I need a video on how to use that one..LOL.No problem… GEX takes some serious computing power. Lower your daily chart aggregation if it’s too slow. Also adjust the distance between strikes and the number of strikes for whatever your going to trade.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Confirmation Candles Indicator For ThinkorSwim

- Thread starter Christopher84

- Start date

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

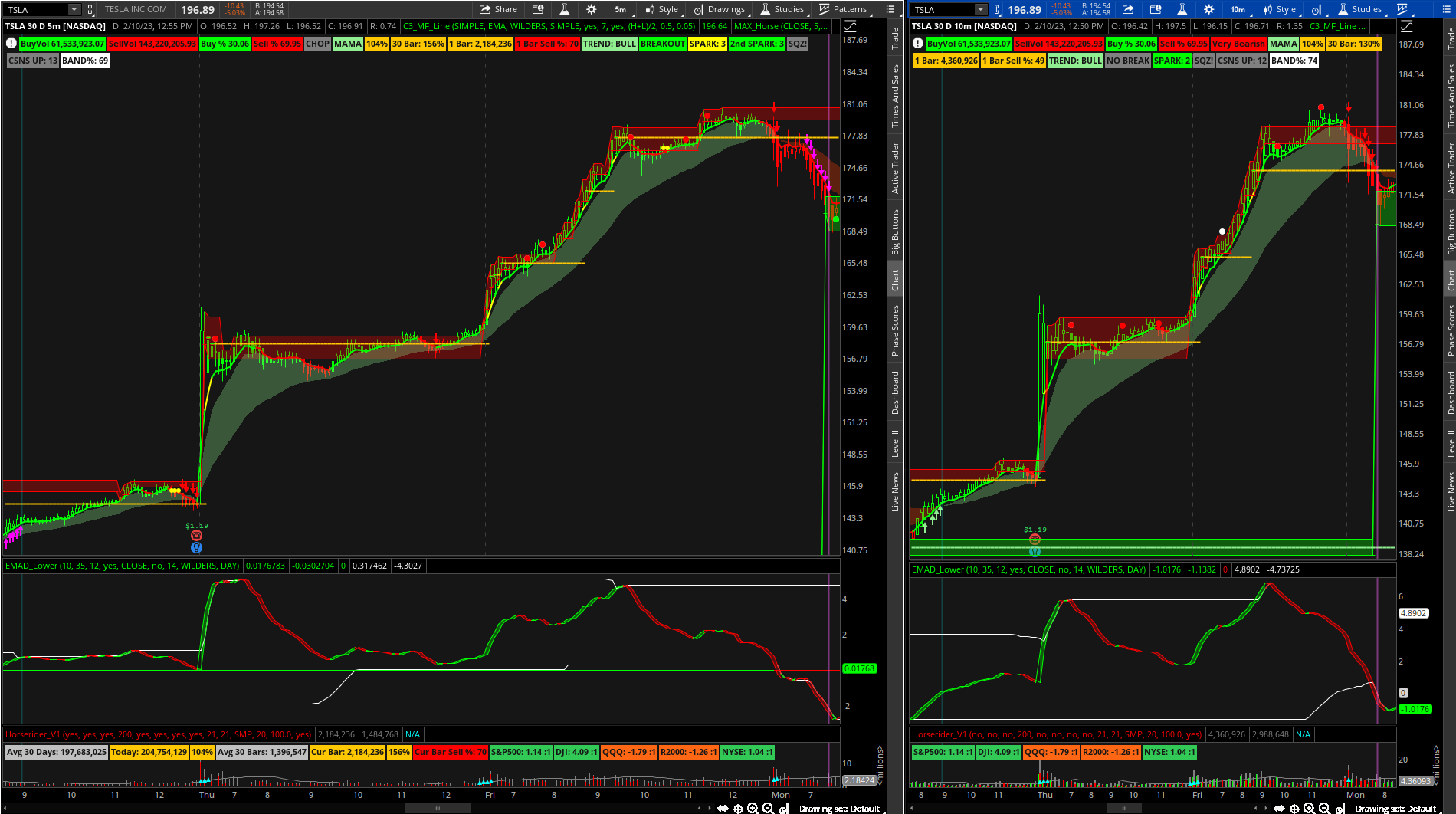

If I understand you correctly…. The 3 min chart only shows arrows from the 3 min chart. I always have two charts open usually a 3/10 chart but will use whichever TF chart I like the look of. The candles are painted using two different timeframes (I set them to whatever timeframe I’m on and the next one up. Default is 5 & 10 so for the 3min I set it to 3 & 5). The candles are painted based on moving average direction, buy/sell volume, and EMAD above or below zero.New here. I have read all pages I like it and have been looking at your shared charts myself. Thanks. Is there a way to separate out the consensus as another study to be plotted as histogram. I liked That idea of separate indicator in 1 of the private pages but I don't know if that has been answered thanks

Also - can you please confirm if the first arrow is for 3 min and then some multiple coming are from 10 mins?

I have seen the post to which you are referring but I do not have that particular version (I do not believe it was shared but may not be too difficult to change to a histogram… I’ll give it a go) however, I believe the C3_MF_Line represents the consensus level if I am not mistaken (which is a separate study).

Hell me too. I never use it to be honest. Just because I haven’t had the time to test whatever I think it is telling me.I need a video on how to use that one..LOL.

@Christopher84

So I came across this code written for a strategy in which one uses the one min chart for entry/exit and the ten minute chart for confirmation... the following code causes the the plot to be delayed 10mins in order to avoid the issue of repainting (I may not be explaining that correctly as it is said that the original signal on the lower timeframe is used for entry?)... Would it be possible to apply this to TS_V9 using a similar concept where the 3min chart is confirmed using the ten minute chart where one would only need look at the 3min chart? And/or added to Bull_Bear_V5 to avoid repainting?

So I came across this code written for a strategy in which one uses the one min chart for entry/exit and the ten minute chart for confirmation... the following code causes the the plot to be delayed 10mins in order to avoid the issue of repainting (I may not be explaining that correctly as it is said that the original signal on the lower timeframe is used for entry?)... Would it be possible to apply this to TS_V9 using a similar concept where the 3min chart is confirmed using the ten minute chart where one would only need look at the 3min chart? And/or added to Bull_Bear_V5 to avoid repainting?

Code:

def FromStart = (secondsfromtime(0000))/3600;

def Hour = rounddown(FromStart, 0);

def Min = ((FromStart - Hour)/100)*60;

#TIME

def GetTime = Hour + Min;

def IndTime1 = StartTime/100;

def IndTime2 = IndTime1 + .1;

def IndTime3 = IndTime2 + .1;

def IndTime4 = IndTime3 + .1;

def IndTime5 = IndTime4 + .1;

def IndTime6 = IndTime5 + .1;

def IndTime7 = IndTime6 + .1;

def IndTime8 = IndTime7 + .1;

def IndTime9 = IndTime8 + .1;

def IndTime10 = IndTime9 + .1;

def IndTime11 = IndTime10 + .1;

def IndTime12 = IndTime11 + .1;

def IndTime13 = IndTime12 + .1;

def IndTime14 = IndTime13 + .1;

def IndTime15 = IndTime14 + .1;

def IndTime16 = IndTime15 + .1;

def IndTime17 = IndTime16 + .1;

def IndTime18 = IndTime17 + .1;

def IndTime19 = IndTime18 + .1;

def IndTime20 = IndTime19 + .1;

def IndTime21 = IndTime20 + .1;

def IndTime22 = IndTime21 + .1;

def IndTime23 = IndTime22 + .1;

def IndTime24 = IndTime23 + .1;

def IndTime25 = IndTime24 + .1;

def IndTime26 = IndTime25 + .1;

def IndTime27 = IndTime26 + .1;

def IndTime28 = IndTime27 + .1;

def IndTime29 = IndTime28 + .1;

def IndTime30 = IndTime29 + .1;

def IndTime31 = IndTime30 + .1;

def IndTime32 = IndTime31 + .1;

def IndTime33 = IndTime32 + .1;

def IndTime34 = IndTime33 + .1;

def IndTime35 = IndTime34 + .1;

def IndTime36 = IndTime35 + .1;

def IndTime37 = IndTime36 + .1;

def IndTime38 = IndTime37 + .1;

def IndTime39 = IndTime38 + .1;

def IndTime40 = IndTime39 + .1;

def IndTime41 = IndTime40 + .1;

def BtwTime1 = GetTime between IndTime1 and (IndTime1 + 0.01);

def BtwTime2 = GetTime between IndTime2 and (IndTime2 + 0.01);

def BtwTime3 = GetTime between IndTime3 and (IndTime3 + 0.01);

def BtwTime4 = GetTime between IndTime4 and (IndTime4 + 0.01);

def BtwTime5 = GetTime between IndTime5 and (IndTime5 + 0.01);

def BtwTime6 = GetTime between IndTime6 and (IndTime6 + 0.01);

def BtwTime7 = GetTime between IndTime7 and (IndTime7 + 0.01);

def BtwTime8 = GetTime between IndTime8 and (IndTime8 + 0.01);

def BtwTime9 = GetTime between IndTime9 and (IndTime9 + 0.01);

def BtwTime10 = GetTime between IndTime10 and (IndTime10 + 0.01);

def BtwTime11 = GetTime between IndTime11 and (IndTime11 + 0.01);

def BtwTime12 = GetTime between IndTime12 and (IndTime12 + 0.01);

def BtwTime13 = GetTime between IndTime13 and (IndTime13 + 0.01);

def BtwTime14 = GetTime between IndTime14 and (IndTime14 + 0.01);

def BtwTime15 = GetTime between IndTime15 and (IndTime15 + 0.01);

def BtwTime16 = GetTime between IndTime16 and (IndTime16 + 0.01);

def BtwTime17 = GetTime between IndTime17 and (IndTime17 + 0.01);

def BtwTime18 = GetTime between IndTime18 and (IndTime18 + 0.01);

def BtwTime19 = GetTime between IndTime19 and (IndTime19 + 0.01);

def BtwTime20 = GetTime between IndTime20 and (IndTime20 + 0.01);

def BtwTime21 = GetTime between IndTime21 and (IndTime21 + 0.01);

def BtwTime22 = GetTime between IndTime22 and (IndTime22 + 0.01);

def BtwTime23 = GetTime between IndTime23 and (IndTime23 + 0.01);

def BtwTime24 = GetTime between IndTime24 and (IndTime24 + 0.01);

def BtwTime25 = GetTime between IndTime25 and (IndTime25 + 0.01);

def BtwTime26 = GetTime between IndTime26 and (IndTime26 + 0.01);

def BtwTime27 = GetTime between IndTime27 and (IndTime27 + 0.01);

def BtwTime28 = GetTime between IndTime28 and (IndTime28 + 0.01);

def BtwTime29 = GetTime between IndTime29 and (IndTime29 + 0.01);

def BtwTime30 = GetTime between IndTime30 and (IndTime30 + 0.01);

def BtwTime31 = GetTime between IndTime31 and (IndTime31 + 0.01);

def BtwTime32 = GetTime between IndTime32 and (IndTime32 + 0.01);

def BtwTime33 = GetTime between IndTime33 and (IndTime33 + 0.01);

def BtwTime34 = GetTime between IndTime34 and (IndTime34 + 0.01);

def BtwTime35 = GetTime between IndTime35 and (IndTime35 + 0.01);

def BtwTime36 = GetTime between IndTime36 and (IndTime36 + 0.01);

def BtwTime37 = GetTime between IndTime37 and (IndTime37 + 0.01);

def BtwTime38 = GetTime between IndTime38 and (IndTime38 + 0.01);

def BtwTime39 = GetTime between IndTime39 and (IndTime39 + 0.01);

def BtwTime40 = GetTime between IndTime40 and (IndTime40 + 0.01);

def BtwTime41 = GetTime between IndTime41 and (IndTime41 + 0.01);

def MTFRepaintFix = BtwTime1 or BtwTime2 or BtwTime3 or BtwTime4 or BtwTime5 or BtwTime6 or BtwTime7 or BtwTime8 or BtwTime9 or BtwTime10 or BtwTime11 or BtwTime12 or BtwTime13 or BtwTime14 or BtwTime15 or BtwTime16 or BtwTime17 or BtwTime18 or BtwTime19 or BtwTime20 or BtwTime21 or BtwTime22 or BtwTime23 or BtwTime24 or BtwTime25 or BtwTime26 or BtwTime27 or BtwTime29 or BtwTime29 or BtwTime30 or BtwTime31 or BtwTime32 or BtwTime33 or BtwTime34 or BtwTime35 or BtwTime36 or BtwTime37 or BtwTime38 or BtwTime39 or BtwTime40 or BtwTime41;Thanks ...at ease no hurry..Hey no problem. I’ll post screenshots for the EMAD configuration when I get a min. I changed the EMAs to green and red and set the line weight to 2. Changed the upper and lower lines to gray line weight 2 and the zero line to a white-ish color.

Triple exhaustion are the dots after one or a few of them watch for a pullback / reversal.

Horserider - it’s just the volume attempting to represent buy / sell volume - if it doesn’t look right on mobile it is because you need to change the sell volume to a solid line (not a histogram) and set the line weight to 3 and color to red. Also set the volume average to a solid line - gray - line weight 1.

As for the SPX all I know is there are specific versions of indicators made for SPX. I personally don’t trade SPX so I have never looked into it.

I believe the code can be made "less light" from 1900 lines (as majority of them are not used .. thereby faster

To sum up ( Please feel free to correct me)

1) Look at support or demand areas

2) check corresponding EMAD for entries i.e. EMAD > o and supply bounce long.... (reverse for short) or Demand reject and emad < o short (reverse for long).

So i am wondering (trying to clean up) to remove PLD, and all other Labels calculations etc.,

I don't see the HorseRider volume usage either.

Am i missing something

Best

MN

If you are using the code I shared you can certainly delete all the “Breakouts” code & PLD… or just use C3 Max Spark (which does not have all the extra stuff) and Add bull bear V5 as a separate study to paint the candles. I added all the extra stuff to combine different studies and not all are necessary of course.Thanks ...at ease no hurry..

I believe the code can be made "less light" from 1900 lines (as majority of them are not used .. thereby faster

To sum up ( Please feel free to correct me)

1) Look at support or demand areas

2) check corresponding EMAD for entries i.e. EMAD > o and supply bounce long.... (reverse for short) or Demand reject and emad < o short (reverse for long).

So i am wondering (trying to clean up) to remove PLD, and all other Labels calculations etc.,

I don't see the HorseRider volume usage either.

Am i missing something

Best

MN

The Horserider volume and EMAD (or similar to EMAD) code is used in the “bull bear V5” code to paint the candles. The volume labels are mostly from the Horserider code as well. You could also remove all the labels from the code if you so choose.

If you are using the code I shared you can certainly delete all the “Breakouts” code & PLD… or just use C3 Max Spark (which does not have all the extra stuff) and Add bull bear V5 as a separate study to paint the candles. I added all the extra stuff to combine different studies and not all are necessary of course.

The Horserider volume and EMAD (or similar to EMAD) code is used in the “bull bear V5” code to paint the candles. The volume labels are mostly from the Horserider code as well. You could also remove all the labels from the code if you so choose.

Thanks .. yes I am using the CODE you provided only.

I just want to make sure that i got the essence of your entry/exit.

Am I correct or is there additional criteria you use

Thanks

MN

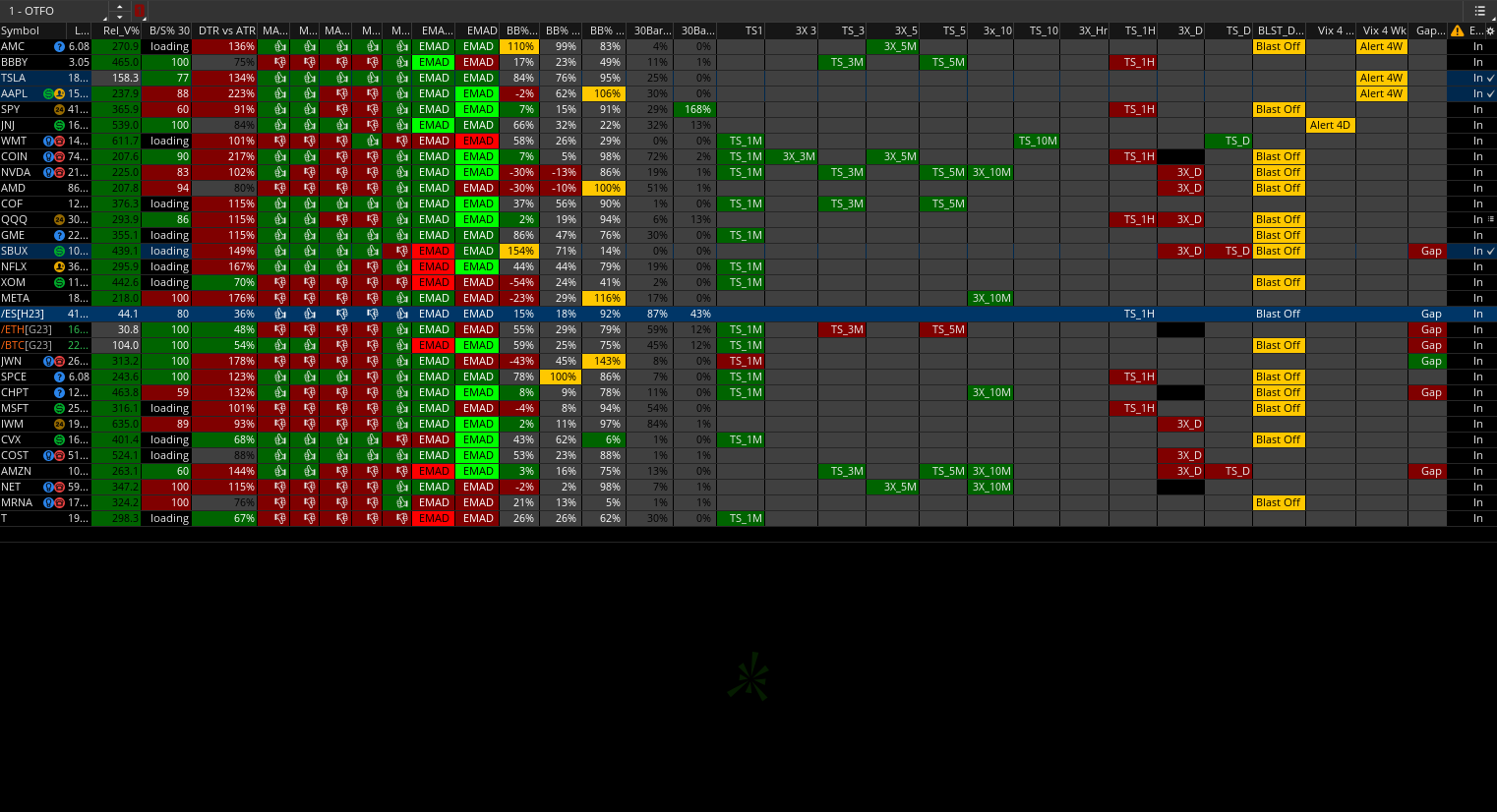

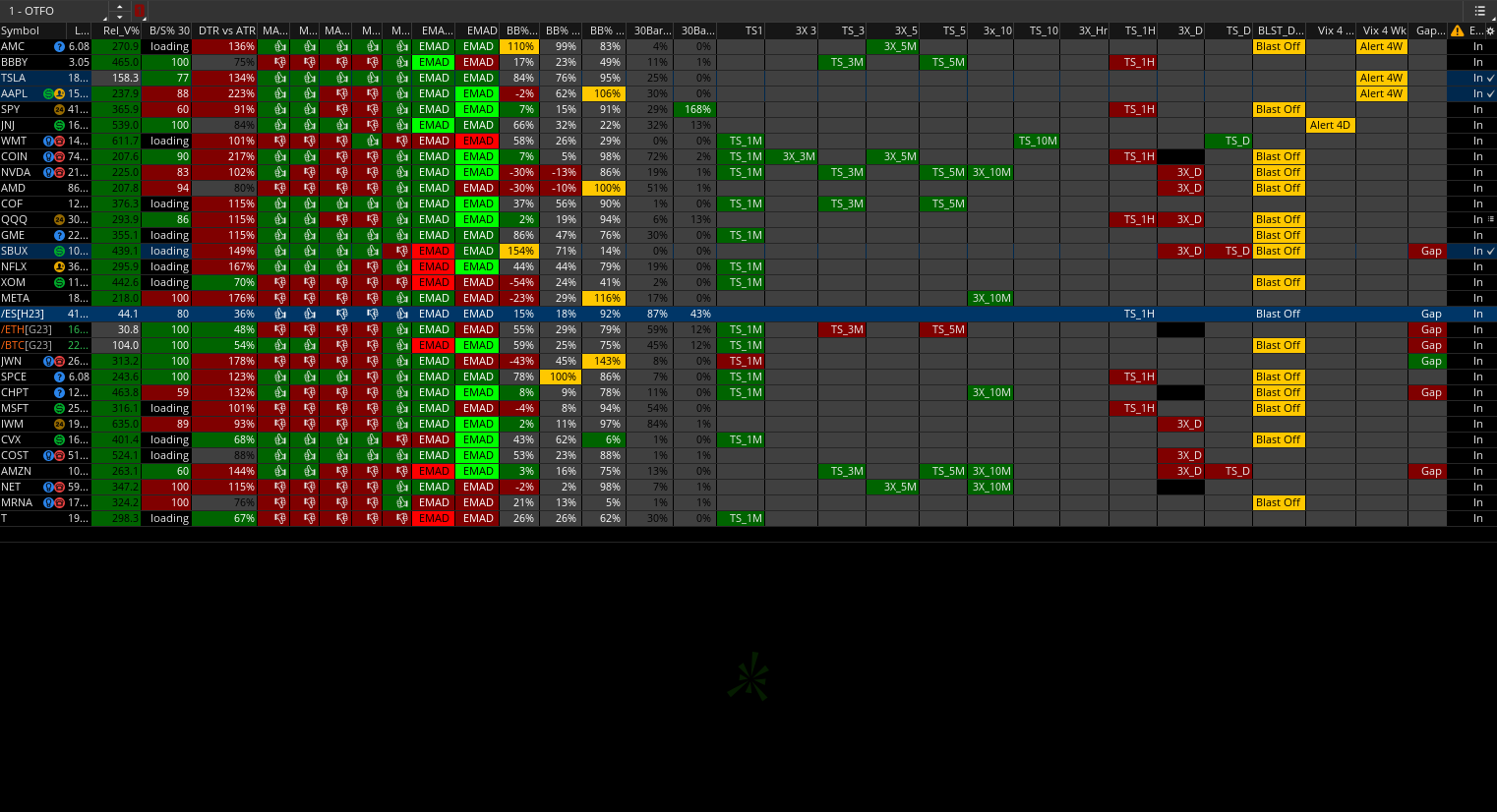

To whom it may concern:

I edited the code for the EMAD watchlist column... https://tos.mx/nH0z25w

The EMAD column originally showed green or red above zero or above zero.

The new version is much more helpful:

1. EMAD is below the zero line and EMAs are down = Dark Red

2. EMAD is above the zero line and EMAs are up = Dark Green

3. EMAD is below the zero line and EMAs are up = Green

4. EMAD is above the zero line and EMAs are down = Red

I currently have one set to Day the red and green colored seem to be the most helpful.

(Will be posting new links to the watchlist columns as I have changed many of them to be easier on the eyes... to myself atleast)

I edited the code for the EMAD watchlist column... https://tos.mx/nH0z25w

The EMAD column originally showed green or red above zero or above zero.

The new version is much more helpful:

1. EMAD is below the zero line and EMAs are down = Dark Red

2. EMAD is above the zero line and EMAs are up = Dark Green

3. EMAD is below the zero line and EMAs are up = Green

4. EMAD is above the zero line and EMAs are down = Red

I currently have one set to Day the red and green colored seem to be the most helpful.

(Will be posting new links to the watchlist columns as I have changed many of them to be easier on the eyes... to myself atleast)

Last edited:

can you pls show the steps how to open watchlist column ? I imported but I dont to how to open up the page.To whom it may concern:

I edited the code for the EMAD watchlist column... https://tos.mx/nH0z25w

The EMAD column originally showed green or red above zero or above zero.

The new version is much more helpful:

1. EMAD is below the zero line and EMAs are down = Dark Red

2. EMAD is above the zero line and EMAs are up = Dark Green

3. EMAD is below the zero line and EMAs are up = Green

4. EMAD is above the zero line and EMAs are down = Red

I currently have one set to Day the red and green colored seem to be the most helpful.

(Will be posting new links to the watchlist columns as I have changed many of them to be easier on the eyes... to myself atleast)

can you pls show the steps how to open watchlist column ? I imported but I dont to how to open up the page.

Go to your Watchlist.

Click on WHEEL at the end ( on the edge of the header)

Click on customize

Search for EMAD (or whatever additional you want to add)..

Okay... and it will show

@Christopher84

Beautiful artwork dedicated to Christopher of the 84th order.

Beautiful artwork dedicated to Christopher of the 84th order.

Code:

##########################################################################################

##########################################################################################

### ###

### ############################# ######### ######### ###

### ################################# ######### ######### ###

### #################################### ######### ######### ###

### ######## ######### ######### ######### ###

### ######## ######### ######### ######### ###

### ######## @Christopher84 ######### ######### ######### ###

### ######## ######### ######### ######### ###

### ######## ######### ######### ######### ###

### ###################################### ################################## ###

### #################################### ################################## ###

### ################################# ################################## ###

### #################################### ################################## ###

### ######## ######### ######### ###

### ######## ######### ######### ###

### ######## ######### ######### ###

### ######## ######### ######### ###

### ######## ######### ######### ###

### ######## ######### ######### ###

### #################################### ######### ###

### ################################## ######### ###

### ############################### ######### ###

### ###

##########################################################################################

##########################################################################################tonmoybhagawati

New member

I cant tell you how thankful I am that you posted this question. The indicators are absolutely amazing, but it was starting to look like looking for a needle in a haystack.Hey everyone. I've read pages and pages on this thread, but I'm still really confused as to how to even BEGIN to use this strategy/indicator.

Here are some things that confuse me:

Thank you to all the guys who have invested so much time into this thread. I'm not trying to judge at all. I just want to try to get on the same page as those really benefiting from these indicators.

- Am I supposed to use the Confirmation Candle indicator or the C3 Max indicator?

- What time frame(s) works best? I see some people mention the 3-minute chart, and then I see @Christopher84 say to use the monthly chart. I am extremely confused by this.

- I applied the latest version of Confirmation Candle to the SPY 5-minute chart and there were arrows everywhere. How should one begin to make sense of that? Are there any videos that can maybe consolidate all the information in this thread to make it a bit more digestible?

Clickforlife

New member

@HODL-Lay-HE-hoo! hello how do i get my watchlist to look like yours ? do you have a link ? also could you explain in short terms what to look for in that watchlist for a potential play? thanks

@Christopher84

Good people... I have once again done the unthinkable! ... although you know what they say... "If you werent thinkin you wouldnta' thought that"

Anyway I added two more avg lengths to the C3_Max_Spark code (inputs are called LengthTest_1 & 2) in order to show the spark arrows from a higher aggregation chart one the lower aggregation chart. The following screenshot shows the 5min chart and a 10min chart (unmodified study). The magenta arrows are the 2nd Spark arrows. I added #hint to the inputs that show if you want to use a 5min chart to show 10min spark change LengthTest_1 & 2 to 20 & 70 and so on... notice the green and purple vertical lines marking the last 10min spark arrow on the 5min chart. seems like it could be useful when you see the first spark arrow of your higher agg to confirm entry... check it out! also added the 2nd Spark label... hell I may add more.

Maybe we can make a strategy to confirm entry when the first spark arrow for the 2nd Spark appears?? hmmmmm.... upon further review it would seem there are far too many indications at least with the current settings.

https://tos.mx/ULVl7dj

Good people... I have once again done the unthinkable! ... although you know what they say... "If you werent thinkin you wouldnta' thought that"

Anyway I added two more avg lengths to the C3_Max_Spark code (inputs are called LengthTest_1 & 2) in order to show the spark arrows from a higher aggregation chart one the lower aggregation chart. The following screenshot shows the 5min chart and a 10min chart (unmodified study). The magenta arrows are the 2nd Spark arrows. I added #hint to the inputs that show if you want to use a 5min chart to show 10min spark change LengthTest_1 & 2 to 20 & 70 and so on... notice the green and purple vertical lines marking the last 10min spark arrow on the 5min chart. seems like it could be useful when you see the first spark arrow of your higher agg to confirm entry... check it out! also added the 2nd Spark label... hell I may add more.

Maybe we can make a strategy to confirm entry when the first spark arrow for the 2nd Spark appears?? hmmmmm.... upon further review it would seem there are far too many indications at least with the current settings.

https://tos.mx/ULVl7dj

Last edited:

I can share the updated links… however my watchlist as pictured is way overkill and I cannot say I have been using it for much. I will likely cut it down significantly seeing as I really only need columns for maybe 10min 1hr & Daily timeframe. My only use for it at the moment is easily identifying the “blast off” daily, “Vix Alert 4” daily “TS_V9” 10min/1hr/Daily - easily in a list of course but I do not necessarily use it for anything actionable I guess you would say… just to easily identify some of the higher timeframe indications… but having all the lower timeframe columns on there is just too much for me.@HODL-Lay-HE-hoo! hello how do i get my watchlist to look like yours ? do you have a link ? also could you explain in short terms what to look for in that watchlist for a potential play? thanks

Will update with links.

Good DAY!

Hi Everyone!

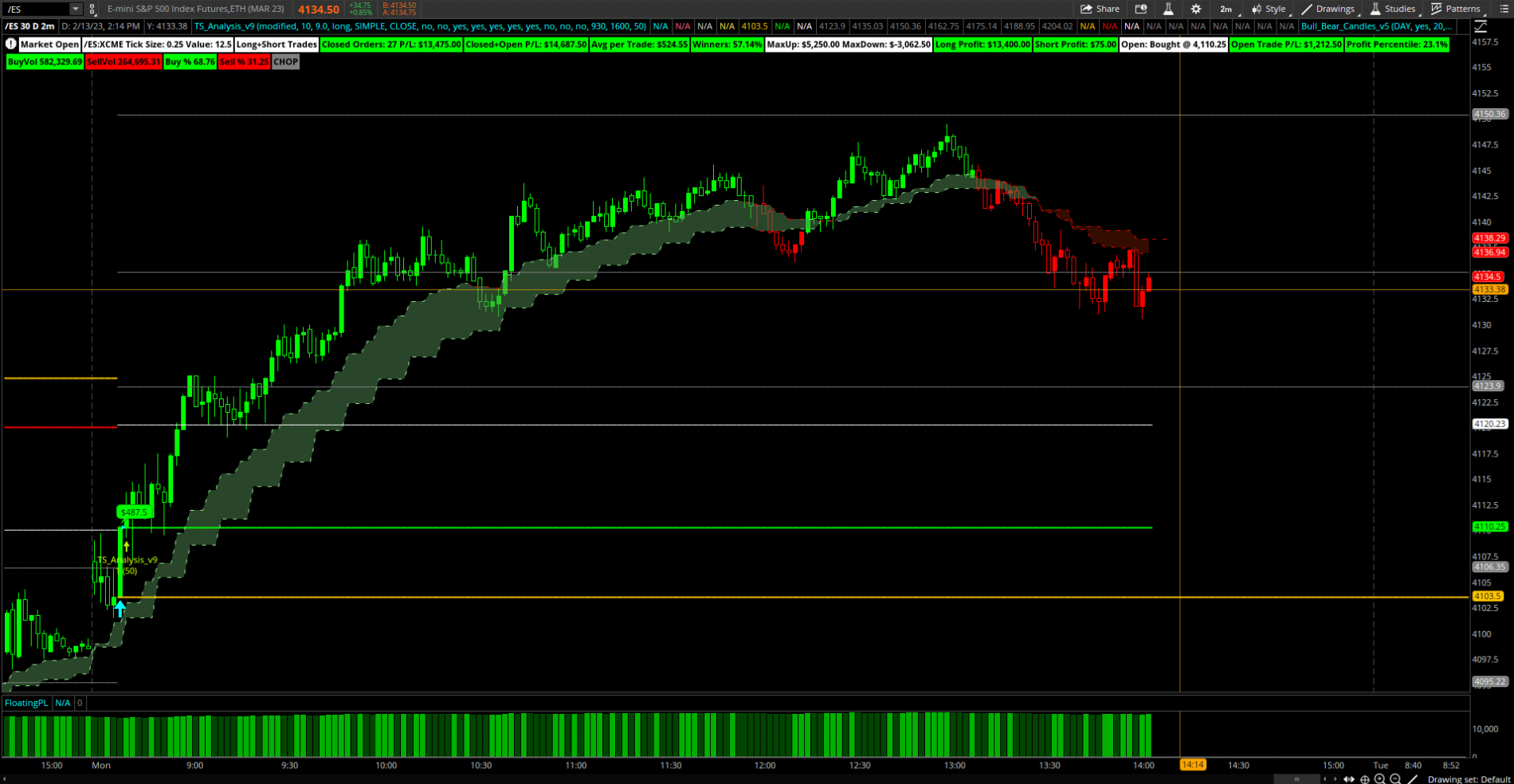

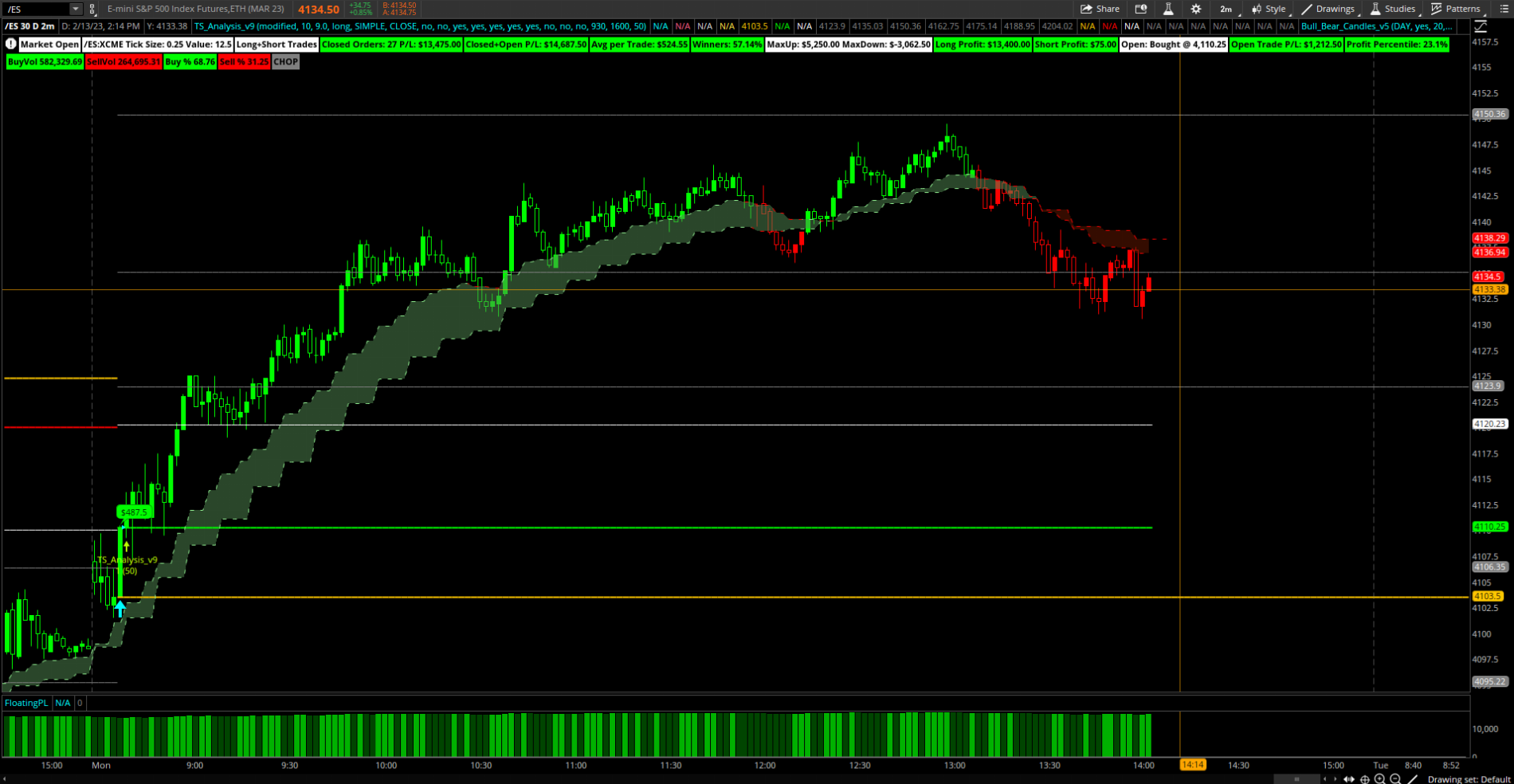

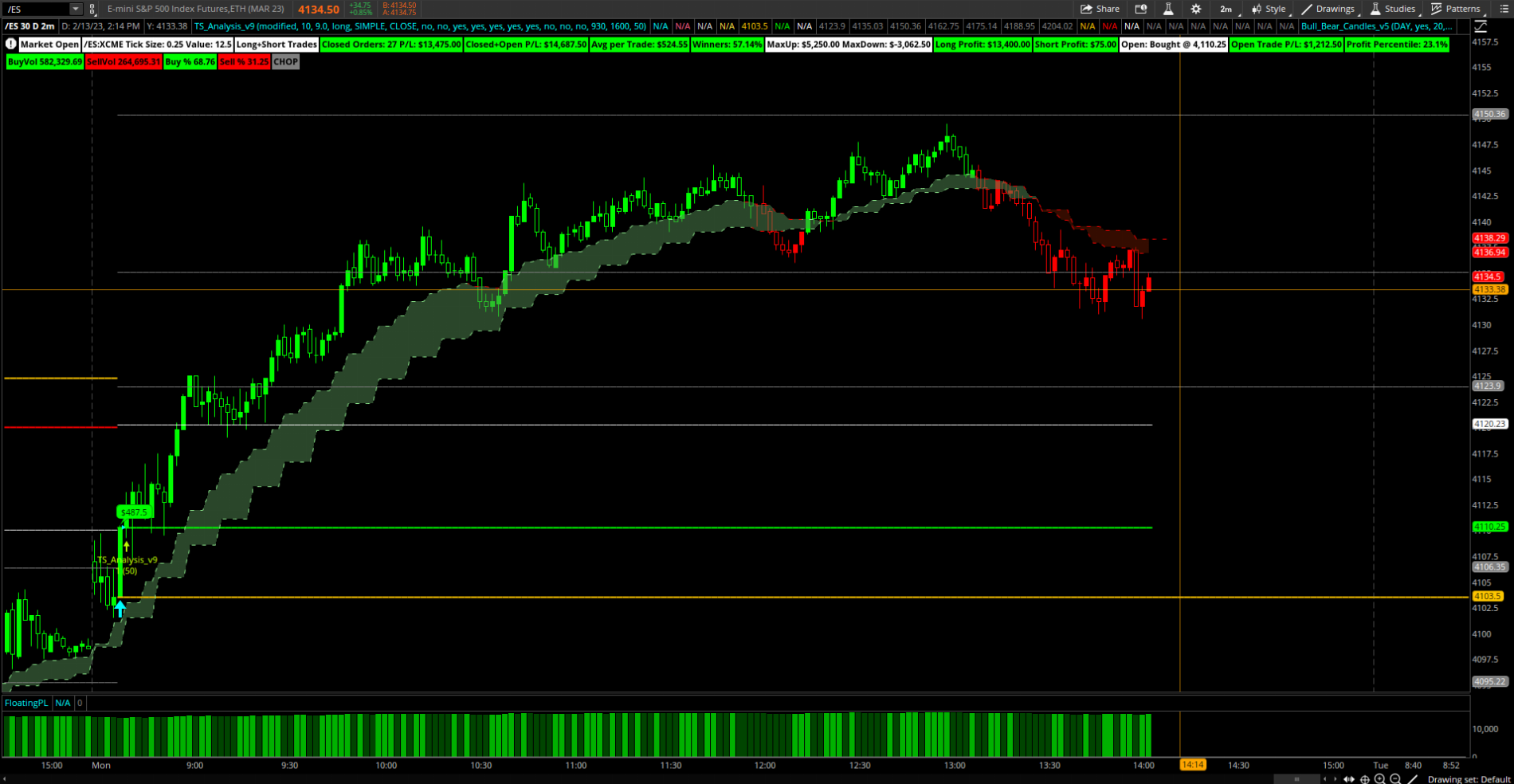

Just wanted to take a minute and share this 2 min chart utilizing Bull_Bear_Combo and TS_v9 (adjusted settings for the 2 min chart). Currently this strategy has 57% Winners. https://tos.mx/Yb4ajVS Happy trading everyone!

Just wanted to take a minute and share this 2 min chart utilizing Bull_Bear_Combo and TS_v9 (adjusted settings for the 2 min chart). Currently this strategy has 57% Winners. https://tos.mx/Yb4ajVS Happy trading everyone!

webattorney

Member

What is the difference between Confirmation Candles version 10 and C3_Max_v2? And also on the Confirmation Candles setting, the highest Confirmation Factor you can set is 15 since there are 15 indicators, correct? I will test it out and let you know what I think. Great job by the way. A lot of effort went into this. Amazing. Christopher, you must be very good at programming.

@Christopher84

One question regarding C3 Upper indicator. I understand that the dotted lines are short term trend and solid lines are intermediate trend channel, but what time frames constitute "intermediate trend" in a specific time frame?

I think you were brilliant to pursue an idea of counting how many indicators were in "consensus". I also find the indicator that repaints candles misleading and useless. One question to you because I am sort of color blind. While I can easily see the green reversal cloud that appears on the Consensus indicator, I have a hard time seeing the red reversal cloud. Which line of the code do I have to change to change the RED reversal cloud to MAGENTA color? I think it's because I am sort of color blind - that's why I am asking. Not trying to change your script in any other way. Thanks again.

To try to understand better Ehler's MAMA and FAMA, I found this link below. I cannot say I understand it well but I gleaned that it is the "Mother of All Moving Averages" - therefore MAMA; I assume FAMA must mean Father of All Moving Averages? Now, can anyone point me to any link that explains the SPARK label? I know how it works but I would like to better understand what this indicator does.

http://www.davenewberg.com/Trading/EhlersCodes.html

Can I ask a dumb question regarding this study? After you download the chart from the link you provided, what do you do to actually run this study, i.e., buy and sell /ES using this Study? I see that the Orders are on Auto on TS-v9 indicator but what does that do?

@Christopher84

One question regarding C3 Upper indicator. I understand that the dotted lines are short term trend and solid lines are intermediate trend channel, but what time frames constitute "intermediate trend" in a specific time frame?

What does EMAD Watchlist attempt to show on Daily time frame? Is it helpful to use this in conjunction with Confirmation Candles Watchlists?can you pls show the steps how to open watchlist column ? I imported but I dont to how to open up the page.

Christopher84:Hi @tem2005,

None of my indicators repaint. I find indicators that repaint to be virtually useless. The Confirmation Factor calculates how many indicators are in agreement on the trend direction. I personally use the Consensus Candles. They will work well on any time frame. Hope this helps!

I think you were brilliant to pursue an idea of counting how many indicators were in "consensus". I also find the indicator that repaints candles misleading and useless. One question to you because I am sort of color blind. While I can easily see the green reversal cloud that appears on the Consensus indicator, I have a hard time seeing the red reversal cloud. Which line of the code do I have to change to change the RED reversal cloud to MAGENTA color? I think it's because I am sort of color blind - that's why I am asking. Not trying to change your script in any other way. Thanks again.

I found out this issue the hard way. When you don't turn off the coloring feature on B4, some of price candles come out as gray on some time frames.Hi @AspaTrader,

Looks great! However, I wasn't sure if you noticed B4 is coloring your candles instead of C3? If you set bar color to none on the B4, C3 will color the candles.

Thanks a lot. I need to rewatch the video but your notes do help.I had family out of town this weekend and since I was trying to be productive, i decided to spend my time listening to the video here(its a recording of Christopher explaining the Consensus candles) and here are my rough notes which mostly answered all the questions I had

Notes on the C3

- Green cloud , but red zone, still not going to break out, you want to ensure the green cloud and green zone

- Price action should be evaluated in terms of the intermediate trend- green, red or grey

- green channel - bullish trend

- red candle in green channel is actually bullish

- cloud oversold and flattening out (might see a spike soon), don’t get in here

- if you see red candles in a green channel, go for it, especially a s squeeze in play

- bullish practice action, right now in a support zone , is a bullish play

- green candles in a red channel, nearing resistance is a good place to go short

- red clouds act as markers to say , sell over the cloud or just look to see as you get close to it

- ideally sell over the red cloud every time,they typically are reversal zones

- the long cloud is a good indicator that the price will come to the base of the cloud (exception is if the support is above the base of the channel)

- squeeze dots indicate a squeeze condition,

- the red dots are indicators that its getting oversold (not completely oversold), do start looking at setting stop losses there or take some profits off

- it can go above a long cloud, it can go above the long cloud as long as the support line is higher than the end of the cloud- at some point, it can hammer back below the cloud

- when the price is a channel, indicates the price looking for direction and a squeeze is happening, wait for a breakout over the high (that said, it should be a solid breakout, not one which has a long wick, long wick means the price action is weak. B4 can help with this.

- the consensus numbers are not as relevant as you might think

- the consensus numbers are more binary

- increasing is momentum (more studies and increasing) is good

- red is overbought and green is oversold

- Think of the consensus candles as a binary

- breakout - agreement within the bands, the keltner bands were green

- breakdown - bands were in agreement that it was breaking down, red color

- in sideways move, bands are moving back and forth in terms in color , it oscillates between the high and low, so tagging the high and low

- red channel, green candle is a good opportunity too short, do check with the B4

- in a green cloud, once it descends below the green channel, look to buy since there will be sometimes some upward movement,

- when the price movement punches the top of the channel, and pushes up, that’s a positive movement, when the near term resistance lines are pushing it upwards, its a good sign that you want in.

- when the interim resistance lines are moving down, its a sign of a bearish signal

- when you dont see to a cloud to get out, see for gojis or wait for the candle changes down

- when you see the macdbb being red and the line being bent back its an option to short and the channel is red.

- high hanging candle in red channel is a sharper move down

- if the wicking is below the intermediate channel, multiple wicks, it can show that it has strong support and a potential reversal.

- if its indecisive , consider it as red channel and get it as close as possible to the red channel

- scalp with the trend, mean reversals are hard to to determine

- Always a set a target, where price is going, how long are you going to run it there

- green clouds provide support, but it can break down too

- Look to the left to see the where the resistance channel was, the are always good intermediate areas to take profits or look to scale out,

Please note I still need to watch the last 30 minutes again as I was getting tired around the 1 hour mark (it was 11 PM PST) so the notes dont reflect the ichimoku clouds and the starc bands yet.

Hope this helps someone.

Christopher84, can you expound a little bit on why leaving extended hours on typically provides a better read on the OB/OS levels in C3_Max Upper indicator? I always assumed that unless you trade during extended hours, it's better to turn off the extended hours feature of TOS when you trade during market hours. Thanks in advance.Hi @lolreconlol,

I do leave extended hours on typically. It provides a better read on the OB/OS levels in my opinion. It will work well either way though.

Does the Fib feature supposed to appear automatically once you upload this script? I uploaded it but the Fib feature doesn't show.Speaking of scalping, Scalper is still my favorite. This morning and yesterday it was spot-on for a good RTY entry that hit all fib profit targets. Watched the new TS Strat this morning on a 5 min chart with default settings. Looks like it hit targets too. Am not using TS because I trade fibs differently but am amazed at your generous sharing, Christopher! Thank you!

How would you interpret BuyVol and SellVol label info above? I guess what I am asking is what exactly do these two labels show? Thanks in advance.Hi @ALV and @Falout

Here's a share link for my first attempt at C3_MaxSpark. See what you think.

https://tos.mx/MQGTrc3

To try to understand better Ehler's MAMA and FAMA, I found this link below. I cannot say I understand it well but I gleaned that it is the "Mother of All Moving Averages" - therefore MAMA; I assume FAMA must mean Father of All Moving Averages? Now, can anyone point me to any link that explains the SPARK label? I know how it works but I would like to better understand what this indicator does.

http://www.davenewberg.com/Trading/EhlersCodes.html

According to my research, BuyVol and SellVol are not really volumes but volume pressures, which are different and specifically defined. Logically, any buy volumes and sell volumes must be the same because buyers and sellers have agreed to sell and buy. But the Buy Volume Pressures and Sell Volume Pressures are specifically defined and has something to do with how each price candle bar acts do demand and supply pressures. Perhaps others who have a better grasp of this concept can further explain. Thanks.The BuyVol SellVol is the total volume for the day and the Buy % is the same expressed as a percent. There labels are not per candle. the newer versions of this study include similar labels but include volume per candle (bar) and average volume per 30 bars expressed as a percent as well as the Bull Bear V5 study which @Christopher84 now uses to paint the candles as opposed to the study in your picture painting them. The labels included with bull bear give a very clear indication "very bullish" "Chop" etc.

I agree that the psychology is the hardest thing to do well. The hardest thing to do is to let the market come to you rather than try to go find a good play. I find that my biggest winners were when I just watched some stuff without any purpose and saw very clearly the play I have to or should make. For example, when TSLA was 100 recently and everyone said it can go down lower, I saw clearly that this was a BS and I should Sell Puts 6 months or 12 months out for very good premium. That's because I would have been relatively happy to pick up TSLA below 60 or 70. I feel when I rush, I tend to screw up big time. I feel it's the same thing with GOOGL taking a dive recently due to MISFT's chat AI. (Not recommending this play to others; just using it as an example.) But since I don't feel as certain as I did with TSLA, I am not betting that big on options but just picked up some GOOGL shares for long term.Actually, after losing nearly $400,000 to the market, having been grinding 16 hours/day and 7 days/week for 18+ months, I'm finally on the right track and having seen consistent daily profit (yet I don't stop grinding hard and never stop finding ways to learn and improve, never give up). Perhaps you understand why I don't like "easy" when it comes to anything related to trading. I've never asked anyone to share their chart.

C3_MAX_v2 + other strategies/indicators given by @Christopher84 (God bless him) have provided an excellent system, but I'm sure Christopher would agree that the ULTIMATE system/indicator is the trader himself/herself. Not easy.

Thanks for the explanation. What is the deal with Spark number ranging from 3 to 0? How does the number relate to your explanation?SPARK: look at the red and green arrows on your screenshot and look at the dashed lines on the ema cloud how they are turning green or red as they are in the process of turning over. That is spark.

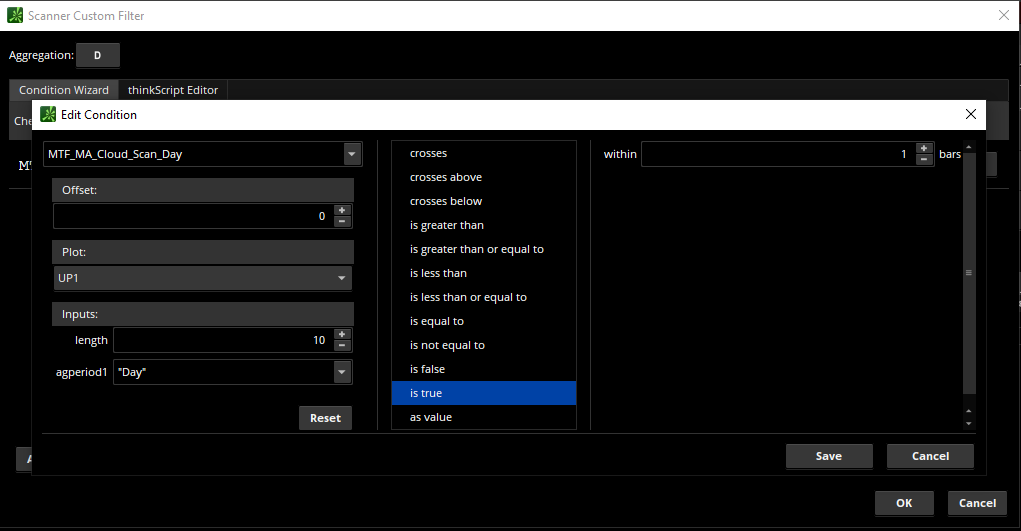

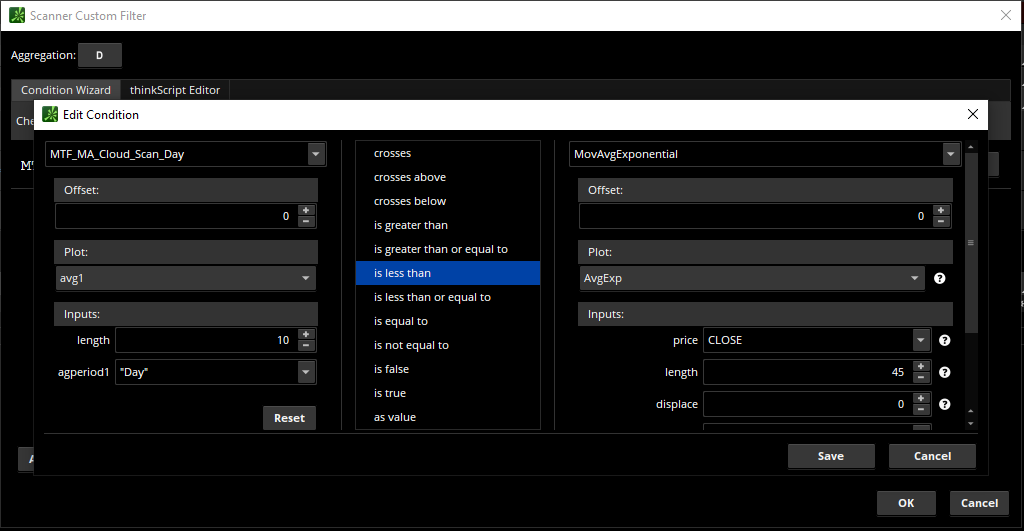

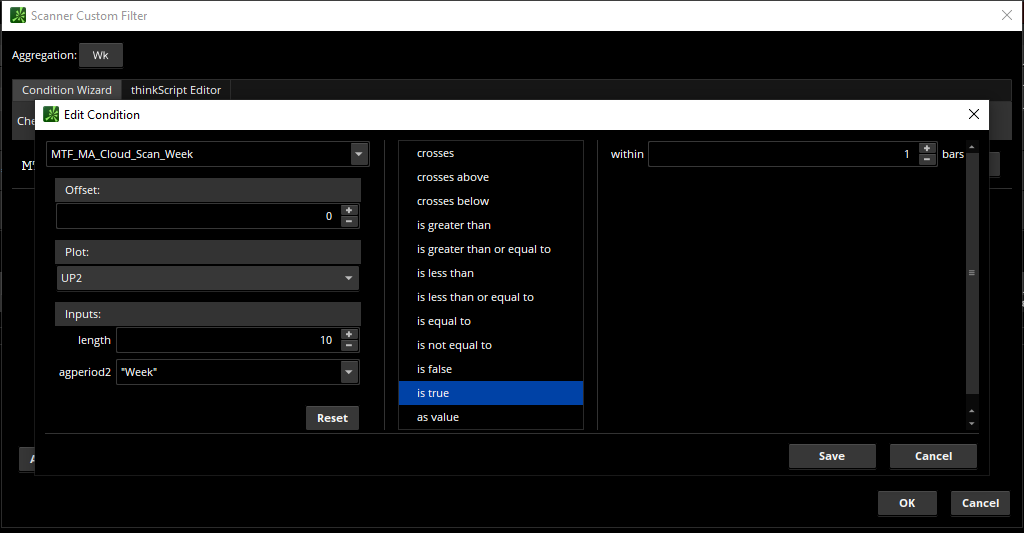

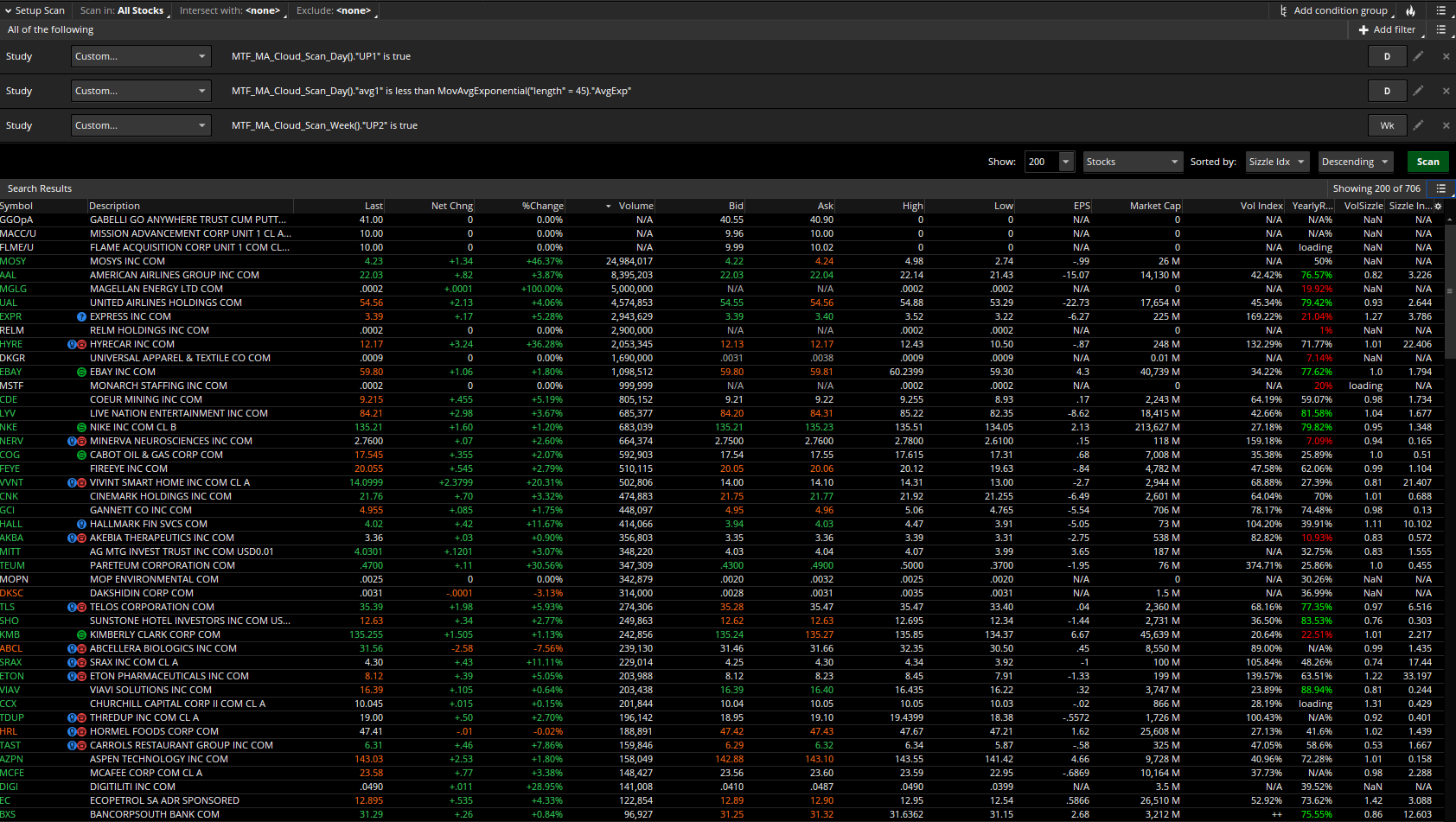

@Christopher84, what would be the scan to find potential shorts after the consolidation? I managed to set up the scan for the potential long plays after the consolidation. I remember you also mentioned that daily time frame is the best with this scan set at Daily and Weekly as aggregation periods, correct? I assume you can also run a scan on Hourly time frame with the same Daily and Weekly aggregation periods? Thanks in advance for your response. Your responses have been very helpful.I think the best idea is to give you the components of the scan so you are able to setup instead of relying on the share link. So here are the codes I am using to do the scan with images to show my settings.

Code:# MTF Moving Average Cloud Scan Day (For Scan Only) declare lower; input length = 10; input agperiod1 = {"1 min", "2 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "4 hours", default "Day", "Week"}; #input agperiod2 = {"1 min", "2 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "4 hours", "Day", default "Week"}; plot avg1 = ExpAverage(close(period = agperiod1), length); def height = avg1 - avg1[length]; avg1.SetStyle(Curve.SHORT_DASH); avg1.SetLineWeight(1); #avg.SetDefaultColor(Color.Gray); plot UP1 = avg1[1] < avg1; def DOWN1 = avg1[1] > avg1; Avg1.AssignValueColor(if UP1 then Color.LIGHT_GREEN else if DOWN1 then Color.RED else Color.YELLOW); #plot avg2 = ExpAverage(close(period = agperiod2), length); #def height2 = avg2 - avg2[length]; #avg2.SetStyle(Curve.SHORT_DASH); #avg2.SetLineWeight(1); #avg.SetDefaultColor(Color.Gray); #def UP2 = avg2[1] < avg2; #def DOWN2 = avg2[1] > avg2; #Avg2.AssignValueColor(if UP2 then Color.LIGHT_GREEN else if DOWN2 then Color.RED else Color.YELLOW); plot price1 = close; def UP3 = price1[1] < price1; def DOWN3 = price1[1] > price1; price1.AssignValueColor(if UP3 then Color.LIGHT_GREEN else if DOWN3 then Color.RED else Color.YELLOW); #AddCloud(avg2, avg1, Color.LIGHT_RED, Color.CURRENT); #AddCloud(avg1, avg2, Color.LIGHT_GREEN, Color.CURRENT);

Here's the MA Week scan component.

Code:# MTF Moving Average Cloud (For Week Scan Only) declare lower; input length = 10; #input agperiod1 = {"1 min", "2 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "4 hours", default "Day", "Week"}; input agperiod2 = {"1 min", "2 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "4 hours", "Day", default "Week"}; #plot avg1 = ExpAverage(close(period = agperiod1), length); #def height = avg1 - avg1[length]; #avg1.SetStyle(Curve.SHORT_DASH); #avg1.SetLineWeight(1); #avg.SetDefaultColor(Color.Gray); #def UP1 = avg1[1] < avg1; #def DOWN1 = avg1[1] > avg1; #Avg1.AssignValueColor(if UP1 then Color.LIGHT_GREEN else if DOWN1 then Color.RED else Color.YELLOW); plot avg2 = ExpAverage(close(period = agperiod2), length); def height2 = avg2 - avg2[length]; avg2.SetStyle(Curve.SHORT_DASH); avg2.SetLineWeight(1); avg2.SetDefaultColor(Color.Gray); plot UP2 = avg2[1] < avg2; def DOWN2 = avg2[1] > avg2; Avg2.AssignValueColor(if UP2 then Color.LIGHT_GREEN else if DOWN2 then Color.RED else Color.YELLOW); plot price1 = close; def UP3 = price1[1] < price1; def DOWN3 = price1[1] > price1; price1.AssignValueColor(if UP3 then Color.LIGHT_GREEN else if DOWN3 then Color.RED else Color.YELLOW); #AddCloud(avg2, avg1, Color.LIGHT_RED, Color.CURRENT); #AddCloud(avg1, avg2, Color.LIGHT_GREEN, Color.CURRENT);

Here are the results of my scan this morning.

Let me know if you have any trouble setting it up. I had to break the code up a bit due to it being an MTF indicator.

@Christopher84,Hi Everyone!

Just wanted to take a minute and share this 2 min chart utilizing Bull_Bear_Combo and TS_v9 (adjusted settings for the 2 min chart). Currently this strategy has 57% Winners. https://tos.mx/Yb4ajVS Happy trading everyone!

Can I ask a dumb question regarding this study? After you download the chart from the link you provided, what do you do to actually run this study, i.e., buy and sell /ES using this Study? I see that the Orders are on Auto on TS-v9 indicator but what does that do?

Oh, I see. I haven't even been able to get to the stage of receiving an order ready. lol If anyone could explain how to get an order ready for review and send, I would appreciate it. Thanks.TOS will not execute orders via a strategy as it does not support auto trade. I believe it would get an order ready that you would need to confirm and send… but not 100% sure seems like most use it for backtesting purposes or something of that nature.

Last edited by a moderator:

It depends really on your preference. I leave afterhours on because I day trade options and when after hours is off the zones do not plot the same and more often than not the levels with afterhours on are more helpful. However with them off you can more easily see the overall trend direction. If you used it with after hours off you would just use the ema or something of that nature to determine the levels at which a bounce may occur.Christopher84, can you expound a little bit on why leaving extended hours on typically provides a better read on the OB/OS levels in C3_Max Upper indicator? I always assumed that unless you trade during extended hours, it's better to turn off the extended hours feature of TOS when you trade during market hours. Thanks in advance.

So apparently the spark is taking into the account what I said previously as well as agreement between various other indicators coded into the study (it does not account for all of them as the consensus level does i believe) spark 3 is basically both emas are turned over going the same direction and a few other indications agree... if I am not mistaken. But you dont use it like "spark level 3 means buy!"Thanks for the explanation. What is the deal with Spark number ranging from 3 to 0? How does the number relate to your explanation?

@METAL @webattorney and to whom it may concern…

What is Spark?

That link has the 2nd spark label and arrows so turn them off as you please… after messing with them some I have not found the arrows useful however the 2nd Spark label representing the higher aggregation spark levels may be more useful. The spark I added are an exact copy of the normal spark but with different lengths… I assume the Spark code during development was tested with more than two EMAs. Anyway messing with it has given me (I think) a better understanding of the Spark code... the purpose of the label and arrows which is (to my current understanding) as follows:

Spark is coded based on Stacked EMA's and Consensus Level as a filter of sorts.

- Spark Arrow: The Spark arrow will plot when the consensus level is OS and all three of the conditions below are true or the opposite.

- Spark label: Spark 1 - One of the following are true, Spark 2 - Two of the following are true, and Spark 3 - Three of the following are true.

- Avg8 of the previous candle is less than Avg8 on the current candle

- Avg9 of the previous candle is less than Avg9 on the current candle

- Avg8 of the current candle is less than Avg9 on the current candle (in other words the EMAs crossed)

- Notice the spark arrows do not plot after the EMAs are fully crossed over

Disregard “2nd Spark” label in the screenshots below

@Christopher84

The C3_Max_Spark plots are all based on whichever timeframe your chart is currently on. The Bull_Bear_V5 study that paints the candles is the only one that uses two different aggregations.@Christopher84

One question regarding C3 Upper indicator. I understand that the dotted lines are short term trend and solid lines are intermediate trend channel, but what time frames constitute "intermediate trend" in a specific time frame?

Well the CC watchlist column. Shows the consensus level among multiple indicators… the EMAD watchlist column is beneficial in that it can help to narrow down tickers that are near reversal/bounce level. I have not looked at it too much to be honest. But it seems to show when the emas are turning over similar to spark but I’m not 100% on that to be honest.What does EMAD Watchlist attempt to show on Daily time frame? Is it helpful to use this in conjunction with Confirmation Candles Watchlists?

I’ll have to add some chart screenshots to show what it does. But overall the verdict is still out on its usefulness as a watchlist column.

The BuyVol SellVol is the total volume for the day and the Buy % is the same expressed as a percent. There labels are not per candle. the newer versions of this study include similar labels but include volume per candle (bar) and average volume per 30 bars expressed as a percent as well as the Bull Bear V5 study which @Christopher84 now uses to paint the candles as opposed to the study in your picture painting them. The labels included with bull bear give a very clear indication "very bullish" "Chop" etc.How would you interpret BuyVol and SellVol label info above? I guess what I am asking is what exactly do these two labels show? Thanks in advance.

Correct the buy sell volume is not a real representation of buying and selling but this is about as close as we can get to it using tos.According to my research, BuyVol and SellVol are not really volumes but volume pressures, which are different and specifically defined. Logically, any buy volumes and sell volumes must be the same because buyers and sellers have agreed to sell and buy. But the Buy Volume Pressures and Sell Volume Pressures are specifically defined and has something to do with how each price candle bar acts do demand and supply pressures. Perhaps others who have a better grasp of this concept can further explain. Thanks.

SPARK: look at the red and green arrows on your screenshot and look at the dashed lines on the ema cloud how they are turning green or red as they are in the process of turning over. That is spark.To try to understand better Ehler's MAMA and FAMA, I found this link below. I cannot say I understand it well but I gleaned that it is the "Mother of All Moving Averages" - therefore MAMA; I assume FAMA must mean Father of All Moving Averages? Now, can anyone point me to any link that explains the SPARK label? I know how it works but I would like to better understand what this indicator does.

http://www.davenewberg.com/Trading/EhlersCodes.html

Hi Everyone!

@Christopher84 - Beast Mode CowboyJust wanted to take a minute and share this 2 min chart utilizing Bull_Bear_Combo and TS_v9 (adjusted settings for the 2 min chart). Currently this strategy has 57% Winners. https://tos.mx/Yb4ajVS Happy trading everyone!

I’ll try it out thank you good sir.

TOS will not execute orders via a strategy as it does not support auto trade. I believe it would get an order ready that you would need to confirm and send… but not 100% sure seems like most use it for backtesting purposes or something of that nature.@Christopher84,

Can I ask a dumb question regarding this study? After you download the chart from the link you provided, what do you do to actually run this study, i.e., buy and sell /ES using this Study? I see that the Orders are on Auto on TS-v9 indicator but what does that do?

Last edited by a moderator:

Hi Everyone!

Just wanted to take a minute and share this 2 min chart utilizing Bull_Bear_Combo and TS_v9 (adjusted settings for the 2 min chart). Currently this strategy has 57% Winners. https://tos.mx/Yb4ajVS Happy trading everyone!

@Christopher84 This looks very interesting. Is there a way to scan for Cyan arrows ?

- Status

- Not open for further replies.

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

764

Online

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.