Not quite it, please post a share of your chart where the signals came through. I am curious. Thanks.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

RSI Laguerre with Fractal Energy for ThinkorSwim

- Thread starter markos

- Start date

-

- Tags

- oscillator

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Is it possible to combine the HULL with an allstar proven short indicator for a watchlist as another proven short/bull watchlist? Although I think the hull watchlist is a good compliment to say, the Cappock short watchlist. I loaded this up today along with the Hull it returns less bull/bears. The Hull watchlist showed msft bearish 100% right on from gap up to 3.00 down end of day although it tagged msft yesterday too.

Difference yesterday I had loaded up the laquerre into the Hull watchlist and a group universe of top notch stocks... many more bull/bear signs. And is it possible to rank the bull/bears as they appear fresh on the watchlist as it is to sort by Hull there is mo way to tell if the ticker is existing or new to the list.

Last edited:

@J007RMC Lost something in translation from Morris Code or somethin' ... I saw the picture you shared, but was looking for where it signaled on the chart. As far as combining them, probably is the answer. You won't know until you try.Is it possible to combine the HULL with an allstar proven short indicator for a watchlist as another proven short/bull watchlist? Although I think the hull watchlist is a good compliment to say, the Cappock short watchlist. I loaded this up today along with the Hull it returns less bull/bears. The Hull watchlist showed msft bearish 100% right on from gap up to 3.00 down end of day although it tagged msft yesterday too.

Difference yesterday I had loaded up the laquerre into the Hull watchlist and a group universe of top notch stocks... many more bull/bear signs. And is it possible to rank the bull/bears as they appear fresh on the watchlist as it is to sort by Hull there is mo way to tell if the ticker is existing or new to the list.

I personally won't mess with my RSILg code as I spent a year messing with it for my type of investing.

Look in the manual under alerts, I believe you can set the scan for new additions to the list, but you'll have to read up on it and let the rest of us know what you find. It updates as a watchlist scan every ~3 minutes.

Last edited:

Thank you very much!@Talochka click on the beaker at the top of the chart. Click on the little gear to the right of the study. If you don't see alerts at the bottom, close the input panel. When that moves up, you should be able to see the alerts.

TheoTrade has a YouTube video on this with "indicator finds tops and bottoms" in the description.

@markos Here's the Youtube video:

UPDATE: the video was already posted...sorry about that, @mc01439

In any event, thank you @markos for your time and efforts to bring this to the uTS community...I really appreciate it!

Good Luck and Good Trading

Last edited:

Ill look for the moment the chart catches@J007RMC Lost something in translation from Morris Code or somethin' ... I saw the picture you shared, but was looking for where it signaled on the chart. As far as combining them, probably is the answer. You won't know until you try.

I personally won't mess with my RSILg code as I spent a year messing with it for my type of investing.

Look in the manual under alerts, I believe you can set the scan for new additions to the list, but you'll have to read up on it and let the rest of us know what you find. It updates as a watchlist scan every ~3 minutes.

What do you consider a top notch list?

I'll have to follow up tomorrow or Friday. As of now, time is tight.

What I do see is that you have too many of the same kind in indicator on that chart. I believe you are testing, which in that case is ok to do.

Is anyone able to work with @J007RMC ?

What I do see is that you have too many of the same kind in indicator on that chart. I believe you are testing, which in that case is ok to do.

Is anyone able to work with @J007RMC ?

Is that your question in a nutshell? I think that one is answered above, if not, type Thinky into the search box. You may find something under that persons name, else try the Tutorial section.....And is it possible to rank the bull/bears as they appear fresh on the watchlist as it is to sort by Hull there is mo way to tell if the ticker is existing or new to the list.

Last edited:

@markos Hi Markos.

I have a Laguerre question for you simply because I need validation.

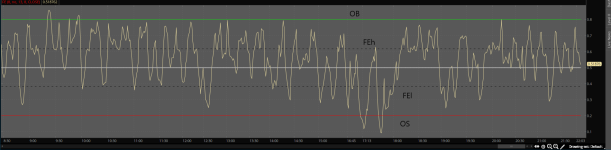

I have pulled up a BYND daily chart w Laguerre. Looking at the Laguerre, RSI at the bottom for a long downtrend, FE on 10/21 is showing drying up of this trend. I assume the Laguerre takes a few days and about now (although with earnings, not"now") but let's say no earnings, here with these last two candles seems a bottom or if there were no earnings at least the beginning of consolidation. What say you? Is this assumption correct?

I have a Laguerre question for you simply because I need validation.

I have pulled up a BYND daily chart w Laguerre. Looking at the Laguerre, RSI at the bottom for a long downtrend, FE on 10/21 is showing drying up of this trend. I assume the Laguerre takes a few days and about now (although with earnings, not"now") but let's say no earnings, here with these last two candles seems a bottom or if there were no earnings at least the beginning of consolidation. What say you? Is this assumption correct?

@markos Hi Markos.

I have a Laguerre question for you simply because I need validation.

I have pulled up a BYND daily chart w Laguerre. Looking at the Laguerre, RSI at the bottom for a long downtrend, FE on 10/21 is showing drying up of this trend. I assume the Laguerre takes a few days and about now (although with earnings, not"now") but let's say no earnings, here with these last two candles seems a bottom or if there were no earnings at least the beginning of consolidation. What say you? Is this assumption correct?

Hi @MBF sure, i'll explain what I see, I tend to ramble when it's late, please try to fill in the missing pieces by asking a follow up question. Your assumption is neither correct or incorrect. What are the probabilities? I could be right or I could be wrong. I don't see a bottom. Losing 50 points or Handles in one month is quite crazy. btw, I consulted a Daily and Hourly chart for this.

To me it's about price action before indicators. The Gamma line (yellow) is a signal to buy or not buy. It will be more likely to move when the Gamma line is over 60ish. It may be a consolidation that will start, but with an earnings announcement due Monday AHours and an Expected Move of around $7-8.00 for Monday, I lean on the probabilities and say not yet.

Looking at the price top, you will see that Gamma was also at its bottom. What both of these Bottoming Gamma's mean is, you are correct, the momentum, whether up or down, is running out of steam. The thing we don't know is where it will stop. Just know that at the top, it's charged up and at the bottom it's exhausted. "That's what the Math Professor teaches."

I stay away from any stock that is riding the RSI on the bottom. The time or signal to buy is when the RSI crosses .2 and sell when the Blue RSI crosses below .8. Price action tells us if it's base building or consolidating. From 8-27 to 9-6 the RSILg made a quick trip up and down. Please notice how the price moved up then back from $150.00 to ~$170.00. Whew! now aren't you glad you asked this old man about this?

Addendum: after all of that blather, all I really wanted to emphasize is that beyond the nuances of this excellent indicator, the Gamma line should be considered a secondary signal. Some ORB day traders that have the RSILg on their charts have gamma as a label. I use Daily & Weekly and like to see it.

Hows that answer? My gamma line is around 20 and so is everyone reading this (still), God bless 'em. Time for bed.

Attachments

Last edited:

pnguyen720

New member

Hey guys,

A little bit of a long shot but has anyone converted this indicator to Ninjascript? I'm relatively new to Thinkscript but have spent a lot of time inside NJT and would like to test this indicator.

Many thanks in advance.

A little bit of a long shot but has anyone converted this indicator to Ninjascript? I'm relatively new to Thinkscript but have spent a lot of time inside NJT and would like to test this indicator.

Many thanks in advance.

Hey @MBF your welcome. Have you read my tutorials on this? Find another stock and we can go thru it again. My preference is for ROKU and a Utility called NRG, but give me another. @Nick if you are available, please feel free to add to the conversation.@markos yes I am having a hard time with this indicator. I understand better now about gamma being secondary. My dailys gamma is around 28. Hourly around 62 and rising and rsi rising also.

Thank you, always appreciative of your time and help.

@MBF I see the same thing on 1-25, 5-29 as well. Take everything in aggregate. This would have been sold if I listened to my second opinion TMO on 7-26. (I'm disobeying a cardinal rule in TA by having 2 similar indicators, don't be like me)@markos ROKU

Looks great on the LaGuerre, chart looks good over 134. BUT ... on 7-26 it has the same little pattern on the LaG and that didn't pan out so well, different set up though.

How do you see it?

The RSIlg is telling me things are well. The stock got way ahead of itself and dropped from >160 to ~100 and now it's waiting for earnings. Notice that the ~40% drop didn't cut thru the 200 day EMA and it was given every opportunity to keep dropping but it made a lazy bottom instead. Going sideways at the 65D MA (No reason why I don't use a 50 Day) for over a week is a bonus for me. Also, it's not a sell signal until it drops below .8. Once that signal is given, I have to decide what I want to do. I am invested in this for my Grandkids, it will take a lot to break my faith. Hope that helps. Just my opinion. Markos

Attachments

blakecmathis

Well-known member

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| D | RSI Laguerre Indicator without Fractal Energy, Red/Green | Indicators | 30 | |

| T | Repaints RSI in Laguerre Time MTF for ThinkorSwim | Indicators | 70 | |

|

|

SuperTrend and RSI Laguerre Indicator for ThinkorSwim | Indicators | 35 | |

|

|

Ultimate RSI [LuxAlgo] for ThinkOrSwim | Indicators | 20 | |

|

|

RSI Levels For ThinkOrSwim | Indicators | 13 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

836

Online

Similar threads

Similar threads

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.