thanks for that but i guess i didn't explain myself clearly enough. just to take your pic as an example -- you've got it set to 5 d 15 min but zoomed in to a much shorter period. below is a shot of the full 5d 15min chart, and the difference between the two accum readings is pretty stark, with one nearly in oversold territory and the other not even close. hence my question about zoom levels and period length. i believe, according to the late deaf trader, that you're supposed to pick a time length and not zoom at all, but i dunno. have i made myself any clearer?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Here are some of the indicators I use every day

- Thread starter J007RMC

- Start date

- Status

- Not open for further replies.

Gottcha, the accumulation indicator I have on the chart is one I recently added to try out it appears to be a modified TD indicator slow stochastic/accumulation I apologize for the confusion. I took it off my charts yes it is very misleading for me too. My primary lower is the smoothed moxie vers indicator 2 lines 15min chart. . https://usethinkscript.com/threads/moxie-indicator-for-thinkorswim.369/page-8#post-53789thanks for that but i guess i didn't explain myself clearly enough. just to take your pic as an example -- you've got it set to 5 d 15 min but zoomed in to a much shorter period. below is a shot of the full 5d 15min chart, and the difference between the two accum readings is pretty stark, with one nearly in oversold territory and the other not even close. hence my question about zoom levels and period length. i believe, according to the late deaf trader, that you're supposed to pick a time length and not zoom at all, but i dunno. have i made myself any clearer?

Thanks always for your generous sharing of your work. It has made a huge different in my trading. Was wondering if you tried tick chart on the same setting as it seems cleaner? http://tos.mx/b4u4gABI suggest you try this set-up and watch the cycles before jumping in and I would feel the pain if you lost money on this. For me, this has been a profitable set-up. All displayed are public indicators. GL, follow your trade management, please. Zig-zag will repaint only so long as the price continues to rise or drop. It helps to know the candle patterns. Need to run this on a 15min chart to see moxie crossovers and 30min to follow price.

https://tos.mx/noM9aPr

Thanks always for your generous sharing of your work. It has made a huge different in my trading. Was wondering if you tried tick chart on the same setting as it seems cleaner? http://tos.mx/b4u4gAB

Yes, I have Jonas but my favorite moxie lower doesn't draw correctly, unfortunately, and I like candles.

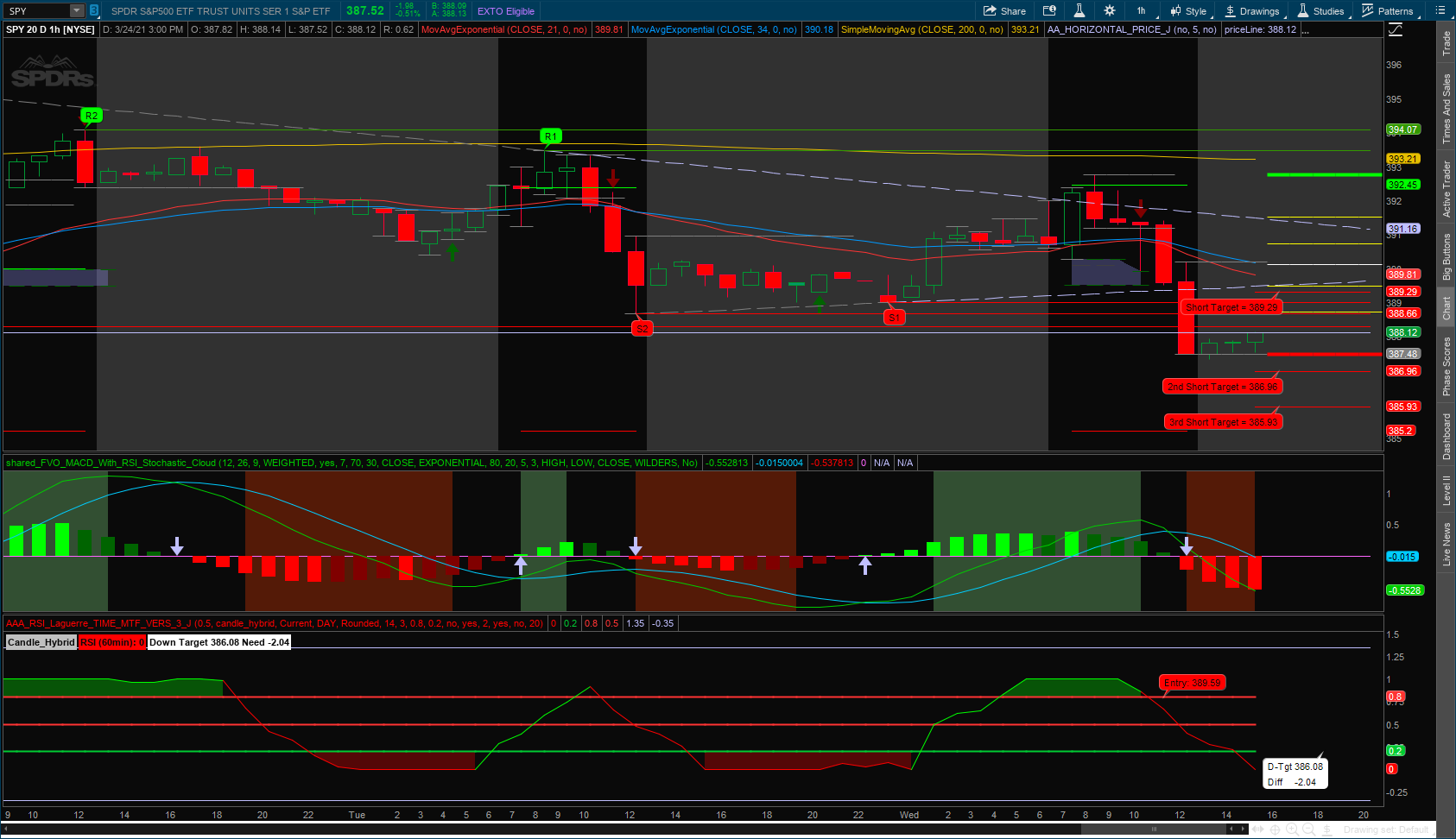

Back to the basics. Well in between trading I have tried a ton of indicators and many of them are great but it depends so much on one's trading style. Ya know the Renko, Bar, Heiki Ashi but candles are much clearer to me. One indicator I have always kept is the Laguerre lines with targets indicator also the Laguerre MTF lower and for some time the MACD RSI indicator, and Ben's Wolf Wave indicator. These indicators are my staples as far as tried and true trades are concerned. And I've tried so many but I always return to start with what I think makes the best and most reliable trade set. Of course, I have added a few complementary indicators well I keep these as well. I use to trade the shorter time frame often nowadays I watch the higher intermediate 1hr, 4hr, and daily but do concentrate mainly on the hourly time frame with attention to the 2 higher time frames and this has worked well for me although I am primarily a day trader and in this market, yeah. So below is what I think a winner and it's done well for me. Now everything on the chart is public domain and all found on our site and ready to explore using the search feature. Today I rode the Spy down from the top great trade......pay special attention to the wolf indicator and the lowers on a 1-hour chart. and I have found the Laguerre to be extremely accurate under most market conditions but hey, RSI and momentum rule right GL, happy trading. TIP. CHECK THE LOWER INDICATORS WHEN IN DOUBT but I rely on the upper indicators for the overall look and the lowers to buy and sell.

If you don't run Advance Market Moves it's definitely something to look into.

https://tos.mx/Eq6EoCT

If you don't run Advance Market Moves it's definitely something to look into.

https://tos.mx/Eq6EoCT

Last edited:

Sounds great. The moxie a really good script that shows price action really well and I am always amazed by the talent on-site. The Heiken indicator I used for a while and like it but I miss the highs and lows it's great for price trends but fails at catching the tops and bottoms. I like to always have up a 21 ema, 34 ema 50 ema, and a 200 sma up. All tickers eventually return to the 200 on the daily and up. I use it as a line in the sand to see if a trend continues downward or springs back up. Sounds like your doing great be sure to watch those ema crosses.@J007RMC I've been using the Moxie as well as the heikin oscillator and the MTF heikin...I don't think I've ever been able to see and execute trades like this before. Truly wonderful! I read somewhere that using the 50 EMA along with the Moxie could help filter out some of the unwanted trades. Haven't tested it, but I have a feeling it might filter too many of the good ones as well.

Also, there are trade techniques built around the VWAP a standard for the mean of price action and worth searching.

@J007RMC In one of your posts you had a fisher_3xStochastic indicator. Do you still use it?

Also, which Laguerre script do you use?

I did comb through this thread. There's a lot of pieces so hopefully I can start piecing it together

This is the Laguerre Targets script that I keep on my charts https://tos.mx/Q3QqavG Stochastic Fischer https://tos.mx/Lq4lWNK

This is another indicator you may want to try and one that you can pair up with others for verification the IronRod SMI Histogram (Lower).Here is the picture of the study you posted. I wanted to give the Fischer one it a shot. Is this the same one you posted above? Thanks a bunch.

Edit: looks like it is.

curious how you use it? Is it good for intraday?

To be honest, I no longer use the Fisher Stochastic there are so many other good indicators on site I like to try them out in real-time trades.

As an example Chart 2: https://tos.mx/5EAdmTh

Last edited:

Laguerre and or slim ribbon I think?Looks interesting, I'll give it a shot. In the upper, are the red/green arrows the AMM2.0? It looks like it's doing a pretty good job.

I have benefited a lot from the plethora of indicators and/or posts on this site so it's time for me to give back. Like everyone else I have used a ton of indicators and have the main indicators I always revert to. The Laguerre MTF lower that @J007RMC mentioned is one indicator that I keep on my charts. There is however one indicator which I think is under-utilized and almost holygrail-esque and that's the Market Forecast indicator. I wish I had this indicator years ago. This indicator is like a cheat code. I once loaded it on my chart and immediately removed it because it has three lines and that was too noisy for me because I love simplicity. However after using it for some time...wow...this indicator has helped me to stay out of bad trades and have aided good trades countless times.

Here's the link: http://tos.mx/3DsfpbU

This is the default TOS Market Forecast indicator with a few colors added to the Interim line.

The color coding is as follows (feel free to modify):

orange - overbought and falling

blue - overbought and rising

red- definitely falling

pink- oversold and falling

plum-oversold and rising

green - rising

blue squares - momentum crossed over the near term

plum squares - momentum crossed below the near term (this is commented out however you can remove the #)

big and small cluster dots - approaching potential reversal or pushing further in the trending direction.

Obviously there's no need to memorize the colors as you can easily see the associations once the indicator is loaded. I would suggest using this on the 5min, 30min and higher time frames. Also when trading...don't just look at one time frame. For example I often trade on the 5min TF but always look at the 30min and daily TF. I love the Market Forecast indicator on the daily for swing trading. Also I initially thought having the momentum line was too noisy but I would suggest keeping the momentum line. The indicator is great with reversals and this is where the momentum line comes in. Lastly....there are many youtube videos on the Market Forecast indicator so if you would like to learn how to use it....check youtube. I've given you the treasure map....go and find the gold.

Here's the link: http://tos.mx/3DsfpbU

This is the default TOS Market Forecast indicator with a few colors added to the Interim line.

The color coding is as follows (feel free to modify):

orange - overbought and falling

blue - overbought and rising

red- definitely falling

pink- oversold and falling

plum-oversold and rising

green - rising

blue squares - momentum crossed over the near term

plum squares - momentum crossed below the near term (this is commented out however you can remove the #)

big and small cluster dots - approaching potential reversal or pushing further in the trending direction.

Obviously there's no need to memorize the colors as you can easily see the associations once the indicator is loaded. I would suggest using this on the 5min, 30min and higher time frames. Also when trading...don't just look at one time frame. For example I often trade on the 5min TF but always look at the 30min and daily TF. I love the Market Forecast indicator on the daily for swing trading. Also I initially thought having the momentum line was too noisy but I would suggest keeping the momentum line. The indicator is great with reversals and this is where the momentum line comes in. Lastly....there are many youtube videos on the Market Forecast indicator so if you would like to learn how to use it....check youtube. I've given you the treasure map....go and find the gold.

Last edited:

here is a new indicator I'm working with a shared Scientific Force script:

#https://usethinkscript.com/threads/...inkorswim-zigzag-bat-butterfly-abcd.69/page-7

#POST 237

Choose the ZZ2nd line, zz3rd line for a longer cycle, or both. Try ticks 501kt, 1000kt you will capture the swing hi/lows perfectly the script is more efficient than what I use so I'm gonna run it from here on out. and really were talking about catching the swing high and low wave patterns here.

https://tos.mx/pzflTLT

#https://usethinkscript.com/threads/...inkorswim-zigzag-bat-butterfly-abcd.69/page-7

#POST 237

Choose the ZZ2nd line, zz3rd line for a longer cycle, or both. Try ticks 501kt, 1000kt you will capture the swing hi/lows perfectly the script is more efficient than what I use so I'm gonna run it from here on out. and really were talking about catching the swing high and low wave patterns here.

https://tos.mx/pzflTLT

Last edited:

Hi, well the market forecast indicator modified be Dix is based on the use of fractals I primarily use the Laguerre indicator also based on fractals.@nitrous and @optionsRS It's essential that you look at multiple stock tickers and observe how the indicator behaves on the daily time frame when the stock price is rising and falling, then you can move to smaller time frames. I usually enter my positions when the intermediate line is trending high (green) with the near-term line residing in the overbought area, and I also usually enter my positions when the intermediate line is trending down (red) with the near-term line residing in the oversold area and the momentum falling.

Two good videos are:

The videos explain what are "clusters", which tend to signal reversals. Armed with this knowledge would you blindly place a bet on a stock just because a cluster appears? No. Before I used the indicator I looked at over 200 stock tickers to see how the indicator related to price action. So look at the videos I linked above and then look at several stocks and observe the related price action.

Yes, refer to post #227 by Dix. I primarily use Laguerre also a fractal-based indicator.@nitrous and @optionsRS It's essential that you look at multiple stock tickers and observe how the indicator behaves on the daily time frame when the stock price is rising and falling, then you can move to smaller time frames. I usually enter my positions when the intermediate line is trending high (green) with the near-term line residing in the overbought area, and I also usually enter my positions when the intermediate line is trending down (red) with the near-term line residing in the oversold area and the momentum falling.

Two good videos are:

The videos explain what are "clusters", which tend to signal reversals. Armed with this knowledge would you blindly place a bet on a stock just because a cluster appears? No. Before I used the indicator I looked at over 200 stock tickers to see how the indicator related to price action. So look at the videos I linked above and then look at several stocks and observe the related price action.

It's a zig-zag so I imagine it does repaint for me capturing a top/bottom it's just a matter of waiting for the next high/low line to develop although this seems a more efficient script see what's under the hood.so wait, how does this work? this actually cathces tops and bottoms im a little lost sorry. does it repaint?

This is my set-upso wait, how does this work? this actually cathces tops and bottoms im a little lost sorry. does it repaint?

https://tos.mx/uiJqpfV

This shows the hourly chart where the zz2nd line yellow needss to continue up to finish out.

I believe zz top/bottoms are very predictive and based on the cyclic nature of waves. If the price finishes low and forms a bottom price will need to move higher to complete the next wave either short or long depending on the time frame so the shorter the time frame the shorter the cyclic waves. Providing we work with proven stocks. So the next direction for price movement is somewhat predictable. I use the WT-TV and RSI Laguerre for lowers.This looks like it's certainly predicting....something with a great deal of efficiency, but the nature of this indicator is so different from anything else I've used that the function is initially somewhat alien to me. How does one interpret it?

Last edited:

Nor to me other than the LL, low low, HL high low, HH high high, and DB down bottomHaving played around a bit I think I'm slowly starting to get it. What's implied by the "DT, LL, DB, etc." labels though? I was looking through the source code to see if it was documented, but it doesn't appear readily obv

Last edited:

Another great indicator I came across yesterday on-site is an accumulation indicator I'm running this today on a 5 to 10 min chart. https://usethinkscript.com/threads/accumulation-swing-index-mtf-indicator-for-thinkorswim.5245/

https://tos.mx/MiCcmRt

https://tos.mx/MiCcmRt

My current chart share

https://tos.mx/wxpmumJ

https://tos.mx/wxpmumJ

I leave overnight on and before open, I look to see where my finished lines are then expect to watch for a line to finish in the opposite direction up or down from that point as well throughout the day. I've run this system for well over a year my win rate is very good to this point. Here is Ben's link to supply-demand zones using zig-zag just be aware yes zz's repaint so patience is required to catch the next line. https://usethinkscript.com/threads/zigzag-high-low-with-supply-demand-zones-for-thinkorswim.172/Nor to me other than the LL, low low, HL high low, HH high high, and DB down bottom

This morning I took 2 trades see the dis overnight bottom to the top of the line extension

And this was my AAPL rade top to bottom and Im done for the day here

Last edited:

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

The View From Here - A Chart Setup for Thinkorswim | Playground | 10 | |

| H | I admit it- I am one of the "Takers" here at UseThinkScript | Playground | 0 | |

| R | Daniel Shay Indicators | Playground | 1 | |

| I | …make a Volume indicator that blows away other indicators? | Playground | 4 | |

|

|

Warning: Shortcomings of Trending Indicators | Playground | 0 |

Similar threads

-

-

I admit it- I am one of the "Takers" here at UseThinkScript

- Started by hockeycoachdoug

- Replies: 0

-

-

…make a Volume indicator that blows away other indicators?

- Started by IHopeToLearn

- Replies: 4

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1228

Online

Similar threads

-

-

I admit it- I am one of the "Takers" here at UseThinkScript

- Started by hockeycoachdoug

- Replies: 0

-

-

…make a Volume indicator that blows away other indicators?

- Started by IHopeToLearn

- Replies: 4

-

Similar threads

-

-

I admit it- I am one of the "Takers" here at UseThinkScript

- Started by hockeycoachdoug

- Replies: 0

-

-

…make a Volume indicator that blows away other indicators?

- Started by IHopeToLearn

- Replies: 4

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.