# https://www.tradingview.com/v/aM7pePxC/

#//@taufan_ganas

#indicator(title='Ultimate MACD')

# converted by Sam4Cok@Samer800 - 09/2023 - request form ww.usethinkscript.com member

declare lower;

input source = close;

input RSIstrength = 50;# (defval=50, title='RSI Strength Level', group=grp_1)

input fastLength = 8;# minval=1, title='MACD Fast Length', group=grp_2)

input slowLength = 16;# minval=1, title='MACD Slow Length', group=grp_2)

input signalLength = 11;# minval=1, title='MACD Signal Length', group=grp_2)

input fastLength1 = 12;#, minval=1, title='MACD Fast Length', group=grp_3)

input slowLength1 = 26;# minval=1, title='MACD Slow Length', group=grp_3)

input signalLength1 = 9;# minval=1, title='MACD Signal Length', group=grp_3)

input periodK = 14;# title='K', minval=1)

input periodD = 3;# title='D', minval=1)

input smoothK = 3;# title='Smooth', minval=1)

def na = Double.NaN;

def pos = Double.POSITIVE_INFINITY;

def neg = Double.NEGATIVE_INFINITY;

def fastMA = ExpAverage(source, fastLength);

def slowMA = ExpAverage(source, slowLength);

def macd = fastMA - slowMA;

def signal = Average(macd, signalLength);

def hist = macd - signal;

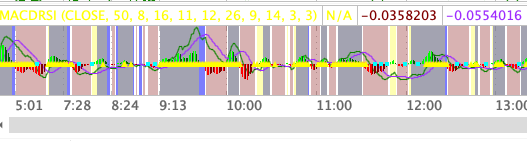

#//RSI Color

def rsivalue = rsi(Price = close,Length = 14);

def colorsi = rsivalue >= RSIstrength;

#//Plot RSI

plot rsiPlot = if colorsi then 0 else na;

rsiPlot.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

rsiPlot.SetDefaultColor(Color.YELLOW);

#//Plot MACD

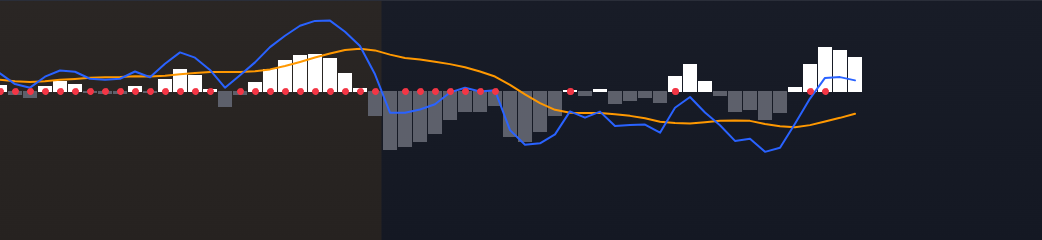

plot macdHist = hist;#, title='Histogram'

macdHist.SetLineWeight(4);

macdHist.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

macdHist.AssignValueColor(if hist >= 0 then if hist[1] < hist then Color.GREEN else Color.DARK_GREEN else

if hist[1] < hist then Color.DARK_RED else Color.RED);

plot sigLine = signal;#, color=color.new(color.red, 0), linewidth=1)

plot macLine = macd;#, color=color.new(color.blue, 0), linewidth=1)

sigLine.SetDefaultColor(GetColor(8));

macLine.SetDefaultColor(GetColor(1));

# 'SLOW MACD SETTINGS:'

def fastMA1 = ExpAverage(source, fastLength1);

def slowMA1 = ExpAverage(source, slowLength1);

def macd1 = fastMA1 - slowMA1;

def signal1 = Average(macd1, signalLength1);

AddCloud(if macd1 >= signal1 then pos else na, neg, Color.BLUE);

def intersection1 = macd >= signal;

def intersection2 = macd1 >= signal1;

AddCloud(if !intersection1 and !intersection2 then pos else na, neg, Color.DARK_RED);

AddCloud(if intersection2 then pos else na, neg, Color.BLUE);

AddCloud(if intersection1 then pos else na, neg, Color.YELLOW);

# //Stochastic

def k = StochasticFull(KPeriod = periodK, DPeriod = periodD, slowing_period = smoothK).FullK;

def d = StochasticFull(KPeriod = periodK, DPeriod = periodD, slowing_period = smoothK).FullD;

def stobull = Crosses(k, d, CrossingDirection.ABOVE) and k <= 20;# ? #3179f5 : na

def stobear = Crosses(d, k, CrossingDirection.ABOVE) and k >= 80;# ? #ff3b7d : na

plot CrossUp = if stobull then 0 else na;#, color=stobull, style=plot.style_cross, linewidth=4)

plot CrossDn = if stobear then 0 else na;#, color=stobear, style=plot.style_cross, linewidth=4)

CrossUp.SetDefaultColor(Color.CYAN);

CrossDn.SetDefaultColor(Color.MAGENTA);

CrossUp.SetPaintingStrategy(PaintingStrategy.SQUARES);

CrossDn.SetPaintingStrategy(PaintingStrategy.SQUARES);

#-- END of CODE