You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Repaints

- Status

- Not open for further replies.

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

@beardeddonut No.

@Christopher84 We can't help until you post the code in question.

@Sirius747 There are cautions that are listed in the 68 pages of this thread; for instance, this is a repainting indicator, this indicator is too complex for scans and watchlists this indicator should only be used by investors willing to read and educate themselves on the best practices for its use.

The reason why a scanner script that results in errors is posted in this thread is because posters' contributions are not normally deleted on this forum. The responses that follow will usually provide perhaps a correction that works, or in the case of this indicator, explanations for why it doesn't and what others have tried.

This forum is chocked-full of more TOS information than any other site on the internet. There are 100's of indicators which can be combined into profitable strategies but to increase the chances of success, it is imperative to understand how they work, by reading through the entire accompanying thread.

HTH

The reason why a scanner script that results in errors is posted in this thread is because posters' contributions are not normally deleted on this forum. The responses that follow will usually provide perhaps a correction that works, or in the case of this indicator, explanations for why it doesn't and what others have tried.

This forum is chocked-full of more TOS information than any other site on the internet. There are 100's of indicators which can be combined into profitable strategies but to increase the chances of success, it is imperative to understand how they work, by reading through the entire accompanying thread.

HTH

Sirius747

New member

ThanksHave you gotten that code to work...??? Hopefully you'll have better luck with it than I have... I usually just get errors... I've seen where others have gotten results but I never have that I can recall... And I've read all 68 pages... Good luck...

Sirius747

New member

Thanks@Sirius747 There are cautions that are listed in the 68 pages of this thread; for instance, this is a repainting indicator, this indicator is too complex for scans and watchlists this indicator should only be used by investors willing to read and educate themselves on the best practices for its use.

The reason why a scanner script that results in errors is posted in this thread is because posters' contributions are not normally deleted on this forum. The responses that follow will usually provide perhaps a correction that works, or in the case of this indicator, explanations for why it doesn't and what others have tried.

This forum is chocked-full of more TOS information than any other site on the internet. There are 100's of indicators which can be combined into profitable strategies but to increase the chances of success, it is imperative to understand how they work, by reading through the entire accompanying thread.

HTH

@rad14733 thanks. Is there one you might recommend? I've seen in the threads comments about Supertrend or Half Trend. Do these work well?

Well, let me ask what it is that you expect from a trend reversal indicator...??? Are you simply looking for a signal that a reversal is coming, trying to catch the extreme tops and bottoms, or some other purpose... What you use depends on your needs...

I don't rely on trend reversals that try to catch the tops and bottoms because they often don't follow through, which is why most trend reversal scripts repaint, like this one does... It would be far better to rely on a reversal that has or is occurring and has momentum because without momentum a reversal is of little good as far as trades are concerned... Something like a moving average crossover combined with a momentum indicator will yield better results than trying to rely on a trend reversal... Just my two cents... YMMV...

Thanks @rad14733. I mostly swing trade and utilize moving averages with weekly and daily time frames to confirm the overall trend, patterns, etc. and use the 4hr and 1hr time frames for entry points in combination with RSI and volume indicators to identify potential trade opportunities. What am I looking for: it would be nice to just find an indicator which just helps reconfirm that my technical analysis is correct especially on trend reversals.Well, let me ask what it is that you expect from a trend reversal indicator...??? Are you simply looking for a signal that a reversal is coming, trying to catch the extreme tops and bottoms, or some other purpose... What you use depends on your needs...

I don't rely on trend reversals that try to catch the tops and bottoms because they often don't follow through, which is why most trend reversal scripts repaint, like this one does... It would be far better to rely on a reversal that has or is occurring and has momentum because without momentum a reversal is of little good as far as trades are concerned... Something like a moving average crossover combined with a momentum indicator will yield better results than trying to rely on a trend reversal... Just my two cents... YMMV...

Thanks @MerryDay. I just saw the strategies link. Very interesting technique. Thanks for sharing.@Leo1015 I find my lows w/ the Buy The Dip indicator and then wait for the reversal using this strategies.

I am not a scalper. This is a swing trading strategy ONLY. Sometimes, it takes a while for the stock to hit its target.

Last edited:

@Leo1015 You're using the right indicators but I agree that something perhaps and additional indicator might help, but not necessarily a trend reversal like this one... TTM_Squeeze[_Pro], Waddah_Attar_Explosion, Didi_Index, and ErgodicOsc are all indicators that I add into the mix... There are others I'm sure but those show momentum and help enter trades, stay in trades, or exit them, which is why I utilize them...

Thanks @rad14733 for the suggestions. I will check them out. Any indicator that can give us an additional edge versus the market is always welcomed!@Leo1015 You're using the right indicators but I agree that something perhaps and additional indicator might help, but not necessarily a trend reversal like this one... TTM_Squeeze[_Pro], Waddah_Attar_Explosion, Didi_Index, and ErgodicOsc are all indicators that I add into the mix... There are others I'm sure but those show momentum and help enter trades, stay in trades, or exit them, which is why I utilize them...

I would really like to be able to run the following scripts as a custom watchlist. To be able to see the high lo swing along with the 5 min reversal signal. Both being in separate WL columns. I don't know if it's possible to add an alert on either for a WL.

Code:

# Swing High and Swing Low

# tomsk

# 11.18.2019

# As requested by chillc15 I have modified [USER=1174]@RobertPayne[/USER] code to include SwingHigh

# points which are now plotted in CYAN with the swing high points painted in PINK.

# So now you have both swing high and low on your charts

# +------------------------------------------------------------+

# | Example: How to extend levels to the right of the chart |

# | Robert Payne |

# | [URL]https://funwiththinkscript.com[/URL] |

# +------------------------------------------------------------+

# SWING LOW

# define swing low points

input length = 10;

def bn = BarNumber();

def lastBar = HighestAll(if IsNaN(close) then 0 else bn);

def offset = Min(length - 1, lastBar - bn);

def swingLow = low < Lowest(low[1], length - 1) and low == GetValue(Lowest(low, length), -offset);

# identify the very last swing low point

def lowPointOneBarNumber = HighestAll(if swingLow then bn else 0);

def lowPointOneValue = if bn == lowPointOneBarNumber then low else lowPointOneValue[1];

plot low1 = if bn < lowPointOneBarNumber then Double.NaN else lowPointOneValue;

low1.SetDefaultColor(Color.LIGHT_RED);

# identify the 2nd to last swing low point

def lowPointTwoBarNumber = HighestAll(if swingLow and bn < lowPointOneBarNumber then bn else 0);

def lowPointTwoValue = if bn == lowPointTwoBarNumber then low else lowPointTwoValue[1];

plot low2 = if bn < lowPointTwoBarNumber then Double.NaN else lowPointTwoValue;

low2.SetDefaultColor(Color.Light_RED);

# just keep doing ths for as many lines as you want to add to the chart

# identify then 3rd to last swingHigh point low

def lowPointThreeBarNumber = HighestAll(if swingLow and bn < lowPointTwoBarNumber then bn else 0);

def lowPointThreeValue = if bn == lowPointThreeBarNumber then low else lowPointThreeValue[1];

plot low3 = if bn < lowPointThreeBarNumber then Double.NaN else lowPointThreeValue;

low3.SetDefaultColor(Color.Light_RED);

# identify then 4th to last swingHigh point low

def lowPointFourBarNumber = HighestAll(if swingLow and bn < lowPointThreeBarNumber then bn else 0);

def lowPointFourValue = if bn == lowPointFourBarNumber then low else lowPointFourValue[1];

plot low4 = if bn < lowPointFourBarNumber then Double.NaN else lowPointFourValue;

low4.SetDefaultColor(Color.Light_RED);

# identify then 5th to last swingHigh point low

def lowPointFiveBarNumber = HighestAll(if swingLow and bn < lowPointFourBarNumber then bn else 0);

def lowPointFiveValue = if bn == lowPointFiveBarNumber then low else lowPointFiveValue[1];

plot low5 = if bn < lowPointFiveBarNumber then Double.NaN else lowPointFiveValue;

low5.SetDefaultColor(Color.Light_RED);

# identify then 6th to last swingHigh point low

def lowPointSixBarNumber = HighestAll(if swingLow and bn < lowPointFiveBarNumber then bn else 0);

def lowPointSixValue = if bn == lowPointSixBarNumber then low else lowPointSixValue[1];

plot low6 = if bn < lowPointSixBarNumber then Double.NaN else lowPointSixValue;

low6.SetDefaultColor(Color.Light_RED);

# identify then 7th to last swingHigh point low

def lowPointSevenBarNumber = HighestAll(if swingLow and bn < lowPointSixBarNumber then bn else 0);

def lowPointSevenValue = if bn == lowPointSevenBarNumber then low else lowPointSevenValue[1];

plot low7 = if bn < lowPointSevenBarNumber then Double.NaN else lowPointSevenValue;

low7.SetDefaultColor(Color.Light_RED);

# identify then 8th to last swingHigh point low

def lowPointEightBarNumber = HighestAll(if swingLow and bn < lowPointSevenBarNumber then bn else 0);

def lowPointEightValue = if bn == lowPointEightBarNumber then low else lowPointEightValue[1];

plot low8 = if bn < lowPointEightBarNumber then Double.NaN else lowPointEightValue;

low8.SetDefaultColor(Color.Light_RED);

# identify then 9th to last swingHigh point low

def lowPointNineBarNumber = HighestAll(if swingLow and bn < lowPointEightBarNumber then bn else 0);

def lowPointNineValue = if bn == lowPointNineBarNumber then low else lowPointNineValue[1];

plot low9 = if bn < lowPointNineBarNumber then Double.NaN else lowPointNineValue;

low9.SetDefaultColor(Color.Light_RED);

# identify then 10th to last swingHigh point low

def lowPointTenBarNumber = HighestAll(if swingLow and bn < lowPointNineBarNumber then bn else 0);

def lowPointTenValue = if bn == lowPointTenBarNumber then low else lowPointTenValue[1];

plot low10 = if bn < lowPointTenBarNumber then Double.NaN else lowPointTenValue;

low10.SetDefaultColor(Color.Light_RED);

# SWING HIGH

# define swing high points

def swingHigh = high > Highest(high[1], length - 1) and high == GetValue(Highest(high, length), -offset);

# identify the very last swing high point

def highPointOneBarNumber = HighestAll(if swingHigh then bn else 0);

def highPointOneValue = if bn == highPointOneBarNumber then high else highPointOneValue[1];

plot high1 = if bn < highPointOneBarNumber then Double.NaN else highPointOneValue;

high1.SetDefaultColor(Color.CYAN);

# identify the 2nd to last swing high point

def highPointTwoBarNumber = HighestAll(if swingHigh and bn < highPointOneBarNumber then bn else 0);

def highPointTwoValue = if bn == highPointTwoBarNumber then high else highPointTwoValue[1];

plot high2 = if bn < highPointTwoBarNumber then Double.NaN else highPointTwoValue;

high2.SetDefaultColor(Color.CYAN);

# just keep doing ths for as many lines as you want to add to the chart

def highPointThreeBarNumber = HighestAll(if swingHigh and bn < highPointTwoBarNumber then bn else 0);

def highPointThreeValue = if bn == highPointThreeBarNumber then high else highPointThreeValue[1];

plot high3 = if bn < highPointThreeBarNumber then Double.NaN else highPointThreeValue;

high3.SetDefaultColor(Color.CYAN);

def highPointFourBarNumber = HighestAll(if swingHigh and bn < highPointThreeBarNumber then bn else 0);

def highPointFourValue = if bn == highPointFourBarNumber then high else highPointFourValue[1];

plot high4 = if bn < highPointFourBarNumber then Double.NaN else highPointFourValue;

high4.SetDefaultColor(Color.CYAN);

def highPointFiveBarNumber = HighestAll(if swingHigh and bn < highPointFourBarNumber then bn else 0);

def highPointFiveValue = if bn == highPointFiveBarNumber then high else highPointFiveValue[1];

plot high5 = if bn < highPointFiveBarNumber then Double.NaN else highPointFiveValue;

high5.SetDefaultColor(Color.CYAN);

def highPointSixBarNumber = HighestAll(if swingHigh and bn < highPointFiveBarNumber then bn else 0);

def highPointSixValue = if bn == highPointSixBarNumber then high else highPointSixValue[1];

plot high6 = if bn < highPointsixBarNumber then Double.NaN else highPointsixValue;

high6.SetDefaultColor(Color.CYAN);

def highPointSevenBarNumber = HighestAll(if swingHigh and bn < highPointSixBarNumber then bn else 0);

def highPointSevenValue = if bn == highPointSevenBarNumber then high else highPointSevenValue[1];

plot high7 = if bn < highPointSevenBarNumber then Double.NaN else highPointSevenValue;

high7.SetDefaultColor(Color.CYAN);

def highPointEightBarNumber = HighestAll(if swingHigh and bn < highPointSevenBarNumber then bn else 0);

def highPointEightValue = if bn == highPointEightBarNumber then high else highPointEightValue[1];

plot high8 = if bn < highPointEightBarNumber then Double.NaN else highPointEightValue;

high4.SetDefaultColor(Color.CYAN);

def highPointNineBarNumber = HighestAll(if swingHigh and bn < highPointEightBarNumber then bn else 0);

def highPointNineValue = if bn == highPointNineBarNumber then high else highPointNineValue[1];

plot high9 = if bn < highPointNineBarNumber then Double.NaN else highPointNineValue;

high4.SetDefaultColor(Color.CYAN);

def highPointTenBarNumber = HighestAll(if swingHigh and bn < highPointNineBarNumber then bn else 0);

def highPointTenValue = if bn == highPointTenBarNumber then high else highPointTenValue[1];

plot high10 = if bn < highPointTenBarNumber then Double.NaN else highPointTenValue;

high4.SetDefaultColor(Color.CYAN);

# ADJUST CANDLE COLORS

# change candle colors just to make it easier to see what we are working with

AssignPriceColor(if swingLow then Color.cyan else if swingHigh then Color.mageNTA else Color.current);

# End Swing High and Swing Low

def price = close;

def superfast_length = 9;

def fast_length = 14;

def slow_length = 21;

def displace = 0;

def mov_avg9 = ExpAverage(price[-displace], superfast_length);

def mov_avg14 = ExpAverage(price[-displace], fast_length);

def mov_avg21 = ExpAverage(price[-displace], slow_length);

#moving averages

def Superfast = mov_avg9;

def Fast = mov_avg14;

def Slow = mov_avg21;

def buy = mov_avg9 > mov_avg14 and mov_avg14 > mov_avg21 and low > mov_avg9;

def stopbuy = mov_avg9 <= mov_avg14;

def buynow = !buy[1] and buy;

def buysignal = CompoundValue(1, if buynow and !stopbuy then 1 else if buysignal[1] == 1 and stopbuy then 0 else buysignal[1], 0);

def Buy_Signal = buysignal[1] == 0 and buysignal == 1;

Alert(condition = buysignal[1] == 0 and buysignal == 1, text = "Buy Signal", sound = Sound.Bell, "alert type" = Alert.BAR);

def Momentum_Down = buysignal[1] == 1 and buysignal == 0;

Alert(condition = buysignal[1] == 1 and buysignal == 0, text = "Momentum_Down", sound = Sound.Bell, "alert type" = Alert.BAR);

def sell = mov_avg9 < mov_avg14 and mov_avg14 < mov_avg21 and high < mov_avg9;

def stopsell = mov_avg9 >= mov_avg14;

def sellnow = !sell[1] and sell;

def sellsignal = CompoundValue(1, if sellnow and !stopsell then 1 else if sellsignal[1] == 1 and stopsell then 0 else sellsignal[1], 0);

def Sell_Signal = sellsignal[1] == 0 and sellsignal;

Alert(condition = sellsignal[1] == 0 and sellsignal == 1, text = "Sell Signal", sound = Sound.Bell, "alert type" = Alert.BAR);

def Momentum_Up = sellsignal[1] == 1 and sellsignal == 0;

Alert(condition = sellsignal[1] == 1 and sellsignal == 0, text = "Momentum_Up", sound = Sound.Bell, "alert type" = Alert.BAR);

plot Colorbars = if buysignal == 1 then 1 else if sellsignal == 1 then 2 else if buysignal == 0 or sellsignal == 0 then 3 else 0;

#Colorbars.Hide();

#Colorbars.DefineColor("Buy_Signal_Bars", Color.GREEN);

#Colorbars.DefineColor("Sell_Signal_Bars", Color.RED);

#Colorbars.DefineColor("Neutral", Color.PLUM);

#___________________________________________________________________________

input method = {default average, high_low};

def bubbleoffset = .0005;

def percentamount = .01;

def revAmount = .05;

def atrreversal = 2.0;

def atrlength = 5;

def pricehigh = high;

def pricelow = low;

def averagelength = 5;

def averagetype = AverageType.EXPONENTIAL;

def mah = MovingAverage(averagetype, pricehigh, averagelength);

def mal = MovingAverage(averagetype, pricelow, averagelength);

def priceh = if method == method.high_low then pricehigh else mah;

def pricel = if method == method.high_low then pricelow else mal;

def EI = ZigZagHighLow("price h" = priceh, "price l" = pricel, "percentage reversal" = percentamount, "absolute reversal" = revAmount, "atr length" = atrlength, "atr reversal" = atrreversal);

def reversalAmount = if (close * percentamount / 100) > Max(revAmount < atrreversal * reference ATR(atrlength), revAmount) then (close * percentamount / 100) else if revAmount < atrreversal * reference ATR(atrlength) then atrreversal * reference ATR(atrlength) else revAmount;

rec EISave = if !IsNaN(EI) then EI else GetValue(EISave, 1);

def chg = (if EISave == priceh then priceh else pricel) - GetValue(EISave, 1);

def isUp = chg >= 0;

rec isConf = AbsValue(chg) >= reversalAmount or (IsNaN(GetValue(EI, 1)) and GetValue(isConf, 1));

def EId = if isUp then 1 else 0;

#plot EnhancedLines = if EId <= 1 then EI else Double.NaN;

#EnhancedLines.AssignValueColor(if EId == 1 then Color.GREEN else if EId == 0 then Color.RED else Color.DARK_ORANGE);

#EnhancedLines.SetStyle(Curve.FIRM);

#EnhancedLines.EnableApproximation();

#EnhancedLines.HideBubble();

#Price Change between Enhanceds

def xxhigh = if EISave == priceh then priceh else xxhigh[1];

def chghigh = priceh - xxhigh[1];

def xxlow = if EISave == pricel then pricel else xxlow[1];

def chglow = pricel - xxlow[1];

def showBubbleschange = no;

AddChartBubble(showBubbleschange and !IsNaN(EI) and BarNumber() != 1, if isUp then priceh * (1 + bubbleoffset) else pricel * (1 - bubbleoffset) , "$" + chg , if isUp and chghigh > 0 then Color.GREEN else if isUp and chghigh < 0 then Color.RED else if isUp then Color.YELLOW else if !isUp and chglow > 0 then Color.GREEN else if !isUp and chglow < 0 then Color.RED else Color.YELLOW, isUp);

#Price at High/Low

def showBubblesprice = no;

AddChartBubble(showBubblesprice and !IsNaN(EI) and BarNumber() != 1, if isUp then priceh * (1 + bubbleoffset) else pricel * (1 - bubbleoffset) , if isUp then "$" + priceh else "$" + pricel , if isUp and chghigh > 0 then Color.GREEN else if isUp and chghigh < 0 then Color.RED else if isUp then Color.YELLOW else if !isUp and chglow > 0 then Color.GREEN else if !isUp and chglow < 0 then Color.RED else Color.YELLOW, isUp);

#Label for Confirmed/Unconfirmed Status of Current Enhanced

#Bar Count between Enhanceds

rec EIcount = if EISave[1] != EISave then 1 else if EISave[1] == EISave then EIcount[1] + 1 else 0;

def EIcounthilo = if EIcounthilo[1] == 0 and (EISave == priceh or EISave == pricel) then 1 else if EISave == priceh or EISave == pricel then EIcounthilo[1] + 1 else EIcounthilo[1];

def EIhilo = if EISave == priceh or EISave == pricel then EIcounthilo else EIcounthilo + 1;

def EIcounthigh = if EISave == priceh then EIcount[1] else Double.NaN;

def EIcountlow = if EISave == pricel then EIcount[1] else Double.NaN;

def showBubblesbarcount = no;

AddChartBubble(showBubblesbarcount and !IsNaN(EI) and BarNumber() != 1, if isUp then priceh * (1 + bubbleoffset) else pricel * (1 - bubbleoffset) , if EISave == priceh then EIcounthigh else EIcountlow, if isUp and chghigh > 0 then Color.GREEN else if isUp and chghigh < 0 then Color.RED else if isUp then Color.YELLOW else if !isUp and chglow > 0 then Color.GREEN else if !isUp and chglow < 0 then Color.RED else Color.YELLOW, if isUp then yes else no );

#Arrows

def EIL = if !IsNaN(EI) and !isUp then pricel else GetValue(EIL, 1);

def EIH = if !IsNaN(EI) and isUp then priceh else GetValue(EIH, 1);

def dir = CompoundValue(1, if EIL != EIL[1] or pricel == EIL[1] and pricel == EISave then 1 else if EIH != EIH[1] or priceh == EIH[1] and priceh == EISave then -1 else dir[1], 0);

def signal = CompoundValue(1, if dir > 0 and pricel > EIL then if signal[1] <= 0 then 1 else signal[1] else if dir < 0 and priceh < EIH then if signal[1] >= 0 then -1 else signal[1] else signal[1], 0);

def showarrows = yes;

def U1 = showarrows and signal > 0 and signal[1] <= 0;

#U1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

#U1.SetDefaultColor(Color.GREEN);

#U1.SetLineWeight(4);

def D1 = showarrows and signal < 0 and signal[1] >= 0;

#D1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

#D1.SetDefaultColor(Color.RED);

#D1.SetLineWeight(4);

def barnumber = BarNumber()[10];

AddChartBubble((barnumber and U1), if isUp then low else high, if showarrows and signal > 0 and signal[1] <= 0 then "Reversal:" + low else "" , if Colorbars == 3 then Color.PLUM else Color.UPTICK, no);

AddChartBubble((barnumber and D1), if isUp then low else high, if showarrows and signal < 0 and signal[1] >= 0 then "Reversal:" + high else "" , if Colorbars == 3 then Color.PLUM else Color.DOWNTICK, yes);

def revLineTop;

def revLineBot;

if barnumber and D1 {

revLineBot = Double.NaN;

revLineTop = high[1];

} else if barnumber and U1 {

revLineTop = Double.NaN;

revLineBot = low[1];

} else if !IsNaN(revLineBot[1]) and (Colorbars[2] == 2 or Colorbars[1] == 2) {

revLineBot = revLineBot[1];

revLineTop = Double.NaN;

} else if !IsNaN(revLineTop[1]) and (Colorbars[2] == 1 or Colorbars[1] == 1) {

revLineTop = revLineTop[1];

revLineBot = Double.NaN;

} else {

revLineTop = Double.NaN;

revLineBot = Double.NaN;

}

plot botLine = revLineBot[-1];

botLine.SetDefaultColor(Color.LIGHT_GREEN);

plot topLine = revLineTop[-1];

topLine.SetDefaultColor(Color.LIGHT_RED);

#Alerts

def usealerts = yes;

Alert(usealerts and U1, "EI-UP", Alert.BAR, Sound.Bell);

Alert(usealerts and D1, "EI-DOWN", Alert.BAR, Sound.Chimes);

#Supply Demand Areas

rec data1 = CompoundValue(1, if (EISave == priceh or EISave == pricel) then data1[1] + 1 else data1[1], 0);

def datacount1 = (HighestAll(data1) - data1[1]);

def numbersuppdemandtoshow = 0;

input showSupplyDemand = {default Pivot, Arrow, None};

def idx = if showSupplyDemand == showSupplyDemand.Pivot then 1 else 0;

def rLow;

def rHigh;

if signal crosses 0 {

rLow = pricel[idx];

rHigh = priceh[idx];

} else {

rLow = rLow[1];

rHigh = rHigh[1];

}

def HighLine = if datacount1 <= numbersuppdemandtoshow and showSupplyDemand != showSupplyDemand.None and !IsNaN(close) and rHigh != 0 then rHigh else Double.NaN;

def LowLine = if datacount1 <= numbersuppdemandtoshow and showSupplyDemand != showSupplyDemand.None and !IsNaN(close) and rLow != 0 then rLow else Double.NaN;

def hlUp = if signal > 0 then HighLine else Double.NaN;

def hlDn = if signal < 0 then HighLine else Double.NaN;

def showsupplydemandcloud = no;

AddCloud(if showsupplydemandcloud then hlUp else Double.NaN, LowLine, Color.LIGHT_GREEN, Color.LIGHT_GREEN);

AddCloud(if showsupplydemandcloud then hlDn else Double.NaN, LowLine, Color.LIGHT_RED, Color.LIGHT_RED);

#Store Previous Data

def EIsave1 = if !IsNaN(EISave) then EISave else EIsave1[1];

def EIsave2 = EIsave1;

rec priorEI1 = if EIsave2 != EIsave2[1] then EIsave2[1] else priorEI1[1];

rec priorEI2 = if priorEI1 != priorEI1[1] then priorEI1[1] else priorEI2[1];

rec priorEI3 = if priorEI2 != priorEI2[1] then priorEI2[1] else priorEI3[1];

#Fibonacci Extensions

rec data = CompoundValue(1, if (EISave == priceh or EISave == pricel) then data[1] + 1 else data[1], 0);

def datacount = (HighestAll(data) - data[1]);

def numberextfibstoshow = 2;

rec cpo = if dir[1] != dir then 0 else 1;

def showFibExtLines = no;

def showtodayonly = no;

def today = if showtodayonly == yes then GetDay() == GetLastDay() else GetDay();

def extfib1 = if EISave == priceh then priceh - AbsValue(priorEI2 - priorEI1) * 1

else extfib1[1];

def extfib100 = if datacount <= numberextfibstoshow and today and showFibExtLines and !IsNaN(extfib1) and dir < 0 and cpo != 0 then extfib1[1] else Double.NaN;

def extfib1a = if EISave == priceh then priceh - AbsValue(priorEI2 - priorEI1) * 0.382

else extfib1a[1];

def extfib382 = if datacount <= numberextfibstoshow and today and showFibExtLines and !IsNaN(extfib1a) and dir < 0 and cpo != 0 then extfib1a[1] else Double.NaN;

def extfib2 = if EISave == priceh then priceh - AbsValue(priorEI2 - priorEI1) *

0.618 else extfib2[1];

def extfib618 = if datacount <= numberextfibstoshow and today and showFibExtLines and !IsNaN(extfib2) and dir < 0 and cpo != 0 then extfib2[1] else Double.NaN;

def extfib3 = if EISave == priceh then priceh - AbsValue(priorEI2 - priorEI1) *

1.618 else extfib3[1];

def extfib1618 = if datacount <= numberextfibstoshow and today and showFibExtLines and !IsNaN(extfib3) and dir < 0 and cpo != 0 then extfib3[1] else Double.NaN;

def extfib3a = if EISave == priceh then priceh - AbsValue(priorEI2 - priorEI1) *

2.000 else extfib3a[1];

def extfib2000 = if datacount <= numberextfibstoshow and today and showFibExtLines and !IsNaN(extfib3a) and dir < 0 and cpo != 0 then extfib3a[1] else Double.NaN;

def extfib4 = if EISave == priceh then priceh - AbsValue(priorEI2 - priorEI1) *

2.618 else extfib4[1];

def extfib2618 = if datacount <= numberextfibstoshow and today and showFibExtLines and !IsNaN(extfib4) and dir < 0 and cpo != 0 then extfib4[1] else Double.NaN;

def extfib5 = if EISave == priceh then priceh - AbsValue(priorEI2 - priorEI1) *

3.618 else extfib5[1];

def extfib3618 = if datacount <= numberextfibstoshow and today and showFibExtLines and !IsNaN(extfib5) and dir < 0 and cpo != 0 then extfib5[1] else Double.NaN;

def extfib1_ = if EISave == pricel then pricel + AbsValue(priorEI2 - priorEI1) * 1

else extfib1_[1];

def extfib100_ = if datacount <= numberextfibstoshow and today and showFibExtLines and !IsNaN(extfib1_) and dir > 0 and cpo != 0 then extfib1_[1] else Double.NaN;

def extfib1a_ = if EISave == pricel then pricel + AbsValue(priorEI2 - priorEI1) * 0.382

else extfib1a_[1];

def extfib382_ = if datacount <= numberextfibstoshow and today and showFibExtLines and !IsNaN(extfib1a_) and dir > 0 and cpo != 0 then extfib1a_[1] else Double.NaN;

def extfib2_ = if EISave == pricel then pricel + AbsValue(priorEI2 - priorEI1) *

0.618 else extfib2_[1];

def extfib618_ = if datacount <= numberextfibstoshow and today and showFibExtLines and !IsNaN(extfib2_) and dir > 0 and cpo != 0 then extfib2_[1] else Double.NaN;

def extfib3_ = if EISave == pricel then pricel + AbsValue(priorEI2 - priorEI1) *

1.618 else extfib3_[1];

def extfib1618_ = if datacount <= numberextfibstoshow and today and showFibExtLines and !IsNaN(extfib3_) and dir > 0 and cpo != 0 then extfib3_[1] else Double.NaN;

def extfib3a_ = if EISave == pricel then pricel + AbsValue(priorEI2 - priorEI1) *

2.000 else extfib3a_[1];

def extfib2000_ = if datacount <= numberextfibstoshow and today and showFibExtLines and !IsNaN(extfib3a_) and dir > 0 and cpo != 0 then extfib3a_[1] else Double.NaN;

def extfib4_ = if EISave == pricel then pricel + AbsValue(priorEI2 - priorEI1) *

2.618 else extfib4_[1];

def extfib2618_ = if datacount <= numberextfibstoshow and today and showFibExtLines and !IsNaN(extfib4_) and dir > 0 and cpo != 0 then extfib4_[1] else Double.NaN;

def extfib5_ = if EISave == pricel then pricel + AbsValue(priorEI2 - priorEI1) *

3.618 else extfib5_[1];

def extfib3618_ = if datacount <= numberextfibstoshow and today and showFibExtLines and !IsNaN(extfib5_) and dir > 0 and cpo != 0 then extfib5_[1] else Double.NaN;

def fibextbubblespacesinexpansion = 8;

def b = fibextbubblespacesinexpansion;

def direction = if !isUp then 1 else 0;

AddChartBubble( direction[b + 1] == 1 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close), extfib1[b + 2], "100%", Color.RED, no);

AddChartBubble( direction[b + 1] == 1 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close), extfib1a[b + 2], "38.2%", Color.RED, no);

AddChartBubble( direction[b + 1] == 1 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close), extfib2[b + 2], "61.8%", Color.RED, no);

AddChartBubble( direction[b + 1] == 1 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close), extfib3[b + 2], "161.8%", Color.RED, no);

AddChartBubble( direction[b + 1] == 1 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close), extfib3a[b + 2], "200%", Color.RED, no);

AddChartBubble( direction[b + 1] == 1 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close), extfib4[b + 2], "261.8%", Color.RED, no);

AddChartBubble( direction[b + 1] == 1 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close), extfib5[b + 2], "361.8%", Color.RED, no);

AddChartBubble( direction[b + 1] == 0 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close), extfib1_[b + 2], "100%", Color.GREEN, yes);

AddChartBubble( direction[b + 1] == 0 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close), extfib1a_[b + 2], "38.2%", Color.GREEN, yes);

AddChartBubble( direction[b + 1] == 0 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close), extfib2_[b + 2], "61.8%", Color.GREEN, yes);

AddChartBubble( direction[b + 1] == 0 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close), extfib3_[b + 2], "161.8%", Color.GREEN, yes);

AddChartBubble( direction[b + 1] == 0 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close), extfib3a_[b + 2], "200%", Color.GREEN, yes);

AddChartBubble( direction[b + 1] == 0 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close), extfib4_[b + 2], "261.8%", Color.GREEN, yes);

AddChartBubble( direction[b + 1] == 0 and showFibExtLines and !IsNaN(close[b + 1]) and IsNaN(close), extfib5_[b + 2], "361.8%", Color.GREEN, yes);

#Volume at Reversals

def vol = if BarNumber() == 0 then 0 else volume + vol[1];

def vol1 = if BarNumber() == 1 then volume else vol1[1];

def xxvol = if EISave == priceh or EISave == pricel then TotalSum(volume) else xxvol[1];

def chgvol = if xxvol - xxvol[1] + vol1 == vol then vol else xxvol - xxvol[1];

def showBubblesVolume = no;

AddChartBubble(showBubblesVolume and !IsNaN(EI) and BarNumber() != 1, if isUp then priceh * (1 + bubbleoffset) else pricel * (1 - bubbleoffset), chgvol, if isUp and chghigh > 0 then Color.GREEN else if isUp and chghigh < 0 then Color.RED else if isUp then Color.YELLOW else if !isUp and chglow > 0 then Color.GREEN else if !isUp and chglow < 0 then Color.RED else Color.YELLOW, if isUp then yes else no );

input usemanualfibskip = no;#Hint usemanualfibskip: Select no to use preprogrammed fibskip amounts. Select no, to use the amount entered at input fibskip.

input fibskip = .50;#Hint fibskip: Set input usemanualfibskip == yes to use this amount versus preprogrammed amounts. Standard is 1.0. This is percentage difference between fib high and low before a new fib grid created.

def showBubblesfibratio = no;

def showFibLabel = no;#Hint showfibLabel: Select yes to show label of current fib level as of last price

def showfiblines = yes;

def fib1level = .236;

def fib2level = .382;

def fibMlevel = .500;

def fib3level = .618;

def fib4level = .786;

#Fibs

def datacount2 = (HighestAll(data1) - data1[1]);

def numberfibretracementstoshow = 2;

def fibskipit = if usemanualfibskip == no then if close > 800 then .25 else .5 else fibskip;

def EIfibh = if EISave == priceh and AbsValue(EISave - EISave[1]) > priceh * fibskipit * .01 then priceh else EIfibh[1];

def EIfibl = if EISave == pricel and AbsValue(EISave - EISave[1]) > priceh * fibskipit * .01 then pricel else EIfibl[1];

def range = EIfibh - EIfibl;

def fibH = if showfiblines == no then Double.NaN else if datacount2 <= numberfibretracementstoshow then EIfibh else Double.NaN;

def fibL = if showfiblines == no then Double.NaN else if datacount2 <= numberfibretracementstoshow then EIfibl else Double.NaN;

def fibM = if showfiblines == no then Double.NaN else if datacount2 <= numberfibretracementstoshow then EIfibl + range * fibMlevel else Double.NaN;

def fib1 = if showfiblines == no then Double.NaN else if datacount2 <= numberfibretracementstoshow then EIfibl + range * fib1level else Double.NaN;

def fib2 = if showfiblines == no then Double.NaN else if datacount2 <= numberfibretracementstoshow then EIfibl + range * fib2level else Double.NaN;

def fib3 = if showfiblines == no then Double.NaN else if datacount2 <= numberfibretracementstoshow then EIfibl + range * fib3level else Double.NaN;

def fib4 = if showfiblines == no then Double.NaN else if datacount2 <= numberfibretracementstoshow then EIfibl + range * fib4level else Double.NaN;

AddLabel(showFibLabel, Concat( "Current Fib Level ", AsPercent((close - EIfibl) / (range))), if close > EIfibl then Color.GREEN else if EIfibh == close then Color.WHITE else Color.RED);

AddChartBubble(showBubblesfibratio and !IsNaN(EI) and BarNumber() != 1, if isUp then priceh * (1 + bubbleoffset) else pricel * (1 - bubbleoffset) , if isUp then AsPercent((priceh - EIfibl) / (range)) else AsPercent((pricel - EIfibl) / range), if isUp and chghigh > 0 then Color.GREEN else if isUp and chghigh < 0 then Color.RED else if isUp then Color.GREEN else if !isUp and chglow > 0 then Color.GREEN else if !isUp and chglow < 0 then Color.RED else Color.RED, isUp);RockSolid21

New member

I would like to add an alert to this indicator.

I want to scan a specific list of stocks and look for reversal alerts. How would I go about setting this up?

I want to scan a specific list of stocks and look for reversal alerts. How would I go about setting this up?

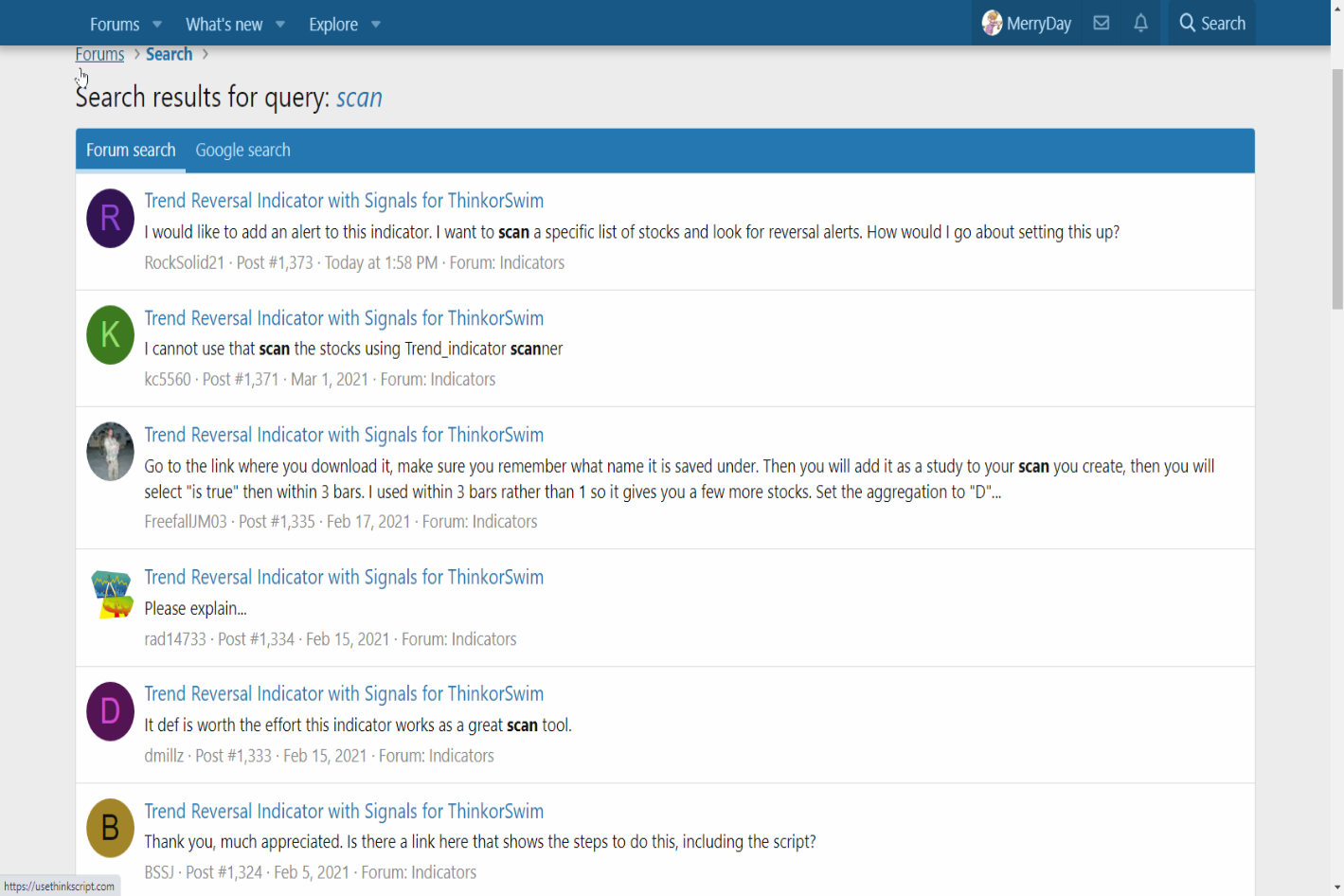

@RockSolid21

There are over 200 answers in this thread to your question. To find them:

per @rad14733

Goto the Search feature in the upper right corner of the page... Enter the term "scan", select "This thread" from the dropdown on the right where it is defaulted to "Everywhere", and press Enter or click on the word "Search"... You'll get a list of posts in this topic that contain the word "scan"... I bet you'll find your answer... If you press the "G" part of the "Search" button you'll get an even longer list of Google Search results, so start with the standard "Search" first and if you're not satisfied then try the "G"... Get the feel for it because you'll be using it a lot...

Come on back here, If you have a specific question after following the directions about how to set up your scan and watchlist. Attach a screenshot so we can help troubleshoot your issue.

HTH

There are over 200 answers in this thread to your question. To find them:

per @rad14733

Goto the Search feature in the upper right corner of the page... Enter the term "scan", select "This thread" from the dropdown on the right where it is defaulted to "Everywhere", and press Enter or click on the word "Search"... You'll get a list of posts in this topic that contain the word "scan"... I bet you'll find your answer... If you press the "G" part of the "Search" button you'll get an even longer list of Google Search results, so start with the standard "Search" first and if you're not satisfied then try the "G"... Get the feel for it because you'll be using it a lot...

Come on back here, If you have a specific question after following the directions about how to set up your scan and watchlist. Attach a screenshot so we can help troubleshoot your issue.

HTH

RockSolid21

New member

Thank you so very much!!@RockSolid21

There are over 200 answers in this thread to your question. To find them:

per @rad14733

Goto the Search feature in the upper right corner of the page... Enter the term "scan", select "This thread" from the dropdown on the right where it is defaulted to "Everywhere", and press Enter or click on the word "Search"... You'll get a list of posts in this topic that contain the word "scan"... I bet you'll find your answer... If you press the "G" part of the "Search" button you'll get an even longer list of Google Search results, so start with the standard "Search" first and if you're not satisfied then try the "G"... Get the feel for it because you'll be using it a lot...

Come on back here, If you have a specific question after following the directions about how to set up your scan and watchlist. Attach a screenshot so we can help troubleshoot your issue.

HTH

@Marvin187 @barbaros .. Thanks for posting this auto bot stuff. I know it is an old thread and you may have solved it... would it be possible to you to post the updated script ( to run this in a loop).. TIA@MerryDay I reached out to @BenTen and he asked me to post the request on the forum. I know is not a perfect system and it repaints. Just need help with the details of the code to get it working per my description. If anyone is able to help with the code I will appreciate it. Below is the idea of the code and what I would like for it to do.

I am using the Trend Reversal Indicator as a trading strategy for an auto trading robot for TOS (BETA PAPER TRADING). The Robot takes signals from the Labels and Alert notifications to execute trades. What I need help with is to make sure the Robot enters the trade on “Buy” signals and closes the trade on “Sell” signal ( I am able to get this part done perfectly). What is giving trouble is adding a delay of 3-5 seconds for robot to reset and start scanning to enter “Short”. This needs to be accomplished via the Labels and Alert notifications. I also have a Stop-Loss incorporated in the study and need that working on a switch basis. Need to alert based on CASE 1 “LONG” or CASE 2 “SHORT” on a trade.

Below is the coded strategy (work in progress).

Code:#Date: Dec-13-2020 #TrendReversal Version 2.1 #Updated # Removed fibs # Changed bubbles from Reversal to BUY and SELL # Added Tradesize and Order Entry ### TradeSIZE Size input TRADESIZE = 100; ### EXIT BAD input stop = 20; input offsetType = {default tick, percent, value}; def price = close; def superfast_length = 9; def fast_length = 14; def slow_length = 21; def displace = 0; def mov_avg9 = ExpAverage(price[-displace], superfast_length); def mov_avg14 = ExpAverage(price[-displace], fast_length); def mov_avg21 = ExpAverage(price[-displace], slow_length); #moving averages def Superfast = mov_avg9; def Fast = mov_avg14; def Slow = mov_avg21; def buy = mov_avg9 > mov_avg14 and mov_avg14 > mov_avg21 and low > mov_avg9; def stopbuy = mov_avg9 <= mov_avg14; def buynow = !buy[1] and buy; def buysignal = CompoundValue(1, if buynow and !stopbuy then 1 else if buysignal[1] == 1 and stopbuy then 0 else buysignal[1], 0); def Buy_Signal = buysignal[1] == 0 and buysignal == 1; def Momentum_Down = buysignal[1] == 1 and buysignal == 0; def sell = mov_avg9 < mov_avg14 and mov_avg14 < mov_avg21 and high < mov_avg9; def stopsell = mov_avg9 >= mov_avg14; def sellnow = !sell[1] and sell; def sellsignal = CompoundValue(1, if sellnow and !stopsell then 1 else if sellsignal[1] == 1 and stopsell then 0 else sellsignal[1], 0); def Sell_Signal = sellsignal[1] == 0 and sellsignal; plot Colorbars = if buysignal == 1 then 1 else if sellsignal == 1 then 2 else if buysignal == 0 or sellsignal == 0 then 3 else 0; Colorbars.Hide(); Colorbars.DefineColor("Buy_Signal_Bars", Color.GREEN); Colorbars.DefineColor("Sell_Signal_Bars", Color.RED); Colorbars.DefineColor("Neutral", Color.YELLOW); #___________________________________________________________________________ input method = {default average, high_low}; def bubbleoffset = .0005; def percentamount = .01; def revAmount = .05; def atrreversal = 2.0; def atrlength = 5; def pricehigh = high; def pricelow = low; def averagelength = 5; def averagetype = AverageType.EXPONENTIAL; def mah = MovingAverage(averagetype, pricehigh, averagelength); def mal = MovingAverage(averagetype, pricelow, averagelength); def priceh = if method == method.high_low then pricehigh else mah; def pricel = if method == method.high_low then pricelow else mal; def EI = ZigZagHighLow("price h" = priceh, "price l" = pricel, "percentage reversal" = percentamount, "absolute reversal" = revAmount, "atr length" = atrlength, "atr reversal" = atrreversal); rec EISave = if !IsNaN(EI) then EI else GetValue(EISave, 1); def chg = (if EISave == priceh then priceh else pricel) - GetValue(EISave, 1); def isUp = chg >= 0; def EIL = if !IsNaN(EI) and !isUp then pricel else GetValue(EIL, 1); def EIH = if !IsNaN(EI) and isUp then priceh else GetValue(EIH, 1); def dir = CompoundValue(1, if EIL != EIL[1] or pricel == EIL[1] and pricel == EISave then 1 else if EIH != EIH[1] or priceh == EIH[1] and priceh == EISave then -1 else dir[1], 0); def signal = CompoundValue(1, if dir > 0 and pricel > EIL then if signal[1] <= 0 then 1 else signal[1] else if dir < 0 and priceh < EIH then if signal[1] >= 0 then -1 else signal[1] else signal[1], 0); def bullish2 = signal > 0 and signal[1] <= 0; plot upArrow = bullish2; upArrow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); upArrow.SetDefaultColor(CreateColor(145, 210, 144)); def bearish2 = signal < 0 and signal[1] >= 0; plot downArrow = bearish2; downArrow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); downArrow.SetDefaultColor(CreateColor(255, 15, 10)); def showarrows = yes; def U1 = showarrows and signal > 0 and signal[1] <= 0; #U1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); #U1.SetDefaultColor(Color.GREEN); #U1.SetLineWeight(4); def D1 = showarrows and signal < 0 and signal[1] >= 0; #D1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); #D1.SetDefaultColor(Color.RED); #D1.SetLineWeight(4); def barnumber = BarNumber()[10]; #START AddChartBubble((barnumber and U1), if isUp then low else high, if showarrows and signal > 0 and signal[1] <= 0 then " BUY " else "" , if Colorbars == 3 then Color.YELLOW else Color.UPTICK, no); AddChartBubble((barnumber and D1), if isUp then low else high, if showarrows and signal < 0 and signal[1] >= 0 then " SELL " else "" , if Colorbars == 3 then Color.YELLOW else Color.DOWNTICK, yes); #END def revLineTop; def revLineBot; if barnumber and D1 { revLineBot = Double.NaN; revLineTop = high[1]; } else if barnumber and U1 { revLineTop = Double.NaN; revLineBot = low[1]; } else if !IsNaN(revLineBot[1]) and (Colorbars[2] == 2 or Colorbars[1] == 2) { revLineBot = revLineBot[1]; revLineTop = Double.NaN; } else if !IsNaN(revLineTop[1]) and (Colorbars[2] == 1 or Colorbars[1] == 1) { revLineTop = revLineTop[1]; revLineBot = Double.NaN; } else { revLineTop = Double.NaN; revLineBot = Double.NaN; } plot botLine = revLineBot[-1]; botLine.SetDefaultColor(Color.LIGHT_GREEN); plot topLine = revLineTop[-1]; topLine.SetDefaultColor(Color.LIGHT_RED); ################ EXIT BAD def entryPrice = EntryPrice(); def mult; switch (offsetType) { case percent: mult = entryPrice / 100; case value: mult = 1; case tick: mult = TickSize(); } def stopPriceLE = entryPrice - stop * mult; def stopPriceSE = entryPrice + stop * mult; plot BAD_LONG_STOP = stopPriceLE; plot BAD_SHORT_STOP = stopPriceSE; ### ORDERS AddOrder(OrderType.BUY_AUTO, upArrow[1] == 1, open, TRADESIZE, tickcolor = GetColor(1), arrowcolor = GetColor(1), name = "ENTER TRADE"); AddOrder(OrderType.SELL_AUTO, downArrow[1] == 1, open, TRADESIZE, tickcolor = GetColor(9), arrowcolor = GetColor(9), name = "EXIT TRADE"); AddOrder(OrderType.BUY_TO_CLOSE, high >= stopPriceSE from 1 bars ago crosses above stopPriceSE, close, TRADESIZE, tickcolor = GetColor(3), arrowcolor = GetColor(3), name = "EXIT BAD SHORT"); AddOrder(OrderType.SELL_TO_CLOSE, low <= stopPriceLE from 1 bars ago crosses below stopPriceLE, close, TRADESIZE, tickcolor = GetColor(3), arrowcolor = GetColor(3), name = "EXIT BAD LONG"); ### ALERTS Alert(upArrow[1] == 1, " BUY SIGNAL ", Alert.BAR, Sound.Chimes); Alert(downArrow[1] == 1, " SELL SIGNAL ", Alert.BAR, Sound.Chimes); Alert(high >= stopPriceSE from 1 bars ago crosses above stopPriceSE and TRADESIZE * -100 <= -1 == 1, " BAD SHORT EXIT TRADE ", Alert.BAR, Sound.Chimes); Alert(low <= stopPriceLE from 1 bars ago crosses below stopPriceLE and TRADESIZE * 100 >= 1 == 1, " BAD LONG EXIT TRADE ", Alert.BAR, Sound.Chimes); ### LABELS AddLabel(yes, if (upArrow[1] >= 1 within 2 bars) or (high >= stopPriceSE from 1 bars ago crosses above stopPriceSE) then " BUY BUY BUY " else " NO SIGNAL ", Color.YELLOW); AddLabel(yes, if (downArrow[1] >= 1 within 2 bars) or (low <= stopPriceLE from 1 bars ago crosses below stopPriceLE) then " SELL SELL SELL " else " NO SIGNAL ", Color.WHITE); ### The Robot uses the Labels and Alerts for order execution. A long order must be closed and after a 3-5 seconds delay I would like the robot to enter a "short" trade that will be closed by a "Buy" signal from the study. This will run on a loop. ### STOP-LOSS, The Stop-loss should be on a switch or similar code. Trigger stop-loss alert and label only if price goes against the trade in place at the time. ### Plan on running strategy on Renko Charts. ### If there's unnessessary code on this study that can be removed without affecting functionality please do so to make code cleaner and easier to read.

- Status

- Not open for further replies.

Volatility Trading Range

VTR is a momentum indicator that shows if a stock is overbought or oversold based on its Weekly and Monthly average volatility trading range.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Repaints Enhanced Trend Reversal Indicator for ThinkorSwim | Indicators | 125 | |

|

|

Reversal Candles (Saikou / Hikui) Trend Change for ThinkorSwim | Indicators | 10 | |

| C | AGAIG Trend Vertical Line For ThinkOrSwim | Indicators | 11 | |

| D | Trend Trader Buy/Sell Signals For ThinkOrSwim | Indicators | 9 | |

|

|

LNL Trend System for ThinkOrSwim | Indicators | 27 |

Similar threads

-

Repaints Enhanced Trend Reversal Indicator for ThinkorSwim

- Started by BenTen

- Replies: 125

-

Reversal Candles (Saikou / Hikui) Trend Change for ThinkorSwim

- Started by BenTen

- Replies: 10

-

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

631

Online

Similar threads

-

Repaints Enhanced Trend Reversal Indicator for ThinkorSwim

- Started by BenTen

- Replies: 125

-

Reversal Candles (Saikou / Hikui) Trend Change for ThinkorSwim

- Started by BenTen

- Replies: 10

-

-

-

Similar threads

-

Repaints Enhanced Trend Reversal Indicator for ThinkorSwim

- Started by BenTen

- Replies: 125

-

Reversal Candles (Saikou / Hikui) Trend Change for ThinkorSwim

- Started by BenTen

- Replies: 10

-

-

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.