts during the day.)

Yes I look at the hourly and the 10min and sometimes the 3min it just depends on which is easier on the eyes given the price action and whatnot… also pretty much always have extended hours turned on.

This is spot on and I am sure everyone can relate to all you have explained. What I need a little help with, is, getting Ts to be at its "best" in a 1m or 2m TF. Would love to see what steps you take to achieve that. I believe we need to adjust it daily/intraday adn with different stocks. It seems to take quite a long time to do this so I am wandering if I am doing it wrong.The strategy works flawlessly… however I am not an emotionless robot so I still make mistakes. My mistakes are looking at too many things at once and trying to predict a breakdown in a bullish trend instead of just trading the same direction as the trend. For example just because candles enter the supply zone doesn’t mean you buy puts as it could just be consolidating inside that zone then breakout above it. Doesn’t matter what timeframe chart. You need to wait for candles to breakout of the zone then come back and test/reject the zone then enter the trade assuming the elhers moving average is near the crossover point… or the TS_V9 arrow is present etc. When trading using this setup make sure you make note of the price action if the price action is not all that strong or volatile then do not buy the first time you see spark arrows or even TS_V9 arrow because price will likely do just as I have shown on the screenshot. And other times the arrows will come after the breakout and test/rejection of a zone to confirm / signal entry.

When in doubt trust TS_V9 but you will need to consider how far you are from expiration and how far out of the money your strike is. If your 0-1-2DTE and out of the money and price action is slow and / or sideways you might as well cut the trade and re enter or you could just cut the trade as soon as it goes against you but it will save you a lot of heartache to just wait for confirmation and do not buy the first time candles breakout/breakdown from a zone.

Also notice premarket how the EMAs are green for a while then red for a few bars right at the open then green then right back to red (basically the same thing I pointed out in the screenshots just a different way of looking at it) that’s a dead giveaway that a pullback is coming. Another point about the EMAD is it makes those things easier to interpret at times as the EMAD EMAs broke below the zero line pulled back up and rejected at zero line.

But yes the system works like a charm when you follow it and don’t try to predict a breakout or breakdown just follow the trend. Also when the bull bear v5 candles / label says “Very Bullish” don’t trade against it… unless you are extremely disciplined at marking quick trades against the trend catching wicks or something.

And just to illustrate my point about my own trading I bought puts on coin when it was up 12% disregarding everything the chart was telling me… it went up 17% that day. Luckily it tanked the following day but I still took a good loss on it overall. Discipline to know when to cut winners or at least risk off and especially the discipline to cut losers quick is the key.

Hope that helps.

Exactly as I do. I was curious if this is a daily/intraday chore. It does take quite a bit of time to narrow down the best P/L. What I have found is we continually get good or bad results as we change the numbers and or the MA type. I do these changes as you do, but it takes a ton of time. Do you typically leave the setting close to a particular ticker or do you run through the task each and every day?what I understood in using TS is

1. decide the ticker & TF, say SPX/2min

2. play around with TS (ATR period/ATR factor) by adding floating PL

3. make a note of the labels like winners/ closed order/PL/avg per trade/Long profit/short profit.

4. take the ones which get the highest winner/closed order etc

5. For SPX, I found 83/3.3(atr) gave me best winners for 2min

above all is based on what chris mentioned in this group.

Note, not always the default settings works fine.. so tune it based on time (30/2min or 90/5min etc)

Totally agree. I guess what I was asking and I didn't do a great job, is, are you guys doing this for every stock you change to and is there any shortcut. I have tried keeping certain sets for different stocks based off of my adjustments but that really goes away the next day sometimes. sometimes it is really close.Agree, its tedious job but our money is on the line so keep reviewing the floating PL/labels to make sure they are not way off. As Chris mentioned previously in this thread, take the highest time available for any given time, say 2min, best is 30days. If you go with 2min/20days, values will be different.

Arrow.You can get in at or shortly after open… I would not do so without a stop loss usually when it’s one of those situations like COIN today right at open started wrapping so when that happens you generally will not be able to enter on a pullback. But when the trend is that strong you won’t get stopped out. Even under normal circumstances when using the 3 step method you enter on a pullback the likelihood of getting stopped out is far less than other methods… (in my opinion) but my problem is when a COIN situation happens like today and a few weeks ago and it’s up 5-6% and I’m like damn I missed the move up im gunna short the top… and it goes up another 10% after that but thankfully I learned from my last COIN mistake.

Also I have been using the TS 2nd agg at 3 or 5 mins. But yeah set up a default order to have a stop loss and test it out it would be nice to have a watchlist column to indicate candle wrapping… not sure how that would work out though.

When you say C3 signal you mean the line or the arrow?

Oh ok just making sure… as I would refer to “C3” as the line and the arrow as “Spark” but all good.I am officially offended.

Great examples. Definitely a learning moment for me. Did you trade today? If so, How did you do. I believe I asked before if you trade options. If you answered, I must have missed the reply. I believe one of my issues, is recognizing that a divergence is happening in real time. something I need to get better at for sure. Thanks again for the chart explanations. They really do help a ton!

@Christopher84 Is there a watchlist code for the PLD and or Elhers strategies? If not, Is there a way to make one that would show the buy/sell signals for both?

Yep. I had not noticed the divergence with the EMAD before you pointed it out. What settings do you have for the TS watchlist? I have one set at 3m TF, ATR Period = 11, ATR Factor = 2.2.

What is the point of using Bull/Bear Study? As far as I can tell, C3Max colors the candles the same. Do you mind explaining?

How in the world did you get 48%+ Winn percentage? I have tried or quite a long time now and cannot get better than 35%

Thanks. I will test the Bull Bear more. I was just trying to get m chart to match yours and could not. Very odd. The two 2m/5 day charts. I could not get the Bull/Bear to color the candles in the same place as the left chart with AH on.

Also, with the Bull/Bear, If you are on a 2m TF chart, Do you set the agg1 to 2m and agg2 to 10 min

No. The first one you posted that has the pink writing. They both say 2m 5 day.

I figured it out. I need to be on the Higher agg TF.

I am not getting Buy2/sell2 signals.

I changed the settings to:

atr period -11

atr period2 - 83

atr fact - 2.2

atr fact2 - 5

agperiod2 - 10 m

Both day trade only - no

I am only getting the cyan agg1. No magenta for the others are showing up.

Did I miss something?

Much better. Thank you. This is pretty Dang solid man. Good work. If you don't mind, could you share your TS watchlist. Mine doesn't seem to be working correctly.

Hodl, Where exactly are these in settings? I do not see them. I looked in C3 and TS

Still cannot locate these. Hmm. Also, Do you mind explaining what Band% is for and how you utilize it?

Okay. I am not sure how the percentage comes into play but I will look into it more. Thanks. I still cannot locate the "near term support / resistance" anywhere.

I will watch it a little closer to see if I can figure how to use it better. @Christopher84 wouldn't have put it there if it didn't matter right. Chris, If you read this, can you elaborate on how to use the Bands%?

I figured it was tied in but it may be something to watch. I typically have an exit in place anyway.

Hodl, Doo yu ever get in right at open? There are soo many times that TS and C3 signal at open and they are spot on. I typically wait a bit for the market to settle a bit but after going back and looking, I miss a ton of great trades.

Suk Up!

On a serious note, With your latest updated C4 version, Does it cause lag on TOS for you. I have a very high end PC and I get quite a bit of lag. I have already upped the memory and such.

I think the removal of those 2 will make a considerable difference. I will give the latest version a try. Is this it? https://tos.mx/ULVl7dj

Do you recommend changing the Bull/Bear agperiod1 to 2min? or should it stay at 5m. I can do some testing. Curious if that is the way it should be set up.

@HODL-Lay-HE-hoo! Can you share your entire watchlist? Is that possible? If not, can you share the TS watchlist column. I cannot locate it.

@Christopher84 , Take a look at todays SPY on the 2 min. Not good results at all. What do you think needs adjusting if at all?

Has anyone tested this TS 2 min< If so, please share the results as well as the settings that you used. Thanks

Thank you for that. I was getting bad results with the original settings and tried changing a lot and really did not get the results I hoped for. I will try what you used and see how that works. Thanks again!

Thanks for noticing the TF. I had changed that do to the chart moving/jittering as I found the further out the day the more it does it and it was driving me crazy. I do not get the use of the EMAD. The B4 is pretty solid for helping with chop and confirmation so far. Still testing.

I notice you have this on a 1m TF. That is awesome!. Great job with the explanation. May I ask, what is the latest indicators you are using for this or would you mind sharing that chart? BTW, I never noticed the divergence detail before. Also, do you use support/resistance or supply/Demand zones from say daily or hourly chart as confirmation or do you just follow upper/lower zones? I typically go in every morning and mark out the zones from a blank chart so I know where the main zones are. curious if you even do that.

I believe you mentioned that you trade options also. Is that correct? That is what I have been doing for a while now. If so, How have you done using this strat if you don't mind me asking?

This is spot on and I am sure everyone can relate to all you have explained. What I need a little help with, is, getting Ts to be at its "best" in a 1m or 2m TF. Would love to see what steps you take to achieve that. I believe we need to adjust it daily/intraday adn with different stocks. It seems to take quite a long time to do this so I am wandering if I am doing it wrong.

Exactly as I do. I was curious if this is a daily/intraday chore. It does take quite a bit of time to narrow down the best P/L. What I have found is we continually get good or bad results as we change the numbers and or the MA type. I do these changes as you do, but it takes a ton of time. Do you typically leave the setting close to a particular ticker or do you run through the task each and every day?

As @HODL-Lay-HE-hoo! mentioned above, I also look at where the arrows are plotting to attempt to get the best entries.

Thanks for your reply. I will look at the numbers you provided for SPX and compare to what I used.

Totally agree. I guess what I was asking and I didn't do a great job, is, are you guys doing this for every stock you change to and is there any shortcut. I have tried keeping certain sets for different stocks based off of my adjustments but that really goes away the next day sometimes. sometimes it is really close.

Arrow.

It’s pretty accurate man but be aware that after stepping up multiple times it can certainly breakdown and go the opposite way depending on the timeframe.Oh goodness I never looked at the lower EMAD too closely.. is it really this accurate?! Looks like it really nails the reversals when the white line starts curling up/down.

It’s pretty accurate man but be aware that after stepping up multiple times it can certainly breakdown and go the opposite way depending on the timeframe.

@HODL-Lay-HE-hoo!@HODL-Lay-HE-hoo! This is really helpful. This saves a lot of time compared to scanning individually.

Can you please add watchlist for EMAD (crossing zero line) ?

Yeah I expect a pullback first but it is possible. Keep in mind after stepping up X number of times it can certainly break to the downside.@HODL-Lay-HE-hoo! guess we are continuing up on SPY.. 5/10 min EMAD curling up

Hodl, Got a question for you. Does your stop arrows work for TS_V9? Mine do not. I made sure they are turned on in settings and they are set to plot. I get nothing ever. I have changed TF's and do not get them to work. I thought they were just removed.Yeah I expect a pullback first but it is possible. Keep in mind after stepping up X number of times it can certainly break to the downside.

Also if I were going to make that prediction based on those time frames it would be with AH on near open. I generally look at the hourly, daily, weekly for that purpose.

Look at the hourly with AH off (for this example)… you will see that the candles are wrapping - on the last candle the top and bottom of the zone are squeezing together… in my experience that is generally a sign of continuation… But I would definitely expect a pullback on a lower TF - that is not to say one should short the pullback… follow the overall trend. When in doubt trust TS_V9 and turn the stop arrows on.

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.