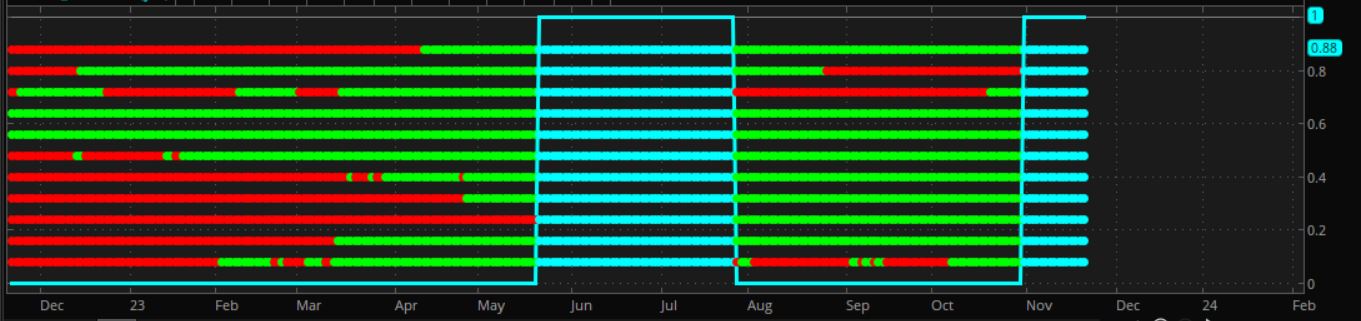

Need help. Made an attempt to convert TV pine script for Volume Composition.

https://www.tradingview.com/script/d4TDeuRU-Volume-composition-Buy-sell-active-passive/

No syntax errors returned but having problems making it a lower study. The converted script also does not produce any visible output on the chart.

#Begin Script

# Fetch volume data

def volume = volume;

def closePrice = close;

# Calculate buy and sell volume

def buyVol;

def sellVol;

if closePrice > closePrice[1] {

buyVol = volume;

sellVol = 0;

} else if closePrice < closePrice[1] {

buyVol = 0;

sellVol = volume;

} else {

buyVol = 0;

sellVol = 0;

}

# Calculate total buy and sell volume

def length = 20; # You can adjust this as needed

def totalBuyVol = Sum(buyVol, length);

def totalSellVol = Sum(sellVol, length);

# Calculate buy and sell volume percentages

def totalVol = totalBuyVol + totalSellVol;

def buyVolPerc = (totalBuyVol / totalVol) * 100;

def sellVolPerc = (totalSellVol / totalVol) * 100;

# Define conditions for high volume

input volThreshold = 70;

def highBuyVolCondition = buyVolPerc >= volThreshold;

def highSellVolCondition = sellVolPerc >= volThreshold;

# Define conditions for high active volume

input volAThreshold = 70;

def highBuyVolACondition = buyVolPerc >= volAThreshold;

def highSellVolACondition = sellVolPerc >= volAThreshold;

# Plot high volume conditions as bubbles

plot highBuyVolBubble = highBuyVolCondition;

plot highSellVolBubble = highSellVolCondition;

highBuyVolBubble.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

highBuyVolBubble.SetDefaultColor(Color.GREEN);

highBuyVolBubble.SetLineWeight(1);

highSellVolBubble.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

highSellVolBubble.SetDefaultColor(Color.RED);

highSellVolBubble.SetLineWeight(1);

# Plot high active volume conditions as bubbles

plot highBuyVolABubble = highBuyVolACondition;

plot highSellVolABubble = highSellVolACondition;

highBuyVolABubble.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

highBuyVolABubble.SetDefaultColor(Color.BLUE);

highBuyVolABubble.SetLineWeight(1);

highSellVolABubble.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

highSellVolABubble.SetDefaultColor(Color.ORANGE);

highSellVolABubble.SetLineWeight(1);

#End Script