You should upgrade or use an alternative browser.

High Tight Flag Scanner (Leif Soreide) For ThinkOrSwim

- Thread starter prolab

- Start date

-

- Tags

- candlestick patterns

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

IsItPossible

Member

Hi Everyone!

Leif Soreide posted his HTF scan for free but this is only for StockCharts.com. Can anyone please transcribe it to TOS or is there a post for it where someone else did it?

# High Tight Flag

#Copy Paste into custom scan window

#Slope of 200 SMA 10 days apart > 0

(SimpleMovingAvg(length = 200)-SimpleMovingAvg(length = 200)[10])/10 > 0

and

# Volume moderation

# Slope of 50 SMA Volume 10 days apart < 0

(SimpleMovingAvg(length = 50, price = VOLUME)-SimpleMovingAvg(length = 50, price = VOLUME)[10])/10 < 0

and

# Close > 50 SMA and 50 SMA > 200 SMA

SimpleMovingAvg("length" = 50)."SMA" is less than or equal to close and SimpleMovingAvg("length" = 200)."SMA" is less than or equal to close and SimpleMovingAvg("length" = 50)."SMA" is greater than or equal to SimpleMovingAvg("length" = 200)."SMA"

and

# Price change over 60 bars is atleast 50%

Close / Close[60] > 1.5

and

# limits results to tighter stop location

ATR() / close < 0.08

and

# Volatility moderation

# Slope of ATR14 10 days apart < 0

(ATR()-ATR()[10])/10 < 0

and

# 8 week price change is greater than 90%

close > Close[40] * 1.9Thank you for doing this! Could you mind sharing the Tos.mx link? For some reason I am unable to import it to the TOS scanner manually. Thanks again!Here you go:

# High Tight Flag

#

#Copy Paste into custom scan window

#Slope of 200 SMA 10 days apart > 0

(SimpleMovingAvg(length = 200)-SimpleMovingAvg(length = 200)[10])/10 > 0

and

# Volume moderation

# Slope of 50 SMA Volume 10 days apart < 0

(SimpleMovingAvg(length = 50, price = VOLUME)-SimpleMovingAvg(length = 50, price = VOLUME)[10])/10 < 0

and

# Close > 50 SMA and 50 SMA > 200 SMA

SimpleMovingAvg("length" = 50)."SMA" is less than or equal to close and SimpleMovingAvg("length" = 200)."SMA" is less than or equal to close and SimpleMovingAvg("length" = 50)."SMA" is greater than or equal to SimpleMovingAvg("length" = 200)."SMA"

and

# Price change over 60 bars is atleast 50%

Close / Close[60] > 1.5

and

# limits results to tighter stop location

ATR() / close < 0.08

and

# Volatility moderation

# Slope of ATR14 10 days apart < 0

(ATR()-ATR()[10])/10 < 0

and

# 8 week price change is greater than 90%

close > Close[40] * 1.9

Thank you for doing this! Could you mind sharing the Tos.mx link? For some reason I am unable to import it to the TOS scanner manually. Thanks again!

Here ya go.

https://tos.mx/L7zBBgS

I tried running this with tabs extended hours (5m) & Daily tab, nothing is coming up. Unless is this specifically used for active live searches?

IsItPossible

Member

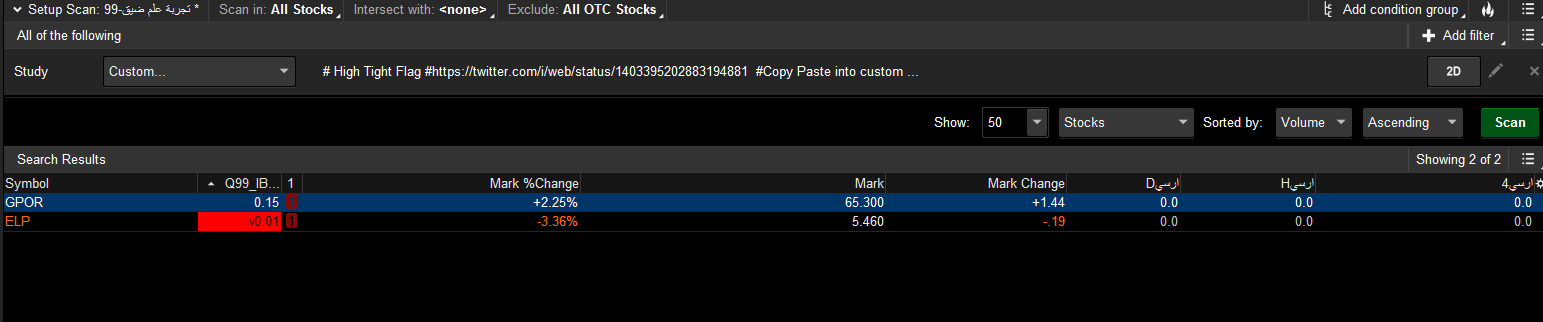

Works fine on daily check below results for today: GPOR, JILL, HITIHere ya go.

https://tos.mx/L7zBBgS

I tried running this with tabs extended hours (5m) & Daily tab, nothing is coming up. Unless is this specifically used for active live searches?

and also works on weekly. Ideally the scan should work on all time frames but might require some tweaks for intraday.

gravityflyer

New member

Agreed. HTFs are a rare but powerful formation. While the current script for the scanner appears decent, it is missing some strong HTFs that are currently forming, most notably AMC.I urge anyone who finds interest in this scan to improve it, optimize it, backtest it,.... this is the most successful pattern

according to the Bukowski studies that you can use. It will work until it's flooded with users, but implement

it early into your education and become an expert....

Thomas

Guest

Many choices are made eyeballing charts with strong momentum scans....Agreed. HTFs are a rare but powerful formation. While the current script for the scanner appears decent, it is missing some strong HTFs that are currently forming, most notably AMC.

Here ya go.

https://tos.mx/L7zBBgS

I tried running this with tabs extended hours (5m) & Daily tab, nothing is coming up. Unless is this specifically used for active live searches?

Did anyone try this? I did, but no results returned, don't know why.

Thomas

Guest

Maybe not many set ups exist, but when they do....readyDid anyone try this? I did, but no results returned, don't know why.

This was back in the 1990s. The high tight flag doesn't work like it used to. Like you said, it was flooded with too many people and stopped working. It is currently rank 43.I urge anyone who finds interest in this scan to improve it, optimize it, backtest it,.... this is the most successful pattern

according to the Bukowski studies that you can use. It will work until it's flooded with users, but implement

it early into your education and become an expert....

I would. It might work 20-30% of the time, so the only way you aren't going to lose huge amounts of money is if you have a stop that you follow no matter what, and you keep trying through taking losses 70%+ of the time.Thank you, let's throw that one away..

bottomphishing

New member

yes 2day

Attachments

Similar threads

-

Previous Day High/Low/Close + Premarket High/Low + High/Low/Open of Day + ATR Lines for ThinkorSwim

- Started by Wiinii

- Replies: 106

-

-

-

-

Previous Days High, Low, Open, Close, and High/Low of defined timeframe For ThinkOrSwim

- Started by Svanoy

- Replies: 46

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

Previous Day High/Low/Close + Premarket High/Low + High/Low/Open of Day + ATR Lines for ThinkorSwim

- Started by Wiinii

- Replies: 106

-

-

-

-

Previous Days High, Low, Open, Close, and High/Low of defined timeframe For ThinkOrSwim

- Started by Svanoy

- Replies: 46

Similar threads

-

Previous Day High/Low/Close + Premarket High/Low + High/Low/Open of Day + ATR Lines for ThinkorSwim

- Started by Wiinii

- Replies: 106

-

-

-

-

Previous Days High, Low, Open, Close, and High/Low of defined timeframe For ThinkOrSwim

- Started by Svanoy

- Replies: 46

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/