I have the code in my laptop and my desk top. The laptop does not paint the bars blue, whereas the desktop paints them. Why does it paint the bars blue. Arrows show on both machines though@GetRichOrDieTrying I don’t think it repaint.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bull Flag and Bear Flag Formations for ThinkorSwim

- Thread starter BenTen

- Start date

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

@stamenski Try two things - check your appearance settings for the pricebar color, and/or check if you have any study loaded on the chart that changes the pricebar color. The codes in post #1 do not change the color of your bars.I have the code in my laptop and my desk top. The laptop does not paint the bars blue, whereas the desktop paints them. Why does it paint the bars blue. Arrows show on both machines though

@stormy77 yes, the indicator script is included in the thread. It has an arrow that indicates Bull/Bear Flag completion. I have mine just to show Bullish arrows (YELLOW). I've added an alert, which I prefer. Add the following lines if you've like at the end of the script.Can this indicator be added to the chart?

Alert(bearish, Round(close, 2) + " Bearish Flag", Alert.BAR);

Alert(bullish, Round(close, 2) + " Bullish Flag", Alert.BAR);

Last edited by a moderator:

robertj daytrade

New member

Old man needs help !!! I use TOS and I have a watchlist with 25 etf's and or stocks. I would like for someone to write a ThinkScript to run in a sub graph to show how many are up on the day based on the time frame I chose "5min, 30min or what ever" !!! If it requires 25 inputs that is OK or if it looks at a watchlist is OK. Will not have to count during the day !!!

Last edited by a moderator:

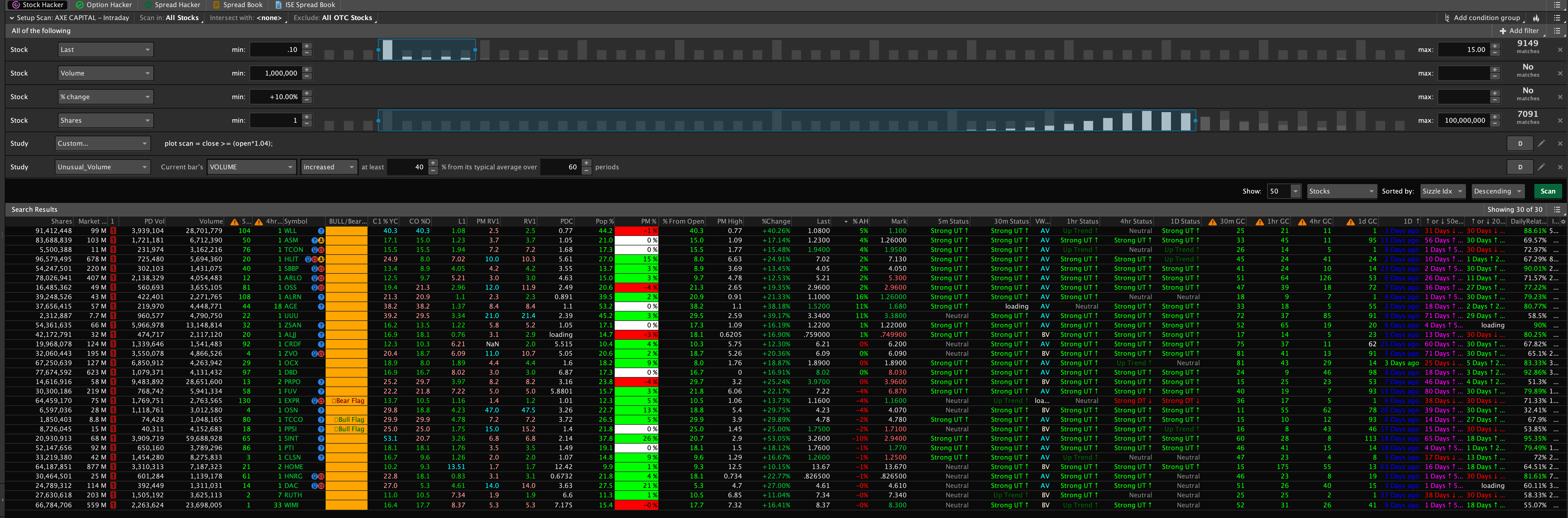

@robertj daytrade You could set up a watchlist column using the Bull Flag Formation

found here ==> https://usethinkscript.com/threads/bull-flag-and-bear-flag-formations-for-thinkorswim.467/

found here ==> https://usethinkscript.com/threads/bull-flag-and-bear-flag-formations-for-thinkorswim.467/

Regarding the code on the main page of this thread, I'm finding the signal on the chart does not exactly correlate to the thumbs up signal in the watchlist column. The watchlist will show a thumbs up even if the arrow up on the chart came 5-10 bars ago, even on a daily.

Would be great if this can be fixed to only show the thumbs up signal (in the watchlist) if the chart signal is within one or two bars.

Otherwise I'm finding this is almost useless as a watchlist column.

Would be great if this can be fixed to only show the thumbs up signal (in the watchlist) if the chart signal is within one or two bars.

Otherwise I'm finding this is almost useless as a watchlist column.

Ah. So you're saying the watchlist code was correct but chart incorrect. I was expecting the opposite, but will take a look...@Hybety Great Catch! Chart script is now fixed. Copy&Paste the new code for the upper study in post#1

It now matches the WatchList code.

View attachment 905

View attachment 906

Thanks!

@Hybety Ken Rose provided the update to the watchlist to weed out false signals by adding a moving average filter.

If you like the previous version better, find the below statements in the study and in the watchlist and remove the struck-through words.

If you like the previous version better, find the below statements in the study and in the watchlist and remove the struck-through words.

def Bulltrigger = trend and MacdLowand trigATR and PriceSma;

def BearTrigger = TrendBear and MacdHighBearand BtrigATR and BPriceSma;

Anyone know how to make this work for a MAC? When adding:Still not working ughh.. here is a screenshot see how it shows orange bars and only 2/3 have bearflag /bull i added that because the thumbs arent working..

--- UPDATE FROM KEN --- it doesn't work on MAC apples he said.

If you click on the 3 bar icon at the top and click share scan can you send me the link cuz maybe that will work for me.

AddLabel(yes, if Bulltrigger then "

AssignBackgroundColor(color.light_ORANGE);

I get an error message: AddLabel is not allowed in this context

Not sure how to fix this. Does anyone know?

TIA

T

Thomas

Guest

I've had this script for years,...and began to explore it's code.

# __ Bull flag indicator for Thinkorswim by Steve from thestudentloanranger.wordpress.com

# Input and basic definitions

input pChg = 1.50; # Daily minimum percent increase during expansion phase (def=1.50)

def C = close;

def O = open;

def H = high;

def L = low;

def V = volume;

# isHigh is to stop a plotting issue inertia code, don't touch it!

def isHigh = C > 20000;

# Expansion range price and volume

def XRANGE = C[3] - O[5];

def XRANGEH = H[3] - O[5];

def XVOL = V[5] + V[4] + V[3];

# Define average true ranges and amount above

def atr = Average(TrueRange(high, C, low), 1.0);

def EXPANDER = atr > (Average(atr) * 1.10);

def EXPNDR = if EXPANDER[5] && EXPANDER[4] && EXPANDER[3] then 1 else 0;

# Percentage change characteristics

def PercentChg = Round(100 * (C / C[1] - 1), 3);

def PCCOUNT = if (PercentChg[5] > pChg && PercentChg[4] > pChg && PercentChg[3] > pChg)

or Round(100 * (C[3] / C[5] - 1), 3) > 10.0 then 1 else 0;

# Higher than average V characteristics

def Volavg = if (V[5] + V[4] + V[3]) / 3 > Average(V) * 1.10 then 1 else 0;

# Price action characteristics

def CandleAction = (C[5] > O[5] && C[4] > O[4] && C[3] > O[3]);

def Signal = if EXPNDR == 1 && Volavg == 1 && CandleAction && PCCOUNT then 1 else 0;

# 3-day consolidation settings

def CRANGE = Highest(H, 3) - Lowest(L, 3);

def UPDRIFT = Highest(H, 3) < (H[3] + (XRANGEH * 0.25));

def CONVOL = V[0] + V[1] + V[2];

# Ratio calculations

def XCRATIO = XRANGE / CRANGE;

def XVRATIO = XVOL / CONVOL;

# Confirmations and plot formatting

plot BULL = if XCRATIO > 2 && XVRATIO > 1.20 && UPDRIFT && Signal == 1 then 1 else 0;

BULL.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

BULL.SetDefaultColor(Color.LIME);

BULL.SetLineWeight(2);

AssignPriceColor(if BULL then Color.BLUE else Color.CURRENT);

plot STPPRICE = If(BULL and C > 0, (C[3] - (XRANGE * 0.40)), If(C < 0 and !BULL , (C[0] + (XRANGE * 0.95)), Double.NaN));

STPPRICE.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

STPPRICE.SetDefaultColor(Color.RED);

STPPRICE.SetLineWeight(2);

plot TGTPRICE = If(BULL and C > 0, (C[0] + (XRANGE * 0.90)), If(C < 0 and !BULL , (C[0] - (XRANGE * 0.40)), Double.NaN));

TGTPRICE.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

TGTPRICE.SetDefaultColor(Color.GREEN);

TGTPRICE.SetLineWeight(2);

# __ Bull flag indicator for Thinkorswim by Steve from thestudentloanranger.wordpress.com

# Input and basic definitions

input pChg = 1.50; # Daily minimum percent increase during expansion phase (def=1.50)

def C = close;

def O = open;

def H = high;

def L = low;

def V = volume;

# isHigh is to stop a plotting issue inertia code, don't touch it!

def isHigh = C > 20000;

# Expansion range price and volume

def XRANGE = C[3] - O[5];

def XRANGEH = H[3] - O[5];

def XVOL = V[5] + V[4] + V[3];

# Define average true ranges and amount above

def atr = Average(TrueRange(high, C, low), 1.0);

def EXPANDER = atr > (Average(atr) * 1.10);

def EXPNDR = if EXPANDER[5] && EXPANDER[4] && EXPANDER[3] then 1 else 0;

# Percentage change characteristics

def PercentChg = Round(100 * (C / C[1] - 1), 3);

def PCCOUNT = if (PercentChg[5] > pChg && PercentChg[4] > pChg && PercentChg[3] > pChg)

or Round(100 * (C[3] / C[5] - 1), 3) > 10.0 then 1 else 0;

# Higher than average V characteristics

def Volavg = if (V[5] + V[4] + V[3]) / 3 > Average(V) * 1.10 then 1 else 0;

# Price action characteristics

def CandleAction = (C[5] > O[5] && C[4] > O[4] && C[3] > O[3]);

def Signal = if EXPNDR == 1 && Volavg == 1 && CandleAction && PCCOUNT then 1 else 0;

# 3-day consolidation settings

def CRANGE = Highest(H, 3) - Lowest(L, 3);

def UPDRIFT = Highest(H, 3) < (H[3] + (XRANGEH * 0.25));

def CONVOL = V[0] + V[1] + V[2];

# Ratio calculations

def XCRATIO = XRANGE / CRANGE;

def XVRATIO = XVOL / CONVOL;

# Confirmations and plot formatting

plot BULL = if XCRATIO > 2 && XVRATIO > 1.20 && UPDRIFT && Signal == 1 then 1 else 0;

BULL.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

BULL.SetDefaultColor(Color.LIME);

BULL.SetLineWeight(2);

AssignPriceColor(if BULL then Color.BLUE else Color.CURRENT);

plot STPPRICE = If(BULL and C > 0, (C[3] - (XRANGE * 0.40)), If(C < 0 and !BULL , (C[0] + (XRANGE * 0.95)), Double.NaN));

STPPRICE.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

STPPRICE.SetDefaultColor(Color.RED);

STPPRICE.SetLineWeight(2);

plot TGTPRICE = If(BULL and C > 0, (C[0] + (XRANGE * 0.90)), If(C < 0 and !BULL , (C[0] - (XRANGE * 0.40)), Double.NaN));

TGTPRICE.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

TGTPRICE.SetDefaultColor(Color.GREEN);

TGTPRICE.SetLineWeight(2);

T

Thomas

Guest

This is a scan share to the BullFlag,...... https://tos.mx/BjHoijL

⚠ edited by moderator. Shared media blocked.

**Images, Videos, Media content from commercial websites can NOT be shared on this forum. The Internet is not in and of itself public domain. Most commercial material is protected by copyright.

You can edit your post and provide a link to a commercial website but you can't share their images.

Last edited by a moderator:

the above scan does not return anything,This is a scan share to the BullFlag,...... https://tos.mx/BjHoijL

⚠ edited by moderator. Shared media blocked. **Images, Videos, Media content from commercial websites can NOT be shared on this forum. The Internet is not in and of itself public domain. Most commercial material is protected by copyright.You can edit your post and provide a link to a commercial website but you can't share their images.

Does it work for you ?

T

Thomas

Guest

CRVS was the only chart that came up,....very restrictive scan but the pattern is perfect.....the above scan does not return anything,

Does it work for you ?

try changing to last price more than 30.00.CRVS was the only chart that came up,....very restrictive scan but the pattern is perfect.....

Am not able to find any alert , can we relax it abit and get some more alerts ?

T

Thomas

Guest

Yes, that is the reason the post to play with it. After lunch was a suggestion to run the scan.....so

play as the pattern is perfect flag....things just need to workout in the market.

play as the pattern is perfect flag....things just need to workout in the market.

Best flags I've seen yet Thomas. This is the one I'll be using.Yes, that is the reason the post to play with it. After lunch was a suggestion to run the scan.....so

play as the pattern is perfect flag....things just need to workout in the market.

The way I use it is to combine day, week, and month into one scan.

Cheers and thank you!

T

Thomas

Guest

Column,... https://tos.mx/2FRXxT1Best flags I've seen yet Thomas. This is the one I'll be using.

The way I use it is to combine day, week, and month into one scan.

Cheers and thank you!

Scan,.... https://tos.mx/mvt5aMJ

2day 1minute chart,...market cap set higher to find lowfloat to mid-cap....

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| C | Bull Bear Power VOID Oscillator For ThinkOrSwim | Indicators | 21 | |

| M | Automatic patterns studies, Bull, Bear, Bullish only & Bearish only For ThinkOrSwim | Indicators | 8 | |

| P | High Tight Flag Scanner (Leif Soreide) For ThinkOrSwim | Indicators | 17 |

Similar threads

-

-

Automatic patterns studies, Bull, Bear, Bullish only & Bearish only For ThinkOrSwim

- Started by mourningwood4521

- Replies: 8

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1399

Online

Similar threads

-

-

Automatic patterns studies, Bull, Bear, Bullish only & Bearish only For ThinkOrSwim

- Started by mourningwood4521

- Replies: 8

-

Similar threads

-

-

Automatic patterns studies, Bull, Bear, Bullish only & Bearish only For ThinkOrSwim

- Started by mourningwood4521

- Replies: 8

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.