Author Message:

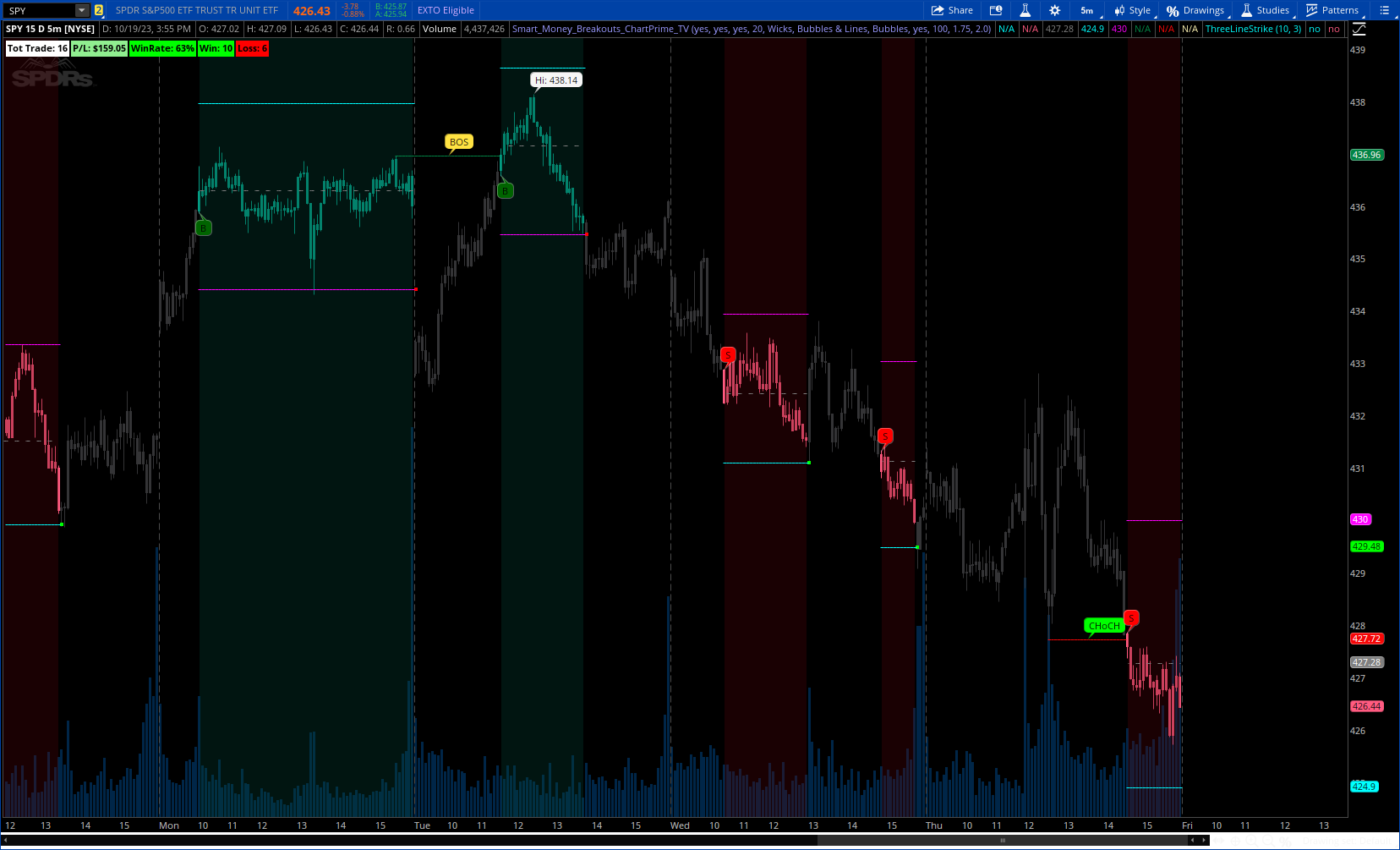

The "Smart Money Breakouts" indicator is designed to identify breakouts based on changes in character (CHOCH) or breaks of structure (BOS) patterns, facilitating automated trading with user-defined Take Profit (TP) level.

More Details : https://www.tradingview.com/v/aM3PRWEM/

CODE:

CSS:

# https://www.tradingview.com/v/aM3PRWEM/

#// This source code is subject to the terms of the Mozilla Public License 2.0 at

#// © ChartPrime

#indicator("Smart Money Breakouts [ChartPrime]", overlay=true, max_labels_count=500

# Converted and mod By Sam4Cok@Samer800 - 10 / 2023

input showInfoLabel = yes;

input colorBars = yes;

input colorBackground = yes;

input period = 20; #, 'Length',group = CORE,tooltip = "Swing Length")

input WicksOrBodyOfTheCandle = {default "Wicks", "Body"}; # "Wicks or Body of the candle"

input showBosChoch = {Default "Bubbles & Lines", "Bubbles Only", "Lines Only", "Don't Show"};

input signalType = {Default "Bubbles", "Arrows", "Don't Show"};

input showTargetLines = yes;

input LotSize = 100;

input ProfitMultiplyer = 1.75; # "Target Multiplyer "

input StopLossMultiplyer = 2.00;

def na = Double.NaN;

def pos = Double.POSITIVE_INFINITY;

def neg = Double.NEGATIVE_INFINITY;

def Sync = AbsValue(BarNumber());

def tar = ProfitMultiplyer * 10;

def stL = StopLossMultiplyer * 10;

def wick = WicksOrBodyOfTheCandle == WicksOrBodyOfTheCandle."Wicks";

def sigBubble = signalType == signalType."Bubbles";

def sigArrows = signalType == signalType."Arrows";

#method volAdj(int len)=>

def nATR = ATR(Length = 30);

def volAdj = Min(nATR * 0.3, close * (0.3 / 100));

def Adj = volAdj[20] / 2;

def bubble; def lines;

Switch (showBosChoch) {

Case "Bubbles Only" :

bubble = yes;

lines = no;

Case "Lines Only" :

bubble = no;

lines = yes;

Case "Don't Show" :

bubble = no;

lines = no;

Default :

bubble = yes;

lines = yes;

}

#-- Colors

DefineGlobalColor("GREEN", CreateColor(2, 133, 69));

DefineGlobalColor("TAIL", CreateColor(20, 141, 154));

DefineGlobalColor("RED" , CreateColor(246, 7, 7));

DefineGlobalColor("_Green", CreateColor(3, 156, 131));

DefineGlobalColor("_RED", GetColor(2));

DefineGlobalColor("dGreen", CreateColor(3,69,57));

DefineGlobalColor("dRed", CreateColor(86,3,10));

#-- Script

script VolCal {

input Index = 100;

input Sync = 50;

def Bars = AbsValue(Index - Sync);

def Green = fold i = 0 to Bars with p do

p + (if GetValue(close, i) > GetValue(open, i)

then GetValue(volume, i) else 0);

def Red = fold j = 0 to Bars with q do

q + (if GetValue(close, j) < GetValue(open, j)

then GetValue(volume, j) else 0);

def Total = fold v = 0 to Bars with l do

l + GetValue(volume, v);

def GreenRatio = Green / Total * 100;

def RedRatio = Red / Total * 100;

def VolCal = if GreenRatio > 55 then 1 else

if RedRatio > 55 then -1 else 0;

plot Out = VolCal;

}

script FindPivots {

input dat = close; # default data or study being evaluated

input HL = 0; # default high or low pivot designation, -1 low, +1 high

input lbL = 5; # default Pivot Lookback Left

input lbR = 1; # default Pivot Lookback Right

##############

def _nan; # used for non-number returns

def _BN; # the current barnumber

def _VStop; # confirms that the lookforward period continues the pivot trend

def _V; # the Value at the actual pivot point

def _pivotRange;

##############

_BN = BarNumber();

_nan = Double.NaN;

_pivotRange = lbL + lbL;

_VStop = if !IsNaN(dat[_pivotRange]) and lbR > 0 and lbL > 0 then

fold a = 1 to lbR + 1 with b=1 while b do

if HL > 0 then dat > GetValue(dat, -a) else dat < GetValue(dat, -a) else _nan;

if (HL > 0) {

_V = if _BN > lbL and dat == Highest(dat, lbL + 1) and _VStop

then dat else _nan;

} else {

_V = if _BN > lbL and dat == Lowest(dat, lbL + 1) and _VStop

then dat else _nan;

}

plot result = if !IsNaN(_V) and _VStop then _V else _nan;

}

def ph = findpivots(high, 1, period, period);

def pl = findpivots(low ,-1, period, period);

def nanPh = !isNaN(ph);

def nanPl = !isNaN(pl);

def fixPh = if nanPh then ph else fixPh[1];

def fixPl = if nanPl then pl else fixPl[1];

def ScrHigh = if wick then high else close;

def ScrLow = if wick then low else close;

def UpdatedHigh;

def UpdatedLow;

def ShortTrade;

def TradeisON;

def LongTrade;

def HighIndex;

def phActive;

def plActive;

def phActive_;

def plActive_;

def LowIndex;

def HBreak;

def TP;

def SL;

def BUY;

def SELL;

if nanPh {

UpdatedHigh = ph;

phActive_ = yes;

HighIndex = Sync;

} else {

UpdatedHigh = UpdatedHigh[1];

phActive_ = phActive[1];

HighIndex = HighIndex[1];

}

if nanPl {

UpdatedLow = pl;

plActive_ = yes;

LowIndex = Sync;

} else {

UpdatedLow = UpdatedLow[1];

plActive_ = plActive[1];

LowIndex = LowIndex[1];

}

#// LONG

if ScrHigh > UpdatedHigh and phActive_ {

BUY = yes;

phActive = no;

} else {

BUY = no;

phActive = phActive_;

}

#//Sell

if ScrLow < UpdatedLow and plActive_ {

SELL = yes;

plActive = no;

} else {

SELL = no;

plActive = plActive_;

}

#// lets Draw

def barB;def LabLocB;def labB;

def barS;def LabLocS;def labS;

if BUY and !TradeisON[1] {

barB = Sync;

barS = barS[1];

LabLocB = floor(Sync - (Sync - HighIndex) / 2);

LabLocS = LabLocS[1];

labB = if !HBreak[1] then 1 else -1;

labS = labS[1];

HBreak = yes;

} else

if SELL and !TradeisON[1] {

barB = barB[1];

barS = Sync;

LabLocB = LabLocB[1];

LabLocS = floor(Sync - (Sync - LowIndex) / 2);

labB = labB[1];

labS = if HBreak[1] then 1 else -1;

HBreak = no;

} else {

barB = barB[1];

barS = barS[1];

LabLocB = LabLocB[1];

LabLocS = LabLocS[1];

labB = labB[1];

labS = labS[1];

HBreak = HBreak[1];

}

def Long = BUY and !TradeisON[1];

def Short = SELL and !TradeisON[1];

def TradeFire = Long or Short;

if Long and !TradeisON[1] {

LongTrade = yes;

ShortTrade = no;

} else

if Short and !TradeisON[1] {

LongTrade = no;

ShortTrade = yes;

} else {

LongTrade = LongTrade[1];

ShortTrade = ShortTrade[1];

}

def win; def los;def entry;

def profit; def losses;

if TradeFire and !TradeisON[1] {

entry = ohlc4[-1];

TP = if Long then entry + (Adj * Tar) else

if Short then entry - (Adj * Tar) else na;

SL = if Long then entry - (Adj * stL) else

if Short then entry + (Adj * stL) else na;

win = if !sync then 0 else win[1];

los = if !sync then 0 else los[1];

profit = profit[1];

losses = losses[1];

TradeisON = yes;

} else

if LongTrade and TradeisON[1] {

entry = entry[1];

TP = TP[1];

SL = SL[1];

win = if high >= TP then win[1] + 1 else win[1];

los = if close <= SL then los[1] + 1 else los[1];

profit = if high crosses above TP then profit[1] + AbsValue(close - Entry) * lotSize else profit[1];

losses = if close crosses below SL then losses[1] + AbsValue(Entry - close) * lotSize else losses[1];

TradeisON = if high >= TP then no else

if close <= SL then no else TradeisON[1];

} else

if ShortTrade and TradeisON[1] {

entry = entry[1];

TP = TP[1];

SL = SL[1];

win = if low <= TP then win[1] + 1 else win[1];

los = if close >= SL then los[1] + 1 else los[1];

profit = if low crosses below TP then profit[1] + AbsValue(entry - close) * lotSize else profit[1];

losses = if close Crosses Above SL then losses[1] + AbsValue(close - Entry) * lotSize else losses[1];

TradeisON = if low <= tp then no else

if close >= SL then no else TradeisON[1];

} else {

entry = na;

TP = TP[1];

SL = SL[1];

win = if !sync then 0 else win[1];

los = if !sync then 0 else los[1];

profit = profit[1];

losses = losses[1];

TradeisON = TradeisON[1];

}

def volH = VolCal(HighIndex,Sync);

def volL = VolCal(LowIndex,Sync);

def BearCon = TradeisON and ShortTrade;

def BullCon = TradeisON and LongTrade;

def signH = if BUY and !TradeisON then volH else signH[1];

def signS = if SELL and !TradeisON then volL else signS[1];

def buyCond = BullCon and !BullCon[1];

def sellCond = BearCon and !BearCon[1];

def barBuy = if buyCond then HighIndex -1 else barBuy[1];

def barSell = if sellCond then lowIndex -1 else barSell[1];

#-- Signals

plot arrUp = if sigArrows and buyCond then low else na;

plot arrDn = if sigArrows and sellCond then high else na;

arrUp.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

arrDn.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

arrUp.AssignValueColor(if signH>0 then color.CYAN else Color.VIOLET);

arrDn.AssignValueColor(if signS<0 then color.MAGENTA else Color.PLUM);

AddchartBubble(sigBubble and buyCond, low,"B" ,if signH>0 then color.GREEN else Color.DARK_GREEN, no);

AddchartBubble(sigBubble and sellCond, high,"S",if signS<0 then color.RED else Color.DARK_RED);

#-- Trade

plot entryLine = if !showTargetLines then na else

if TradeisON then entry else na;

entryLine.SetDefaultColor(Color.GRAY);

entryLine.SetStyle(Curve.SHORT_DASH);

plot lineUp = if !showTargetLines then na else

if BullCon then tp else

if BearCon then tp else na;

plot lineDn = if !showTargetLines then na else

if BullCon then sl else

if BearCon then sl else na;

lineUp.SetDefaultColor(Color.CYAN);

lineDn.SetDefaultColor(Color.MAGENTA);

lineUp.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

lineDn.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

def plotUp = lines and highestAll(barB) > Sync and Sync > highestAll(barBuy);

def plotDn = lines and highestAll(barS) > Sync and Sync > highestAll(barSell);

plot BullPvt = if plotUp then if fixPh then fixPh else na else na;

plot BearPvt = if plotDn then if fixPl then fixPl else na else na;

BullPvt.SetStyle(Curve.LONG_DASH);

BearPvt.SetStyle(Curve.LONG_DASH);

BullPvt.SetDefaultColor(GlobalColor("Green"));

BearPvt.SetDefaultColor(GlobalColor("Red"));

BullPvt.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

BearPvt.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

def bubUpCond = bubble and highestAll(LabLocB) == sync;

def bubDnpCond = bubble and highestAll(LabLocS) == sync;

AddChartBubble(bubUpCond, fixPh ,if labB > 0 then "BOS" else "CHoCH",

if signH>0 then Color.GREEN else if signH < 0 then Color.RED else GetColor(4));

AddChartBubble(bubDnpCond, fixPl ,if labS > 0 then "BOS" else "CHoCH",

if signS<0 then Color.GREEN else if signS > 0 then Color.RED else GetColor(4));

#-- BG and Bar Color

AddCloud(if !colorBackground then na else if BullCon then pos else na, neg, GlobalColor("dGreen"));

AddCloud(if !colorBackground then na else if BearCon then pos else na, neg, GlobalColor("dRed"));

AssignPriceColor(if !colorBars then Color.CURRENT else

if BearCon then GlobalColor("_RED") else

if BullCon then GlobalColor("_Green") else CreateColor(52, 52, 54));

#--

plot TradeEnd = if !TradeisON and TradeisON[1] then

if los>los[1] then lineDn[1] else lineUp[1] else na;

TradeEnd.AssignValueColor(if win>win[1] then Color.GREEN else Color.RED);

TradeEnd.SetPaintingStrategy(PaintingStrategy.SQUARES);

#-- Label

def totTrade = win + los;

def winRate = Round(win / totTrade * 100, 0);

def PandL = Round(profit - losses, 2);

AddLabel(showInfoLabel, "Tot Trade: " + totTrade, color.WHITE);

AddLabel(showInfoLabel, "P/L: $" + PandL,

if PandL > 0 then Color.LIGHT_GREEN else

if PandL < 0 then Color.PINK else Color.GRAY);

AddLabel(showInfoLabel, "WinRate: " + winRate + "%",

if winRate > 50 then Color. Green else

if winRate < 50 then color.RED else Color.GRAY);

AddLabel(showInfoLabel, "Win: " + win, color.GREEN);

AddLabel(showInfoLabel, "Loss: " + los, color.RED);

#-- END of CODE