Hello Benten. Thank you very much for your hard work! I was wondering if there's a way for this scanner to scan within 1 bar instead of 3? Thank you in advance or your reply!@Sohelator Link to import the scanner is in the original thread. Add it.

Once you have it added, switch over to the Scan tab.

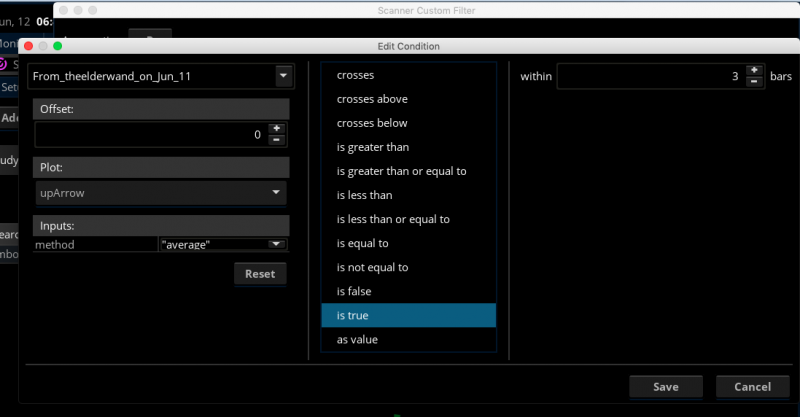

Click on Add Study Filter > Study > type in the name of the indicator > and select upArrow or downArrow.

Like this:

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Repaints

- Status

- Not open for further replies.

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

You literally just click the minus sign where it says 3 bars. Easy peasyHello Benten. Thank you very much for your hard work! I was wondering if there's a way for this scanner to scan within 1 bar instead of 3? Thank you in advance or your reply!

Thank you for your reply. I actually did that but no result came out of the scan. And I also notice that the "within 1 bar" does not appear at all. It seems its only coded to show 3 bars. I may be mistaken. Please help if anyone can explain. Thank you.You literally just click the minus sign where it says 3 bars. Easy peasy

Are you using the condition wizard or the code? If it's the code you just replace "within 3 bars" with "within 1 bars"Thank you for your reply. I actually did that but no result came out of the scan. And I also notice that the "within 1 bar" does not appear at all. It seems its only coded to show 3 bars. I may be mistaken. Please help if anyone can explain. Thank you.

hawkifan1997

New member

hello out there...

has anyone been able to get the scanner going for this indicator that's linked on the first page? i haven't had time to read through the 74 pages of this thread, so apologies if it was raised prior.

link to scanner:

i was able to import, but when creating scanner, the "save" button was still greyed out. thoughts? help?

thanks.

has anyone been able to get the scanner going for this indicator that's linked on the first page? i haven't had time to read through the 74 pages of this thread, so apologies if it was raised prior.

link to scanner:

i was able to import, but when creating scanner, the "save" button was still greyed out. thoughts? help?

thanks.

hello out there...

has anyone been able to get the scanner going for this indicator that's linked on the first page? i haven't had time to read through the 74 pages of this thread, so apologies if it was raised prior.

link to scanner:

i was able to import, but when creating scanner, the "save" button was still greyed out. thoughts? help?

thanks.

Try reading all 74 pages so you have a full overview of the indicator and its shortcomings... Doing your research is part of the overall process... I get that you are new but that's how these forums and most others work... Ask yourself, why would anyone use an indicator they don't fully understand...??? You're going to find you answer, most likely many times, so no need mucking up an already exceedingly long of a topic... Hint...!!! It's long because nobody reads... Don't be "that guy"...

@hawkifan1997 You can try this:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/#post-58238

Scanning with this indicator is problematic. Test out the instructions of some of the posters from the search result using the above link.

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/#post-58238

Scanning with this indicator is problematic. Test out the instructions of some of the posters from the search result using the above link.

hawkifan1997

New member

thanks merryday! appreciate the patience most people have with newbies like me. i didn't realize that search option was even possible so it'll come in handy. thanks again.@hawkifan1997 You can try this:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/#post-58238

Scanning with this indicator is problematic. Test out the instructions of some of the posters from the search result using the above link.

T

Thomas

Guest

I've had on my chart what I named "BillMurray," as it was posted in a share of the same name. This indicator has been on my chart for a year and is extremely accurate. You can use it intraday or as I do, on a daily timeframe. It will pick a bottom, and a top, from the top, getting in as close as possible you can short position until it reaches a bottom and vice versa.....here's a chart on XLE, can't go higher, yes, but the main trend is now down and you can think longer term short until it bottoms with an arrow up. You can use a trendline on line and gives you a great idea of where you are....

hawkifan1997

New member

I've had on my chart what I named "BillMurray," as it was posted in a share of the same name. This indicator has been on my chart for a year and is extremely accurate. You can use it intraday or as I do, on a daily timeframe. It will pick a bottom, and a top, from the top, getting in as close as possible you can short position until it reaches a bottom and vice versa.....here's a chart on XLE, can't go higher, yes, but the main trend is now down and you can think longer term short until it bottoms with an arrow up. You can use a trendline on line and gives you a great idea of where you are....

hi Thomas, I've searched through this whole discussion thread and for the life of me, nothing is popping out at me with regards to the sub chart you have shown. would you be able to help me get my hands on it? I've been working with the original and like it, but would like to try this one... as it's more pleasing to my eye. thanks in advance.

Does anyone know how to replace the reversal bubbles with up/down arrows instead? Not sure if this has been done/asked before but if anyone has done so already can you please post your code? The bubbles tend to get busy if youre looking at like 4 timeframes at once. Thank you.

GoldStriple

Member

Fungus, try this. and then comment out the addchartbubble line

# Buy/Sell Arrows

plot BuySignalArrow = if U1 then revLineBot[-1] else Double.NaN;

BuySignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

BuySignalArrow.SetDefaultColor(color.blue);

BuySignalArrow.SetLineWeight(5);

plot SellSignalArrow = if D1 then revLineTop[-1] else Double.NaN;

SellSignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

SellSignalArrow.SetDefaultColor(color.dark_green);

SellSignalArrow.SetLineWeight(5);

# Buy/Sell Arrows

plot BuySignalArrow = if U1 then revLineBot[-1] else Double.NaN;

BuySignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

BuySignalArrow.SetDefaultColor(color.blue);

BuySignalArrow.SetLineWeight(5);

plot SellSignalArrow = if D1 then revLineTop[-1] else Double.NaN;

SellSignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

SellSignalArrow.SetDefaultColor(color.dark_green);

SellSignalArrow.SetLineWeight(5);

Thanks dude. The issue is there are so many addchartbubble lines I'm not sure which ones I should remove or where. Just all of them?Fungus, try this. and then comment out the addchartbubble line

# Buy/Sell Arrows

plot BuySignalArrow = if U1 then revLineBot[-1] else Double.NaN;

BuySignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

BuySignalArrow.SetDefaultColor(color.blue);

BuySignalArrow.SetLineWeight(5);

plot SellSignalArrow = if D1 then revLineTop[-1] else Double.NaN;

SellSignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

SellSignalArrow.SetDefaultColor(color.dark_green);

SellSignalArrow.SetLineWeight(5);

GoldStriple

Member

the ones like these below.. note - yours might have the word "Reversal .. with + price " i think . I removed that for only a "R:" on my bubble.

AddChartBubble((barnumber and U1), if isUp then low else high, if showarrows and signal > 0 and signal[1] <= 0 then "R:" else "" , if Colorbars == 3 then Color.PLUM else GlobalColor("MyBlue"), no); # Color.UPTICK, no);

AddChartBubble((barnumber and D1), if isUp then low else high, if showarrows and signal < 0 and signal[1] >= 0 then "R:" else "" , if Colorbars == 3 then Color.PLUM else GlobalColor("MyYellow") , yes);#Color.DOWNTICK, yes);

AddChartBubble((barnumber and U1), if isUp then low else high, if showarrows and signal > 0 and signal[1] <= 0 then "R:" else "" , if Colorbars == 3 then Color.PLUM else GlobalColor("MyBlue"), no); # Color.UPTICK, no);

AddChartBubble((barnumber and D1), if isUp then low else high, if showarrows and signal < 0 and signal[1] >= 0 then "R:" else "" , if Colorbars == 3 then Color.PLUM else GlobalColor("MyYellow") , yes);#Color.DOWNTICK, yes);

I did that and while the arrows work most of the time, I referenced this new version without the bubbles with the other version and in some cases the arrows don't show up with the bubbles do:the ones like these below.. note - yours might have the word "Reversal .. with + price " i think . I removed that for only a "R:" on my bubble.

AddChartBubble((barnumber and U1), if isUp then low else high, if showarrows and signal > 0 and signal[1] <= 0 then "R:" else "" , if Colorbars == 3 then Color.PLUM else GlobalColor("MyBlue"), no); # Color.UPTICK, no);

AddChartBubble((barnumber and D1), if isUp then low else high, if showarrows and signal < 0 and signal[1] >= 0 then "R:" else "" , if Colorbars == 3 then Color.PLUM else GlobalColor("MyYellow") , yes);#Color.DOWNTICK, yes);

I think it might be because in some of the addbubble lines there are formulas embedded into them. Not sure though. On the red reversal in the image, the arrow is not covered up by the bubble. I checked for that.

Last edited:

GoldStriple

Member

not sure - you can you post your TR study and and equity and time frame of your chart and I could tinker if you want.

Sure man, here's the chart: https://tos.mx/Dq37Gyonot sure - you can you post your TR study and and equity and time frame of your chart and I could tinker if you want.

So the only studies on there are the "v2" study which is the study without the bubbles, and the original TR. The candle on 6/16/21 2:00PM shows a reversal bubble but no arrow. There are more examples the more you look like 6/14 1:00AM and 6/10 4:45PM

GoldStriple

Member

ok so replace what I gave you earlier with this:

there's already code for arrows but there's an issue with Boolean. and since I don't all that much care to figure that out.. this works instead.

Feel free to change the colors.

def MyUp = signal > 0 and signal[1] <= 0;

def MyDn = signal < 0 and signal[1] >= 0;

plot BuySignalArrow = if MyUp then low else Double.NaN;

BuySignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

BuySignalArrow.SetDefaultColor(color.dark_green);

BuySignalArrow.SetLineWeight(5);

plot SellSignalArrow = if MyDn then high else Double.NaN;

SellSignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

SellSignalArrow.SetDefaultColor(color.dark_red);

SellSignalArrow.SetLineWeight(5);

there's already code for arrows but there's an issue with Boolean. and since I don't all that much care to figure that out.. this works instead.

Feel free to change the colors.

def MyUp = signal > 0 and signal[1] <= 0;

def MyDn = signal < 0 and signal[1] >= 0;

plot BuySignalArrow = if MyUp then low else Double.NaN;

BuySignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

BuySignalArrow.SetDefaultColor(color.dark_green);

BuySignalArrow.SetLineWeight(5);

plot SellSignalArrow = if MyDn then high else Double.NaN;

SellSignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

SellSignalArrow.SetDefaultColor(color.dark_red);

SellSignalArrow.SetLineWeight(5);

Here you go, This script show arrows only.Does anyone know how to replace the reversal bubbles with up/down arrows instead? Not sure if this has been done/asked before but if anyone has done so already can you please post your code? The bubbles tend to get busy if youre looking at like 4 timeframes at once. Thank you.

https://usethinkscript.com/threads/enhanced-trend-reversal-indicator-for-thinkorswim.393/

Awesome man it worked. Thanks a ton!ok so replace what I gave you earlier with this:

there's already code for arrows but there's an issue with Boolean. and since I don't all that much care to figure that out.. this works instead.

Feel free to change the colors.

def MyUp = signal > 0 and signal[1] <= 0;

def MyDn = signal < 0 and signal[1] >= 0;

plot BuySignalArrow = if MyUp then low else Double.NaN;

BuySignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

BuySignalArrow.SetDefaultColor(color.dark_green);

BuySignalArrow.SetLineWeight(5);

plot SellSignalArrow = if MyDn then high else Double.NaN;

SellSignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

SellSignalArrow.SetDefaultColor(color.dark_red);

SellSignalArrow.SetLineWeight(5);

I tried that one before but it wasn't exactly the same was the original TrendReversals, they had differing signals.Here you go, This script show arrows only.

https://usethinkscript.com/threads/enhanced-trend-reversal-indicator-for-thinkorswim.393/

- Status

- Not open for further replies.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Repaints Enhanced Trend Reversal Indicator for ThinkorSwim | Indicators | 125 | |

|

|

Reversal Candles (Saikou / Hikui) Trend Change for ThinkorSwim | Indicators | 10 | |

| C | AGAIG Trend Vertical Line For ThinkOrSwim | Indicators | 11 | |

| D | Trend Trader Buy/Sell Signals For ThinkOrSwim | Indicators | 9 | |

|

|

LNL Trend System for ThinkOrSwim | Indicators | 27 |

Similar threads

-

Repaints Enhanced Trend Reversal Indicator for ThinkorSwim

- Started by BenTen

- Replies: 125

-

Reversal Candles (Saikou / Hikui) Trend Change for ThinkorSwim

- Started by BenTen

- Replies: 10

-

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

2357

Online

Similar threads

-

Repaints Enhanced Trend Reversal Indicator for ThinkorSwim

- Started by BenTen

- Replies: 125

-

Reversal Candles (Saikou / Hikui) Trend Change for ThinkorSwim

- Started by BenTen

- Replies: 10

-

-

-

Similar threads

-

Repaints Enhanced Trend Reversal Indicator for ThinkorSwim

- Started by BenTen

- Replies: 125

-

Reversal Candles (Saikou / Hikui) Trend Change for ThinkorSwim

- Started by BenTen

- Replies: 10

-

-

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.