Mobius Projection Pivots For ThinkOrSwim

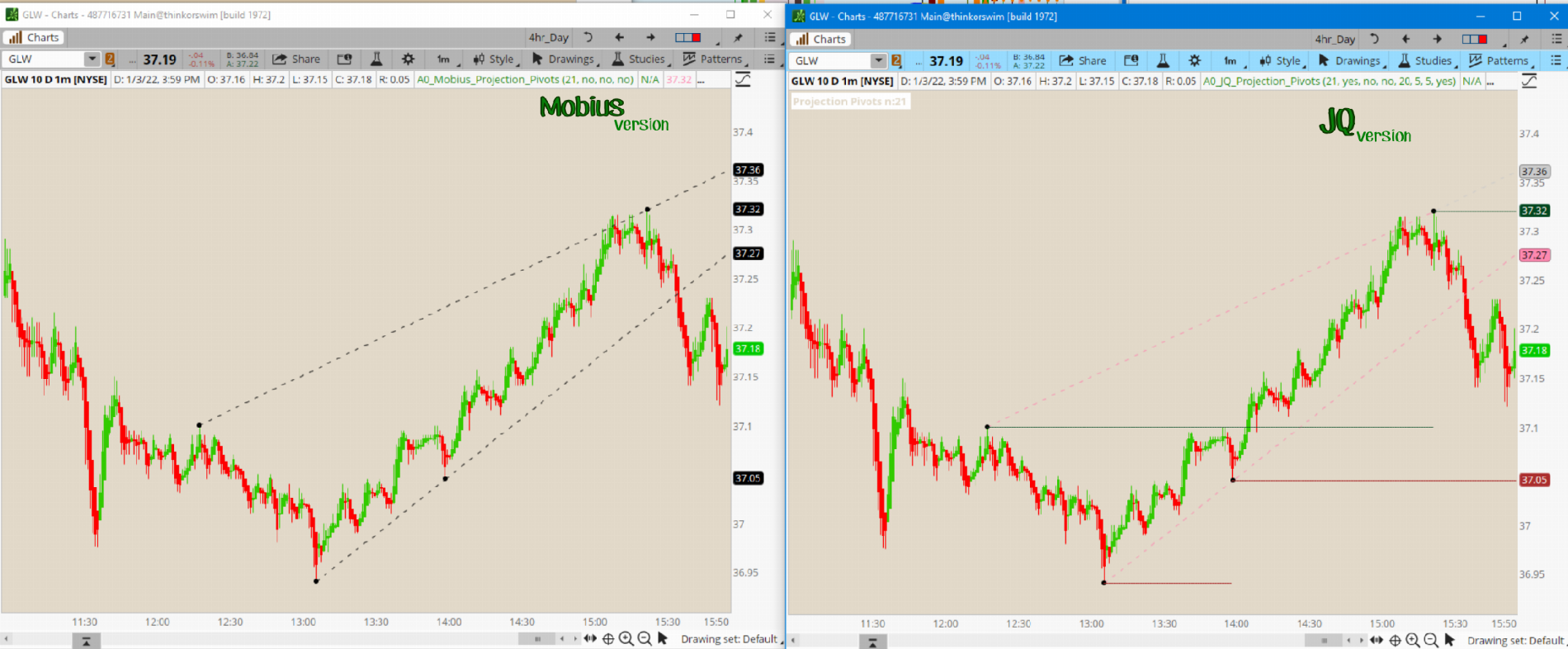

This was a poster request. Mobius Project Pivots is the same script as found in the top post (and as shown in image2) with less plots.

The code for the 1st image is directly below. The code for the JQ version is in the top post.

Shared Chart link: http://tos.mx/BFx7MRL Click here for --> Easiest way to load shared links

This was a poster request. Mobius Project Pivots is the same script as found in the top post (and as shown in image2) with less plots.

read more here: https://www.investopedia.com/trading/using-pivot-points-for-predictions/Pivot points are used by traders in equity and commodity exchanges. They're calculated based on the high, low, and closing prices of previous trading sessions, and they're used to predict support and resistance levels in the current or upcoming session. These support and resistance levels can be used by traders to determine entry and exit points, both for stop-losses and profit taking. ~Investopedia

The code for the 1st image is directly below. The code for the JQ version is in the top post.

Shared Chart link: http://tos.mx/BFx7MRL Click here for --> Easiest way to load shared links

Ruby:

# V01.08.2012 Projection Pivots

# mobius

# 10.06.2016 Altered the fold expression relacing the index variable with -1

input n = 13;

input showLines = no;

input showValues = no;

input showBarNumbers = no;

def h = high;

def l = low;

def bar = barNumber();

def PH;

def PL;

def hh = fold i = 1 to n + 1

with p = 1

while p

do h > getValue(h, -i);

PH = if (bar > n and

h == highest(h, n) and

hh)

then h

else double.NaN;

def ll = fold j = 1 to n + 1

with q = 1

while q

do l < getValue(l, -j);

PL = if (bar > n and

l == lowest(l, n) and

ll)

then l

else double.NaN;

def PHBar = if !isNaN(PH)

then bar

else PHBar[1];

def PLBar = if !isNaN(PL)

then bar

else PLBar[1];

def PHL = if !isNaN(PH)

then PH

else PHL[1];

def priorPHBar = if PHL != PHL[1]

then PHBar[1]

else priorPHBar[1];

def PLL = if !isNaN(PL)

then PL

else PLL[1];

def priorPLBar = if PLL != PLL[1]

then PLBar[1]

else priorPLBar[1];

def HighPivots = bar >= highestAll(priorPHBar);

def LowPivots = bar >= highestAll(priorPLBar);

def FirstRpoint = if HighPivots

then bar - PHBar

else 0;

def PriorRpoint = if HighPivots

then bar - PriorPHBar

else 0;

def RSlope = (getvalue(PH, FirstRpoint) - getvalue(PH, PriorRpoint))

/ (PHBar - PriorPHBar);

def FirstSpoint = if LowPivots

then bar - PLBar

else 0;

def PriorSpoint = if LowPivots

then bar - PriorPLBar

else 0;

def SSlope = (getvalue(PL, FirstSpoint) - getvalue(PL, PriorSpoint))

/ (PLBar - PriorPLBar);

def RExtend = if bar == highestall(PHBar)

then 1

else RExtend[1];

def SExtend = if bar == highestall(PLBar)

then 1

else SExtend[1];

plot pivotHigh = if HighPivots

then PH

else double.NaN;

pivotHigh.SetDefaultColor(GetColor(1));

pivotHigh.setPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

pivotHigh.setHiding(!showValues);

plot pivotHighLine = if PHL > 0 and

HighPivots

then PHL

else double.NaN;

pivotHighLine.SetPaintingStrategy(PaintingStrategy.DASHES);

pivotHighLine.setHiding(!showLines);

plot RLine = pivotHigh;

RLine.enableApproximation();

RLine.SetDefaultColor(GetColor(7));

RLine.SetStyle(Curve.Short_DASH);

plot RExtension = if RExtend

then (bar - PHBar) * RSlope + PHL

else double.NaN;

RExtension.SetStyle(Curve.Short_DASH);

RExtension.SetDefaultColor(GetColor(7));

plot pivotLow = if LowPivots

then PL

else double.NaN;

pivotLow.setDefaultColor(GetColor(4));

pivotLow.setPaintingStrategy(PaintingStrategy.VALUES_BELOW);

pivotLow.setHiding(!showValues);

plot pivotLowLine = if PLL > 0 and

LowPivots

then PLL

else double.NaN;

pivotLowLine.SetPaintingStrategy(PaintingStrategy.DASHES);

pivotLowLine.setHiding(!showLines);

plot SupportLine = pivotLow;

SupportLine.enableApproximation();

SupportLine.SetDefaultColor(GetColor(7));

SUpportLine.SetStyle(Curve.Short_DASH);

plot SupportExtension = if SExtend

then (bar - PLBar) * SSlope + PLL

else double.NaN;

SupportExtension.SetDefaultColor(GetColor(7));

SupportExtension.SetStyle(Curve.Short_DASH);

plot BN = bar;

BN.SetDefaultColor(GetColor(0));

BN.setHiding(!showBarNumbers);

BN.SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

plot PivotDot = if !isNaN(pivotHigh)

then pivotHigh

else if !isNaN(pivotLow)

then pivotLow

else double.NaN;

pivotDot.SetDefaultColor(GetColor(7));

pivotDot.SetPaintingStrategy(PaintingStrategy.POINTS);

pivotDot.SetLineWeight(3);

# End Code Projection PivotsHi Ben/Team, Where can I find the original Mobius algorithm for this? I want to develop a python script for this. Thank you!

Last edited: