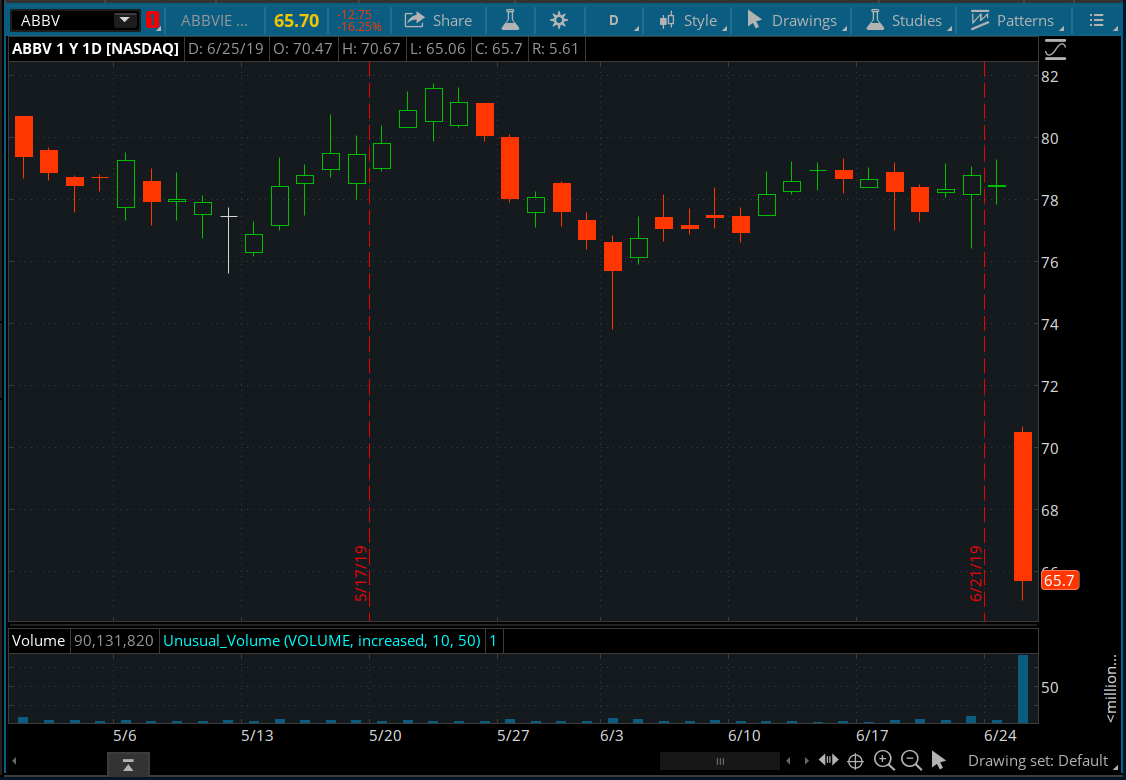

Here is a scanner that will help you screen for stocks with unusual volume in ThinkorSwim. When a stock suddenly increased or decreased in trading volume, that means it's being traded at an unexpectedly high level and a lot of traders often take advantage of this.

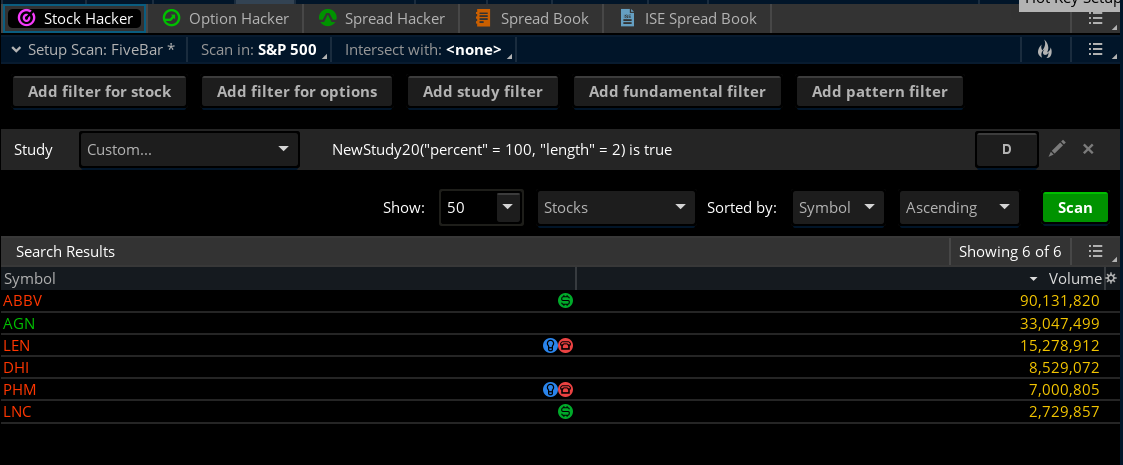

Create a new indicator in ThinkorSwim and import this code. You can add it to your chart but it won't do anything to it. Switch over to the Scan tab and look up the name of your indicator. From there you can scan for stocks that are increasing or decreasing in trading volume. You can also adjust the percentage (%) and length.

Credit

Create a new indicator in ThinkorSwim and import this code. You can add it to your chart but it won't do anything to it. Switch over to the Scan tab and look up the name of your indicator. From there you can scan for stocks that are increasing or decreasing in trading volume. You can also adjust the percentage (%) and length.

thinkScript Code

Code:

# UNUSUALVOLUME

# DREWGRIFFITH15 (C) 2014

input price = volume;

input choice = {default increased, decreased};

input percent = 10;

input length = 50;

def avg = average(price, length)[1];

def chg = 100 * (price/avg -1);

plot scan;

switch (choice) {

case increased:

scan = chg >= percent;

case decreased:

scan = chg <= -percent;

}Shareable Link

https://tos.mx/msxN1ZCredit

- hwrdprkns