Author Message : - With Diversions

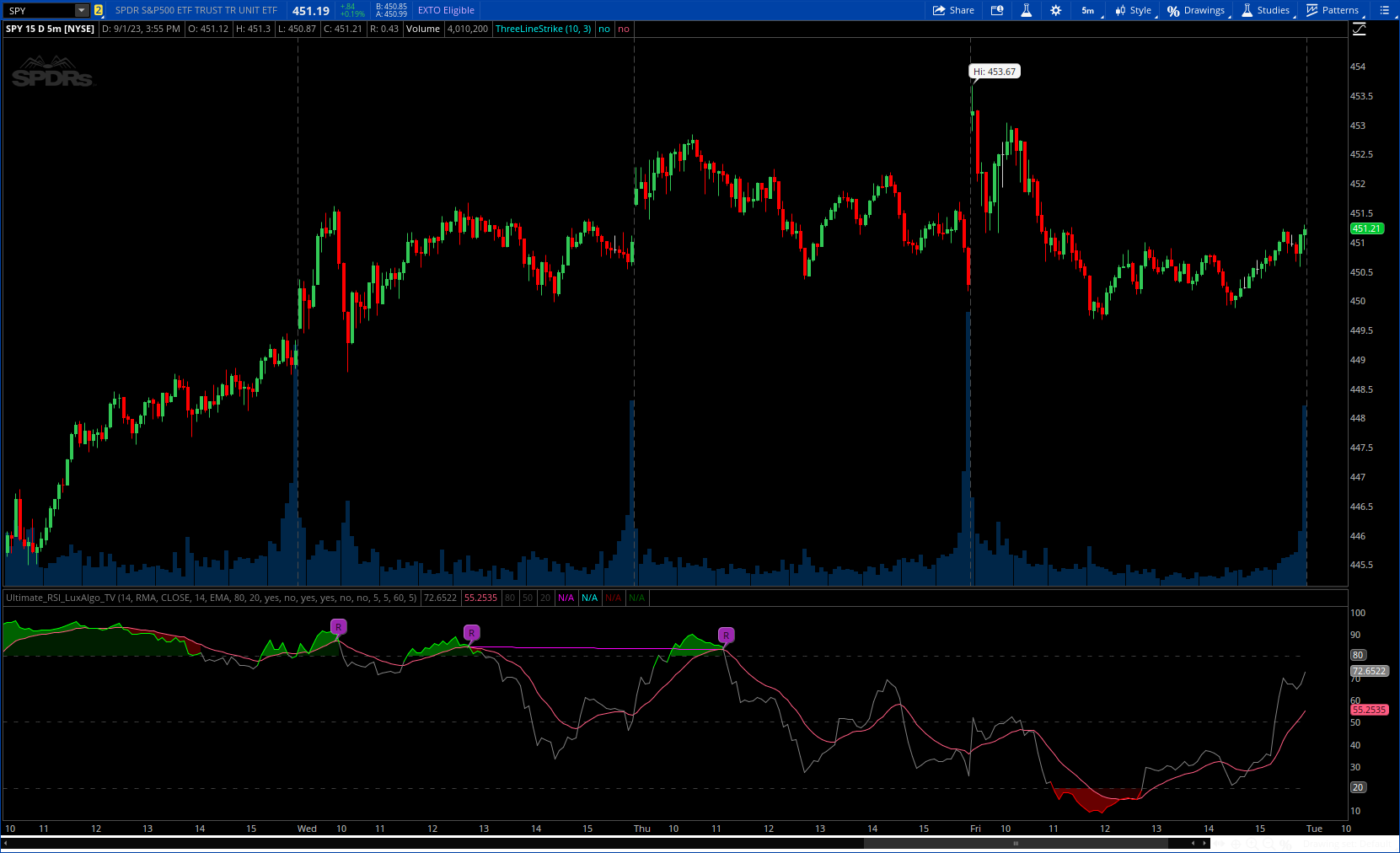

The Ultimate RSI indicator is a new oscillator based on the calculation of the Relative Strength Index that aims to put more emphasis on the trend, thus having a less noisy output. Opposite to the regular RSI, this oscillator is designed for a trend trading approach instead of a contrarian one.

CODE:

CSS:

#// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International

#// © LuxAlgo

#indicator("Ultimate RSI [LuxAlgo]", "LuxAlgo - Ultimate RSI")

# Converted and mod by Sam4Cok@Samer800 - 09/2023

declare lower;

input length = 14;

input method = {EMA, SMA, default RMA, TMA}; # 'Method'

input Source = close; # 'Source'

input smooth = 14; # 'Signal Line'

input smoothingType = {default EMA, SMA, RMA, TMA}; # 'Signal Line'

input Overbought = 80; # 'Overbought'

input Oversold = 20; # 'Oversold '

def na = Double.NaN;

def last = isNaN(close);

#//Functions

script ma {

input x = close;

input len = 14;

input maType = "TMA";

def ma = if maType == "EMA" then ExpAverage(x, len) else

if maType == "SMA" then Average(x, len) else

if maType == "RMA" then WildersAverage(x, len) else

if maType == "TMA" then Average(Average(x, len), len) else ma[1];

plot out = ma;

}

#//Augmented RSI

def upper = Highest(Source, length);

def lower = Lowest(Source, length);

def r = upper - lower;

def d = Source - Source[1];

def diff = if upper > upper[1] then r else

if lower < lower[1] then -r else d;

def absDiff = AbsValue(diff);

def num = ma(diff, length, method);

def den = ma(absDiff, length, method);

def arsi = num / den * 50 + 50;

def signal = ma(arsi, smooth, smoothingType);

def css = if arsi > Overbought then 1 else

if arsi < Oversold then -1 else 0;

def max = max(signal,Overbought);

def min = min(signal,Oversold);

#//Plots

plot plot_rsi = arsi;#, 'Ultimate RSI'

plot_rsi.AssignValueColor(if css > 0 then Color.GREEN else

if css < 0 then Color.RED else Color.GRAY);

plot SigLine = signal;#, 'Signal Line'

SigLine.SetDefaultColor(GetColor(2));

#//Levels

plot plot_up = if last then na else Overbought;

plot plot_avg = if last then na else 50;

plot plot_dn = if last then na else Oversold;

plot_up.SetDefaultColor(Color.DARK_GRAY);

plot_avg.SetDefaultColor(Color.DARK_GRAY);

plot_dn.SetDefaultColor(Color.DARK_GRAY);

plot_up.SetStyle(Curve.SHORT_DASH);

plot_avg.SetStyle(Curve.SHORT_DASH);

plot_dn.SetStyle(Curve.SHORT_DASH);

#//OB-OS

AddCloud(if css > 0 then plot_rsi else na, plot_up, Color.DARK_GREEN);

AddCloud(if css < 0 then plot_dn else na, plot_rsi, Color.DARK_RED);

AddCloud(if css > 0 then plot_rsi else na, max, Color.GREEN);

AddCloud(if css < 0 then min else na, plot_rsi, Color.RED);

#----Div-----------

input ShowLastDivLines = yes;

input ShowLastHiddenDivLines = no;

input DivBull = no; # "Plot Bullish"

input DivBear = no; # "Plot Bearish"

input DivHiddenBull = no; # "Plot Hidden Bullish"

input DivHiddenBear = no; # "Plot Hidden Bearish"

input LookBackRight = 5; # "Pivot Lookback Right"

input LookBackLeft = 5; # "Pivot Lookback Left"

input MaxLookback = 60; # "Max of Lookback Range"

input MinLookback = 5; # "Min of Lookback Range"

def divSrc = signal;

def h = high;

def l = low;

script FindPivots {

input dat = close; # default data or study being evaluated

input HL = 0; # default high or low pivot designation, -1 low, +1 high

input lbL = 5; # default Pivot Lookback Left

input lbR = 1; # default Pivot Lookback Right

##############

def _nan; # used for non-number returns

def _BN; # the current barnumber

def _VStop; # confirms that the lookforward period continues the pivot trend

def _V; # the Value at the actual pivot point

##############

_BN = BarNumber();

_nan = Double.NaN;

_VStop = if !isNaN(dat) and lbr > 0 and lbl > 0 then

fold a = 1 to lbR + 1 with b=1 while b do

if HL > 0 then dat > GetValue(dat,-a) else dat < GetValue(dat,-a) else _nan;

if (HL > 0) {

_V = if _BN > lbL + 1 and dat == Highest(dat, lbL + 1) and _VStop

then dat else _nan;

} else {

_V = if _BN > lbL + 1 and dat == Lowest(dat, lbL + 1) and _VStop

then dat else _nan;

}

plot result = if !IsNaN(_V) and _VStop then _V else _nan;

}

#_inRange(cond) =>

script _inRange {

input cond = yes;

input rangeUpper = 60;

input rangeLower = 5;

def bars = if cond then 0 else bars[1] + 1;

def inrange = (rangeLower <= bars) and (bars <= rangeUpper);

plot retrun = inRange;

}

def pl_ = findpivots(divSrc,-1, LookBackLeft, LookBackRight);

def ph_ = findpivots(divSrc, 1, LookBackLeft, LookBackRight);

def pl = !isNaN(pl_);

def ph = !isNaN(ph_);

def pll = lowest(divSrc,LookBackLeft);

def phh = highest(divSrc,LookBackLeft);

def sll = lowest(l, LookBackLeft);

def shh = highest(h, LookBackLeft);

#-- Pvt Low

def plStart = if pl then yes else plStart[1];

def plFound = if (plStart and pl) then 1 else 0;

def vlFound1 = if plFound then divSrc else vlFound1[1];

def vlFound_ = if vlFound1!=vlFound1[1] then vlFound1[1] else vlFound_[1];

def vlFound = if !vlFound_ then pll else vlFound_;

def plPrice1 = if plFound then l else plPrice1[1];

def plPrice_ = if plPrice1!=plPrice1[1] then plPrice1[1] else plPrice_[1];

def plPrice = if !plPrice_ then sll else plPrice_;

#-- Pvt High

def phStart = if ph then yes else phStart[1];

def phFound = if (phStart and ph) then 1 else 0;

def vhFound1 = if phFound then divSrc else vhFound1[1];

def vhFound_ = if vhFound1!=vhFound1[1] then vhFound1[1] else vhFound_[1];

def vhFound = if !vhFound_ then phh else vhFound_;

def phPrice1 = if phFound then h else phPrice1[1];

def phPrice_ = if phPrice1!=phPrice1[1] then phPrice1[1] else phPrice_[1];

def phPrice = if !phPrice_ then sll else phPrice_;

#// Regular Bullish

def inRangePl = _inRange(plFound[1],MaxLookback,MinLookback);

def oscHL = divSrc > vlFound and inRangePl;

def priceLL = l < plPrice and divSrc <= 40;

def bullCond = plFound and oscHL and priceLL;

#// Hidden Bullish

def oscLL = divSrc < vlFound and inRangePl;

def priceHL = l > plPrice and divSrc <= 50;

def hiddenBullCond = plFound and oscLL and priceHL;

#// Regular Bearish

def inRangePh = _inRange(phFound[1],MaxLookback,MinLookback);

def oscLH = divSrc < vhFound and inRangePh;

def priceHH = h > phPrice and divSrc >= 60;;

def bearCond = phFound and oscLH and priceHH;

#// Hidden Bearish

def oscHH = divSrc > vhFound and inRangePh;

def priceLH = h < phPrice and divSrc >= 50;

def hiddenBearCond = phFound and oscHH and priceLH;

#------ Bubbles

def bullBub = DivBull and bullCond;

def HbullBub = DivHiddenBull and hiddenBullCond;

def bearBub = DivBear and bearCond;

def HbearBub = DivHiddenBear and hiddenBearCond;

addchartbubble(bullBub, divSrc, "R", color.GREEN, no);

addchartbubble(bearBub, divSrc, "R", CreateColor(156,39,176), yes);

addchartbubble(HbullBub, divSrc, "H", color.DARK_green, no);

addchartbubble(HbearBub, divSrc, "H", color.DARK_red, yes);

##### Lines

def bar = BarNumber();

#-- Bear Line

def lastPhBar = if ph then bar else lastPhBar[1];

def prePhBar = if lastPhBar!=lastPhBar[1] then lastPhBar[1] else prePhBar[1];

def priorPHBar = if bearCond then prePhBar else priorPHBar[1];

#-- Bull Line

def lastPlBar = if pl then bar else lastPlBar[1];

def prePlBar = if lastPlBar!=lastPlBar[1] then lastPlBar[1] else prePlBar[1];

def priorPLBar = if bullCond then prePlBar else priorPLBar[1];

def lastBullBar = if bullCond then bar else lastBullBar[1];

def lastBearBar = if bearCond then bar else lastBearBar[1];

def HighPivots = ph and bar >= HighestAll(priorPHBar) and bar <= HighestAll(lastBearBar);

def LowPivots = pl and bar >= HighestAll(priorPLBar) and bar <= HighestAll(lastBullBar);

def pivotHigh = if HighPivots then divSrc else na;

def pivotLow = if LowPivots then divSrc else na;

plot PlotHline = if ShowLastDivLines then pivotHigh else na;

PlotHline.EnableApproximation();

PlotHline.SetDefaultColor(Color.MAGENTA);

plot PlotLline = if ShowLastDivLines then pivotLow else na;

PlotLline.EnableApproximation();

PlotLline.SetDefaultColor(Color.CYAN);

#--- Hidden Lines

#-- Bear Line

def priorHPHBar = if hiddenBearCond then prePhBar else priorHPHBar[1];

#-- Bull Line

def priorHPLBar = if hiddenBullCond then prePlBar else priorHPLBar[1];

def lastHBullBar = if hiddenBullCond then bar else lastHBullBar[1];

def lastHBearBar = if hiddenBearCond then bar else lastHBearBar[1];

def HighHPivots = ph and bar >= HighestAll(priorHPHBar) and bar <= HighestAll(lastHBearBar);

def LowHPivots = pl and bar >= HighestAll(priorHPLBar) and bar <= HighestAll(lastHBullBar);

def pivotHidHigh = if HighHPivots then divSrc else na;

def pivotHidLow = if LowHPivots then divSrc else na;

plot PlotHBearline = if ShowLastHiddenDivLines then pivotHidHigh else na;

PlotHBearline.EnableApproximation();

PlotHBearline.SetDefaultColor(Color.DARK_RED);

plot PlotHBullline = if ShowLastHiddenDivLines then pivotHidLow else na;

PlotHBullline.EnableApproximation();

PlotHBullline.SetDefaultColor(Color.DARK_GREEN);

#-- END of CODE