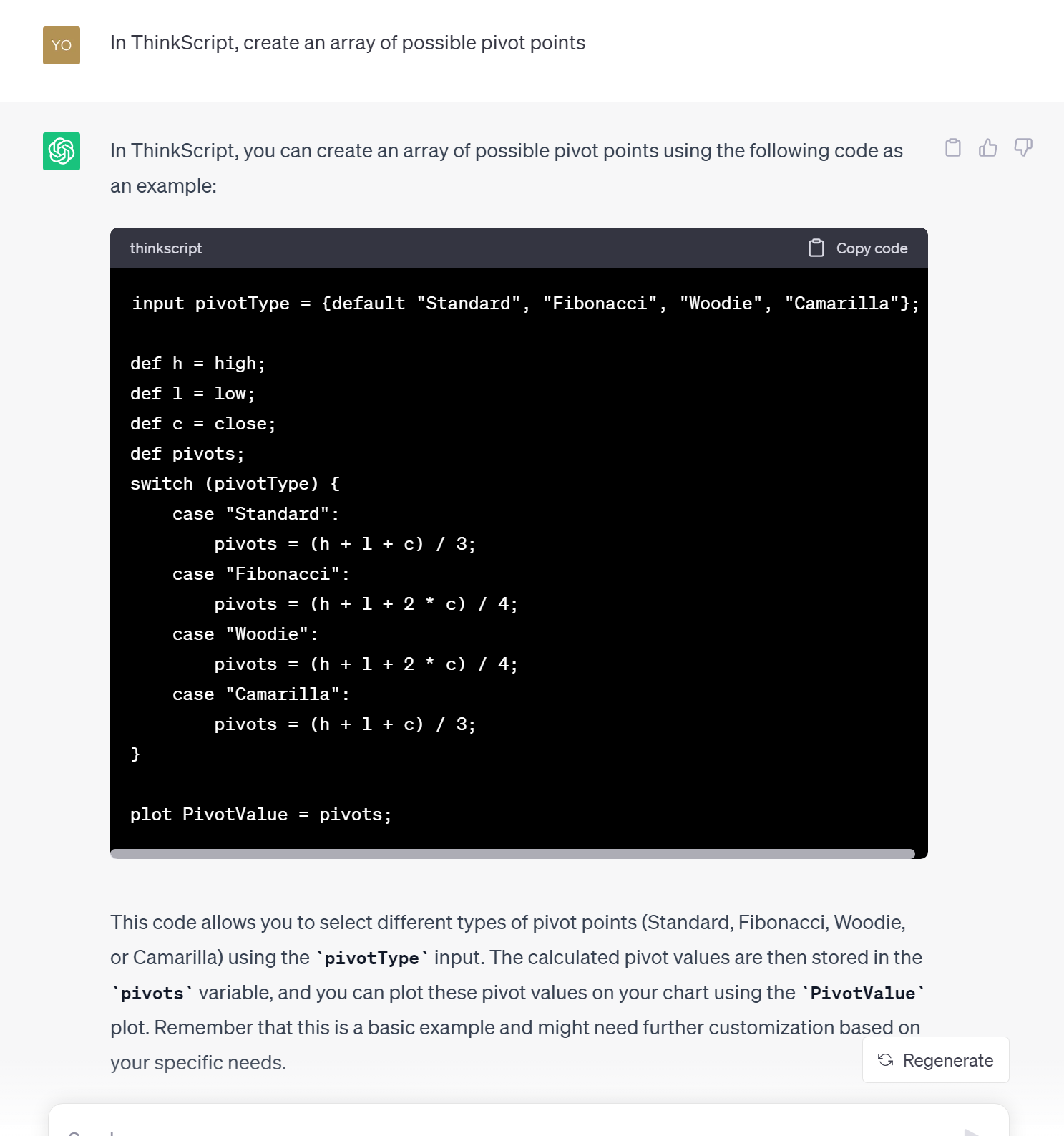

90% of the members attempting chatGPT scripting; do not provide good detailed specifications.

Members know what end result that they want but lack the ability to tell chatGPT, the step-by-step logic required to code a script to achieve that end result.

This results in chatGPT creating non-working garbage code.

Here is a video on how to successfully have chatGPT create functional scripts.

The above video, explains the basics of providing good specifications to AI which results in better scripts.

Members know what end result that they want but lack the ability to tell chatGPT, the step-by-step logic required to code a script to achieve that end result.

This results in chatGPT creating non-working garbage code.

Here is a video on how to successfully have chatGPT create functional scripts.

The above video, explains the basics of providing good specifications to AI which results in better scripts.

Last edited: