You should upgrade or use an alternative browser.

Relative Volume Strategy and Momentum Scanner for ThinkorSwim

Ben's Swing Trading Strategy + Indicator

I wouldn't call this a course. My goal is zero fluff. I will jump right into my current watchlist, tell you the ThinkorSwim indicator that I'm using, and past trade setups to help you understand my swing trading strategy.

I literally press scan in the morning and I get nothing until after the bell and it is too late.

reread your post. Adjust the 10% to lower number. I personally use 3%. I do not use unusual volume. For me the bread and butter to the scan is the plot scan = close >= (open*1.04);

Rv1 is not a criteria for trading a stock. It just points out what stock is trading higher than normal volume. With these low floats they are basically pump and dumps. So if a stock already pumped odds are it doesnt come back a second time. Now if there is news with the initial pump then I would pay more attention to that.

I saw OPGN today as well but it was already at 3.60 and "too late" for my discipline even tho it still ran to 4+ I didn't want to chase.

thanks. I will have to test both out (unusual volume vs no unusual volume) and see what happens monday. I know these are all small cap/pump and dumps, just trying to get in on them earlier, because from what has been spoken about in this forum and the set up it does well 20-30% a day. I can see how the set up works and I'm always watching 5/15MA's. thanks jezzer46

I saw OPGN today as well but it was already at 3.60 and "too late" for my discipline even tho it still ran to 4+ I didn't want to chase.

No worries. I was having problems with some failures of these stocks too. Just got to grind harder and find what works the best for you.

I had OPGN at $2.50 around 0945am myself. Sold a bit early @ $4 but I was fine with $1.50 gain

I want it to stay above 2.55 even if it dips in the morning. Tho if it dips below temporarily that’s okWhat do you mean when you say "stocks within the top 50% of this range at market open?" Are you saying that if a stock had gone between 2.30 to 2.80, you want it to be above 2.55 at open? Or even 2.60 for being above 61.8%?

And any that fit that criteria are among your considerations?

CDJay

Member

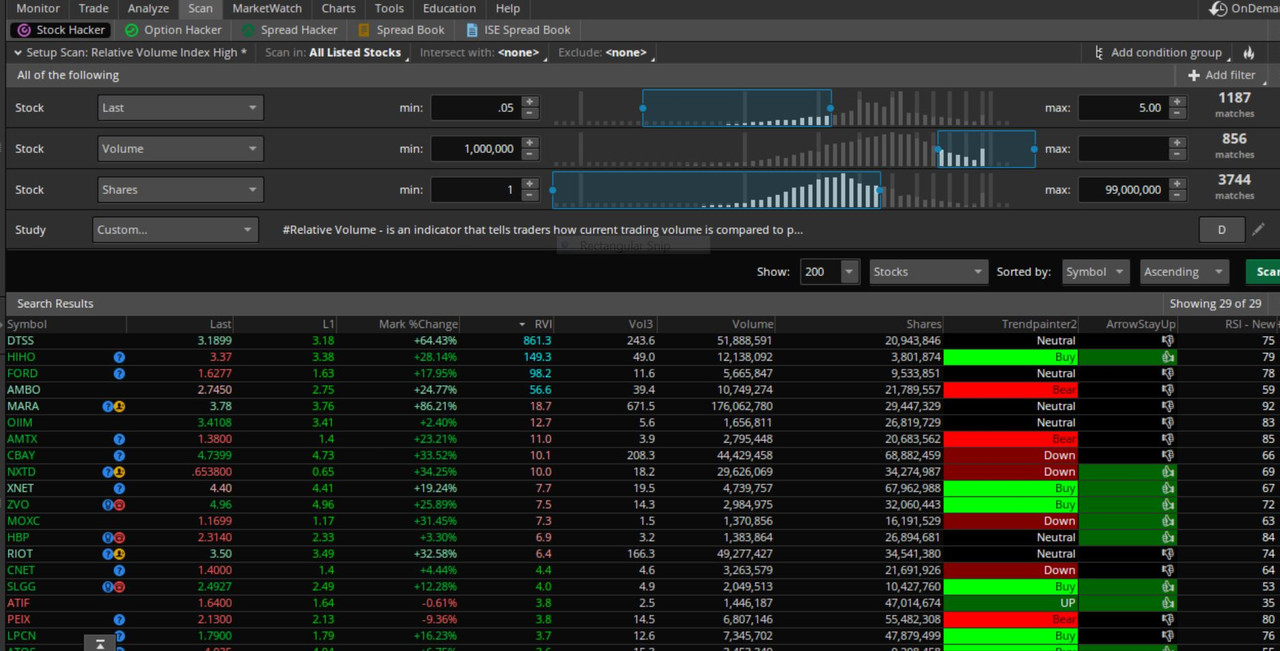

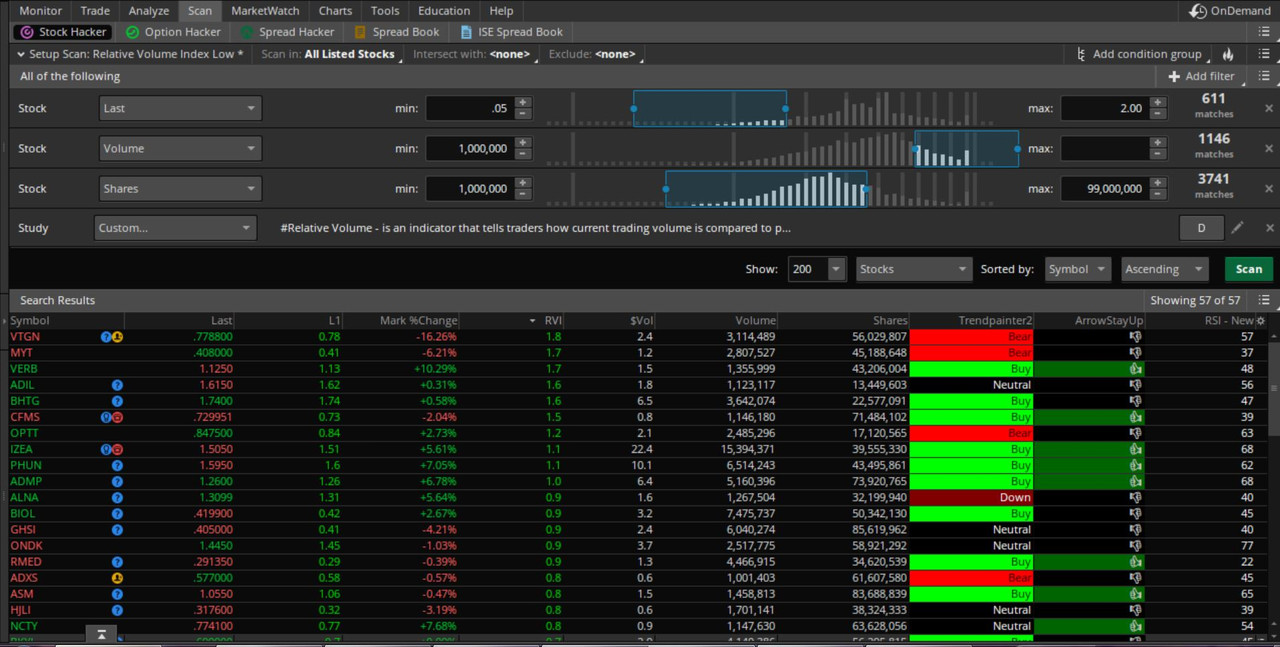

If you are only looking for high RV1, what's the purpose of the scan with the <2 RV1? I assume that code goes into the Study > Custom > ThinkScript?@Sonny @BenTen Thanks to everyone for their input, knowledge and guidance regarding the RVI watchlist. I agree that the RVI code assists in making strategic choices when trading. I was searching for code that I could manipulate when scanning for RVI instead of a watchlist. I then decided to use @Sonny's code to create a scan for RVI; resulting in two RSI scans. The first code is for tickers with a RVI >=2; and the other is for tickers with a RVI <2. This helps to narrow down my search enabling me to focus on the high RVI. I included low float shares, vol of 1m etc within the scan.

Additionally, as some members indicated, these tickers also appear in my momentum and premarket and gapper's scan. I tend to trade the penny stocks at this time (.05 to 3.00 or 5.00). The scan can be altered if looking to trade large caps, larger floats etc. Upon executing the scan I simply check my watchlist and select the tickers with catalysts. I have the VWAP, 9EMA etc on my chart and these along with the Fibonacci retracement helps a lot.

I also created an alert which alerts when tickers are removed or added to the watchlist/scan.

Please see below the scan as well as a pic of the scanner (this is from today's trading session). Thanks once again to everyone who has contributed to my growth as I continue my trading journey on this forum.

Code:#Relative Volume High; def x = Average(volume, 60)[1]; def v = volume; def r = Round((v/x),1); def rvi = r >= 2; plot scan = rvi;

Code:#Relative Volume Low; def x = Average(volume, 60)[1]; def v = volume; def r = Round((v/x),1); def rvi = r < 2; plot scan = rvi;

Also, how did you get the red, green and black highlights?

Finally, if you're using this in a scan, how do you easily see the charts? I've been using watchlists, because I can cycle through the charts, but I like this format as long as I could see a chart. Do you have them in a detached page, and does it link up to the scan?

Thank you.

Hey everyone. I used my premarket scanner just to get a feel for the pm movers. Then at 9:30 I ran my RVI scanner (using the thinkscript "buysignal" instead of the thinkscript strongbuyl). IPDN, PEIX, IZEA and ARC were the top ones based on my scan. I usually scan .05-$3.00

The buy signal for IPDN came at $1.20 and it went to a high of $2.20 before retracing.

The buy signal for PEIX came at $1.93 and it went to a high of $2.48. It has not retraced or made a significant dip as yet.

The buy signal for ARC came at $1.09 and it went to a high of $1.39.

The buy signal for IZEA came at $1.36 and it went to a high of $1.72.

what code is the buy signal based on generated?

BonBon

Active member

@jezzer46 and @mas00 . Jezzer46 you are correct. I constantly have to hit the scan button as well. Additionally, I pick up the tickers with the high RVI on my other watchlists before the market opens and at the market open so I am able to catch the early buy signals etc. Hence the reason for the PM RVI scan and my other scans.@jezzer46 If you are waiting on you watchlist to populate then its a TOS thing not the scanner settings. At 930 to 935 just go into the scan tab and basically manually press the scan button. unfortunately I myself have found to miss alot by waiting for the watchlist.

I have been playing with the PM and regular RVI script in an attempt to incorporate them into one. In this way the RVI scan will begin before 9:30am. I will be testing tomorrow.

axlerod

Member

Yes those i did not share cuz those are private. 1D can't explain at this time but uses many more complex variables like aroonocillator kst and momentum and EMAs combined.

But the other 2 is if the close is above the 50ema or 200ema is above or below and how many days above since it crossed. above that line.

BonBon

Active member

Yes those i did not share cuz those are private. 1D can't explain at this time but uses many more complex variables like aroonocillator kst and momentum and EMAs combined.

But the other 2 is if the close is above the 50ema or 200ema is above or below and how many days above since it crossed. above that line.

Great. I understand the privacy. So its basically tallying the number of days a ticker is above or below 50 and 200 EMA. I can see this being useful with those who like to swing trade and favor oversold and overbought. (combined with other technical analysis such as RSI, MACD etc) Thanks once again.

"(using the thinkscript "buysignal" instead of the thinkscript strongbuyl)" What is the difference?

Also waiting on a reply to axelrods question about PM because that is where I got confused about this RV1 reguarding PM

https://usethinkscript.com/threads/color-coded-watchlist-columns-for-thinkorswim.2977/post-28578

https://usethinkscript.com/threads/color-coded-watchlist-columns-for-thinkorswim.2977

which one is used for PM?

thanks agian and I will be looking to test this strategy out monday/this week. I will try and post runners that I see on here as well on Monday

axlerod

Member

So RV1 Is completely SEPERATE from mine. I just wanted to share my PM (pre market) script and 3 columns I use.OK , so going back and re-reading and there is a lot of adjusting, and it has lead to confusion on my part now.

"(using the thinkscript "buysignal" instead of the thinkscript strongbuyl)" What is the difference?

Also waiting on a reply to axelrods question about PM because that is where I got confused about this RV1 reguarding PM

https://usethinkscript.com/threads/color-coded-watchlist-columns-for-thinkorswim.2977/post-28578

https://usethinkscript.com/threads/color-coded-watchlist-columns-for-thinkorswim.2977

which one is used for PM?

thanks agian and I will be looking to test this strategy out monday/this week. I will try and post runners that I see on here as well on Monday

If anyone wanted to add or improve to that they are welcome too.

I played with the Rv1 and did not find it to be very accurate or consistent maybe the way I have it setup or what not but was not too happy with it because I got confused reading all the previous posts as which is why I figure i share something simple that works good but could be improved on being my PM gainer script.

Gabrielx77

Active member

I agree with you, but at the same time everyone is just trying to put in their input about how they use Relative Volume with other indicators and personal scans/watchlists. Just make sure to do this, it has worked well for me, but I stepped away from penny stocks due to the volatility:this thread is so confusing and cluttered now with other "gap scanners" "PM scanners" "AH scanners" things are not relevant to the original post/strategy of RV1 now lol

Scan pre-market with one of the scanners provided above. I personally keep it simple by setting:

1. Last: 0.5-15

2. Volume: 10k-MAX

3. After-hours Percentage Change < the CLOSE has moved greater than < 10% in after hours trading < 1m aggregate

Sort by the highest Relative Volume stocks; look for patterns and most importantly: worthy catalysts

Once market opens, wait for a pull back for one of the stocks that you were watching pre-market and then to pop up on your intraday watchlist/scanner. It's important that they pop up on intraday because that shows you it has strong RV pre and intraday.

The scanner I use is one of the originals that Sonny provided, but made some tweaks because it was hard to find more stocks to run. Here's my intraday scanner:

1. Last: 0.5 - 15

2. Volume: 250k - MAX

3. % change: 5% - MAX

4. Shares: MIN - 50,000,000

5. Unusual Volume < current bar's volume increased at least 40% from its typical average over 60 periods < D agg

6. Custom...

#Relative Volume High;

def x = Average(volume, 60)[1];

def v = volume;

def r = Round((v/x),1);

def rvi = r >= 2;

plot scan = rvi;If your pre-market tickers fail by 10:45, then you can try and be patient for stocks that pop up on the intraday scanner; but like sonny taught me, you just have to be patient and most of the time your PM tickers actually do run up, even if it's later in the morning.

My process is looking for PM gappers to pullback between the 32.8-50 right before market open, then pull back even more until it reaches the 50-61.8% levels (using the Fib Retracement and plot PM low to high). After I'll watch for a break over VWAP and place an entry price. It works really well, but since I have been trying to get into more large caps I had to step away from the penny stocks. I did some back testing on other indicators called the Trend Reversal and TMO, provided by BenTen, I think I'm going to try and use them for these small caps starting tomorrow. I'll let you know how that goes.

P.S. if you wanted to see my chart setup:

CDJay

Member

2) If the scans are faster, is there a similar way to see the charts as there is in watchlists where we can link the two? Or would our quickest method be a second screen and typing in the name from the scan?

CDJay

Member

BonBon, would you mind sharing your Fibonacci code? I'm curious to try it, particularly since I've been the King of Missed Opportunities. I find the stocks, but I'm doing a horrible job with my decisions on entries.@Gabrielx77 you are welcome. There are several ways I use the Fibonacci retracement. If it is a stock that gapped up I would wait until it retraces to the 78.6. levels and wait for the buy signal (I have found that the 78% levels is near the stock's previous support level).

For momentum stocks, I would wait for a retracement no further than the 50% or 66% levels. I have found that these stocks that retrace below the 66% can simply be a pump. I also consider the catalyst when drawing the retracement lines as some tickers may only retrace to the 28% or 36% retracement levels if its a very strong catalyst. I also utilize other technical analysis to help make decisions regarding the trade.

CDJay

Member

Thanks, @BenTen. Really dumb question, because I assume the answer is no, but are there any macros that could be set to automatically run the scans every X number of seconds?@CDJay Expect around 3-5 mins delay if you're going to wait for the watchlist (created from the scanner) to update itself. That's the issue with ToS, nothing we can do. An alternative would be to hit that Scan button manually every time you want to refresh data.

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

Slingshot Relative Volume & Zones Setup For ThinkOrSwim

- Started by rip78

- Replies: 12

-

Relative Volume Spike Buy Sell Chart Setup For ThinkOrSwim

- Started by UpTwoBucks

- Replies: 27

-

Next Gen Volume Momentum Oscillator For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 8

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Mastering Market Pullbacks: Volume Spikes, Moving Averages, Pull Backs and Crossovers For ThinkOrSwim

- Started by UpTwoBucks

- Replies: 31

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

Slingshot Relative Volume & Zones Setup For ThinkOrSwim

- Started by rip78

- Replies: 12

-

Relative Volume Spike Buy Sell Chart Setup For ThinkOrSwim

- Started by UpTwoBucks

- Replies: 27

-

Next Gen Volume Momentum Oscillator For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 8

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Mastering Market Pullbacks: Volume Spikes, Moving Averages, Pull Backs and Crossovers For ThinkOrSwim

- Started by UpTwoBucks

- Replies: 31

Similar threads

-

Slingshot Relative Volume & Zones Setup For ThinkOrSwim

- Started by rip78

- Replies: 12

-

Relative Volume Spike Buy Sell Chart Setup For ThinkOrSwim

- Started by UpTwoBucks

- Replies: 27

-

Next Gen Volume Momentum Oscillator For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 8

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Mastering Market Pullbacks: Volume Spikes, Moving Averages, Pull Backs and Crossovers For ThinkOrSwim

- Started by UpTwoBucks

- Replies: 31

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/