The Finite Volume Elements (FVE) strategy is a money flow indicator that combines trading volume and volatility indicators to gauge market sentiment. The FVE strategy is considered stable and reliable compared to single indicators.

This indicator is the work of Markos Katsanos. I have ported the indicator to thinkorswim.

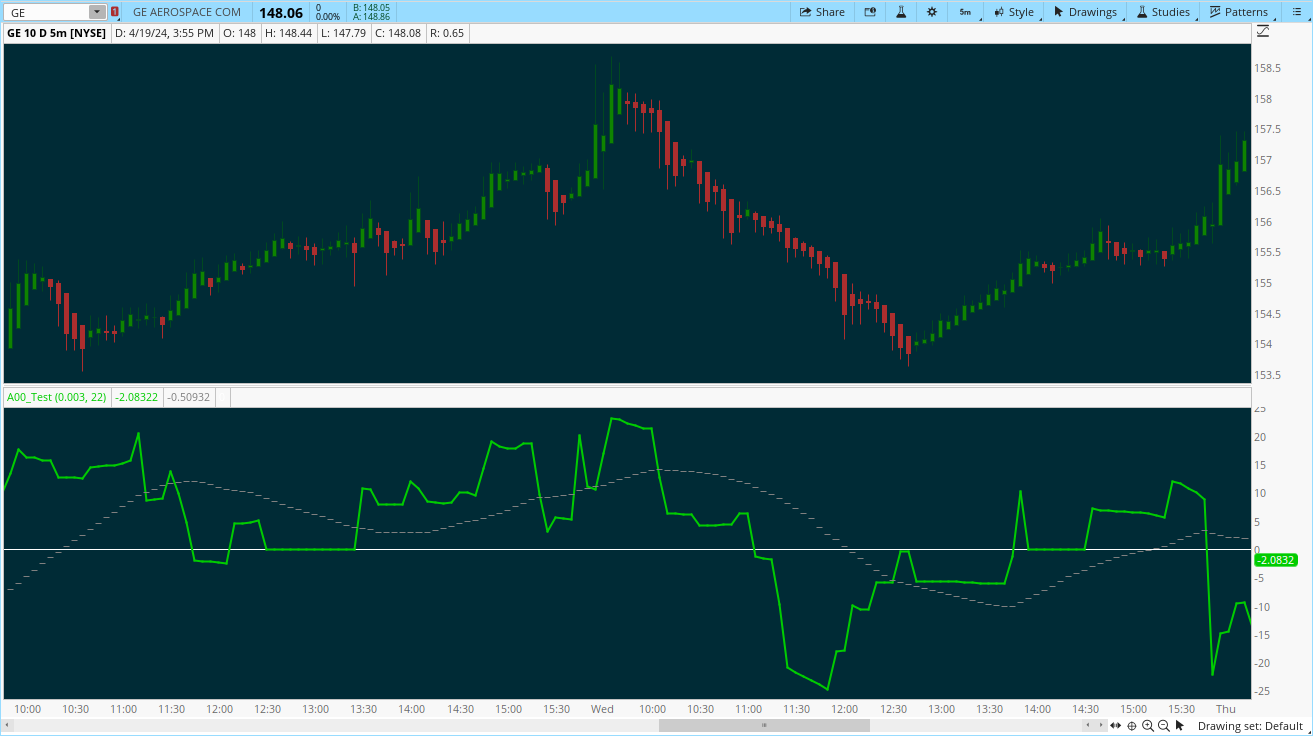

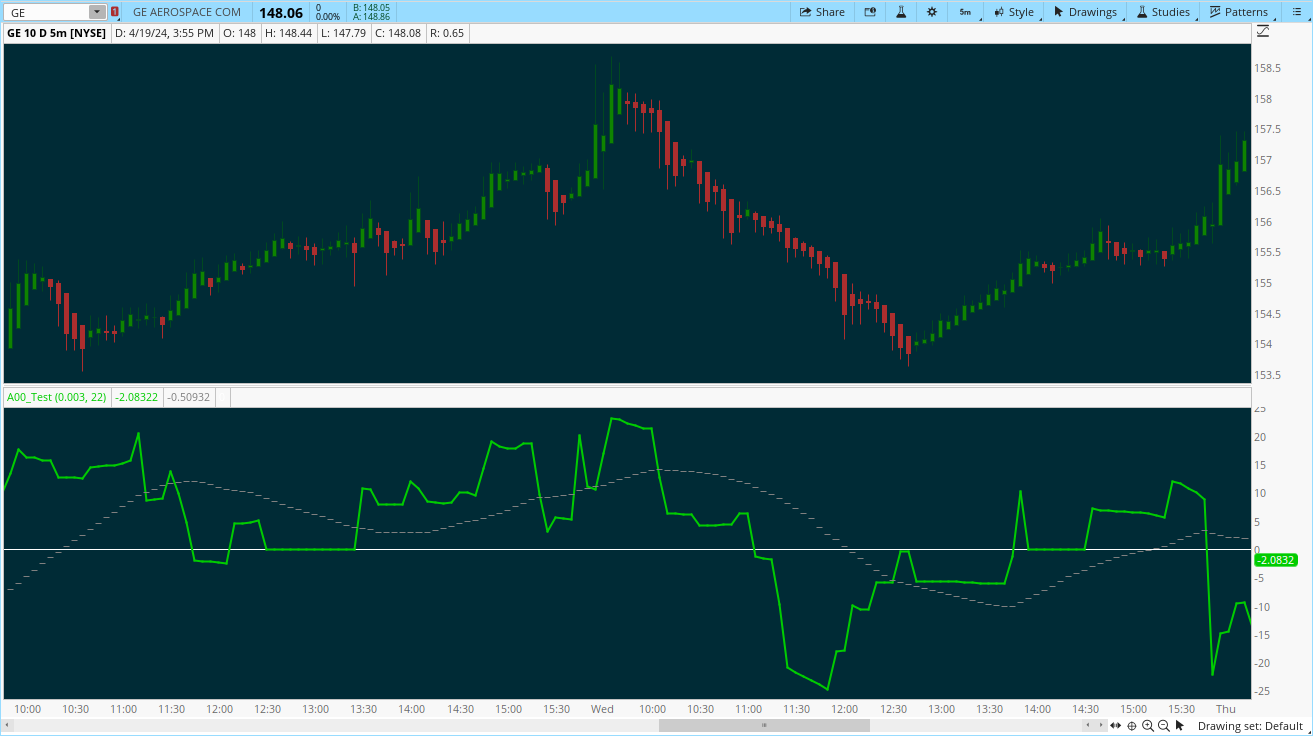

Here is a chart of the indicator from Markos

ThinkScript code for this indicator

Link to a flex grid as shown above

https://tos.mx/PUmEFD

Happy trading,

Kory Gill, @korygill

This indicator is the work of Markos Katsanos. I have ported the indicator to thinkorswim.

Here is a chart of the indicator from Markos

ThinkScript code for this indicator

Code:

#

# FiniteVolumeElements_FVE

#

# Author: Kory Gill, @korygill

#

# Created from idea on https://usethinkscript.com/threads/finite-volume-elements.593/

# Original idea is from http://mkatsanos.com/FVE.html

#

# VERSION HISTORY (sortable date and time (your local time is fine), and your initials

# 20190907-1200-KG - Created.

# ...

# ...

declare once_per_bar;

declare lower;

#

# inputs

#

input CutOff = 0.003;

input Samples = 22;

#

# logic

#

def bn = BarNumber();

def nan = double.NaN;

def tp = hlc3;

def mf = (close - (high+low)/2) + tp - tp[1];

def fveFactor = if mf > (CutOff*Close)

then 1

else if mf < (-1*CutOff*Close) then -1

else 0;

def VolumePlusMinus = volume * fveFactor;

def fveSum = Sum(VolumePlusMinus, Samples);

def fve = if bn > Samples

then (fveSum / (Average(volume,Samples) * Samples)) * 100

else nan;

#

# plots

#

plot pFVE = fve;

plot pFVE_MA = MovingAverage(AverageType.SIMPLE, fve, 30);

pFVE_MA.SetDefaultColor(Color.Gray);

PFVE_MA.SetPaintingStrategy(PaintingStrategy.DASHES);

plot zeroLine = 0;

zeroLine.SetDefaultColor(Color.White);Link to a flex grid as shown above

https://tos.mx/PUmEFD

Happy trading,

Kory Gill, @korygill

Attachments

Last edited by a moderator: