Yes there is a TS_V9 scan. You may be able to just copy and paste the code from the watchlist column into the scanner. But I know there is a link to one floating around here.@Christopher84 This looks very interesting. Is there a way to scan for Cyan arrows ?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Confirmation Candles Indicator For ThinkorSwim

- Thread starter Christopher84

- Start date

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

somthing wrong red candle is turning to greyHi Everyone!

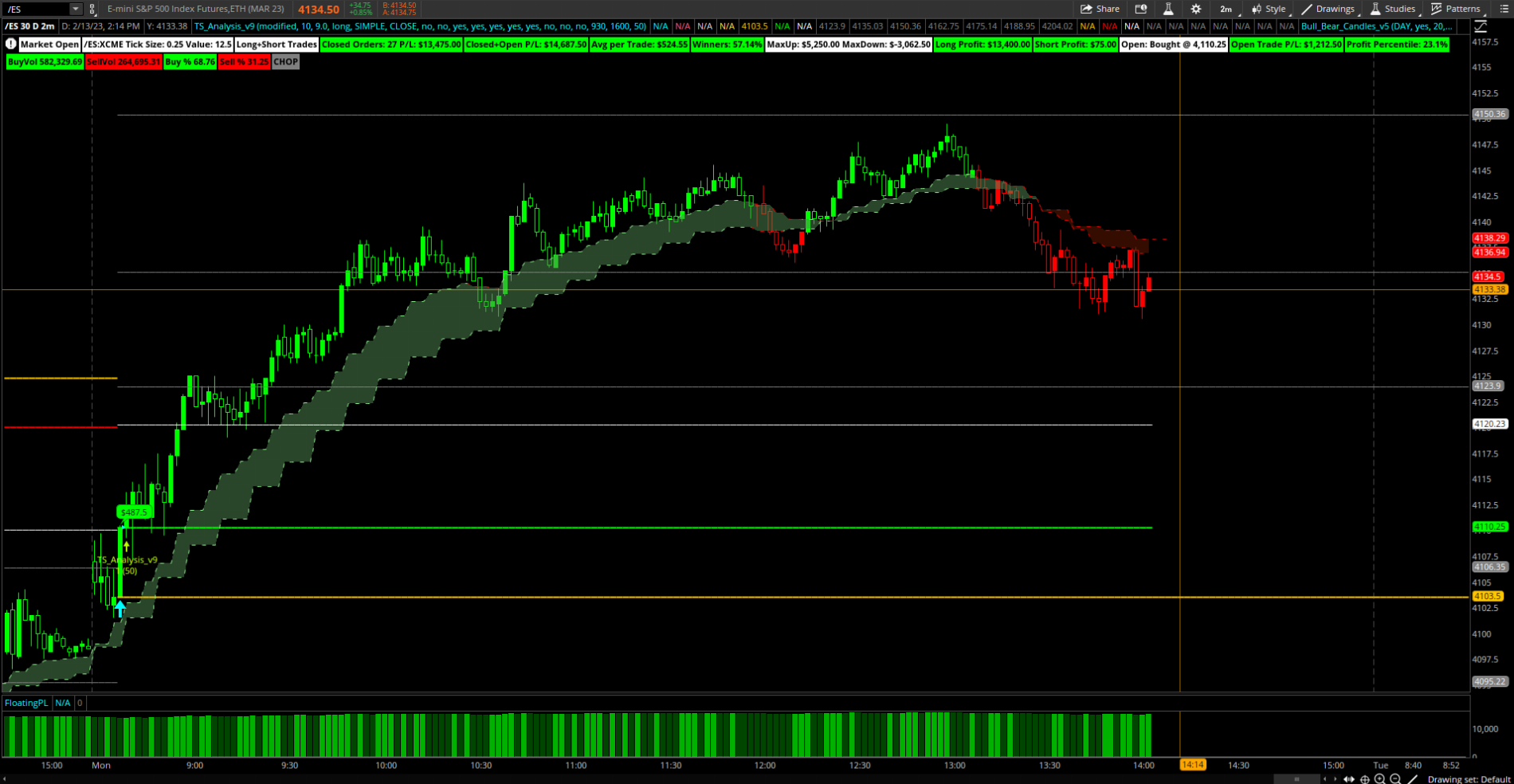

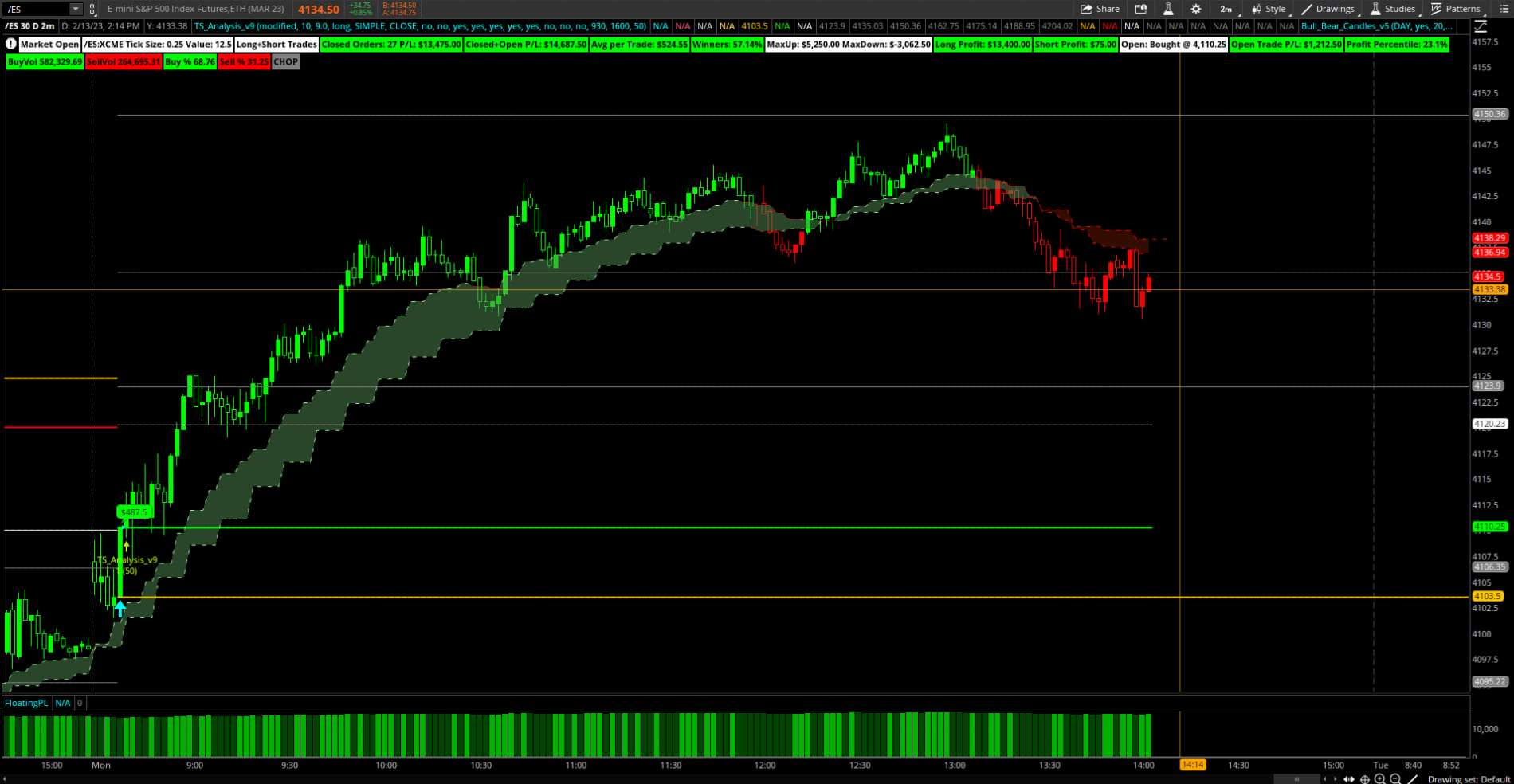

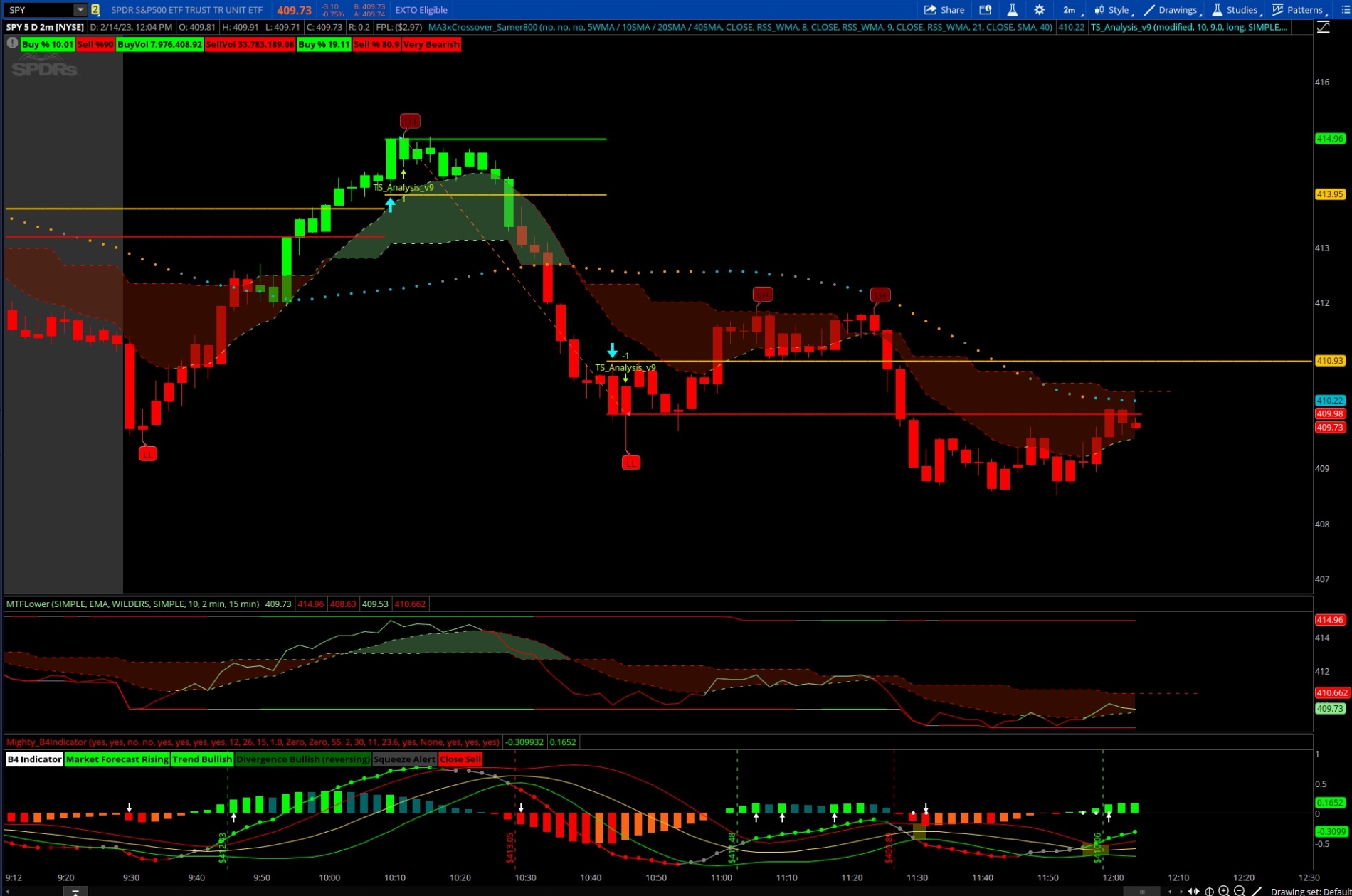

Just wanted to take a minute and share this 2 min chart utilizing Bull_Bear_Combo and TS_v9 (adjusted settings for the 2 min chart). Currently this strategy has 57% Winners. https://tos.mx/Yb4ajVS Happy trading everyone!

lolreconlol

Active member

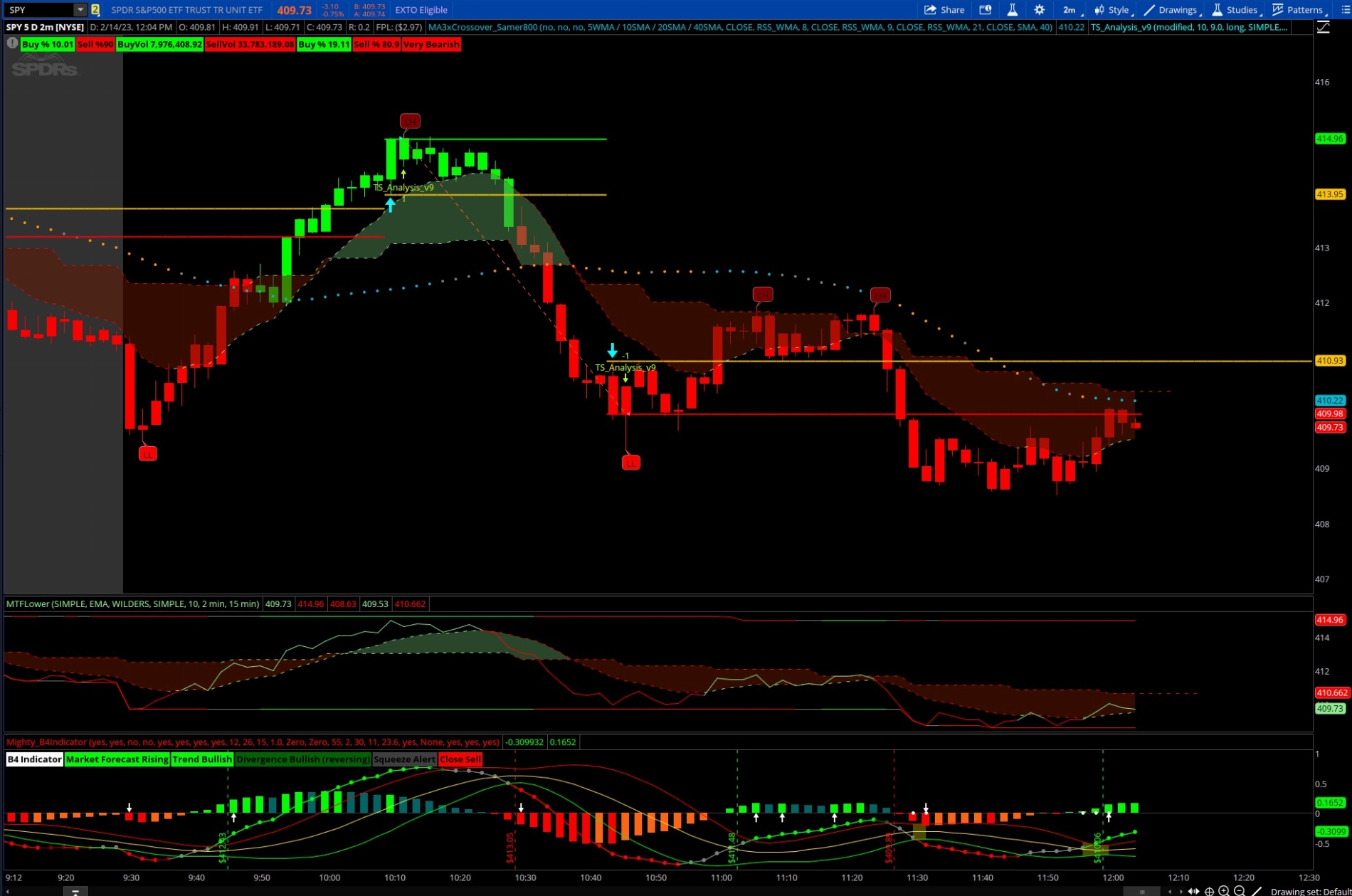

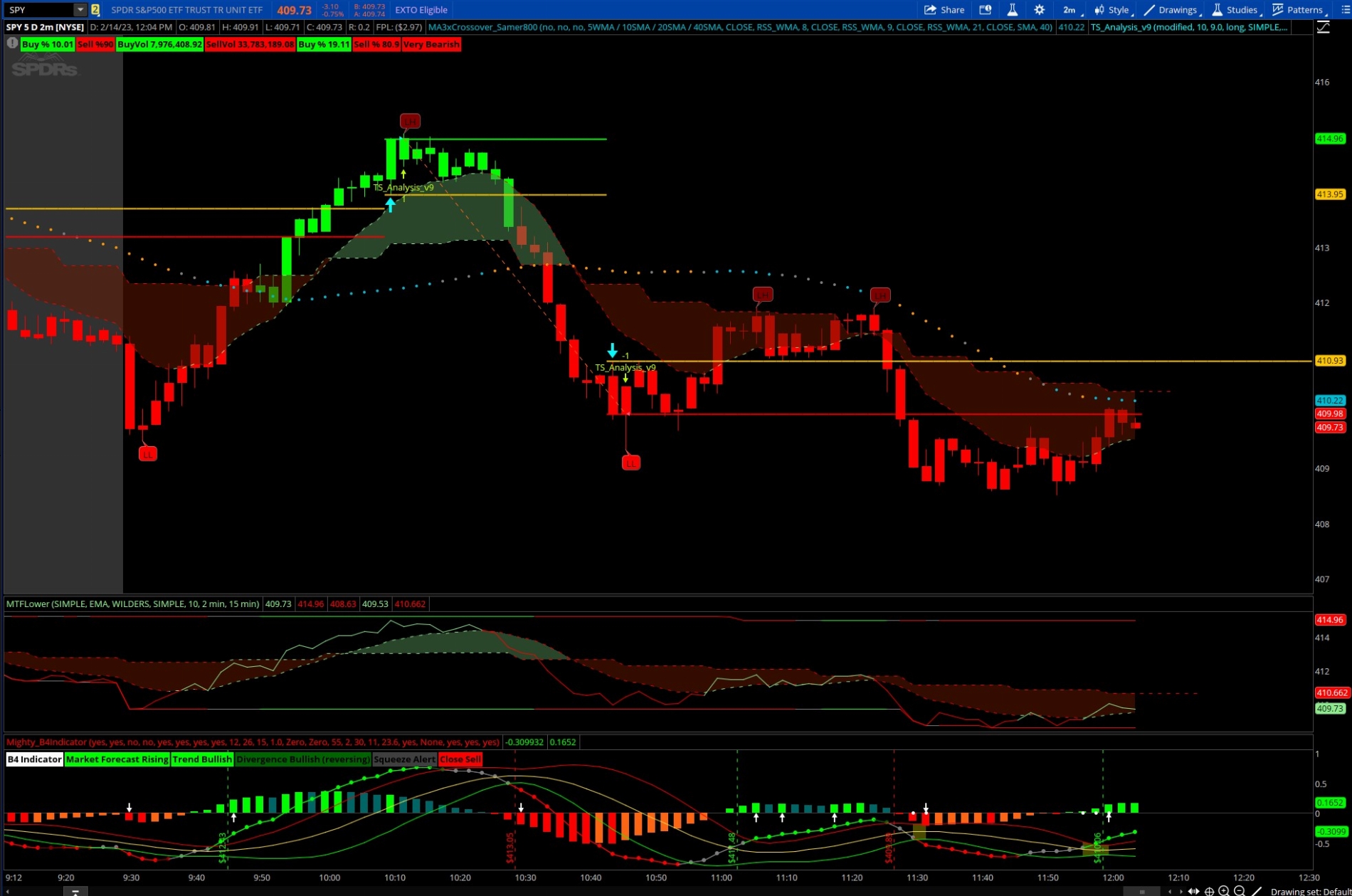

Agreed.. would've gotten chopped up.@Christopher84 , Take a look at todays SPY on the 2 min. Not good results at all. What do you think needs adjusting if at all?

Won't speak for C84, but from the look of it you may want to adjust the settings in the TS Analysis ATR Period and ATR Factor. They'll most likely be considerably different for trading SPY.@Christopher84 , Take a look at todays SPY on the 2 min. Not good results at all. What do you think needs adjusting if at all?

Hi @Christopher84, thank you for sharing your latest strategy. Any thoughts on why my image below has gray candles and no red candles for yesterday? I used your link from yesterday to load the set. Under the "Futures" tab, Extended Hours is not checked and I get gray candles whether or not "Start aggregations at Market Open" is checked. I'm assuming I must have some other setting not quite right.Hi Everyone!

Just wanted to take a minute and share this 2 min chart utilizing Bull_Bear_Combo and TS_v9 (adjusted settings for the 2 min chart). Currently this strategy has 57% Winners. https://tos.mx/Yb4ajVS Happy trading everyone!

I appreciate any help. Thanks again!

The strategy probably doesn’t begin until that time so candles are gray or bc it’s not in a tradeHi @Christopher84, thank you for sharing your latest strategy. Any thoughts on why my image below has gray candles and no red candles for yesterday? I used your link from yesterday to load the set. Under the "Futures" tab, Extended Hours is not checked and I get gray candles whether or not "Start aggregations at Market Open" is checked. I'm assuming I must have some other setting not quite right.

I appreciate any help. Thanks again!

It's working now. Thanks!The strategy probably doesn’t begin until that time so candles are gray or bc it’s not in a trade

I changed the ATR Period to 11 and ATR Factor 2.1 SPY and today SPY was great:try “trade daytime only”

Yes I tested this in live market on SPY yesterday and today, the performance on 2 min chart was superb and for the settings I changed ATR Period to 11 and ATR Factor 2.1. Also going back in time for past 30 days was spot on accurate. Many thanks to @Christopher84 , great work, as always very much appreciated.Has anyone tested this TS 2 min< If so, please share the results as well as the settings that you used. Thanks

Can you share this chart setup bro? Really looks interesting and id love to try it out. Appreciate you.@Christopher84 , Take a look at todays SPY on the 2 min. Not good results at all. What do you think needs adjusting if at all?

lolreconlol

Active member

@Trader Raider are you still using the scalper setup? Have you made any adjustments?

Where may I find the script used in the screenshots provided? Thank you.Edited

The following are indications one will notice overtime using the various indicators in this thread. It is not a rules based system.

If you have trouble understanding all the various indicators THEN JUST GIVE UP! Joking people! Just a joke! But seriously if that is the case and you like to trade short term 1-3min charts just focus on the Bull Bear V5 candles and watch the other indications until you understand them. (You could turn everything off except for Bull Bear V5 candles and Spark Up/Down arrows on only and do well ((I would also add triple exhaustion))

* End edit *

This is generally my method (note: I use a watchlist column for high relative volume with only high liquidity tickers like AAPL TSLA SPY etc):

1. Determine the direction of the hourly trend (before market open) using one or more of the following indications:

A. C3 MF Line color

B. Spark Up / Down arrow

C. EMAD EMA color

D. PLD crossover

E. Price wrapping

- Trending up - take long trades only

- Trending down - take short trades only

** Exceptions to step 1 **

- Triple Exhaustion indication (dots)

- Significant levels (supply or demand zone with yellow or light green line inside the cloud of respective zone)if a supply zone with a yellow line inside the zone is acting as support in a bullish trend then the zone moves up and is now used as resistance —> wait for a breakdown or up from this level as it may go sideways at said level

Note

If your using one of the hourly indications that signal the trend change later than the others then be patient and wait for a good entry… if using an indication that alerts trend change rather quickly that goes against the slower indicator (like the upper EMA cloud) that is fine just know that it will likely be a short lived pullback as opposed to a full trend reversal.

2. Determine wether or not the 1Min - 3Min chart agrees with the hourly trend direction (look at both timeframes)

- If the hourly is bearish I’m waiting for a move in the opposite direction to reject the supply zone or for Triple Exhaustion indication and/or bull bear V5 candles turn from green to red to buy puts (make sure you do not trade opposite a zone that is wrapping)

- If the hourly is bearish and 1/3min trends agree I will buy puts if one or more of the following is true:

A. Candles wrapping at open

B. Major zone rejection premarket (near open)

C. PLD crossover reject before open (wicks)

D. Bull bear V5 candles red

E. C3 Line red

3. Exit trade when one of the following occurs:

- Triple Exhaustion indication (usually good to use as a “risk off” point (bought 5 contracts sell 4 let one ride if the trend is not broken)

- Supply / Demand zone moving horizontal (or hold until candle breaks out of the zone)

- Candles move above a zone (depending on price action)

- If price is moving towards a significant zone (zone with yellow or light green line inside) I will expect a bounce and risk off accordingly also if the lower line of the EMAD is stepping up while price is going down I will expect a bounce

** The triple exhaustion in particular shines on strong price action for high liquidity underlyings like TSLA NVDA etc. also I look for the indication on other timeframes as well but works best used on the 1-3min I find **

Test first trade later.

I believe I shared the “C3_Max_Spark_Mobile” a few pages back… you can also search my name and see my posts. I will look for it when I get around my computer.Where may I find the script used in the screenshots provided? Thank you.

Found it. Thank you.I believe I shared the “C3_Max_Spark_Mobile” a few pages back… you can also search my name and see my posts. I will look for it when I get around my computer.

To whom it may concern...

The following shows entry/exit methods and some of the ways to use the EMAD lower concerning divergence among others. Each entry has three arrows as explained in the notes on the left of side of the chart

http://tos.mx/xDW1Nic

The following shows entry/exit methods and some of the ways to use the EMAD lower concerning divergence among others. Each entry has three arrows as explained in the notes on the left of side of the chart

http://tos.mx/xDW1Nic

Last edited:

lolreconlol

Active member

Thank you for the detailed post! Can you please share your latest chart?The strategy works flawlessly… however I am not an emotionless robot so I still make mistakes. My mistakes are looking at too many things at once and trying to predict a breakdown in a bullish trend instead of just trading the same direction as the trend. For example just because candles enter the supply zone doesn’t mean you buy puts as it could just be consolidating inside that zone then breakout above it. Doesn’t matter what timeframe chart. You need to wait for candles to breakout of the zone then come back and test/reject the zone then enter the trade assuming the elhers moving average is near the crossover point… or the TS_V9 arrow is present etc. When trading using this setup make sure you make note of the price action if the price action is not all that strong or volatile then do not buy the first time you see spark arrows or even TS_V9 arrow because price will likely do just as I have shown on the screenshot. And other times the arrows will come after the breakout and test/rejection of a zone to confirm / signal entry.

When in doubt trust TS_V9 but you will need to consider how far you are from expiration and how far out of the money your strike is. If your 0-1-2DTE and out of the money and price action is slow and / or sideways you might as well cut the trade and re enter or you could just cut the trade as soon as it goes against you but it will save you a lot of heartache to just wait for confirmation and do not buy the first time candles breakout/breakdown from a zone.

Also notice premarket how the EMAs are green for a while then red for a few bars right at the open then green then right back to red (basically the same thing I pointed out in the screenshots just a different way of looking at it) that’s a dead giveaway that a pullback is coming. Another point about the EMAD is it makes those things easier to interpret at times as the EMAD EMAs broke below the zero line pulled back up and rejected at zero line.

But yes the system works like a charm when you follow it and don’t try to predict a breakout or breakdown just follow the trend. Also when the bull bear v5 candles / label says “Very Bullish” don’t trade against it… unless you are extremely disciplined at marking quick trades against the trend catching wicks or something.

And just to illustrate my point about my own trading I bought puts on coin when it was up 12% disregarding everything the chart was telling me… it went up 17% that day. Luckily it tanked the following day but I still took a good loss on it overall. Discipline to know when to cut winners or at least risk off and especially the discipline to cut losers quick is the key.

Hope that helps.

The original link from my last post may have had a version of bull bear v5 without the 2 aggregations in settings... I updated the link with the correct Bull Bear V5 as the other will repaint http://tos.mx/VhX2cLH (*** UPDATED LINK.... AGAIN... I did not set the default settings correctly for the 2-3-4th spark length in the previous link)

Last edited:

what I understood in using TS isThis is spot on and I am sure everyone can relate to all you have explained. What I need a little help with, is, getting Ts to be at its "best" in a 1m or 2m TF. Would love to see what steps you take to achieve that. I believe we need to adjust it daily/intraday adn with different stocks. It seems to take quite a long time to do this so I am wandering if I am doing it wrong.

1. decide the ticker & TF, say SPX/2min

2. play around with TS (ATR period/ATR factor) by adding floating PL

3. make a note of the labels like winners/ closed order/PL/avg per trade/Long profit/short profit.

4. take the ones which get the highest winner/closed order etc

5. For SPX, I found 83/3.3(atr) gave me best winners for 2min

above all is based on what chris mentioned in this group.

Note, not always the default settings works fine.. so tune it based on time (30/2min or 90/5min etc)

Wow I have never tried those settings before... interesting. I change each number at random then look at where the arrows are plotting and the percent winners I have after hours on but disregard any TS indication after hours unless maybe it is right before open.what I understood in using TS is

1. decide the ticker & TF, say SPX/2min

2. play around with TS (ATR period/ATR factor) by adding floating PL

3. make a note of the labels like winners/ closed order/PL/avg per trade/Long profit/short profit.

4. take the ones which get the highest winner/closed order etc

5. For SPX, I found 83/3.3(atr) gave me best winners for 2min

above all is based on what chris mentioned in this group.

Note, not always the default settings works fine.. so tune it based on time (30/2min or 90/5min etc)

- Status

- Not open for further replies.

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

757

Online

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.