jackaltr8s

New member

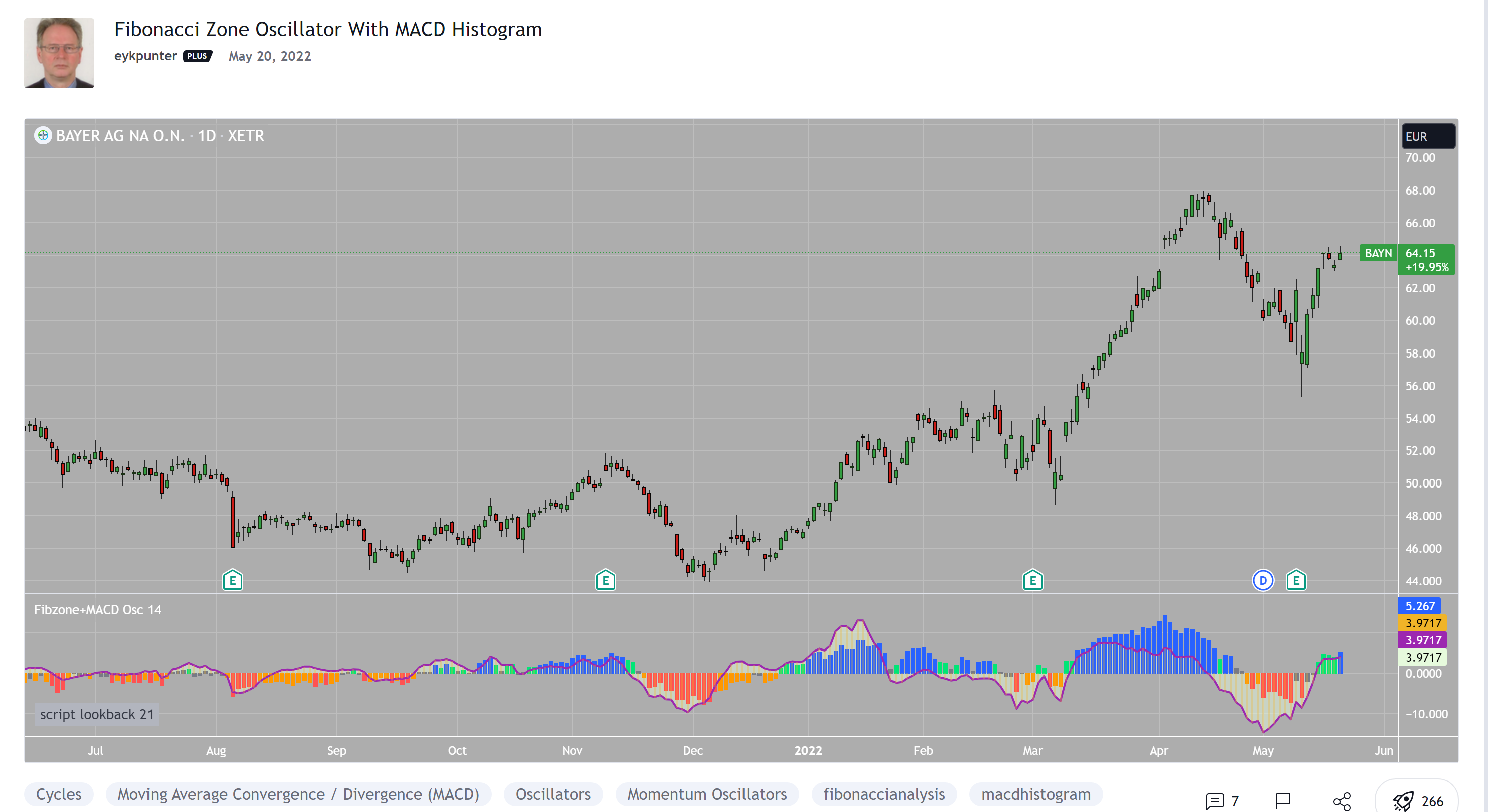

The author states:

Strategy and Use:

Blue column: Close in uptrend area, 4 supports, 0 resistance, ready to rally up.

Green column: Close in buyers area, 3 supports, 1 resistance, looking up.

Gray column: Close in center area 2 supports, 2 resistances, undecided.

Yellow column: Close in sellers area 1 support, 3 resistances, looking down.

Red column: Close in downtrend area, 0 support, 4 resistances, ready to rally down.

I use this indicator in a layout with three timeframes which I use for stock picking, I pick all stocks with a blue column in every timeframe, the indicator is so clear that I can flip through the 50 charts of my universe of high liquid European blue chips in 15 minutes to make a list of these stocks.

Because I use it in conjunction with KeltCOG I also gave it a ‘script sets lookback’ option which can be checked with a feedback label and switched off in the inputs.

The MACD histogram

I admire the MACD because it is spot on when predicting tops and bottoms. It is also the most sexy indictor in TA. Actually just the histogram is needed, so I don’t show the macd-line and the signal line. I use the same lookback for the slow-ma as for the columns, set the fast-ma to half and the signal-line to a third of the general lookback. Therefore I gave the lookback a minimum value of 6, so the signal gets at least a lookback of 2.

The histogram is plotted three times, first as a whitish area to provide a background, then the colums of the Fibzone Oscillator are plotted, then the histogram as a purple line, which contrasts nicely and then as a hardly visible brown histogram.

The input settings give the option to show columns and histogram separate or together.

Strategy and use:

I think about the columns as showing a ‘longer term chosen momentum’ and about the histogram as a ‘short term power momentum’. I use it as additional information.

Hi Team - I came across this amazing oscillator and wonder if anyone with good scripting skills could conver to TOS version.

https://www.tradingview.com/script/L2piavbm-Fibonacci-Zone-Oscillator-With-MACD-Histogram/

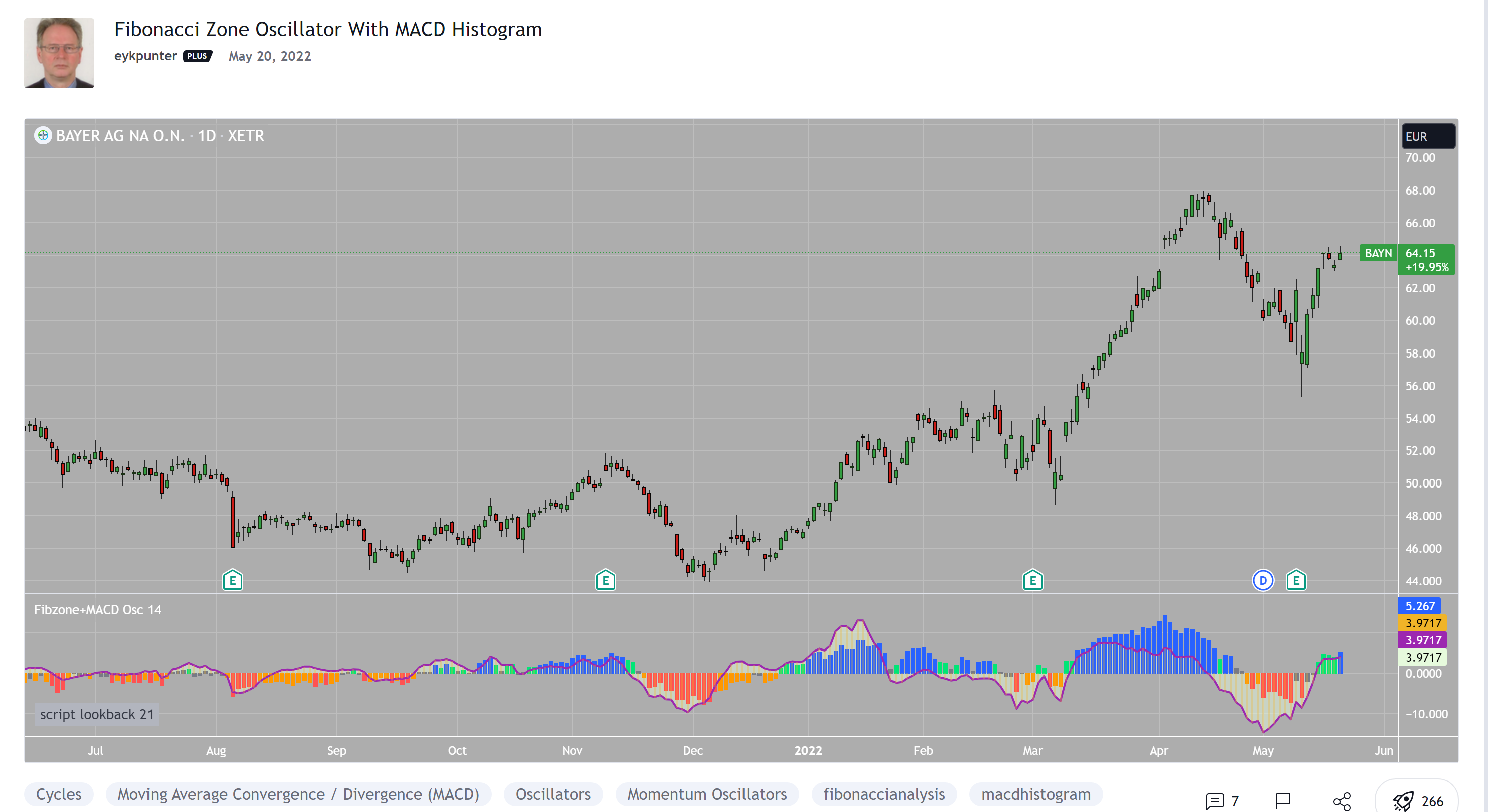

Strategy and Use:

Blue column: Close in uptrend area, 4 supports, 0 resistance, ready to rally up.

Green column: Close in buyers area, 3 supports, 1 resistance, looking up.

Gray column: Close in center area 2 supports, 2 resistances, undecided.

Yellow column: Close in sellers area 1 support, 3 resistances, looking down.

Red column: Close in downtrend area, 0 support, 4 resistances, ready to rally down.

I use this indicator in a layout with three timeframes which I use for stock picking, I pick all stocks with a blue column in every timeframe, the indicator is so clear that I can flip through the 50 charts of my universe of high liquid European blue chips in 15 minutes to make a list of these stocks.

Because I use it in conjunction with KeltCOG I also gave it a ‘script sets lookback’ option which can be checked with a feedback label and switched off in the inputs.

The MACD histogram

I admire the MACD because it is spot on when predicting tops and bottoms. It is also the most sexy indictor in TA. Actually just the histogram is needed, so I don’t show the macd-line and the signal line. I use the same lookback for the slow-ma as for the columns, set the fast-ma to half and the signal-line to a third of the general lookback. Therefore I gave the lookback a minimum value of 6, so the signal gets at least a lookback of 2.

The histogram is plotted three times, first as a whitish area to provide a background, then the colums of the Fibzone Oscillator are plotted, then the histogram as a purple line, which contrasts nicely and then as a hardly visible brown histogram.

The input settings give the option to show columns and histogram separate or together.

Strategy and use:

I think about the columns as showing a ‘longer term chosen momentum’ and about the histogram as a ‘short term power momentum’. I use it as additional information.

Hi Team - I came across this amazing oscillator and wonder if anyone with good scripting skills could conver to TOS version.

https://www.tradingview.com/script/L2piavbm-Fibonacci-Zone-Oscillator-With-MACD-Histogram/

Last edited by a moderator: