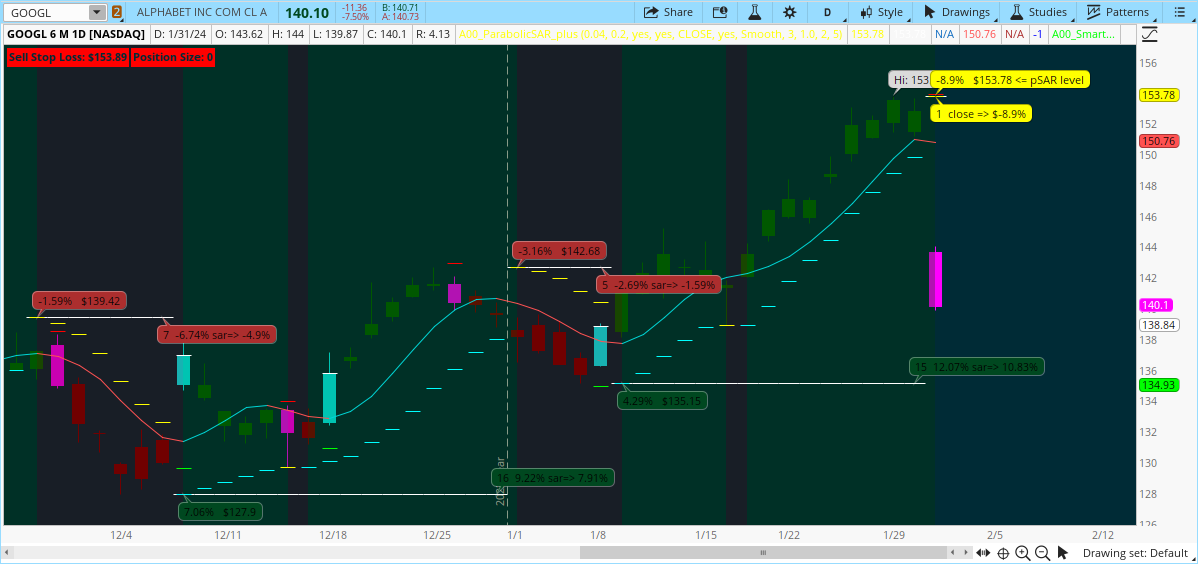

is anyone able to convert this indicator to thinkorswim?

https://www.tradingview.com/script/vLyl4omf-SuperTrend-Entry/

Code:

//@version=5

indicator("Smart Entry", shorttitle="Smart Entry", overlay=true , max_bars_back=5000)

factor = input.float(1, "Factor", step = 0.01, group="Smart Momentum", inline="z")

atrPeriod = input.int(1, "ATR Period", step = 1, group="Smart Momentum", inline="z")

smartOverlay = input.bool(true, title="[Smart Overlay]", inline="z", group="Momentum Colors")

bullColor1 = input.color(#22ad22, title="[-Momentum Bull-]", inline="z", group="Momentum Colors")

bearColor1 = input.color(#e10000, title="[Momentum Bear]", inline="z", group="Momentum Colors")

momentumSwitch = input.bool(true, title="[Momentum Switch]", inline="z", group="Momentum Colors")

momentumSwitchBull = input.color(#ffe900, title="[--Switch Bull--]", inline="z", group="Momentum Colors")

momentumSwitchBear = input.color(#0006ff, title="[--Switch Bear--]", inline="z", group="Momentum Colors")

hlowRClose = input.bool(defval=true, title="High & Low or Highest Close & Lowest Close", tooltip="Use HIGH & LOW as stop loss refrence or Highest CLOSE & Lowest Close", group="Stops and Targets")

buyColorsl = input.color(#22ad22, title="*Long Stop Loss Color", inline="1", group="Stops and Targets")

sellColorsl = input.color(#e10000, title="*Short Stop Loss Color", inline="1", group="Stops and Targets")

buyColortp = input.color(color.white, title="Long Take Profit Color", inline="1", group="Stops and Targets")

sellColortp = input.color(color.gray, title="Short Take Profit Color", inline="1", group="Stops and Targets")

stopLossMultiplier = input.float(title="Stop Loss Multiplier", tooltip="0 Disables Take Profit", defval=0.08, step=0.05, group="Money Management", inline="2")

takeProfitMultiplier = input.float(title="Take Profit Multiplier", defval=0, step=0.05, group="Money Management", inline="2")

accountSize = input.float(title="Account Size", defval=200000.0, group="Money Management", inline="2")

betPercentage = input.float(title="------- Bet Percentage", defval=0.25, group="Money Management", inline="2")

spread = input.float(title="Spread", defval=0.00002,step=0.00001, group="Money Management", inline="2")

chartSizex = input.string("Small", title="Table Size", options=["Tiny","Small","Normal","Large","Huge"],inline="8",group="Entry Table")

chartPositionx = input.string(title="Table Position",group="Entry Table", defval="Top Right", inline="8",

options=["Top Right", "Top Center", "Top Left", "Middle Right", "Middle Center", "Middle Left", "Bottom Right", "Bottom Center", "Bottom Left"])

// Dynamic Table Position using user input string

var chartSize = size.tiny

if chartSizex == "Tiny"

chartSize := size.tiny

if chartSizex == "Small"

chartSize := size.small

if chartSizex == "Normal"

chartSize := size.normal

if chartSizex == "Large"

chartSize := size.large

if chartSizex == "Huge"

chartSize := size.huge

// Dynamic Table Position using user input string

var chartPosition = position.top_right

if chartPositionx == "Top Right"

chartPosition := position.top_right

if chartPositionx == "Top Center"

chartPosition := position.top_center

if chartPositionx == "Top Left"

chartPosition := position.top_left

if chartPositionx == "Middle Right"

chartPosition := position.middle_right

if chartPositionx == "Middle Center"

chartPosition := position.middle_center

if chartPositionx == "Middle Left"

chartPosition := position.middle_left

if chartPositionx == "Bottom Right"

chartPosition := position.bottom_right

if chartPositionx == "Bottom Center"

chartPosition := position.bottom_center

if chartPositionx == "Bottom Left"

chartPosition := position.bottom_left

//Wait for candle to close before you show signal or change in realtime

closeRrealtime = true

barState = (closeRrealtime == true) ? barstate.isconfirmed : barstate.isrealtime

HRC = hlowRClose ? high : close

LRC = hlowRClose ? low : close

HRO = hlowRClose ? high : open

LRO = hlowRClose ? low : open

// Get SuperTrend Values

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

// Get ATR Filter

atr = ta.atr(14)

//Entry signal

bull_STC = close > supertrend and close[1] < supertrend[1]

bear_STC = close < supertrend and close[1] > supertrend[1]

//To get around runtime issue

bar_DEX =(bar_index > 10)

// How Many Green Bars Before the condtion hapeens again

howManyGB = (ta.barssince(bull_STC)) + 1

howManyRB = (ta.barssince(bear_STC)) + 1

howManyGBX = ta.barssince(bull_STC)

howManyRBX =ta.barssince(bear_STC)

howManyGBText = str.tostring(howManyGBX)

howManyRBText = str.tostring(howManyRBX)

// lookbackperiod so i dont get ZEROS in my look back period

lookBack = howManyGB > howManyRB ? howManyGB : howManyRB

// Get level using a changing lookback period added bar_DEX to fix loading on to chart issues

// get open values for the rare occurance that its actually the high rare but happens

lowLevel = bar_DEX ? ta.lowest(LRC,lookBack + 1) : na

lowLevelOpen = bar_DEX ? ta.lowest(open,lookBack + 1) : na

lowLevelX = lowLevelOpen < lowLevel ? lowLevelOpen : lowLevel

highLevel = bar_DEX ? ta.highest(HRC,lookBack + 1) : na

highLevelOpen = bar_DEX ? ta.highest(open,lookBack + 1) : na

highLevelX= highLevelOpen > highLevel ? highLevelOpen : highLevel

// include entry cand high or low in the lookback

lowLevelB = lowLevelX < LRO ? lowLevelX : LRO

highLevelB = highLevelX > HRO ? highLevelX : HRO

// Create StopLoss Point

sellStopLoss = highLevelB + (atr*stopLossMultiplier) + spread

buyStopLoss = lowLevelB - (atr*stopLossMultiplier) - spread

// Create TakeProfit / a reflection of stop loss

sellTakeProfit = (close - (sellStopLoss - close) * takeProfitMultiplier)

buyTakeProfit = (takeProfitMultiplier * (close - buyStopLoss) + close)

//position Sizing accountSize default 100,000 betpercentage default = 1 and

//0.01 to turn it into a percentage divide: stoploss too entry candle close is = sellTakeProfit (reflection)

// Minus close from sellTakeProfit to just get entry candle's stoploss to its close only

//multilpy by 10000 to get number of pips multiply by 10 to get answer in LOTs! (not micro or mini)

sellbuyPositionSizeA =(accountSize * (betPercentage * 0.01))

sellPositionSizeB= (sellStopLoss - close) * 10000 * 10

buyPositionSizeB= (close - buyStopLoss) * 10000 * 10

sellPositionSizeC = sellbuyPositionSizeA / sellPositionSizeB

buyPositionSizeC = sellbuyPositionSizeA / buyPositionSizeB

// change color based on current charts momentum

trendColor = bull_STC and momentumSwitch and smartOverlay ? momentumSwitchBull : bear_STC and momentumSwitch and smartOverlay ? momentumSwitchBear : close > supertrend and smartOverlay ? bullColor1 : close < supertrend and smartOverlay ? bearColor1 : na

barcolor(trendColor, title="Current Chart Momentum",editable=false)

// Prepare a table

var table myTable = table.new(chartPosition, 2, 3, border_width=1)

// Draw table

if barstate.islast and bear_STC

table.cell(myTable, column = 0, row = 2 ,text="SellStopLoss: " + str.tostring(math.round(sellStopLoss, 5)), text_color=#e10000, bgcolor=color.new(color.black,70), text_size=chartSize)

table.cell(myTable, column = 0, row = 1 ,text="Position Size: " + str.tostring(math.round(sellPositionSizeC, 2)), text_color=color.white, bgcolor=color.new(color.black,70), text_size=chartSize)

table.cell(myTable, column = 0, row = 0 ,text= takeProfitMultiplier > 0 ?"SellTakeProfit: " + str.tostring(math.round(sellTakeProfit, 5)) : na, text_color=#22ad22, bgcolor=color.new(color.black,takeProfitMultiplier > 0 ? 70 : 100), text_size=chartSize)

if barstate.islast and bull_STC

table.cell(myTable, column = 1, row = 2 ,text="BuyStopLoss: " + str.tostring(math.round(buyStopLoss, 5)), text_color=#e10000, bgcolor=color.new(color.gray,50), text_size=chartSize)

table.cell(myTable, column = 1, row = 1 ,text="Position Size: " + str.tostring(math.round(buyPositionSizeC, 2)), text_color=color.white, bgcolor=color.new(color.gray,50), text_size=chartSize)

table.cell(myTable, column = 1, row = 0 ,text= takeProfitMultiplier > 0 ? "BuyTakeProfit: " + str.tostring(math.round(buyTakeProfit, 5)) : na, text_color=#22ad22, bgcolor=color.new(color.gray,takeProfitMultiplier > 0 ? 50: 100), text_size=chartSize)

// Draw Take Profit and Stop Loss points

plot(bull_STC ? buyStopLoss : na, title = "Buy Stop Loss", color= #22ad22, linewidth=1, style=plot.style_linebr)

plot(bear_STC ? sellStopLoss : na, title = "Sell Stop Loss", color = #e10000, linewidth=1, style=plot.style_linebr)

plot(bull_STC ? buyTakeProfit : na, title = "Buy Take Profit", color = color.new(color.white, 0), linewidth=1, style=plot.style_linebr)

plot(bear_STC ? sellTakeProfit : na, title = "Sell Take Profit", color = color.new(color.gray, 0), linewidth=1, style=plot.style_linebr)

View attachment 20720