Hello,

I would really love if someone capable

@BenTen @horserider @BonBon @MerryDay and other coders help in converting this script from tradingview to ToS. I found it very useful and would prefer to have it in ToS so I can create a scan from it.

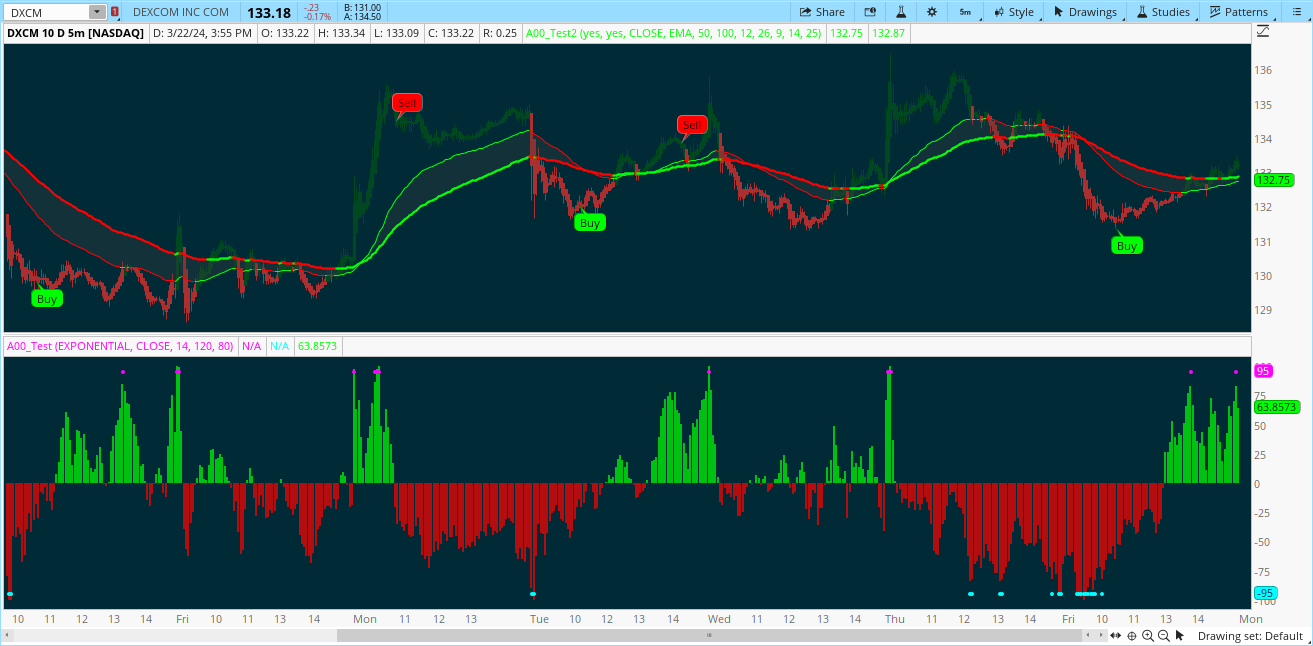

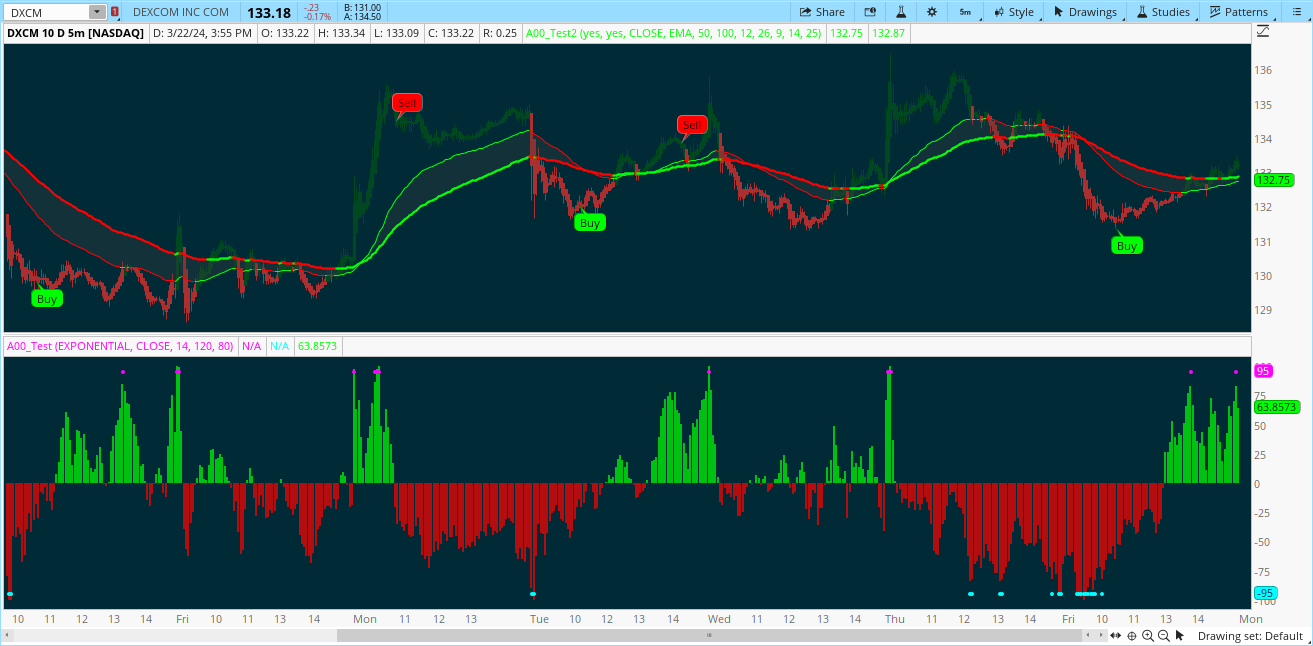

It is a free script in TradingView created by UnknownUnicorn1946597. It gives a buy/sell signal that has worked very well for me.

View attachment 21398

Release Notes

Dec 15, 2020

Trend Trader

The code is open source, what it uses to print signals is MACD cross and ADX. Bar colors change in relation to where price is according to the 50 day MA. The MA ribbon is used for visualizing trend and using it for dynamic support/resistance. The ribbon is comprised of the 50 day and 100 day MAs.

Main reason to publish this script is because some like to jumble up scripts together slap some moving averages on it to "follow trend" and then label it an algorithm, market it and sell it to people online. No single system will work 100% of the time, do you due diligence in anything you are interested in buying. Plenty of free scripts in the TV library that can do you justice when trading.

Dec 30, 2020

Release Notes:

Logic calculation change

Code:

++++++++

///version=4

study("Trend Trader", shorttitle = "TT", overlay = true)

// Inputs

showBuySell = input(defval = true, title="Show Buy/Sell Labels")

//

// Logic ///

fast_length = 12

slow_length = 26

src = close

signal_length = 9

// adx inputs

adxlen = 14

dilen = 14

dirmov(len) =>

up = change(close)

down = -change(close)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = rma(tr, len)

plus = fixnan(100 * rma(plusDM, len) / truerange)

minus = fixnan(100 * rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

sig = adx(dilen, adxlen)

// Plot colors

col_grow_above = #26A69A

col_grow_below = #FFCDD2

col_fall_above = #B2DFDB

col_fall_below = #EF5350

col_macd = #0094ff

col_signal = #ff6a00

// Calculating

fast_ma = ema(src, fast_length)

slow_ma = ema(src, slow_length)

macd = fast_ma - slow_ma

signal = ema(macd, signal_length)

hist = macd - signal

// Check adx

macd_crossup=macd < 0 and crossover(macd, signal)

macd_crossdown=macd > 0 and crossover(signal, macd)

bullish = sig > 25 and macd_crossup

bearish = sig > 25 and macd_crossdown

plotshape(bullish and showBuySell, title="Buy", text="Buy", color=#00FF00, style=shape.labelup, location=location.belowbar, size=size.small, textcolor=#000000, transp = 0) //plot for buy icon

plotshape(bearish and showBuySell, title="Sell", text="Sell", color=#FF0000, style=shape.labeldown, location=location.abovebar, size=size.small, textcolor=#000000, transp = 0) //plot for sell icon

/// Bar color ///

ema1 = 50

shema = true

usedEma = ema(close, ema1)

emaUpColor() => hlc3 >= usedEma

emaDownColor() => hlc3 < usedEma

col = hlc3 >= usedEma ? lime : hlc3 < usedEma ? red : white

barcolor(emaUpColor() ? lime: emaDownColor() ? red : na)

///

/// MA Ribbon ///

pricetype = close

useCurrentRes = true

resC = "W"

res = useCurrentRes ? period : resC

price = security(tickerid, res, pricetype)

// MA period input

shortperiod = 50

longperiod = 100

// MA calculation

smoothinput = 2

short = smoothinput == 1 ? sma(price, shortperiod) :

smoothinput == 2 ? ema(price, shortperiod) :

smoothinput == 3 ? wma(price, shortperiod) :

smoothinput == 4 ? linreg(price, shortperiod,0) :

na

long = smoothinput == 1 ? sma(price, longperiod) :

smoothinput == 2 ? ema(price, longperiod) :

smoothinput == 3 ? wma(price, longperiod) :

smoothinput == 4 ? linreg(price, longperiod,0) :

na

// MA trend direction color

shortcolor = short > short[1] ? lime : short < short[1] ? red : blue

longcolor = long > long[1] ? lime : long < long[1] ? red : blue

// MA output

MA1 = plot(short, title="Short Period", style=linebr, linewidth=2, color=shortcolor)

MA2 = plot(long, title="Long Period", style=linebr, linewidth=4, color=longcolor)

fill(MA1, MA2, color=silver, transp=50)