Have not been looking on watch list, but I see the scanner is keep updating the results, I will recheck it tomorrow.....

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

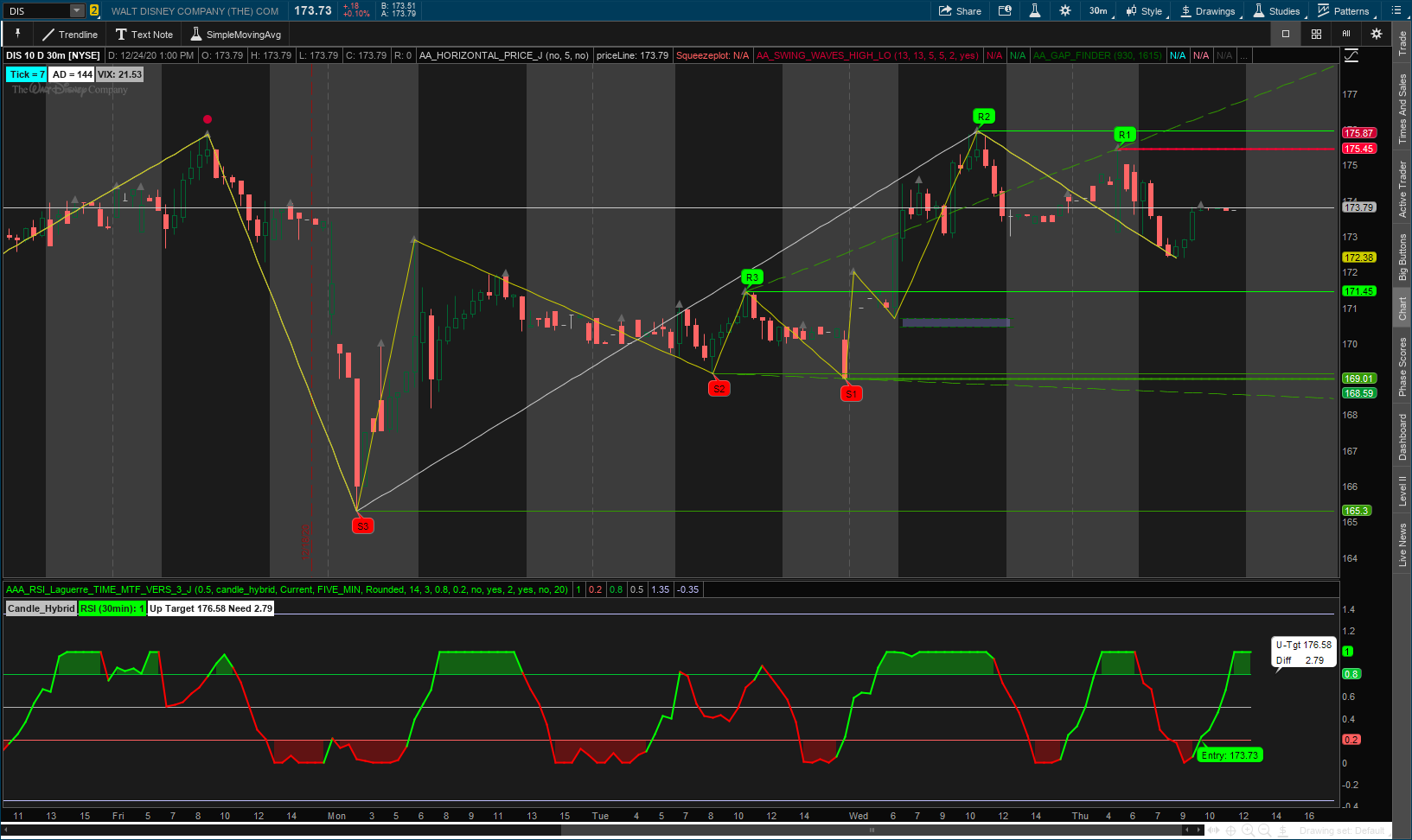

Here are some of the indicators I use every day

- Thread starter J007RMC

- Start date

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

yesHave not been looking on watch list, but I see the scanner is keep updating the results, I will recheck it tomorrow.....

For those who like dual upper SMA'S along with dual SMA histograms try this out on a 4 hr chart. I have this set to 4/9 sma with an upper 19ema line

thinkorswim Sharing (tos.mx)

thinkorswim Sharing (tos.mx)

Last edited:

Yea, I only use the swing hi/lo waves for the pivots and the swing short waves for the alerts I uncheck everything else. And the hi/lo pivots just another confirmation with the projection pivot lines on the lower time frames so lrc on higher time frames.

Last night I put down an ema cloud for the best of both worlds and so far I'm kinda liking it but really my only intent is to recommend the toolsthank you boss, ill give those a try.

EMA cloud crossover thinkorswim Sharing (tos.mx)

Fisher CCI combo thinkorswim Sharing (tos.mx)

Simple LRC thinkorswim Sharing (tos.mx)

Last edited:

I recently come across a neat Williams fractal script that pegs the tops.

thinkorswim Sharing (tos.mx)

thinkorswim Sharing (tos.mx)

Nope will definitely check this out thanks.thanks bro, have yo ever seen this

The swing wave script is extremely helpful as a stand-alone- Really just one upper depending on your time frames and the securities you trade BA is a good example, something that moves. Do some research to pair this with a waves script and life becomes better.

Yes, practically everything repaints with price movement but really really once the hi-low price sets and the reversal happens, there you go...patience is 95% of the game. I don't believe absolute indicators exist without reversal. 5 wave counts are a good rule for me.Do they repaint or have bar delay?

Time to put this thread to rest. I'm going to take this 1 step further my only interests here are to turn you guys onto a killer system but you have to do the research to find the missing piece of the puzzle. I've added major/minor lines, basic swing waves high script, and projection pivots scripts.

How do I trade the waves?

Always watch the pre-market I leave my setting on.

At what point is the ending/beginning wave pe-open

At what point is the ending/beginning wave at close

Can be used with any time frame

I prefer watching my charts on 30 min time frame and enter/exit 2-5min

I trade the beginning and end of the minor/major wave sets.

Of course, the minor-major waves are based on resistance/support levels GL

Basic Script: https://tos.mx/8QkMnqz

Chart for illustrated purposes not duplicable/transferable.

How do I trade the waves?

Always watch the pre-market I leave my setting on.

At what point is the ending/beginning wave pe-open

At what point is the ending/beginning wave at close

Can be used with any time frame

I prefer watching my charts on 30 min time frame and enter/exit 2-5min

I trade the beginning and end of the minor/major wave sets.

Of course, the minor-major waves are based on resistance/support levels GL

Basic Script: https://tos.mx/8QkMnqz

Chart for illustrated purposes not duplicable/transferable.

ApeX Predator

Well-known member

@Esvee/SV Unfortunately, can't code for that indicator any longer. but the basic logic for what you are asking is here.

https://usethinkscript.com/threads/consecutive-bar-count-indicator-for-thinkorswim.324/ you just have to change the condition to what you need.

https://usethinkscript.com/threads/consecutive-bar-count-indicator-for-thinkorswim.324/ you just have to change the condition to what you need.

Hi Surya... tried my level best, but coding is above my head and not able to make it up@Esvee/SV Unfortunately, can't code for that indicator any longer. but the basic logic for what you are asking is here.

https://usethinkscript.com/threads/consecutive-bar-count-indicator-for-thinkorswim.324/ you just have to change the condition to what you need.

but wondering to check the specific reason why the restriction on coding - on this specific indicator.. Any help on this is highly appreciated... /Srini

ApeX Predator

Well-known member

@ikeyoung17 You must be referring to this RAF indicator posted here: https://usethinkscript.com/threads/raf-ready-aim-fire-indicator-for-thinkorswim.2592/

Unfortunately, it's not available for free. We do not promote piracy within our community.

Unfortunately, it's not available for free. We do not promote piracy within our community.

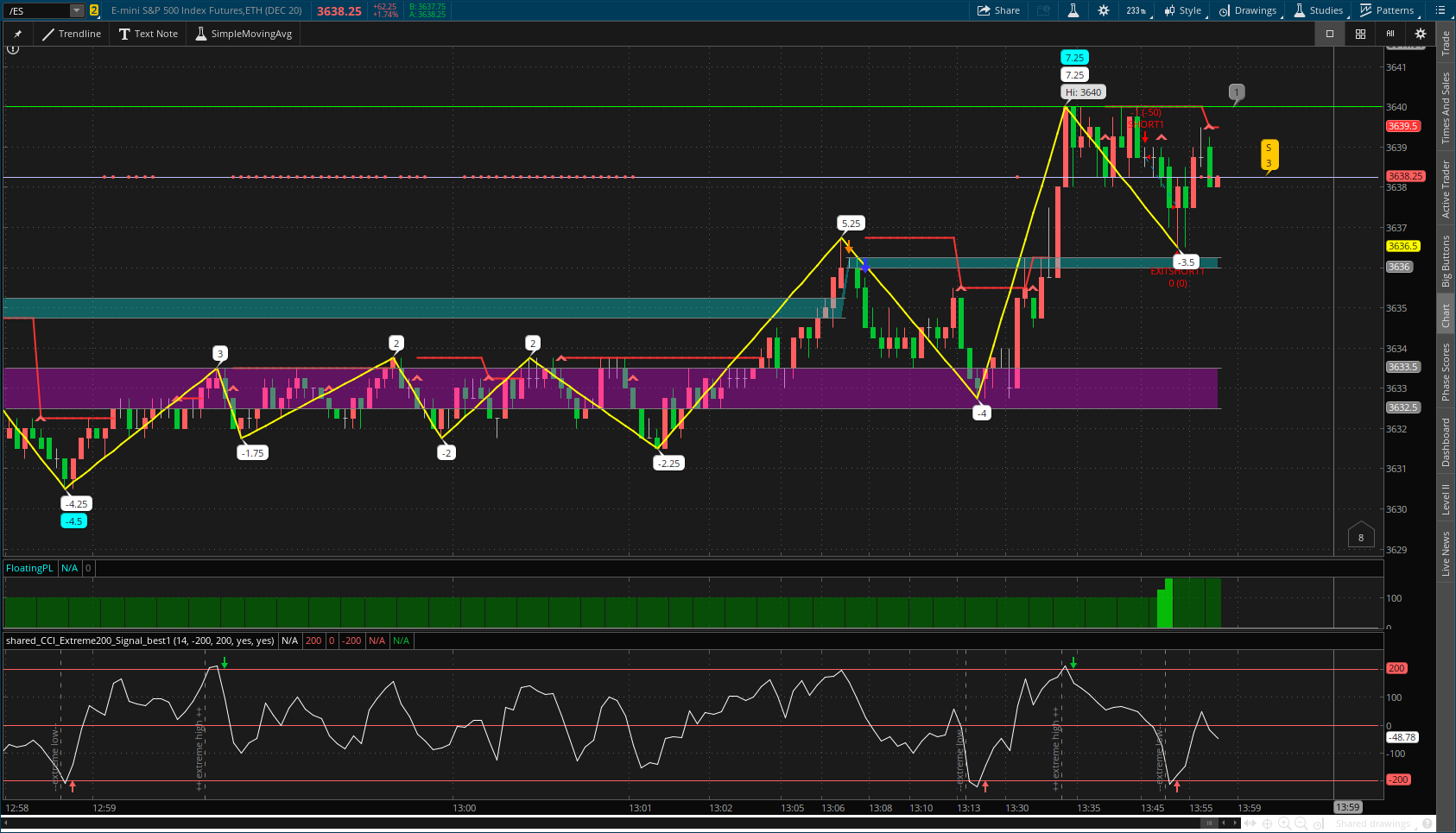

can you share a TOS link for this screen?I don't trade the /es but thought I would throw this up because people need to know.

Well, it's been a while since I last posted to the thread. I'm posting a chart of public domain indicators for your enjoyment folks try em' out.

https://tos.mx/FaBKUMb

https://tos.mx/FaBKUMb

Could This Study be change into a long study?Well, it's been a while since I last posted to the thread. I'm posting a chart of public domain indicators for your enjoyment folks try em' out.

https://tos.mx/FaBKUMb

Code:

###SWING_WAVES_SHORT_ENTRY

input n = 5;#hint n: For pivot and standard deviation

input addAtPercentStDev = 75;#hint addAtPercentStDev: Add at this percent of standard deviation below previous low

input initialLots = 4;#hint initialLots: Set to preference

input lotsToAdd = 2;#hint lotsToAdd: Number of lots to add on a pull back

input stDevMult = 2.0;#hint stDevMult: trail stop multiplier

input labels = no;

def openingLots = Max(4, initialLots);

def addedlots = Max(2, lotsToAdd);

AddLabel(initialLots < openingLots, " Error: Initial lots must be 4 or more ", Color.Cyan);

AddLabel(lotsToAdd < addedLots, " Error: Lots to add must be 2 or more ", Color.Cyan);

def h = high;

def l = low;

def c = close;

def nan = Double.NaN;

def tick = TickSize();

def x = BarNumber();

def stDev = CompoundValue(1, StDev(c, n), nan);

def hh = h == Highest(h, n);

def LPx = if hh then x else nan;

def LP_low = if !IsNaN(LPx) then l else LP_Low[1];

def LP_High = if !IsNaN(LPx) then h else LP_High[1];

def confirmation_count = if hh then 0 else

if c crosses below LP_Low

then confirmation_count[1] + 1

else confirmation_count[1];

def confirmationX = if confirmation_count crosses above 0

then x else nan;

def confirmed = confirmation_count crosses above 0;

def ro;

def stc;

def trail;

def retrace;

if confirmed {

ro = Round((c - (LP_High - c) / (openingLots - 2)) / tick, 0) * tick;

stc = LP_High;

trail = LP_High;

retrace = LP_High;

}else{

ro = CompoundValue(1, ro[1], nan);

stc = stc[1];

trail = Round(Min(trail[1], h[1] + stDev[1] * stDevMult) / tick, 0) * tick;

retrace = Round(Min(retrace[1], h[1] + StDev[1] * addAtPercentStDev / 100) / tick, 0) * tick;

}

def ro_reached = if confirmed then 0 else

if l < ro then 1 else ro_reached[1];

def added = if confirmed then 0 else

if h crosses above retrace then 1 else added[1];

def trail_hit = if confirmed then 0 else

if c > trail then 1 else trail_hit[1];

def stop_hit = if confirmed then 0 else

if h > stc then 1 else stop_hit[1];

plot

PivotConfirmed = confirmed;

PivotConfirmed.SetDefaultColor(Color.Light_Red);

PivotConfirmed.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

plot

BuyToOpen = if confirmed then c else nan;

BuyToOpen.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

BuyToOpen.SetDefaultColor(Color.Light_Green);

plot

SellToClose = if !stop_hit or stop_hit crosses above 0 then stc else nan;

SellToClose.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

SellToClose.SetDefaultColor(Color.RED);

plot

TrailingStop = if ! trail_hit or trail_hit crosses above 0 then trail else nan;

TrailingStop.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

TrailingStop.SetDefaultColor(Color.Pink);

plot

Add = if !added or added crosses above 0 then retrace else nan;

Add.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

Add.SetDefaultColor(Color.Dark_Green);

plot

RiskOut = if !ro_reached or ro_reached crosses above 0 then ro else nan;

RiskOut.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

RiskOut.SetDefaultColor(CreateColor(215, 215, 215));

AddLabel(labels and BuyToOpen, " BTO "+ openingLots +" = " + BuyToOpen + " ", Color.Light_Green);

Addlabel(labels and BuyToOpen, " ", CreateColor(0, 0, 0));

AddLabel(labels and ro_reached and Add, " Add "+ addedlots +" at = " + Add + " ", Color.Dark_Green);

AddLabel(labels and ro_reached and Add, " ", CreateColor(0, 0, 0));

AddLabel(labels and RiskOut, " Sell " + (openingLots - 2) + " = " + ro + " ", CreateColor(215, 215, 215));

AddLabel(labels and RiskOut, " ", CreateColor(0, 0, 0));

AddLabel(labels and ro_reached and TrailingStop, " Sell "+(1+addedLots-1)+" at = "+trail+" ", Color.Pink);

Addlabel(labels and ro_reached and TrailingStop, " ", CreateColor(0, 0, 0));

AddLabel(labels and SellToClose, " Sell All = " + stc + " ", Color.Red);

Addlabel(labels and SellToClose, " ", CreateColor(0, 0, 0));

#f/ Pivot Confirmation With Trading Levels

#For long,

Alert(confirmed or l crosses below stc, "", Alert.Bar, Sound.Ding);

#For short,

Alert(confirmed or h crosses above stc, "", Alert.Bar, Sound.Ding);- Status

- Not open for further replies.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

The View From Here - A Chart Setup for Thinkorswim | Playground | 10 | |

| H | I admit it- I am one of the "Takers" here at UseThinkScript | Playground | 0 | |

| R | Daniel Shay Indicators | Playground | 1 | |

| I | …make a Volume indicator that blows away other indicators? | Playground | 4 | |

|

|

Warning: Shortcomings of Trending Indicators | Playground | 0 |

Similar threads

-

-

I admit it- I am one of the "Takers" here at UseThinkScript

- Started by hockeycoachdoug

- Replies: 0

-

-

…make a Volume indicator that blows away other indicators?

- Started by IHopeToLearn

- Replies: 4

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

854

Online

Similar threads

-

-

I admit it- I am one of the "Takers" here at UseThinkScript

- Started by hockeycoachdoug

- Replies: 0

-

-

…make a Volume indicator that blows away other indicators?

- Started by IHopeToLearn

- Replies: 4

-

Similar threads

-

-

I admit it- I am one of the "Takers" here at UseThinkScript

- Started by hockeycoachdoug

- Replies: 0

-

-

…make a Volume indicator that blows away other indicators?

- Started by IHopeToLearn

- Replies: 4

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.