IHopeToLearn

New member

I would like to challenge all who participate in “useThinkScript” with this question.

I have been thru maybe ALL the indicators.

LAGGING (old news).

LEADING (I’d like to see the future, ah not quite)

COINCIDENT (the BIG picture, created by the Elite & Politicians, ahh No thanks)

*https://www.investopedia.com/ask/answers/what-are-leading-lagging-and-coincident-indicators/

One indicator that moves all of these indicators is VOLUME (Buyers/Sellers).

The King of indicators appears to be VOLUME!

But I thought Price Action was King?

I did a video of my trades and compared frame by frame what moved.

Usually the indicators discussed didn’t (always) move.

But when the Candle (Price action) moved the Volume moved immediately and maybe first.

If I am right we wasted a lot of time creating/using all of the above indicators.

Should the focus be on how to make a Volume indicator that blows away other indicators?

My current go to Volume is: https://www.floatchecker.com/blog/better-volume-indicators-for-thinkorswim.

Simple (which I REALLY prefer) and I think effective, but NOT ENOUGH.

I am currently looking at the DTS sellers “DTS_Scalping_Indicator”, promising(?).

https://usethinkscript.com/threads/...ators-labels-for-thinkorswim.8466/post-129366

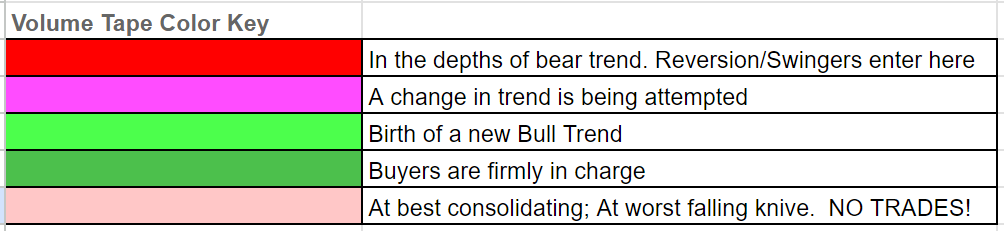

The challenge is creating something like the “ThermoMixIndicator” below but with various VOLUME concepts rolled into one. Maybe we can call it “VolumeMixIndicator”.

Looking in the Edit Studies panel searching Volume (not 100% sure which ones, suggestions?) maybe it could include OnBalanceVolume, PriceandVolumeRank, ThermoSwamiIntradayVolume?, PositiveVolumeIndex & NegativeVolumeIndex, VolumeOsc? You guys would know better which is the ideal combo.

The “ThermoMixIndicator” takes into account Momentum, CCI, RSI, MOBO, CI, ADX and Trend.

And very simple to use, “ Red light Green light, 1,2,3” and it shows the trend.

Red light Green light, 1,2,3” and it shows the trend.

https://usethinkscript.com/threads/...pt-your-one-stop-research-shop.300/#post-4881

Thanks for reading this. I hope you agree with my thought and have the skills (unlike me) to write a script.

I have been thru maybe ALL the indicators.

LAGGING (old news).

LEADING (I’d like to see the future, ah not quite)

COINCIDENT (the BIG picture, created by the Elite & Politicians, ahh No thanks)

*https://www.investopedia.com/ask/answers/what-are-leading-lagging-and-coincident-indicators/

One indicator that moves all of these indicators is VOLUME (Buyers/Sellers).

The King of indicators appears to be VOLUME!

But I thought Price Action was King?

I did a video of my trades and compared frame by frame what moved.

Usually the indicators discussed didn’t (always) move.

But when the Candle (Price action) moved the Volume moved immediately and maybe first.

If I am right we wasted a lot of time creating/using all of the above indicators.

Should the focus be on how to make a Volume indicator that blows away other indicators?

My current go to Volume is: https://www.floatchecker.com/blog/better-volume-indicators-for-thinkorswim.

Simple (which I REALLY prefer) and I think effective, but NOT ENOUGH.

I am currently looking at the DTS sellers “DTS_Scalping_Indicator”, promising(?).

https://usethinkscript.com/threads/...ators-labels-for-thinkorswim.8466/post-129366

The challenge is creating something like the “ThermoMixIndicator” below but with various VOLUME concepts rolled into one. Maybe we can call it “VolumeMixIndicator”.

Looking in the Edit Studies panel searching Volume (not 100% sure which ones, suggestions?) maybe it could include OnBalanceVolume, PriceandVolumeRank, ThermoSwamiIntradayVolume?, PositiveVolumeIndex & NegativeVolumeIndex, VolumeOsc? You guys would know better which is the ideal combo.

The “ThermoMixIndicator” takes into account Momentum, CCI, RSI, MOBO, CI, ADX and Trend.

And very simple to use, “

https://usethinkscript.com/threads/...pt-your-one-stop-research-shop.300/#post-4881

Thanks for reading this. I hope you agree with my thought and have the skills (unlike me) to write a script.