You should upgrade or use an alternative browser.

Relative Volume Strategy and Momentum Scanner for ThinkorSwim

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Gabrielx77

Active member

BonBon

Active member

@BonBon Thanks for your update. I was also starting to use the Fibonacci Retracement to find entry positions, but it would mostly blow past my support levels. Anyway you can send a pic a pic and explain on how you use your indicators while watching a ticker that pops up on this scanner?

@Gabrielx77 you are welcome. There are several ways I use the Fibonacci retracement. If it is a stock that gapped up I would wait until it retraces to the 78.6. levels and wait for the buy signal (I have found that the 78% levels is near the stock's previous support level).

For momentum stocks, I would wait for a retracement no further than the 50% or 66% levels. I have found that these stocks that retrace below the 66% can simply be a pump. I also consider the catalyst when drawing the retracement lines as some tickers may only retrace to the 28% or 36% retracement levels if its a very strong catalyst. I also utilize other technical analysis to help make decisions regarding the trade.

BonBon

Active member

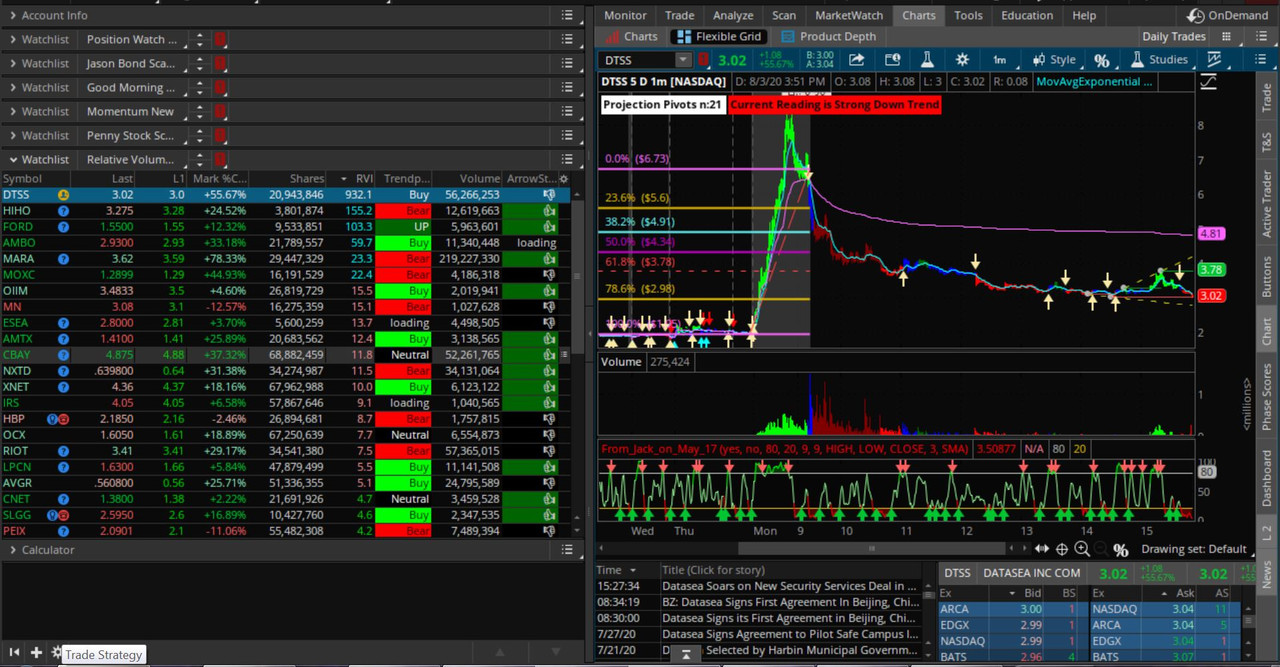

As you can see DTSS had the highest RVI on my scan. This is the scan's watchlist. DTSS was one of the main movers in the premarket with a high RVI but it opened lower than the premarket price. The down arrow shows that the stock has started to retrace. As this stock gapped up tremendously from its previous day's close I assumed it would retrace to the 78% levels. As you can see it retraced throughout the day. It can reach the 78% retracement levels (or near it) and then gap up once again. However in this scenario I would not take the trade but wait until it retraces and look for a buy signal (the up arrow after the retracement to the previous day's levels. This arrow is part of the trendpainter courtesy of @BenTen). To the right there are also support and resistance lines as well. This code was obtained in this forum as well.

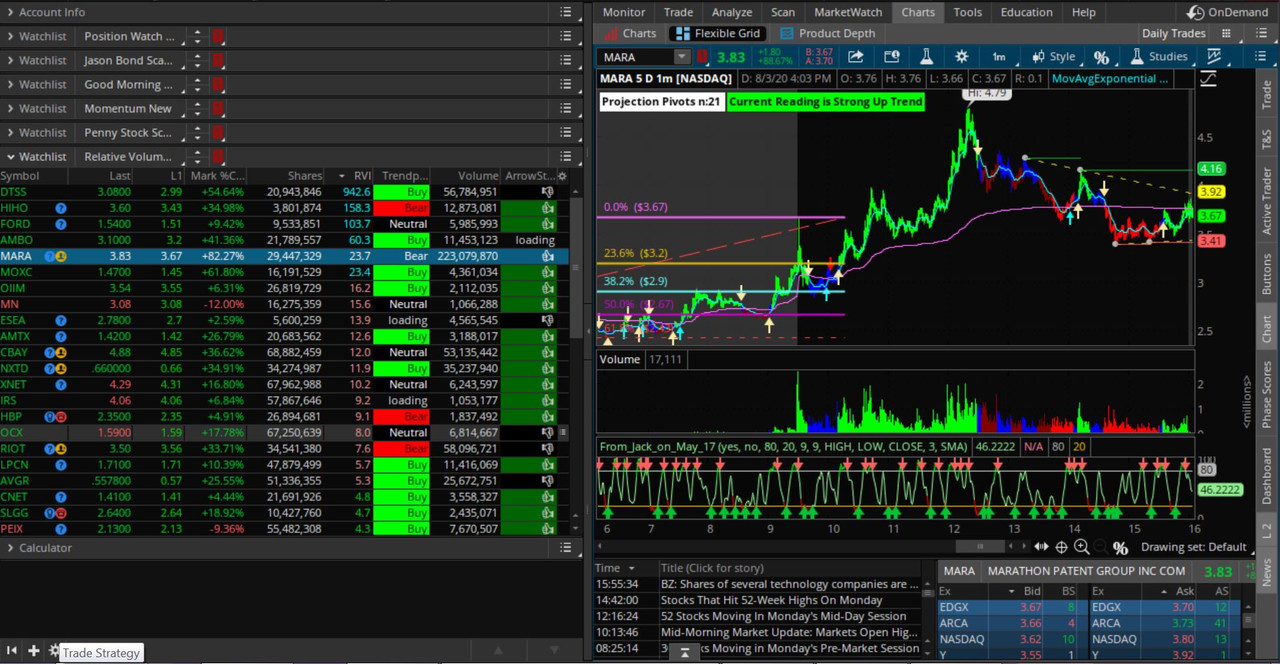

This is the second example

MARA also had a high RVI. It was the 5th highest on my scan/watchlist. However, based on the buy signal (arrow on the chart), VWAP and the strong buy trend this was a better trade. It only retraced to the 38% level and went as high as $4.79. (reminder, the fib retracement was done at the opening. I would have to re-draw the fib retracement reflecting the $4.79 price to get an accurate retracement level.

Gabrielx77

Active member

@BonBon This looks good. I have been trying to implement the Fib Retracements on my gapers to have a more concrete approach for a entry and exit point, but I keep running into trouble when it comes to knowing which stock will bounce and which will run straight through. I draw my support lines, look at trend and I use my RSI to help determine when a good entry point is. I need to look more at the pre-market gapers using the RV1 indicator. Thank you for the input, I'll let you know what I do tomorrow.

Here's my method:

1. Take the top RV1 stocks.

2. Take the pre-market high and lows. I only consider stocks within the top 50% of this range at market open. Sometimes I may look to the top 61.8% range. The reason for this is you want stocks that have the highest change of breaking above the pre-market high. Those are the runners. If a stock has too far to go to reach the pre-market high, it likely won't break that level.

3. Generally, VWAP is hanging out in the area just above the consolidation zone. Prioritize these.

4. Look for volume + price divergence.

You'll find there's only one, maybe two, that meet this criteria each morning.

axlerod

Member

Love this scan and logic alot. Got the RVI columns etc but do you have the Arrow with thumbs up or down and Trend Script ?Here's my method:

1. Take the top RV1 stocks.

2. Take the pre-market high and lows. I only consider stocks within the top 50% of this range at market open. Sometimes I may look to the top 61.8% range. The reason for this is you want stocks that have the highest change of breaking above the pre-market high. Those are the runners. If a stock has too far to go to reach the pre-market high, it likely won't break that level.

3. Generally, VWAP is hanging out in the area just above the consolidation zone. Prioritize these.

4. Look for volume + price divergence.

You'll find there's only one, maybe two, that meet this criteria each morning.

Love this scan and logic alot. Got the RVI columns etc but do you have the Arrow with thumbs up or down and Trend Script ?

Nope

poststreet

Member

at what time do you categorize the rv1s ! " take the top RV1" stocks as Gin09 wrote , how many do you watch and what time do you run a scan? thanks.

I just use a watchlist and when one pops up I quickly scan to see if it’s greater than 50% of the pre-market move. If not I generally ignore it

BonBon

Active member

@Ginu09, @axlerodNope

Please go to my post in Trend Painter thread to see the code that I created for the trendpainter watchlist. @BenTen created the original trendpainter code which is on the chart and I adapted it to create the watchlist. Please let me know if you want the code for the arrows which are the buysignals (arrows) that are on the chart.

Gabrielx77

Active member

This is a good way to look at it. What tickers did were you eyeing out today right before market open?I just use a watchlist and when one pops up I quickly scan to see if it’s greater than 50% of the pre-market move. If not I generally ignore it

axlerod

Member

I have 2 scripts for RV1

This one referring to this post https://usethinkscript.com/threads/color-coded-watchlist-columns-for-thinkorswim.2977/post-28578

def isRollover = GetYYYYMMDD() != GetYYYYMMDD()[1];

def beforeStart = GetTime() < RegularTradingStart(GetYYYYMMDD());

def vol = if isRollover and beforeStart then volume else if beforeStart then vol[1] + volume else Double.NaN;

def PMV = if IsNaN(vol) then PMV[1] else vol;

def AV = AggregationPeriod.DAY;

def x = Average(Volume(period=AV)[1],60);

def y1 = Round((PMV/x),2);

def L = Lg(y1);

def p = if L>=1 then 0 else if L>=0 then 1 else 2;

def y2 = Round(y1,p);

plot z = y2;

z.assignValueColor(if z>=10 then color.CYAN else if z>=1 then createcolor(255,153,153) else createcolor(0,215,0));

The the original code on page 1 - https://usethinkscript.com/threads/color-coded-watchlist-columns-for-thinkorswim.2977

def x = Average(volume, 60)[1];

def v = volume;

plot r = Round((v/x),1);

r.assignValueColor(if r >= 20 then color.CYAN else if r>=5 then createcolor(255,153,153) else createcolor(0,215,0));

Which one do I use? Or Do i use both and one called Pre Market RV1 and the other RV1 ?

Thank you very much also the other columns you posted on page 1 I set all to 1d time is that correct? @sunny

Today nothing caught my eye.This is a good way to look at it. What tickers did were you eyeing out today right before market open?

axlerod

Member

Be great if we can have it so they fall off if volume doenst hit 1mill by that time. I know we can add it into the code just gotta figure out exactly how.Focus on stocks that appear on the scan before 10:15am and track them. If a stock's volume is not 1,000,000 by 9:45am, then it is not worth tracking. Today, BOXL and BKYI showed up and had decent spikes.

axlerod

Member

Ya just noticed that becasue the thumbs I tried didn't work for me but I also noticed in the picture above the THUMBS for example MARA (picture 1) had a THUMBS UP but said BEARISH in red. Hate to ask but could you post the link for the THUMBS portion and what time frame do you have that set too? Thank you very much god bless you all for your knowledge and wisdom! Much appreciated!@Ginu09, @axlerod

Please go to my post in Trend Painter thread to see the code that I created for the trendpainter watchlist. @BenTen created the original trendpainter code which is on the chart and I adapted it to create the watchlist. Please let me know if you want the code for the arrows which are the buysignals (arrows) that are on the chart.

What is this Volume study?@Gabrielx77

As you can see DTSS had the highest RVI on my scan. This is the scan's watchlist. DTSS was one of the main movers in the premarket with a high RVI but it opened lower than the premarket price. The down arrow shows that the stock has started to retrace. As this stock gapped up tremendously from its previous day's close I assumed it would retrace to the 78% levels. As you can see it retraced throughout the day. It can reach the 78% retracement levels (or near it) and then gap up once again. However in this scenario I would not take the trade but wait until it retraces and look for a buy signal (the up arrow after the retracement to the previous day's levels. This arrow is part of the trendpainter courtesy of @BenTen). To the right there are also support and resistance lines as well. This code was obtained in this forum as well.

This is the second example

MARA also had a high RVI. It was the 5th highest on my scan/watchlist. However, based on the buy signal (arrow on the chart), VWAP and the strong buy trend this was a better trade. It only retraced to the 38% level and went as high as $4.79. (reminder, the fib retracement was done at the opening. I would have to re-draw the fib retracement reflecting the $4.79 price to get an accurate retracement level.

BonBon

Active member

@Gabrielx77, @Ginu09, @axlerod

The code for the thumbsup watch list is:-

Thumbs Up/Down Watchlist (based on the trendpainter thinkscript originally coded by @BenTen.) The thumbs up is based on the buysignal section of the thinkscript.

The thumbs up is aligned to the thumps up or thumps down within the chart.) The time frame is the same as the chart 1m but you can change the time frame. Remember if you change the time frame for the trendpainter chart you have to change it for the watchlist as well. I also created a scan for the trendpainter where you can scan for stocks that are only strongbuy, etc. I also use this with the RVI as well. In this way it would only show RVI stocks that are strongbuy.

The below code was added to the original trendpainter code to create the custom Thumbs up/down watchlist.

def arrowup = buysignal;

def arrowdown = sellsignal;

def trigger = if arrowup then 100 else if arrowdown then -100 else trigger [1];

AddLabel(yes,(if trigger == 100 then "👍" else if trigger == -100 then "👎" else "NA"));

AssignbackgroundColor(if trigger == 100 then Color.dark_Green else if arrowdown == -100 then Color.dark_Red else Color.black);TrendPainter Custom Watchlist

I used the original trendpainter script and added the following script to create the custom watchlist.

def uptrend = buy;

def Stronguptrend = strongbuy;

def downtrend = sell;

def Strongdowntrend = strongsell;

AssignbackgroundColor (if uptrend then Color.Dark_GREEN else if Stronguptrend then Color.Green else if downtrend then color.dark_RED else if Strongdowntrend then Color.RED else Color.Black);

AddLabel(yes,if uptrend then "UP" else if Stronguptrend then "Buy" else if downtrend then "Down" else if Strongdowntrend then "Bear" else "Neutral", if stronguptrend then color.black else if strongdowntrend then color.black else color.white );

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

Similar threads

-

Slingshot Relative Volume & Zones Setup For ThinkOrSwim

- Started by rip78

- Replies: 12

-

Relative Volume Spike Buy Sell Chart Setup For ThinkOrSwim

- Started by UpTwoBucks

- Replies: 27

-

Next Gen Volume Momentum Oscillator For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 8

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Mastering Market Pullbacks: Volume Spikes, Moving Averages, Pull Backs and Crossovers For ThinkOrSwim

- Started by UpTwoBucks

- Replies: 31

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

Slingshot Relative Volume & Zones Setup For ThinkOrSwim

- Started by rip78

- Replies: 12

-

Relative Volume Spike Buy Sell Chart Setup For ThinkOrSwim

- Started by UpTwoBucks

- Replies: 27

-

Next Gen Volume Momentum Oscillator For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 8

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Mastering Market Pullbacks: Volume Spikes, Moving Averages, Pull Backs and Crossovers For ThinkOrSwim

- Started by UpTwoBucks

- Replies: 31

Similar threads

-

Slingshot Relative Volume & Zones Setup For ThinkOrSwim

- Started by rip78

- Replies: 12

-

Relative Volume Spike Buy Sell Chart Setup For ThinkOrSwim

- Started by UpTwoBucks

- Replies: 27

-

Next Gen Volume Momentum Oscillator For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 8

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Mastering Market Pullbacks: Volume Spikes, Moving Averages, Pull Backs and Crossovers For ThinkOrSwim

- Started by UpTwoBucks

- Replies: 31

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/