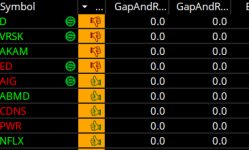

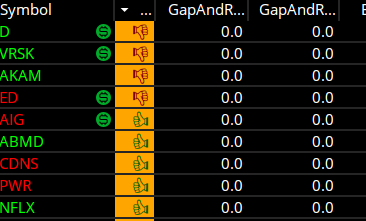

Ken Rose of TD Ameritrade shared a watchlist column that shows potential bull flag and bear flag patterns being formed.

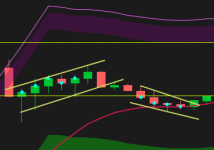

This forum version is modified to also plot bull flag signal and also bear flag signal on your chart.

To trade a flag pattern, wait for the price to break above the flag.

Set a stop loss below the lowest price of the flag.

This forum version is modified to also plot bull flag signal and also bear flag signal on your chart.

To trade a flag pattern, wait for the price to break above the flag.

Set a stop loss below the lowest price of the flag.

Here is the indicator

Shareable link: http://tos.mx/c4jNKVn

Code:

# Follow @KRose_TDA on twitter for updates to this and other scripts

# Thanks to Alan Burch for emoji enhancement

# Thumbs up = potential Bull Flag - Thumbs Down potential bear flag

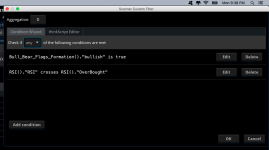

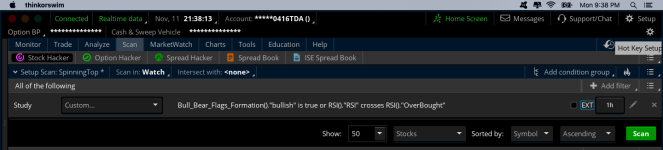

# To use for scan place # signs before 2 Addlabel statements.

# For Bull Flag Scan change "def" before Bulltrigger statement to "plot"

# For Bear Flag scan change "def" before BearTrigger Statement to "Plot"

#Enter desired distance of flag by changing FlagDistance value

def FlagDistance = .75; #Percent of ATR from high/low

##############Bull Flag

def StockPrice = close>=10;

##############ThinkScriptWebcast##################

def FATR = ATR();

def trigATR = (highest(high,5)-close)> (FlagDistance*FATR); #flag slopping down

def PriceSma = close>simpleMovingAvg("length"=30); #Trend still in force

##########################################

def trend = simpleMovingAvg("length"=30)> (simpleMovingAvg("length"=30)[5]);

def MacdLow = macdHistogram(8,17,9)[1]< macdHistogram(8,17,9)[2]and close[1]<close[2];

#def Momentum = macdHistogram(8,17,9) > macdHistogram(8,17,9)[1];

##############Bear Flag

def StockPriceBear = close>=10;

def trendBear = simpleMovingAvg("length"=30)< (simpleMovingAvg("length"=30)[5]);

def MacdHighBear = macdHistogram(8,17,9)[1]> macdHistogram(8,17,9)[2]and close[1]>close[2];

#########################################

##############ThinkScriptWebcast##################

def BFATR = reference ATR();

def BtrigATR = (close-lowest(low,5))> (FlagDistance*FATR); #flag slopping up

def BPriceSma = close<simpleMovingAvg("length"=30); #Trend still in force

##########################################

def Bulltrigger = trend and MacdLow and trigATR and PriceSma;

def BearTrigger = TrendBear and MacdHighBear and BtrigATR and BPriceSma ;

############################################################

#AddLabel(yes, if Bulltrigger then "Bull Flag" else " ",Color.PLUM);

#AddLabel(yes, if Bulltrigger then "Bull Flag" else if BearTrigger then "Bear Flag" else " ",Color.black);

#AssignBackgroundColor(if Bulltrigger then color.YELLOW else if bearTrigger then color.LIGHT_RED else color.WHITE);

# Plot Confirmed Signals

plot bullish = Bulltrigger;

bullish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

bullish.SetDefaultColor(Color.CYAN);

bullish.SetLineWeight(1);

plot bearish = BearTrigger;

bearish.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

bearish.SetDefaultColor(Color.CYAN);

bearish.SetLineWeight(1);Watchlist

Shareable Link: https://tos.mx/6xou4xs

Code:

# Follow @KRose_TDA on twitter for updates to this and other scripts

# Thanks to Alan Burch for emoji enhancement

# Thumbs up = potential Bull Flag - Thumbs Down potential bear flag

# To use for scan place # signs before 2 Addlabel statements.

# For Bull Flag Scan change "def" before Bulltrigger statement to "plot"

# For Bear Flag scan change "def" before BearTrigger Statement to "Plot"

#Enter desired distance of flag by changing FlagDistance value

def FlagDistance = .75; #Percent of ATR from high/low

##############Bull Flag

def StockPrice = close>=10;

##############ThinkScriptWebcast##################

def FATR = ATR();

def trigATR = (highest(high,5)-close)> (FlagDistance*FATR); #flag slopping down

def PriceSma = close>simpleMovingAvg("length"=30); #Trend still in force

##########################################

def trend = simpleMovingAvg("length"=30)> (simpleMovingAvg("length"=30)[5]);

def MacdLow = macdHistogram(8,17,9)[1]< macdHistogram(8,17,9)[2]and close[1]<close[2];

#def Momentum = macdHistogram(8,17,9) > macdHistogram(8,17,9)[1];

##############Bear Flag

def StockPriceBear = close>=10;

def trendBear = simpleMovingAvg("length"=30)< (simpleMovingAvg("length"=30)[5]);

def MacdHighBear = macdHistogram(8,17,9)[1]> macdHistogram(8,17,9)[2]and close[1]>close[2];

#########################################

##############ThinkScriptWebcast##################

def BFATR = reference ATR();

def BtrigATR = (close-lowest(low,5))> (FlagDistance*FATR); #flag slopping up

def BPriceSma = close<simpleMovingAvg("length"=30); #Trend still in force

##########################################

def Bulltrigger = trend and MacdLow and trigATR and PriceSma;

def BearTrigger = TrendBear and MacdHighBear and BtrigATR and BPriceSma ;

AssignBackgroundColor(if Bulltrigger then color.YELLOW else if bearTrigger then color.LIGHT_RED else color.WHITE);

##########################################################

AddLabel(yes, if Bulltrigger then "👍" else if BearTrigger then "👎" else " ", if BearTrigger then Color.dark_red else if Bulltrigger then Color.dark_GREEN else Color.ORANGE);

AssignBackgroundColor(color.light_ORANGE);

############################################################Attachments

Last edited by a moderator: