T

Thomas

Guest

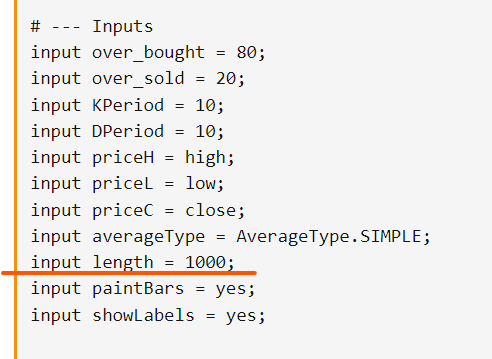

HELP,...what I don't understand is this count???? What are correct settings?

Last edited by a moderator:

You'll want to lower this to near 400 if you are using Daily chart or increase the amount of time you have loaded on the chart. Just needs enough data to do the calculation.HELP,...what I don't understand is this count???? What are correct settings?

OK, I dropped it to 126, I assume these are lookback bars,.....I honestly don't trade the signals, price only, but interesting to have this pop up at same instant....there are far more signals on daily chart than previously....very good, clear signals.....You'll want to lower this to near 400 if you are using Daily chart or increase the amount of time you have loaded on the chart. Just needs enough data to do the calculation.

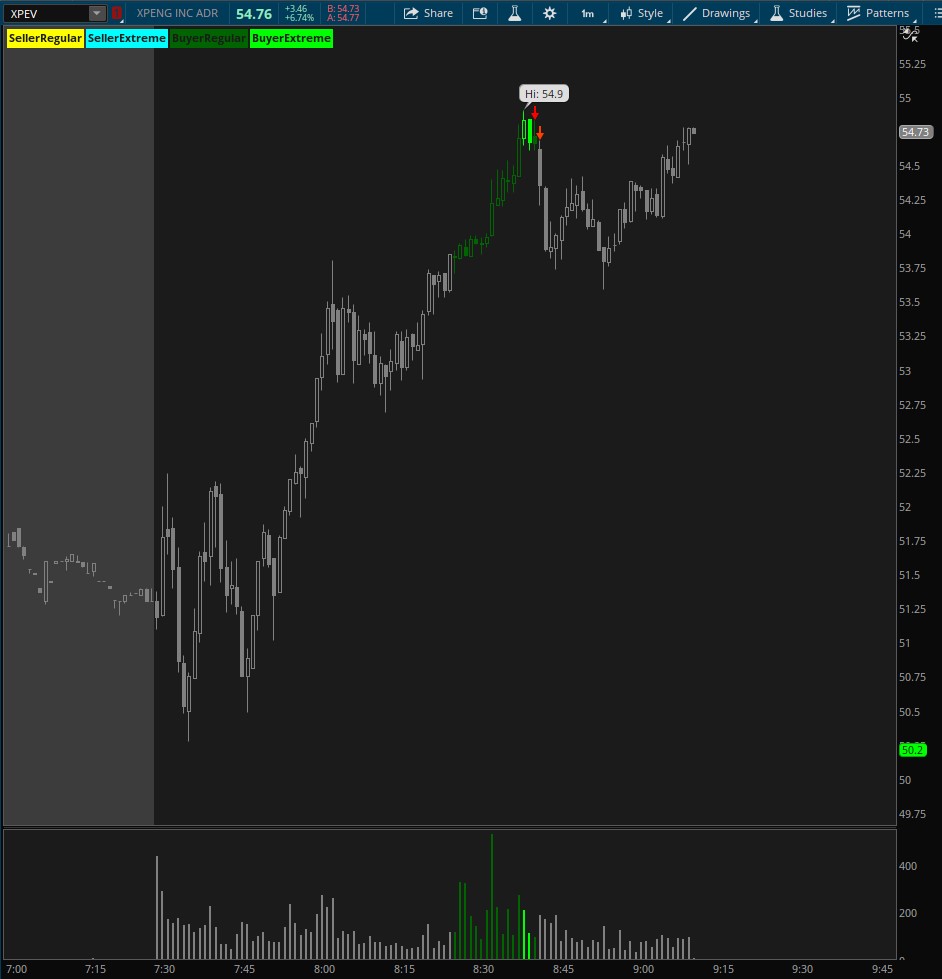

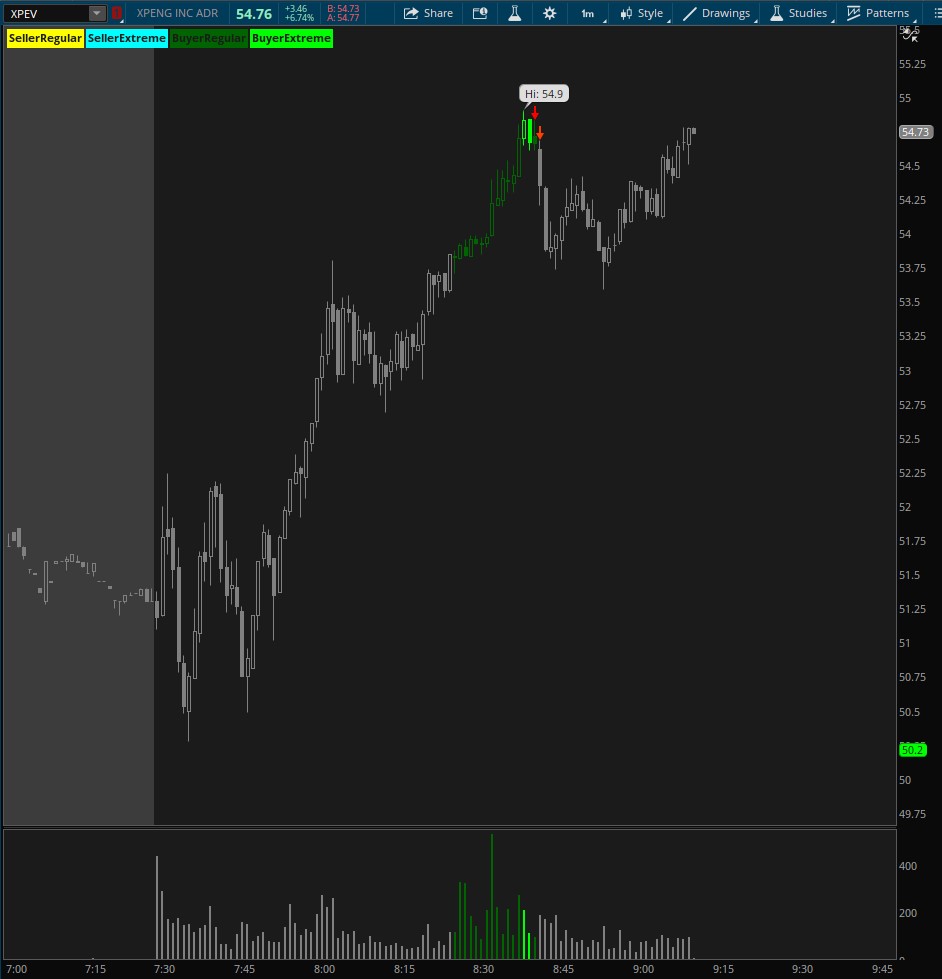

What timeframe do you typically use?Awesome indicator @Chence27 .... Have been using this for few weeks now. Great reliable signals.... Many thanks for sharing. Wishing you greater success....

I generally use 15M, 1H, and 1D.... 15m primarily for entry exit guidanceWhat timeframe do you typically use?

Thanks! I will have to zoom out a bit and try.. typically I use it on the 5 minute chart and I get a ton of signals.. I will try it on 15M/1H. Thank you!I generally use 15M, 1H, and 1D.... 15m primarily for entry exit guidance

I think that is more or less a given.... shorter time frame -> more signals/shorter term reliability .... Longer time frame -> fewer signals/comparatively longer term reliability....Thanks! I will have to zoom out a bit and try.. typically I use it on the 5 minute chart and I get a ton of signals.. I will try it on 15M/1H. Thank you!

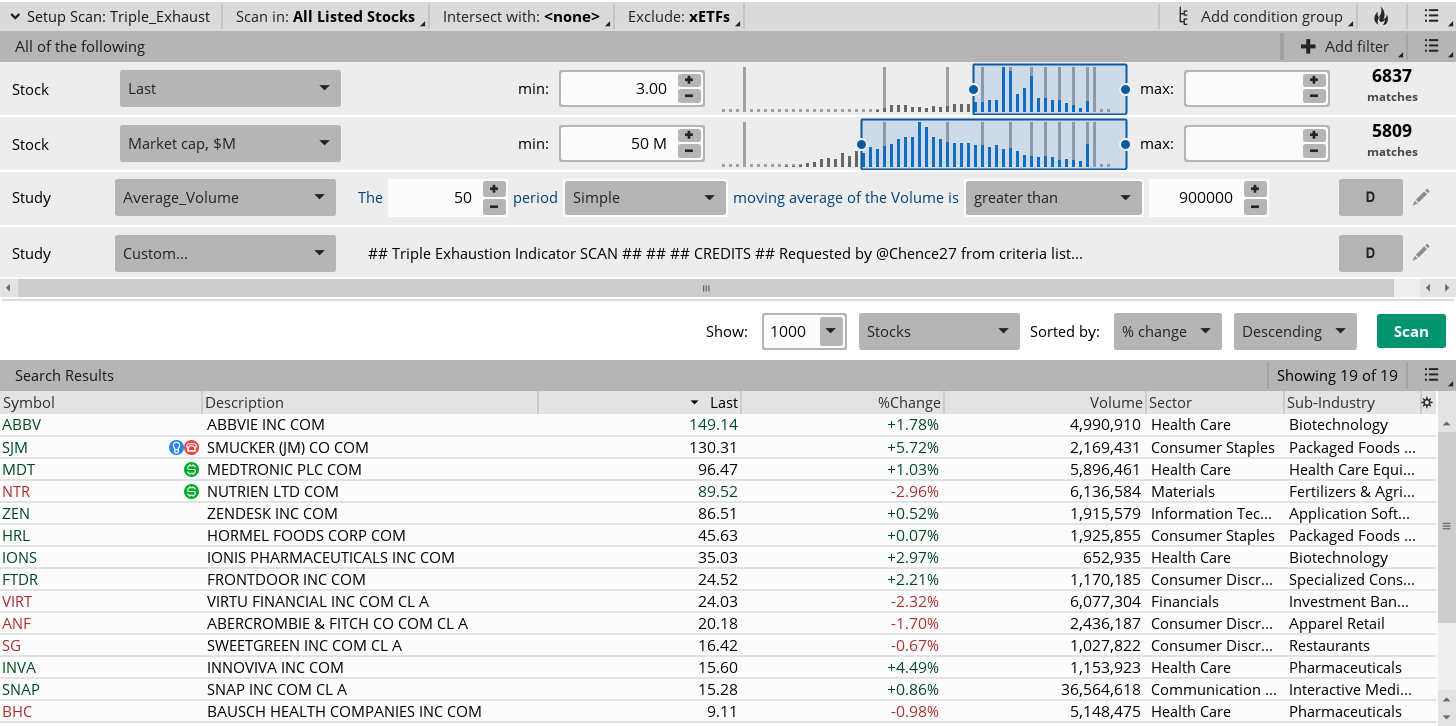

How do I get this scan to include the last 5 bars?Check to see if all criteria was coded as you indicated. Hopefully this is what you were looking for.

Triple Exhaustion Indicator

Ruby:## Triple Exhaustion Indicator ## ## ## CREDITS ## Requested by @Chence27 from criteria listed here https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## ## ## Removing the header Credit credits and description is not permitted, any modification needs to be shared. ## ## V 1.0 : @cos251 - Initial release per request from www.usethinkscript.com forum thread: ## : https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## ## ## declare upper; # --- Inputs input over_bought = 80; input over_sold = 20; input KPeriod = 10; input DPeriod = 10; input priceH = high; input priceL = low; input priceC = close; input averageType = AverageType.SIMPLE; input length = 1000; input paintBars = yes; input showLabels = yes; # --- Indicators - StochasticSlow / MACD / MACD StDev / DMI+/- def SlowK = reference StochasticFull(over_bought, over_sold, KPeriod, DPeriod, priceH, priceL, priceC, 3, averageType).FullK; def MACD = reference MACD()."Value"; def priceMean = Average(MACD, length); def MACD_stdev = (MACD - priceMean) / StDev(MACD, length); def dPlus = reference DMI()."DI+"; def dMinus = reference DMI()."DI-"; # --- End Indicators # --- Conditions def sellerRegular = SlowK < 20 and MACD_stdev < -1 and dPlus < 15; def sellerExtreme = SlowK < 20 and MACD_stdev < -2 and dPlus < 15; def buyerRegular = SlowK > 80 and MACD_stdev > 1 and dMinus < 15; def buyerExtreme = SlowK > 80 and MACD_stdev > 2 and dMinus < 15; # --- End Conditions # -- Price Color AssignPriceColor( if paintBars and sellerExtreme then Color.CYAN else if buyerExtreme and paintBars then Color.GREEN else if paintBars and sellerRegular then Color.YELLOW else if buyerRegular and paintBars then Color.DARK_GREEN else if paintBars then Color.GRAY else Color.Current); # --- Arrows/Triggers plot RegularBuy = if sellerRegular[1] and !sellerRegular then low else Double.NaN; plot ExtremeBuy = if sellerExtreme[1] and !sellerExtreme then low else Double.NaN; RegularBuy.SetPaintingStrategy(PaintingSTrategy.ARROW_UP); ExtremeBuy.SetPaintingSTrategy(paintingSTrategy.Arrow_UP); RegularBuy.SetDefaultColor(Color.LIME); ExtremeBuy.SetDefaultColor(Color.GREEN); plot RegularSell = if buyerRegular[1] and !buyerRegular then high else Double.NaN; plot ExtremeSell = if buyerExtreme[1] and !buyerExtreme then high else Double.NaN; RegularSell.SetPaintingStrategy(PaintingSTrategy.ARROW_Down); ExtremeSell.SetPaintingSTrategy(paintingSTrategy.Arrow_DOWN); RegularSell.SetDefaultColor(Color.Light_RED); ExtremeSell.SetDefaultColor(Color.RED); # --- Labels AddLabel(showLabels,"SellerRegular",Color.YELLOW); AddLabel(showLabels,"SellerExtreme",Color.CYAN); AddLabel(showLabels,"BuyerRegular",Color.DARK_GREEN); AddLabel(showLabels,"BuyerExtreme",Color.GREEN);

Triple Exhaustion Indicator SCAN (Scanner)

Ruby:## Triple Exhaustion Indicator SCAN ## ## ## CREDITS ## Requested by @Chence27 from criteria listed here https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## SCAN requested by @Trader_Andrew ## ## Removing the header Credit credits and description is not permitted, any modification needs to be shared. ## ## V 1.0 : @cos251 - Initial release per request from www.usethinkscript.com forum thread: ## : https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## : SCAN version requested by @Trader_Andrew ## ## ## # --- Inputs input over_bought = 80; input over_sold = 20; input KPeriod = 10; input DPeriod = 10; input priceH = high; input priceL = low; input priceC = close; input averageType = AverageType.SIMPLE; input length = 1000; input paintBars = yes; input showLabels = yes; # --- Indicators - StochasticSlow / MACD / MACD StDev / DMI+/- def SlowK = reference StochasticFull(over_bought, over_sold, KPeriod, DPeriod, priceH, priceL, priceC, 3, averageType).FullK; def MACD = reference MACD()."Value"; def priceMean = Average(MACD, length); def MACD_stdev = (MACD - priceMean) / StDev(MACD, length); def dPlus = reference DMI()."DI+"; def dMinus = reference DMI()."DI-"; # --- End Indicators # --- Conditions def sellerRegular = SlowK < 20 and MACD_stdev < -1 and dPlus < 15; def buyerRegular = SlowK > 80 and MACD_stdev > 1 and dMinus < 15; # --- End Conditions # --- Arrows/Triggers plot RegularBuyArrow = if sellerRegular[1] and !sellerRegular then 1 else Double.NaN; plot RegularSellArrow = if buyerRegular[1] and !buyerRegular then 1 else Double.NaN; plot RegularBuyTrendExists = if sellerRegular then 1 else Double.NaN; plot RegularSellTrendExists = if buyerRegular then 1 else Double.NaN;

Your scanner says error in TOS. Can you instead share study layout...Thank youCheck to see if all criteria was coded as you indicated. Hopefully this is what you were looking for.

Triple Exhaustion Indicator

Ruby:## Triple Exhaustion Indicator ## ## ## CREDITS ## Requested by @Chence27 from criteria listed here https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## ## ## Removing the header Credit credits and description is not permitted, any modification needs to be shared. ## ## V 1.0 : @cos251 - Initial release per request from www.usethinkscript.com forum thread: ## : https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## ## ## declare upper; # --- Inputs input over_bought = 80; input over_sold = 20; input KPeriod = 10; input DPeriod = 10; input priceH = high; input priceL = low; input priceC = close; input averageType = AverageType.SIMPLE; input length = 1000; input paintBars = yes; input showLabels = yes; # --- Indicators - StochasticSlow / MACD / MACD StDev / DMI+/- def SlowK = reference StochasticFull(over_bought, over_sold, KPeriod, DPeriod, priceH, priceL, priceC, 3, averageType).FullK; def MACD = reference MACD()."Value"; def priceMean = Average(MACD, length); def MACD_stdev = (MACD - priceMean) / StDev(MACD, length); def dPlus = reference DMI()."DI+"; def dMinus = reference DMI()."DI-"; # --- End Indicators # --- Conditions def sellerRegular = SlowK < 20 and MACD_stdev < -1 and dPlus < 15; def sellerExtreme = SlowK < 20 and MACD_stdev < -2 and dPlus < 15; def buyerRegular = SlowK > 80 and MACD_stdev > 1 and dMinus < 15; def buyerExtreme = SlowK > 80 and MACD_stdev > 2 and dMinus < 15; # --- End Conditions # -- Price Color AssignPriceColor( if paintBars and sellerExtreme then Color.CYAN else if buyerExtreme and paintBars then Color.GREEN else if paintBars and sellerRegular then Color.YELLOW else if buyerRegular and paintBars then Color.DARK_GREEN else if paintBars then Color.GRAY else Color.Current); # --- Arrows/Triggers plot RegularBuy = if sellerRegular[1] and !sellerRegular then low else Double.NaN; plot ExtremeBuy = if sellerExtreme[1] and !sellerExtreme then low else Double.NaN; RegularBuy.SetPaintingStrategy(PaintingSTrategy.ARROW_UP); ExtremeBuy.SetPaintingSTrategy(paintingSTrategy.Arrow_UP); RegularBuy.SetDefaultColor(Color.LIME); ExtremeBuy.SetDefaultColor(Color.GREEN); plot RegularSell = if buyerRegular[1] and !buyerRegular then high else Double.NaN; plot ExtremeSell = if buyerExtreme[1] and !buyerExtreme then high else Double.NaN; RegularSell.SetPaintingStrategy(PaintingSTrategy.ARROW_Down); ExtremeSell.SetPaintingSTrategy(paintingSTrategy.Arrow_DOWN); RegularSell.SetDefaultColor(Color.Light_RED); ExtremeSell.SetDefaultColor(Color.RED); # --- Labels AddLabel(showLabels,"SellerRegular",Color.YELLOW); AddLabel(showLabels,"SellerExtreme",Color.CYAN); AddLabel(showLabels,"BuyerRegular",Color.DARK_GREEN); AddLabel(showLabels,"BuyerExtreme",Color.GREEN);

Triple Exhaustion Indicator SCAN (Scanner)

Ruby:## Triple Exhaustion Indicator SCAN ## ## ## CREDITS ## Requested by @Chence27 from criteria listed here https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## SCAN requested by @Trader_Andrew ## ## Removing the header Credit credits and description is not permitted, any modification needs to be shared. ## ## V 1.0 : @cos251 - Initial release per request from www.usethinkscript.com forum thread: ## : https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## : SCAN version requested by @Trader_Andrew ## ## ## # --- Inputs input over_bought = 80; input over_sold = 20; input KPeriod = 10; input DPeriod = 10; input priceH = high; input priceL = low; input priceC = close; input averageType = AverageType.SIMPLE; input length = 1000; input paintBars = yes; input showLabels = yes; # --- Indicators - StochasticSlow / MACD / MACD StDev / DMI+/- def SlowK = reference StochasticFull(over_bought, over_sold, KPeriod, DPeriod, priceH, priceL, priceC, 3, averageType).FullK; def MACD = reference MACD()."Value"; def priceMean = Average(MACD, length); def MACD_stdev = (MACD - priceMean) / StDev(MACD, length); def dPlus = reference DMI()."DI+"; def dMinus = reference DMI()."DI-"; # --- End Indicators # --- Conditions def sellerRegular = SlowK < 20 and MACD_stdev < -1 and dPlus < 15; def buyerRegular = SlowK > 80 and MACD_stdev > 1 and dMinus < 15; # --- End Conditions # --- Arrows/Triggers plot RegularBuyArrow = if sellerRegular[1] and !sellerRegular then 1 else Double.NaN; plot RegularSellArrow = if buyerRegular[1] and !buyerRegular then 1 else Double.NaN; plot RegularBuyTrendExists = if sellerRegular then 1 else Double.NaN; plot RegularSellTrendExists = if buyerRegular then 1 else Double.NaN;

Try this.... http://tos.mx/kLqwubSHow do I get this scan to include the last 5 bars?

How do I get this scan to include the last 5 bars?

Edited @Thomas's post to include the last 5 bars:Your scanner says error in TOS. Can you instead share study layout...Thank you

Thank you. I appreciate. Now its working..Edited @Thomas's post to include the last 5 bars:

Shared Scan Link: http://tos.mx/90D5NcI Click here for --> Easiest way to load shared links

https://usethinkscript.com/threads/converting-indicator-to-multi-timeframe-mtf-in-thinkorswim.8050/Can anyone help me add a chart label that displays a secondary higher aggregation and is color coded based on how the candles are painted on that higher timeframe?

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| H | Triple TSI For ThinkOrSwim | Indicators | 12 | |

|

|

Triple 3 Inside Bars Indicator and Scanner for ThinkorSwim | Indicators | 94 | |

|

|

4 & 20 Period Historical Volatility - Reversals and Trend Exhaustion | Indicators | 6 | |

|

|

Leledc Exhaustion Indicator for ThinkorSwim | Indicators | 46 | |

|

|

Trend Exhaustion Indicator for ThinkorSwim | Indicators | 28 |

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.